Yoshitsu Co., Ltd (“Yoshitsu” or the “Company”) (Nasdaq:

TKLF), a retailer and wholesaler of Japanese beauty and health

products, as well as other products in Japan, today announced its

unaudited financial results for the first six months of fiscal year

2022 ended September 30, 2021.

Mr. Mei Kanayama, the Principal Executive

Officer of Yoshitsu, commented, “We are pleased to announce that we

delivered solid financial results for the first six months of

fiscal year 2022 with total revenue of $112.3 million, growing

34.8% year over year, along with our increased global market

coverage and customer base, despite unfavorable market conditions.

The COVID-19 pandemic has caused (i) delays in exporting and

transporting as a result of supply chain constraints and (ii) a

sluggish number of overseas tourists, and, as a result, our

business was negatively impacted and our physical store sales

suffered significantly. The expansion of our business scale and

global market share, however, has led to the expansion of our

customer base, through which we believe we have established a

foundation for our financial growth. In addition, we have timely

adjusted our development strategy to target overseas online

markets, which has successfully offset the impact of reduced

in-store shopping due to travel restrictions. I would like to thank

our team for their efforts to overcome challenges during the

COVID-19 pandemic and their tremendous contributions fostering the

steady growth in our business, which we believe will allow us to

execute strategic plans to propel our future growth.”

Mr. Youichiro Haga, Principal Accounting and

Financial Officer of Yoshitsu, stated, “Throughout the first six

months of fiscal year 2022, the COVID-19 pandemic caused a surge in

various costs and a shortage of staff. However, we tackled these

challenges and achieved record revenue with our dedicated effort.

Our profitability has also grown consistently, with gross profit

rising by 24.1% and net income growing by 40.5%, respectively,

mainly because our overseas e-commerce business maintained

excellent growth momentum. The financial results indicate a good

start for 2022, with our global market expansion, increased

profitability, and consistent strategic execution that translated

into stronger financial results.”

