Yield10 Bioscience, Inc. (Nasdaq:YTEN), an agricultural bioscience

company, today reported financial and operational results for the

three and nine months ended September 30, 2021.

“During the third quarter we continued to execute

against our strategic objectives for 2021," said Oliver Peoples,

Ph.D., Chief Executive Officer of Yield10 Bioscience. "We completed

the harvest of Camelina in our 2021 spring field tests and seed

scale up activities. We are pleased to report that following our

successful scale up of our two prototype PHA bioplastic Camelina

lines, we confirmed levels of PHA bioplastic in seed consistent

with results obtained in field tests last year. We plan to move

ahead with further scale up in 2022. The development of commercial

lines with higher PHA bioplastic seed content is ongoing, and we

are progressing outreach to partner prospects in the plastics

sector. Our observations across our broader field test program

suggest that our Camelina varieties displayed good heat tolerance

in a season in North America that was very challenging for many

commercial crops. This provides us with confidence that we will be

able to report our overall findings when analysis of seed and oil

samples are complete, which is anticipated in first quarter 2022.

We will use this data set to finalize the plans for our 2022 spring

field test and seed scale up program.

“We have obtained partial results to date from our

field tests of E3902, a CRISPR edited Camelina line, and they are

consistent with prior testing of this line. As a result, we will

soon begin contra season seed scale up of E3902 to enable the

production of additional seed inventory.

“Our elite winter Camelina varieties have the

potential to provide a source of oil for biodiesel production, a

rapidly growing market in the U.S. and Canada. Winter Camelina may

have important advantages in use as a rotation crop in geographies

which are more challenging for other oilseed crops or as a relay

crop with soybean or corn. In both cases processing the winter

Camelina seed would allow expansion of feedstock oil production to

meet growing demand for low carbon biofuels while increasing

protein production for feed. Our winter varieties performed well in

the 2020-2021 winter planting therefore we are moving forward with

the planting of our 2021-2022 winter field test and seed scale up

program in the U.S. and Canada. As part of this program, we will be

conducting field tests in various southern locations in the U.S. to

characterize the range of geography possible for achieving target

yields in our Camelina varieties.

“Our team is also making excellent progress

deploying herbicide tolerance traits into our elite Camelina

varieties and obtaining the data necessary to develop the

regulatory strategy and timelines for producing omega-3

(DHA+EPA).

“We remain focused on identifying opportunities for

expanded collaboration on the GRAIN platform and trait licenses, as

well as for Camelina seed products including feedstock oil for

biodiesel, omega-3 (DHA+EPA) oil and for PHA bioplastics. During

the third quarter, we worked with Forage Genetics to extend their

research license to traits for testing in forage sorghum. A top

priority for our team is to secure revenue generating

collaborations and non-dilutive funding as we continue to

demonstrate the significant potential of Camelina as a new crop,”

said Peoples.

COVID-19 Impact on Operations. The

Company has implemented business continuity plans to address the

COVID-19 pandemic and minimize disruptions to ongoing operations.

To date, despite the pandemic, we have been able to move forward

with the operational steps required to execute our 2021 field

trials in Canada and the United States. However, it is possible

that any potential future closures of our research facilities,

should they continue for an extended time, or delays in receiving

supplies and materials needed to conduct our field trials and

research could adversely impact our anticipated time frames for

evaluating and/or reporting data from our field trials and other

work we plan to accomplish during 2021 and beyond.

THIRD QUARTER 2021 FINANCIAL

OVERVIEW

Cash Position

Yield10 Bioscience is managed with an emphasis on

cash flow and deploys its financial resources in a disciplined

manner to achieve its key strategic objectives.

Yield10 ended the third quarter of 2021 with $18.5

million in unrestricted cash and investments; a net decrease of

$2.1 million from unrestricted cash and investments of $20.6

million reported as of June 30, 2021. Net cash used by operating

activities during the third quarter of 2021 was $2.0 million

compared to $2.1 million used in the third quarter of 2020. The

Company is revising its previous estimate of net cash usage for the

full year 2021 to a lower range of $10.0 - $10.5 million.

The Company's present capital resources are

expected to fund its planned operations into the second quarter of

2023. Yield10's ability to continue operations after its current

cash resources are exhausted is dependent on its ability to obtain

additional financing, including public or private equity financing,

secured or unsecured debt financing, receipt of additional

government research grants, as well as licensing or other

collaborative arrangements.

