SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

Vodafone Group

Plc

(Name of Issuer)

Ordinary Shares of 20 20/21 US

cents each

(Title of Class or Securities)

BH4HKS3

(SEDOL Number)

| |

Nazih El Hassanieh

Emirates Telecommunications Group Company PJSC

Head Office Building A

Intersection of Zayed the 1st Street and Sheikh Rashid

Bin Saeed Al Maktoum Street

PO Box 3838

Abu Dhabi

United Arab Emirates

+971 2-628-3333

|

|

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communication) |

April 12, 2023

(Date of Event to Which This Filing Relates)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule

because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☒

| * | This statement on Schedule 13D (the “Schedule 13D”) constitutes an initial Schedule

13D filing on behalf of each of the Reporting Persons (as herein defined), with respect to the Ordinary Shares of 20 20/21

US cents each (the “Ordinary Shares”) of Vodafone Group Plc (the “Issuer”). The Ordinary Shares

beneficially owned by the Reporting Persons were previously reported on Schedule 13G filed by the Reporting Persons on May 16, 2022, as

amended from time to time. |

| * | The remainder of this cover page shall be filled out for a reporting person’s initial filing on

this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures

provided in a prior cover page. |

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange

Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however, see the notes).

(Continued on following pages)

| 1 |

Names of reporting persons:

Atlas 2022 Holdings Limited |

| 2 |

Check the appropriate box if a member of a group

(see instructions)

(a) ☐

(b) ☐ |

| 3 |

SEC use only |

| 4 |

Source of funds (see instructions):

AF |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐ |

| 6 |

Citizenship or place of organization:

Cayman Islands |

| Number of shares beneficially owned by each reporting person with |

7 |

Sole voting power:

3,944,743,685 Ordinary Shares 1, 2 |

| 8 |

Shared voting power:

0 Ordinary Shares |

| 9 |

Sole dispositive power:

3,944,743,685 Ordinary Shares |

| 10 |

Shared dispositive power:

0 Ordinary Shares1 |

| 11 |

Aggregate amount beneficially owned by each

reporting person:

3,944,743,685 Ordinary Shares1, 2 |

| 12 |

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) ☐ |

| 13 |

Percent of class represented by amount in row

(11):

14.61%1, 2, 3 |

| 14 |

Type of reporting person (see instructions):

CO |

| |

|

|

|

| 1 | Atlas 2022 Holdings Limited is wholly-owned by Emirates Telecommunications Group Company PJSC (“e&”),

which is in turn 60% owned by the Emirates Investment Authority (“EIA”). Together

these entities indirectly and directly beneficially own 3,944,743,685 Ordinary Shares of Vodafone

Group Plc (“Vodafone”), as of April 24, 2023, representing approximately 14.61% of the voting rights attached to

Vodafone shares. In addition, See Items 2, 3, 4, 5 and 6 of this Schedule 13D. |

| 2 | Based on a total of 26,992,564,629 Ordinary Shares outstanding (i.e. excluding treasury shares) as of

March 31, 2023 as reported by Vodafone in its press release dated April 3, 2023. |

| 1 |

Names of reporting persons:

Emirates Telecommunications Group Company PJSC |

| 2 |

Check the appropriate box if a member of a group

(see instructions)

(a) ☐

(b) ☐ |

| 3 |

SEC use only |

| 4 |

Source of funds (see instructions):

PF, OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐ |

| 6 |

Citizenship or place of organization:

United Arab Emirates |

| Number of shares beneficially owned by each reporting person with |

7 |

Sole voting power:

0 |

| 8 |

Shared voting power:

3,944,743,685 Ordinary Shares1, 2 |

| 9 |

Sole dispositive power:

0 |

| 10 |

Shared dispositive power:

3,944,743,685 Ordinary Shares1 |

| 11 |

Aggregate amount beneficially owned by each

reporting person:

3,944,743,685 Ordinary Shares1, 2 |

| 12 |

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) ☐ |

| 13 |

Percent of class represented by amount in row

(11):

14.61%1, 2, 3 |

| 14 |

Type of reporting person (see instructions):

