Xometry, Inc. (NASDAQ:XMTR), a leading AI-enabled marketplace for

on-demand manufacturing, today reported financial results for the

third quarter ended September 30, 2021, including the following

highlights:

- Revenue grew 35% year-over-year from $42.0 million as of

September 30, 2020 to $56.7 million as of September 30, 2021.

Revenue increased 77% year-over-year in Q3 2021, when excluding

sales of masks by one customer from both periods.

- Gross profit increased 42% year-over-year to $14.5 million as

of September 30, 2021, as compared to $10.2 million as of September

30, 2020. Gross profit margin improved to 25.6% as of

September 30, 2021 from 24.3% as of September 30,

2020.

- Active Buyers increased 61% from 16,266 as of September 30,

2020 to 26,187 as of September 30, 2021.

- Accounts with Last Twelve-Months Spend of at least $50,000

increased 67% from 361 as of September 30, 2020 to 603 as of

September 30, 2021.

- Percentage of Revenue from Existing Accounts was 95%,

consistent with the prior quarter.

- Net loss was $14.7 million for the quarter, an increase of $8.5

million year-over-year, and Adjusted EBITDA was negative $10.0

million for the quarter, reflecting an increase of $5.4 million

year-over-year. Net loss for Q3 2021 includes $2.3 million of

stock-based compensation expense and $1.2 million of expense for

charitable contributions.

- Xometry expects business momentum to continue and is providing

guidance for Q4 2021 of 58%-63% revenue growth year-over-year. Q4

2021 revenue when excluding sales of masks by one customer from

both periods, is expected to be 75%-80% year-over-year.

- Cash and cash equivalents and marketable securities were $324.5

million as of September 30, 2021.

“Xometry’s third quarter 2021 performance was

outstanding as we saw accelerated demand from larger customers

across many verticals on our platform”, said Randy Altschuler,

Xometry’s CEO. “Active Buyer growth was robust at 61%

year-over-year and Accounts with Last Twelve Month Spend of at

least $50,000 increased 67% year-over-year. Excluding the

sales of masks by one customer which accounted for significant

revenue in the prior year, third quarter revenue accelerated

significantly to 77% growth year-over-year. Additionally, we

delivered significant improvement in gross margin on a

year-over-year and quarter-over-quarter basis driven by AI based

pricing and expanding seller network.”

“We remain in the early innings of the secular

digitization of the manufacturing industry, one of the largest

industries in the world. We continue to grow our great team to

build out the leading global on-demand manufacturing marketplace

including the recent acquisitions of Big Blue Saw and

FactoryFour. Big Blue Saw extends our marketplace capabilities

in water jet and laser cutting while FactoryFour will provide a

SaaS based solution to help manufacturers in the Xometry

marketplace improve lead times and make strong, data-driven

decisions through real-time production tracking. We expect

these acquisitions to make an impact on our product offering

beginning in 2022.”

“Marketplace trends remain robust in Q4 and we

expect revenue growth of 75-80% year-over-year excluding sales of

masks by one customer in both periods. Our machine learning

pricing algorithms continue to drive improving gross margins and we

expect that trend to continue with sequential growth in gross

margins from Q3 to Q4.”

Unaudited Financial Summary

(In thousands, except per share amounts)

|

|

|

For the Three Months Ended September 30, |

|

|

|

|

|

For the Nine Months Ended September 30, |

|

|

|

|

|

|

|

2021 |

|

|

2020 |

|

|

% Change |

|

|

2021 |

|

|

2020 |

|

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

56,727 |

|

|

$ |

41,953 |

|

|

|

35 |

% |

|

$ |

151,238 |

|

|

$ |

103,425 |

|

|

|

46 |

% |

| Gross

profit |

|

|

14,494 |

|

|

|

10,175 |

|

|

|

42 |

% |

|

|

36,205 |

|

|

|

23,806 |

|

|

|

52 |

% |

| Net

loss |

|

|

(14,711 |

) |

|

|

(6,183 |

) |

|

|

138 |

% |

|

|

(37,476 |

) |

|

|

(20,909 |

) |

|

|

79 |

% |

| EPS—basic

and diluted |

|

|

(0.33 |

) |

|

|

(1.99 |

) |

|

|

(83 |

)% |

|

|

(1.87 |

) |

|

|

(3.98 |

) |

|

|

(53 |

)% |

| Adjusted

EBITDA (Non-GAAP)(1) |

|

|

(10,024 |

) |

|

|

(4,605 |

) |

|

|

118 |

% |

|

|

(27,905 |

) |

|

|

(16,910 |

) |

|

|

65 |

% |

(1) These non-GAAP financial measures, and

reasons why we believe these non-GAAP financial measures are

useful, are described below and reconciled to their most directly

comparable GAAP measures in the accompanying tables.