Operating Results

Grant revenues for the third quarters of 2021 and

2020 were $0.1 million and $0.2 million, respectively, and were

derived from the Company's Department of Energy sub-award with

Michigan State University. Research and development expenses

increased by $0.3 million from $1.3 million during the third

quarter of 2020 to $1.6 million in the third quarter of 2021. This

increase was primarily the result of higher employee compensation

costs, including higher stock-based compensation expense, the

Company's expanded 2021 crop field trials and related work at sites

in the U.S., Canada and Argentina, and from greater use of research

services provided by third parties. General and administrative

expenses increased by $0.4 million from $1.1 million during the

third quarter of 2020 to $1.5 million during the third quarter of

2021. This increase was primarily due to higher employee

compensation and benefit expenses, including stock-based

compensation expenses, and the greater use of consultants and other

third parties to assist with early stage business development

activities for the Company's Camelina plant varieties.

Yield10 reported a loss from operations of $3.1

million for the third quarter ended September 30, 2021,

compared to a loss from operations of $2.2 million for the same

quarter of 2020. The Company also reported a net loss after income

taxes of $2.4 million, or $0.49 per share, for the three months

ended September 30, 2021, in comparison to a net loss after

income taxes of $2.2 million, or $0.87 per share, for the three

months ended September 30, 2020. During the third quarter of

2021, Yield10 recognized a $0.7 million gain in other income

(expense) from its 2002 investment in Tepha, Inc. ("Tepha"), a

related party, as a result of Tepha's acquisition by Becton

Dickinson in July 2021.

For the nine months ended September 30, 2021,

the Company reported a loss from operations of $8.7 million in

comparison to a loss from operations of $7.0 million during the

same period of 2020. Net loss after taxes was $8.1 million and $7.6

million during the nine months ended September 30, 2021 and

2020, respectively. Year to date grant revenue earned through

September 30, 2021 and September 30, 2020 was $0.5

million and $0.6 million, respectively. Research and development

and general and administrative expenses were both $4.6 million

during the nine months ended September 30, 2021. In

comparison, research and development and general and administrative

expenses were $3.9 million and $3.7 million for the nine months

ended September 30, 2020. During the nine months ended

September 30, 2021, Yield10 recognized the $0.7 million gain

from its Tepha investment, as previously mentioned. During the

first nine months of 2020, Yield10 reported a loss of $1.0 million

within other income (expense) as a result of a change in the fair

value of its warrant liability. The Company also reported $0.3

million of income from its forgiven PPP loan during this nine-month

period.

Conference Call Information

Yield10 Bioscience management will host a

conference call at 4:30 p.m. (ET) today to discuss the third

quarter 2021 results. The Company also will provide an update on

the business and answer questions from the investor community. A

live webcast of the call with slides can be accessed through the

Company's website at www.yield10bio.com in the investor

relations events section. To participate in the call, dial

toll-free 877-709-8150 or 201-689-8354 (international).

To listen to a telephonic replay of the conference

call, dial toll-free 877-660-6853 or 201-612-7415 (international)

and enter pass code 13724014. The replay will be available until

November 24, 2021. In addition, the webcast will be archived on the

Company's website in the investor relations events section.

About Yield10 Bioscience

Yield10 Bioscience, Inc. is an agricultural

bioscience company that is using its differentiated trait gene

discovery platform, the “Trait Factory”, to develop improved

Camelina varieties for the production of proprietary seed products,

and to discover high value genetic traits for the agriculture and

food industries. Our goals are to efficiently establish a high

value seed products business based on developing superior varieties

of Camelina for the production of feedstock oils, nutritional oils,

and PHA bioplastics, and to license our yield traits to major seed

companies for commercialization in major row crops, including corn,

soybean and canola. Yield10 is headquartered in Woburn, MA and has

an Oilseeds Center of Excellence in Saskatoon, Canada.

For more information about the company, please

visit www.yield10bio.com, or follow the Company on Twitter,

Facebook and LinkedIn. (YTEN-E)

Safe Harbor for Forward-Looking

Statements

This press release contains forward-looking

statements which are made pursuant to the safe harbor provisions of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. The

forward-looking statements in this release do not constitute

guarantees of future performance. Investors are cautioned that

statements in this press release which are not strictly historical

statements, including, without limitation, expectations regarding

Yield10’s cash position, cash forecasts and runway, expectations

related to research and development activities, intellectual

property, the expected regulatory path for traits, reproducibility

of data from field tests, the timing of completion of additional

greenhouse and field test studies, the outcomes of 2021 spring and

2021-2022 winter field tests and seed scale-up activities, the

signing of research licenses and collaborations, including whether

the objectives of those collaborations will be met, whether the

Company will be able to generate proof points for traits in

development and advance business discussions around its Camelina

business plan, the potential impact on operations of the COVID-19

pandemic, and value creation as well as the overall progress of

Yield10 Bioscience, Inc., constitute forward-looking statements.