CO |

| |

|

|

|

| 1 | Atlas 2022 Holdings Limited is wholly-owned by Emirates Telecommunications Group Company PJSC (“e&”),

which is in turn 60% owned by the Emirates Investment Authority (“EIA”). Together

these entities indirectly and directly beneficially own 3,944,743,685 Ordinary Shares of Vodafone

Group Plc (“Vodafone”), as of April 24, 2023, representing approximately 14.61% of the voting rights attached to

Vodafone shares. In addition, See Items 2, 3, 4, 5 and 6 of this Schedule 13D. |

| 2 | Based on a total of 26,992,564,629 Ordinary Shares outstanding (i.e. excluding treasury shares) as of

March 31, 2023 as reported by Vodafone in its press release dated April 3, 2023. |

| 1 |

Names of reporting persons:

Emirates

Investment Authority |

| 2 |

Check the appropriate box if a member of a group

(see instructions)

(a) ☐

(b) ☐ |

| 3 |

SEC use only |

| 4 |

Source of funds (see instructions):

AF |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ☐ |

| 6 |

Citizenship or place of organization:

United Arab Emirates |

| Number of shares beneficially owned by each reporting person with |

7 |

Sole voting power:

0 |

| 8 |

Shared voting power:

3,944,743,685 Ordinary Shares1, 2 |

| 9 |

Sole dispositive power:

0 |

| 10 |

Shared dispositive power:

3,944,743,685 Ordinary Shares1 |

| 11 |

Aggregate amount beneficially owned by each

reporting person:

3,944,743,685 Ordinary Shares1, 2 |

| 12 |

Check if the aggregate amount in Row (11) excludes certain shares (see instructions) ☐ |

| 13 |

Percent of class represented by amount in row

(11):

14.61%1, 2, 3 |

| 14 |

Type of reporting person (see instructions):

OO3 |

| |

|

|

|

| 1 | Atlas 2022 Holdings Limited is wholly-owned by Emirates Telecommunications Group Company PJSC (“e&”),

which is in turn 60% owned by the Emirates Investment Authority (“EIA”). Together these entities indirectly and directly

beneficially own 3,944,743,685 Ordinary Shares of Vodafone Group Plc (“Vodafone”), as of April 24, 2023, representing

approximately 14.61% of the voting rights attached to Vodafone shares. In addition, See Items 2, 3, 4, 5 and 6 of this Schedule 13D. |

| 2 | Based on a total of 26,992,564,629 Ordinary Shares outstanding (i.e. excluding treasury shares) as of

March 31, 2023 as reported by Vodafone in its press release dated April 3, 2023. |

| 3 | EIA is an integral part of the Federal Government and was established through Federal Decree Law No. 4 of 2007 as amended by Federal Decree Law

No. 13 of 2009 and Federal Decree Law No. 11 of 2018. EIA has an independent legal

identity with full capacity to act in fulfilling its statutory mandate and objectives. |

| Item | 1.

Security and Issuer. |

This statement on Schedule 13D (the “Statement”)

relates to the Ordinary Shares of 20 20/21 US cents each (the “Ordinary Shares”) of Vodafone Group Plc (the

“Issuer”), whose principal executive offices are located at Vodafone House, The Connection, Newbury, Berkshire RG14

2FN, England.

| Item | 2.

Identity and Background. |

This Schedule 13D is being

filed by:

| (i) | Atlas 2022 Holdings Limited, a limited liability exempted company formed under the laws

of the Cayman Islands (“Atlas Holdings”); |

| (ii) | Emirates Telecommunications Group Company PJSC, a public joint-stock company incorporated under the laws of the United Arab Emirates

(“e&”); and |

| (iii) | Emirates Investment Authority, a public institution established under the laws of the United Arab Emirates (“EIA”). |

Each of the foregoing is

referred to as a “Reporting Person” and collectively as the “Reporting Persons.”

Atlas Holdings is a wholly-owned

subsidiary of e&, which in turn is 60% owned by EIA (which, therefore, is deemed a control person of Atlas Holdings and e&).

Atlas Holdings is a special

purpose vehicle created to hold e&’s investment in the Issuer. The address of the principal business office of Atlas Holdings

is 190 Elgin Avenue, George Town, Grand Cayman KY1-9001, Cayman Islands. The principal business purposes of Atlas Holdings is to hold

the Issuer’s shares on behalf of e&.

e& is an Abu Dhabi

public joint-stock company listed on the Abu Dhabi Securities Exchange (“ADX”) and is principally engaged in the

telecommunications business. The address of the principal business office of e& is Emirates Telecommunications Group Company

PJSC, Head Office Building A, Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box

3838, Abu Dhabi, United Arab Emirates.

