Maintains Full Year Adjusted EPS

Guidance

First quarter highlights, year-over-year

- Sales increased 1.6 percent to $34.3 billion, up 2.3 percent on

a constant currency basis

- Operating income decreased 27.6 percent to $1.0 billion;

Adjusted operating income decreased 15.6 percent to $1.5 billion,

down 15.4 percent on a constant currency basis

- EPS decreased 19.8 percent to $0.95; Adjusted EPS decreased 6.0

percent to $1.37, down 5.7 percent on a constant currency

basis

- Net cash provided by operating activities was $1.1 billion, an

increase of $601 million; Free cash flow was $674 million, an

increase of $684 million

Fiscal 2020 outlook

- Company maintained its guidance of roughly flat growth in

fiscal 2020 adjusted EPS on a constant currency basis

Transformational Cost Management Program

- On track to deliver in excess of $1.8 billion in annual cost

savings by fiscal 2022

Strategic updates announced after end of quarter

- WBA agreed to create German wholesale joint venture with

McKesson

- Kroger and Walgreens formed group purchasing organization

Walgreens Boots Alliance, Inc. (Nasdaq: WBA) today announced

financial results for the first quarter of fiscal 2020, which ended

November 30, 2019.

Executive Vice Chairman and CEO Stefano Pessina said, “We are

maintaining our outlook for the year despite a soft first quarter.

We are confident our strategic plans are the right ones to drive

long-term sustainable growth going forward. In addition, during the

quarter we were very satisfied with the progress made in our

Transformational Cost Management Program and with the strong cash

flow we delivered.”

Overview of First Quarter Results

Fiscal 2020 first quarter net earnings attributable to Walgreens

Boots Alliance decreased 24.8 percent to $845 million compared with

the same quarter a year ago, while net earnings per share1

decreased 19.8 percent to $0.95 compared with the same quarter a

year ago.

Adjusted net earnings attributable to Walgreens Boots Alliance2

decreased 11.8 percent to $1.2 billion, down 11.6 percent on a

constant currency basis, compared with the same quarter a year ago.

Adjusted earnings per share were $1.37, a decrease of 6.0 percent

on a reported currency basis and a decrease of 5.7 percent on a

constant currency basis, compared with the same quarter a year

ago.

Sales in the first quarter were $34.3 billion, an increase of

1.6 percent from the year-ago quarter, and an increase of 2.3

percent on a constant currency basis.

Compared to the same quarter a year ago, operating income was

$1.0 billion, a decrease of 27.6 percent, and adjusted operating

income was $1.5 billion, a decrease of 15.6 percent, down 15.4

percent on a constant currency basis, including more than 5

percentage points of adverse items such as year-over-year bonus

changes. Operating income also reflected costs related to the

acquisition of Rite Aid stores and to the implementation of the

Transformational Cost Management Program.

Net cash provided by operating activities was $1.1 billion in

the first quarter, an increase of $601 million from the same

quarter last year, and free cash flow was $674 million, an increase

of $684 million from the same quarter a year earlier, reflecting

working capital efficiencies as the company executed against

optimization initiatives.

Company Outlook

The company maintained guidance of roughly flat growth in fiscal

2020 adjusted earnings per share at constant currency rates, with a

range of plus or minus 3 percent.

Progress on Strategic Priorities

During the first quarter of fiscal 2020, and since the close of

the quarter, the company made substantial progress on its four

strategic priorities: accelerating digitalization; transforming and

restructuring retail offering; creating neighborhood health

destinations; and the Transformational Cost Management Program.

Selected highlights include the following:

- WBA and McKesson announced an agreement to create a German

joint venture, combining their wholesale operations to drive long

term value in a key European market;

- Walgreens and Kroger formed a group purchasing organization,

expanding their collaboration with a new joint venture aimed at

delivering cost savings and other benefits across owned brand

sourcing;

- Flagship No7 beauty brand saw sales growth in the mid teens in

the U.S.;

- Jenny Craig health and weight loss management on track to

locate in approximately 100 Walgreens by the end of January;

- The first two of five VillageMD primary care clinics, Village

Medical at Walgreens, opened in Houston;

- Walgreens expansion of Save A Trip Refills program to drive

better clinical outcomes;

- Record on-line sales over Black Friday weekend in the U.S. and

the UK; and

- Boots UK announced an exclusive franchise agreement in the UK

with Mothercare.

