Ziff Davis, Inc. (NASDAQ: ZD) (“Ziff Davis” or “the Company”)

today reported unaudited financial results for the fourth quarter

and year ended December 31, 2024.

“We believe 2024 marked an inflection point for the Company as

it returned to revenue, adjusted diluted EPS, and free cash flow

growth,” said Vivek Shah, Chief Executive Officer of Ziff Davis.

“We are also excited to introduce a new segment reporting structure

that we believe will aid investors in gaining a better

understanding and appreciation of our business.”

FOURTH QUARTER 2024 RESULTS

- Q4 2024 quarterly revenues increased 5.9% to $412.8 million

compared to $389.9 million for Q4 2023.

- Income from operations decreased to $78.5 million compared to

$80.7 million for Q4 2023.

- Net income (1) increased 1.0% to $64.1 million compared to

$63.4 million for Q4 2023.

- Net income per diluted share (1) increased to $1.43 in Q4 2024

compared to $1.29 for Q4 2023.

- Adjusted EBITDA (2) for the quarter increased 2.5% to $171.8

million compared to $167.6 million for Q4 2023.

- Adjusted net income (2) increased 3.0% to $110.2 million

compared to $107.0 million for Q4 2023.

- Adjusted net income per diluted share (1)(2) (or “Adjusted

diluted EPS”) for the quarter increased 10.7% to $2.58 compared to

$2.33 for Q4 2023.

- Net cash provided by operating activities was $158.2 million in

Q4 2024 compared to $92.1 million in Q4 2023. Free cash flow (2)

was $131.1 million in Q4 2024 compared to $65.9 million in Q4

2023.

- Ziff Davis ended the quarter with approximately $664.1 million

in cash, cash equivalents, and investments after deploying

approximately $6.4 million for current and prior year acquisitions

during the quarter and $1.2 million primarily related to share

repurchases.

FULL YEAR 2024 RESULTS

- 2024 yearly revenues increased 2.8% to $1.40 billion compared

to $1.36 billion for 2023.

- Income from operations decreased to $113.6 million compared to

$132.6 million for 2023. This includes a $85.3 million goodwill

impairment recognized in 2024 compared to a $56.9 million goodwill

impairment recognized in 2023.

- Net income (1) increased 51.9% to $63.0 million compared to

$41.5 million for 2023.

- Net income per diluted share (1) increased to $1.42 in 2024

compared to $0.89 for 2023.

- Adjusted EBITDA (2) for the year increased 2.3% to $493.5

million compared to $482.3 million for 2023.

- Adjusted net income (2) for the year increased 2.5% to $294.5

million compared to $287.4 million for 2023.

- Adjusted diluted EPS (1)(2) for the year increased 6.9% to

$6.62 compared to $6.19 for 2023.

- Net cash provided by operating activities was $390.3 million in

2024 compared to $320.0 million in 2023. Free cash flow (2) was

$283.7 million in 2024 compared to $211.2 million in 2023.

- Ziff Davis deployed approximately $225.4 million for current

and prior year acquisitions during the year and $185.2 million

related to share repurchases in 2024.

The following table reflects results for the three months and

year ended December 31, 2024 and 2023, respectively (in millions,

except per share amounts).

(Unaudited)

Three months ended

December 31,

% Change

Years ended December

31,

% Change

2024

2023

2024

2023

Revenues

Technology & Shopping

$132.9

$105.2

26.3%

$361.9

$330.6

9.5%

Gaming & Entertainment

$50.9

$49.2

3.5%

$180.3

$168.8

6.8%

Health & Wellness

$105.7

$106.5

(0.7)%

$362.4

$361.9

0.1%

Connectivity

$54.3

$57.0

(4.9)%

$213.6

$211.5

1.0%

Cybersecurity and Martech

$69.0

$72.0

(4.0)%

$283.5

$291.2

(2.6)%

Total revenues (3)

$412.8

$389.9

5.9%

$1,401.7

$1,364.0

2.8%

Income from operations

$78.5

$80.7

(2.7)%

$113.6

$132.6

(14.3)%

Operating income margin

19.0%

20.7%

(1.7)%

8.1%

9.7%

(1.6)%

Net income (1)

$64.1

$63.4

1.0%

$63.0

$41.5

51.9%

Net income per diluted share

(1)

$1.43

$1.29

10.9%

$1.42

$0.89

59.6%

Adjusted EBITDA (2)

$171.8

$167.6

2.5%

$493.5

$482.3

2.3%

Adjusted EBITDA margin (2)

41.6%

43.0%

(1.4)%

35.2%

35.4%

(0.2)%

Adjusted net income (1)(2)

$110.2

$107.0

3.0%

$294.5

$287.4

2.5%

Adjusted diluted EPS (1)(2)

$2.58

$2.33

10.7%

$6.62

$6.19

6.9%

Net cash provided by operating

activities

$158.2

$92.1

71.8%

$390.3

$320.0

22.0%

Free cash flow (2)

$131.1

$65.9

99.0%

$283.7

$211.2

34.3%

Notes:

(1)

GAAP effective tax rates were

approximately 18.3% and 17.0% for the three months ended December

31, 2024 and 2023, respectively, and 44.4% and 32.2% for the year

ended December 31, 2024 and 2023, respectively. Adjusted effective

tax rates were approximately 22.8% and 22.5% for the three months

ended December 31, 2024 and 2023, respectively, and 23.5% and 23.3%

for the year ended December 31, 2024 and 2023, respectively.