EIA is an integral part of the Federal Government and was established through Federal Decree Law No. 4 of 2007 as amended by Federal Decree

Law No. 13 of 2009 and Federal Decree Law No. 11 of 2018. The address of the principal

business office of EIA is PO Box 3235, International Tower, ADNEC Capital Centre, Abu Dhabi, United Arab Emirates.

The name, business address,

citizenship and present principal occupation or employment of each director and executive officer of the Reporting Persons are set forth

on Annex A hereto and are incorporated herein by reference.

During

the last five years, none of the Reporting Persons nor, to the best of each Reporting Person’s knowledge, any person referred

to in Annex A has been (a) convicted in a criminal proceeding (excluding traffic

violations or similar misdemeanors) or (b) a party to a civil proceeding of a judicial or administrative body of competent

jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations

of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to

such laws.

| Item | 3.

Source and Amount of Funds or Other Consideration. |

The Ordinary Shares beneficially

owned by the Reporting Persons were originally acquired and previously reported on Schedule 13G filed by the Reporting Persons on May

16, 2022, as amended on November 8, 2022 and January 18, 2023. None of the Reporting Persons has acquired or disposed any Ordinary Shares

since March 20, 2023 and this Schedule 13D is being filed on the basis of the fact and circumstances described under Item 4, which is

incorporated herein by reference in its entirety.

Item

4. Purpose of Transaction.

The Ordinary Shares beneficially owned by the Reporting

Persons were originally acquired for investment purposes and the rationale of such investment by e& was to gain significant exposure

to the Issuer as a world leader in connectivity and digital service at an attractive valuation.

On April 12, 2023, e& determined that it was in

its best interests, and the best of interests of the Issuer and its shareholders, for e& and its representatives to be able to engage

with the Issuer and its representatives on a variety of topics, including topics for which e& may be deemed to be seeking to influence

the Issuer. On April 12, e& initiated preliminary discussions with the Issuer in respect of the non-executive composition of the Issuer’s

board of directors.

Subject to the limitations imposed by applicable

laws and receipt of any required approvals, the Reporting Persons from time to time may decide to increase or decrease their

investment in the Issuer through purchases or sales of Ordinary Shares in open market or private transactions or otherwise. The

Reporting Persons have obtained, and may continue to seek, regulatory approvals necessary to enable them to increase their

shareholding in the Issuer. The timing and amount of any such increase or decrease may depend upon the price and availability of

Ordinary Shares, subsequent developments affecting the Issuer, the Issuer’s business and prospects, other investment and

business opportunities available to the Reporting Persons, the Reporting Persons obtaining any required regulatory approvals,

general stock market and economic conditions, liquidity requirements of the Reporting Persons, tax considerations and other factors

considered relevant. Any acquisition or disposition may be effected at any time without prior notice.

e& may engage in

discussions with management, the board of directors, other shareholders of the Issuer and other relevant parties concerning the business,

operations, board composition, management, strategy and future plans of the Issuer and/or plans or proposals that could result in or relate

to, among other things, any of the matters set forth in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

Except as set forth herein, none of the Reporting Persons

has any plans or proposals which relate to or would result in any transaction, event or action enumerated in subparagraphs (a) through (j)

of Item 4 of Schedule 13D. This is not a statement to which Rule 2.8 of the UK Takeover Code applies.

e& intends to review its investment in the Issuer

on a continuing basis and reserves the right, at any time and from time to time in compliance with applicable law and regulation, to review

or reconsider its position, change its purpose, take other actions or formulate and implement plans or proposals with respect to any and

all matters referred to in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

| Item | 5.

Interest in Securities of the Issuer. |

The aggregate percentage of Ordinary Shares reported

by each person named herein is based upon 26,992,564,629 Ordinary Shares outstanding (i.e. excluding treasury shares) as of March 31,

2023, as reported by the Issuer in its press release dated April 3, 2023.

