As filed with the Securities and Exchange Commission on March 16,

2021

No. 333-253892

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM F-10

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Westport Fuel Systems Inc.

(Exact name of Registrant as specified in its charter)

|

Alberta

|

|

3537

|

|

Not Applicable

|

(Province or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number (if applicable))

|

|

(I.R.S. Employer

Identification Number (if applicable)

|

1750 West 75th Avenue, Suite 101

Vancouver, British Columbia, Canada V6P 6G2

(604) 718-2000

(Address, including zip code, and telephone number, including area

code, of registrant's principal executive offices)

C T Corporation System

111 Eighth Avenue

New York, NY 10011

USA

(212) 590-9070

(Name, address (including zip code) and telephone number (including

area code) of agent for service in the United States)

Copies of all communications, including communications sent

to agent for service, should be sent to:

|

Steven B. Stokdyk, Esq.

Lewis W. Kneib, Esq.

Latham & Watkins LLP

355 South Grand Avenue, Suite 100

Los Angeles, CA 90071

USA

|

|

Bruce Hibbard

Bennett Jones LLP

4500 Bankers Hall East

855 2nd Street SW

Calgary, AB T2P 4K7

Canada

|

Approximate date of commencement of proposed sale to the public

from time to time after the effectiveness of this Registration Statement.

Province of British Columbia, Canada

(Principal jurisdiction regulating this offering (if applicable))

It is proposed that this filing shall become effective (check

appropriate box):

|

|

A. ☐

|

upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada)

|

|

|

B. ☐

|

at some future date (check the appropriate box below)

|

|

|

1. ☐

|

pursuant to Rule 467(b) on (date) at (time) (designate a time not sooner than 7 calendar days after filing).

|

|

|

2. ☐

|

pursuant to Rule 467(b) on (date) at (time) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on (date).

|

|

|

3. ☒

|

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

|

|

|

4. ☐

|

after the filing of the next amendment to this Form (if preliminary material is being filed).

|

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the

following box. ☒

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

No securities regulatory authority has expressed an opinion

about these securities and it is an offence to claim otherwise.

This short form base shelf prospectus has been

filed under legislation in each of the provinces of Canada that permits certain information about these securities to be determined

after this short form base shelf prospectus has become final and that permits the omission from this short form base shelf prospectus

of that information. The legislation requires the delivery to purchasers of a prospectus supplement containing the omitted information

within a specified period of time after agreeing to purchase any of these securities, except in cases where an exemption from such

delivery requirements has been obtained.

This short form base shelf prospectus constitutes a public

offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons

permitted to sell such securities.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE

SEC NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Information has been incorporated by reference in this

short form base shelf prospectus from documents filed with securities commissions or similar authorities in Canada. Copies

of the documents incorporated herein by reference may be obtained on request without charge from the Investor Relations Department

of Westport Fuel Systems Inc. ("Westport Fuel Systems" the "Corporation", "we",

"us" or "our") at 101 – 1750 West 75th Avenue, Vancouver, British Columbia V6P 6G2, telephone

(604) 718-2046 and are also available electronically at www.sedar.com. See "Documents

Incorporated by Reference".

FINAL SHORT FORM BASE SHELF PROSPECTUS

|

New Issue and Secondary Offering

|

March 16, 2021

|

WESTPORT FUEL SYSTEMS INC.

U.S.$400,000,000

Common Shares

Preferred Shares

Subscription Receipts

Warrants

Debt Securities

Units

This short form base shelf prospectus (the

"Prospectus") relates to the offering for sale from time to time, during the 25-month period that this Prospectus,

including any amendments, remains valid, of up to U.S.$400,000,000 (or the equivalent in other currencies or currency units based

on the applicable exchange rate at the time of the offering) aggregate initial offering price of our common shares ("Common

Shares"), preferred shares ("Preferred Shares"), subscription receipts ("Subscription Receipts"),

warrants to purchase Common Shares ("Warrants"), senior or subordinated debt securities ("Debt Securities"),

and/or units comprised of one or more of the other securities described in this Prospectus in any combination, ("Units"

and, together with the Common Shares, Preferred Shares, Subscription Receipts, Debt Securities and Warrants, the "Securities").

The Securities may be offered by us or by our securityholders. We, or our securityholders, may offer Securities in such amount

and, in the case of the Preferred Shares, Subscription Receipts, Warrants, Debt Securities, and Units, with such terms as we, or

our securityholders, may determine in light of market conditions. We, or our securityholders, may sell the Preferred Shares, Subscription

Receipts, Warrants, and Debt Securities in one or more series.

The distribution of Securities may be effected

from time to time in one or more transactions at a fixed price or prices, which may be changed, or at non-fixed prices, such as

market prices prevailing at the time of sale or prices related to such prevailing market prices to be negotiated with purchasers,

including sales in transactions that are deemed to be "at-the-market distributions" as defined in National Instrument

44-102 Shelf Distributions ("NI 44-102") including sales made directly on the TSX, the Nasdaq or other

existing trading markets for the Securities, and as set forth in one or more supplements to this Prospectus (each, a "Prospectus

Supplement"). This Prospectus may qualify an "at-the-market distribution", as defined under NI 44-102 (an "ATM

Distribution").

There are certain risk factors that should

be carefully reviewed by prospective purchasers. See "Risk Factors".

All shelf information permitted under applicable

laws to be omitted from this Prospectus will be contained in one or more Prospectus Supplements that will be delivered to prospective

purchasers together with this Prospectus, except in cases where an exemption from such delivery requirements is available or has

been obtained. Each Prospectus Supplement will be incorporated by reference into this Prospectus for the purposes of securities

legislation as of the date of the Prospectus Supplement and only for the purposes of the distribution of the Securities to which

the Prospectus Supplement pertains.

The specific variable terms of any offering

of Securities will be set forth in a Prospectus Supplement, including where applicable: (i) in the case of the Common Shares, the

number of Common Shares offered, the currency (which may be Canadian dollars or any other currency), the issue price and any other

specific terms; (ii) in the case of Preferred Shares, the number of Preferred Shares being offered, the designation of the series,

the offering price, dividend rate, if any, and any other specific terms; (iii) in the case of Subscription Receipts, the number

of Subscription Receipts offered, the currency (which may be Canadian dollars or any other currency), the issue price, the terms

and procedures for the exchange of the Subscription Receipts and any other specific terms; (iv) in the case of Warrants, the designation,

the number of Warrants offered, the currency (which may be Canadian dollars or any other currency), number of the Common Shares

that may be acquired upon exercise of the Warrants, the exercise price, dates and periods of exercise, adjustment procedures and

any other specific terms; (v) in the case of Debt Securities, the designation, aggregate principal amount and authorized denominations

of the Debt Securities, any limit on the aggregate principal amount of the Debt Securities, the currency (which may be Canadian

dollars or any other currency), the issue price (at par, at a discount or at a premium), the issue and delivery date, the maturity

date (including any provisions for the extension of a maturity date), the interest rate (either fixed or floating and, if floating,

the method of determination thereof), the interest payment date(s), the provisions (if any) for subordination of the Debt Securities

to other indebtedness, any redemption or purchase provisions, any repayment provisions, any terms entitling the holder to exchange

or convert the Debt Securities into other securities, any defeasance provisions, security (if any) applicable to such Debt Securities

and any other specific terms; and (vi) in the case of Units, the designation, the number of Units offered, the offering price,

the currency (which may be Canadian dollars or any other currency), terms of the Units and of the securities comprising the Units

and any other specific terms. Where required by statute, regulation or policy, and where Securities are offered in currencies other

than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to such Securities will be included in the Prospectus

Supplement describing such Securities.

