Democrats' Comments Give Health-Care Stocks a Stronger Pulse--Update

June 27 2019 - 5:08PM

Dow Jones News

By Alexander Osipovich

Beaten-down health-care stocks saw some relief Thursday, a day

after most Democratic presidential candidates shied away from

forcefully endorsing plans to nationalize the U.S. health-insurance

industry.

The moves come after such stocks have lagged behind the broader

market in 2019. Insurance stocks in particular fell sharply in

April, when Vermont Sen. Bernie Sanders introduced a bill that

would extend government-run health insurance to every American,

dubbed Medicare for All.

But at Wednesday night's closely watched debate with 10

Democratic contenders, most hesitated to embrace a total federal

takeover of health care. Massachusetts Sen. Elizabeth Warren and

New York City Mayor Bill de Blasio were the only two who raised

their hands when asked if they would eliminate private insurance as

part of a Medicare-for-All plan.

"There was trepidation entering the debates, and we came away

without a single new idea on healthcare reform," said Josh Raskin,

an analyst with Nephron Research who covers health insurers.

Shares of insurance company UnitedHealth Group Inc. gained 1.2%,

while Anthem Inc. and Humana Inc. were up 1.3% and 1.2%

respectively. That helped make health care one of the

best-performing sectors in the S&P 500 on Thursday.

Historically, investors have been attracted to health-care

stocks for their growth and defensive nature. But they can also be

sensitive to shifts in government regulation, concerns that have

pummeled their prices in recent months.

Mr. Raskin said such jitters are now subsiding. "With every

passing day, we move further from the tail risk of a single-payer

system, an ideal that is clearly not shared by the majority of the

Democratic candidates, " he said.

Still, health care remains the worst-performing sector in the

S&P 500 this year, having risen 6.7% from the start of 2019

while the broader index has climbed nearly 17%.

Other health-related stocks were also up Thursday. CVS Health

Corp., whose business spans from pharmacies to insurance plans

since its acquisition of Aetna last year, rose 1.9%.

Rite Aid Corp. soared more than 20% after Amazon.com said it

would allow shoppers to pick up purchases at specialized counters

in more than 1,500 Rite Aid locations.

Walgreens Boots Alliance Inc., which has struggled this year

with a slumping business and ailing stock price, was up 4.1% after

it reported better-than-expected earnings.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

June 27, 2019 16:53 ET (20:53 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

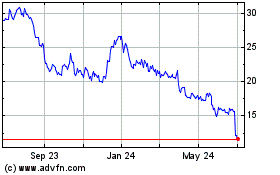

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

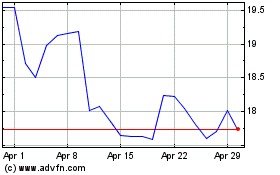

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Apr 2023 to Apr 2024