First Six Months of Fiscal Year 2022

Financial and Operational Highlights

| |

For the Six Months Ended September 30, |

| (USD

millions, except per share data) |

2021 |

|

2020 |

|

% Change |

|

Revenue |

|

112.3 |

|

|

|

83.3 |

|

|

|

34.8 |

% |

|

Directly-operated physical stores |

|

5.2 |

|

|

|

20.6 |

|

|

|

(74.5 |

)% |

|

Online stores |

|

62.4 |

|

|

|

29.4 |

|

|

|

111.6 |

% |

|

Franchise stores and wholesale customers |

|

44.7 |

|

|

|

33.3 |

|

|

|

34.2 |

% |

| Gross

Profit |

|

18.3 |

|

|

|

14.8 |

|

|

|

24.1 |

% |

| Gross

Margin |

|

16.3 |

% |

|

|

17.7 |

% |

|

|

(1.4 |

)pp* |

| Income from

Operations |

|

4.6 |

|

|

|

3.7 |

|

|

|

25.8 |

% |

| Net

Income |

|

2.4 |

|

|

|

1.7 |

|

|

|

40.5 |

% |

| Earnings Per

Share |

|

0.09 |

|

|

|

0.06 |

|

|

|

36.4 |

% |

| * |

Notes: pp represents percentage points |

| |

|

| ● |

Revenue was $112.3 million, an increase of 34.8%

from $83.3 million for the same period of last year. |

| |

|

| ● |

Gross profit was $18.3 million, an increase of 24.1% from

$14.8 million for the same period of last year. |

| |

|

| ● |

Gross margin was 16.3%, compared with 17.7% for the same period of

last year. |

| |

|

| ● |

Net income was $2.4 million, an increase of 40.5% from $1.7 million

for the same period of last year. |

| |

|

| ● |

Basic and diluted earnings per share were $0.09, compared with

$0.06 for the same period of last year. |

| |

|

| ● |

As of February 28, 2022, the Company’s distribution channels

consisted of (i) 10 directly-operated physical stores in Japan,

(ii) 24 online stores through the Company’s websites and various

e-commerce marketplaces in Japan and China, and (iii) 9 franchise

stores in the U.S., 4 franchise stores in Canada, 4 franchise

stores in Hong Kong, 1 franchise store in the U.K., and

approximately 148 wholesale customers in Japan and other countries,

including China, the U.S., and Canada. |

First Six Months of Fiscal Year 2022 Financial

Results

Revenue

Revenue increased by $28.9 million, or 34.8%, to

$112.3 million for the six months ended September 30, 2021 from

$83.3 million for the same period of last year. The increase in

revenue was primarily due to increased revenue from online stores,

franchise stores, and wholesale customers, which was partially

offset by a decrease in revenue from directly-operated physical

stores.

| |

|

For the Six Months Ended September 30, |

|

| |

|

2021 |

|

|

2020 |

|

| ($ millions) |

|

Revenue |

|

|

Cost of Revenue |

|

|

Gross Margin |

|

|

Revenue |

|

|

Cost of Revenue |

|

|

Gross Margin |

|

| Directly-operated physical

stores |

|

|

5.2 |

|

|

|

4.4 |

|

|

|

15.5 |

% |

|

|

20.6 |

|

|

|

17.2 |

|

|

|

16.2 |

% |

| Online stores |

|

|

62.4 |

|

|

|

52.0 |

|

|

|

16.6 |

% |

|

|

29.4 |

|

|

|

23.3 |

|

|

|

21.0 |

% |

| Franchise stores and wholesale

customers |

|

|

44.7 |

|

|

|

37.5 |

|

|

|

16.1 |

% |

|

|

33.3 |

|

|

|

28.0 |

|

|

|

15.8 |

% |

| Total |

|

|

112.3 |

|

|

|

93.9 |

|

|

|

16.3 |

% |

|

|

83.3 |

|

|

|

68.5 |

|

|

|

17.7 |

% |

Revenue from directly-operated physical stores

decreased by $15.4 million, or 74.5%, to $5.2 million for the six

months ended September 30, 2021, from $20.6 million for the same

period of last year. The decrease was mainly attributable to the

state of emergency declared by the Japanese government in April

2021 in response to the COVID-19 pandemic. Due to this state of

emergency, almost all of the Company’s physical stores were

temporarily closed during the period between late April 2021 and

the end of May 2021. After the Company’s physical stores resumed

their business in June 2021, most of the Company’s physical stores

remained closed on Saturdays or Sundays, and the opening hours were

reduced by two to four hours to eight to nine hours per weekday.

From July 2021 to the present, most of the Company’s physical

stores resumed their nearly normal business with working hours

reduced by one to two hours every day. Despite this, the Company’s

business was still negatively affected during the six months ended

September 30, 2021.

Revenue from online stores increased by $33.0

million, or 111.6%, to $62.4 million for the six months ended

September 30, 2021, from $29.4 million for the same period of last

year. The increase was mainly attributable to the growing

popularity of online shopping, given that the e-commerce industry

has been rapidly expanding in recent years. In order to seize the

opportunities, the Company expanded its online store network by

opening new stores on multiple popular and reputable third-party

e-commerce marketplaces in overseas regions, while improving the

efficiency of its supply chain and storage and inventory

management. In order to reduce the Company’s operating expenses and

credit risk, the Company outsourced the entire operations of some

of its online stores to third-party companies, and sold products to

these third-party companies instead of to individual customers.

During the six months ended September 30, 2021, revenue from

overseas online sales, which was mainly from the China market,

increased by $33.9 million. The increase in overseas sales was in

line with the fast-growing purchasing power of the Chinese

consumers and the increasing popularity of high-quality Japanese

products among Chinese consumers. The increase was partially offset

by the decreased revenue from Japanese domestic online sales of

$1.0 million, which was mainly due to the closing of three

unprofitable domestic online stores.