Such forward-looking statements are subject to a number of risks

and uncertainties that could cause actual results to differ

materially from those anticipated, including the risks and

uncertainties detailed in Yield10 Bioscience’s filings with the

Securities and Exchange Commission. Yield10 Bioscience assumes no

obligation to update any forward-looking information contained in

this press release or with respect to the announcements described

herein.

Contacts:

Yield10 Bioscience:Lynne H. Brum, (617) 682-4693,

LBrum@yield10bio.com

Investor Relations: Bret Shapiro, (561) 479-8566,

brets@coreir.comManaging Director, CORE IR

Media Inquiries: Eric Fischgrund,

eric@fischtankpr.comFischTank PR

(FINANCIAL TABLES FOLLOW)

YIELD10

BIOSCIENCE, INC.CONDENSED CONSOLIDATED

STATEMENTS OF

OPERATIONSUNAUDITED(In thousands,

except share and per share amounts)

| |

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Revenue: |

|

|

|

|

|

|

|

|

Grant revenue |

$ |

92 |

|

|

$ |

204 |

|

|

$ |

462 |

|

|

$ |

604 |

|

|

Total revenue |

92 |

|

|

204 |

|

|

462 |

|

|

604 |

|

| |

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

Research and development |

1,636 |

|

|

1,300 |

|

|

4,603 |

|

|

3,939 |

|

|

General and administrative |

1,547 |

|

|

1,098 |

|

|

4,583 |

|

|

3,664 |

|

|

Total expenses |

3,183 |

|

|

2,398 |

|

|

9,186 |

|

|

7,603 |

|

|

Loss from operations |

(3,091 |

) |

|

(2,194 |

) |

|

(8,724 |

) |

|

(6,999 |

) |

| |

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

Change in fair value of warrants |

— |

|

|

— |

|

|

— |

|

|

(957 |

) |

|

Loan forgiveness income |

— |

|

|

— |

|

|

— |

|

|

333 |

|

|

Gain on investment in related party |

700 |

|

|

— |

|

|

700 |

|

|

— |

|

|

Other income (expense), net |

(1 |

) |

|

37 |

|

|

(2 |

) |

|

85 |

|

|

Total other income (expense) |

699 |

|

|

37 |

|

|

698 |

|

|

(539 |

) |

|

Net loss from operations before income taxes |

(2,392 |

) |

|

(2,157 |

) |

|

(8,026 |

) |

|

(7,538 |

) |

|

Income tax provision |

(6 |

) |

|

(11 |

) |

|

(25 |

) |

|

(26 |

) |

|

Net loss |

$ |

(2,398 |

) |

|

$ |

(2,168 |

) |

|

$ |

(8,051 |

) |

|

$ |

(7,564 |

) |

| |

|

|

|

|

|

|

|

|

Basic and diluted net loss per share |

$ |

(0.49 |

) |

|

$ |

(0.87 |

) |

|

$ |

(1.72 |

) |

|

$ |

(3.69 |

) |

| |

|

|

|

|

|

|

|

|

Number of shares used in per share calculations: |

|

|

|

|

|

|

|

|

Basic and diluted |

4,873,248 |

|

|

2,492,274 |

|

|

4,681,292 |

|

|

2,050,726 |

|

YIELD10

BIOSCIENCE, INC.CONDENSED CONSOLIDATED

BALANCE SHEETSUNAUDITED(In

thousands, except share and per share amounts)