Key Operating Metrics:

|

|

|

As of September 30, |

|

|

|

|

2021 |

|

|

2020 |

|

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

Active Buyers(2) |

|

|

26,187 |

|

|

|

16,266 |

|

|

|

61 |

% |

| Percentage

of Revenue from Existing Accounts(2) |

|

|

95 |

% |

|

|

96 |

% |

|

|

(1 |

)% |

| Accounts

with Last Twelve-Months Spend of at Least $50,000(2) |

|

|

603 |

|

|

|

361 |

|

|

|

67 |

% |

(2) Amounts shown for Active Buyers and

Accounts with Last Twelve-Months Spend of at Least $50,000 are as

of September 30, 2021 and 2020, and Percentage of Revenue from

Existing Accounts is presented for the quarters ended September 30,

2021 and 2020.

Subsequent to Third Quarter

2021

On November 1, 2021, the Company acquired certain

assets and liabilities from Big Blue Saw LLC, subject to an Asset

Purchase Agreement for total consideration of $2.5 million. The

total consideration includes cash consideration at closing of $1.25

million, $250,000 of Class A common stock at closing and contingent

consideration of $1.0 million.

On November 5, 2021, the Company acquired certain

assets and liabilities from Fusiform, Inc. (dba FactoryFour),

subject to an Asset Purchase Agreement for total consideration of

$6.3 million. The total consideration includes cash consideration

at closing of $1.9 million, $1.9 million of Class A common stock at

closing and contingent consideration of $2.5 million.

Financial Guidance and

Outlook:

| |

|

Q4 2021 |

|

| |

|

(in millions) |

|

| |

|

Low |

|

|

|

High |

|

|

Revenue |

|

$ |

60.0 |

|

|

|

$ |

62.0 |

|

| Adjusted

EBITDA |

|

$ |

(12.0 |

) |

|

|

$ |

(11.0 |

) |

- In 2020, one customer, that produces masks, accounted for

approximately 10% of our revenue in Q4 2020. Excluding revenue from

that one customer, growth is expected to be between 75%-80% for Q4

2021, as compared to Q4 2020.

- The acquisitions of Big Blue Saw and FactoryFour are not

expected to materially impact our Q4 2021 revenue and Adjusted

EBITDA guidance.

Use of Non-GAAP Financial

Measures

To supplement its consolidated financial

statements, which are prepared and presented in accordance with

generally accepted accounting principles in the United States of

America (“GAAP”), Xometry, Inc. ("Xometry", the "Company", "we" or

"our") uses Adjusted EBITDA, a non-GAAP financial measure, as

described below. This non-GAAP financial measure is presented to

enhance the user’s overall understanding of Xometry’s financial

performance and should not be considered a substitute for, or

superior to, the financial information prepared and presented in

accordance with GAAP. The non-GAAP financial measure presented in

this release, together with the GAAP financial results, are the

primary measures used by the Company’s management and board of

directors to understand and evaluate the Company’s financial

performance and operating trends, including period-to-period

comparisons, because they exclude certain expenses and gains that

management believes are not indicative of the Company’s core

operating results. Management also uses this measure to prepare and

update the Company’s short and long term financial and operational

plans, to evaluate investment decisions, and in its discussions

with investors, commercial bankers, equity research analysts and

other users of the Company’s financial statements. Accordingly, the

Company believes that this non-GAAP financial measure provides

useful information to investors and others in understanding and

evaluating the Company’s operating results in the same manner as

the Company’s management and in comparing operating results across

periods and to those of Xometry’s peer companies. In addition, from

time to time we may present adjusted information (for example,

revenue growth) to exclude the impact of certain gains, losses or

other changes that affect period-to-period comparability of our

operating performance.

