| | | | | |

PROSPECTUS SUPPLEMENT NO. 7 (TO PROSPECTUS DATED MAY 6, 2022) | Filed Pursuant to Rule 424(b)(3)

Registration No. 333-264258 |

_____________________________

This prospectus supplement updates and supplements the prospectus dated May 6, 2022 (the “Prospectus”), which forms a part of our Registration Statement on Form S-1, as amended (Registration No. 333-264258). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission on October 26, 2022 (the “Current Report on Form 8-K”). Accordingly, we have attached the Current Report on Form 8-K to this prospectus supplement.

You should read this prospectus supplement in conjunction with the Prospectus, including any amendments or supplements to it. This prospectus supplement is not complete without, and may not be delivered or used except in conjunction with, the Prospectus, including any amendments or supplements to it. This prospectus supplement is qualified by reference to the Prospectus, except to the extent that the information provided by this prospectus supplement supersedes information contained in the Prospectus. You should not assume that the information provided in this prospectus supplement, the Prospectus or any prior prospectus supplement is accurate as of any date other than their respective dates. Neither the delivery of this prospectus supplement, the Prospectus, or any prior prospectus supplement, nor any sale made hereunder or thereunder, shall under any circumstances create any implication that there has been no change in our affairs since the date of this prospectus supplement, or that the information contained in this prospectus supplement, the Prospectus or any prior prospectus supplement is correct as of any time after the date of that information.

Our Common Stock and Public Warrants are listed on The Nasdaq Capital Market (“Nasdaq”) under the symbols “XOS” and “XOSWW,” respectively. On October 25, 2022, the closing price of our Common Stock was $1.05 and the closing price for our Public Warrants was $0.096.

_____________________________

See the section entitled “Risk Factors” beginning on page 8 of the Prospectus, as updated and supplemented by the section entitled “Risk Factors” in this prospectus supplement and under similar headings in any further amendments or supplements to the prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is October 26, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 20, 2022

XOS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39598 | | 98-1550505 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

3550 Tyburn Street

Los Angeles, California | | 90065 |

| (Address of principal executive offices) | | (Zip Code) |

(818) 316-1890

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | XOS | | Nasdaq Global Market |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | | XOSWW | | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of Director

On October 20, 2022, Sara Mathew informed Xos, Inc. (the "Company") of her resignation as a member of the board of directors of the Company (the "Board"), effective immediately. Ms. Mathew's resignation was due to her desire to devote more time to her other business interests and was not the result of any disagreements with the Company on any matter regarding the Company’s operations, policies or practices. Ms. Mathews served as a member of the Audit Committee of the Board (the "Audit Committee").

In connection with her resignation, 50,289 of Ms. Mathew's unvested restricted stock units granted under the Company's 2021 Equity Incentive Plan will vest.

Appointment of Director

On October 20, 2022, the Board, upon recommendation of the Nominating and Corporate Governance Committee of the Board (the "Nominating Committee"), voted to appoint Stuart Bernstein as a Class III Director to fill the vacancy created by Ms. Mathew's resignation, effective immediately. Mr. Bernstein will serve until the Company's 2024 Annual Meeting, and until his successors have been duly elected and qualified, or until his earlier death, resignation or removal. The Board appointed Mr. Bernstein to the Audit Committee and Compensation Committee of the Board. The Board has determined that Mr. Bernstein qualifies as an independent director under the independence requirements set forth under Rule 5605(a)(2) of the Nasdaq Rules and listing standards.

There are no arrangements or understandings between Mr. Bernstein and any other persons pursuant to which he was selected as a director and there are no family relationships between Mr. Bernstein and any director or other executive officer of the Company.

In February 2021 and concurrently with the execution of the Agreement and Plan of Merger, as amended on May 14, 2021, by and among the Company (formerly known as NextGen Acquisition Corporation (“NextGen”)), Sky Merger Sub I, Inc. and Xos, Inc., (now known as Xos Fleet, Inc.), the Company entered into a Subscription Agreement with Mr. Bernstein, who was an advisor to NextGen and an affiliate of NextGen Sponsor LLC, pursuant to which he subscribed for 50,000 shares of the Company’s common stock, par value $0001, (the “Common Stock”.) for $500,000. Mr. Bernstein received the shares of the Company’s Common Stock on August 20, 2021.

In connection with his appointment to the Board and pursuant to the Company’s amended and restated non-employee director compensation policy (filed as Exhibit 10.1 of the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2022 filed with the Securities and Exchange Commission (the "SEC") on August 11, 2022), Mr. Bernstein will receive the standard compensation received by non-employee directors serving on the Company’s Board. Pursuant to the standard compensation program, an initial award of restricted stock units with an aggregate value of $146,000, based on the 30-day average closing price of the Company’s Common Stock ending five days prior to the date of grant, will be granted on November 10, 2022. This represents a pro-rated amount of the non-employee director grant for his partial service in 2022 and 2023.

Additionally, the Company entered into its standard indemnification agreement with Mr. Bernstein (filed as Exhibit 10.5 to the Company’s Current Report on Form 8-K filed with the SEC on August 26, 2021).

Item 7.01 Regulation FD Disclosure.

On October 21, 2022, the Company issued a press release announcing the appointment of Mr. Bernstein to the Board. A copy of the Company’s press release announcing the appointment is attached hereto as Exhibit 99.1.

The information in this Item 7.01, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

| | | | | | | | |

Exhibit No. | | Description |

99.1 | | |

| 104 | | iXBRL language is updated in the Exhibit Index |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 26, 2022

| | | | | | | | |

| XOS, INC. |

| | |

| By: | /s/ Kingsley Afemikhe |

| | Kingsley Afemikhe |

| | Chief Financial Officer |

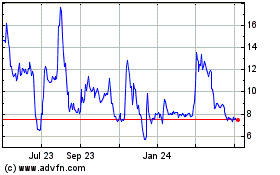

Xos (NASDAQ:XOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Xos (NASDAQ:XOS)

Historical Stock Chart

From Apr 2023 to Apr 2024