UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________

Form 11-K

__________________________________

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2020

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission file number: 000-19599

|

|

|

|

|

WORLD ACCEPTANCE CORPORATION RETIREMENT SAVINGS PLAN

|

|

(Full title of the plan and address of the plan, if different from that of the issuer named below)

|

|

|

|

|

|

WORLD ACCEPTANCE CORPORATION

|

|

104 S. Main Street, Greenville, South Carolina 29601

|

|

(Name of issuer of the securities held pursuant to the plan and the address of its principal executive office)

|

WORLD ACCEPTANCE CORPORATION

Form 11-K

Table of Contents

|

|

|

|

|

|

|

|

|

Page

|

|

GLOSSARY OF DEFINED TERMS

|

|

|

|

|

|

REQUIRED INFORMATION

|

|

|

Financial Statements:

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Schedules:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

|

|

|

|

EXHIBIT INDEX

|

|

|

|

|

|

SIGNATURES

|

|

GLOSSARY OF DEFINED TERMS

The following terms may be used throughout this Report.

|

|

|

|

|

|

|

|

Term

|

Definition

|

|

ASC

|

Accounting Standards Codification

|

|

ASU

|

Accounting Standards Update

|

|

CARES

|

Coronavirus Aid, Relief, and Economic Security

|

|

COVID-19

|

Coronavirus Disease 2019

|

|

Employer

|

World Acceptance Corporation

|

|

ERISA

|

Employee Retirement Income Security Act of 1974, as amended

|

|

FASB

|

Financial Accounting Standards Board

|

|

GAAP

|

U.S. Generally Accepted Accounting Principles

|

|

IRC

|

Internal Revenue Code

|

|

Plan

|

World Acceptance Corporation Retirement Savings Plan

|

|

Plan Sponsor

|

World Acceptance Corporation

|

|

Principal

|

Principal Trust Company

|

|

RMD

|

Required Minimum Distribution

|

|

SAFII

|

Stable Asset II Fund

|

|

SEC

|

U.S. Securities and Exchange Commission

|

|

Stancorp

|

Stancorp Financial Group, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WORLD ACCEPTANCE CORPORATION

|

|

RETIREMENT SAVINGS PLAN

|

|

Statements of Net Assets Available for Benefits

|

|

|

|

|

December 31,

|

|

|

2020

|

|

2019

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

Investments at fair value

|

|

|

|

|

Mutual funds

|

$

|

52,593,965

|

|

|

$

|

47,580,883

|

|

|

Common stock

|

3,138,300

|

|

|

2,166,055

|

|

|

Total investments at fair value

|

55,732,265

|

|

|

49,746,938

|

|

|

Investments at contract value

|

|

|

|

|

Stable Asset II Fund

|

10,675,038

|

|

|

10,005,966

|

|

|

Receivables

|

|

|

|

|

Notes receivable from participants

|

4,456,817

|

|

|

4,797,112

|

|

|

Participants' contributions

|

111,820

|

|

|

233,229

|

|

|

Employer's contributions

|

44

|

|

|

54,742

|

|

|

Total receivables

|

4,568,681

|

|

|

5,085,083

|

|

|

Total assets

|

70,975,984

|

|

|

64,837,987

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

Refund payable for excess contributions

|

211,537

|

|

|

193,195

|

|

|

Total liabilities

|

211,537

|

|

|

193,195

|

|

|

Net assets available for benefits

|

$

|

70,764,447

|

|

|

$

|

64,644,792

|

|

See accompanying notes to financial statements.

