UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

|

|

|

|

|

|

|

|

o

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

OR

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2020

____________________________________________________________________________

Commission file number: 001-34152

WESTPORT FUEL SYSTEMS INC.

(Exact Name of Registrant as Specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alberta

|

|

3537

|

|

N/A

|

(Province or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial Classification

Code Number (if applicable))

|

|

(I.R.S. Employer Identification Number (if applicable))

|

1750 West 75th Avenue, Suite 101

Vancouver, British Columbia, Canada V6P 6G2

(604) 718-2000

(Address and telephone number of Registrant’s principal executive offices)

|

|

|

|

|

|

|

|

|

|

C T Corporation System

111 Eighth Avenue

New York, NY 10011

(212) 590-9070

|

|

Copies to:

Steven B. Stokdyk, Esq.

Lewis W. Kneib, Esq.

Latham & Watkins LLP

355 South Grand Avenue, Suite 100

Los Angeles, CA 90071

|

(Name, address (including zip code) and telephone number (including

area code) of agent for service in the United States)

|

|

____________________________________________________________________________

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class:

|

Trading Symbol(s)

|

Name of Each Exchange On Which Registered:

|

|

Common Shares, no par value

|

WPRT

|

NASDAQ Global Select Market

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: N/A

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: N/A

For annual reports, indicate by check mark the information filed with this form:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x Annual Information Form

|

|

x Audited Annual Financial Statements

|

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: As at December 31, 2020, 144,069,972 common shares of the Registrant were issued and outstanding.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ý Yes o No

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ý

EXPLANATORY NOTE

Westport Fuel Systems Inc. (the “Company” or the “Registrant”) is a Canadian issuer eligible to file its annual report pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on Form 40-F pursuant to the multi-jurisdictional disclosure system of the Exchange Act. The Company is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act. Equity securities of the Company are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3.

FORWARD-LOOKING STATEMENTS

This annual report on Form 40-F and the exhibits attached hereto contain forward-looking statements or information within the meaning of the United States Private Securities Litigation Reform Act of 1995. When used in this annual report on Form 40-F, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect”, “project” and similar expressions, as they relate to the Company or the Company’s management, are intended to identify forward-looking statements. In particular, this annual report on Form 40-F and the documents incorporated by reference herein contain forward-looking statements pertaining to the following:

•our liquidity and going concern discussed in the audited consolidated financial statements of the Company filed as Exhibit 99.2 to this annual report on Form 40-F;

•the impact of the COVID-19 pandemic on the Company’s future performance, earnings, supply and demand for our products;

•our ability to integrate Westport High Pressure Direct Injection 2.0 ("Westport HPDI 2.0™" or "HPDI") to into natural gas solutions with attractive pricing, performance and fuel economy;

•our ability to integrate Westport HPDI 2.0™ into original equipment manufacture ("OEM") operations and to reach scalable volume deliveries;

•the timing for the launch and certification of Weichai Westport Inc.’s HPDI engine;

•the future demand for Cummins Westport Inc. ("CWI") products and the Company's products;

•the availability of funding and funding requirements;

•our future cash flows, including cash flows specific to CWI;

•monetization of joint venture intellectual property;

•conversion of existing convertible debt;

•increasing penetration within our existing markets and expansion of those markets geographically;

•continuing growth in the transportation sector and in the natural gas engine market;

•our ability to successfully launch new technology and market initiatives, and integrate our products in to existing OEM products;

•the manufacture of Westport HPDI 2.0™ system components;

•CWI's focus on sales in North America with engines manufactured in Cummins, Inc.’s North American plants;

•our ability to exploit and protect our intellectual property;

•our capital expenditure and investment programs;

•the future desirability and use of alternative fuels such as liquefied petroleum gas ("LPG"), natural gas (compressed natural gas ("CNG"), liquefied natural gas ("LNG") and renewable natural gas ("RNG")) and hydrogen;

•commodity prices and the fuel price differential between natural gas and diesel;

•ongoing relationships between us and our business partners and the results of our development programs with such partners;

•potential disputes regarding the rights and obligations of the parties which may in the future arise under our agreements with our strategic partners;

•our ability to continue to compete with our competitors and their technologies;