(2)

For definitions of non-GAAP financial

measures and reconciliations of GAAP to non-GAAP financial measures

refer to section “Non-GAAP Financial Measures” further in this

release.

(3)

The revenues associated with each of the

businesses may not foot precisely since each is presented

independently.

ZIFF DAVIS GUIDANCE

The Company’s full year 2025 outlook is as follows (in millions,

except per share data):

2024 Actual

2025 Range of

Estimates

Growth

(unaudited)

Low

High

Low

High

Revenue

$

1,402

$

1,442

$

1,502

2.9

%

7.2

%

Adjusted EBITDA

$

494

$

505

$

542

2.3

%

9.8

%

Adjusted diluted EPS*

$

6.62

$

6.64

$

7.28

0.3

%

10.0

%

_______________________

*

It is anticipated that the Adjusted

effective tax rate for 2025 will be between 23.25% and 25.25%.

A reconciliation of forward-looking Adjusted EBITDA and Adjusted

diluted EPS to the corresponding GAAP financial measures is not

available without unreasonable effort due primarily to variability

and difficulty in making accurate forecasts and projections of

certain non-operating items such as (Gain) loss on investments,

net, Other (income) loss, net, and other unanticipated items that

may arise in the future.

SEGMENT REALIGNMENT

Following changes to our internal reporting structure, the

Company concluded that it has five operating segments, which are

now presented as the following five reportable segments: 1)

Technology & Shopping, 2) Gaming & Entertainment, 3) Health

& Wellness, 4) Connectivity, and 5) Cybersecurity &

Martech. Prior period segment information is presented on a

comparable basis to conform to this new segment presentation with

no effect on previously reported consolidated results.

EARNINGS CONFERENCE CALL AND AUDIO WEBCAST

Ziff Davis will host a live audio webcast and conference call

discussing its fourth quarter and year-end 2024 financial results

on Tuesday, February 25, 2025, at 8:30AM ET. The live webcast and

call will be accessible by phone by dialing (844) 985-2014 or via

www.ziffdavis.com. Following the event, the audio recording and

presentation materials will be archived and made available at

www.ziffdavis.com.

ABOUT ZIFF DAVIS

Ziff Davis, Inc. (NASDAQ: ZD) is a vertically focused digital

media and internet company whose portfolio includes leading brands

in technology, shopping, gaming and entertainment, health and

wellness, connectivity, cybersecurity, and martech. For more

information, visit www.ziffdavis.com.

“Safe Harbor” Statement Under the Private Securities

Litigation Reform Act of 1995: Certain statements in this press

release are “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, including those

contained in Vivek Shah’s quote, the “Ziff Davis Guidance” section

regarding the Company’s expected fiscal 2025 financial performance,

and our discussion of net cash provided by operating activities and

free cash flow. These forward-looking statements are based on

management’s current expectations or beliefs and are subject to

numerous assumptions, risks, and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements. These factors and uncertainties

include, among other items: the Company’s ability to grow

advertising, licensing, and subscription revenues, profitability,

and cash flows, particularly in light of an uncertain U.S. or

worldwide economy, including the possibility of economic downturn

or recession; the Company’s ability to make interest and debt

payments; the Company’s ability to identify, close, and

successfully transition acquisitions; customer growth and

retention; the Company’s ability to create compelling content; our

reliance on third-party platforms; the threat of content piracy and

developments related to artificial intelligence; increased

competition and rapid technological changes; variability of the

Company’s revenue based on changing conditions in particular

industries and the economy generally; protection of the Company’s

proprietary technology or infringement by the Company of

intellectual property of others; the risk of losing critical

third-party vendors or key personnel; the risks associated with

fraudulent activity, system failure, or a security breach; risks

related to our ability to adhere to our internal controls and

procedures; the risk of adverse changes in the U.S. or

international regulatory environments, including but not limited to

the imposition or increase of taxes or regulatory-related fees; the

risks related to supply chain disruptions, inflationary conditions,

and rising interest rates; the risk of liability for legal and

other claims; and the numerous other factors set forth in Ziff

Davis’ filings with the Securities and Exchange Commission (“SEC”).

For a more detailed description of the risk factors and

uncertainties affecting Ziff Davis, refer to our most recent Annual

Report on Form 10-K and the other reports filed by Ziff Davis from

time-to-time with the SEC, each of which is available at

www.sec.gov. The forward-looking statements provided in this press

release, including those contained in Vivek Shah’s quote, in the

“Ziff Davis Guidance” portion regarding the Company’s expected

fiscal 2025 financial performance, and our discussion of net cash

provided by operating activities and free cash flows are based on

limited information available to the Company at this time, which is

subject to change. Although management’s expectations may change

after the date of this press release, the Company undertakes no

obligation to revise or update these statements.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(UNAUDITED, IN

THOUSANDS)

December 31,

2024

2023

ASSETS

Cash and cash equivalents

$

505,880

$

737,612

Short-term investments

—

27,109

Accounts receivable, net of allowances of

$8,148 and $6,871, respectively

660,223

337,703

Prepaid expenses and other current

assets

105,966

88,570

Total current assets

1,272,069

1,190,994

Long-term investments

158,187

140,906

Property and equipment, net of accumulated

depreciation of $361,710 and $327,015, respectively

197,216

188,169

Intangible assets, net

425,749

325,406

Goodwill

1,580,258

1,546,065

Deferred income taxes

7,487

8,731

Other assets

63,368

70,751

TOTAL ASSETS

$

3,704,334

$

3,471,022

LIABILITIES AND STOCKHOLDERS’

