Filed pursuant to Rule 433

Registration Statement No. 333-240163

February 7,

2023

Final Term Sheet

U.S.$1,200,000,000

Vodafone Group

Public Limited Company

U.S.$700,000,000

5.625% Notes due 2053

U.S.$500,000,000 5.750% Notes due 2063

We have filed a registration

statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read

the prospectus in that registration statement and other documents we have filed with the SEC for more complete information about us and

this offering.

You

may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, we, any underwriter or any dealer

participating in the offering will arrange to send you the prospectus if you request it by calling BofA Securities, Inc. at 1-800-294-1322,

Citigroup Global Markets Inc. at 1-800-831-9146, Goldman Sachs & Co. LLC at 1-866-471-2526, SMBC Nikko Securities America, Inc.

at 1-888-868-6856 and TD Securities (USA) LLC at 1-855-495-9846.

The

SEC allows us to “incorporate by reference” into the registration statement the information we file with them. Any

statement in a document incorporated or deemed to be incorporated by reference into the registration statement (or the prospectus) shall

be automatically modified or superseded for purposes of the registration statement (or the prospectus) to the extent that a statement

contained in the prospectus or in any subsequently filed document that is incorporated by reference into the registration statement (or

prospectus) modifies or supersedes such prior statement. Any statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of the registration statement.

| U.S.$700,000,000 5.625% Notes due 2053 (the “Tranche 1 Notes”) |

| |

| Expected Ratings(1) |

Baa2 / BBB / BBB (Moody’s / S&P / Fitch). |

| |

|

| Maturity Date |

We will repay the Tranche 1 Notes on February 10, 2053 at 100% of their principal amount, plus accrued and unpaid interest. |

| |

|

| Issue Date |

February 10, 2023. |

| |

|

| Benchmark Treasury |

3.000% UST due August 15, 2052. |

| |

|

| Benchmark Treasury Price and Yield |

87-13+, 3.704%. |

| |

|

| Spread to Benchmark Treasury |

T+195bps. |

| Reoffer Yield |

5.654%. |

| |

|

| Issue Price |

99.583% of the principal amount, plus accrued interest, if any, from and including February 10, 2023 to the date the Tranche 1 Notes are delivered to investors. |

| |

|

| Interest Rate |

5.625% per annum. |

| |

|

| Interest Payment Dates |

Semi-annually on February 10 and August 10 of each year, commencing August 10, 2023 up to and including the maturity date for the Tranche 1 Notes, subject to the applicable business day convention. |

| |

|

| Business Day Convention |

Following, Unadjusted. |

| |

|

| Day Count Fraction |

30/360. |

| |

|

| Optional Make-Whole Redemption |

We have the right to redeem the Tranche 1 Notes, in whole or in part, at a redemption price equal to: (i) if redemption occurs prior to 10 August 2052, the greater of (x) 100% of the principal amount of such notes, plus accrued interest to the date of redemption and (y) as determined by the quotation agent, the sum of the present values of the remaining scheduled payments of principal and interest on such notes (excluding any portion of such payments of interest accrued as of the date of redemption) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the adjusted treasury rate, plus 30 basis points; or (ii) if redemption occurs on or after 10 August 2052, 100% of the principal amount of such notes, plus accrued interest to the date of redemption. |

| |

|

| Underwriting Discount |

0.75%. |

| |

|

| CUSIP Number |

92857W BY5 |

| |

|

| ISIN |

US92857WBY57 |

| U.S.$500,000,000 5.750% Notes due 2063 (the “Tranche 2 Notes” and, together with the Tranche 1 Notes, the “Notes”) |

| |

| Expected Ratings(1) |

Baa2 / BBB / BBB (Moody’s / S&P / Fitch). |

| |

|

| Maturity Date |

We will repay the Tranche 2 Notes on February 10, 2063 at 100% of their principal amount, plus accrued and unpaid interest. |

| |

|

| Issue Date |

February 10, 2023. |

| |

|

| Benchmark Treasury |

3.000% UST due August 15, 2052. |

| |

|

| Benchmark Treasury Price and Yield |

87-13+, 3.704%. |

| |

|

| Spread to Benchmark Treasury |

T+210bps. |

| |

|

| Reoffer Yield |

5.804%. |

| Issue Price |

99.164% of the principal amount, plus accrued interest, if any, from and including February 10, 2023 to the date the Tranche 2 Notes are delivered to investors. |