The use of non-GAAP financial measures has certain

limitations because they do not reflect all items of income and

expense, or cash flows, that affect the Company’s financial

performance and operations. An additional limitation of non-GAAP

financial measures is that they do not have standardized meanings,

and therefore other companies, including peer companies, may use

the same or similarly named measures but exclude or include

different items or use different computations. Management

compensates for these limitations by reconciling these non-GAAP

financial measures to their most comparable GAAP financial measures

in the tables captioned “Reconciliations of Non-GAAP Financial

Measures” included at the end of this release. Investors and others

are encouraged to review the Company’s financial information in its

entirety and not rely on a single financial measure.

Key Terms for our Key Metrics and Non-GAAP

Financial Measures

The Company defines Adjusted earnings

before interest, taxes, depreciation and amortization (Adjusted

EBITDA) as net income (loss) excluding interest income

(expense), income tax (expense) benefit, and certain other non-cash

or non-recurring items impacting net loss from time to time,

principally comprised of depreciation and amortization, stock-based

compensation, charitable contributions and impairment charges.

Management believes that the exclusion of certain expenses and

gains in calculating Adjusted EBITDA provides a useful measure for

period-to-period comparisons of the Company’s underlying core

revenue and operating costs that is focused more closely on the

current costs necessary to operate the Company’s businesses, and

reflects its ongoing business in a manner that allows for

meaningful analysis of trends. Management also believes that

excluding certain non-cash charges can be useful because the

amounts of such expenses is the result of long-term investment

decisions made in previous periods rather than day-to-day operating

decisions.

Active Buyers: The Company

defines “buyers” as individuals who have placed an order to

purchase on-demand parts or assemblies on our platform. The

Company defines Active Buyers as the number of buyers who have made

at least one purchase on our marketplace during the last twelve

months.

Percentage of Revenue from Existing

Accounts: The Company defines “accounts” as an individual

entity, such as a sole proprietor with a single buyer or corporate

entities with multiple buyers, having purchased at least one part

on our marketplace. The Company defines an existing account as

an account where at least one buyer has made a purchase on our

marketplace.

Accounts with Last Twelve-Month Spend of

At Least $50,000: The Company defines Accounts with

Last Twelve-Month Spend of At Least $50,000 as an account that has

spent at least $50,000 on our marketplace in the most recent

twelve-month period.

About Xometry

Xometry, Inc. (NASDAQ: XMTR) is a

leading AI-enabled marketplace for on demand

manufacturing, transforming one of the largest industries in the

world. Xometry uses its proprietary technology to create a

marketplace that enables buyers to efficiently source on-demand

manufactured parts and assemblies, and empowers sellers of

manufacturing services to grow their businesses. Xometry's buyers

range from self-funded startups to Fortune 100 companies. Learn

more at www.xometry.com or follow @xometry.

Conference Call

The Company will discuss its third quarter and

year to date financial results during a teleconference

on 11/10/2021, at 5:00 PM EST/2:00 PM PT. The

conference call can be accessed in the U.S. at

877-313-2061 or outside the U.S. at 470-495-9537 with the

conference ID# 8195399. A live audio webcast of the call will

also be available simultaneously at investors.xometry.com.

Following completion of the call, a recorded replay of the

teleconference will be available in the investor relations section

of Xometry's website. The earnings webcast presentation will be

archived within the Investor Relations section of Xometry's

website.

Cautionary Information Regarding

Forward-Looking Statements This press release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, which statements

involve substantial risks and uncertainties. Forward-looking

statements generally relate to future events or our future

financial or operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

“may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,”

“would,” “intend,” “target,” “project,” “contemplate,” “believe,”

“estimate,” “predict,” “potential” or “continue” or the negative of

these words or other similar terms or expressions that concern our

expectations, strategy, plans or intentions. Forward-looking

statements in this press release include, but are not limited to,

our beliefs regarding our financial position and operating

performance, including our outlook and guidance for the third

quarter and full year 2021, and demand for our marketplace in

general. Our expectations and beliefs regarding these matters may

not materialize, and actual results in future periods are subject

to risks and uncertainties that could cause actual results to

differ materially from those projected, including risks and

uncertainties related to: competition, managing our growth,

financial performance, including the impact of the COVID-19

pandemic on our business and operations and our ability to forecast

our performance due to our limited operating history and the

COVID-19 pandemic, investments in new products or offerings, our

ability to attract buyers and sellers to our marketplace, legal

proceedings and regulatory matters and developments, any future

changes to our business or our financial or operating model, and

our brand and reputation. The forward-looking statements contained

in this press release are also subject to other risks and

uncertainties that could cause actual results to differ from the

results predicted, including those more fully described in our

filings with the SEC, including our Quarterly Report on Form 10-Q

for the period ended September 30, 2021. All forward-looking

statements in this press release are based on information available

to Xometry and assumptions and beliefs as of the date hereof, and

we disclaim any obligation to update any forward-looking

statements, except as required by law.