EQUITY

Accounts payable and accrued expenses

$

670,769

$

216,936

Income taxes payable, current

19,715

14,458

Deferred revenue, current

199,664

184,549

Other current liabilities

9,499

15,890

Total current liabilities

899,647

431,833

Long-term debt

864,282

1,001,312

Deferred revenue, noncurrent

5,504

8,169

Income taxes payable, noncurrent

—

8,486

Liability for uncertain tax positions

30,296

36,055

Deferred income taxes

46,018

45,503

Other noncurrent liabilities

47,705

46,666

TOTAL LIABILITIES

1,893,452

1,578,024

Common stock

428

461

Additional paid-in capital

491,891

472,201

Retained earnings

1,401,034

1,491,956

Accumulated other comprehensive loss

(82,471

)

(71,620

)

TOTAL STOCKHOLDERS’ EQUITY

1,810,882

1,892,998

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

3,704,334

$

3,471,022

ZIFF DAVIS, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(UNAUDITED, IN THOUSANDS

EXCEPT SHARE AND PER SHARE DATA)

Three months ended December

31,

Years ended December

31,

2024

2023

2024

2023

Total revenues

$

412,823

$

389,885

$

1,401,688

$

1,364,028

Operating costs and expenses:

Direct costs

53,242

45,070

200,323

185,650

Sales and marketing

150,510

126,449

519,694

487,365

Research, development, and engineering

17,549

15,532

67,373

68,860

General, administrative, and other related

costs

53,029

52,483

203,461

195,726

Depreciation and amortization

59,971

69,631

211,916

236,966

Goodwill impairment

—

—

85,273

56,850

Total operating costs and expenses

334,301

309,165

1,288,040

1,231,417

Income from operations

78,522

80,720

113,648

132,611

Interest expense, net

(6,391

)

(2,251

)

(13,988

)

(20,031

)

Loss on sale of businesses

—

—

(3,780

)

—

Income (loss) on investments, net

—

1,065

(7,654

)

(28,138

)

Other income (loss), net

2,438

(3,486

)

4,968

(9,468

)

Income before income tax expense and

income (loss) from equity method investment

74,569

76,048

93,194

74,974

Income tax expense

(13,610

)

(12,962

)

(41,370

)

(24,142

)

Income (loss) from equity method

investment, net of tax

3,128

336

11,223

(9,329

)

Net income

$

64,087

$

63,422

$

63,047

$

41,503

Net income per common share:

Basic

$

1.51

$

1.39

$

1.42

$

0.89

Diluted

$

1.43

$

1.29

$

1.42

$

0.89

Weighted average shares outstanding:

Basic

42,577,188

45,772,689

44,457,071

46,400,941

Diluted

46,690,090

50,985,086

44,519,693

46,464,261

ZIFF DAVIS, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(UNAUDITED, IN

THOUSANDS)

Years ended December

31,

2024

2023

Cash flows from operating activities:

Net income

$

63,047

$

41,503

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

211,916

236,966

Non-cash operating lease costs

10,923

11,141

Share-based compensation

40,915

31,920

Provision for credit losses on accounts

receivable

2,898

2,809

Deferred income taxes, net

(18,822

)

(30,017

)

Loss on sale of businesses

3,780

—

Goodwill impairment

85,273

56,850

Changes in fair value of contingent

consideration

—

(200

)

(Income) loss from equity method

investments

(11,223

)

9,329

Loss on investment, net

7,654

28,138

Other

3,601

5,159

Decrease (increase) in:

Accounts receivable

(153,121

)

(35,371

)

Prepaid expenses and other current

assets

(17,153

)

(8,700

)

Other assets

11,367

(5,574

)

Increase (decrease) in:

Accounts payable

171,280

9,419

Deferred revenue

5,043

(6,802

)

Accrued liabilities and other current

liabilities

(27,063

)

(26,608

)

Net cash provided by operating

activities

390,315

319,962

Cash flows from investing activities:

Purchases of property and equipment

(106,635

)

(108,729

)

Acquisition of businesses, net of cash

received

(217,570

)

(9,492

)

Purchase of equity investments

—

(11,858

)

Proceeds from sale of equity

investments

19,455

3,174

Proceeds from sale of businesses, net of

cash divested

7,860

—

Other

(565

)

(503

)

Net cash used in investing activities

(297,455

)

(127,408

)

Cash flows from financing activities:

Payment of debt

(134,989

)

—

Debt extinguishment costs

(277

)

—

Repurchase of common stock

(185,181

)

(108,527

)

Issuance of common stock under employee

stock purchase plan

8,371

8,727

Deferred payments for acquisitions

(7,842

)

(15,241

)

Other

(1,076

)

250

Net cash used in financing activities

(320,994

)

(114,791

)

Effect of exchange rate changes on cash

and cash equivalents

(3,598

)

7,056

Net change in cash and cash

equivalents

(231,732

)

84,819

Cash and cash equivalents at beginning of

year

737,612

652,793

Cash and cash equivalents at end of

year

$

505,880

$

737,612

Non-GAAP Financial

Measures

To supplement our condensed consolidated financial statements,

which are prepared and presented in accordance with U.S. generally

accepted accounting principles (“GAAP”), we use the following

non-GAAP financial measures: Adjusted EBITDA, Adjusted EBITDA

margin, Adjusted net income (loss), Adjusted net income (loss) per

diluted share, Free cash flow, and Adjusted effective tax rate

(collectively the “non-GAAP financial measures”). The presentation

of this financial information is not intended to be considered in

isolation or as a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP.