You should read this Prospectus and any

Prospectus Supplement before you invest in any Securities.

We have filed with the U.S. Securities and

Exchange Commission (the "SEC") a registration statement on Form F-10 relating to the Securities. This Prospectus,

which constitutes a part of the registration statement, does not contain all of the information contained in the registration statement,

certain items of which are contained in the exhibits to the registration statement as permitted by the rules and regulations of

the SEC. Statements included or incorporated by reference into this Prospectus about the contents of any contract, agreement or

other documents referred to are not necessarily complete, and in each instance, you should refer to any applicable full version

or more detailed description of the contract, agreement or other document, as may be available electronically on SEDAR at www.sedar.com

or on Westport Fuel Systems' website at www.wfsinc.com, for a more complete description of

the matter involved. Each such statement is qualified in its entirety by such reference. See "Where You Can Find Additional

Information".

This offering is made by a Canadian issuer

that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada (the "MJDS"),

to prepare this Prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such

requirements are different from those of the United States. The financial statements incorporated by reference into this Prospectus

have been prepared in accordance with United States generally accepted accounting principles ("U.S. GAAP") and are subject

to Canadian and U.S. auditing and auditor independence standards.

Prospective investors should be aware

that the acquisition of the Securities may have tax consequences both in the United States and in Canada. Such consequences for

investors who are resident in, or citizens of, the United States may not be described fully herein or in any applicable Prospectus

Supplement with respect to a particular offering of Securities. Prospective investors should consult their own tax advisors prior

to deciding to purchase any of the Securities. See "Certain Income Tax Considerations".

The enforcement by investors of civil liabilities

under United States federal securities laws may be affected adversely by the fact that we are incorporated or organized under the

laws of Alberta, Canada, that some or all of our officers and directors are residents of Canada, that some or all of the underwriters

or experts named in this Prospectus are residents of Canada, and that all or a substantial portion of our assets and the assets

of such persons are located outside the United States. See "Enforcement of Civil Liabilities".

THESE SECURITIES HAVE NOT BEEN APPROVED

OR DISAPPROVED BY THE SEC NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY

IS A CRIMINAL OFFENSE.

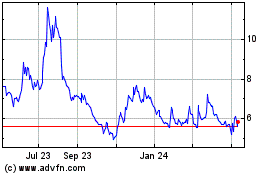

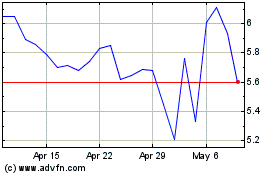

Our issued and outstanding Common Shares

are listed for trading on the Toronto Stock Exchange ("TSX") under the trading symbol "WPRT" and on

the Nasdaq Global Select Market ("Nasdaq") under the trading symbol "WPRT". On March 15, 2021, the last

trading day prior to the date of this Prospectus, the closing price of the Common Shares on the TSX was Cdn.$12.79 per Common Share

and the closing price of the Common Shares on Nasdaq was U.S.$10.25 per Common Share. Any offering of Securities other than Common

Shares will be a new issue of securities with no established trading market. Unless otherwise specified in the applicable Prospectus

Supplement, the Securities to be offered thereunder will not be listed on any securities exchange. Unless otherwise specified

in the applicable Prospectus Supplement, there is no market through which the Securities other than Common Shares may be sold and

purchasers may not be able to resell such Securities purchased under this Prospectus or any applicable Prospectus Supplement. This

may affect the pricing of these Securities in the secondary market (if any), the transparency and availability of trading prices,

the liquidity of the Securities, and the extent of issuer regulation. See "Risk Factors".

No underwriter has been involved in the

preparation of, or has performed a review of, the contents of this Prospectus.

Subject to applicable laws, and other than in relation

to an ATM Distribution, in connection with any offering of Securities, the underwriters, dealers or agents, as the case may be,

may over-allot or conduct transactions intended to stabilize, maintain or otherwise affect the market price for the Securities

at levels other than those which otherwise might prevail in the open market. Such transactions may be commenced, interrupted or

discontinued at any time. See "Plan of Distribution".

No underwriter or dealer of an ATM Distribution,

and no person or company acting jointly or in concert with such underwriter or dealer, may, in connection with the distribution,

enter into any transaction that is intended to stabilize or maintain the market price of the securities or securities of the same

class as the securities distributed under this Prospectus, including selling an aggregate number or principal amount of securities

that would result in the underwriter creating an over-allocation position in the securities. The Prospectus Supplement relating

to a particular offering of Securities will identify each person who may be deemed to be an underwriter, dealer or agent, as the

case may be, with respect to such offering and will set forth the terms of the offering of such Securities, including, to the extent

applicable, the amounts, if any, to be purchased by underwriters, the plan of distribution for such securities, the public offering

price, the proceeds expected to be received by us or any selling security holder, any fees, discounts or other compensation payable

to underwriters, dealers or agents, and any other material terms of the plan of distribution will be named in the related Prospectus

Supplement.

D. Johnson, D. Hancock, R. Forst, V. Schaller

and E. Wheatman are directors of the Corporation who reside outside of Canada. Each of these directors has appointed Bennett Jones

LLP, 4500 – 855 2nd Street S.W., Calgary, Alberta T2P 4K7, as their agent for service of process. Prospective investors are

advised that it may not be possible for investors to enforce judgements obtained in Canada against any person that resides outside

of Canada, even if the party has appointed an agent for service of process.

You should rely only on the information

contained in this Prospectus. We have not authorized anyone to provide you with information different from that contained in this

Prospectus.

Our head office is located at 101 –

1750 West 75th Avenue, Vancouver, British Columbia V6P 6G2, and our registered office is located at 4500 – 855 2nd Street

S.W., Calgary, Alberta T2P 4K7.