|

|

|

|

|

|

|

|

WORLD ACCEPTANCE CORPORATION

|

|

RETIREMENT SAVINGS PLAN

|

|

Statement of Changes in Net Assets Available for Benefits

|

|

|

|

|

Year Ended December 31,

|

|

|

2020

|

|

Additions:

|

|

|

Investment income:

|

|

|

Net appreciation in fair value of investments

|

$

|

6,681,774

|

|

|

Dividends and interest

|

823,918

|

|

|

Total investment income

|

7,505,692

|

|

|

Interest income on notes receivable from participants

|

250,435

|

|

|

Contributions:

|

|

|

Employer, net of forfeitures

|

1,399,631

|

|

|

Participant

|

3,883,422

|

|

|

Rollovers

|

144,858

|

|

|

Total contributions

|

5,427,911

|

|

|

Total additions

|

13,184,038

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

Benefits paid to participants

|

6,844,866

|

|

|

Administrative expenses

|

219,517

|

|

|

Total deductions

|

7,064,383

|

|

|

Net increase in net assets available for benefits

|

6,119,655

|

|

|

|

|

|

Net assets available for benefits at beginning of year

|

64,644,792

|

|

|

Net assets available for benefits at end of year

|

$

|

70,764,447

|

|

See accompanying notes to financial statements.

|

|

|

|

|

WORLD ACCEPTANCE CORPORATION

|

|

RETIREMENT SAVINGS PLAN

|

|

Notes to Financial Statements

|

(1)Description of Plan

The following description of the Plan provides only general information. Participants should refer to the plan agreement for a complete description of the Plan's provisions.

General

The Plan was formed in February 1993 and is a defined-contribution plan subject to the provisions of ERISA. Quarterly, employees of the Plan Sponsor who meet eligibility requirements may elect to become participants in the Plan. Eligibility requirements include a) being at least 21 years of age and b) having completed at least six months of service.

Principal is the Plan’s trustee and custodian of all Plan assets.

The Retirement Plan Committee determines the appropriateness of the Plan's investment offerings, monitors investment performance, and reports to the Employer's board of directors.

Administrative Costs

Certain expenses of maintaining the Plan are paid directly by the Employer and are excluded from these financial statements. Administrative expenses include fees related to the administration of notes receivable charged directly to the participant's account and certain record-keeping and consulting fees paid by the Plan. Investment-related expenses are included in net appreciation (depreciation) of fair value of investments.

Contributions

The Plan provides for participant contributions on a pre-tax compensation reduction basis. Participants who have attained age 50 before the end of the plan year are eligible to make catch-up contributions. Participants may also contribute amounts representing distributions from other qualified defined benefit or contribution plans (rollovers). The Plan also allows participants to make contributions on an after-tax basis (Roth-type). Participants may elect to contribute to the Plan by deferring up to 100% of annual compensation up to specified maximum amounts. The Employer matches a specified percentage of employee contributions, as determined by the Employer. For 2020, the Employer matched 50% of each employee's contributions up to the first 6% of the employee's eligible compensation, providing a maximum Employer contribution of 3% of eligible compensation. The Employer may also contribute a discretionary, non-elective Employer contribution as determined annually by the Employer, of which there was none in Plan year 2020. Contributions are subject to certain Internal Revenue Service limitations.

Participant Accounts

Each participant’s account is credited with the participant’s contribution and the Employer’s matching contribution. Discretionary, non-elective Employer contributions are allocated to individual participant accounts based on the proportion of each participant’s annual compensation, as defined by the Plan, compared to the total annual compensation of all participants. Investment income (loss) and administrative expenses are allocated to the individual participant accounts based on the proportion of each participant’s account balance compared to the total balance within each fund. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Vesting

Participants are immediately vested in their voluntary contributions plus earnings thereon. Vesting of Employer contributions is based on years of continuous service. A participant is 100% vested after six years of credited service, according to the following schedule:

|

|

|

|

|

|

|

|

|

|

|

Years of service

|

|

Percent of non-forfeitable interest

|

|

Less than 2

|

|

0%

|

|

2

|

|

20%

|

|

3

|

|

40%

|

|

4

|

|

60%

|

|

5

|

|

80%

|

|

6 or more

|

|

100%

|

Notwithstanding the aforementioned, upon reaching normal retirement age or upon death or disability, participants become 100% vested.

