Micron, Western Digital Looking at Possible Deal for Chip Maker Kioxia

March 31 2021 - 6:57PM

Dow Jones News

By Cara Lombardo and Dana Cimilluca

Micron Technology Inc. and Western Digital Corp. are each

exploring a potential deal for Kioxia Holdings Corp. that could

value the Japanese semiconductor company at around $30 billion,

according to people familiar with the matter, as a global scramble

for memory chips used in smartphones and other devices heats

up.

A deal for Kioxia, controlled by private-equity firm Bain

Capital, isn't guaranteed, and it isn't clear how one might be

structured. Should a deal come together, it could be finalized

later this spring, some of the people said.

The Tokyo-based company had been planning an initial public

offering before shelving it in late September, citing the

coronavirus pandemic and market volatility.

An IPO later this year is still a possibility should the company

fail to reach agreement on a deal with one of the suitors, the

people said.

Kioxia is considered a crown-jewel asset in Japan, and -- given

the additional political sensitivities of transferring ownership of

key technology like that in chips -- any transaction would likely

require the blessing of the government there. Washington would also

likely play a role, but a deal could fit with a push by the U.S. to

boost its chipmaking capabilities to increase competitiveness with

China.

Kioxia makes NAND flash-memory chips used in smartphones,

computer servers and other devices. It's become a hot area in part

because of increased demand during the coronavirus pandemic for

personal computers, with people working remotely and distance

learning, as well as gaming and the growing popularity of 5G

smartphones.

That has helped Kioxia's valuation soar since it backed away

from the IPO. It was expecting a valuation then of around $16

billion. Its business had been hit by U.S. export restrictions on

China's Huawei Technologies Co. that threatened to lead to excess

supply and price drops for flash-memory products.

Micron shares have also shot up since then, almost doubling to

give the company a market value of about $100 billion. Western

Digital's shares have surged too, giving the company a valuation of

around $20 billion.

Write to Cara Lombardo at cara.lombardo@wsj.com and Dana

Cimilluca at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

March 31, 2021 18:42 ET (22:42 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

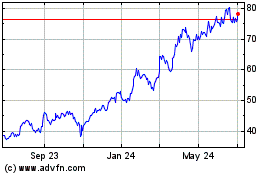

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

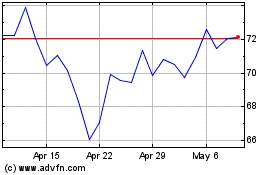

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024