Business Divisions

Retail Pharmacy USA:

Retail Pharmacy USA had first quarter sales of $26.1 billion, an

increase of 1.6 percent over the year-ago quarter. Sales in

comparable stores increased by the same percentage.

Pharmacy sales increased 2.9 percent compared with the year-ago

quarter, reflecting higher brand inflation and prescription volume,

and strong growth in central specialty. Comparable pharmacy sales

increased 2.5 percent. The division filled 294.0 million

prescriptions, including immunizations, adjusted to 30-day

equivalents in the quarter, an increase of 1.4 percent over the

year-ago quarter. Prescriptions filled in comparable stores

increased 2.8 percent compared with the same quarter a year

ago.

The division’s retail prescription market share on a 30-day

adjusted basis in the first quarter decreased approximately 55

basis points over the year-ago quarter to 20.9 percent, which was

in line with the fourth quarter of fiscal 2019, as reported by

IQVIA.3 The year-over-year change includes the impact of the store

optimization program.

Retail sales decreased 2.2 percent in the first quarter compared

with the year-ago period. Comparable retail sales were down 0.5

percent in the quarter, mostly due to continued de-emphasis of

tobacco. Excluding tobacco and e-cigarettes, comparable retail

sales increased around 0.8 percent, reflecting solid growth in the

core health and wellness and beauty categories.

Gross profit decreased 5.2 percent compared with the same

quarter a year ago and adjusted gross profit decreased 4.9 percent,

with procurement savings and pharmacy prescription growth

insufficient to offset year-on-year reimbursement pressure.

First quarter selling, general and administrative expenses

(SG&A) as a percentage of sales decreased by 0.3 percentage

point compared with the year-ago quarter. Adjusted SG&A as a

percentage of sales decreased by 0.6 percentage point in the same

period. Both decreases reflect strong cost savings, which more than

offset incremental investments, impact of inflation and higher

year-on-year bonus impact.

Operating income in the first quarter decreased 27.3 percent

from the year-ago quarter to $848 million. Excluding costs related

to the acquisition of Rite Aid stores and to the Transformational

Cost Management Program, adjusted operating income in the first

quarter decreased 16.2 percent from the year-ago quarter to $1.2

billion.

Retail Pharmacy International:

Retail Pharmacy International had first quarter sales of $2.7

billion, a decrease of 5.4 percent from the year-ago quarter,

reflecting an adverse currency impact of 2.7 percent. Sales

decreased 2.7 percent on a constant currency basis, mainly due to

lower retail sales in Boots UK and lower sales in Chile, reflecting

social unrest.

Comparable pharmacy sales increased 0.6 percent on a constant

currency basis, primarily due to the UK, driven by higher National

Health Service (NHS) reimbursement and increased sales of services,

partially offset by lower prescription volume. Comparable retail

sales decreased 3.0 percent on a constant currency basis, with

Boots UK holding share in a declining market.

Gross profit decreased 6.3 percent compared with the same

quarter a year ago, including an adverse currency impact of 2.6

percent. On a constant currency basis, gross profit and adjusted

gross profit decreased 3.7 percent and 3.6 percent, respectively,

reflecting lower retail sales and margin in Boots UK.

SG&A as a percentage of sales increased 0.7 percentage point

and adjusted SG&A as a percentage of sales, on a constant

currency basis, increased 1.3 percentage points, both reflecting

higher year-on-year bonus impact and technology investments.

Operating income in the first quarter decreased 43.7 percent

from the year-ago quarter to $44 million, while adjusted operating

income decreased 40.5 percent to $79 million, down 39.1 percent on

a constant currency basis.

Pharmaceutical Wholesale:

Pharmaceutical Wholesale had first quarter sales of $6.0

billion, an increase of 5.2 percent from the year-ago quarter,

including an adverse currency impact of 3.0 percent. On a constant

currency basis, comparable sales increased 8.3 percent, led by

emerging markets and the UK, including a customer contract change

in the UK.

Operating income in the first quarter was $122 million, which

included $13 million from the company’s equity earnings in

AmerisourceBergen. This compared with operating income of $155

million in the year-ago quarter, which included $39 million from

the company's equity earnings in AmerisourceBergen.

Adjusted operating income increased 4.1 percent to $229 million,

up 4.9 percent on a constant currency basis, reflecting strong

revenue growth and higher contribution from AmerisourceBergen.

Dividends Declared

During the first quarter, the company declared a quarterly

dividend of 45.75 cents per share, unchanged from the previous

quarter and an increase of 4 percent from the year-ago quarter. The

dividend was payable December 12, 2019 to stockholders of record as

of November 18, 2019.

