Current Report Filing (8-k)

July 23 2019 - 5:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 22, 2019

Zynex,

Inc.

(Exact Name of Registrant as Specified in

its Charter)

|

Nevada

|

001-38804

|

90-0275169

|

(State or other jurisdiction

of incorporation)

|

Commission File

Number

|

(I.R.S. Employer Identification number)

|

9555 Maroon Circle, Englewood,

CO 80112

(Address of principal

executive offices) (Zip Code)

Registrant's telephone number, including

area code:

(303) 703-4906

______________________________________________________

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Ticker symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

ZYXI

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

ITEM 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

|

Appointment of Giuseppe Papandrea as Chief Operating Officer

Effective July 22, 2019, the Board of Directors

appointed Giuseppe Papandrea as Chief Operating Officer of Zynex, Inc. (the “Company”). Additionally, on such

date, the Company entered into an employment agreement with Mr. Papandrea, as described below.

Giuseppe Papandrea served as Vice President

of Operations at Arrow Electronics, a global provider of electronic components and enterprise computing solutions from December

2016 to July 2019. In this capacity he utilized his global background, breadth of organizational functional knowledge, and analogous

vertical experience to help customers in Security, Healthcare and Medical, Technology and Media scale rapidly (e.g. +25% quarter

on quarter growth). From January 2003 through July 2016, Mr. Papandrea worked for Orica USA, Inc. in Australia, Singapore, Germany,

the UK, Chile and the USA in a variety of senior leadership roles driving scale, and transformation across industries including;

Resources, Energy, Technology, Industrial, Transportation, and Retail .

Mr. Papandrea holds a Bachelor of Commerce,

(minor in Accounting and Law) from the University of Western Sydney in Australia and has undertaken Business Administration Leadership

and Management development through INSEAD, and Korn Ferry.

There is no arrangement or understanding

between Mr. Papandrea and any other person pursuant to which he was selected as an officer of the Company. There is no family relationship

between Mr. Papandrea and any director or executive officer of the Company, and Mr. Papandrea is not a party to a related party

transaction within the meaning of Item 404(a) of Regulation S-K.

Pursuant to Mr. Papandrea’s employment agreement, the

Company and Mr. Papandrea agreed to the following:

|

|

•

|

Mr. Papandrea will receive annual base salary of $235,000 and be eligible for annual incentive compensation of up to $235,000 in cash and up to 50,000 stock options, based upon achievement of annual incentive compensation targets established by the Company’s Board of Directors.

|

|

|

•

|

The Company awarded Mr. Papandrea an initial grant of stock options exercisable for 200,000

shares at an exercise price of $7.87 of the Company’s common stock and 30,000 restricted shares, each vesting annually

over a four-year period.

|

|

|

•

|

Mr. Papandrea will also be eligible to receive quarterly grants equal to 5,000 shares of restricted stock, vesting annually over a four-year period.

|

|

|

•

|

Mr. Papandrea will be employed “at will.”

|

|

|

•

|

If the Company terminates Mr. Papandrea’s employment for reasons other than cause or disability, or Mr. Papandrea resigns for “Good Reason,” as such terms are defined in his employment agreement, prior to July 22, 2020, the Company will pay Mr. Papandrea severance equal to 6 months of his base salary or if the termination occurs after July 22, 2020, Mr. Papandrea will be entitled to severance equal to 9 months of his base salary. The Company will also pay a proportionate amount of Mr. Papandrea’s health and dental insurance premiums, based upon the same proportion the Company paid at the time Mr. Papandrea’s employment was terminated, for the applicable severance period or until Mr. Papandrea obtains substitute insurance. Severance and insurance premium payments will be made in equal installments over the applicable 6-month or 9-month period, based upon the Company’s normal payroll practices.

|

|

|

•

|

Mr. Papandrea agreed that following termination of employment he will not compete with the Company (as defined in the employment agreement), or solicit or entice any employee of the Company to leave the employ of the Company or interfere with the Company’s relationship with a customer during the period of time that severance is paid.

|

The full text of the employment

agreement is attached as Exhibit 10.1 to this Current Report on Form 8-K and the above description is qualified in its

entirety thereby.

|

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

d)

Exhibits

.

The following exhibits are filed with this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

Zynex, Inc.

(Registrant)

|

|

|

|

|

|

|

|

Dated:

July 23, 2019

|

|

/s/

Daniel Moorhead

Chief Financial Officer

|

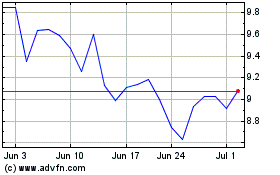

Zynex (NASDAQ:ZYXI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Zynex (NASDAQ:ZYXI)

Historical Stock Chart

From Apr 2023 to Apr 2024