Investment Options

A participant may direct employee contributions in 1% increments in a variety of investment options. Participants may make changes in their investment elections at any time. Participants may change their deferral percentage as of each payroll period.

Notes Receivable from Participants

The Plan allows participants to borrow a minimum of $1,000 up to a maximum equal to the lesser of $50,000 or 50% of their vested account balance. Loan terms range from 1 to 5 years or up to 10 years for the purchase of a primary residence. The loans are secured by the vested balance in the participant’s account and bear interest at prime plus 1%. For participant loans outstanding as of December 31, 2020, interest rates ranged from 3.25% to 6.50% and mature through 2028. Principal and interest are paid through payroll deductions although lump sum prepayments are allowed. Effective June 5, 2020, the Plan no longer allows for participant refinancing or re-consolidation of outstanding loan balances. As of the effective date, any outstanding loan must be paid in full prior to a new loan being issued. This change does not affect loans that were outstanding prior to the effective date of the change. See “COVID-19 Pandemic” below for special loan provisions applicable during the 2020 Plan year.

Payment of Benefits

Participants are entitled to receive a distribution of their vested accounts upon the occurrence of retirement, death, total and permanent disability, financial hardship (as defined by the Plan), at age 59 ½ while still employed, or termination of employment for any other reason. The methods of distribution include lump-sum distribution, substantially equal installments, or partial withdrawals, provided the minimum withdrawal is $1,000.

Forfeitures

Forfeitures are used to reduce Plan expenses or Employer contributions to the Plan. For the year ended December 31, 2020, forfeitures used to reduce Employer contributions totaled $164,098. There were $94,281 and $0, respectively, of unapplied forfeitures at December 31, 2020 and 2019.

COVID-19 Pandemic

On March 11, 2020, the World Health Organization declared COVID-19 a pandemic. The COVID-19 pandemic and resulting global disruptions have caused significant economic uncertainty and volatility in financial markets. The impact of COVID-19 continues to evolve rapidly, which has prevented the Plan Sponsor from estimating its full impact on the Plan's financial statements.

Effective April 3, 2020, the Plan adopted the provisions of the CARES Act that was signed into law on March 27, 2020. To qualify for the provisions outlined in the CARES Act a participant must self-certify that they have been impacted by COVID-19 in one of the following ways:

•Been diagnosed with virus SARS-CoV-2 or with COVID-19 by a test approved by the Centers for Disease Control and Prevention;

•Have a spouse or dependent (as defined in Section 152 of the IRC of 1986) diagnosed with the virus or disease by such a test;

•Experienced adverse financial consequences resulting from a reduction in work hours, layoff, quarantine, furlough, or been unable to work due to lack of childcare or business closing, all on account of the virus or disease; or

•Other factors determined by the Treasury Secretary.

A self-certified participant qualifies for the following provisions as outlined in the CARES Act:

Withdrawals

•Impacted participants may receive up to $100,000 in aggregate for withdrawals before December 31, 2020.

•10% penalty tax for early withdrawal is waived.

•Not treated as eligible rollover distributions; therefore, a 402(f) notice is not required, and mandatory 20% withholding will not apply. However, 10% federal withholding applies unless the participant elects to opt out.

•Will be included in the participant’s taxable income over a three-year period, unless the participant elects to have it taxed in the year of distribution.

•No limit to the number of such withdrawals each participant can make.

•Withdrawals available from a participant’s entire vested account (subject to any trading restrictions and excluding accounts subject to spousal consent, such as money purchase assets).

•Repayment of withdrawal amount permitted if repayment occurs within three years of distribution.

Plan loans

•Participants may borrow up to the lesser of $100,000 or 100% of their vested balance (subject to any trading restrictions and limitations to specific contributions sources as currently in the Plan) for 180 days beginning March 27, 2020.