Conference Call

Walgreens Boots Alliance will hold a one-hour conference call to

discuss the first quarter results beginning at 8:30 a.m. Eastern

time today, January 8, 2020. The conference call will be simulcast

through the Walgreens Boots Alliance investor relations website at:

http://investor.walgreensbootsalliance.com. A

replay of the conference call will be archived on the website for

12 months after the call.

The replay also will be available from 11:30 a.m. Eastern time,

January 8, 2020 through January 15, 2020, by calling +1 800 585

8367 within the U.S. and Canada, or +1 416 621 4642 outside the

U.S. and Canada, using replay code 4998459.

1 All references to earnings per share (EPS) are to diluted EPS

attributable to Walgreens Boots Alliance.

2 Please see the “Supplemental Information (Unaudited) Regarding

Non-GAAP Financial Measures” at the end of this press release for

more detailed information regarding non-GAAP financial measures

used, including all measures presented as "adjusted" or on a

"constant currency" basis, and free cash flow.

3 Due to revisions made by IQVIA to the methodology used for its

retail prescription database, market share has been restated for

the comparable year-ago period.

Cautionary Note Regarding Forward-Looking Statements: All

statements in this release that are not historical including,

without limitation, those regarding estimates of and goals for

future tax, financial and operating performance and results

(including those under “Company Outlook” and “Progress on Strategic

Priorities” above), the expected execution and effect of our

business strategies, our cost-savings and growth initiatives, pilot

programs, strategic partnerships and initiatives, and restructuring

activities and the amounts and timing of their expected impact and

the delivery of annual cost savings are forward-looking statements

made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Words such as “expect,”

“likely,” “outlook,” “forecast,” “preliminary,” “pilot,” “would,”

“could,” “should,” “can,” “will,” “project,” “intend,” “plan,”

“goal,” “guidance,” “target,” “aim,” “transform,” “accelerate,”

“model,” “long-term,” “continue,” “sustain,” “synergy,” “on track,”

“on schedule,” “headwind,” “tailwind,” “believe,” “seek,”

“estimate,” “anticipate,” “upcoming,” “to come,” “may,” “possible,”

“assume,” and variations of such words and similar expressions are

intended to identify such forward-looking statements. These

forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties and assumptions, known or

unknown, that could cause actual results to vary materially from

those indicated or anticipated, including, but not limited to,

those relating to the impact of private and public third-party

payers’ efforts to reduce prescription drug reimbursements,

fluctuations in foreign currency exchange rates, the timing and

magnitude of the impact of branded to generic drug conversions and

changes in generic drug prices, our ability to realize synergies

and achieve financial, tax and operating results in the amounts and

at the times anticipated, the inherent risks, challenges and

uncertainties associated with forecasting financial results of

large, complex organizations in rapidly evolving industries,

particularly over longer time periods, our supply, commercial and

framework arrangements and transactions with AmerisourceBergen and

their possible effects, the risks associated with the company’s

equity method investment in AmerisourceBergen, circumstances that

could give rise to the termination, cross-termination or

modification of any of our contractual obligations, the amount of

costs, fees, expenses and charges incurred in connection with

strategic transactions, whether the costs and charges associated

with restructuring initiatives will exceed estimates, our ability

to realize expected savings and benefits from cost-savings

initiatives, restructuring activities and acquisitions and joint

ventures in the amounts and at the times anticipated, the timing

and amount of any impairment or other charges, the timing and

severity of cough, cold and flu season, risks related to pilot

programs and new business initiatives and ventures generally,

including the risks that anticipated benefits may not be realized,

changes in management’s plans and assumptions, the risks associated

with governance and control matters, the ability to retain key

personnel, changes in economic and business conditions generally or

in particular markets in which we participate, changes in financial

markets, credit ratings and interest rates, the risks relating to

the terms, timing, and magnitude of any share repurchase activity,

the risks associated with international business operations,

including the risks associated with the proposed withdrawal of the

United Kingdom from the European Union and international trade

policies, tariffs, including tariff negotiations between the United

States and China, and relations, the risks associated with

cybersecurity or privacy breaches related to customer information,

changes in vendor, customer and payer relationships and terms,

including changes in network participation and reimbursement terms

and the associated impacts on volume and operating results, risks

related to competition, including changes in market dynamics,

participants, product and service offerings, retail formats and

competitive positioning, risks associated with new business areas

and activities, risks associated with acquisitions, divestitures,

joint ventures and strategic investments, including those relating

to the asset acquisition from Rite Aid, the risks associated with

the integration of complex businesses, regulatory restrictions and

outcomes of legal and regulatory matters, and risks associated with

changes in laws, including those related to the December 2017 U.S.

