Current Report Filing (8-k)

January 29 2020 - 4:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 24, 2020

AAC HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

Nevada

|

|

001-36643

|

|

35-2496142

|

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

200 Powell Place

Brentwood, Tennessee

(Address of Principal Executive Offices)

|

|

37027

(Zip Code)

|

(615) 732-1231

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

|

AACH

|

|

OTC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

|

ITEM 1.01

|

Entry into a Material Definitive Agreement.

|

On January 24, 2020 (the “Closing Date”), AAC Holdings, Inc., a Nevada corporation (the “Company”), entered into Amendment No. 3 (the “Senior Amendment”) to that certain Credit Agreement, dated as of March 8, 2019, together with Credit Suisse AG, as administrative agent and collateral agent, and the lenders and other parties thereto (as amended, the “Senior Credit Facility”). Pursuant to the Senior Amendment, certain lenders thereunder agreed to advance new term loans to the Company in an aggregate principal amount equal to $12.0 million (the “New Term Loan”), of which $10.0 million was funded on the Closing Date. Pursuant to the Senior Amendment, the Company may borrow the additional $2.0 million upon the extension of the Forbearance Periods (as defined in Item 8.01 of this Current Report on Form 8-K) to a date later than February 21, 2020. The Senior Amendment otherwise amended certain terms of the Senior Credit Facility to provide for the New Term Loan, the maturity date of which is April 15, 2020. The Company intends to use the proceeds of the New Term Loan for working capital and other general corporate purposes.

Also on the Closing date, the Company entered into Amendment No. 4 (the “Junior Amendment” and, together with the Senior Amendment, the “Amendments”) to that certain Credit Agreement, dated as of June 30, 2017, together with Credit Suisse AG, as administrative agent and collateral agent, and the lenders and other parties thereto (as amended, the “Junior Credit Facility” and, together with the Senior Credit Facility, the “Credit Facilities”). The Junior Amendment amended the Junior Credit Facility to the extent necessary to permit the Company to incur the New Term Loan.

Except as described in this Current Report on Form 8-K, the material terms of the Credit Facilities remain unchanged.

As previously reported, on October 30, 2019, the Company entered into forbearance agreements (together, the “Forbearance Agreements”) with the applicable lenders (the “Forbearing Lenders”) and agents in respect of the Credit Facilities, pursuant to which, among other things, the Forbearing Lenders agreed to forbear from exercising their respective creditors’ remedies under the Credit Facilities that would have otherwise been available due to the existence of certain events of default by the Company under the Credit Facilities. Also as previously reported, on January 9, 2020, the Forbearing Lenders delivered to the Company notice of the termination of the respective forbearance periods under the Forbearance Agreements (collectively, the “Forbearance Periods”).

On the Closing Date, in connection with the Company’s entering into the Amendments, the Company entered into amendments to the Forbearance Agreements with the Forbearing Lenders, pursuant to which the Forbearing Lenders agreed to extend the Forbearance Periods through February 21, 2020, subject to extension in the discretion of the Forbearing Lenders if the Company shall not have entered into agreements embodying the material terms of a consensual financial restructuring among the Company and the parties to the Credit Facilities.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

AAC HOLDINGS, INC.

|

|

|

|

|

By:

|

|

/s/ Andrew W. McWilliams

|

|

|

|

Andrew W. McWilliams

|

|

|

|

Chief Executive Officer

|

Date: January 29, 2020

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

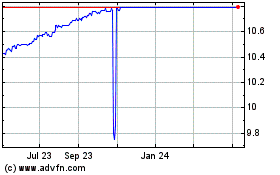

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Apr 2023 to Apr 2024