| |

|

| Interest Rate |

5.750% per annum. |

| |

|

| Interest Payment Dates |

Semi-annually on February 10 and August 10 of each year, commencing August 10, 2023 up to and including the maturity date for the Tranche 2 Notes, subject to the applicable business day convention. |

| |

|

| Business Day Convention |

Following, Unadjusted. |

| |

|

| Day Count Fraction |

30/360. |

| |

|

| Optional Make-Whole Redemption |

We have the right to redeem the Tranche 2 Notes, in whole or in part, at a redemption price equal to: (i) if redemption occurs prior to 10 August 2062, the greater of (x) 100% of the principal amount of such notes, plus accrued interest to the date of redemption and (y) as determined by the quotation agent, the sum of the present values of the remaining scheduled payments of principal and interest on such notes (excluding any portion of such payments of interest accrued as of the date of redemption) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the adjusted treasury rate, plus 35 basis points; or (ii) if redemption occurs on or after 10 August 2062, 100% of the principal amount of such notes, plus accrued interest to the date of redemption. |

| |

|

| Underwriting Discount |

0.75%. |

| |

|

| CUSIP Number |

92857W BZ2 |

| |

|

| ISIN |

US92857WBZ23 |

| |

|

| The following terms apply to each tranche of the Notes: |

| |

| Adjusted Treasury Rate |

“Adjusted treasury rate” means, with respect to any redemption date, the rate per year equal to the semi-annual equivalent yield to maturity of the comparable treasury issue, assuming a price for the comparable treasury issue (expressed as a percentage of its principal amount) equal to the comparable treasury price for such redemption date. |

| |

|

| Comparable Treasury Issue |

“Comparable treasury issue” means the U.S. Treasury security selected by the quotation agent as having a maturity comparable to the remaining term of the Notes to be redeemed that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable maturity to the remaining terms of the Notes. |

| |

|

| Comparable Treasury Price |

“Comparable treasury price” means, with respect to any redemption date, the average of the reference treasury dealer quotations for such redemption date. |

| Quotation Agent |

“Quotation agent” means the reference treasury dealer appointed by us. |

| |

|

| Reference Treasury Dealer |

“Reference treasury dealer” means any primary U.S. government securities dealer in New York City selected by us |

| |

|

| Reference Treasury Dealer Quotations |

“Reference treasury dealer quotations” means with respect to each reference treasury dealer and any redemption date, the average, as determined by the Quotation Agent, of the bid and asked prices for the comparable treasury issue (expressed as a percentage of its principal amount) quoted in writing to the Quotation Agent by such reference treasury dealer at 5:00 p.m. New York City time on the third business day preceding such redemption date. |

| |

|

| Optional Tax Redemption |

We may redeem the Notes before they mature if we are obligated to pay additional amounts due to changes on or after the date of this final term sheet in UK withholding tax requirements, a merger or consolidation with another entity or a sale or lease of substantially all our assets and other limited circumstances described under “Description of Debt Securities We May Offer—Payment of Additional Amounts” in the prospectus. In that event, we may redeem the Notes in whole but not in part on any interest payment date, at a price equal to 100% of their principal amount plus accrued interest to the date fixed for redemption. |

| |

|

| Redemption or Repurchase Following a Change of Control |

If a Change of Control Put Event (as defined in the prospectus) occurs, then the holder of a Note will have the option, as described under ‘‘Additional Mechanics—Redemption or Repurchase Following a Change of Control” in the prospectus, to require Vodafone to redeem or, at Vodafone’s option, purchase (or procure the purchase of) such Note at an optional redemption amount or purchase price equal to 101% of the aggregate principal amount of such Note, plus accrued and unpaid interest on such Note to the date of redemption or repurchase, according to the terms and limitations described under ‘‘Additional Mechanics—Redemption or Repurchase Following a Change of Control’’ in the prospectus. |

| |

|

| Business Days |

New York. |

| |

|

| Ranking |

The Notes will rank equally with all present and future unsecured and unsubordinated indebtedness of Vodafone Group Plc. Because we are a holding company, the Notes will effectively rank junior to any indebtedness or other liabilities of our subsidiaries. |