•the capital and operating costs of vehicles using our technologies relative to competing technologies;

•continued growth in the transportation sector and in the natural gas engine market;

•profit margins and production costs of engines incorporating our technologies;

•the further development of infrastructure supporting the application of natural gas as an alternative fuel;

•increasing penetration of our technologies in key markets within the transportation sector and in key geographical markets;

•increasingly stringent environmental and emissions legislation and regulations in the future;

•our ability to attract and retain employees;

•demand for engines incorporating our technologies;

•the timing of commissioning of LNG refueling stations;

•the ability of our products to adapt to the use of RNG and manufactured fuels, including hydrogen, as fuels;

•our future growth and the expected changes to the transportation sector;

•expansion of our product offerings and markets;

•our estimates and assumptions used in our accounting policies, and accruals, including warranty accruals, and financial condition;

•our adoption, timing and ability to meet certain accounting standards;

•our ability to predict when and to achieve sustainable profitability or generate positive cash flows;

•our compliance with environmental regulations and regulatory policies;

•our ongoing assessments of targets for improving our commitment to environment and social responsibilities;

•the strategy of our transportation segment and resulting growth in market share;

•the expansion of existing relationships with truck and engine OEMs;

•expansion of alternative fuel product offerings to develop and supply high pressure components to OEM partners; and

•expected fluctuations in our revenues and results of operations.

Such statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions. Actual results may differ materially from those expressed in these forward-looking statements due to a number of uncertainties and risks, including the risks described in this annual report on Form 40-F and in the documents incorporated by reference herein and other unforeseen risks, including, without limitation:

•risks related to our liquidity and going concern discussed in the audited consolidated financial statements of the Company filed as Exhibit 99.2 to this annual report on Form 40-F;

•risks related to our financing agreement with Cartesian Capital Group, including, but not limited to failure to realize the anticipated benefits of the agreement;

•market acceptance of our products;

•product development delays and delays in contractual commitments;

•changing environmental legislation and regulations;

•the ability to attract and retain business partners;

•the success of our business partners and OEMs, with whom we partner;

•future levels of government funding and incentives;

•competition from other technologies;

•price differential between compressed natural gas, LNG and liquefied petroleum gas relative to petroleum-based fuels;

•limitations on our ability to protect our intellectual property;

•potential claims or disputes in respect of our intellectual property;

•limitations in our ability to successfully integrate acquired businesses;

•limitations in the development of natural gas refueling infrastructure;

•the ability to provide and access the capital required for research, product development, operations and marketing;

•unforeseen claims made against us;

•exposure to factors beyond our control through our international business operations, such as currency exchange rates, changes in governmental policy, trade barriers, trade embargoes and delays in the development of international markets for our products;

•risks related to our share capital, including our common shares and the ability of the board to issue preferred shares at its discretion;

•risk of conflict related to our directors and executive officers who may currently, or in the future, also serve as directors and/or officers of other public companies; and

•those risks discussed under the heading “Risk Factors” in the Annual Information Form (“AIF”) of the Company filed as Exhibit 99.1 to this annual report on Form 40-F.

You should not rely on any forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this annual report on Form 40-F, except as otherwise required by law.

CURRENCY

Unless specifically stated otherwise, all dollar amounts in this annual report on Form 40-F are in United States dollars. The exchange rate of Canadian dollars into United States dollars, based upon the closing rate of exchange on December 31, 2020 as reported by the Bank of Canada for the conversion of Canadian dollars into United States dollars, was U.S.$1.00 = Cdn.$1.27.

ANNUAL INFORMATION FORM

The Company’s AIF for the fiscal year ended December 31, 2020 is filed as Exhibit 99.1 and incorporated by reference in this annual report on Form 40-F.

AUDITED ANNUAL FINANCIAL STATEMENTS

The audited consolidated financial statements of the Company for the years ended December 31, 2020 and 2019, including the report of the independent registered public accounting firm with respect thereto, are filed as Exhibit 99.2 and incorporated by reference in this annual report on Form 40-F.

MANAGEMENT’S DISCUSSION AND ANALYSIS

The Company’s management’s discussion and analysis is filed as Exhibit 99.3 and incorporated by reference in this annual report on Form 40-F.

