UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

|

|

|

|

|

|

|

|

☒

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2020

|

|

|

OR

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from_______to_______

|

Commission File Number: 001-37552

MOBILE MINI, INC. PROFIT SHARING PLAN AND TRUST

(Full title of the Plan)

(Name of the issuer of the securities held pursuant to the Plan)

4646 E VAN BUREN ST., SUITE 400

PHOENIX, ARIZONA 85008

(Address of principal executive office of the issuer)

MOBILE MINI, INC. PROFIT SHARING PLAN AND TRUST

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Page No.

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

1

|

|

FINANCIAL STATEMENTS

|

|

|

|

2

|

|

|

3

|

|

|

4

|

|

SUPPLEMENTAL SCHEDULE

|

|

|

|

9

|

|

|

10

|

|

|

11

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Plan Administrator, Administrative Committee, and Audit Committee of

Mobile Mini, Inc. Profit Sharing Plan and Trust

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Mobile Mini, Inc. Profit Sharing Plan and Trust (the Plan) as of December 31, 2020 and 2019, and the related statement of changes in net assets available for benefits for the year ended December 31, 2020, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2020 and 2019, and the changes in net assets available for benefits for the year ended December 31, 2020, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental schedule of assets (held at end of year) as of December 31, 2020 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Mayer Hoffman McCann P.C.

We have served as the Plan's auditor since 2003.

Phoenix, Arizona

June 29, 2021

MOBILE MINI, INC. PROFIT SHARING PLAN AND TRUST

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

2020

|

|

2019

|

|

Assets

|

|

|

|

|

|

Cash

|

|

$

|

39,976,288

|

|

|

$

|

88

|

|

|

Investments - at fair value

|

|

1,937,265

|

|

|

33,769,583

|

|

|

Notes receivable from participants

|

|

950,783

|

|

|

1,091,624

|

|

|

Net Assets Available for Benefits

|

|

$

|

42,864,336

|

|

|

$

|

34,861,295

|

|

The accompanying notes are an integral part of these financial statements.

MOBILE MINI, INC. PROFIT SHARING PLAN AND TRUST

Statement of Changes in Net Assets Available for Benefits

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2020

|

|

Additions to net assets attributed to:

|

|

|

|

Contributions:

|

|

|

|

Participants

|

|

$

|

4,892,457

|

|

|

Rollovers

|

|

1,231,400

|

|

|

Employer

|

|

2,596,597

|

|

|

Total Contributions

|

|

8,720,454

|

|

|

Interest income on notes receivable from participants

|

|

56,937

|

|

|

Investment income:

|

|

|

|

Net appreciation in fair value of investments

|

|

5,828,217

|

|

|

Interest and dividends

|

|

93,272

|

|

|

Total investment income

|

|

5,921,489

|

|

|

Total Additions

|

|

14,698,880

|

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

|

Benefits paid to participants

|

|

6,572,243

|

|

|

Administrative fees

|

|

123,596

|

|

|

Total Deductions

|

|

6,695,839

|

|

|

|

|

|

|

Net increase in net assets available for benefits

|

|

8,003,041

|

|

|

|

|

|

|

Net assets available for benefits

|

|

|

|

Beginning of year

|

|

34,861,295

|

|

|

End of year

|

|

$

|

42,864,336

|

|

The accompanying notes are an integral part of this financial statement.

MOBILE MINI, INC. PROFIT SHARING PLAN AND TRUST

Notes to the Financial Statements

1. DESCRIPTION OF PLAN

The following is a brief description of the Mobile Mini, Inc. Profit Sharing Plan and Trust (the “Plan”). Participants should refer to the Plan agreement for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan which was originally adopted by Mobile Mini, Inc. (the “Company” or “Plan Sponsor”) in 1994 under the provisions of Section 401(a) of the Internal Revenue Code (the “IRC”), which includes a qualified cash or deferred arrangement as described in Section 401(k) of the IRC, for the benefit of the eligible employees of the Company. Effective January 1, 2019, the Plan agreement was restated to incorporate changes in the eligibility, contribution and vesting requirements as described in the following sections. As a result of the changes, the Plan has become a 401(k) safe harbor plan. Participation in the Plan is open to all eligible employees of the Company (individually, “Participant” and collectively, “Participants”). The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”).

Participants may apply to withdraw their 401(k) contributions in the event a Participant is over age 59 1/2, or apply for a loan when the Participant has a financial hardship as stipulated in the Plan provisions. Only funds from an active employee’s other investment options (not Company stock in the Plan) can be used to provide the funds for the loan or withdrawal.