| |

|

| Regular Record Dates for Interest |

With respect to each interest payment date, the regular record date for interest on global securities in registered form will be the close of business on the Clearing System Business Day prior to the date for payment, where “Clearing System Business Day” means Monday to Friday, inclusive, except December 25 and January 1. The regular record date for interest on debt securities that are represented by physical certificates will be the close of business on the date that is 15 calendar days prior to such date, whether or not such date is a business day. |

| Payment of Additional Amounts |

All payments on the Notes will be made without deducting United Kingdom (“UK”) withholding taxes, except as required by law. If any such deduction is required on payments to non-UK investors, we will pay additional amounts on those payments to the extent described under “Description of Debt Securities We May Offer—Payment of Additional Amounts” in the prospectus. Notwithstanding the foregoing, any amounts to be paid on the Notes by us, or on our behalf, will be paid net of any deduction or withholding imposed or requirement pursuant to an agreement described in Section 1471(b) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), or otherwise imposed pursuant to Sections 1471 through 1474 of the Code (or any regulations thereunder or official interpretations thereof) or an intergovernmental agreement between the United States and another jurisdiction facilitating the implementation thereof (or any fiscal or regulatory legislation, rules or practices implementing such an intergovernmental agreement) (and any such withholding or deduction, a “FATCA Withholding”). Neither we, nor any person, will be required to pay any additional amounts in respect of FATCA Withholding. |

| |

|

| Listing |

We will file an application to list the Notes on the Nasdaq Global Market. We expect that the Notes will be eligible for trading on the Nasdaq Global Market within 30 days after delivery of the Notes. |

| |

|

| Concurrent Tender Offers |

On February 7, 2023, we announced offers to purchase for cash any and all of the 5.250% Notes due May 2048 (the “2048 Notes”), 4.375% Notes due February 2043 (the “2043 Notes”) and 5.000% Notes due May 2038 (the “2038 Notes” and, together with the 2048 Notes and the 2043 Notes, the “Tender Offer Notes”) up to a cap of $2.0 billion aggregate principal amount of the Tender Offer Notes (the “Concurrent Tender Offers”). We expect to purchase Tender Offer Notes validly tendered and not validly withdrawn, subject to the conditions of the Concurrent Tender Offers. The Concurrent Tender Offers are made pursuant to an offer to purchase dated February 7, 2023 (the “Offer to Purchase”), and are conditioned on, amongst other things, the completion of this offering. The offering of the Notes is not contingent on the consummation of the Concurrent Tender Offers or any minimum amount of tenders in the Concurrent Tender Offers. |

| Use of Proceeds (after deducting underwriting discounts but not estimated expenses) |

We intend to use the net proceeds from this offering (i) to fund the purchase of 2048 Notes, of which $3,000,000,000 is outstanding, 2043 Notes, of which $1,400,000,000 is outstanding and 2038 Notes, of which $1,000,000,000 is outstanding, that are validly tendered (and not validly withdrawn), up to a cap of $2.0 billion aggregate principal amount of the Tender Offer Notes, pursuant to the Concurrent Tender Offers and (ii) for general corporate purposes. The Concurrent Tender Offers are being made pursuant to the Offer to Purchase. The foregoing does not constitute an offer to purchase the Tender Offer Notes. |

| |

|

| Risk Factors |

You should carefully consider all of the information in this final term sheet, the prospectus supplement and the prospectus, which includes information incorporated by reference. In particular, you should evaluate the specific factors under “Risk Factors” beginning on page S-3 of the prospectus supplement dated February 7, 2023, “Risk Factors” beginning on page 6 of the prospectus, “Principal risk factors and uncertainties” beginning on page 59 of our Annual Report on Form 20-F for the fiscal year ended March 31, 2022 and “Risk factors” beginning on page 21 of our Half Year Report for the six months ended September 30, 2022 for risks involved with an investment in the Notes. |

| |

|

| Trustee and Principal Paying Agent |

The Bank of New York Mellon. |

| |

|

| Timing and Delivery |

We currently expect delivery of the Notes to occur on or about February 10, 2023. |

| |

|

| Underwriters |

BofA Securities, Inc., Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, SMBC Nikko Securities America, Inc. and TD Securities (USA) LLC. |

| |

|

| Prohibition of Sales to EEA Retail Investors |

Applicable. |

| |

|

| Prohibition of Sales to UK Retail Investors |

Applicable. |

Note:

| (1) | An explanation of the significance of ratings may be obtained from the ratings agencies. Generally, rating agencies base their ratings

on such material and information, and such of their own investigations, studies and assumptions, as they deem appropriate. The rating

of the notes should be evaluated independently from similar ratings of other securities. A credit rating of a security is not a recommendation

to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning

rating agency. |

Vodafone Group Plc is currently rated

Baa2 (stable outlook) / BBB (positive outlook) / BBB (stable outlook) (Moody’s Corporation/Standard & Poor’s Financial