We use these non-GAAP financial measures for financial and

operational decision making and as a means to evaluate

period-to-period comparisons. We believe that these non-GAAP

financial measures provide meaningful supplemental information

regarding our performance and liquidity by excluding certain items

that may not be indicative of our recurring core business operating

results or, in certain cases, may be non-cash in nature. We believe

that both management and investors benefit from referring to these

non-GAAP financial measures in assessing our performance and when

planning, forecasting, and analyzing future periods. These non-GAAP

financial measures also facilitate management’s internal

comparisons to our historical performance and liquidity. We believe

these non-GAAP financial measures are useful to investors both

because (1) they allow for greater transparency with respect to key

metrics used by management in its financial and operational

decision-making, (2) certain measures are used to determine the

amount of annual incentive compensation paid to our named executive

officers, and (3) they are used by the analyst community to help

them analyze the health of our business.

These non-GAAP financial measures are not measures presented in

accordance with GAAP, and our use of these terms may vary from that

of other companies, limiting their usefulness for comparison

purposes. These non-GAAP financial measures are not based on any

comprehensive set of accounting rules or principles. These non-GAAP

financial measures have limitations in that they do not reflect all

of the amounts associated with the Company’s results of operations

determined in accordance with GAAP.

Non-GAAP financial measures exclude the certain items listed

below. We believe that excluding these items from the non-GAAP

measures facilitates comparisons to historical operating results

and comparisons to peers, many of which exclude similar items. We

believe that non-GAAP financial measures provide meaningful

supplemental information regarding operational performance. We

further believe these measures are useful to investors in that they

allow for greater transparency of certain line items in the

Company’s financial statements.

Adjusted EBITDA is defined as Net income (loss) with

adjustments to reflect the addition or elimination of certain items

including, but not limited to:

- Interest expense, net. Interest expense is generated primarily

from interest due on outstanding debt, partially offset by interest

income generated from the interest earned on cash, cash

equivalents, and investments;

- (Gain) loss on debt extinguishment, net. This is a non-cash

expense that relates to extinguishments of long-term debt

obligations. We believe this (gain) loss does not represent

recurring core business operating results of the Company;

- (Gain) loss on sale of business. This gain or loss relates to

the sales of businesses and does not represent recurring core

business operating results of the Company;

- (Gain) loss on investments, net. This item includes realized

gains and losses, unrealized gains and losses, and impairment

charges on debt and equity investments. The amount of gain or loss

depends on the share price for investments with readily

determinable fair value and on observable price changes for

investments without a readily determinable fair value, and does not

represent core business operating results of the Company;

- Other (income) loss, net. This income or expense relates to

other non-operating items and does not represent recurring core

business operating results of the Company;

- Income tax (benefit) expense. This benefit or expense depends

on the pre-tax loss or income of the Company, statutory tax rates,

tax regulations, and different tax rates in various jurisdictions

in which the Company operates and which the Company does not have

the control over;

- (Income) loss from equity method investments, net. This is a

non-cash expense as it relates primarily to our investment in OCV

Fund I, LP (the “Fund”). We believe that gain or loss resulting

from our equity method investment does not represent core business

operating results of the Company;

- Depreciation and amortization. This is a non-cash expense at it

relates to use and associated reduction in value of certain assets

including equipment, fixtures, and certain capitalized

internal-used software and website development costs, and

identifiable definite-lived intangible assets of the acquired

businesses;

- Share-based compensation. This is a non-cash expense as it

relates to awards granted under the various share-based incentive

plans of the Company. We view the economic cost of share-based

awards to be the dilution to our share base;

- Acquisition, integration, and other costs. Includes adjustments

to contingent consideration, lease terminations, retention bonuses,

other acquisition-specific items, and other costs, such as

severance, third-party debt modification costs and legal

settlements. These expenses do not represent core business

operating results of the Company;

- Disposal related costs. These are expenses associated with the

disposal of certain businesses that do not represent core business

operating results of the Company;

- Lease asset impairments and other charges. These expenses are

incurred in connection with impaired right-of-use (“ROU”) assets of

the Company. Associated expenses are comprised of insurance,

utility, and other charges related to assets that are no longer in

use, and partially offset by the sublease income earned. These

expenses do not represent core business operating results of the

Company; and

- Goodwill impairment. This is a non-cash expense that is

recorded when the carrying value of the reporting unit exceeds its

fair value and does not represent core business operating results

of the Company.

Adjusted EBITDA margin is calculated by dividing Adjusted

EBITDA by Total revenues.