On March 1, 2020, the Company entered into a definitive merger agreement (the “Merger Agreement”) with WillScot Corporation (“WillScot”). The Merger Agreement provided for the merger of Mobile Mini, Inc. with and into a newly formed subsidiary of WillScot, with the Company surviving as a wholly owned subsidiary (the “Merger”). On July 1, 2020, the effective time of the Merger, and subject to the terms and conditions set forth in the Merger Agreement, each outstanding share of the common stock of Mobile Mini, Inc. held in the Plan was converted into 2.4050 shares of WillScot Class A Common Stock. Immediately following the Merger, WillScot changed its name to “WillScot Mobile Mini Holdings Corp” and filed an amended and restated certificate of incorporation which reclassified all outstanding shares of WillScot Class A Common Stock and converted such shares into shares of common stock of WillScot Mobile Mini Holdings Corp.

As part of the Merger with WillScot, the Plan was merged into the Williams Scotsman, Inc. 401(k) Plan (“WillScot Plan”) which was reinstated to be known as the WillScot Mobile Mini 401(k) Plan. The merger of the Plan was effective January 1, 2021 and the Plan assets transferred during January and February 2021.

Recent Legislation

The Setting Every Community Up for Retirement Enhancement (“SECURE”) Act was enacted in December 2019, and became effective January 1, 2020. The SECURE Act was designed to encourage investing for retirement by increasing the required minimum distribution age and making certain other changes to certain tax-qualified retirement plans.

The United States Congress passed the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act, on March 27, 2020. The CARES Act includes several employee benefit plan provisions that expanded the ability of participants to access their retirement savings through their employer’s tax-qualified retirement plans when they were personally impacted as a result of Coronavirus. Specifically, participants could opt to distribute funds from their retirement account or take a loan from the plan if the distribution or loan was related to Coronavirus (as defined in the CARES Act), and receive relief for loan repayments.

The Plan incorporated the SECURE and CARES Act changes in its Plan document by the deadlines prescribed in the legislation.

Trustee

Effective January 1, 2019, the Plan engaged Principal Financial (the “Trustee” or “Principal”) as Trustee and Custodian to the Plan, as well as to provide recordkeeping, custodial and administrative services to the Plan. All Plan assets were transferred to Principal from Wells Fargo as of February 1, 2019 and subsequently allocated to Participant accounts and reinvested in funds offered by Principal. All Plan assets are held in trust with the Trustee as of December 31, 2020 and 2019.

Eligibility

Employees are eligible to participate in the Plan with Participant elective deferrals on the first day of the following month upon meeting the following eligibility conditions: (1) completed 30 days of service and (2) have attained age 18. Employees are also eligible for the Company’s discretionary matching contribution and the Company’s non-elective contribution on the first day of the following month upon meeting the following eligibility conditions: (1) completed 30 days of service and (2) have attained age 18. Generally, employees of acquired companies, who meet the eligibility conditions of the Plan, may participate immediately upon acquisition.

Contributions

Participants may contribute a fixed amount or a percentage of their annual compensation on a before-tax basis, provided the amounts do not exceed the annual limit imposed by the Internal Revenue Service (“IRS”). Such contributions are withheld by the Company from each Participant’s compensation and deposited with the Trustee to be applied to the appropriate fund in accordance with the Participant’s directives. Participants may roll over distributions from other qualified

MOBILE MINI, INC. PROFIT SHARING PLAN AND TRUST

Notes to the Financial Statements

plans and certain Individual Retirement Accounts to the Plan within 60 days of receipt of the distribution. Effective January 1, 2020, the Plan automatically enrolls eligible employees hired after that date at a rate of 5% of compensation.

The Company provides a discretionary match to eligible Participants of 100% up to 3% of their pay, plus 50% over 3% up to 5% of their pay. The discretionary match is Participant directed and is deposited to the Participants’ account on a bi-weekly basis. At its sole discretion, the Company may make an additional non-elective contribution to Participants who are employed by the Company on the last day of the Plan year. There was no discretionary non-elective contribution made in 2020.

Participant and Company contributions made on behalf of highly compensated employees are limited pursuant to non-discrimination rules set forth in the Plan document and the applicable IRC.

Participant Accounts

Separate accounts are maintained for each Participant. Each Participant’s 401(k) account is credited with the Participant’s contribution and rollovers, the Company’s matching contributions and any allocation of the Company’s discretionary non-elective contributions. Plan earnings are allocated to each Participant’s account in proportion to the average daily balance in each fund option. The benefit to which a Participant is entitled is the benefit that can be provided from the Participant’s vested account balance.

Vesting

Participants in the Plan are 100% vested at all times with respect to their own contributions to the Plan, the Company’s match and discretionary contributions, qualified non-elective contributions, and the earnings thereon.