A. Atlas Holdings

| (a) | Rows (11) and (13) of the cover pages to this Schedule 13D are hereby incorporated by reference. |

| (b) | Rows (7) through (10) of the cover pages to this Schedule 13D set forth the number of Ordinary Shares as to which there

is sole power to vote or direct the vote or to dispose or to direct the disposition, and the number of Ordinary Shares of the Issuer as

to which there is shared power to vote or to direct the vote, or shared power to dispose or to direct the disposition. |

B. e&

| (a) | Rows (11) and (13) of the cover pages to this Schedule 13D are hereby incorporated by reference. |

| (b) | Rows (7) through (10) of the cover pages to this Schedule 13D set forth the number of Ordinary Shares as to which there

is sole power to vote or direct the vote or to dispose or to direct the disposition, and the number of Ordinary Shares of the Issuer as

to which there is shared power to vote or to direct the vote, or shared power to dispose or to direct the disposition. |

C. EIA

| (a) | Rows (11) and (13) of the cover pages to this Schedule 13D are hereby incorporated by reference. |

(b)

Rows (7) through (10) of the cover pages to this Schedule 13D set forth the number of Ordinary Shares as to which there

is sole power to vote or direct the vote or to dispose or to direct the disposition, and the number of Ordinary Shares of the Issuer as

to which there is shared power to vote or to direct the vote, or shared power to dispose or to direct the disposition.

Except as described in this Item 5 and Annex A,

none of the Reporting Persons or, to the best of each Reporting Person’s knowledge, the persons included in Annex A has

beneficial ownership of any Ordinary Shares. Annex B hereto set forth all the transactions made on the Ordinary Shares in the past

60 days by any of the Reporting Persons or, to the best of each Reporting Person’s knowledge, any of the persons listed in

Annex A hereto.

No other person is known to have the right to receive

or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Ordinary Shares owned, directly or indirectly,

by the Reporting Persons.

| Item | 6.

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

On April 24, 2023, the Reporting Persons entered into

a Joint Filing Agreement in which the Reporting Persons agreed to the joint filing on behalf of each of them of statements on Schedule

13D with respect to the securities of the Issuer to the extent required by applicable law. The Joint Filing Agreement is attached hereto

as Exhibit 99.1 and is incorporated herein by reference.

Other than as described herein, there are no contracts,

arrangements, understandings or relationships among the Reporting Persons, or between the Reporting Persons and any other person, with

respect to the securities of the Issuer.

| Item | 7.

Material to Be Filed as Exhibits. |

| Exhibit No |

Description |

| 99.1 |

Joint Filing Agreement, dated April 24, 2023, between Atlas Holdings, e& and EIA |

Annex

A-1

Directors of Atlas Holdings

|

Name |

Citizenship |

Business Address |

Present Principal

Occupation |

Beneficial Ownership of

Vodafone

Ordinary Shares

|

| Mr. Hatem Dowidar |

Egyptian, Emirati |

Emirates Telecommunications Group Company PJSC, Head Office Building A, Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE |

Group Chief Executive Officer, e& |

None |

| Mr. Karim Bennis |

French |

Emirates Telecommunications Group Company PJSC, Head Office Building A, Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE |

Group Chief Financial Officer, e& |

None |

| Mr. Hasan Mohamed Al Hosani |

Emirati |

Emirates Telecommunications Group Company PJSC, Head Office Building A, Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE |

Group Corporate Secretary, e& |

None |

Annex

A-2

Directors and Executive Officers of e&

|

Name |

Citizenship |

Business Address |

Present Principal

Occupation |

Beneficial Ownership of

Vodafone

Ordinary Shares

|

| Directors of e& |

| H.E. Jassem Mohamed Bu Ataba Alzaabi |

Emirati |

Emirates Telecommunications Group Company PJSC, Head Office Building A,

Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE

|

Chairman of e& Group |

None |

| Mr. Essa Abdulfattah Kazim Al Mulla |

Emirati |

Dubai International Financial Centre (“DIFC”), the Gate

Building, Level 14, East Wing

|

Governor, DIFC |

None |

| Mr. Hesham Abdulla Qassim Al Qassim |

Emirati |

Dubai Real Estate Corporation, P.O. Box 23073, Dubai, UAE

|

Chief Executive Officer, Dubai Real Estate Corporation |

None |

| Sheikh Ahmed Mohamed Sultan Al Dhahiri |

Emirati |

Pan Emirates Bldg ,01 floor 04 office, Airport Road, Abu Dhabi

|

Entrepreneur |

None |

|

Ms. Mariam Saeed Ahmed Ghobash

|

Emirati |

PO Box 47233, Abu Dhabi, UAE |

Self-employed |

None |

| Mr. Saleh Abdulla Ahmed Alabdooli |

Emirati |

Emirates Telecommunications Group Company PJSC, Head Office Building A,

Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE

|

Director of e& |

None |

| Mr. Mansoor Ibrahim Ahmed Al Mansoori |

Emirati |

13th Floor, Capital Gate, Abudhabi, UAE

|

Group Chief Operating Officer, G42 |

None |

| Mr. Michel Combes |

French |

200 S Biscayne Llvd 19th Floor, Miami, Fl 33131

|

Chief Executive Officer, SoftBank Group |

1,622,121 Ordinary Shares |

|

Mr. Abdelmonem Bin Eisa Bin Nasser Alserkal

|

Emirati |

PO Box 1219, Dubai, United Arab Emirates |

Managing Director |

None |

|

Mr. Khalid Abdulwahid Hassan Alrustamani

|

Emirati |

AW Rostamani Head Office, 7th Floor, 25 Al Ittihad Rd. Al Khabaisi, PO Box

22715, Dubai, UAE

|

Chairman and Chief Executive Officer, AW Rostamani Group |

151,750 Ordinary Shares(1) |

| Mr. Otaiba Khalaf Ahmed Al Otaiba |

Emirati |

6th Floor, Hamdan Street, Al Otaiba Tower, Abu Dhabi, UAE

|

Al Otaiba and Hamdan Budebes Lawyers and Legal Consultants |

None |

| Executive Officers of e& |

| Mr. Hatem Dowidar |

Egyptian, Emirati |

Emirates Telecommunications Group Company PJSC, Head Office Building A,

Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE

|

Group Chief Executive Officer |

None |

| Mr. Karim Bennis |

French |

Emirates Telecommunications Group Company PJSC, Head Office Building A,

Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE

|

Group Chief Financial Officer |

None |

| Mr. Obaid Bokisha |

Emirati |

Emirates Telecommunications Group Company PJSC, Head Office Building A,

Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE

|

Group Chief Operations Officer |

None |

| Mr. Mikhail Gerchuk |

United Kingdom |

Emirates Telecommunications Group Company PJSC, Head Office Building A,

Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE

|

Chief Executive Officer, e& International |

None |

| Mr. Salvador Anglada |

Spanish |

Emirates Telecommunications Group Company PJSC, Head Office Building A,

Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE

|

Chief Executive Officer, e& Enterprise |

None |

| Mr. Khalifa Al Shamsi |

Emirati |

Emirates Telecommunications Group Company PJSC, Head Office Building A,

Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE

|

Chief Executive Officer, e& Life |

None |

| Mr. Nabil Baccouche |

Belgian |

Emirates Telecommunications Group Company PJSC, Head Office Building A,

Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE

|

Group Chief Carrier & Wholesale Officer |

None |

| Mr. Hasan Mohamed Al Hosani |

Emirati |

Emirates Telecommunications Group Company PJSC, Head Office Building A, Intersection of Zayed the 1st Street and Sheikh Rashid Bin Saeed Al Maktoum Street, PO Box 3838, Abu Dhabi, UAE |

Group Corporate Secretary, e& |

None |

| 1 | All Ordinary Shares are owned directly by the AW Rostamani Group. |

Annex

A-3

Directors and Executive Officers of EIA

|

Name |

Citizenship |

Business Address |

Present Principal

Occupation |

Beneficial Ownership of

Vodafone

Ordinary Shares

|

| Directors of EIA |

| H.H. Sheikh Mansour Bin Zayed Al Nahyan |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Chairman of the BoardN |

None |

| H.E. Mohammad Abdulla Ali AlGergawi |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Director of the Board |

None |

| H.E. Dr. Sultan Ahmed Al Jaber |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Director of the Board |

None |

| H.E. Hareb Masood Hamad Rashed Al Darmaki |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Director of the Board |

None |

| H.E. Eissa Mohamed Ghanem Al Suwaidi |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Director of the Board |