Revenue from franchise stores and wholesale

customers increased by $11.4 million, or 34.2%, to $44.7 million

for the six months ended September 30, 2021, from $33.3 million for

the same period of last year. The increase in revenue from

franchise stores and wholesale customers was mainly attributable to

the increased sales to overseas franchise stores and wholesale

customers amounting to $11,446,738, offset by a slight decrease in

sales of $65,439 to the Company’s Japanese domestic wholesale

customers. With the improvement of the Company’s supply chain and

storage and logistic capacity, it added two new franchise stores

and increased its sales to overseas wholesale customers on a per

customer basis during the six months ended September 30, 2021.

Meanwhile, the Company’s Japanese domestic wholesales decreased

slightly during the six months ended September 30, 2021, due to the

impact of the COVID-19 pandemic.

Gross Profit and Gross Margin

Total cost of revenue increased by $25.4

million, or 37.1%, to $93.9 million for the six months ended

September 30, 2021, from $68.5 million for the same period of last

year.

Gross profit increased by $3.6 million, or

24.1%, to $18.3 million for six months ended September 30, 2021,

from $14.8 million for the same period of last year. Overall gross

margin decreased by 1.4 percentage points to 16.3% for the six

months ended September 30, 2021, from 17.7% for the same period of

last year.

Gross margin for directly-operated physical

stores, online stores, and franchise stores and wholesale customers

was 15.5%, 16.6%, and 16.1%, respectively, for the six months ended

September 30, 2021, compared to 16.2%, 21.0%, and 15.8%,

respectively, for the same period of last year.

Operating Expenses

Operating expenses consist of selling and

marketing expenses and general and administrative expenses, which

primarily include payroll, employee benefit expenses and bonus

expenses, shipping expenses, promotion and advertising expenses,

and other facility-related costs, such as store rent, utilities,

and depreciation.

Operating expenses increased by $2.6 million, or

23.5%, to $13.7 million for the six months ended September 30,

2021, from $11.1 million for the same period of last year. The

increase was primarily due to an increase in shipping expenses,

transaction commissions paid to third-party e-commerce marketplace

operators, consulting and professional service fees, promotion and

advertising expenses, payroll, and employee benefit expenses and

bonus expenses.

Interest Expense, net

Interest expense, net include interest expense

calculated at interest rate per loan agreements and loan service

costs, which are directly incremental to the loan agreements and

amortized over the loan periods. Interest expense, net increased by

$0.2 million, or 27.8%, to $1.0 million for the six months ended

September 30, 2021, from $0.8 million for the same period of last

year.

Other Income, net

Other income, net primarily includes tax

refunds, foreign exchange gain or loss, disposal gain or loss from

property and equipment, government subsidies, and other immaterial

income and expense items. Other income, net increased by $455,987,

or 23,761.7%, to $457,906 for the six months ended September 30,

2021, from $1,919 for the same period of last year. The increase

was mainly due to an increase of $226,853 received in the form of

government subsidies as the financial support during the COVID-19

pandemic, and a decrease in foreign exchange transaction loss by

$91,762 as a result of foreign exchange rate fluctuations, as well

as an increase of $79,257 in royalty fees collected from the

Company’s franchisees during the six months ended September 30,

2021.

Provision for Income Taxes

Provision for income taxes increased by $0.5

million, to $1.6 million for the six months ended September 30,

2021, from $1.1 million for the same period of last year. The

increase in provision for income taxes was mainly due to the

increased taxable income for the six months ended September 30,

2021. The effective income tax rate remained stable with a slight

increase from 39.5% to 39.8%.

Net Income

Net income was $2.4 million, or $0.09 per basic

and diluted share for the six months ended September 30, 2021,

compared to $1.7 million, or $0.06 per basic and diluted share for

the same period of last year.