TABLE OF CONTENTS

Page

|

DEFINITIONS AND OTHER MATTERS

|

1

|

|

SPECIAL NOTICE REGARDING FORWARD-LOOKING STATEMENTS

|

1

|

|

DOCUMENTS INCORPORATED BY REFERENCE

|

3

|

|

WHERE YOU CAN FIND ADDITIONAL INFORMATION

|

4

|

|

ENFORCEABILITY OF CIVIL LIABILITIES

|

5

|

|

WESTPORT FUEL SYSTEMS INC.

|

5

|

|

OUR BUSINESS

|

5

|

|

CONSOLIDATED CAPITALIZATION

|

6

|

|

USE OF PROCEEDS

|

7

|

|

PLAN OF DISTRIBUTION

|

7

|

|

EARNINGS COVERAGE

|

9

|

|

DESCRIPTION OF COMMON SHARES

|

10

|

|

DESCRIPTION OF PREFERRED SHARES

|

10

|

|

DESCRIPTION OF SUBSCRIPTION RECEIPTS

|

11

|

|

DESCRIPTION OF WARRANTS

|

12

|

|

DESCRIPTION OF DEBT SECURITIES

|

13

|

|

DESCRIPTION OF UNITS

|

15

|

|

PRIOR SALES

|

16

|

|

MARKET FOR SECURITIES

|

17

|

|

SELLING SECURITYHOLDERS

|

17

|

|

RISK FACTORS

|

17

|

|

CERTAIN INCOME TAX CONSIDERATIONS

|

18

|

|

EXEMPTIONS

|

18

|

|

LEGAL MATTERS

|

18

|

|

AGENT FOR SERVICE OF PROCESS

|

18

|

|

AUDITORS

|

18

|

|

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

|

19

|

|

PURCHASERS' STATUTORY AND CONTRACTUAL RIGHTS

|

19

|

|

CERTIFICATE OF THE CORPORATION

|

C-1

|

DEFINITIONS

AND OTHER MATTERS

In this Prospectus and any Prospectus Supplement,

unless otherwise indicated, references to "we", "us", "our", "Westport Fuel Systems" or

the "Corporation" are to Westport Fuel Systems Inc. All references to "dollars", "Cdn.$" or "$"

are to Canadian dollars and all references to "U.S.$" are to United States dollars. Unless otherwise indicated, all financial

information included and incorporated by reference into this Prospectus and any Prospectus Supplement is determined using U.S.

GAAP.

SPECIAL

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Prospectus

and any Prospectus Supplement, and in certain documents incorporated by reference into this Prospectus, contain certain forward-looking

statements and forward-looking information (collectively referred to as "forward-looking statements"). When used

in such documents, the words "may", "would", "could", "will", "intend", "plan",

"anticipate", "believe", "estimate", "expect", "project" and similar expressions,

as they relate to us or our management, are intended to identify forward-looking statements. In particular, this Prospectus and

the documents incorporated by reference into this Prospectus contain forward-looking statements which include, but are not limited

to, the manner in which the selling securityholders may sell Securities, the filing of one or more Prospectus Supplement(s), the

expansion of our product offering, our business objectives and the expected impacts of previously announced acquisitions and developments.

In addition to those forward-looking statements

referred to above, readers should also refer to the AIF (as defined below), under the heading "Forward-Looking Information"

and the Annual MD&A (as defined below) under the heading "Forward-Looking Statements", both of which are incorporated

by reference into this Prospectus, for a list of some additional forward-looking statements made by us in this Prospectus and the

documents incorporated by reference into this Prospectus.

Such statements reflect our current views

with respect to future events and are subject to certain risks, uncertainties and assumptions. Actual results may differ materially

from those expressed in these forward-looking statements due to a number of uncertainties and risks, including the risks described

in this Prospectus, any Prospectus Supplement and in the documents incorporated by reference into this Prospectus and other unforeseen

risks, including, without limitation:

-

our response to, and preparedness for, the COVID-19 pandemic and other widespread

health emergencies;

-

market acceptance of our products;

-

product development delays and delays in contractual commitments;

-

changing environmental regulations;

-

the ability to attract and retain business partners;

-

the success of our business partners and original equipment manufacturers ("OEMs")

with whom we partner;

-

future levels of government funding and incentives;

-

competition from other technologies;

-

price differential between compressed natural gas, liquid natural gas and liquid

petroleum gas relative to petroleum-based fuels;

-

limitations on our ability to protect our intellectual property;

-

potential claims or disputes in respect of our intellectual property;

-

limitations in our ability to successfully integrate acquired businesses;

-

limitations in the development of natural gas refueling infrastructure;

-

the ability to provide the capital required for research, product development, operations

and marketing;

-

there could be unforeseen claims made against us;

-

our international business operations could expose us to regulatory risks or factors

beyond our control such as currency exchange rates, changes in governmental policy, trade barriers, trade embargoes, investigation

of sanctions relating to corruption of foreign public officials or international sanctions and delays in the development of international

markets for our products;

-

other risks relating to our Common Shares and Debt Securities;

-

risk of conflict related to directors and officers of Westport Fuel Systems who may

currently, or in the future, also serve as directors and/or officers of other public companies that may be involved in the same

industry as Westport Fuel Systems; and

-

those other risks discussed in the AIF under the heading "Risk Factors"

and in the Annual MD&A under the heading "Forward-Looking Statements".

Any forward-looking statement is made only

as of the date of this Prospectus or the applicable document incorporated by reference into this Prospectus. We undertake no obligation

to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, after we

distribute this Prospectus, except as otherwise required by law.

DOCUMENTS

INCORPORATED BY REFERENCE

Information has been incorporated by reference

into this Prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents

incorporated herein by reference may be obtained on request without charge from Investor Relations at 101 – 1750 West 75th

Avenue, Vancouver, British Columbia V6P 6G2, telephone (604) 718-2046. Copies of documents incorporated by reference are also available

electronically at www.sedar.com.

We have filed the following documents with

the securities commissions or similar regulatory authorities in certain of the provinces of Canada and such documents are specifically

incorporated by reference into this Prospectus:

|

|

·

|

the annual information form of Westport Fuel Systems for the year ended December 31, 2020 dated

March 15, 2021 (the "AIF");

|

|

|

·

|

the management proxy circular dated March 17, 2020, relating to the annual general and special

meeting of shareholders held on April 29, 2020;

|

|

|

·

|

audited consolidated financial statements as at December 31, 2020 and December 31, 2019 and for

the years ended December 31, 2020 and December 31, 2019, together with the notes thereto, and the auditors' report thereon; and

|

|

|

·

|

management's discussion and analysis of financial condition and results of operations dated March

15, 2021 for the fiscal year ended December 31, 2020 (the "Annual MD&A").

|

Any documents of the type required by National

Instrument 44-101 Short Form Prospectus Distributions of the Canadian Securities Administrators to be incorporated by reference

in a short form prospectus, including any annual information form, comparative annual financial statements and the auditors' report

thereon, comparative unaudited interim financial statements, management's discussion and analysis of financial condition and results

of operations, material change report (except a confidential material change report), business acquisition report and information

circular, if filed by us with the securities commissions or similar authorities in the provinces of Canada after the date of this

Prospectus and before the termination of the distribution shall be deemed to be incorporated by reference into this Prospectus.

To the extent that any document or information

incorporated by reference into this Prospectus is included in a report that is filed with the SEC on Form 40-F or 6-K (or any respective

successor form), such document or information shall also be deemed to be incorporated by reference as an exhibit to the registration

statement on Form F-10 of which this Prospectus forms a part, if and to the extent expressly provided in such filings. In addition,

we have and will incorporate by reference into this Prospectus from documents that we file with the SEC pursuant to Section 13(a)

or 15(d) of the United States Securities Exchange Act of 1934, as amended (the "U.S. Exchange Act"). Our U.S.

filings are electronically available from the SEC's Electronic Document Gathering and Retrieval System, which may be accessed at

www.sec.gov.