None |

| H.E. Mohamed Hadi Al Hussaini |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Director of the Board |

None |

| H.E. Abdulla bin Mohammad Saeed Abdulla Touq Al Marri |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Director of the Board |

None |

| H.E. Kaltham Hamad Al Ghafli |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Director of the Board |

None |

| Executive Officers of EIA |

| H.E. Mubarak Rashed Khamis Mukhaizen Al Mansoori |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Chief Executive Officer |

None |

| Mr. Salem Lafi Obaid Lafi Almehairi |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Executive Director of Asset Management |

None |

| Mr. Mohamed Hamad Ghanem Al Mehairi |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Executive Director of Strategic Assets |

None |

| Mr. Majed Salem Saeed Saad Almenhali |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Chief Finance Officer |

None |

| Dr. Vasilios Siokis |

Greek |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Chief Risk Officer |

None |

| Mr. Aaron James Clayton |

United Kingdom |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Chief Human Resources Officer |

None |

| Ms. Salwa Asban |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Chief Internal Audit |

None |

| Ms. Rima Hadid |

Australian |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

General Counsel |

None |

| Mr. Troy John Rieck |

Australian |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE

|

Chief Investment Officer of Asset Management |

None |

| Ms. Hassa Abdulrazzaq Balouma |

Emirati |

9th Floor, International Tower, ADNEC, Abu Dhabi, UAE |

Acting Chief Investment Officer of Strategic Assets |

None |

ANNEX B

Transactions in the Securities of the Issuer During the Past 60 Days

| Nature of the Transaction |

Amount of Securities Purchased |

Price (GBP) |

Date of Purchase |

| Atlas Holdings |

| Purchase of Shares |

20,000,000 |

0.9929 |

23/02/2023 |

| Purchase of Shares |

20,000,000 |

0.9941 |

24/02/2023 |

| Purchase of Shares |

35,000,000 |

1.0053 |

27/02/2023 |

| Purchase of Shares |

10,000,000 |

0.9967 |

02/03/2023 |

| Purchase of Shares |

10,000,000 |

1.0047 |

03/03/2023 |

| Purchase of Shares |

10,000,000 |

1.0099 |

06/03/2023 |

| Purchase of Shares |

20,000,000 |

0.9924 |

07/03/2023 |

| Purchase of Shares |

10,000,000 |

0.9872 |

08/03/2023 |

| Purchase of Shares |

10,000,000 |

0.9835 |

09/03/2023 |

| Purchase of Shares |

10,000,000 |

0.9869 |

10/03/2023 |

| Purchase of Shares |

20,000,000 |

0.9660 |

13/03/2023 |

| Purchase of Shares |

10,000,000 |

0.9609 |

14/03/2023 |

| Purchase of Shares |

14,000,000 |

0.9485 |

15/03/2023 |

| Purchase of Shares |

10,000,000 |

0.9298 |

16/03/2023 |

| Purchase of Shares |

10,000,000 |

0.9262 |

17/03/2023 |

| Purchase of Shares |

10,000,000 |

0.9110 |

20/03/2023 |

Signature

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: April 24, 2023

| |

ATLAS 2022 HOLDINGS LIMITED |

| |

|

| |

/s/ Hatem Dowidar |

| |

Name: Hatem Dowidar

Title: Director |

Signature

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: April 24, 2023

| |

EMIRATES TELECOMMUNICATIONS GROUP COMPANY PJSC |

| |

|

| |

/s/ Hatem Dowidar |

| |

Name: Hatem Dowidar

Title: Group Chief Executive Officer |

Signature

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: April 24, 2023

| |

EMIRATES INVESTMENT AUTHORITY |

| |

|

| |

/s/ Mubarak Rashed Al Mansoori |

| |

Name: Mubarak Rashed Al Mansoori

Title: Chief Executive Officer |

EXHIBIT INDEX

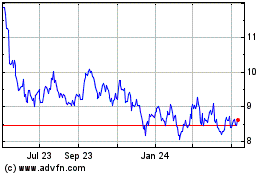

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

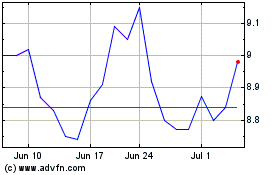

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024