tax law changes, regulations or interpretations thereof. These and

other risks, assumptions and uncertainties are described in Item 1A

(Risk Factors) of our Annual Report on Form 10-K for the fiscal

year ended August 31, 2019 and in other documents that we file or

furnish with the Securities and Exchange Commission. Should one or

more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those indicated or anticipated by such

forward-looking statements. Accordingly, you are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date they are made. Except to the extent

required by law, we do not undertake, and expressly disclaim, any

duty or obligation to update publicly any forward-looking statement

after the date of this release, whether as a result of new

information, future events, changes in assumptions or

otherwise.

Please refer to the supplemental information presented below for

reconciliations of the non-GAAP financial measures used in this

release to the most comparable GAAP financial measure and related

disclosures.

Notes to Editors:

About Walgreens Boots Alliance

Walgreens Boots Alliance (Nasdaq: WBA) is a global leader in

retail and wholesale pharmacy, touching millions of lives every day

through dispensing and distributing medicines, its convenient

retail locations, digital platforms and health and beauty products.

The company has more than 100 years of trusted health care heritage

and innovation in community pharmacy and pharmaceutical

wholesaling.

Including equity method investments, WBA has a presence in more

than 25 countries, employs more than 440,000 people and has more

than 18,750 stores.

WBA’s purpose is to help people across the world lead healthier

and happier lives. The company is proud of its contributions to

healthy communities, a healthy planet, an inclusive workplace and a

sustainable marketplace. The company’s businesses have been

recognized for their Corporate Social Responsibility. Walgreens was

named to FORTUNE* magazine’s 2019 Companies that Change the World

list and Boots UK was recognized as Responsible Business of the

Year 2019-2020 by Business in the Community.

WBA is included in FORTUNE’s 2019 list of the World’s Most

Admired Companies, ranked first in the food and drugstore category.

This is the 26th consecutive year that WBA or its predecessor

company, Walgreen Co., has been named to the list.

More company information is available at www.walgreensbootsalliance.com.

*© 2019, Fortune Media IP Limited. Used under license.

(WBA-ER)

WALGREENS BOOTS ALLIANCE, INC.

AND SUBSIDIARIES

CONSOLIDATED CONDENSED

STATEMENTS OF EARNINGS

(UNAUDITED)

(in millions, except per share

amounts)

Three months ended November

30,

2019

2018

Sales

$

34,339

$

33,793

Cost of sales

27,077

26,152

Gross profit

7,263

7,641

Selling, general and administrative

expenses

6,262

6,280

Equity earnings in AmerisourceBergen

13

39

Operating income

1,013

1,400

Other income

35

26

Earnings before interest and income tax

provision

1,048

1,427

Interest expense, net

166

161

Earnings before income tax provision

882

1,265

Income tax provision

32

180

Post tax earnings (loss) from other equity

method investments

(9

)

15

Net earnings

842

1,100

Net loss attributable to noncontrolling

interests

(3

)

(23

)

Net earnings attributable to Walgreens

Boots Alliance, Inc.

$

845

$

1,123

Net earnings per common share:

Basic

$

0.95

$

1.18

Diluted

$

0.95

$

1.18

Weighted average common shares

outstanding:

Basic

891.4

948.2

Diluted

892.6

951.4

WALGREENS BOOTS ALLIANCE, INC.

AND SUBSIDIARIES

CONSOLIDATED CONDENSED BALANCE

SHEETS

(UNAUDITED)

(in millions)

November 30, 2019

August 31, 2019

Assets

Current assets:

Cash and cash equivalents

$

811

$

1,023

Accounts receivable, net

7,435

7,226

Inventories

10,536

9,333

Other current assets

822

1,118

Total current assets

19,604

18,700

Non-current assets:

Property, plant and equipment, net

13,620

13,478

Operating lease right-of-use assets

21,674

—

Goodwill

16,800

16,560

Intangible assets, net

11,055

10,876

Equity method investments

6,902

6,851

Other non-current assets

1,152

1,133

Total non-current assets

71,203

48,899

Total assets

$

90,807

$

67,598

Liabilities and equity

Current liabilities:

Short-term debt

$

6,225

$

5,738

Trade accounts payable

15,401

14,341

Operating lease obligation

2,288

—

Accrued expenses and other liabilities

5,370

5,474

Income taxes

210

216

Total current liabilities

29,494

25,769

Non-current liabilities:

Long-term debt

10,628

11,098

Operating lease obligation

21,894

—

Deferred income taxes

1,618

1,785

Other non-current liabilities

2,861

4,795

Total non-current liabilities

37,000

17,678

Total equity

24,314

24,152

Total liabilities and equity

$

90,807

$

67,598

WALGREENS BOOTS ALLIANCE, INC.