Any "template version" of any

"marketing materials" (as such terms are defined in National Instrument 41-101 General Prospectus Requirements)

filed by the Corporation after the date of a Prospectus Supplement and before the termination of the distribution of Securities

offered pursuant to such Prospectus Supplement (together with this Prospectus) will be deemed to be incorporated by reference into

such Prospectus Supplement for the purposes of the distribution of Securities to which the Prospectus Supplement pertains.

Any statement contained in this Prospectus

or in a document incorporated or deemed to be incorporated by reference into this Prospectus will be deemed to be modified or superseded

for purposes of this Prospectus to the extent that a statement contained in this Prospectus or in any other subsequently filed

document which also is, or is deemed to be, incorporated by reference into this Prospectus modifies or supersedes that statement.

The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other

information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall

not be deemed an admission for any purposes that the modified or superseded statement when made, constituted a misrepresentation,

an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary

to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded

shall not be deemed, except as so modified or superseded, to constitute part of this Prospectus.

Upon a new annual information form, audited

annual consolidated financial statements and related management's discussion and analysis being filed by us with, and where required,

accepted by, the securities commission or similar regulatory authority in each of the provinces of Canada during the term of this

Prospectus, the previous annual information form, the previous audited consolidated annual financial statements and related management's

discussion and analysis, all unaudited interim consolidated financial statements and related management's discussion and analysis,

material change reports and business acquisition reports filed prior to the commencement of our financial year in which the new

annual information form and related audited annual consolidated financial statements and management's discussion and analysis are

filed shall be deemed no longer to be incorporated into this Prospectus for purposes of future offers and sales of Securities under

this Prospectus. Upon new unaudited interim consolidated financial statements and related management's discussion and analysis

being filed by us with the securities commission or similar regulatory authority in each of the provinces of Canada during the

term of this Prospectus, all unaudited interim consolidated financial statements and related management's discussion and analysis

filed prior to the new unaudited interim consolidated financial statements and related management's discussion and analysis shall

be deemed no longer to be incorporated into this Prospectus for purposes of future offers and sales of Securities under this Prospectus.

Upon a new information circular relating to an annual meeting of holders of Common Shares being filed by us with the securities

commission or similar regulatory authority in each of the provinces of Canada during the term of this Prospectus, the information

circular for the preceding annual meeting of holders of Common Shares shall be deemed no longer to be incorporated into this Prospectus

for purposes of future offers and sales of Securities under this Prospectus.

One or more Prospectus Supplements containing

the specific variable terms for an issue of the Securities and other information in relation to such Securities will be delivered

to purchasers of such Securities together with this Prospectus and will be deemed to be incorporated by reference into this Prospectus

as of the date of the Prospectus Supplement solely for the purposes of the offering of the Securities covered by any such Prospectus

Supplement.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We have filed with the SEC a registration

statement on Form F-10 relating to the Securities. This Prospectus, which constitutes a part of the registration statement, does

not contain all of the information contained in the registration statement, certain items of which are contained in the exhibits

to the registration statement as permitted by the rules and regulations of the SEC. Statements included or incorporated by reference

into this Prospectus about the contents of any contract, agreement or other documents referred to are not necessarily complete,

and in each instance, you should refer to the exhibits for a more complete description of the matter involved. Each such statement

is qualified in its entirety by such reference.

We are subject to the information requirements

of the U.S. Exchange Act and applicable Canadian securities legislation, and in accordance therewith we file reports and other

information with the SEC and with the securities regulatory authorities in Canada. Under the MJDS adopted by Canada and the United

States, documents and other information that we file with the SEC may be prepared in accordance with the disclosure requirements

of Canada, which are different from those of the United States. As a foreign private issuer, we are exempt from the rules under

the U.S. Exchange Act prescribing the furnishing and content of proxy statements, and our officers, directors and principal shareholders

are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the U.S. Exchange Act. In addition,

we are not required to publish financial statements as promptly as United States companies.

Investors may read any document that we have

filed with the SEC and may also obtain copies of those documents by paying a fee at the public reference room of the SEC at 100

F Street, N.E., Washington, D.C. 20549. Investors should call the SEC at 1-800-SEC-0330 or access its website at www.sec.gov

for further information about the public reference rooms. Investors may read and download some of the documents we have filed with

the SEC at the SEC's Electronic Data Gathering, Analysis and Retrieval system at www.sec.gov.

We are also subject to filing requirements prescribed by the securities legislation of all Canadian provinces. These filings are

available electronically from SEDAR at www.sedar.com.

ENFORCEABILITY

OF CIVIL LIABILITIES

We are a corporation existing under the Business

Corporations Act (Alberta). A number of our officers and directors and some of the experts named in this Prospectus, are residents

of Canada or otherwise reside outside the United States, and all, or a substantial portion of their assets and a substantial portion

of our assets, are located outside the United States.

We have appointed an agent for service of

process in the United States, but it may be difficult for holders of Securities who reside in the United States to effect service

within the United States upon those directors, officers and experts who are not residents of the United States. It may also be

difficult for holders of Securities who reside in the United States to realize in the United States upon judgments of courts of

the United States predicated upon our civil liability and the civil liability of our directors, officers and experts under the

United States federal securities laws or the securities laws of any state of the United States.

We have been advised by our Canadian counsel

that a judgment of a United States court predicated solely upon civil liability under United States federal securities laws would

likely be enforceable in Canada if the United States court in which the judgment was obtained has a basis for jurisdiction in the

matter that would be recognized by a Canadian court for the same purposes. We have also been advised by such counsel, however,

that there is substantial doubt whether an action could be brought in Canada in the first instance on the basis of liability predicated

solely upon United States federal securities laws.

We filed with the SEC, concurrently with

our registration statement on Form F-10 of which this Prospectus is a part, an appointment of agent for service of process on Form

F-X. Under the Form F-X, we appointed CT Corporation System as our agent for service of process in the United States in connection

with any investigation or administrative proceeding conducted by the SEC, and any civil suit or action brought against or involving

us in a United States court arising out of or related to or concerning the offering of the Securities under this Prospectus.

WESTPORT

FUEL SYSTEMS INC.

Our governing corporate statute is the Business

Corporations Act (Alberta). Our head office and principal place of business is at 101 – 1750 West 75th Avenue, Vancouver,

British Columbia V6P 6G2. Our registered office is at 4500 Bankers Hall East, 855 – 2nd Street S.W., Calgary, Alberta T2P

4K7.

As of the date hereof, Westport Fuel Systems currently

has three material subsidiaries: (i) Westport Power Inc., which is wholly-owned by Westport Fuel Systems and incorporated pursuant

to the Business Corporations Act (British Columbia); (ii) Westport Fuel Systems Italia S.r.l., an Italian corporation and indirect

subsidiary of Westport Fuel Systems; and (iii) Prins Autogassystemen B.V., a Netherlands corporation and indirect subsidiary of

Westport Fuel Systems.