Services LLC/Fitch Ratings Inc.). An explanation of the significance of ratings may be obtained from the rating agencies. Generally, rating

agencies base their ratings on such material and information, and such of their own investigations, studies and assumptions, as they deem

appropriate. The rating of the notes should be evaluated independently from similar ratings of other securities. A credit rating of a

security is not a recommendation to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal

at any time by the assigning rating agency.

Selling Restrictions

Professional clients and ECPs only

/No EEA or UK PRIIPs KID

Manufacturer target market (UK MiFIR/MiFID

II product governance) is eligible counterparties and professional clients only (all distribution channels). No key information document

(KID) required by the EEA PRIIPs Regulation or UK PRIIPs Regulation has been prepared as the Securities will not be made available to

retail investors in the EEA or in the UK.

Notice to Prospective Investors

in the United Kingdom

This communication is only being distributed

only to and is directed only at (i) persons who are outside the United Kingdom or (ii) investment professionals falling within

Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (iii) high

net worth companies, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of

the Order (all such persons together being referred to as “relevant persons”). The Notes are only available to, and any invitation,

offer or agreement to subscribe, purchase or otherwise acquire such Notes will be engaged in only with, relevant persons. Any person who

is not a relevant person should not act or rely on this document or any of its contents.

Notice to Prospective Investors

in Canada

The Notes may be sold only to purchasers

purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106 Prospectus

Exemptions or subsection 73.3(1) of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument 31-103

Registration Requirements, Exemptions and Ongoing Registrant Obligations. Any resale of the Notes must be made in accordance with

an exemption from, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces

or territories of Canada may provide a purchaser with remedies for rescission or damages if this document, the prospectus supplement and

the accompanying prospectus (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission

or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s province

or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province

or territory for particulars of these rights or consult with a legal advisor.

Pursuant to section 3A.3 (or, in the

case of securities issued or guaranteed by the government of a non-Canadian jurisdiction, section 3A.4) of National Instrument 33-105

Underwriting Conflicts (NI 33-105), the underwriters are not required to comply with the disclosure requirements of NI 33-105 regarding

underwriter conflicts of interest in connection with this offering.

Notice to Prospective Investors

in Switzerland

The Notes may not be publicly offered

in Switzerland and will not be listed on the SIX Swiss Exchange (“SIX”) or on any other stock exchange or regulated trading

facility in Switzerland. This document does not constitute a prospectus within the meaning of, and has been prepared without regard to,

the disclosure standards for issuance prospectuses under art. 652a or art. 1156 of the Swiss Code of Obligations or the disclosure standards

for listing prospectuses under art. 27 ff. of the SIX Listing Rules or the listing rules of any other stock exchange or regulated

trading facility in Switzerland. Neither this document nor any other offering or marketing material relating to the Notes or the offering

thereof may be publicly distributed or otherwise made publicly available in Switzerland.

Neither this document nor any other

offering or marketing material relating to us, the Notes or the offering thereof have been or will be filed with or approved by any Swiss

regulatory authority. In particular, this document will not be filed with, and the offer of Notes will not be supervised by, the Swiss

Financial Market Supervisory Authority FINMA (“FNMA”), and the offer of Notes has not been and will not be authorized under

the Swiss Federal Act on Collective Investment Schemes (“CISA”). The investor protection afforded to acquirers of interests

in collective investment schemes under the CISA does not extend to acquirers of the Notes.

Notice to Prospective Investors

in the United Arab Emirates

The Notes have not been, and are not

being, publicly offered, sold, promoted or advertised in the United Arab Emirates (including the Dubai International Financial Centre)

other than in compliance with the laws of the United Arab Emirates (and the Dubai International Financial Centre) governing the issue,

offering and sale of securities. Further, this document, the prospectus supplement and the accompanying prospectus do not constitute a

public offer of securities in the United Arab Emirates (including the Dubai International Financial Centre) and are not intended to be

a public offer. This document, the prospectus supplement and the accompanying prospectus have not been approved by or filed with the Central

Bank of the United Arab Emirates, the Securities and Commodities Authority or the Dubai Financial Services Authority.

