Current Report Filing (8-k)

November 07 2019 - 8:19AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 7, 2019 (October 30, 2019)

AAC HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

Nevada

|

|

001-36643

|

|

35-2496142

|

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

200 Powell Place

Brentwood, Tennessee

(Address of Principal Executive Offices)

|

|

37027

(Zip Code)

|

(615) 732-1231

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

|

AAC

|

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

|

|

|

|

|

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Amendment to the 2019 Senior Credit Facility

On October 30, 2019, AAC Holdings, Inc. (the “Company”) and affiliated loan parties entered into Amendment No. 2 to Credit Agreement and Amendment No. 1 to Guarantee and Collateral Agreement (the “2019 Senior Credit Facility Amendments”) with the consenting and new lenders party thereto, and Credit Suisse AG, as administrative agent and collateral agent. The 2019 Senior Credit Facility Amendments amend that certain Credit Agreement, dated as of March 8, 2019, as previously amended (the “2019 Senior Credit Facility”), by and among the Company, Credit Suisse AG, as administrative agent and collateral agent, and the lenders party thereto, to effectuate the agreement of the lenders party to the 2019 Senior Credit Facility Amendments to make an additional $5 million of term loans under the 2019 Senior Credit Facility.

In accordance with the terms of the 2019 Senior Credit Facility Amendments, the Company and affiliated loan parties also entered into a Forbearance Agreement (the “Forbearance Agreement”) dated October 30, 2019 with the forbearing lenders and the agent party thereto, pursuant to which the forbearing lenders agreed to forbear from exercising remedies under the 2019 Senior Credit Facility that might be triggered by certain specified events of default until March 31, 2020.

Amendment to the 2017 Junior Credit Facility

On October 30, 2019, the Company and affiliated loan parties entered into Amendment No. 2 to Credit Agreement (“Amendment No. 2 to the 2017 Junior Credit Facility”) and Amendment No. 3 to Credit Agreement and Amendment No. 3 to Guarantee and Collateral Agreement (together with Amendment No. 2 to the 2017 Junior Credit Facility, the “2017 Junior Credit Facility Amendments”) with the consenting lenders party thereto, and Credit Suisse AG, as administrative agent and collateral agent, amending that certain Credit Agreement dated as of June 30, 2017, as previously amended (the “2017 Junior Credit Facility”), by and among the Company, Credit Suisse AG, as administrative agent and collateral agent, and the lenders party thereto.

Among other things, the 2017 Junior Credit Facility Amendments permit the additional $5 million in term loans made under the 2019 Senior Credit Facility. In accordance with the terms of the 2017 Junior Credit Facility Amendments, the Company and affiliated loan parties also entered into a Forbearance Agreement (the “Forbearance Agreement”) dated October 30, 2019 with the forbearing lenders and the agents party thereto, pursuant to which the forbearing lenders agreed to forbear from exercising remedies under the 2017 Junior Credit Facility that might be triggered by certain specified events of default until March 31, 2020.

The 2019 Senior Credit Facility Amendments and the Amendments to the 2017 Junior Credit Facility contain customary conditions precedent, representations and warranties, and covenants.

The foregoing descriptions of the 2019 Senior Credit Facility Amendments and the 2017 Junior Credit Facility Amendments do not purport to be complete and are qualified in their entirety by reference to the complete 2019 Senior Credit Facility Amendments and the complete 2017 Junior Credit Facility Amendments, copies of which will be timely filed with the SEC.

|

|

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information disclosed under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

|

|

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On November 5, 2019, the Board of Directors (the “Board”) of the Company appointed Bob Nash, Scott D. Vogel and T. Michael Logan to serve as directors on the Board, effective immediately, until a successor is duly elected and qualified. Each of Messrs. Nash, Vogel and Logan will receive compensation in accordance with the Company’s standard compensatory arrangements for non-employee directors, which are described under the caption “Director Compensation” in the Company’s definitive proxy statement on Schedule 14A filed with the SEC on April 13, 2018. The Board may appoint Messrs. Nash, Vogel and Logan to one or more committees of the Board at a later date. The Company will file an amendment to this Current Report on Form 8-K to report any such appointment within four business days after the information is determined or becomes available.

There are no arrangements or understandings between any of Messrs. Nash, Vogel and Logan, and any other persons pursuant to which Messrs. Nash, Vogel and Logan were appointed as directors of the Company.

|

|

|

|

Item 7.01.

|

Regulation FD Disclosure.

|

On November 5, 2019, the Company issued a press release announcing the amendments to the Company’s credit facilities described above and the appointment of Messrs. Nash, Vogel and Logan to the Board. A copy of the release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Pursuant to the rules and regulations of the SEC, the information in this Item 7.01 disclosure, including Exhibit 99.1 and information set forth therein, is deemed to have been furnished and shall not be deemed to be “filed” under the Securities Exchange Act of 1934, as amended.

|

|

|

|

Item 9.01.

|

Exhibits and Financial Statements.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

AAC HOLDINGS, INC.

|

|

|

|

|

By:

|

|

/s/ Andrew W. McWilliams

|

|

|

|

Andrew W. McWilliams

|

|

|

|

Chief Financial Officer

|

Date: November 7, 2019

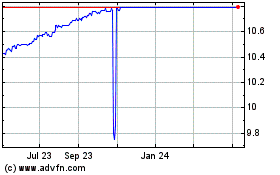

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Apr 2023 to Apr 2024