UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

July 29, 2022

Commission File Number 001-37974

VIVOPOWER INTERNATIONAL PLC

(Translation of registrant’s name into English)

The Scalpel, 18th Floor, 52 Lime Street

London EC3M 7AF

United Kingdom

+44-794-116-6696

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20- F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

On July 29, 2022, VivoPower International PLC, a public limited company organized under the laws of England and Wales (the “Company”), entered into a Securities Purchase Agreement (the “Purchase Agreement”) with a certain investor named therein (the “Investor”), pursuant to which the Company agreed to issue and sell, in a registered direct offering by the Company directly to the Investor (the “Registered Offering”), (i) an aggregate of 2,300,000 ordinary shares (the “Shares”), nominal value $0.012 per share, of the Company (“Ordinary Shares”), at an offering price of $1.30 per share and (ii) an aggregate of 1,930,770 pre-funded warrants exercisable for Ordinary Shares (the “Pre-Funded Warrants”) at an offering price of $1.2999 per Pre-Funded Warrant, for gross proceeds of approximately $5.5 million before deducting the placement agent fee and related offering expenses.

The Pre-Funded Warrants were sold to the Investor whose purchase of Ordinary Shares in the Registered Offering would otherwise result in the Investor, together with its affiliates and certain related parties, beneficially owning more than 4.99% of the Company’s outstanding Ordinary Shares immediately following the consummation of the Registered Offering, in lieu of Ordinary Shares. Each Pre-Funded Warrant represents the right to purchase one Ordinary Share at an exercise price of $0.0001 per share. The Pre-Funded Warrants are exercisable immediately and may be exercised at any time until the Pre-Funded Warrants are exercised in full.

The Purchase Agreement contains customary representations and warranties and agreements of the Company and the Investor and customary indemnification rights and obligations of the parties. Pursuant to the terms of the Purchase Agreement, the Company has agreed to certain restrictions on the issuance and sale of its Ordinary Shares or Ordinary Shares Equivalents (as defined in the Purchase Agreement) during the 90-day period following the closing of the Registered Offering.

The Shares and Pre-Funded Warrants were offered by the Company pursuant to a registration statement on Form F-3 (File No. 333-251304) (the “Registration Statement”), previously filed and declared effective by the Securities and Exchange Commission (the “Commission”) on December 23, 2020, the base prospectus filed as part of the Registration Statement, and the prospectus supplement dated July 29, 2022 (the “Prospectus Supplement”).

In a concurrent private placement (the “Private Placement” and together with the Registered Offering, the “Offerings”), the Company agreed to issue to the Investor who participated in the Registered Offering series A warrants (the “Series A Warrants” and collectively with the Shares and the Pre-Funded Warrants, the “Securities”) exercisable for an aggregate of 4,230,770 Ordinary Shares at an exercise price of $1.30 per share. Each Series A Warrant will be immediately exercisable and will expire five and one-half years from the issuance date. The Series A Warrants and the Ordinary Shares issuable upon the exercise of the Series A Warrants are not being registered under the Securities Act of 1933, as amended (the “Securities Act”), were not offered pursuant to the Registration Statement and Prospectus Supplement and were offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act, and Rule 506(b) promulgated thereunder.

A holder (together with its affiliates) may not exercise any portion of the Pre-Funded Warrant or Series A Warrant to the extent that the holder would own more than 4.99% (or, at the purchaser’s option upon issuance, 9.99%) of the Company’s outstanding Ordinary Shares immediately after exercise. However, upon at least 61 days’ prior notice from the holder to the Company, a holder with a 4.99% ownership blocker may increase the amount of ownership of outstanding Ordinary Shares after exercising the holder’s Pre-Funded Warrant or Series A Warrant up to 9.99% of the number of the Company’s Ordinary Shares outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrant or Series A Warrant.

Pursuant to the terms of the Purchase Agreement, the Company agreed to use commercially reasonable efforts to cause a registration statement on Form F-1 providing for the resale by holders of its Ordinary Shares issuable upon the exercise of the Series A Warrants, to become effective 180 days following the closing of the Registered Offering and to keep such registration statement effective at all times.

The Offerings closed on August 2, 2022.

On July 29, 2022, the Company entered into a placement agency agreement (the “Placement Agency Agreement”) with A.G.P./Alliance Global Partners (“A.G.P.” or the “Placement Agent”) pursuant to which the Company engaged A.G.P. as the exclusive placement agent in connection with the Offerings. The Placement Agent agreed to use its reasonable best efforts to arrange for the sale of the Securities. The Company agreed to pay the Placement Agent a placement agent fee in cash equal to 7.0% of the gross proceeds from the sale of the Shares and Pre-Funded Warrants. In addition, the Company agreed to reimburse A.G.P. for all reasonable and documented travel and other out-of-pocket expenses, including the reasonable fees of legal counsel not to exceed $50,000. The Placement Agency Agreement also contains representations, warranties, indemnification and other provisions customary for transactions of this nature.

The foregoing summaries of the Placement Agency Agreement, the Purchase Agreement, the Series A Warrants and the Pre-Funded Warrants do not purport to be complete and are subject to, and qualified in their entirety by, such documents attached as Exhibits 1.1, 10.1, 4.1 and 4.2, respectively, to this Report on Form 6-K, which are incorporated herein by reference.

This Report on Form 6-K does not constitute an offer to sell any securities or a solicitation of an offer to buy any securities, nor shall there be any sale of any securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

A copy of the opinion of Shoosmiths LLP relating to the legality of the issuance and sale of the Shares and Pre-Funded Warrants is attached as Exhibit 5.1 hereto.

The information contained in this Report on Form 6-K is hereby incorporated by reference into the Company's registration statement on Form F-3 (File No. 333-251304) that was filed with the Commission and became effective on December 23, 2020.

EXHIBIT INDEX

Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: August 2, 2022

|

|

| |

VivoPower International PLC

/s/ Kevin Chin

Kevin Chin

Executive Chairman

|

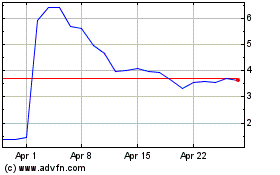

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

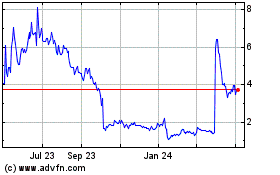

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Apr 2023 to Apr 2024