Administration

The Plan is sponsored by the Company. Operating and administrative expenses incurred in the administration of the Plan are the responsibility of the Plan, unless assumed by the Company.

Distributions

Benefits are distributed to Participants upon any of the following: (1) termination of employment with the Company; (2) retirement and in-service distributions upon or following age 59 1/2; (3) financial hardship as stipulated in the Plan provisions; or (4) disability or death. Benefits are distributed to Participants (or the designated beneficiary) in a lump-sum payment or installment payments. Distributions from the Plan will normally be taxed as ordinary income for income tax purposes, unless the Participant (or the designated beneficiary) elects to rollover his or her distributions into an Individual Retirement Account or another qualified employer plan.

Notes Receivable from Participants

The Plan allows Participants to obtain loans of their vested account balances, the amounts of which are subject to specific limitations set forth in the Plan loan policy and the IRC. Notes receivable from Participants represent the aggregate amount of principal and accrued interest outstanding on such loans. The loans are secured by the vested balance in the Participant’s account. As of December 31, 2020, the maturity dates of loans range from 2021 to 2026 and loans bear interest between 4.25% and 6.50%. Principal and interest are paid ratably through payroll deductions.

Termination of the Plan

Although it has not expressed any intent to do so, the Plan Sponsor has the right to terminate the Plan subject to the provisions of ERISA.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The accompanying financial statements have been prepared on the accrual basis of accounting in accordance with generally accepted accounting principles in the United States of America (“GAAP”).

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities and the reported amounts of additions to and deductions from net assets. Actual results could differ from those estimates.

Investment Valuation

Investments are stated at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Plan’s management determines the Plan’s valuation policies utilizing information provided by the investment advisors, custodians, and insurance company. See Note 3 for discussion of fair value measurements.

MOBILE MINI, INC. PROFIT SHARING PLAN AND TRUST

Notes to the Financial Statements

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation includes the Plan’s gains and losses on investments bought and sold as well as held during the year.

Payment of Benefits

Benefit payments to Participants are recorded when paid.

Administrative Expenses

Certain expenses of maintaining the Plan are paid by the Plan, unless otherwise paid by the Plan Sponsor. Expenses that are paid by the Plan Sponsor are excluded from these financial statements. Fees related to the administration of notes receivable from participants and benefit payments are charged directly to the participant’s account balance and are included in administrative fees. Investment-related expenses are included in the net appreciation of fair value of investments.

3. FAIR VALUE MEASUREMENT

Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) 820 Fair Value Measurement establishes a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under FASB ASC 820 are described as follows:

|

|

|

|

|

|

|

|

Level 1

|

Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access.

|

|

|

|

|

Level 2

|

Inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets or liabilities in inactive markets; inputs other than quoted prices that are observable for the asset or liability; inputs that are derived principally from or collaborated by observable market data by correlation or other means. If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability.

|

|

|

|

|

Level 3

|

Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

|

The asset’s or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques maximize the use of observable inputs and minimize the use of unobservable inputs.

Following is a description of the valuation methodologies used for assets measured at fair value. There has been no changes to methodologies used as of December 31, 2020 and 2019.

Common stock: Valued at the closing price reported on the active market on which the individual securities are traded.

Mutual funds: Valued at the Net Asset Value (“NAV”) of shares held by the Plan at year end, which are readily determinable fair values of those shares as they are published daily and are the basis for current transactions. Accordingly, these investments are reported at Level 1.

Pooled separate accounts: Investments in sub-accounts of the Plan’s group annuity contract with Principal Life Insurance Company are valued at unit value, which is based on the aggregate fair value of the underlying assets in relation to the total number of units outstanding. Unit value is the equivalent of NAV , which is a practical expedient for estimating the fair values of these investments. Each of these investments may be redeemed daily with a notice period of one day. The Plan had no unfunded commitments as of December 31, 2020. Accordingly, these investments have been excluded from the fair value hierarchy.

Collective trust funds: The collective trust fund investments are valued at NAV per share, which is a practical expedient used to estimate the fair value of each respective fund. The investments underlying the collective trust fund include other publicly traded investment funds and are valued at the respective fund's NAV. The collective trust fund does not have a finite life, unfunded commitments, or significant restrictions on redemptions. Accordingly, these investments have been excluded from the fair value hierarchy.