Adjusted net income (loss) is defined as Net income

(loss) with adjustments to reflect the addition or elimination of

certain statement of operations items including, but not limited

to:

- Interest, net. This reflects the difference between the imputed

and coupon interest expense associated with the 4.625% Senior Notes

and a charge that the Company determined to be penalty interest

associated with the 1.75% Convertible Notes, offset in part by a

certain interest income earned by the Company. These net expenses

do not represent core business operating results of the

Company;

- (Gain) loss on debt extinguishment, net. This is a non-cash

expense that relates to extinguishments of long-term debt

obligations. We believe this gain or loss does not represent

recurring core business operating results of the Company;

- (Gain) loss on sale of business. This gain or loss relates to

the sales of businesses and does not represent recurring core

business operating results of the Company;

- (Gain) loss on investments, net. This item includes realized

gains and losses, unrealized gains and losses, and impairment

charges on debt and equity investments. The amount of gain or loss

depends on the share price for investments with readily

determinable fair value and on observable price changes for

investments without a readily determinable fair value, and does not

represent core business operating results of the Company;

- (Income) loss from equity method investments, net. This is a

non-cash income or expense as it relates primarily to our

investment in the OCV Fund. We believe that gains or losses

resulting from our equity method investment do not represent core

business operating results of the Company;

- Amortization. Includes the amortization of patents and

intangible assets that we acquired. This is a non-cash expense as

it primarily relates to identifiable definite-lived intangible

assets of the acquired businesses. We believe that acquired

intangible assets represent cost incurred by the acquiree to build

value prior to the acquisition and the amortization of this cost

does not represent core business operating results of the

Company;

- Share-based compensation. This is a non-cash expense as it

relates to awards granted under the various incentive plans of the

Company. We view the economic cost of share-based awards to be the

dilution to our share base;

- Acquisition, integration, and other costs. Includes adjustments

to contingent consideration, lease terminations, retention bonuses,

other acquisition-specific items, and other costs, such as

severance, third-party debt modification costs and legal

settlements. These expenses do not represent core business

operating results of the Company;

- Disposal related costs. These are expenses associated with the

disposal of certain businesses that do not represent core business

operating results of the Company;

- Lease asset impairments and other charges. These expenses are

incurred in connection with impaired ROU assets of the Company.

Associated expenses are comprised of insurance, utility, and other

charges related to assets that are no longer in use, and partially

offset by the sublease income earned. These expenses do not

represent core business operating results of the Company; and

- Goodwill impairment. This is a non-cash expense that is

recorded when the carrying value of the reporting unit exceeds its

fair value and does not represent core business operating results

of the Company.

Adjusted net income (loss) per diluted share is

calculated by dividing Adjusted net income (loss) by the diluted

weighted average shares of common stock outstanding excluding the

effect of convertible debt dilution.

Free cash flow is defined as Net cash provided by

operating activities, less purchases of property and equipment,

plus changes in contingent consideration (if any).

Adjusted effective tax rate is calculated based upon the

GAAP effective tax rate with adjustments for the tax applicable to

non-GAAP adjustments to Net income (loss), generally based upon the

effective marginal tax rate of each adjustment.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

The following table sets forth a

reconciliation of Net income to Adjusted EBITDA:

Three months ended December

31,

Years ended December

31,

2024

2023

2024

2023

Net income

$

64,087

$

63,422

$

63,047

$

41,503

Interest expense, net

6,391

2,251

13,988

20,031

Loss on sale of businesses

—

—

3,780

—

(Income) loss on investment, net

—

(1,065

)

7,654

28,138

Other (income) loss, net

(2,438

)

3,486

(4,968

)

9,468

Income tax expense

13,610

12,962

41,370

24,142

(Income) loss from equity method

investments, net

(3,128

)

(336

)

(11,223

)

7,829

Depreciation and amortization

59,971

69,633

211,916

236,966

Share-based compensation

10,282

7,527

40,915

31,920

Acquisition, integration, and other

costs

23,386

9,649

40,194

21,000

Disposal related costs

(350

)

375

201

2,217

Lease asset impairments and other

charges

(9

)

(338

)

1,361

2,245

Goodwill impairment

—

—

85,273

56,850

Adjusted EBITDA

$

171,802

$

167,566

$

493,508

$

482,309

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

The following table sets forth Revenues

and a reconciliation of Income (loss) from operations to Adjusted

EBITDA by segment:

Three months ended December

31, 2024

Technology &

Shopping

Gaming &

Entertainment

Health & Wellness

Connectivity

Cybersecurity &

Martech

Corporate (1)

Total

Revenues

$

132,922

$

50,941

$

105,671

$

54,248

$

69,041

$

—

$

412,823

Income (loss) from operations

$

22,245

$

20,244

$

27,058

$

17,500

$

9,095

$

(17,620

)

$

78,522

Depreciation and amortization

25,313

2,869

13,849

9,397

8,505

38

59,971

Share-based compensation

1,164

190

1,411

638

1,097

5,782

10,282

Acquisition, integration, and other

costs

9,710

1,323

4,509

1,987

3,587

2,270

23,386

Disposal related costs

—

—

—

—

—

(350

)

(350

)

Lease asset impairments and other

charges

(179

)

94

—

—

76

—

(9

)

Goodwill impairment

—

—

—

—

—

—

—

Adjusted EBITDA

$

58,253

$

24,720

$

46,827

$

29,522

$

22,360

$

(9,880

)

$

171,802

Three months ended December

31, 2023

Technology &

Shopping

Gaming &

Entertainment

Health & Wellness

Connectivity

Cybersecurity &

Martech

Corporate (1)

Total

Revenues

$

105,222

$

49,230

$

106,449

$

57,038

$

71,946

$

—

$

389,885

Income (loss) from operations

$

25,621

$

22,147

$

24,169

$

17,281

$

5,430

$

(13,928

)

$

80,720

Depreciation and amortization

19,569

2,067

18,074

11,456

18,457

10

69,633

Share-based compensation

1,001

80

1,136

419

932

3,959

7,527

Acquisition, integration, and other

costs

4,114

551

3,421

1,109

420

34

9,649

Disposal related costs

180

—

—

—

—

195

375

Lease asset impairments and other

charges

(663

)

—

34

—

206

85

(338

)

Adjusted EBITDA

$

49,822

$

24,845

$

46,834

$

30,265

$

25,445

$

(9,645

)

$

167,566

_______________________

Figures above are net of inter-segment

revenues and operating costs and expenses.

