Current Report Filing (8-k)

July 02 2021 - 3:22PM

Edgar (US Regulatory)

FALSEXCEL ENERGY INC0000072903MNPUBLIC SERVICE CO OF COLORADO0000081018CO00000729032021-03-312021-03-3100000729032021-07-022021-07-020000072903xel:PublicServiceCompanyOfColoradoMember2021-07-022021-07-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) July 2, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commission File Number

|

|

Exact Name of Registrant as Specified in its Charter; State of Incorporation; Address of Principal Executive Offices; and Telephone Number

|

|

IRS Employer Identification Number

|

|

001-3034

|

|

XCEL ENERGY INC.

|

|

41-0448030

|

|

|

|

(a Minnesota corporation)

|

|

|

|

|

|

414 Nicollet Mall

|

|

|

|

|

|

Minneapolis

|

Minnesota

|

55401

|

|

|

|

|

|

(612)

|

330-5500

|

|

|

|

|

|

|

|

|

|

001-3280

|

|

PUBLIC SERVICE COMPANY OF COLORADO

|

|

84-0296600

|

|

|

|

(a Colorado corporation)

|

|

|

|

|

|

1800 Larimer Street Suite 1100

|

|

|

|

|

|

Denver

|

Colorado

|

80202

|

|

|

|

|

|

(303)

|

571-7511

|

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, $2.50 par value

|

|

XEL

|

|

Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. £

Item 8.01. Other Events

Colorado Electric Rate Request

On July 2, 2021, Public Service Company of Colorado (PSCo), a wholly owned subsidiary of Xcel Energy Inc. (Xcel Energy), filed a request with the Colorado Public Utilities Commission (CPUC) seeking a net increase to retail electric base rate revenue of $343 million (or 12.4% of total revenue). The total request reflects a $470 million increase, which includes $127 million of previously authorized costs currently recovered through various rider mechanisms. The request is based on a 10.0% return on equity (ROE), an equity ratio of 55.64% and a 2022 forecast test year. A historical test year including a 10.5% ROE was also filed as required by the CPUC.

The request reflects continued investments in several initiatives the CPUC has previously approved, including: (1) distribution infrastructure to meet growing customer energy needs, (2) wildfire mitigation improvements, (3) investment in an Advanced Grid Intelligence and Security (AGIS) initiative, which will provide increased reliability and improve customer products and services, (4) transmission expansion projects to enable industry leading renewable integration in Colorado and (5) the 500-MW Cheyenne Ridge wind farm, which provides enough clean energy to power approximately 270,000 average Colorado homes. The avoided fuel costs and PTC benefits from Cheyenne Ridge are estimated at approximately $120 million, which are passed back to customers through the fuel clause mechanism. The request also includes impacts of a new depreciation and decommissioning study. PSCo has requested rates effective April 1, 2022.

|

|

|

|

|

|

|

|

|

|

|

Revenue Request (millions of dollars)

|

|

2022

|

|

Changes since 2019 rate case:

|

|

|

|

Plant-related growth

|

|

$

|

95

|

|

|

AGIS

|

|

73

|

|

|

Updated cost of capital

|

|

53

|

|

|

New depreciation rates

|

|

43

|

|

|

Wildfire mitigation

|

|

25

|

|

Property taxes

|

|

25

|

|

Amortization of previously approved deferrals

|

|

17

|

|

|

Other

|

|

12

|

|

|

Net increase to revenue

|

|

343

|

|

|

Roll-in of previously authorized costs:

|

|

|

|

TCA rider revenues and Cheyenne Ridge costs

|

|

127

|

|

|

Total base revenue request

|

|

$

|

470

|

|

|

|

|

|

|

|

|

|

|

Expected average 2022 rate base (billions of dollars)

|

|

$

|

10.3

|

|

Certain information discussed in this Current Report on Form 8-K is forward-looking information that involves risks, uncertainties and assumptions. Such forward-looking statements, including our expectations regarding the regulatory proceedings, as well as assumptions and other statements are intended to be identified in this document by the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “objective,” “outlook,” “plan,” “project,” “possible,” “potential,” “should,” “will,” “would” and similar expressions. Actual results may vary materially. Forward-looking statements speak only as of the date they are made, and we expressly disclaim any obligation to update any forward-looking information. The following factors, in addition to those discussed in Xcel Energy's and PSCo's Annual Report on Form 10-K for the year ended Dec. 31, 2020, and subsequent filings with the Securities and Exchange Commission, could cause actual results to differ materially from management expectations as suggested by such forward-looking information: uncertainty around the impacts and duration of the COVID-19 pandemic; operational safety; successful long-term operational planning; commodity risks associated with energy markets and production; rising energy prices and fuel costs; qualified employee work force and third-party contractor factors; ability to recover costs; changes in regulation; reductions in our credit ratings and the cost of maintaining certain contractual relationships; general economic conditions, including inflation rates, monetary fluctuations and their impact on capital expenditures and the ability of PSCo and its subsidiaries to obtain financing on favorable terms; availability or cost of capital; our customers’ and counterparties’ ability to pay their debts to us; assumptions and costs relating to funding our employee benefit plans and health care benefits; tax laws; effects of geopolitical events, including war and acts of terrorism; cyber security threats and data security breaches; seasonal weather patterns; changes in environmental laws and regulations; climate change and other weather; natural disaster and resource depletion, including compliance with any accompanying legislative and regulatory changes; and costs of potential regulatory penalties.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

July 2, 2021

|

Xcel Energy Inc. (a Minnesota corporation)

|

|

|

Public Service Company of Colorado (a Colorado corporation)

|

|

|

|

|

|

/s/ BRIAN J. VAN ABEL

|

|

|

Brian J. Van Abel

|

|

|

Executive Vice President, Chief Financial Officer

|

Xcel Energy (NASDAQ:XEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

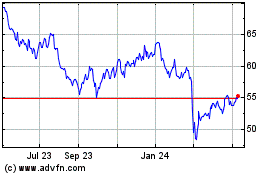

Xcel Energy (NASDAQ:XEL)

Historical Stock Chart

From Apr 2023 to Apr 2024