Financial Condition

As of September 30, 2021, the Company had cash

of $7.0 million, compared to $16.4 million as of March 31, 2021. As

of September 30, 2021, the Company had accounts receivable balances

due from third parties and related parties of $47.8 million and

$5.2 million, respectively, compared to $43.7 million and $3.5

million as of March 31, 2021. The balance as of September 30, 2021

had been fully collected as of March 21, 2022. The collected

balances of such receivable provide cash available for use in the

Company’s operations as working capital, if necessary. As of

September 30, 2021, the Company had merchandise inventories of

$35.3 million, which the Company believes can be sold quickly,

based on its analysis of the current trend in demand for its

products, compared to $27.1 million as of March 31, 2021.

Net cash used in operating activities was $19.7

million for the six months ended September 30, 2021, mainly derived

from net income of $2.4 million for the period, and net changes in

the Company’s operating assets and liabilities, which mainly

included an increase in accounts receivable from third parties and

related parties of $6.3 million, which was in line with the

increase in revenue. Net cash used in operating activities was

$11.9 million for the six months ended September 30, 2020, mainly

derived from net income of $1.7 million for the period, and net

changes in the Company’s operating assets and liabilities, which

mainly included a decrease in accounts receivable from third

parties and related parties of $4.6 million, due to the increased

collection of outstanding account receivable balances, and an

increase in merchandise inventories of $17.0 million.

Net cash used in investing activities was $1.6

million for the six months ended September 30, 2021, mainly due to

the purchases of property and equipment of $1.5 million. Net cash

provided by investing activities was $4.1 million for the six

months ended September 30, 2020, mainly due to the collection of a

long-term loan made to a related party of $3.7 million, as well as

proceeds from disposal of property and equipment of $0.4

million.

Net cash provided by financing activities was

$11.9 million for the six months ended September 30, 2021, which

primarily consisted of proceeds from short-term borrowings of

$265.5 million, proceeds from long-term borrowings of $7.8 million,

and capital contributions of $1.8 million, partially offset by

repayments of short-term borrowings of $262.9 million and

repayments of long-term borrowings of $0.5 million. Net cash

provided by financing activities was $6.1 million for the six

months ended September 30, 2020, which primarily consisted of

proceeds from short-term borrowings of $150.4 million and proceeds

from long-term borrowings of $0.5 million, partially offset by

repayments of short-term borrowings of $143.9 million and

repayments of long-term borrowings of $0.6 million.

Recent Development

Completion of the Initial Public Offering

(“IPO”)

On January 13, 2022, the Company closed its IPO

of 6,250,000 American Depositary Shares (“ADSs”) at a public

offering price of $4.00 per ADS, which included 250,000 ADSs issued

pursuant to the partial exercise of the underwriters’

over-allotment option. Each ADS represents one ordinary share of

the Company. The closing for the sale of the over-allotment shares

took place on February 21, 2022. Gross proceeds of the Company’s

IPO, including the proceeds from the sale of the over-allotment

shares, totaled $25.0 million, before deducting underwriting

discounts and other related expenses. Net proceeds of the Company’s

IPO, including over-allotment shares, was approximately $22.7

million. In connection with the IPO, the Company’s ordinary shares

began trading on the Nasdaq Capital Market under the symbol

“TKLF” on January 18, 2022.

Conference Call Information

The Company will host an earnings conference

call at 8:00 am U.S. Eastern Time (9:00 pm Japan Standard

Time) on March 29, 2022. Dial-in details for the conference call

are as follows:

| Date: |

March 29, 2022 |

|

Time: |

8:00 am U.S. Eastern Time |

|

International: |

1-412-902-4272 |

| United

States Toll Free: |

1-888-346-8982 |

| Japan

Toll Free: |

0066-33-812830 |

|

Conference ID |

Yoshitsu Co., Ltd |

Please dial in at least 15 minutes before the

commencement of the call to ensure timely participation.

For those unable to participate, an audio replay

of the conference call will be available from approximately one

hour after the end of the live call until April 5, 2022. The

dial-in for the replay is +1-877-344-7529 within the United

States or +1-412-317-0088 internationally. The replay access

code is No. 9286519.

A live and archived webcast of the conference

call will also be available at the Company’s investor relations

website at https://www.ystbek.co.jp/irystbek/.