(Tables Follow)

|

Investor Contact: |

Media Contact: |

| Shawn Milne

VP Investor Relations 240-335-8132 shawn.milne@xometry.com |

Ted Weismann

fama PR for Xometry 617-396-7740 xometry@famapr.com |

Xometry, Inc. and Subsidiaries

Unaudited Condensed Consolidated Balance Sheets (In thousands,

except share and per share data)

|

|

|

September 30, 2021 |

|

|

December 31, 2020 |

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

57,778 |

|

|

$ |

59,874 |

|

|

Marketable securities |

|

|

266,739 |

|

|

|

— |

|

|

Accounts receivable, less allowance for doubtful accounts of $0.7

million as of September 30, 2021 and $0.6 million as of December

31, 2020, respectively |

|

|

25,157 |

|

|

|

14,574 |

|

|

Inventory |

|

|

1,427 |

|

|

|

2,294 |

|

|

Prepaid expenses |

|

|

4,988 |

|

|

|

913 |

|

|

Total current assets |

|

|

356,089 |

|

|

|

77,655 |

|

|

Property and equipment, net |

|

|

8,615 |

|

|

|

6,113 |

|

|

Operating lease right-of-use assets |

|

|

3,101 |

|

|

|

1,922 |

|

|

Other assets |

|

|

204 |

|

|

|

788 |

|

|

Intangible assets, net |

|

|

1,455 |

|

|

|

1,652 |

|

|

Goodwill |

|

|

833 |

|

|

|

833 |

|

|

Total assets |

|

$ |

370,297 |

|

|

$ |

88,963 |

|

|

Liabilities, convertible preferred stock and stockholders’

equity |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

5,198 |

|

|

$ |

5,640 |

|

|

Accrued expenses |

|

|

17,487 |

|

|

|

13,606 |

|

|

Contract liabilities |

|

|

3,379 |

|

|

|

2,355 |

|

|

Operating lease liabilities, current portion |

|

|

1,108 |

|

|

|

1,013 |

|

|

Finance lease liabilities, current portion |

|

|

5 |

|

|

|

14 |

|

|

Short-term debt |

|

|

— |

|

|

|

15,753 |

|

|

Total current liabilities |

|

|

27,177 |

|

|

|

38,381 |

|

|

Operating lease liabilities, net of current portion |

|

|

2,197 |

|

|

|

1,118 |

|

|

Total liabilities |

|

|

29,374 |

|

|

|

39,499 |

|

|

Commitments and contingencies (Note 12) |

|

|

|

|

|

|

|

Convertible preferred stock |

|

|

|

|

|

|

|

Convertible preferred stock, $0.000001 par value, Seed-1, Seed-2,

Series A-1, Series A-2, Series B, Series C, Series D and Series E.

Authorized; zero shares and 27,970,966 shares, zero shares and

27,758,941 shares issued and outstanding as of September 30, 2021

and December 31, 2020, respectively |

|

|

— |

|

|

|

160,713 |

|

|

Stockholders’ equity (deficit) |

|

|

|

|

|

|

|

Preferred stock, $0.000001 par value. Authorized; 50,000,000 shares

and zero shares; zero shares issued and outstanding as of September

30, 2021 and December 31, 2020, respectively |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.000001 par value. Authorized; zero shares and

42,000,000 shares; zero shares and 7,755,782 shares issued and

outstanding as of September 30, 2021 and December 31, 2020,

respectively |

|

|

— |

|

|

|

— |

|

|

Class A Common stock, $0.000001 par value. Authorized; 750,000,000

shares and zero shares 41,714,711 shares and zero shares issued and

outstanding as of September 30, 2021 and December 31, 2020,

respectively |

|

|

— |

|

|

|

— |

|

|

Class B Common stock, $0.000001 par value. Authorized; 5,000,000

shares and zero shares, 2,676,154 shares and zero shares issued and

outstanding as of September 30, 2021 and December 31, 2020,

respectively |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

490,175 |

|

|

|

503 |

|

|

Accumulated other comprehensive income |

|

|

186 |

|

|

|

210 |

|

|

Accumulated deficit |

|

|

(149,438 |

) |

|

|

(111,962 |

) |

|

Total stockholders’ equity (deficit) |

|

|

340,923 |

|

|

|

(111,249 |

) |

|

Total liabilities, convertible preferred stock and

stockholders’ equity |

|

$ |

370,297 |

|

|

$ |

88,963 |

|

Xometry, Inc. and Subsidiaries

Unaudited Condensed Consolidated Statements of Operations and

Comprehensive Loss (In thousands, except per share amounts)