TAX MATTERS

Purchasing, holding or disposing of securities of the Company may have tax consequences under the laws of the United States and Canada that are not described in this annual report on Form 40-F.

DISCLOSURE CONTROLS AND PROCEDURES

See Management’s Discussion and Analysis of Financial Condition and Results of Operations for the year ended December 31, 2020, included as Exhibit 99.3 to this annual report on Form 40-F, under the heading “Disclosure Controls and Procedures and Internal Controls Over Financial Reporting”.

MANAGEMENT’S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

See Management’s Discussion and Analysis of Financial Condition and Results of Operations for the year ended December 31, 2020, included as Exhibit 99.3 to this annual report on Form 40-F, under the heading “Disclosure Controls and Procedures and Internal Controls Over Financial Reporting”.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

See the audited consolidated financial statements of the Company and notes thereto for the years ended December 31, 2020 and 2019, including the reports of the independent auditors with respect thereto, filed as Exhibit 99.2 to this annual report on Form 40-F, under the heading “Report of Independent Registered Public Accounting Firm”.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

See Management’s Discussion and Analysis of Financial Condition and Results of Operations for the year ended December 31, 2020, included as Exhibit 99.3 to this annual report on Form 40-F, under the heading “Disclosure Controls and Procedures and Internal Controls Over Financial Reporting”.

AUDIT COMMITTEE

Audit Committee

The Company has a separately designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Exchange Act and Nasdaq Rule 5605(c)(2). On March 15, 2021, the Company’s Audit Committee consists of Brenda J. Eprile, Rita Forst, Tony Guglielmin and Karl-Viktor Schaller. Each member of the Audit Committee, in the opinion of the directors, is independent (as determined under Rule 10A-3 of the Exchange Act and Nasdaq Rule 5605(a)(2)) and financially literate. Please refer to the Company’s AIF attached as Exhibit 99.1 to this annual report on Form 40-F for details in connection with each of these members and their qualifications.

The members of the Audit Committee do not have fixed terms and are appointed and replaced from time to time by resolution of the directors.

The Audit Committee meets with the CEO, CFO and the Company’s independent auditors to review and inquire into matters affecting financial reporting, the system of internal accounting and financial controls, as well as audit procedures and audit plans. The Audit Committee also recommends to the Board of Directors which independent registered public auditing firm should be appointed by the Company. In addition, the Audit Committee reviews and recommends to the Board of Directors for approval the annual financial statements and the Management’s Discussion and Analysis of Financial Condition and Results of Operations, and undertakes other activities required by exchanges on which the Company’s securities are listed and by regulatory authorities to which the Company is held responsible.

The full text of the Audit Committee Charter is disclosed in the Company’s AIF, attached hereto as Exhibit 99.1, and is incorporated by reference in this annual report on Form 40-F. The Audit Committee Charter is also available on the Company’s website at www.wfsinc.com.

Audit Committee Financial Expert

The Company’s Board of Directors has determined that Brenda J. Eprile, Rita Forst and Tony Guglielmin qualify as financial experts (as defined in Item 407 of Regulation S-K under the Exchange Act) and are independent (as determined under Exchange Act Rule 10A-3 and Nasdaq Rule 5605(a)(2)).

PRINCIPAL ACCOUNTING FEES AND SERVICES — INDEPENDENT AUDITORS

Information about the Company’s principal accounting fees and services can be found under “Principal Accountant Fees and Services” of the Company's AIF, attached hereto as Exhibit 99.1, which is incorporated by reference in this annual report on Form 40-F.

PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES PROVIDED BY

INDEPENDENT AUDITORS

The Audit Committee nominates and engages the independent auditors to audit the consolidated financial statements and approves all audit, audit-related services, tax services and other services provided by the Company’s external auditors. Any services provided by the Company’s external auditors that are not specifically included within the scope of the audit must be pre-approved by the Audit Committee prior to any engagement. The Chairman of the Audit Committee is permitted to pre-approve work undertaken by the Company’s external auditors between Audit Committee meetings. All such approvals must be formally affirmed at the next compliance meeting, or if not approved, the services must be canceled immediately. The Audit Committee does not delegate to management its responsibilities to pre-approve services performed by the Company’s external auditor.