AND SUBSIDIARIES

CONSOLIDATED CONDENSED

STATEMENTS OF CASH FLOWS

(UNAUDITED)

(in millions)

Three months ended November

30,

2019

2018

Cash flows from operating

activities:

Net earnings

$

842

$

1,100

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization

477

490

Deferred income taxes

(62

)

24

Stock compensation expense

28

27

Equity (earnings) from equity method

investments

(4

)

(54

)

Other

28

97

Changes in operating assets and

liabilities:

Accounts receivable, net

(116

)

(515

)

Inventories

(1,099

)

(1,424

)

Other current assets

(5

)

(83

)

Trade accounts payable

924

1,097

Accrued expenses and other liabilities

45

(341

)

Income taxes

2

94

Other non-current assets and

liabilities

1

(54

)

Net cash provided by operating

activities

1,061

460

Cash flows from investing

activities:

Additions to property, plant and

equipment

(387

)

(470

)

Proceeds from sale-leaseback

transactions

147

—

Proceeds from sale of other assets

22

30

Business, investment and asset

acquisitions, net of cash acquired

(180

)

(200

)

Other

(4

)

5

Net cash used for investing activities

(402

)

(635

)

Cash flows from financing

activities:

Net change in short-term debt with

maturities of 3 months or less

(392

)

1,067

Proceeds from debt

5,072

1,085

Payments of debt

(4,702

)

(545

)

Stock purchases

(473

)

(912

)

Proceeds related to employee stock

plans

14

101

Cash dividends paid

(410

)

(422

)

Other

24

16

Net cash (used for) provided by financing

activities

(866

)

390

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

1

(6

)

Changes in cash, cash equivalents and

restricted cash:

Net increase (decrease) in cash, cash

equivalents and restricted cash

(206

)

208

Cash, cash equivalents and restricted cash

at beginning of period

1,207

975

Cash, cash equivalents and restricted

cash at end of period

$

1,000

$

1,183

WALGREENS BOOTS ALLIANCE, INC. AND

SUBSIDIARIES SUPPLEMENTAL INFORMATION (UNAUDITED) REGARDING

NON-GAAP FINANCIAL MEASURES (in millions, except per share

amounts)

The following information provides reconciliations of the

supplemental non-GAAP financial measures, as defined under SEC

rules, presented in this press release to the most directly

comparable financial measures calculated and presented in

accordance with generally accepted accounting principles in the

United States (GAAP). The company has provided the non-GAAP

financial measures in the press release, which are not calculated

or presented in accordance with GAAP, as supplemental information

and in addition to the financial measures that are calculated and

presented in accordance with GAAP.

These supplemental non-GAAP financial measures are presented

because management has evaluated the company’s financial results

both including and excluding the adjusted items or the effects of

foreign currency translation, as applicable, and believe that the

supplemental non-GAAP financial measures presented provide

additional perspective and insights when analyzing the core

operating performance of the company’s business from period to

period and trends in the company’s historical operating results.

These supplemental non-GAAP financial measures should not be

considered superior to, as a substitute for or as an alternative

to, and should be considered in conjunction with, the GAAP

financial measures presented in the press release. The company does

not provide a reconciliation for non-GAAP estimates on a

forward-looking basis (including the information under “Company

Outlook” above) where it is unable to provide a meaningful or

accurate calculation or estimation of reconciling items and the

information is not available without unreasonable effort. This is

due to the inherent difficulty of forecasting the timing or amount

of various items that have not yet occurred, are out of the

company’s control and/or cannot be reasonably predicted, and that

would impact diluted net earnings per share, the most directly

comparable forward-looking GAAP financial measure. For the same

reasons, the company is unable to address the probable significance

of the unavailable information. Forward-looking non-GAAP financial

measures provided without the most directly comparable GAAP

financial measures may vary materially from the corresponding GAAP

financial measures.