•Impacted participant loan payments due from March 27, 2020 through December 31, 2020, including those due following a severance from employment, may be delayed for one year. This period is disregarded in determining the loan term, including the 5-year maximum. Subsequent loan payments will be adjusted appropriately to reflect the payment delay, any interest accruing during that delay, and the revised loan term.

RMD

◦RMD rules for distributions required for the 2020 calendar year are temporarily waived. Plan participants and beneficiaries may still request to receive a distribution equal to the RMD in 2020 if they would prefer.

(2)Summary of Significant Accounting Policies

Basis of Presentation

The financial statements have been prepared on an accrual basis of accounting in accordance with GAAP.

Investments

Plan investments are reported at fair value except, for fully benefit-responsive investment contracts, which are reported at contract value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Investments held by a defined contribution plan are required to be reported at fair value, except for fully benefit-responsive investment contracts. Contract value is the relevant measurement for the portion of the net assets available for benefits attributable to fully benefit-responsive investment contracts because contract value is the amount participants normally would receive if they were to initiate permitted transactions under the terms of the Plan.

The Retirement Plan Committee determines the Plan's valuation policies utilizing information provided by the trustee. See Note 7 for discussion of fair value measurement. Purchases and sales are recorded on a trade-date basis. Dividends are recorded on the ex-dividend date. Interest income is recorded on the accrual basis. Net appreciation or depreciation in fair value of investments includes the gains and losses on investments bought and sold as well as held during the year.

Notes Receivable from Participants

Notes receivable from participants are carried at their unpaid principal balance plus accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when they are incurred. If a participant ceases to make the scheduled repayments and the Plan Administrator deems the participant to be in default, the participant’s note receivable is reduced and a benefit payment is recorded based on the terms of the Plan. No allowance for credit losses has been recorded as of December 31, 2020 and 2019.

Contributions

Contributions from Plan participants and the matching contributions from the Employer are recorded in the year in which the participant compensation is earned. All participant and Employer contributions are participant-directed.

Refund Payable for Excess Contributions

Amounts payable to participants in excess of amounts allowed by the Internal Revenue Service are recorded as a liability with a corresponding reduction to contributions. Refunds payable to participants at December 31, 2020 and 2019 were $211,537 and $193,195, respectively. These refunds were due to excess contributions, which were refunded to participants in 2021 for the year ended December 31, 2020, and in 2020 for the year ended December 31, 2019.

Payment of Benefits

Benefits are recorded when paid.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets, liabilities, and changes therein and the disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Investment Risk

The Plan provides for various registered investment company (mutual fund) investment options in stocks, bonds and fixed income securities, as well as direct common stock investments and a deposit administration contract. Investment securities are exposed to various risks such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

Recently Adopted Accounting Standards

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement. The amendments in this Update modify the disclosure requirements on fair value measurements in Topic 820, Fair Value Measurement, based on the concepts in the FASB Concepts Statement, including the consideration of costs and benefits. The Plan adopted this ASU for the removal, modification, or addition of certain fair value measurement disclosures, applicable, and presented in the financial statements. The amendments in this Update were effective for all entities for fiscal years beginning after December 15, 2019.

(3)Plan Termination

Although it has not expressed any intent to do so, the Employer has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of plan termination, participants will become 100% vested in Employer contributions.

(4)Tax Status

The Plan has adopted a volume submitter plan sponsored by Principal Life Insurance Co., an affiliate of the trustee of the Plan. The volume submitter plan provider has obtained an advisory letter from the Internal Revenue Service dated August 8, 2014 as to the volume submitter plan's qualified status. The Plan administrator believes the Plan is currently designed and operated in compliance with the applicable requirements of the Code and continues to qualify and to operate as designed.

GAAP require plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue Service. The Plan administrator has analyzed the tax positions taken by the Plan and has concluded that as of December 31, 2020 and 2019 there are no uncertain positions taken, or expected to be taken, that would require recognition of a liability or asset or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

(5)Deposit Administration Contract

The SAFII represents a deposit administration contract entered into by the Plan with Stancorp. Stancorp maintains the contributions in an unallocated fund whose assets are invested with other assets in the general account of Stancorp.