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

56,727 |

|

|

$ |

41,953 |

|

|

$ |

151,238 |

|

|

$ |

103,425 |

|

| Cost of

revenue |

|

|

42,233 |

|

|

|

31,778 |

|

|

|

115,033 |

|

|

|

79,619 |

|

|

Gross profit |

|

|

14,494 |

|

|

|

10,175 |

|

|

|

36,205 |

|

|

|

23,806 |

|

| Sales and

marketing |

|

|

9,828 |

|

|

|

5,986 |

|

|

|

26,250 |

|

|

|

15,842 |

|

| Operations

and support |

|

|

5,775 |

|

|

|

3,671 |

|

|

|

15,594 |

|

|

|

10,138 |

|

| Product

development |

|

|

4,376 |

|

|

|

3,003 |

|

|

|

12,131 |

|

|

|

8,879 |

|

| General and

administrative |

|

|

8,778 |

|

|

|

3,282 |

|

|

|

18,343 |

|

|

|

8,792 |

|

| Total

operating expenses |

|

|

28,757 |

|

|

|

15,942 |

|

|

|

72,318 |

|

|

|

43,651 |

|

|

Loss from operations |

|

|

(14,263 |

) |

|

|

(5,767 |

) |

|

|

(36,113 |

) |

|

|

(19,845 |

) |

|

Other (expenses) income |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

expense |

|

|

(79 |

) |

|

|

(309 |

) |

|

|

(799 |

) |

|

|

(939 |

) |

| Interest and

dividend income |

|

|

417 |

|

|

|

2 |

|

|

|

457 |

|

|

|

215 |

|

| Other

expenses |

|

|

(786 |

) |

|

|

(109 |

) |

|

|

(1,021 |

) |

|

|

(340 |

) |

| Total other

expenses |

|

|

(448 |

) |

|

|

(416 |

) |

|

|

(1,363 |

) |

|

|

(1,064 |

) |

|

Net loss |

|

|

(14,711 |

) |

|

|

(6,183 |

) |

|

|

(37,476 |

) |

|

|

(20,909 |

) |

| Deemed

dividend to preferred stockholders |

|

|

— |

|

|

|

(8,801 |

) |

|

|

— |

|

|

|

(8,801 |

) |

|

Net loss attributable to common stockholders |

|

$ |

(14,711 |

) |

|

$ |

(14,984 |

) |

|

$ |

(37,476 |

) |

|

$ |

(29,710 |

) |

| Net loss per

share, basic and diluted |

|

$ |

(0.33 |

) |

|

$ |

(1.99 |

) |

|

$ |

(1.87 |

) |

|

$ |

(3.98 |

) |

|

Weighted-average number of shares outstanding used to compute net

loss per share, basic and diluted |

|

|

43,962,863 |

|

|

|

7,546,458 |

|

|

|

20,092,600 |

|

|

|

7,458,671 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation |

|

$ |

(41 |

) |

|

$ |

(65 |

) |

|

$ |

(24 |

) |

|

$ |

(92 |

) |

|

Total other comprehensive loss |

|

|

(41 |

) |

|

|

(65 |

) |

|

|

(24 |

) |

|

|

(92 |

) |

| Net

loss |

|

|

(14,711 |

) |

|

|

(6,183 |

) |

|

|

(37,476 |

) |

|

|

(20,909 |

) |

| Total

comprehensive loss |

|

$ |

(14,752 |

) |

|

$ |

(6,248 |

) |

|

$ |

(37,500 |

) |

|

$ |

(21,001 |

) |

Xometry, Inc. and Subsidiaries

Unaudited Condensed Consolidated Statements of Cash Flows (In

thousands)

|

|

|

Nine Months Ended

September 30, |

|

|

|

|

2021 |

|

|

2020 |

|

| Cash

flows from operating activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(37,476 |