The preceding methods may produce a fair value calculation that may not be indicative of the net realizable value or reflective of future fair value. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

MOBILE MINI, INC. PROFIT SHARING PLAN AND TRUST

Notes to the Financial Statements

The carrying amounts of cash and receivables approximate fair values based on their short-term nature. The following table sets forth by level, within the fair value hierarchy, the Plan’s investments.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of December 31, 2020

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Common stock:

|

|

|

|

|

|

|

|

|

Willscot Mobile Mini Holdings Corp. Common Stock

|

$

|

1,729,376

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

1,729,376

|

|

|

Mutual funds

|

22,307

|

|

|

—

|

|

|

—

|

|

|

22,307

|

|

|

Total assets in the fair value hierarchy

|

$

|

1,751,683

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

1,751,683

|

|

|

Investments measured at net asset value(a):

|

|

|

|

|

|

|

|

|

Pooled separate accounts

|

|

|

|

|

|

|

3,574

|

|

|

Collective trust funds

|

|

|

|

|

|

|

182,008

|

|

|

Total Investments at Fair Value

|

|

|

|

|

|

|

$

|

1,937,265

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of December 31, 2019

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Common stock:

|

|

|

|

|

|

|

|

|

Mobile Mini, Inc. Common Stock

|

$

|

1,327,043

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

1,327,043

|

|

|

Mutual funds

|

4,166,210

|

|

|

—

|

|

|

—

|

|

|

4,166,210

|

|

|

Total assets in the fair value hierarchy

|

$

|

5,493,253

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

5,493,253

|

|

|

Investments measured at net asset value(a):

|

|

|

|

|

|

|

|

|

Pooled separate accounts

|

|

|

|

|

|

|

386,466

|

|

|

Collective trust funds

|

|

|

|

|

|

|

27,889,864

|

|

|

Total Investments at Fair Value

|

|

|

|

|

|

|

$

|

33,769,583

|

|

(a) In accordance with Subtopic 820-10 of FASB ASC 820 Fair Value Measurement, certain investments that were measured at NAV per share (or its equivalent) have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of fair value hierarchy to the line items presented in the statements of net assets available for benefits.

Transfers Between Levels

For years ended December 31, 2020 and 2019, there were no significant transfers between Levels 1 and 2 and no transfers in or out of Level 3.

The following table summarizes investments measured at fair value based on net asset value (NAV) per share as of December 31, 2020 and 2019, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investments

|

|

December 31, 2020

|

|

December 31, 2019

|

|

Unfunded Commitments

|

|

Redemption Frequency (if currently eligible)

|

|

Redemption Notice Period

|

|

Pooled Separate accounts

|

|

$

|

3,574

|

|

|

$

|

386,466

|

|

|

None

|

|

Daily

|

|

One Day

|

|

Collective trust funds

|

|

182,008

|

|

|

27,889,864

|

|

|

None

|

|

Daily

|

|

One Day

|

|

|

|

$

|

185,582

|

|

|

$

|

28,276,330

|

|

|

|

|

|

|

|

4. TAX STATUS OF THE PLAN

The Plan is a non-standardized prototype plan developed by the Plan Sponsor of the Plan. The Plan obtained its latest opinion letter on August 8, 2014, in which the Internal Revenue Service (“IRS”) stated that the Plan, as then designed, was in compliance with the applicable requirements of the Internal Revenue Code (“the Code”). The Plan has been amended since receiving the opinion letter consisting primarily of changes resulting from changes in regulations. The Plan Administrator and the Plan’s tax counsel believe that the Plan is currently designed and being operated in compliance with the applicable requirements of the Code and that the Plan was qualified, and the related trust remains tax-exempt as of December 31, 2020. Accordingly, no provision for income taxes has been made in the accompanying financial statements.

MOBILE MINI, INC. PROFIT SHARING PLAN AND TRUST

Notes to the Financial Statements

5. PARTIES IN INTEREST AND RELATED PARTY TRANSACTIONS

Certain investments of the Plan are shares of funds managed by the Trustee. In addition, the Plan held investments in the Company’s common stock during the year consisting of 74,638 shares as of December 31, 2020. These transactions are considered exempt party-in-interest transactions. Of the total administrative fees of $123,596, $78,227 was paid to the Trustee, and is considered exempt party-in-interest transactions.

6. SUBSEQUENT EVENTS

As part of the Merger, the Plan was merged into the WillScot Plan which was reinstated to be known as the WillScot Mobile Mini 401(k) Plan. The merger was effective January 1, 2021 and the Plan assets transferred during January and February 2021.

Plan management has evaluated subsequent events through the date the financial statements of the Plan were issued.

7. RISKS AND UNCERTAINTIES

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market and credit risks. Due to the general level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investments could occur and that such changes could materially affect Participants’ account balances and the amounts reported in the statements of net assets available for benefits. These and other economic events may have a significant adverse impact on investment portfolios in the near term.