About Yoshitsu Co., Ltd

Headquartered in Tokyo, Japan, Yoshitsu Co., Ltd

is a retailer and wholesaler of Japanese beauty and health

products, as well as other products. The Company offers various

beauty products (including cosmetics, skin care, fragrance, and

body care products), health products (including over-the-counter

drugs, nutritional supplements, and medical supplies and devices),

and other products (including home goods, food, and alcoholic

beverages). The Company currently sells its products through

directly-operated physical stores, through online stores, and to

franchise stores and wholesale customers. For more information,

please visit the Company’s website at

https://www.ystbek.co.jp/irystbek/.

Forward-Looking Statements

All statements other than statements of

historical fact in this press release are forward-looking

statements, within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and as defined in the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements involve known and unknown risks and

uncertainties and are based on current expectations and projections

about future events and financial trends that the Company believes

may affect its financial condition, results of operations, business

strategy, and financial needs. Investors can identify these

forward-looking statements by words or phrases such as “may,”

“will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,”

“plan,” “believe,” “potential,” “continue,” “is/are likely to,” or

other similar expressions. The Company undertakes no obligation to

update forward-looking statements to reflect subsequent occurring

events or circumstances, or changes in its expectations, except as

may be required by law. Although the Company believes that the

expectations expressed in these forward-looking statements are

reasonable, it cannot assure you that such expectations will turn

out to be correct, and the Company cautions investors that actual

results may differ materially from the anticipated results and

encourages investors to review other factors that may affect its

future results in the Company’s registration statement and in its

other filings with the SEC.

For more information, please

contact:

Yoshitsu Co., Ltd Investor

Relations DepartmentEmail: ir@ystbek.co.jp

Ascent Investors Relations

LLCTina XiaoPresidentPhone: +1-917-609-0333Email:

tina.xiao@ascent-ir.com

YOSHITSU CO.,

LTDUNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS

| |

|

September 30, |

|

|

March 31, |

|

| |

|

2021 |

|

|

2021 |

|

| |

|

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

| Cash |

|

$ |

6,974,352 |

|

|

$ |

16,380,363 |

|

| Accounts receivable, net |

|

|

47,816,444 |

|

|

|

43,683,575 |

|

| Accounts receivable - related

parties, net |

|

|

5,174,870 |

|

|

|

3,499,070 |

|

| Merchandise inventories,

net |

|

|

35,271,643 |

|

|

|

27,122,504 |

|

| Due from related parties |

|

|

754,889 |

|

|

|

632,380 |

|

| Prepaid expenses and other

current assets, net |

|

|

5,617,715 |

|

|

|

3,926,590 |

|

| TOTAL CURRENT

ASSETS |

|

|

101,609,913 |

|

|

|

95,244,482 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

12,069,589 |

|

|

|

10,553,724 |

|

| Operating lease right-of-use

assets |

|

|

2,867,451 |

|

|

|

2,898,551 |

|

| Long term investment |

|

|

330,332 |

|

|

|

333,357 |

|

| Long-term prepaid expenses and

other non-current assets, net |

|

|

3,472,175 |

|

|

|

3,464,617 |

|

| Deferred tax assets, net |

|

|

431,389 |

|

|

|

447,124 |

|

|

TOTAL ASSETS |

|

$ |

120,780,849 |

|

|

$ |

112,941,855 |

|

| |

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

|

| Short-term borrowings |

|

$ |

66,278,370 |

|

|

$ |

65,084,803 |

|

| Current portion of long-term

borrowings |

|

|

1,273,583 |

|

|

|

645,570 |

|

| Accounts payable |

|

|

5,201,498 |

|

|

|

11,625,477 |

|

| Accounts payable - related

parties |

|

|

11,849 |

|

|

|

63,011 |

|

| Due to related parties |

|

|

695,309 |

|

|

|

235,774 |

|

| Deferred revenue |

|

|

165,474 |

|

|

|

186,046 |

|

| Income tax payable |

|

|

1,678,708 |

|

|

|

2,180,764 |

|

| Operating lease liabilities,

current |

|

|

814,599 |

|

|

|

811,299 |

|

| Finance lease liabilities,

current |

|

|

233,634 |

|

|

|

174,904 |

|

| Other payables and other

current liabilities |

|

|

2,349,972 |

|

|

|

627,179 |

|

| TOTAL CURRENT

LIABILITIES |

|

|

78,702,996 |

|

|

|

81,634,827 |

|

| |

|

|

|

|

|

|

|

|

| Operating lease liabilities,

non-current |

|

|

1,930,342 |

|

|

|

1,928,682 |

|

| Finance lease liabilities,

non-current |

|

|

585,184 |

|

|

|

414,428 |

|

| Long-term borrowings |

|

|

12,932,319 |

|

|

|

6,439,751 |

|

| Other non-current

liabilities |

|

|

429,729 |

|

|

|

289,730 |

|

| TOTAL

LIABILITIES |

|

$ |

94,580,570 |

|

|

$ |

90,707,418 |

|

| |

|

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| SHAREHOLDERS’

EQUITY |

|

|

|

|

|

|

|

|

|

Ordinary shares, 100,000,000 shares authorized; 30,000,054 shares

and 27,327,594 shares issued and outstanding as of September 30,

2021 and March 31, 2021, respectively* |

|

|

3,336,827 |

|

|

|

2,416,635 |

|

| Capital reserve |

|

|

902,224 |

|

|

|

- |

|

| Retained earnings |

|

|

22,640,447 |

|

|

|

20,221,300 |

|

| Accumulated other

comprehensive loss |

|

|

(679,219 |

) |

|

|

(403,498 |

) |

| TOTAL SHAREHOLDERS’