) |

|

$ |

(20,909 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

2,304 |

|

|

|

2,256 |

|

|

Reduction in carrying amount of right-of-use asset |

|

|

912 |

|

|

|

770 |

|

|

Stock based compensation |

|

|

4,747 |

|

|

|

679 |

|

|

Non-cash interest expense |

|

|

111 |

|

|

|

238 |

|

|

Loss on debt extinguishment |

|

|

272 |

|

|

|

- |

|

|

Donation of common stock |

|

|

1,157 |

|

|

|

- |

|

|

Unrealized loss on marketable securities |

|

|

239 |

|

|

|

- |

|

|

Changes in other assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

(10,645 |

) |

|

|

(4,381 |

) |

|

Inventory |

|

|

842 |

|

|

|

(618 |

) |

|

Prepaid expenses |

|

|

(4,080 |

) |

|

|

88 |

|

|

Other assets |

|

|

580 |

|

|

|

(544 |

) |

|

Accounts payable |

|

|

(400 |

) |

|

|

(3,142 |

) |

|

Accrued expenses |

|

|

3,931 |

|

|

|

8,100 |

|

|

Contract liabilities |

|

|

1,053 |

|

|

|

1,038 |

|

|

Lease liabilities |

|

|

(917 |

) |

|

|

(720 |

) |

|

Net cash used in operating activities |

|

|

(37,370 |

) |

|

|

(17,145 |

) |

| Cash

flows from investing activities: |

|

|

|

|

|

|

|

Purchase of marketable securities |

|

|

(266,978 |

) |

|

|

- |

|

|

Purchase of short-term investments |

|

|

- |

|

|

|

(17,711 |

) |

|

Proceeds from short-term investments |

|

|

- |

|

|

|

28,571 |

|

|

Purchases of property and equipment |

|

|

(4,625 |

) |

|

|

(2,888 |

) |

|

Net cash (used in) provided by investing

activities |

|

|

(271,603 |

) |

|

|

7,972 |

|

| Cash

flows from financing activities: |

|

|

|

|

|

|

|

Proceeds from issuance of Series A-2, Series B, Series C, Series D

and Series E convertible preferred stock, net of issuance

costs |

|

|

- |

|

|

|

52,409 |

|

|

Repurchase of Series A-2, Series B, Series C and Series D

convertible preferred stock |

|

|

- |

|

|

|

(12,852 |

) |

|

Deemed dividend to preferred stockholders |

|

|

- |

|

|

|

(8,801 |

) |

|

Proceeds from initial public offering, net of underwriters'

discount |

|

|

325,263 |

|

|

|

- |

|

|

Payments in connection with initial public offering |

|

|

(3,995 |

) |

|

|

- |

|

|

Proceeds from stock options exercised |

|

|

1,787 |

|

|

|

405 |

|

|

Proceeds from term loan |

|

|

- |

|

|

|

4,000 |

|

|

Repayment of term loan |

|

|

(16,136 |

) |

|

|

- |

|

|

Proceeds from other borrowings |

|

|

- |

|

|

|

4,783 |

|

|

Repayment of other borrowings |

|

|

- |

|

|

|

(4,783 |

) |

|

Payments on finance lease obligations |

|

|

(9 |

) |

|

|

(9 |

) |

|

Net cash provided by financing activities |

|

|

306,910 |

|

|

|

35,152 |

|

|

Effect of foreign currency translation on cash and cash

equivalents |

|

|

(33 |

) |

|

|

(9 |

) |

|

Net (decrease) increase in cash and cash

equivalents |

|

|

(2,096 |

) |

|

|

25,970 |

|

| Cash

and cash equivalents at beginning of period |

|

|

59,874 |

|

|

|

40,122 |

|

| Cash

and cash equivalents at end of period |

|

$ |

57,778 |

|

|

$ |

66,092 |

|

|

Supplemental cash flow information: |

|

|

|

|

|

|

| Cash paid

for interest |

|

$ |

907 |

|

|

$ |

970 |

|

|

Non-cash investing activity: |

|

|

|

|

|

|

| Non-cash

purchase of property and equipment |

|

$ |

(19 |

) |

|

$ |

- |

|

Xometry, Inc. and Subsidiaries

Unaudited Reconciliations of Non-GAAP Financial Measures (In

thousands)

