Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

December 05 2022 - 5:27PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-267053

Supplement No. 3

(To Prospectus dated October 13, 2022)

Waldencast plc

29,533,282 CLASS A ORDINARY SHARES (for issuance)

121,120,063 CLASS A ORDINARY SHARES (for

resale)

18,033,332 WARRANTS TO PURCHASE CLASS A ORDINARY

SHARES (for resale)

This prospectus supplement updates and

amends certain information contained in the prospectus of Waldencast plc, a public limited company organized under the laws of

Jersey, or “we”, “our”, the “Company”, dated October 13, 2022, or the “Prospectus”,

which forms a part of our Registration Statement on Form F-1 (Registration No. 333-267053). Capitalized terms used in this

prospectus supplement and not otherwise defined herein have the meanings specified in the Prospectus.

This prospectus supplement is being filed to update

and amend the information included in the Prospectus with the information contained in our Current Report on Form 6-K filed with the SEC

on December 5, 2022, which is set forth below.

This prospectus supplement is not complete without the Prospectus.

This prospectus supplement should be read in conjunction with the Prospectus, which is to be delivered with this prospectus supplement,

and is qualified by reference thereto, except to the extent that the information in this prospectus supplement updates or supersedes the

information contained in the Prospectus. Please keep this prospectus supplement with your Prospectus for future reference.

Our Class A ordinary shares and warrants are traded

on The Nasdaq Stock Market LLC (“Nasdaq”) under the symbols “WALD” and “WALDW,” respectively. On December 2, 2022, the closing price of our Class A ordinary shares was $9.60 per share and the closing price of our warrants was $0.74 per warrant.

Investing in our securities involves risks. See “Risk Factors”

beginning on page 10 of the Prospectus and in any applicable prospectus supplement.

None of the U.S. Securities and Exchange Commission

or any state securities commission has approved or disapproved of the securities or determined if this prospectus or this prospectus supplement

is accurate or adequate. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is December 5, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 or 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2022

Commission File Number: 001-40207

Waldencast plc

(Translation of Registrant’s name into English)

10 Bank Street, Suite 560

White Plains, New York, 10606

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

WALDENCAST PLC

On December 1, 2022, Waldencast plc (the “Company”) appointed

American Stock & Trust Company, LLC (“AST”) as its new transfer agent, replacing Continental Stock Transfer & Trust

Company (“CST”), effective as of December 1, 2022.

In connection with such appointment, the Company

entered into the First Amendment to the Warrant Agreement (“Amendment No. 1 to the Warrant Agreement”), dated as of December 1, 2022, by and among the Company, AST, and CST, pursuant to which, AST replaced CST as the warrant agent.

The foregoing description of the Amendment No. 1 to the Warrant Agreement

is not complete and is subject to, and qualified in its entirety, by reference to the Amendment No. 1 to the Warrant Agreement, a copy

of which is attached hereto as Exhibit 4.1, and the terms of which are incorporated by reference herein.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, Waldencast plc has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

Waldencast plc |

| |

|

(Registrant) |

| |

|

|

|

| Date: December 5, 2022 |

By: |

/s/ Michel Brousset |

| |

|

Name: |

Michel Brousset |

| |

|

Title: |

Chief Executive Officer |

2

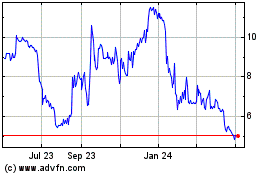

Waldencast (NASDAQ:WALD)

Historical Stock Chart

From Mar 2024 to Apr 2024

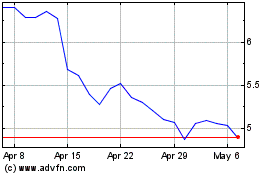

Waldencast (NASDAQ:WALD)

Historical Stock Chart

From Apr 2023 to Apr 2024