(1)

Corporate includes certain unallocated

overhead costs that were historically presented within the Digital

Media reportable segment.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

Year ended December 31,

2024

Technology &

Shopping

Gaming &

Entertainment

Health & Wellness

Connectivity

Cybersecurity &

Martech

Corporate (1)

Total

Revenues

$

361,882

$

180,276

$

362,408

$

213,620

$

283,502

$

—

$

1,401,688

(Loss) income from operations

$

(71,072

)

$

54,001

$

67,207

$

79,374

$

54,961

$

(70,823

)

$

113,648

Depreciation and amortization

83,424

10,733

52,766

31,882

33,025

86

211,916

Share-based compensation

5,014

1,070

5,604

2,658

4,631

21,938

40,915

Acquisition, integration, and other

costs

18,554

2,727

9,788

(3,823

)

5,395

7,553

40,194

Disposal related costs

(24

)

—

—

—

20

205

201

Lease asset impairments and other

charges

223

93

15

—

756

274

1,361

Goodwill impairment

85,273

—

—

—

—

—

85,273

Adjusted EBITDA

$

121,392

$

68,624

$

135,380

$

110,091

$

98,788

$

(40,767

)

$

493,508

Year ended December 31,

2023

Technology &

Shopping

Gaming &

Entertainment

Health & Wellness

Connectivity

Cybersecurity &

Martech

Corporate (1)

Total

Revenues

$

330,557

$

168,821

$

361,923

$

211,518

$

291,209

$

—

$

1,364,028

(Loss) income from operations

$

(50,498

)

$

57,299

$

63,575

$

70,591

$

43,210

$

(51,566

)

$

132,611

Income from equity method investment,

net

—

—

—

—

—

(1,500

)

(1,500

)

Depreciation and amortization

83,271

10,368

59,870

31,793

52,618

(954

)

236,966

Share-based compensation

4,941

758

4,843

2,014

4,186

15,178

31,920

Acquisition, integration, and other

costs

4,452

2,441

10,004

2,820

887

396

21,000

Disposal related costs

633

—

—

—

202

1,382

2,217

Lease asset impairments and other

charges

1,019

—

510

—

471

245

2,245

Goodwill impairment

56,850

—

—

—

—

—

56,850

Adjusted EBITDA

$

100,668

$

70,866

$

138,802

$

107,218

$

101,574

$

(36,819

)

$

482,309

_______________________ Figures above are

net of inter-segment revenues and operating costs and expenses.

(1)

Corporate includes certain unallocated

overhead costs that were historically presented within the Digital

Media reportable segment.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS)

The following tables set forth a

reconciliation of Net income to Adjusted net income with

adjustments presented on after-tax basis:

Three months ended December

31,

2024

Per diluted share*

2023

Per diluted share*

Net income

$

64,087

$

1.43

$

63,422

$

1.29

Interest, net

60

—

(20

)

—

Loss on sale of business

—

—

276

0.01

Loss (income) on investments, net

942

0.02

(775

)

(0.02

)

Income from equity method investments,

net

(3,128

)

(0.07

)

(336

)

(0.01

)

Amortization

25,040

0.59

31,105

0.68

Share-based compensation

5,178

0.12

6,289

0.14

Acquisition, integration, and other

costs

18,265

0.43

7,011

0.15

Disposal related costs

(262

)

(0.01

)

238

0.01

Lease asset impairments and other

charges

7

—

(224

)

—

Dilutive effect of the convertible

debt

—

0.07

—

0.08

Adjusted net income

$

110,189

$

2.58

$

106,986

$

2.33

Years ended December

31,

2024

Per diluted share*

2023

Per diluted share*

Net income

$

63,047

$

1.42

$

41,503

$

0.89

Interest, net

132

—

5,881

0.13

Loss on sale of business

103

—

3,797

0.08

Loss on investments, net

8,019

0.18

21,103

0.45

(Income) loss from equity method

investments, net

(11,223

)

(0.25

)

8,204

0.18

Amortization

87,052

1.96

106,593

2.30

Share-based compensation

31,013

0.70

27,100

0.58

Acquisition, integration, and other

costs

29,805

0.67

13,498

0.29

Disposal related costs

195

—

1,538

0.03

Lease asset impairments and other

charges

1,045

0.02

1,295

0.04

Goodwill impairment

85,273

1.92

56,850

1.22

Adjusted net income

$

294,461

$

6.62

$

287,362

$

6.19

_______________________

*

The reconciliation of Net income per

diluted share to Adjusted net income per diluted share may not foot

since each is calculated independently.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

The following are the adjustments to

certain statement of operations items used to derive Adjusted net

income, which we believe provide useful information about our

operating results and enhance the overall understanding of past

financial performance and future prospects of the Company.