OUR

BUSINESS

Westport Fuel Systems is a global company

focused on engineering, manufacturing, and supply of alternative fuel systems and components for transportation applications. Our

diverse product offering sold under a wide range of established global brands enable the use of a number of alternative fuels,

which provide environmental and economic advantages, including liquid petroleum gas, compressed natural gas, liquefied natural

gas, renewable natural gas or biomethane and hydrogen. We supply our products and services through a network of distributors, OEMs

and delayed OEM programs and we have customers in more than 70 countries. Today, our products and services are available for the

passenger car and light-, medium- and heavy-duty truck, cryogenics, and hydrogen applications.

Westport Fuel Systems believes it is well-positioned

to increase revenues and market share as new stringent environmental regulations mandating greenhouse gas emission reductions

have been introduced in key markets around the world. We are leveraging our market ready products and customer base to capitalize

on these opportunities. In addition to our significant operational competency in well-established transportation markets, our

development of new technologies provides us a premier technology leadership position which is expected to drive future growth.

Westport Fuel Systems has a track record of innovation, specialized engineering capabilities, and a deep patent portfolio resulting

in a strong intellectual property position.

CONSOLIDATED

CAPITALIZATION

The following table sets forth our consolidated

capitalization as of December 31, 2020 on an actual basis. The following table is based on the audited consolidated balance sheet

of Westport Fuel Systems as at December 31, 2020 and should be read in conjunction with other information included in the documents

incorporated by reference in this Prospectus and any Prospectus Supplement. In addition, as a result of any offering of Securities

hereunder, equity of Westport Fuel Systems will increase by the amount of the net proceeds, less expenses, of such offering and

there will be additional Common Shares outstanding. There have been no material changes in our share and debt capitalization that

have occurred subsequent to December 31, 2020, other than: (a) the issuance of an aggregate of 1,819,712 Common Shares through

an at-the-market equity offering program, announced by the Corporation on November 9, 2020, that allows the Corporation to issue

up to U.S.$50.0 million (or the equivalent in Canadian dollars) in Common Shares from treasury to the public from time to time,

at the Corporation’s discretion and subject to regulatory requirements (the "ATM Program"); and (b) the

issuance of 1,815,117 Common Shares on January 21, 2021 pursuant to the terms of our existing convertible notes with Cartesian

Capital Group and its affiliates ("Cartesian") at the option of the holder at a conversion price of U.S.$1.42

per share, reducing the principal amount of the convertible notes from U.S.$5.0 million

as at December 31, 2020 to U.S.$2.5 million.

|

Indebtedness

|

|

Total Short-Term Debt

|

U.S.$23.4 million

|

|

Total Long-Term Debt, including current portion

|

U.S.$62.0 million

|

|

Total Royalty Payable, including current portion

|

U.S.$16.0 million

|

|

Shareholder Equity

|

|

Common Shares

|

U.S.$1,115.1 million

|

Basic Shares Outstanding

(presented on an as-converted to Common Shares basis)

|

144,069,972

|

|

Restricted Share Units (RSUs)

|

533,228

|

|

Performance Share Units (PSUs)

|

919,150

|

|

Convertible debt conversion option to common shares

|

3,521,127

|

|

Fully-Diluted Shares Outstanding

|

149,043,477

|

USE

OF PROCEEDS

Unless otherwise indicated in an applicable

Prospectus Supplement relating to an offering of Securities, we expect to use the net proceeds we receive from the sale of Securities

to finance future growth opportunities including acquisitions and investments, to finance our capital expenditures, to reduce our

outstanding indebtedness, for working capital purposes or for general corporate purposes, as will be further described in one or

more Prospectus Supplements. All Prospectus Supplements under the Prospectus will include reasonable detail of the use of proceeds.

The amount of net proceeds to be used for each of the principal purposes will be described in the applicable Prospectus Supplement.

All expenses relating to an offering of Securities and any compensation paid to underwriters, dealers or agents will be paid out

of our general funds. From time to time, we may issue debt securities or incur additional indebtedness other than through the issue

of Securities pursuant to this Prospectus. We will not receive any proceeds from any sales of Securities by any selling securityholders

pursuant to a secondary offering. More detailed information regarding anticipated expenses associated with any underwriter, broker,

dealer manager or similar securities industry professionals in respect of any sales by us or a selling securityholder will be described

in any applicable Prospectus Supplement.

PLAN

OF DISTRIBUTION

New Issue

We may sell Securities to or through underwriters,

dealers, placement agents or other intermediaries and also may sell Securities directly to purchasers or through agents, subject

to obtaining any applicable exemption from registration requirements.

The distribution of Securities may be effected from

time to time in one or more transactions at a fixed price or prices, which may be changed, or at non-fixed prices, such as market

prices prevailing at the time of sale or prices related to such prevailing market prices to be negotiated with purchasers, including

sales in transactions that are deemed to be ATM Distributions, including sales made directly on the TSX, the Nasdaq or other existing

trading markets for the Securities, and as set forth in an accompanying Prospectus Supplement.

In connection with the sale of Securities,

underwriters may receive compensation from us or from purchasers of Securities for whom they may act as agents in the form of discounts,

concessions or commissions. Underwriters, dealers, placement agents or other intermediaries that participate in the distribution

of Securities may be deemed to be underwriters and any discounts or commissions received by them from us and any profit on the

resale of Securities by them may be deemed to be underwriting discounts and commissions under applicable securities legislation.

If so indicated in the applicable Prospectus

Supplement, we may authorize dealers or other persons acting as our agents to solicit offers by certain institutions to purchase

the Securities directly from us pursuant to contracts providing for payment and delivery on a future date. These contracts will

be subject only to the conditions set forth in the applicable Prospectus Supplement or supplements, which will also set forth the

commission payable for solicitation of these contracts.

The Prospectus Supplement relating to any

offering of Securities will also set forth the terms of the offering of the Securities, including, to the extent applicable, the

initial offering price, the proceeds to us, the underwriting discounts or commissions, and any other discounts or concessions to

be allowed or reallowed to dealers. Underwriters with respect to any offering of Securities sold to or through underwriters will

be named in the Prospectus Supplement relating to such offering.

Under agreements which may be entered into

by us, underwriters, dealers, placement agents and other intermediaries who participate in the distribution of Securities may be

entitled to indemnification by us against certain liabilities, including liabilities under applicable securities legislation. The

underwriters, dealers, placement agents and other intermediaries with whom we enter into agreements may be customers of, engage

in transactions with or perform services for us in the ordinary course of business.