The SAFII is a traditional, fully benefit-responsive guaranteed investment contract, which is recorded at contract value. Contract value represents contributions made under the SAFII, plus earnings, less withdrawals and administrative expenses. The contract crediting rate is established at the end of each quarter and is guaranteed for the subsequent quarter, with a minimum crediting rate of 1%. The effective annual crediting rate and yield for the Contract was approximately 2.41% for the year ended December 31, 2020 and 2.68% for the year ended December 31, 2019. There are no reserves against contract value for the credit risk of the SAFII issuer or otherwise.

Certain events might limit the ability of the Plan to transact at contract value; however, no such events are probable of occurring at the time of this filing. Generally, participants may direct the withdrawal or transfer of all or a portion of their investment at contract value. Stancorp may defer any withdrawal request for 30 days after receipt of written notice of the withdrawal request made by the Employer. Stancorp may terminate the contract with 30 days' advance written notice to the Employer.

(6)Related Party and Party-in-Interest Transactions

As the recordkeeper of the Plan and a related affiliate of the Plan's trustee, Principal Trust Company, Principal Life Insurance Company qualifies as a party-in-interest to the Plan. MMC Securities Corporations, serving in its capacity as an investment adviser to the Plan also qualifies as a party-in-interest. Administrative fees remitted to Principal Life Insurance Company and MMC Securities Corporations totaled $170,804 and $48,713 in 2020, respectively. Both amounts are included in the administrative expenses line item in the accompanying Statement of Changes in Net Assets Available for Benefits.

Plan assets also include shares of World Acceptance Corporation common stock. World Acceptance Corporation, as the Plan Sponsor, qualifies as a party-in-interest for transactions involving the aforementioned assets. The investment in World Acceptance Corporation common stock was $3,138,300 and $2,166,055 at December 31, 2020 and 2019, respectively, and is participant directed.

Participant loans held by the Plan qualify as party-in-interest transactions. All such transactions are exempt from the prohibited transaction rules under ERISA, except for those disclosed in Schedule G, Part III.

(7)Fair Value

The FASB ASC 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. FASB ASC 820 also establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure fair value:

◦Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities.

◦Level 2 – Inputs other than quoted prices that are observable for assets and liabilities, either directly or indirectly. These inputs include quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in markets that are less active.

◦Level 3 – Unobservable inputs for assets or liabilities reflecting the reporting entity’s own assumptions.

The following tables set forth the fair value of the Plan’s investments by category within the fair value hierarchy, if applicable, as of December 31, 2020 and 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2020

|

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Investments at fair value

|

|

|

|

|

|

|

|

|

Mutual funds

|

$

|

52,593,965

|

|

|

$

|

52,593,965

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Common stock

|

3,138,300

|

|

|

3,138,300

|

|

|

—

|

|

|

—

|

|

|

Total investments at fair value

|

$

|

55,732,265

|

|

|

$

|

55,732,265

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2019

|

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Investments at fair value

|

|

|

|

|

|

|

|

|

Mutual funds

|

$

|

47,580,883

|

|

|

$

|

47,580,883

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Common stock

|

2,166,055

|

|

|

2,166,055

|

|

|

—

|

|

|

—

|

|

|

Total investments at fair value

|

$

|

49,746,938

|

|

|

$

|

49,746,938

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Valuation methodologies for the asset classes listed above are described below. There have been no changes in the methodologies used at December 31, 2020 and 2019.

Mutual funds: Valued at daily closing price as reported by the fund. Mutual funds held by the Plan are open-ended mutual funds that are registered with the SEC. These funds are required to publish their daily net asset value and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

Common stock: Valued at the closing price reported on the active market on which the individual securities are traded.