Constant currency

The company also presents certain information related to current

period operating results in “constant currency,” which is a

non-GAAP financial measure. These amounts are calculated by

translating current period results at the foreign currency exchange

rates used in the comparable period in the prior year. The company

presents such constant currency financial information because it

has significant operations outside of the United States reporting

in currencies other than the U.S. dollar and this presentation

provides a framework to assess how its business performed excluding

the impact of foreign currency exchange rate fluctuations.

Comparable sales

For the company's Retail Pharmacy divisions, comparable stores

are defined as those that have been open for at least twelve

consecutive months without closure for seven or more consecutive

days and without a major remodel or being subject to a natural

disaster in the past twelve months. Relocated stores are not

included as comparable stores for the first twelve months after the

relocation. Acquired stores are not included as comparable stores

for the first twelve months after acquisition or conversion, when

applicable, whichever is later. Comparable store sales, comparable

pharmacy sales and comparable retail sales refer to total sales,

pharmacy sales and retail sales, respectively, in such stores. For

the Retail Pharmacy USA division, comparable numbers of

prescriptions refer to number of prescriptions in such stores. For

the Pharmaceutical Wholesale division, comparable sales are defined

as sales excluding acquisitions and dispositions. The method of

calculating comparable sales varies across the retail industry. As

a result, the company's method of calculating comparable sales may

not be the same as other retailers’ methods.

With respect to the Retail Pharmacy Internal division,

comparable store sales, comparable pharmacy sales and comparable

retail sales, and with respect to the Pharmaceutical Wholesale

division, comparable sales, are presented on a constant currency

basis, which are non-GAAP financial measures. Refer to the

discussion above in "Constant currency" for further details on

constant currency calculations.

NET EARNINGS AND DILUTED NET EARNINGS

PER SHARE

Three months ended November

30,

2019

2018

Net earnings attributable to Walgreens

Boots Alliance, Inc. (GAAP)

$

845

$

1,123

Adjustments to operating

income:

Acquisition-related costs

124

66

Acquisition-related amortization and

impairment

118

123

Transformational cost management

86

30

Adjustments to equity earnings in

AmerisourceBergen

80

44

LIFO provision

33

39

Store optimization

9

20

Certain legal and regulatory accruals and

settlements

—

10

Total adjustments to operating income

449

332

Adjustments to other income:

Gain on sale of equity method

investment

(1

)

—

Net investment hedging gain

(11

)

(3

)

Total adjustments to other income

(12

)

(3

)

Adjustments to income tax

provision:

Equity method non-cash tax

(2

)

4

U.S. tax law changes1

(6

)

(12

)

Tax impact of adjustments2

(80

)

(57

)

Total adjustments to income tax

provision

(88

)

(65

)

Adjustments to post tax equity earnings

from other equity method investments:

Adjustments to equity earnings in other

equity method investments3

28

—

Total adjustments to post tax equity

earnings from other equity method investments

28

—

Adjusted net earnings attributable to

Walgreens Boots Alliance, Inc. (Non-GAAP measure)

$

1,222

$

1,386

Diluted net earnings per common share

(GAAP)

$

0.95

$

1.18

Adjustments to operating income

0.50

0.35

Adjustments to other income (expense)

(0.01

)

—

Adjustments to income tax provision

(0.10

)

(0.07

)

Adjustments to equity earnings in other

equity method investments3

0.03

—

Adjusted diluted net earnings per

common share (Non-GAAP measure)

$

1.37

$

1.46

Weighted average common shares

outstanding, diluted (in millions)

892.6

951.4

1

Discrete tax-only items.

2

Represents the adjustment to the GAAP

basis tax provision commensurate with non-GAAP adjustments and the

adjusted tax rate true-up.

3

Beginning in the quarter ended May 31,

2019, management reviewed and refined its practice to reflect the

proportionate share of certain equity method investees’ non-cash

items or unusual or infrequent items consistent with the Company’s

non-GAAP measures in order to provide investors with a comparable

view of performance across periods. These adjustments include

acquisition-related amortization and acquisition-related costs and

were immaterial for the prior periods presented. Although the

Company may have shareholder rights and board representation

commensurate with its ownership interests in these equity method

investees, adjustments relating to equity method investments are

not intended to imply that the Company has direct control over

their operations and resulting revenue and expenses. Moreover,

these non-GAAP financial measures have limitations in that they do

not reflect all revenue and expenses of these equity method

investees.