Any offering of Preferred Shares, Subscription

Receipts, Warrants, Debt Securities, or Units that is not a secondary offering will be a new issue of securities with no established

trading market. Unless otherwise specified in the applicable Prospectus Supplement, the Preferred Shares, Subscription Receipts,

Warrants, Debt Securities or Units will not be listed on any securities exchange. Unless otherwise specified in the applicable

Prospectus Supplement, there is no market through which the Preferred Shares, Subscription Receipts, Warrants, Debt Securities

or Units may be sold and purchasers may not be able to resell Preferred Shares, Subscription Receipts, Warrants, Debt Securities

or Units purchased under this Prospectus or any Prospectus Supplement. This may affect the pricing of the Preferred Shares, Subscription

Receipts, Warrants, Debt Securities or Units in the secondary market, the transparency and availability of trading prices, the

liquidity of the securities, and the extent of issuer regulation. Certain dealers may make a market in the Preferred Shares,

Subscription Receipts, Warrants, Debt Securities or Units, as applicable, but will not be obligated to do so and may discontinue

any market making at any time without notice. No assurance can be given that any dealer will make a market in the Preferred Shares,

Subscription Receipts, Warrants, Debt Securities or Units or as to the liquidity of the trading market, if any, for the Preferred

Shares, Subscription Receipts, Warrants, Debt Securities or Units.

Subject to applicable laws, and other than

in relation to an ATM Distribution, in connection with any offering of Securities, the underwriters, dealers or agents, as the

case may be, may over-allot or conduct transactions intended to stabilize, maintain or otherwise affect the market price for the

Securities at levels other than those which otherwise might prevail in the open market. Such transactions may be commenced, interrupted

or discontinued at any time.

No underwriter or dealer of an ATM Distribution,

and no person or company acting jointly or in concert with such underwriter or dealer, may, in connection with the distribution,

enter into any transaction that is intended to stabilize or maintain the market price of the securities or securities of the same

class as the securities distributed under this Prospectus, including selling an aggregate number or principal amount of securities

that would result in the underwriter creating an over-allocation position in the securities.

Secondary Offering

This Prospectus may also, from time to time,

relate to the offering of our Securities by certain selling securityholders. The selling securityholders may sell all or a portion

of our Securities beneficially owned by them and offered hereby from time to time directly or through one or more underwriters,

broker-dealers or agents. If our Securities are sold through underwriters or broker-dealers, the selling securityholders will be

responsible for underwriting discounts or commissions or agent's commissions. Our Securities may be sold by the selling securityholders

in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined

at the time of sale, or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions,

as follows:

-

on any national securities exchange or quotation service on which the Securities

may be listed or quoted at the time of sale;

-

in the over-the-counter market;

-

in transactions otherwise than on these exchanges or systems or in the over-the-counter

market;

-

through the writing of options, whether such options are listed on an options exchange

or otherwise;

-

ordinary brokerage transactions and transactions in which the broker-dealer solicits

purchasers;

-

block trades in which the broker-dealer will attempt to sell the Securities as agent

but may position and resell a portion of the block as principal to facilitate the transaction;

-

purchases by a broker-dealer as principal and resale by the broker-dealer for its

account;

-

an exchange distribution in accordance with the rules of the applicable exchange;

-

privately negotiated transactions;

-

short sales;

-

sales pursuant to Rule 144 under United States Securities Act of 1933, as amended

(the "U.S. Securities Act");

-

broker-dealers may agree with the selling securityholders to sell a specified number

of such Securities at a stipulated price per Security;

-

a combination of any such methods of sale; and

-

any other method permitted pursuant to applicable law.

If the selling securityholders effect such

transactions by selling our Securities to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers

or agents may receive commissions in the form of discounts, concessions or commissions from the selling securityholders or commissions

from purchasers of our Securities for whom they may act as agent or to whom they may sell as principal (which discounts, concessions

or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions

involved). In connection with sales of our Securities or otherwise, the selling securityholders may enter into hedging transactions

with broker-dealers, which may in turn engage in short sales of our Securities in the course of hedging in positions they assume.

The selling securityholders may also sell our Securities short and deliver our Securities covered by this Prospectus to close out

short positions and to return borrowed Securities in connection with such short sales.

The selling securityholders may also loan

or pledge our Securities to broker-dealers that in turn may sell such Securities. The selling securityholders may pledge or grant

a security interest in some or all of the Securities owned by them and, if they default in the performance of their secured obligations,

the pledgees or secured parties may offer and sell our Securities from time to time pursuant to this Prospectus or any supplement

to this Prospectus filed under General Instruction II.L. of Form F-10 under the U.S. Securities Act, amending, if necessary, the

list of selling securityholders to include, pursuant to a prospectus amendment or Prospectus Supplement, the pledgee, transferee

or other successors in interest as selling securityholders under this Prospectus. The selling securityholders also may transfer

and donate our Securities in other circumstances in which case the transferees, donees, pledgees or other successors in interest

will be the selling beneficial owners for purposes of this Prospectus.

The selling securityholders and any broker-dealer

participating in the distribution of our Securities may be deemed to be "underwriters" within the meaning of the U.S.

Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be

underwriting commissions or discounts under the U.S. Securities Act. At the time a particular offering of our Securities is made,

a Prospectus Supplement, if required, will be distributed which will identify the selling securityholders and provide the other

information set forth under "Selling Securityholders", set forth the aggregate amount of our Securities being offered

and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other

terms constituting compensation from the selling securityholders and any discounts, commissions or concessions allowed or reallowed

or paid to broker-dealers.

Under the securities laws of some states, our

Securities may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states our Securities

may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or

qualification is available and is complied with.

There can be no assurance that any securityholder

will sell any or all of our Securities registered pursuant to the registration statement, of which this Prospectus forms a part.

The selling securityholders and any other

person participating in such distribution will be subject to applicable provisions of Canadian and United States securities legislation

and the rules and regulations thereunder, including, without limitation, Regulation M under the U.S. Exchange Act, which may limit

the timing of purchases and sales of any of our Securities by the selling securityholders and any other participating person. Regulation

M may also restrict the ability of any person engaged in the distribution of our Securities to engage in market-making activities

with respect to our Securities. All of the foregoing may affect the marketability of our Securities and the ability of any person

or entity to engage in market-making activities with respect to our Securities.

Once sold under the shelf registration statement,

of which this Prospectus forms a part, our Securities will be freely tradable in the hands of persons other than our affiliates.

EARNINGS

COVERAGE

If we offer Debt Securities or Preferred

Shares having a term to maturity in excess of one year, under this Prospectus and any applicable Prospectus Supplement, the applicable

Prospectus Supplement will include earnings coverage ratios giving effect to the issuance of such securities.

DESCRIPTION

OF COMMON SHARES

The following description of our Common Shares

is a summary only and is qualified in its entirety by reference to our articles of incorporation, which have been filed with the

securities commission or similar regulatory authority in each of the provinces of Canada, and are available for review at www.sedar.com.

We are authorized to issue an unlimited number

of Common Shares. Each Common Share entitles the holder to: (i) one vote per share held at meetings of shareholders; (ii) receive

such dividends as declared by us, subject to any contractual restrictions on the payment of dividends and to any restrictions on

the payment of dividends imposed by the terms of any outstanding Preferred Shares and our credit facilities; and (iii) receive

our remaining property and assets upon dissolution or winding up. Our Common Shares are not subject to any future call or assessment

and there are no pre-emptive, conversion or redemption rights attached to such shares.