MOBILE MINI, INC. PROFIT SHARING PLAN AND TRUST

Schedule H, line 4i - Schedule of Assets (Held at End of Year)

As of December 31, 2020

EIN: 86-0748362

Plan Number: 001

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

(b)

|

(c)

|

(e)

|

|

|

Identity of issuer, borrower, lessor, or similar party

|

Description of investment including maturity date, rate of interest, collateral, par, or maturity value

|

Current value

|

|

|

Collective Trust Funds

|

|

|

|

*

|

Principal Global Investors Trust Co

|

Principal Stable Value Z Fund

|

$

|

3,432

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid 2010 CIT

|

304

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid 2015 CIT

|

2,169

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid 2020 CIT

|

5,261

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid 2025 CIT

|

17,146

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid 2030 CIT

|

27,621

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid 2035 CIT

|

26,384

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid 2040 CIT

|

25,584

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid 2045 CIT

|

26,163

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid 2050 CIT

|

25,891

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid 2055 CIT

|

13,308

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid 2060 CIT

|

7,217

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid 2065 CIT

|

1,402

|

|

*

|

Principal Global Investors Trust Co

|

Principal Lifetime Hybrid Income CIT

|

126

|

|

|

Total collective trust funds

|

|

182,008

|

|

|

Pooled Separate Accounts

|

|

|

|

*

|

Principal Life Insurance Company

|

Principal Real Estate SECS SA

|

1,054

|

|

*

|

Principal Life Insurance Company

|

Principal Small Cap Growth I Sep Acct

|

2,520

|

|

|

Total pooled separate accounts

|

|

3,574

|

|

|

Mutual funds

|

|

|

|

|

American Beacon

|

Amer Beacon S Cp Val R6 Fd

|

182

|

|

|

Mass Mutual

|

MassMutual Select Mid Cap Growth Inst Fund

|

2,007

|

|

|

Mass Mutual

|

MassMutual Sel Blchp Grw I Fd

|

5,324

|

|

|

MFS Investment Management

|

MFS Mid Cap Value R6 Fund

|

149

|

|

|

MFS Investment Management

|

MFS Value R6 Fund

|

599

|

|

|

MFS Investment Management

|

MFS Intl Diversification R6 Fd

|

340

|

|

|

Invesco

|

Invesco Developing Markets R6 Fund

|

513

|

|

|

Vanguard Group

|

Vanguard TTL B Mkt Idx Adm Fd

|

1,600

|

|

|

Vanguard Group

|

Vgd Ttl Intl Stk Idx Adm Fd

|

1,104

|

|

|

Vanguard Group

|

Vanguard Mid Cap Index Adm Fd

|

1,921

|

|

|

Vanguard Group

|

Vanguard Sm Cap Index Adm Fund

|

1,463

|

|

|

Vanguard Group

|

Vanguard 500 Index Admiral Fd

|

6,176

|

|

|

Metropolitan Management

|

Metropolitan WT TL Rtn Bd Plan

|

929

|

|

|

Total mutual funds

|

|

22,307

|

|

*

|

Willscot Mobile Mini Holdings Corp

|

Common stock of Plan Sponsor

|

1,729,376

|

|

*

|

Participants

|

Notes receivable from participants **

|

950,783

|

|

|

Total Investments

|

|

$

|

2,888,048

|

* Indicates a party-in-interest in the Plan.

** Interest rates range from 4.25% through 6.50%; maturity dates range from 2021 through 2026.

Note: Historical cost is not required to be presented, as all investments are participant-directed.

Exhibit filed with Form 11-K for the year ended December 31, 2020:

|

|

|

|

|

|

|

|

Exhibit No.

|

Description of Exhibit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Plan Administrator has duly caused this Annual Report to be signed on its behalf by the undersigned hereunto duly authorized.

MOBILE MINI, INC. PROFIT SHARING PLAN AND TRUST

Date: June 29, 2021

|

|

|

|

|

|

|

|

|

/s/ Hezron Timothy Lopez

|

|

|

Hezron Timothy Lopez

|

|

|

Chief Human Resources Officer

|

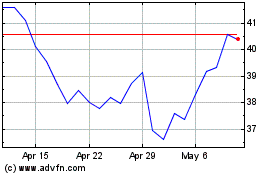

WillScot Mobile Mini (NASDAQ:WSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

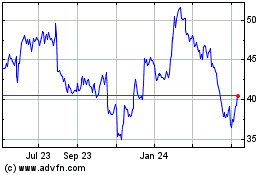

WillScot Mobile Mini (NASDAQ:WSC)

Historical Stock Chart

From Apr 2023 to Apr 2024