OFF-BALANCE SHEET TRANSACTIONS

The Company does not have any off-balance sheet financing arrangements or relationships with unconsolidated special purpose entities.

CODE OF ETHICS

The Company has adopted a Code of Conduct (the “Code”) for all its directors, executive officers and employees. The Code is available on the Company’s website at www.wfsinc.com.

All amendments to the Code, and all waivers of the Code with respect to any of the officers covered by it, will be posted on the Company’s website.

There have been no amendments, waivers or implicit waivers to the Code during the year ended December 31, 2020. Shareholders may submit a request online at the Company’s website www.wfsinc.com for a free printed copy of the Code.

CONTRACTUAL OBLIGATIONS

See Management’s Discussion and Analysis of Financial Condition and Results of Operations for the year ended December 31, 2020, included as Exhibit 99.3 to this annual report on Form 40-F, under the heading “Contractual Obligations and Commitments”.

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Company sent during the year ended December 31, 2020 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

MINE SAFETY DISCLOSURE

Not applicable.

NASDAQ CORPORATE GOVERNANCE

Our common shares are quoted for trading on the Nasdaq Global Select Market under the symbol WPRT. Nasdaq Rule 5615(a)(3) permits a foreign private issuer to follow its home country practice in lieu of the Nasdaq corporate governance requirements if such issuer, amongst other requirements, makes appropriate disclosure in its annual report filed with the SEC relating to each requirement of Rule 5600 that it does not follow including a brief statement of the home country practice it follows in lieu of such Nasdaq corporate governance requirements.

A description of the significant ways in which our governance practices differ from those followed by domestic companies pursuant to Rule 5600 of the Nasdaq Rules is as follows:

Rule 5620(c) requires that each listed company provide for a quorum for any meeting of the holders of the listed company’s common stock that is not less than 33 1/3% of the listed company’s outstanding shares of common stock entitled to vote. The Company’s bylaws provide for a quorum of at least two persons present in person and holding or representing by proxy not less than 25% of the shares entitled to vote at the meeting.

Rule 5605(d)(1)(D) requires that each listed company adopt a formal written compensation committee charter that specifies, among other things, the specific compensation committee responsibilities and authority set forth in Rule 5605(d)(3).

The Company’s Human Resources and Compensation Committee Charter does not specify the specific compensation committee responsibilities and authority set forth in Rule 5605(d)(3).

The foregoing is consistent with the laws, customs and practices in Canada and the rules of The Toronto Stock Exchange.

UNDERTAKING

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the SEC’s staff, and to furnish promptly, when requested to do so by the SEC staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company previously filed an Appointment of Agent for Service of Process and Undertaking on Form F-X with the SEC on March 5, 2021, with respect to the class of securities in relation to which the obligation to file this annual report on Form 40-F arises.

EXHIBIT INDEX

The following exhibits have been filed as part of this annual report:

|

|

|

|

|

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

|

Annual Information

|

|

99.1

|

|

|

|

|

|

|

|

|

99.2

|

|

|

|

|

|

|

|

|

99.3

|

|

|

|

|

|

|

|

|

Certifications

|

|

99.4

|

|

|

|

|

|

|

|

|

99.5

|

|

|

|

|

|

|

|

|

99.6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

99.7

|

|

|

|

|

|

|

|

|

Consents

|

|

99.8

|

|

|

|

|

|

|

|

|

Exhibits

|

|

|

|

101

|

|

|

XBRL Interactive Data File

|

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

WESTPORT FUEL SYSTEMS INC.

|

|

|

|

|

|

By:

|

/s/ David M. Johnson

|

|

|

Name:

|

David M. Johnson

|

|

|

Title:

|

Chief Executive Officer

|

Date: March 15, 2021

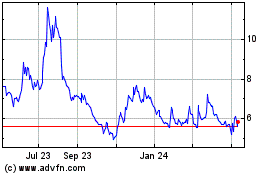

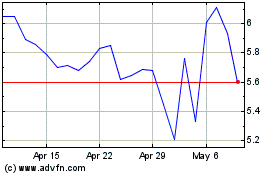

Westport Fuel Systems (NASDAQ:WPRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Westport Fuel Systems (NASDAQ:WPRT)

Historical Stock Chart

From Apr 2023 to Apr 2024