In the event of our merger or consolidation

with or into another entity, in connection with which our Common Shares are converted into or exchanged for shares or other securities

of another entity or property (including cash), all holders of our Common Shares will thereafter be entitled to receive the same

kind and number of securities or kind of property (including cash). Upon our dissolution or liquidation or the sale of all or

substantially all of our assets, after payment in full of all amounts required to be paid to creditors and to the holders of Preferred

Shares having liquidation preferences, if any, the holders of our Common Shares will be entitled to receive pro rata our remaining

assets available for distribution.

DESCRIPTION

OF PREFERRED SHARES

The following description of our Preferred

Shares is a summary only and is qualified in its entirety by reference to our articles of incorporation, which have been filed

with the securities commission or similar regulatory authority in each of the provinces of Canada, and are available for review

at www.sedar.com.

We are authorized to issue an unlimited number

of Preferred Shares issuable in series with no par value, none of which are currently outstanding. Our board of directors has the

authority to determine, with respect to any series of Preferred Shares, the rights, privileges, restrictions and conditions of

that series, including:

-

the designation of the series;

-

the number of shares of the series, which our board may, except where otherwise provided

in the provisions applicable to such series, increase or decrease, but not below the number of shares then outstanding;

-

whether dividends, if any, will be cumulative or non-cumulative and the dividend

rate of the series;

-

the dates at which dividends, if any, will be payable;

-

the redemption rights and price or prices, if any, for shares of the series;

-

the terms and amounts of any sinking fund provided for the purchase or redemption

of shares of the series;

-

the amounts payable on shares of the series in the event of any voluntary or involuntary

liquidation, dissolution or winding-up of our affairs;

-

whether the shares of the series will be convertible into shares of any other class

or series, or any other security, of the Corporation or any other entity, and, if so, the specification of the other class or series

or other security, the conversion price or prices or rate or rates, any rate adjustments, the date or dates at which the shares

will be convertible and all other terms and conditions upon which the conversion may be made;

-

restrictions on the issuance of shares of the same series or of any other class or

series; and

-

the voting rights, if any, of the holders of the series.

Subject to any rights, privileges, restrictions

and conditions that may have been determined by the directors to apply to any series of Preferred Shares, the holders of our Preferred

Shares shall have no right to receive notice of or to be present at or vote either in person, or by proxy, at any of our general

meetings by virtue of or in respect of their holding of Preferred Shares.

Subject to any rights, privileges, restrictions

and conditions that may have been determined by the directors to apply to any series of Preferred Shares or any restrictions in

any of our debt agreements, the directors shall have complete uncontrolled discretion to pay dividends on any class or classes

of shares or any series within a class of shares issued and outstanding in any particular year to the exclusion of any other class

or classes of shares or any series within a class of shares out of any or all profits or surplus available for dividends.

On our winding-up, liquidation or dissolution

or upon the happening of any other event giving rise to a distribution of our assets other than by way of dividend amongst our

shareholders for the purposes of winding-up its affairs, subject to any rights, privileges, restrictions and conditions that may

have been determined by the board of directors to attach to any series of Preferred Shares, the holders of all Common Shares and

Preferred Shares shall be entitled to participate pari passu.

DESCRIPTION

OF SUBSCRIPTION RECEIPTS

The following description of the terms of

Subscription Receipts sets forth certain general terms and provisions of Subscription Receipts in respect of which a Prospectus

Supplement may be filed. The particular terms and provisions of Subscription Receipts offered by any Prospectus Supplement, and

the extent to which the general terms and provisions described below may apply thereto, will be described in the Prospectus Supplement

filed in respect of such Subscription Receipts.

Subscription Receipts may be offered separately

or in combination with one or more other Securities. The Subscription Receipts will be issued under a subscription receipt agreement.

A copy of the subscription receipt agreement will be filed by us with the applicable securities commission or similar regulatory

authorities after it has been entered into by us and will be available electronically at www.sedar.com.

Pursuant to the subscription receipt agreement,

original purchasers of Subscription Receipts may have a contractual right of rescission against Westport Fuel Systems, following

the issuance of the underlying Common Shares or other securities to such purchasers upon the surrender or deemed surrender of the

Subscription Receipts, to receive the amount paid for the Subscription Receipts in the event that this Prospectus and any amendment

thereto contains a misrepresentation or is not delivered to such purchaser, provided such remedy for rescission is exercised within

180 days from the closing date of the offering of Subscription Receipts.

The description of general terms and provisions

of Subscription Receipts described in any Prospectus Supplement will include, where applicable:

-

the number of Subscription Receipts offered;

-

the price at which the Subscription Receipts will be offered;

-

if other than Canadian dollars, the currency or currency unit in which the Subscription

Receipts are denominated;

-

the procedures for the exchange of the Subscription Receipts into Common Shares or

other securities;

-

the number of Common Shares or other securities that may be obtained upon exercise

of each Subscription Receipt;

-

the designation and terms of any other Securities with which the Subscription Receipts

will be offered, if any, and the number of Subscription Receipts that will be offered with each Security;

-

the terms applicable to the gross proceeds from the sale of the Subscription Receipts

plus any interest earned thereon;

-

the material tax consequences of owning the Subscription Receipts; and

-

any other material terms, conditions and rights (or limitations on such rights) of

the Subscription Receipts.

We reserve the right to set forth in a Prospectus

Supplement specific terms of the Subscription Receipts that are not within the options and parameters set forth in this Prospectus.

In addition, to the extent that any particular terms of the Subscription Receipts described in a Prospectus Supplement differ from

any of the terms described in this Prospectus, the description of such terms set forth in this Prospectus shall be deemed to have

been superseded by the description of such differing terms set forth in such Prospectus Supplement with respect to such Subscription

Receipts.

DESCRIPTION

OF WARRANTS

The following description of the terms of

Warrants sets forth certain general terms and provisions of Warrants in respect of which a Prospectus Supplement may be filed.

The particular terms and provisions of Warrants offered by any Prospectus Supplement, and the extent to which the general terms

and provisions described below may apply thereto, will be described in the Prospectus Supplement filed in respect of such Warrants.

Warrants may be offered separately or in

combination with one or more other Securities. Each series of Warrants will be issued under a separate warrant agreement to be

entered into between us and one or more banks or trust companies acting as warrant agent. The applicable Prospectus Supplement

will include details of the warrant agreements covering the Warrants being offered. The warrant agent will act solely as our agent

and will not assume a relationship of agency with any holders of Warrant certificates or beneficial owners of Warrants. A copy

of the warrant agreement will be filed by us with the applicable securities commission or similar regulatory authorities after

it has been entered into by us and will be available electronically at www.sedar.com.

Pursuant to the warrant agreement, original

purchasers of Warrants may have a contractual right of rescission against Westport Fuel Systems, following the issuance of the

underlying Common Shares or other securities to such purchasers upon the exercise or deemed exercise of the Warrants, to receive

the amount paid for the Warrants and the amount paid upon exercise of the Warrants in the event that this Prospectus and any amendment

thereto contains a misrepresentation or is not delivered to such purchaser, provided such remedy for rescission is exercised within

180 days from the closing date of the offering of Warrants.