Three months ended November

30, 2019

Retail Pharmacy USA

Retail Pharmacy

International

Pharmaceutical

Wholesale1

Eliminations

Walgreens Boots Alliance,

Inc.

Sales

$

26,133

$

2,745

$

6,007

$

(545

)

$

34,339

Gross profit (GAAP)

$

5,691

$

1,056

$

517

$

(1

)

$

7,263

Acquisition-related costs

28

—

—

—

28

Transformational cost management

—

3

—

—

3

LIFO provision

33

—

—

—

33

Adjusted gross profit (Non-GAAP

measure)

$

5,753

$

1,059

$

517

$

(1

)

$

7,327

Selling, general and administrative

expenses (GAAP)

$

4,843

$

1,012

$

407

$

—

$

6,262

Acquisition-related costs

(94

)

—

(1

)

—

(95

)

Acquisition-related amortization and

impairment

(77

)

(22

)

(19

)

—

(118

)

Transformational cost management

(66

)

(10

)

(7

)

—

(83

)

Store optimization

(8

)

—

—

—

(8

)

Adjusted selling, general and

administrative expenses (Non-GAAP measure)

$

4,597

$

980

$

380

$

—

$

5,957

Operating income (GAAP)

$

848

$

44

$

122

$

—

$

1,013

Acquisition-related costs

122

—

1

—

124

Acquisition-related amortization and

impairment

77

22

19

—

118

Transformational cost management

66

12

7

—

86

Adjustments to equity earnings in

AmerisourceBergen

—

—

80

—

80

LIFO provision

33

—

—

—

33

Store optimization

9

—

—

—

9

Adjusted operating income (Non-GAAP

measure)

$

1,155

$

79

$

229

$

—

$

1,463

Gross margin (GAAP)

21.8

%

38.5

%

8.6

%

21.1

%

Adjusted gross margin (Non-GAAP

measure)

22.0

%

38.6

%

8.6

%

21.3

%

Selling, general and administrative

expenses percent to sales (GAAP)

18.5

%

36.9

%

6.8

%

18.2

%

Adjusted selling, general and

administrative expenses percent to sales (Non-GAAP measure)

17.6

%

35.7

%

6.3

%

17.3

%

Operating margin2

3.2

%

1.6

%

1.8

%

2.9

%

Adjusted operating margin (Non-GAAP

measure)2

4.4

%

2.9

%

2.3

%

4.0

%

1

Operating income for Pharmaceutical

Wholesale includes equity earnings in AmerisourceBergen. As a

result of the two month reporting lag, operating income for the

three month period ended November 30, 2019 includes

AmerisourceBergen equity earnings for the period of July 1, 2019

through September 30, 2019. Operating income for the three month

period ended November 30, 2018 includes AmerisourceBergen equity

earnings for the period of July 1, 2018 through September 30,

2018.

2

Operating margins and adjusted operating

margins have been calculated excluding equity earnings in

AmerisourceBergen and adjusted equity earnings in

AmerisourceBergen, respectively.

Three months ended November

30, 2018

Retail Pharmacy USA

Retail Pharmacy

International

Pharmaceutical

Wholesale1

Eliminations

Walgreens Boots Alliance,

Inc.

Sales

$

25,721

$

2,901

$

5,708

$

(537

)

$

33,793

Gross profit (GAAP)

$

6,000

$

1,128

$

512

$

1

$

7,641

Acquisition-related costs

9

—

—

—

9

Transformational cost management

—

2

—

—

2

LIFO provision

39

—

—

—

39

Adjusted gross profit (Non-GAAP

measure)

$

6,049

$

1,129

$

512

$

1

$

7,692

Selling, general and administrative

expenses (GAAP)

$

4,834

$

1,050

$

396

$

—

$

6,280

Acquisition-related costs

(57

)

—

—

—

(57

)

Acquisition-related amortization and

impairment

(76

)

(27

)

(20

)

—

(123

)

Transformational cost management

(2

)

(25

)

(1

)

—

(28

)

Store optimization

(19

)

—

—

—

(19

)

Certain legal and regulatory accruals and

settlements

(10

)

—

—

—

(10

)

Adjusted selling, general and

administrative expenses (Non-GAAP measure)

$

4,670

$

997

$

375

$

—

$

6,043

Operating income (GAAP)