Notice to Prospective Investors

in Hong Kong

The Notes may not be offered or sold

by means of any document other than (i) in circumstances which do not constitute an offer to the public within the meaning of the

Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap.32, Laws of Hong Kong), or (ii) to “professional investors”

within the meaning of the Securities and Futures Ordinance (Cap.571, Laws of Hong Kong) and any rules made thereunder, or (iii) in

other circumstances which do not result in the document being a “prospectus” within the meaning of the Companies (Winding

Up and Miscellaneous Provisions) Ordinance (Cap.32, Laws of Hong Kong), and no advertisement, invitation or document relating to the Notes

may be issued or may be in the possession of any person for the purpose of issue (in each case whether in Hong Kong or elsewhere), which

is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so under

the laws of Hong Kong) other than with respect to Notes which are or are intended to be disposed of only to persons outside Hong Kong

or only to “professional investors” within the meaning of the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong)

and any rules made thereunder.

Notice to Prospective Investors

in Japan

The Notes have not been and will not

be registered for a public offering in Japan pursuant to Article 4, Paragraph 1 of the Financial Instruments and Exchange Act of

Japan (Act No. 25 of 1948, as amended; the “FIEA”). The Notes may not be offered or sold, directly or indirectly, in

Japan or to or for the account or benefit of any resident of Japan (which term as used herein means any person resident in Japan, including

any corporation or other entity organized under the laws of Japan or having its principal office in Japan) or to, or for the account or

benefit of, others for reoffering or resale, directly or indirectly, in Japan or to or for the account or benefit of any resident of Japan,

except pursuant to an exemption from the registration requirements of the FIEA and otherwise in compliance with the FIEA and any other

applicable laws, regulations and ministerial guidelines of Japan in effect at the relevant time.

Notice to Prospective Investors

in Singapore

This document, the prospectus supplement

and the accompanying prospectus have not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, the prospectus

supplement, the accompanying prospectus, any free writing prospectus and any other document or material in connection with the offer or

sale, or invitation for subscription or purchase, of the Notes may not be circulated or distributed, nor may the Notes be offered or sold,

or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to any person in Singapore other

than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act, 2001 of Singapore (the “SFA”))

pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to

Section 275(1) of the SFA, or any person pursuant to Section 275(1A), and in accordance with the conditions specified in

Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision

of the SFA.

Where the Notes are subscribed or purchased

under Section 275 of the SFA by a relevant person which is: (a) a corporation (which is not an accredited investor (as defined

in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one

or more individuals, each of whom is an accredited investor; or (b) a trust (where the trustee is not an accredited investor) whose

sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based

derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights

and interest (howsoever described) in that trust shall not be transferred within 6 months after that corporation or that trust has acquired

the Notes pursuant to an offer made under Section 275 of the SFA except: (1) to an institutional investor or to a relevant person,

or any person arising from an offer referred to in Section 275(1A) or Section 276(4)(i)(B) of the SFA; (2) where no

consideration is or will be given for the transfer; (3) by operation of law; (4) as specified in Section 276(7) of

the SFA; or (5) as specified in Regulation 37A of the Securities and Futures (Offers of Investments) Securities and Securities-based

Derivatives Contracts Regulations 2018).

Singapore Securities and Futures Act

Product Classification: In connection with Section 309B of the SFA and the CMP Regulations 2018, we have determined, and hereby notifies

all relevant persons (as defined in Section 309A(1) of the SFA), that the Notes are 'prescribed capital markets products' (as

defined in the CMP Regulations 2018) and Excluded Investment Products (as defined in MAS Notice SFA 04-N12: Notice on the Sale of Investment

Products and MAS Notice FAA-N16: Notice on Recommendations on Investment Products).

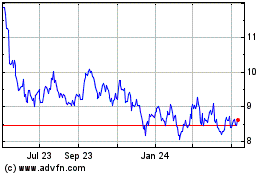

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

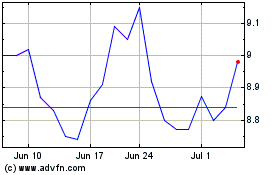

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024