The description of general terms and provisions

of Warrants described in any Prospectus Supplement will include, where applicable:

-

the designation and aggregate number of Warrants offered;

-

the price at which the Warrants will be offered;

-

if other than Canadian dollars, the currency or currency unit in which the Warrants

are denominated;

-

the designation and terms of the Common Shares that may be acquired upon exercise

of the Warrants;

-

the date on which the right to exercise the Warrants will commence and the date on

which the right will expire;

-

the number of Common Shares that may be purchased upon exercise of each Warrant and

the price at which and currency or currencies in which that amount of securities may be purchased upon exercise of each Warrant;

-

the designation and terms of any Securities with which the Warrants will be offered,

if any, and the number of the Warrants that will be offered with each Security;

-

the date or dates, if any, on or after which the Warrants and the related Securities

will be transferable separately;

-

the minimum or maximum amount, if any, of Warrants that may be exercised at any one

time;

-

whether the Warrants will be subject to redemption or call, and, if so, the terms

of such redemption or call provisions; and

-

any other material terms, conditions and rights (or limitations on such rights) of

the Warrants.

We reserve the right to set forth in a Prospectus

Supplement specific terms of the Warrants that are not within the options and parameters set forth in this Prospectus. In addition,

to the extent that any particular terms of the Warrants described in a Prospectus Supplement differ from any of the terms described

in this Prospectus, the description of such terms set forth in this Prospectus shall be deemed to have been superseded by the description

of such differing terms set forth in such Prospectus Supplement with respect to such Warrants.

DESCRIPTION

OF DEBT SECURITIES

The following description of the terms of

Debt Securities sets forth certain general terms and provisions of Debt Securities in respect of which a Prospectus Supplement

may be filed. The particular terms and provisions of Debt Securities offered by any Prospectus Supplement, and the extent to which

the general terms and provisions described below may apply thereto, will be described in the Prospectus Supplement filed in respect

of such Debt Securities. Debt Securities may be offered separately or in combination with one or more other Securities. We may,

from time to time, issue Debt Securities and incur additional indebtedness other than through the issuance of Debt Securities pursuant

to this Prospectus.

Debt Securities will be issued under one

or more indentures (each, an "Indenture"), in each case between Westport Fuel Systems and an appropriately qualified

financial institution authorized to carry on business as a trustee (each, a "Trustee").

The following description sets forth certain

general terms and provisions of Debt Securities. The description is not, however, exhaustive and is subject to, and qualified in

its entirety by reference to, the detailed provisions of the applicable Indenture. Accordingly, reference should also be made to

the applicable Indenture, a copy of which will be filed by us with applicable provincial securities commissions or similar regulatory

authorities in Canada after it has been entered into and before the issue of any Debt Securities thereunder, and will be available

electronically on SEDAR at www.sedar.com.

The Debt Securities may be issued from time

to time in one or more series. We may specify a maximum aggregate principal amount for the Debt Securities of any series and, unless

otherwise provided in the applicable Indenture, a series of Debt Securities may be reopened for issuance of additional Debt Securities

of that series.

The Debt Securities will be direct unsecured

obligations of Westport Fuel Systems, and will constitute senior or subordinated indebtedness of Westport Fuel Systems as described

in the applicable Prospectus Supplement. If the Debt Securities are senior indebtedness, they will rank equally and rateably with

all other unsecured indebtedness of Westport Fuel Systems from time to time issued and outstanding which is not subordinated.

If the Debt Securities are subordinated indebtedness, they will be subordinated to senior indebtedness of Westport Fuel Systems

as described in the applicable Prospectus Supplement and their ranking with respect to other subordinated indebtedness of Westport

Fuel Systems from time to time outstanding will be as described in the applicable Prospectus Supplement. We reserve the right

to specify in a Prospectus Supplement whether a particular series of subordinated Debt Securities is subordinated to any other

series of subordinated Debt Securities.

The particular terms and provisions of each issue of Debt Securities will be described

in the applicable Prospectus Supplement. This description will include, as applicable:

|

|

·

|

the designation, aggregate principal amount and authorized denominations

of the Debt Securities;

|

|

|

·

|

any limit upon the aggregate principal amount of the Debt Securities;

|

|

|

·

|

the currency for which the Debt Securities may be purchased and in which

the principal and any premium or interest is payable (in either case, if other than Canadian dollars);

|

|

|

·

|

the offering price of the Debt Securities and percentage of the principal

amount at which they will be issued;

|

|

|

·

|

the date(s) on which the Debt Securities will be issued and delivered;

|

|

|

·

|

the date(s) on which the Debt Securities will mature, including any provision

for the extension of a maturity date, or the method of determining such date(s);

|

|

|

·

|

the rate(s) per annum (either fixed or floating) at which the Debt Securities

will bear interest (if any) and, if floating, the method of determining such rate(s);

|

|

|

·

|

the date(s) from which any interest obligation will accrue and on which

interest will be payable, and the record date(s) for the payment of interest or the method of determining such date(s);

|

|

|

·

|

any guarantees given in respect of the Debt Securities;

|

|

|

·

|

the ranking of the Debt Securities and if applicable, their subordination

to other indebtedness of Westport Fuel Systems;

|

|

|

·

|

the identity of the Trustee under the applicable Indenture pursuant to which

the Debt Securities are to be issued;

|

|

|

·

|

any redemption terms, or terms under which the Debt Securities may be defeased

prior to maturity;

|

|

|

·

|

any repayment or sinking fund provisions;

|

|

|

·

|

events of default and covenants in respect of the Debt Securities;

|

|

|

·

|

whether the Debt Securities are to be issued in registered form or in the

form of temporary or permanent global securities, and the basis of exchange, transfer and ownership thereof;

|

|

|

·

|

whether the Debt Securities may be converted or exchanged for other securities

of Westport Fuel Systems or any other entity;

|

|

|

·

|

if applicable, our ability to satisfy all or a portion of any redemption

of the Debt Securities, payment of any premium or interest thereon, or repayment of the principal owing upon the maturity through

the issuance of securities of Westport Fuel Systems or of any other entity, and any restrictions on the persons to whom such securities

may be issued;

|

|

|

·

|

provisions governing amendments to the Indenture; and

|

|

|

·

|

any other material terms, conditions or other provisions applicable to the

Debt Securities, including, without limitation, transferability, adjustment terms and whether the subscription receipts will be

listed on an exchange.

|

We reserve the right to include in a Prospectus

Supplement specific terms and provisions pertaining to the Debt Securities in respect of which the Prospectus Supplement is filed

that are not within the variables and parameters set forth in this Prospectus. To the extent that any terms or provisions or other

information pertaining to the Debt Securities described in a Prospectus Supplement differ from any of the terms or provisions or

other information described in this Prospectus, the description set forth in this Prospectus shall be deemed to have been superseded

by the description set forth in the Prospectus Supplement with respect to those Debt Securities.

DESCRIPTION

OF UNITS

We may issue Units comprised of one or more

of the other Securities described in this Prospectus in any combination. Each Unit will be issued so that the holder of the Unit

is also the holder of each Security included in the Unit. Thus, the holder of a Unit will have the rights and obligations of a