$

1,166

$

78

$

155

$

1

$

1,400

Acquisition-related costs

66

—

—

—

66

Acquisition-related amortization and

impairment

76

27

20

—

123

Transformational cost management

2

27

1

—

30

Adjustments to equity earnings in

AmerisourceBergen

—

—

44

—

44

LIFO provision

39

—

—

—

39

Store optimization

20

—

—

—

20

Certain legal and regulatory accruals and

settlements

10

—

—

—

10

Adjusted operating income (Non-GAAP

measure)

$

1,379

$

132

$

220

$

1

$

1,732

Gross margin (GAAP)

23.3

%

38.9

%

9.0

%

22.6

%

Adjusted gross margin (Non-GAAP

measure)

23.5

%

38.9

%

9.0

%

22.8

%

Selling, general and administrative

expenses percent to sales (GAAP)

18.8

%

36.2

%

6.9

%

18.6

%

Adjusted selling, general and

administrative expenses percent to sales (Non-GAAP measure)

18.2

%

34.4

%

6.6

%

17.9

%

Operating margin2

4.5

%

2.7

%

2.0

%

4.0

%

Adjusted operating margin (Non-GAAP

measure)2

5.4

%

4.6

%

2.4

%

4.9

%

1

Operating income for Pharmaceutical

Wholesale includes equity earnings in AmerisourceBergen. As a

result of the two month reporting lag, operating income for the

three month period ended November 30, 2019 includes

AmerisourceBergen equity earnings for the period of July 1, 2019

through September 30, 2019. Operating income for the three month

period ended November 30, 2018 includes AmerisourceBergen equity

earnings for the period of July 1, 2018 through September 30,

2018.

2

Operating margins and adjusted operating

margins have been calculated excluding equity earnings in

AmerisourceBergen and adjusted equity earnings in

AmerisourceBergen, respectively.

EQUITY EARNINGS IN

AMERISOURCEBERGEN

Three months ended November

30,

2019

2018

Equity earnings in AmerisourceBergen

(GAAP)

$

13

$

39

U.S. tax law changes

—

(7

)

Acquisition-related amortization

30

31

LIFO provision

12

16

Anti-Trust

(1

)

—

Litigation settlements and other

36

(7

)

Asset Impairment

—

6

PharMEDium remediation costs

3

5

Adjusted equity earnings in

AmerisourceBergen (Non-GAAP measure)

$

92

$

83

ADJUSTED EFFECTIVE TAX

RATE

Three months ended November

30, 2019

Three months ended November

30, 2018

Earnings before income tax

provision

Income tax provision

Effective tax rate

Earnings before income tax

provision

Income tax provision

Effective tax rate

Effective tax rate (GAAP)

$

882

$

32

3.6

%

$

1,265

$

180

14.2

%

Impact of non-GAAP adjustments

437

84

329

55

U.S. tax law changes

—

6

—

12

Equity method non-cash tax

—

2

—

(4

)

Adjusted tax rate true-up

—

(4

)

—

2

Subtotal

$

1,320

$

120

$

1,593

$

245

Exclude adjusted equity earnings in

AmerisourceBergen

(92

)

—

(83

)

—

Adjusted effective tax rate excluding

adjusted equity earnings in AmerisourceBergen (Non-GAAP

measure)

$

1,227

$

120

9.8

%

$

1,510

$

245

16.2

%

FREE CASH FLOW

Three months ended November

30,

2019

2018

Net cash provided by operating

activities (GAAP)

$

1,061

$

460

Less: Additions to property, plant and

equipment

(387

)

(470

)

Free cash flow (Non-GAAP measure)1

$

674

$

(10

)

1

Free cash flow is defined as net cash

provided by operating activities in a period less additions to

property, plant and equipment (capital expenditures) made in that

period. This measure does not represent residual cash flows

available for discretionary expenditures as the measure does not

deduct the payments required for debt service and other contractual

obligations or payments for future business acquisitions.

Therefore, we believe it is important to view free cash flow as a

measure that provides supplemental information to our entire

statements of cash flows.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200108005237/en/

Media Relations U.S. / Fiona Ortiz +1 847 315 6402

International +44 (0)20 7980 8585

Investor Relations Gerald Gradwell and Jay Spitzer +1 847

315 2922

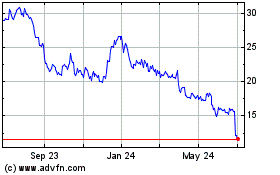

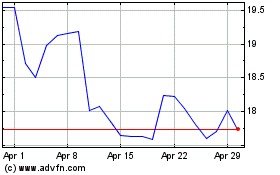

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Apr 2023 to Apr 2024