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(14,711 |

) |

|

$ |

(6,183 |

) |

|

$ |

(37,476 |

) |

|

$ |

(20,909 |

) |

| Add

(deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

expense, interest and dividend income and other expense |

|

|

448 |

|

|

|

416 |

|

|

|

1,363 |

|

|

|

1,064 |

|

| Depreciation

and amortization(1) |

|

|

816 |

|

|

|

869 |

|

|

|

2,304 |

|

|

|

2,256 |

|

| Charitable

contribution of common stock |

|

|

1,157 |

|

|

|

— |

|

|

|

1,157 |

|

|

|

— |

|

| Stock-based

compensation(2) |

|

|

2,266 |

|

|

|

293 |

|

|

|

4,747 |

|

|

|

679 |

|

|

Adjusted EBITDA |

|

$ |

(10,024 |

) |

|

$ |

(4,605 |

) |

|

$ |

(27,905 |

) |

|

$ |

(16,910 |

) |

(1) Represents depreciation expense of the Company’s long-lived

tangible assets and amortization expense of its finite-lived

intangible assets, as included in the Company’s GAAP results of

operations.

(2) Represents the expense related to stock-based awards granted

to employees, as included in the Company’s GAAP results of

operations.

Xometry, Inc. and Subsidiaries

Unaudited Segment Results (In thousands)

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Segment Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. |

|

$ |

51,739 |

|

|

$ |

41,145 |

|

|

$ |

140,266 |

|

|

$ |

101,537 |

|

| Europe |

|

|

4,988 |

|

|

|

808 |

|

|

|

10,972 |

|

|

|

1,888 |

|

|

Total revenue |

|

$ |

56,727 |

|

|

$ |

41,953 |

|

|

$ |

151,238 |

|

|

$ |

103,425 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment Net Loss: |

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. |

|

$ |

(12,550 |

) |

|

$ |

(4,101 |

) |

|

$ |

(30,152 |

) |

|

$ |

(16,092 |

) |

| Europe |

|

|

(2,161 |

) |

|

|

(2,082 |

) |

|

|

(7,324 |

) |

|

|

(4,817 |

) |

| Total net

loss |

|

$ |

(14,711 |

) |

|

$ |

(6,183 |

) |

|

$ |

(37,476 |

) |

|

$ |

(20,909 |

) |

Xometry, Inc. and Subsidiaries

Unaudited Supplemental Information (In thousands)

| |

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

| |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Summary of Stock-based Compensation Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

$ |

335 |

|

|

$ |

46 |

|

|

$ |

690 |

|

|

$ |

106 |

|

| Operations

and support |

|

|

670 |

|

|

|

75 |

|

|

|

1,364 |

|

|

|

175 |

|

| Product

development |

|

|

488 |

|

|

|

109 |

|

|

|

979 |

|

|

|

253 |

|

| General and

administrative |

|

|

773 |

|

|

|

63 |

|

|

|

1,714 |

|

|

|

145 |

|

| Total

stock-based compensation expense |

|

$ |

2,266 |

|

|

$ |

293 |

|

|

$ |

4,747 |

|

|

$ |

679 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary of Depreciation and Amortization

Expense |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

revenue |

|

$ |

21 |

|

|

$ |

60 |

|

|

$ |

70 |

|

|

$ |

178 |

|

| Sales and

marketing |

|

|

26 |

|

|

|

161 |

|

|

|

88 |

|

|

|

508 |

|

| Operations

and support |

|

|

31 |

|

|

|

46 |

|

|

|

118 |

|

|

|

144 |

|

| Product

development |

|

|

672 |

|

|

|

514 |

|

|

|

1,913 |

|

|

|

1,220 |

|

| General and

administrative |

|

|

66 |

|

|

|

88 |

|

|

|

115 |

|

|

|

206 |

|

| Total

depreciation and amortization expense |

|

$ |

816 |

|

|

$ |

869 |

|

|

$ |

2,304 |

|

|

$ |

2,256 |

|

For the three and nine months ended September 30,

2021, general and administrative expense includes $1.2 million of

expense related to charitable contributions.

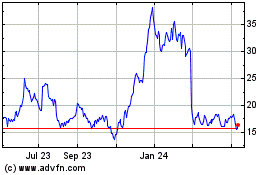

Xometry (NASDAQ:XMTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

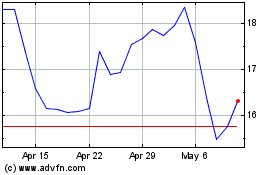

Xometry (NASDAQ:XMTR)

Historical Stock Chart

From Apr 2023 to Apr 2024