Fallout Jeopardizes Proposal To Take Over Victoria's Secret -- WSJ

April 23 2020 - 3:02AM

Dow Jones News

By Khadeeja Safdar and Cara Lombardo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 23, 2020).

Private-equity firm Sycamore Partners wants to scrap its plans

to take control of Victoria's Secret, a high-profile legal test of

whether the coronavirus pandemic allows a buyer to walk away from

an agreement reached before the outbreak.

The investor said the decision by L Brands Inc., parent of the

lingerie brand, to close its U.S. stores in March, furlough the

majority of its workers and skip April rent payments were

violations of the proposed transaction, according to a lawsuit

filed by Sycamore in a Delaware court Wednesday. The firm is

seeking the court's blessing to break the deal.

Shares of L Brands, which is also the parent of Bath & Body

Works, fell 15% to $10.19 in Wednesday's trading. The shares were

trading above $20 in February.

In a statement, L Brands said it believes the termination of the

transaction is invalid and that it "will vigorously defend the

lawsuit and pursue all legal remedies to enforce its contractual

rights." The company said it would continue to work toward closing

the deal. It is preparing a legal response that could be filed as

soon as Thursday, people familiar with the matter said.

L Brands in February agreed to sell a controlling stake in the

chain and its Pink brand to Sycamore for $525 million. As part of

the deal, longtime leader Leslie Wexner agreed to step down as

chairman and CEO. The deal valued the lingerie brand at $1.1

billion.

Sycamore tried to renegotiate the original contract for a lower

price earlier this month, said people familiar with the matter.

Last week, L Brands said it had no obligation to renegotiate the

price or other economic terms, according to the court filing.

The economic fallout and uncertainty from the coronavirus

pandemic has brought new deal discussions largely to a halt and

caused buyers like Xerox Holdings Corp. to drop proposed tie-ups.

In the U.S., announced merger activity this year has dropped 57%

from the same period last year to $233.7 billion, according to

Dealogic.

The environment has claimed few deals that were already signed.

Most deal contracts leave little room for cold-footed buyers to

walk away, mergers and acquisitions lawyers say, though they

sometimes use the threat to negotiate a better deal.

Prior to Sycamore's filing, the highest-profile agreed buyer to

have a change of heart was SoftBank Group Corp. The Japanese

conglomerate, struggling to shore up its portfolio, said it planned

to back out of a deal to buy $3 billion worth of WeWork shares from

investors and former and current employees. It cited various

reasons including regulatory probes, though not the virus. A WeWork

special board committee sued SoftBank for breach of contract this

month and the two sides are set to face off in an early January

trial.

Aerospace suppliers Hexcel Corp. and Woodward Inc. mutually

agreed to ditch their all-stock combination in early April to focus

on responding to the pandemic's far-reaching impact on their own

businesses. Neither side had to pay a termination fee.

A few smaller companies have also had back-and-forths with

possible partners, including Bed Bath & Beyond Inc., which was

set to sell a small business to 1-800-Flowers.com before the

website sought to delay the close. Also, auto-parts maker

BorgWarner Inc., has accused target Delphi Technologies PLC of

breaching their merger contract.

Courts are generally reluctant to let buyers off the hook but do

occasionally, such as when Energy Transfer Equity LP got to walk

away from a deal to buy Williams Cos. over concerns about a tax

opinion in 2016. Verizon Communications Inc. was able to recut a

deal after Yahoo disclosed a data breach while their combination

was pending.

On March 17, L Brands said it was temporarily closing all its

U.S. stores. Ten days later, L Brands said it was furloughing most

of its workers as the coronavirus spread and states extended

shutdown orders. L Brands also drew down $950 million from a

revolving credit line, suspended its quarterly dividend and cut pay

for senior executives.

According to the Delaware lawsuit, Sycamore contacted L Brands

on April 2, saying it hadn't agreed to the actions and was

concerned the conditions necessary for the deal to close might not

be met. L Brands replied it was complying with their agreement.

The back-and-forth continued. Sycamore argued that L Brands had

materially breached the contract; L Brands rejected that

assertion.

Before the pandemic, L Brands was struggling with falling sales

as demand for Victoria's Secret bras and underwear cooled. Like

many other retailers, the company has lost out on the majority of

its revenue since closing its stores.

In March, the company temporarily halted sales on the Victoria's

Secret and Pink websites. It resumed the business after announcing

it had taken safety precautions at its distribution centers, such

as temperature checks and social-distancing measures.

Write to Khadeeja Safdar at khadeeja.safdar@wsj.com and Cara

Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

April 23, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

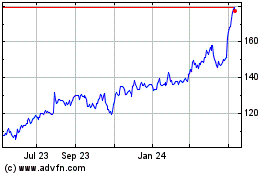

Woodward (NASDAQ:WWD)

Historical Stock Chart

From Mar 2024 to Apr 2024

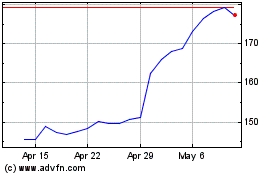

Woodward (NASDAQ:WWD)

Historical Stock Chart

From Apr 2023 to Apr 2024