Current Report Filing (8-k)

July 01 2021 - 4:17PM

Edgar (US Regulatory)

0000793074false00007930742021-06-302021-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 30, 2021

WERNER ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nebraska

|

0-14690

|

47-0648386

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

14507 Frontier Road

|

|

|

|

Post Office Box 45308

|

|

|

|

Omaha

|

,

|

Nebraska

|

|

68145-0308

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(402) 895-6640

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR40.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 Par Value

|

|

WERN

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

The information set forth in Item 2.03 of this current report on Form 8-K is incorporated by reference herein.

ITEM 2.03. CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT.

On June 30, 2021, Werner Enterprises, Inc. (“Werner” or the “Company”), as borrower, amended its existing credit agreement, dated May 14, 2019, with BMO Harris Bank N.A. (“BMO Harris”), as lender (the “Credit Agreement”). The Credit Agreement provides the Company with a $200 million unsecured revolving line of credit and expires on May 14, 2024.

The first amendment to the Credit Agreement (the “Amendment”), dated June 30, 2021, adds an unsecured fixed-rate term loan commitment not to exceed a principal amount of $100 million and increases the Company’s borrowing capacity with BMO Harris from $200 million to $300 million. The outstanding principal balance of the term loan shall bear interest at a fixed rate of 1.28 percent (1.28%). Commencing on September 30, 2021, the Company must make principal payments of $1,250,000 on the last day of March, June, September and December in each year, with a final payment of principal and interest then outstanding being due and payable on May 14, 2024.

On June 30, 2021, the Company borrowed $100 million pursuant to the term loan. As of June 30, 2021, the Company was in compliance with all applicable financial covenants under the Credit Agreement.

The foregoing descriptions of the Credit Agreement and Amendment do not purport to be complete and are subject to, and qualified in their entirety by, the full text of the Credit Agreement and the Amendment. The Amendment will be filed as an exhibit to the Company’s Form 10-Q for the quarter ended June 30, 2021. (Pursuant to General Instruction B.3 to Form 8-K, the information regarding the Credit Agreement contained in Note 5 of the Notes to Consolidated Financial Statements (Unaudited) included in the Company’s Quarterly Report on Form 10-Q for the period ended March 31, 2021, the information disclosed under Item 2.03 of the Company’s Current Report on Form 8-K dated May 14, 2019, and full text of the Credit Agreement filed as Exhibit 10.2 to the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2019 are incorporated by reference herein.)

ITEM 8.01. ALL OTHER EVENTS.

On July 1, 2021, Werner acquired an 80% equity ownership stake in ECM Transport Group (“ECM”), with an exclusive option to purchase the remaining 20% from ECM’s founder and president after a period of five years following transaction close. A copy of the press release announcing the acquisition is filed as Exhibit 99.1 to this Form 8-K.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

101

|

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document).

|

|

|

|

|

|

104

|

|

The cover page from this Current Report on Form 8-K, formatted as Inline XBRL.

|

Forward-Looking Statements

This current report on Form 8-K and exhibits may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements are based on information presently available to Werner’s management and are current only as of the date made. Actual results could also differ materially from those anticipated as a result of a number of factors, including, but not limited to, those discussed in Werner’s Annual Report on Form 10-K for the year ended December 31, 2020 and Quarterly Report on Form 10-Q for the period ended March 31, 2021. For those reasons, undue reliance should not be placed on any forward-looking statement. Werner assumes no duty or obligation to update or revise any forward-looking statement, although it may do so from time to time as management believes is warranted or as may be required by applicable securities law. Any such updates or revisions may be made by the registrant by filing reports with the U.S. Securities and Exchange Commission, through the issuance of press releases or by other methods of public disclosure.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WERNER ENTERPRISES, INC.

|

|

|

|

|

|

Date: July 1, 2021

|

By:

|

|

/s/ John J. Steele

|

|

|

|

|

John J. Steele

|

|

|

|

|

Executive Vice President, Treasurer and

Chief Financial Officer

|

|

|

|

|

|

Date: July 1, 2021

|

By:

|

|

/s/ James L. Johnson

|

|

|

|

|

James L. Johnson

|

|

|

|

|

Executive Vice President, Chief Accounting

Officer and Corporate Secretary

|

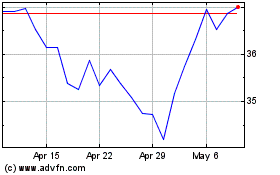

Werner Enterprises (NASDAQ:WERN)

Historical Stock Chart

From Mar 2024 to Apr 2024

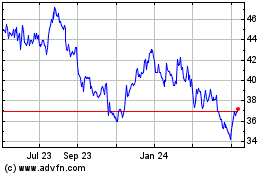

Werner Enterprises (NASDAQ:WERN)

Historical Stock Chart

From Apr 2023 to Apr 2024