Three months ended December

31, 2024

GAAP amount

Adjustments

Adjusted

non-GAAP amount

Interest, net

(Gain) loss on sale of

business

(Gain) loss on investments,

net

(Income) loss from equity

method investments, net

Amortization

Share-based

compensation

Acquisition, integration, and

other costs

Disposal related costs

Lease asset impairments and

other charges

Goodwill impairment

Direct costs

$

(53,242

)

$

—

$

—

$

—

$

—

$

—

$

57

$

425

$

—

$

—

$

—

$

(52,760

)

Sales and marketing

$

(150,510

)

—

—

—

—

—

891

13,366

—

—

—

$

(136,253

)

Research, development, and engineering

$

(17,549

)

—

—

—

—

—

735

3,926

—

—

—

$

(12,888

)

General, administrative, and other related

costs

$

(53,029

)

—

—

—

—

—

8,599

5,669

(350

)

(9

)

—

$

(39,120

)

Depreciation and amortization

$

(59,971

)

—

—

—

—

34,965

—

—

—

—

—

$

(25,006

)

Goodwill impairment

$

—

—

—

—

—

—

—

—

—

—

—

$

—

Interest expense, net

$

(6,391

)

80

—

—

—

—

—

—

—

—

—

$

(6,311

)

Other income, net

$

2,438

—

—

—

—

—

—

(237

)

—

—

—

$

2,201

Income tax expense (1)

$

(13,610

)

(20

)

—

942

—

(9,925

)

(5,104

)

(4,884

)

88

16

—

$

(32,497

)

Loss from equity method investment,

net

$

3,128

—

—

—

(3,128

)

—

—

—

—

—

—

$

—

Total non-GAAP adjustments

$

60

$

—

$

942

$

(3,128

)

$

25,040

$

5,178

$

18,265

$

(262

)

$

7

$

—

_______________________

(1)

Adjusted effective tax rate was

approximately 22.8% for the three months ended December 31, 2024.

The calculation is based on a ratio where the numerator is the

adjusted income tax expense of $32,497 and the denominator is

$142,686, which equals adjusted net income of $110,189 plus

adjusted income tax expense.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

Three months ended December

31, 2023

GAAP amount

Adjustments

Adjusted

non-GAAP amount

Interest, net

(Gain) loss on sale of

business

(Gain) loss on investments,

net

(Income) loss from equity

method investments, net

Amortization

Share-based

compensation

Acquisition, integration, and

other costs

Disposal related costs

Lease asset impairments and

other charges

Goodwill impairment

Direct costs

$

(45,070

)

$

—

$

—

$

—

$

—

$

—

$

15

$

2,561

$

—

$

—

$

—

$

(42,494

)

Sales and marketing

$

(126,449

)

—

—

—

—

—

392

1,668

—

—

—

$

(124,389

)

Research, development, and engineering

$

(15,532

)

—

—

—

—

—

660

177

—

—

—

$

(14,695

)

General, administrative, and other related

costs

$

(52,483

)

—

—

—

—

—

6,460

5,243

375

(338

)

—

$

(40,743

)

Depreciation and amortization

$

(69,631

)

—

—

—

—

44,991

—

—

—

—

—

$

(24,640

)

Goodwill impairment

$

—

—

—

—

—

—

—

—

—

—

—

$

—

Interest expense, net

$

(2,251

)

(11

)

—

—

—

—

—

—

—

—

—

$

(2,262

)

Gain on investments, net

$

1,065

—

—

(1,065

)

—

—

—

—

—

—

—

$

—

Other loss, net

$

(3,486

)

—

422

—

—

—

459

—

—

—

$

(2,605

)

Income tax expense (1)

$

(12,962

)

(9

)

(146

)

290

—

(13,886

)

(1,238

)

(3,097

)

(137

)

114

—

$

(31,071

)

Income from equity method investment,

net

$

336

—

—

—

(336

)

—

—

—

—

—

—

$

—

Total non-GAAP adjustments

$

(20

)

$

276

$

(775

)

$

(336

)

$

31,105

$

6,289

$

7,011

$

238

$

(224

)

$

—

_______________________

(1)

Adjusted effective tax rate was

approximately 22.5% for the three months ended December 31, 2023.

The calculation is based on a ratio where the numerator is the

adjusted income tax expense of $31,071 and the denominator is

$138,057, which equals adjusted net income of $106,986 plus

adjusted income tax expense.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

Year ended December 31,

2024

GAAP amount

Adjustments

Adjusted non-GAAP

amount

Interest, net

(Gain) loss on sale of

business

(Gain) loss on investments,

net

(Income) loss from equity

method investments, net

Amortization

Share-based

compensation

Acquisition, integration, and

other costs

Disposal related costs

Lease asset impairments and

other charges

Goodwill impairment

Direct costs

$

(200,323

)

$

—

$

—

$

—

$

—

$

—

$

248

$

760

$

—

$

—

$

—

$

(199,315

)

Sales and marketing

$

(519,694

)

—

—

—

—

—

3,756

19,072

—

—

—

$

(496,866

)

Research, development, and engineering

$

(67,373

)

—

—

—

—

—

3,665

6,516

40

—

—

$

(57,152

)

General, administrative, and other related

costs

$

(203,461

)

—

—

—

—

—

33,246

13,846

161

1,361

—

$

(154,847

)

Depreciation and amortization

$

(211,916

)