| |

September 30,2021 |

|

December 31,2020 |

|

Assets |

|

|

|

|

Current Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

14,618 |

|

|

$ |

3,423 |

|

|

Short-term investments |

3,904 |

|

|

6,279 |

|

|

Accounts receivable |

24 |

|

|

86 |

|

|

Unbilled receivables |

46 |

|

|

27 |

|

|

Prepaid expenses and other current assets |

462 |

|

|

527 |

|

|

Total current assets |

19,054 |

|

|

10,342 |

|

|

Restricted cash |

264 |

|

|

264 |

|

|

Property and equipment, net |

903 |

|

|

921 |

|

|

Right-of-use assets |

2,447 |

|

|

2,712 |

|

|

Other assets |

278 |

|

|

283 |

|

|

Total assets |

$ |

22,946 |

|

|

$ |

14,522 |

|

| |

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

Current Liabilities: |

|

|

|

|

Accounts payable |

$ |

45 |

|

|

$ |

60 |

|

|

Accrued expenses |

1,122 |

|

|

1,297 |

|

|

Current portion of lease liabilities |

499 |

|

|

457 |

|

|

Total current liabilities |

1,666 |

|

|

1,814 |

|

|

Lease liabilities, net of current portion |

2,783 |

|

|

3,163 |

|

|

Other long-term liabilities |

9 |

|

|

13 |

|

|

Total liabilities |

4,458 |

|

|

4,990 |

|

|

Commitments and contingencies |

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

Preferred stock ($0.01 par value per share); 5,000,000 shares

authorized; no shares issued or outstanding |

— |

|

|

— |

|

|

Common stock ($0.01 par value per share); 60,000,000 shares

authorized at September 30, 2021 and December 31, 2020; 4,877,987

and 3,334,048 shares issued and outstanding at September 30,

2021 and December 31, 2020, respectively |

49 |

|

|

33 |

|

|

Additional paid-in capital |

401,760 |

|

|

384,758 |

|

|

Accumulated other comprehensive loss |

(170 |

) |

|

(159 |

) |

|

Accumulated deficit |

(383,151 |

) |

|

(375,100 |

) |

|

Total stockholders’ equity |

18,488 |

|

|

9,532 |

|

|

Total liabilities and stockholders’ equity |

$ |

22,946 |

|

|

$ |

14,522 |

|

YIELD10

BIOSCIENCE, INC.CONDENSED CONSOLIDATED

STATEMENTS OF CASH

FLOWSUNAUDITED(in

thousands)

| |

Nine Months Ended September

30, |

|

|

2021 |

|

2020 |

|

Cash flows from operating activities |

|

|

|

|

Net loss |

$ |

(8,051 |

) |

|

$ |

(7,564 |

) |

|

Adjustments to reconcile net loss to cash used in operating

activities: |

|

|

|

|

Depreciation and amortization |

165 |

|

|

137 |

|

|

Change in fair value of warrants |

— |

|

|

957 |

|

|

Loan forgiveness income |

— |

|

|

(333 |

) |

|

Loss on disposal of fixed assets |

— |

|

|

206 |

|

|

Charge for 401(k) company common stock match |

100 |

|

|

95 |

|

|

Stock-based compensation |

1,175 |

|

|

506 |

|

|

Non-cash lease expense |

265 |

|

|

345 |

|

|

Deferred income tax provision |

24 |

|

|

33 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

62 |

|

|

(76 |

) |

|

Unbilled receivables |

(19 |

) |

|

(36 |

) |

|

Prepaid expenses and other assets |

60 |

|

|

92 |

|

|

Accounts payable |

(15 |

) |

|

(228 |

) |

|

Accrued expenses |

(192 |

) |

|

(324 |

) |

|

Lease liabilities |

(338 |

) |

|

(495 |

) |

|

Other liabilities |

(4 |

) |

|

15 |

|

|

Net cash used for operating activities |

(6,768 |

) |

|

(6,670 |

) |

| |

|

|

|

|

Cash flows from investing activities |

|

|

|

|

Purchase of property and equipment |

(147 |

) |

|

(42 |

) |

|

Proceeds from sale of property and equipment |

— |

|

|

10 |

|

|

Purchase of investments |

(3,874 |

) |

|

(6,290 |

) |

|

Proceeds from the maturity of short-term investments |

6,250 |

|

|

3,197 |

|

|

Net cash provided by (used by) investing activities |

2,229 |

|

|

(3,125 |

) |

| |

|

|

|

|

Cash flows from financing activities |

|

|

|

|

Proceeds from warrants exercised |

3,856 |

|

|

1,658 |

|

|

Proceeds from PPP loan |

— |

|

|

333 |

|

|

Proceeds from public offering, net of issuance costs |

11,993 |

|

|

5,367 |

|

|

Taxes paid on employees' behalf related to vesting of stock

awards |

(103 |

) |

|

(17 |

) |

|

Net cash provided by financing activities |

15,746 |

|

|

7,341 |

|

| |

|

|

|

|

Effect of exchange rate changes on cash, cash equivalents and

restricted cash |

(12 |

) |

|

(46 |

) |

| |

|

|

|

|

Net increase (decrease) in cash, cash equivalents and restricted

cash |

11,195 |

|

|

(2,500 |

) |

|

Cash, cash equivalents and restricted cash at beginning of

period |

3,687 |

|

|

5,749 |

|

|

Cash, cash equivalents and restricted cash at end of period |

$ |

14,882 |

|

|

$ |

3,249 |

|

| |

|

|

|

|

Supplemental disclosure of non-cash

information: |

|

|

|

|

Offering costs remaining in accrued expenses |

$ |

— |

|

|

$ |

63 |

|

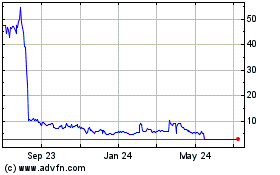

Yield10 Bioscience (NASDAQ:YTEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

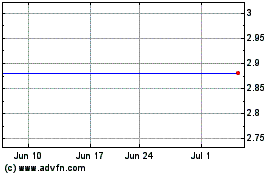

Yield10 Bioscience (NASDAQ:YTEN)

Historical Stock Chart

From Apr 2023 to Apr 2024