EQUITY |

|

|

26,200,279 |

|

|

|

22,234,437 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

$ |

120,780,849 |

|

|

$ |

112,941,855 |

|

YOSHITSU CO.,

LTDUNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

INCOME AND COMPREHENSIVE INCOME

| |

|

For the Six Months Ended September 30, |

|

| |

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

| REVENUE |

|

|

|

|

|

|

|

|

| Revenue - third

parties |

|

$ |

101,202,348 |

|

|

$ |

74,387,425 |

|

| Revenue - related parties |

|

|

11,054,444 |

|

|

|

8,919,507 |

|

|

Total revenue |

|

|

112,256,792 |

|

|

|

83,306,932 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

| Merchandise costs |

|

|

93,936,835 |

|

|

|

68,539,495 |

|

| Selling, general and

administrative expenses |

|

|

13,718,920 |

|

|

|

11,110,459 |

|

|

Total operating expenses |

|

|

107,655,755 |

|

|

|

79,649,954 |

|

| |

|

|

|

|

|

|

|

|

| INCOME FROM

OPERATIONS |

|

|

4,601,037 |

|

|

|

3,656,978 |

|

| |

|

|

|

|

|

|

|

|

| OTHER INCOME

(EXPENSE) |

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

(1,039,508 |

) |

|

|

(813,389 |

) |

| Other income, net |

|

|

457,906 |

|

|

|

1,919 |

|

|

Total other expenses, net |

|

|

(581,602 |

) |

|

|

(811,470 |

) |

| |

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME

TAX PROVISION |

|

|

4,019,435 |

|

|

|

2,845,508 |

|

| |

|

|

|

|

|

|

|

|

| PROVISION FOR INCOME

TAXES |

|

|

1,600,288 |

|

|

|

1,123,881 |

|

| |

|

|

|

|

|

|

|

|

| NET

INCOME |

|

|

2,419,147 |

|

|

|

1,721,627 |

|

| |

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE

INCOME (LOSS) |

|

|

|

|

|

|

|

|

| Foreign currency translation

gain (loss) |

|

|

(275,721 |

) |

|

|

403,724 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL COMPREHENSIVE

INCOME |

|

$ |

2,143,426 |

|

|

$ |

2,125,351 |

|

| |

|

|

|

|

|

|

|

|

| Earnings per ordinary

share - basic and diluted |

|

$ |

0.09 |

|

|

$ |

0.06 |

|

| Weighted average

shares - basic and diluted* |

|

|

27,526,689 |

|

|

|

26,727,540 |

|

| |

* |

Retrospectively restated for effect of share issuances on October

22, 2020 and a 294-for-1 forward split on August 18, 2021. |

YOSHITSU CO.,

LTDUNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

| |

|

For the Six Months Ended September 30, |

|

| |

|

2021 |

|

|

2020 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

| Net

Income |

|

$ |

2,419,147 |

|

|

$ |

1,721,627 |

|

| Adjustments to

reconcile net income to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

230,949 |

|

|

|

223,587 |

|

| Gain from disposal of property

and equipment |

|

|

(23,073 |

) |

|

|

(37,295 |

) |

| Reversal of doubtful

accounts |

|

|

- |

|

|

|

(49,833 |

) |

| Amortization of operating

lease right-of-use assets |

|

|

531,938 |

|

|

|

617,121 |

|

| Deferred tax provision |

|

|

11,883 |

|

|

|

2,841 |

|

| Changes in operating

assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(4,609,319 |

) |

|

|

10,859,565 |

|

| Accounts receivable - related

parties |

|

|

(1,737,698 |

) |

|

|

(6,296,767 |

) |

| Merchandise inventories |

|

|

(8,543,500 |

) |

|

|

(17,042,943 |

) |

| Prepaid expenses and other

current assets |

|

|

(2,594,691 |

) |

|

|

(3,361,028 |

) |

| Long term prepaid expenses and

other non-current assets |

|

|

(39,695 |

) |

|

|

(221,852 |

) |

| Accounts payable |

|

|

(6,429,975 |

) |

|

|

823,060 |

|

| Accounts payable - related

parties |

|

|

(51,483 |

) |

|

|

312,999 |

|

| Deferred revenue |

|

|

(19,218 |

) |

|

|

(191,517 |

) |

| Income tax payable |

|

|

(490,773 |

) |

|

|

(458,913 |

) |

| Other payables and other

current liabilities |

|

|

1,758,992 |

|

|

|

1,752,833 |

|

| Operating lease

liabilities |

|

|

(496,705 |

) |

|

|

(634,760 |

) |

| Other non-current

liabilities |

|

|

362,176 |

|

|

|

121,627 |

|

| Net cash used in

operating activities |

|

|

(19,721,045 |

) |

|

|

(11,859,648 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

| Purchase of property and

equipment |

|

|

(1,518,492 |

) |

|

|

(46,517 |

) |

| Proceeds from disposal of

property and equipment |

|

|

33,707 |

|

|

|

433,180 |

|

| Collections of repayments from