—

—

—

—

117,748

—

—

—

—

—

$

(94,168

)

Goodwill impairment

$

(85,273

)

—

—

—

—

—

—

—

—

—

85,273

$

—

Interest expense, net

$

(13,988

)

176

—

—

—

—

—

—

—

—

—

$

(13,812

)

Loss on sale of business

$

(3,780

)

—

3,780

—

—

—

—

—

—

—

—

$

—

Loss on investments, net

$

(7,654

)

—

—

7,654

—

—

—

—

—

—

—

$

—

Other income (loss), net

$

4,968

—

(4,903

)

—

—

—

—

(774

)

—

—

—

$

(709

)

Income tax expense (1)

$

(41,370

)

(44

)

1,226

365

—

(30,696

)

(9,902

)

(9,615

)

(6

)

(316

)

—

$

(90,358

)

Income from equity method investment,

net

$

11,223

—

—

—

(11,223

)

—

—

—

—

—

—

$

—

Total non-GAAP adjustments

$

132

$

103

$

8,019

$

(11,223

)

$

87,052

$

31,013

$

29,805

$

195

$

1,045

$

85,273

_______________________

(1)

Adjusted effective tax rate was

approximately 23.5% for the year ended December 31, 2024. The

calculation is based on a ratio where the numerator is the adjusted

income tax expense of $90,358 and the denominator is $384,819,

which equals adjusted net income of $294,461 plus adjusted income

tax expense.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

Year ended December 31,

2023

GAAP amount

Adjustments

Adjusted non-GAAP

amount

Interest, net

(Gain) loss on sale of

business

(Gain) loss on investments,

net

(Income) loss from equity

method investments, net

Amortization

Share-based

compensation

Acquisition, integration, and

other costs

Disposal related costs

Lease asset impairments and

other charges

Goodwill impairment

Direct costs

$

(185,650

)

$

—

$

—

$

—

$

—

$

—

$

262

$

2,752

$

—

$

—

$

—

$

(182,636

)

Sales and marketing

$

(487,365

)

—

—

—

—

—

2,686

4,796

4

—

—

$

(479,879

)

Research, development, and engineering

$

(68,860

)

—

—

—

—

—

3,245

712

3

—

—

$

(64,900

)

General, administrative, and other related

costs

$

(195,726

)

—

—

—

(1,500

)

—

25,727

12,740

2,210

2,245

—

$

(154,304

)

Depreciation and amortization

$

(236,966

)

—

—

—

—

145,571

—

—

—

—

—

$

(91,395

)

Goodwill impairment

$

(56,850

)

—

—

—

—

—

—

—

—

—

56,850

$

—

Interest expense, net

$

(20,031

)

7,797

(538

)

—

—

—

—

—

—

—

—

$

(12,772

)

Loss on investments, net

$

(28,138

)

—

—

28,138

—

—

—

—

—

—

—

$

—

Other loss, net

$

(9,468

)

—

5,655

—

—

—

—

459

—

—

—

$

(3,354

)

Income tax expense (1)

$

(24,142

)

(1,916

)

(1,320

)

(7,035

)

375

(38,978

)

(4,820

)

(7,961

)

(679

)

(950

)

—

$

(87,426

)

Loss from equity method investment,

net

$

(9,329

)

—

—

—

9,329

—

—

—

—

—

—

$

—

Total non-GAAP adjustments

$

5,881

$

3,797

$

21,103

$

8,204

$

106,593

$

27,100

$

13,498

$

1,538

$

1,295

$

56,850

_______________________

(1)

Adjusted effective tax rate was

approximately 23.3% for the year ended December 31, 2023. The

calculation is based on a ratio where the numerator is the adjusted

income tax expense of $87,426 and the denominator is $374,788,

which equals adjusted net income of $287,362 plus adjusted income

tax expense.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

The following tables set forth a

reconciliation of Net cash provided by operating activities to Free

cash flow:

2024

Q1

Q2

Q3

Q4

YTD

Net cash provided by operating

activities

$

75,558

$

50,564

$

105,960

$

158,233

$

390,315

Less: Purchases of property and

equipment

(28,129

)

(25,504

)

(25,843

)

(27,159

)

(106,635

)

Free cash flow

$

47,429

$

25,060

$

80,117

$

131,074

$

283,680

2023

Q1

Q2

Q3

Q4

YTD

Net cash provided by operating

activities

$

115,307

$

39,728

$

72,808

$

92,119

$

319,962

Less: Purchases of property and

equipment

(30,017

)

(25,233

)

(27,226

)

(26,253

)

(108,729

)

Free cash flow

$

85,290

$

14,495

$

45,582

$

65,866

$

211,233

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224073132/en/

Alan Steier Investor Relations Ziff Davis, Inc.

investor@ziffdavis.com

Rebecca Wright Corporate Communications Ziff Davis, Inc.

press@ziffdavis.com

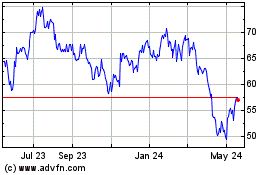

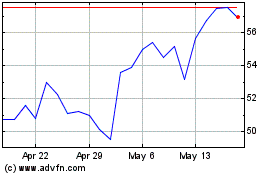

Ziff Davis (NASDAQ:ZD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ziff Davis (NASDAQ:ZD)

Historical Stock Chart

From Feb 2024 to Feb 2025