(8)Reconciliation to Form 5500

The following table reconciles net assets available for benefits per the financial statements to net assets per the Form 5500 as of December 31, 2020 and 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

2019

|

|

Net assets available for benefits per the financial statements

|

|

$

|

70,764,447

|

|

|

$

|

64,644,792

|

|

|

Differences in:

|

|

|

|

|

|

Investments - participant loans

|

|

3,214,061

|

|

|

—

|

|

|

Receivable - notes receivable from participants

|

|

(4,456,817)

|

|

|

—

|

|

|

Excess contributions payable included in financial statements but not in Form 5500

|

|

211,537

|

|

|

193,195

|

|

|

Participants' contribution receivable

|

|

(110,807)

|

|

|

84,149

|

|

|

Net assets per Form 5500

|

|

$

|

69,622,421

|

|

|

$

|

64,753,838

|

|

The following table reconciles the net increase in net assets available for benefits per the financial statements to net income per Form 5500 for the year ended December 31, 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

2020

|

|

Net increase in net assets available for benefits per the financial statements

|

|

$

|

6,119,655

|

|

|

Change in default loans

|

|

(1,242,756)

|

|

|

Excess contributions payable included in financial statements but not in Form 5500 at:

|

|

|

|

December 31, 2020

|

|

211,537

|

|

|

December 31, 2019

|

|

(193,195)

|

|

|

Participants' contribution receivable included in financial statements but not in Form 5500 at:

|

|

|

|

December 31, 2020

|

|

(110,807)

|

|

|

December 31, 2019

|

|

84,149

|

|

|

Net income per Form 5500

|

|

$

|

4,868,583

|

|

(9)Nonexempt Transactions

For the years ended December 31, 2020, 2019, and 2018, the Plan made loans to certain Plan participants in excess of the amount allowed by IRC 72(p). The excess amounts totaled $1,290,347, $1,655,129, and $271,766 respectively, and are considered nonexempt transactions with a party-in-interest. The Plan is working with ERISA counsel on the corrective measures for the nonexempt transactions, which include a Voluntary Correction Program (VCP) application submitted to and approved by the IRS.

For the year ended December 31, 2018, the Sponsor inadvertently failed to deposit $12,216 of participant deferrals and loan repayments within the required timeframe as stated by the DOL regulations. The Sponsor has reimbursed the Plan for lost interest, and a Form 5330 will be filed, and will pay the applicable exercise tax in 2021. For the year ended December 31, 2020, the Sponsor inadvertently failed to deposit $5,375 of participant deferrals and loan repayments within the required timeframe as stated by the DOL regulations. For $3,607 of the late remittances, the Sponsor has reimbursed the Plan for lost interest, will file Form 5330, and pay the applicable excise tax in 2021. For $1,768 of the late remittances, the Sponsor will reimburse the Plan for lost interest, file Form 5330, and pay the applicable excise tax in 2021.

(10)Subsequent Events

The Plan Sponsor is not aware of any significant events occurring subsequent to December 31, 2020 and through June 29, 2021 that would have a material effect on the financial statements thereby requiring adjustment or disclosure.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WORLD ACCEPTANCE CORPORATION

|

|

RETIREMENT SAVINGS PLAN

|

|

Schedule G, Part III - Schedule of Nonexempt Transactions

|

|

December 31, 2020

|

|

|

|

|

|

|

(a)

|

(b)

|

(c)

|

(h)

|

|

Identity of Party involved

|

Relationship to plan, employer, or other party-in-interest

|

Description of transaction including maturity date, rate of interest, collateral, par or maturity value

|

Cost of asset

|

|

Participant

|

Employees of Plan Sponsor

|

Received loan proceeds in 2020 in excess of the amount allowed by IRC 72(p).

|

$

|

1,290,347

|

|

|

Participant

|

Employees of Plan Sponsor

|

Received loan proceeds in 2019 in excess of the amount allowed by IRC 72(p).