(advances made to) related parties |

|

|

(130,512 |

) |

|

|

850 |

|

| Collection of long-term loan

due from a related party |

|

|

- |

|

|

|

3,744,000 |

|

| Net cash provided by

(used in) investing activities |

|

|

(1,615,297 |

) |

|

|

4,131,513 |

|

| |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

| Capital contribution |

|

|

1,822,416 |

|

|

|

- |

|

| Proceeds from short-term

borrowings |

|

|

265,509,656 |

|

|

|

150,387,119 |

|

| Repayments of short-term

borrowings |

|

|

(262,859,584 |

) |

|

|

(143,865,006 |

) |

| Proceeds from long-term

borrowings |

|

|

7,834,600 |

|

|

|

468,000 |

|

| Repayments of long-term

borrowings |

|

|

(522,896 |

) |

|

|

(649,894 |

) |

| Advances received from related

parties |

|

|

469,824 |

|

|

|

(38,712 |

) |

| Repayment of obligations under

finance leases |

|

|

(338,043 |

) |

|

|

(244,565 |

) |

| Net cash provided by

financing activities |

|

|

11,915,973 |

|

|

|

6,056,942 |

|

| |

|

|

|

|

|

|

|

|

| Effect of exchange

rate fluctuation on cash |

|

|

14,358 |

|

|

|

160,707 |

|

| |

|

|

|

|

|

|

|

|

| Net decrease in

cash |

|

|

(9,406,011 |

) |

|

|

(1,510,486 |

) |

| Cash at beginning of

period |

|

|

16,380,363 |

|

|

|

7,529,219 |

|

| Cash at end of

period |

|

$ |

6,974,352 |

|

|

$ |

6,018,733 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental cash flow

information |

|

|

|

|

|

|

|

|

| Cash paid for income

taxes |

|

$ |

2,106,469 |

|

|

$ |

1,583,780 |

|

| Cash paid for

interest |

|

$ |

394,113 |

|

|

$ |

323,093 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental non-cash

operating activity |

|

|

|

|

|

|

|

|

| Purchase of property and

equipment financed under long-term payment |

|

$ |

23,234 |

|

|

$ |

- |

|

| Purchase of property and

equipment financed under finance leases |

|

$ |

340,615 |

|

|

$ |

- |

|

| Right of use assets obtained

in exchange for operating lease liabilities |

|

$ |

527,062 |

|

|

$ |

- |

|

YOSHITSU CO.,

LTDUNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

CHANGES IN SHAREHOLDERS’ EQUITY FOR THE SIX MONTHS

ENDED SEPTEMBER 30, 2021 AND 2020

|

|

|

Ordinary Shares |

|

|

Capital |

|

|

Retained |

|

|

Accumulated Other Comprehensive Income |

|

|

Total Shareholders’ |

|

|

|

|

Shares* |

|

|

Amount |

|

|

Reserve |

|

|

Earnings |

|

|

(Loss) |

|

|

Equity |

|

| Balance,

March 31, 2020 |

|

|

26,727,540 |

|

|

$ |

970,023 |

|

|

$ |

- |

|

|

$ |

14,698,699 |

|

|

$ |

294,942 |

|

|

$ |

15,963,664 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income for the period |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,721,627 |

|

|

|

- |

|

|

|

1,721,627 |

|

| Foreign currency translation

gain |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

403,724 |

|

|

|

403,724 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, September 30,

2020 |

|

|

26,727,540 |

|

|

$ |

970,023 |

|

|

$ |

- |

|

|

$ |

16,420,326 |

|

|

$ |

698,666 |

|

|

$ |

18,089,015 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, March 31,

2021 |

|

|

27,327,594 |

|

|

$ |

2,416,635 |

|

|

$ |

- |

|

|

$ |

20,221,300 |

|

|

$ |

(403,498 |

) |

|

$ |

22,234,437 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital contribution |

|

|

2,672,460 |

|

|

|

920,192 |

|

|

|

902,224 |

|

|

|

- |

|

|

|

- |

|

|

|

1,822,416 |

|

| Net income for the period |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,419,147 |

|

|

|

- |

|

|

|

2,419,147 |

|

| Foreign currency translation

loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(275,721 |

) |

|

|

(275,721 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance, September 30,

2021 |

|

|

30,000,054 |

|

|

$ |

3,336,827 |

|

|

$ |

902,224 |

|

|

$ |

22,640,447 |

|

|

$ |

(679,219 |

) |

|

$ |

26,200,279 |

|

| |

* |

Retrospectively restated for effect of share issuances on October

22, 2020 and a 294-for-1 forward split on August 18, 2021. |

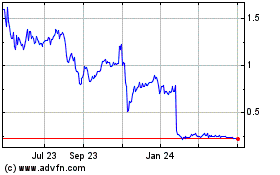

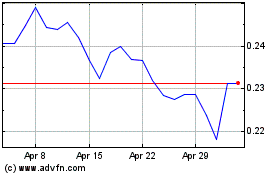

Yoshitsu (NASDAQ:TKLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yoshitsu (NASDAQ:TKLF)

Historical Stock Chart

From Apr 2023 to Apr 2024