|

1,655,129

|

|

|

Participant

|

Employees of Plan Sponsor

|

Received loan proceeds in 2018 in excess of the amount allowed by IRC 72(p).

|

271,766

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WORLD ACCEPTANCE CORPORATION

|

|

RETIREMENT SAVINGS PLAN

|

|

Schedule H, Line 4a - Schedule of Delinquent Participant Contributions

|

|

December 31, 2020

|

|

|

|

|

|

|

|

Participant Contributions Transferred Late to Plan

|

Total that Constitute Nonexempt Prohibited Transactions

|

Total Fully Corrected Under VFCP and PTE 2002-51

|

|

Check here if Late Participant Loan Repayments are included: [X]

|

Contributions Not Corrected

|

Contributions Corrected Outside VFCP

|

Contributions Pending Correction in VFCP

|

|

2018

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

12,216

|

|

|

2020

|

$

|

1,768

|

|

$

|

3,607

|

|

$

|

—

|

|

$

|

—

|

|

Participant deferrals were not remitted timely during the year ended December 31, 2018, but were subsequently deposited into the Plan. Lost earnings were deposited into the Plan and a Form 5330 will be filed with the applicable excise taxes in 2021. Participant deferrals and loan repayments were not remitted timely during the year ended December 31, 2020. Lost earnings related to $3,607 in late remittances were deposited into the Plan and a Form 5330 will be filed with the applicable exercise taxes in 2021. For $1,768 of the late remittances, lost earnings will be deposited into the Plan and a Form 5330 will be filed with the applicable exercise taxes in 2021.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WORLD ACCEPTANCE CORPORATION

|

|

RETIREMENT SAVINGS PLAN

|

|

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

|

|

December 31, 2020

|

|

|

|

|

|

|

|

(a)

|

(b)

|

(c)

|

(d)

|

(e)

|

|

Party in-interest

|

Identity of issuer, borrower, lessor, or similar party

|

Description of investment including maturity date, rate of interest, collateral, par or maturity value

|

Cost

|

Current value

|

|

|

Mutual Funds:

|

|

|

|

|

|

Alliance Bernstein

|

Alliance Bernstein Discovery Value A Fund

|

**

|

$

|

103,068

|

|

|

|

BlackRock

|

Blackrock Lifepath Index 2060 K Fund

|

**

|

1,319,223

|

|

|

|

BlackRock

|

Blackrock Lifepath Index 2065 K Fund

|

**

|

142,341

|

|

|

|

BlackRock

|

Blackrock Lifepath Index Retirement K Fund

|

**

|

2,189,601

|

|

|

|

BlackRock

|

Blackrock Lifepath Index 2025 K Fund

|

**

|

5,502,519

|

|

|

|

BlackRock

|

Blackrock Lifepath Index 2030 K Fund

|

**

|

7,831,361

|

|

|

|

BlackRock

|

Blackrock Lifepath Index 2035 K Fund

|

**

|

6,469,067

|

|

|

|

BlackRock

|

Blackrock Lifepath Index 2040 K Fund

|

**

|

6,848,908

|

|

|

|

BlackRock

|

Blackrock Lifepath Index 2045 K Fund

|

**

|

7,465,064

|

|

|

|

BlackRock

|

Blackrock Lifepath Index 2050 K Fund

|

**

|

4,304,789

|

|

|

|

BlackRock

|

Blackrock Lifepath Index 2055 K Fund

|

**

|

2,407,166

|

|

|

|

Hartford Mutual Funds

|

Hartford International Opportunities Y Fund

|

**

|

523,368

|

|

|

|

Metropolitan Life Insurance Co

|

Metro West Total Return Bond I Fund

|

**

|

365,581

|

|

|

|

MFS Investment Management

|

MFS Value R3 Fund

|

**

|

380,821

|

|

|

|

T. Rowe Price Funds

|

T. Rowe Price Blue Chip Growth Fund

|

**

|

2,000,148

|

|

|

|

Vanguard Group

|

Vanguard Extended Market Index Admiral Fund

|

**

|

808,248

|

|

|

|

Vanguard Group

|

Vanguard Total Bond Market Index Admiral Fund

|

**

|

345,102

|

|

|

|

Vanguard Group

|

Vanguard 500 Index Admiral Fund

|

**

|

1,613,983

|

|

|

|

Vanguard Group

|

Vanguard Total International Stock Index Admiral Fund

|

**

|

340,620

|

|

|

|

William Blair & Company

|

William Blair Small-Mid Cap Growth I Fund

|

**

|

1,632,987

|

|

|

|

|

|

|

52,593,965

|

|

|

|

Deposit Administration Contract:

|

|

|

|

|

|

Standard Insurance Company

|

Stable Asset II Fund

|

**

|

10,675,038

|

|

|

|

|

|

|

|

|

*

|

Participant Loans

|

Interest rates from 3.25% to 6.50% and maturity dates through December of 2028***

|

***

|

3,214,061

|

|

|

|

|

|

|

|

|

|

Common Stock:

|

|

|

|

|

*

|

World Acceptance Corporation

|

Common stock, no par value (quoted at fair value)

|

**

|

3,138,300

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

69,621,364

|

|

|

|

|

|

|

|

|

*

|

Indicates party-in-interest to the Plan

|

|

**

|

Cost information has not been included in column (d) because all investments are participant-directed

|

|

***

|

The accompanying financial statements classify participant loans as notes receivable from participants. Amount is net of $1,242,756 in deemed loan distributions.

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Retirement Plan Committee, Plan Administrator and Plan Participants of World Acceptance Corporation Retirement Savings Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of World Acceptance Corporation Retirement Savings Plan (the Plan) as of December 31, 2020 and 2019, the related statement of changes in net assets available for benefits for the year ended December 31, 2020, and the related notes to the financial statements (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2020 and 2019, and the changes in net assets available for benefits for the year ended December 31, 2020, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Report on Supplemental Information

The supplemental information in the accompanying Schedule of Nonexempt Transactions for the year ended December 31, 2020, Schedule of Delinquent Participant Contributions for the year ended December 31, 2020 and Schedule of Assets (Held at End of Year) as of December 31, 2020, have been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but includes supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedules, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedules are fairly stated in all material respects in relation to the financial statements as a whole.

/s/ RSM US LLP

We have served as the Plan's auditor since 2014.

Atlanta, Georgia

June 29, 2021

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

Exhibit Description

|

Filed

Herewith

|

Incorporated by Reference

|

Form or

Registration

Number

|

Exhibit

|

Filing

Date

|

|

23

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Submitted electronically herewith.

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the World Acceptance Corporation Retirement Plan Committee has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

WORLD ACCEPTANCE CORPORATION RETIREMENT SAVINGS PLAN

|

|

|

|

|

|

|

By: World Acceptance Corporation

|

|

|

Retirement Plan Committee

|

|

|

Date:

|

June 29, 2021

|

|

|

|

|

|

|

By: /s/ R. Chad Prashad

|

|

|

R. Chad Prashad

|

|

|

President and Chief Executive Officer

|

|

|

Date:

|

June 29, 2021

|

|

|

|

|

|

|

By: /s/ Lindsay Caulder

|

|

|

Lindsay Caulder

|

|

|

Senior Vice President, Human Resources

|

|

|

Date:

|

June 29, 2021

|

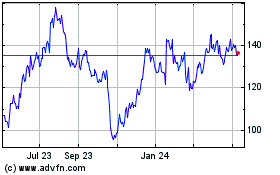

World Acceptance (NASDAQ:WRLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

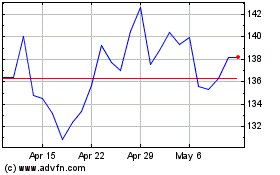

World Acceptance (NASDAQ:WRLD)

Historical Stock Chart

From Apr 2023 to Apr 2024