Pursuant to this prospectus supplement and the accompanying prospectus, we are offering 2,300,000 of our ordinary shares, nominal value $0.012 per share (“Ordinary Shares”) and pre-funded warrants to purchase up to an aggregate of 1,930,770 Ordinary Shares (“Pre-Funded Warrants”). In a concurrent private placement, we are also selling to purchasers of our Ordinary Shares and Pre-Funded Warrants in this offering, Series A warrants to purchase 4,230,770 Ordinary Shares (the “Series A Warrants”). The Series A Warrants will be exercisable commencing on the six month anniversary of the date of issuance and will expire five and one-half years from the date of issuance. The Series A Warrants and the Ordinary Shares issuable upon the exercise of the Series A Warrants are not being registered under the Securities Act of 1933, as amended (the “Securities Act”), are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder.

We are also offering Pre-Funded Warrants in lieu of Ordinary Shares to certain purchasers whose purchase of Ordinary Shares in this offering would otherwise result in the purchaser, together with its affiliates, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our Ordinary Shares. Each Pre-Funded Warrant will be sold in this offering at a purchase price equal to $1.2999 (equal to the purchase price per Ordinary Share, minus $0.0001). The per share exercise price for the Pre-Funded Warrants will be $0.0001, and the Pre-Funded Warrants are immediately exercisable and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. This offering also relates to the Ordinary Shares issuable upon exercise of the Pre-Funded Warrants sold in this offering.

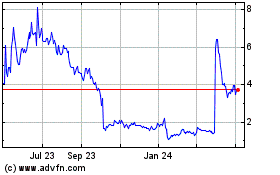

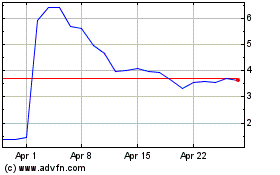

Our Ordinary Shares are listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “VVPR.” There is no established trading market for the Pre-Funded Warrants, and we do not expect a market to develop. We do not intend to apply for a listing for any such Pre-Funded Warrants on any securities exchange or other nationally recognized trading system. The last sale price of our Ordinary Shares on July 28, 2022 was $1.38 per share.

You should read this prospectus supplement and the accompanying prospectus and the documents incorporated by reference in this prospectus supplement carefully before you invest.

As of the date of this prospectus supplement, the aggregate market value of our outstanding Ordinary Shares held by non-affiliates, or public float, was determined to be approximately $20,419,219 based on 21,369,763 Ordinary Shares outstanding, of which 9,115,723 are held by non-affiliates, and the closing sale price of our Ordinary Shares on Nasdaq of $2.24 on June 8, 2022, which is within 60 days of the date of this prospectus supplement. Upon any sale of Ordinary Shares under this prospectus supplement pursuant to General Instruction I.B.5 of Form F-3, in no event will the aggregate market value of securities sold by us or on our behalf pursuant to General Instruction I.B.5 of Form F-3 during the twelve calendar month period immediately prior to, and including, the date of any such sale exceed one-third of the aggregate market value of our Ordinary Shares held by non-affiliates, calculated in accordance with General Instruction I.B.5 of Form F-3. During the prior 12 calendar month period that ends on, and includes, the date of this prospectus supplement (excluding this offering), we have sold approximately $251,044 of our securities pursuant to General Instruction I.B.5 of Form F-3.

We have retained A.G.P./Alliance Global Partners to act as our exclusive placement agent in connection with this offering. The placement agent has agreed to use its reasonable best efforts to place the securities offered by this prospectus supplement. We have agreed to pay the placement agent the fee set forth in the table below.

Delivery of our Ordinary Shares and Pre-Funded Warrants being offered pursuant to this prospectus supplement and the accompanying prospectus is expected to be made on or about August 2, 2022.

NOTE ON FORWARD-LOOKING STATEMENTS

The statements contained in this prospectus supplement and accompanying prospectus and the documents incorporated by reference herein include forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act that relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Words such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “targets,” “likely,” “will,” “would,” “could,” “should,” “continue,” and similar expressions or phrases, or the negative of those expressions or phrases, are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus supplement and incorporated by reference in the accompanying prospectus, we caution you that these statements are based on our projections of the future that are subject to known and unknown risks and uncertainties and other factors that may cause our actual results, level of activity, performance or achievements expressed or implied by these forward-looking statements, to differ. The sections in our periodic reports, including our Annual Report on Form 20-F for the fiscal year ended June 30, 2021, titled “Business,” “Risk Factors,” and “Operating and Financial Review and Prospects,” and any subsequently filed Reports on Form 6-K as well as other sections in this prospectus supplement and accompanying prospectus and the documents or reports incorporated by reference in the accompanying prospectus, discuss some of the factors that could contribute to these differences. These forward-looking statements include, among other things, statements about:

| |

●

|

our expectations regarding our revenue, expenses and other results of operations;

|

| |

●

|

our plans to acquire, invest in, develop or sell our investments in energy projects or joint ventures, including in the electric vehicle sector;

|

| |

●

|

our ability to attract and retain customers;

|

| |

●

|

the growth rates of the markets in which we compete;

|

| |

●

|

our liquidity and working capital requirements;

|

| |

●

|

our ability to raise sufficient capital to realize development opportunities and thereby generate revenue;

|

| |

●

|

our anticipated strategies for growth;

|

| |

●

|

our ability to anticipate market needs and develop new and enhanced solutions to meet those needs;

|

| |

●

|

anticipated trends and challenges in our business and in the markets in which we operate;

|

| |

●

|

our expectations regarding demand for solar power by energy users or investor in projects;

|

| |

●

|

our expectations regarding changes in the cost of developing and constructing solar projects;

|

| |

●

|

our ability to compete in our industry and innovation by our competitors;

|

| |

●

|

the extent to which the COVID-19 pandemic affects our business, financial condition and results of operations;

|

| |

●

|

our expectations regarding our ongoing legal proceedings;

|

| |

●

|

our ability to adequately protect our intellectual property; and

|

| |

●

|

our plans to pursue strategic acquisitions.

|

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important cautionary statements in this prospectus supplement, the accompanying prospectus or in the documents incorporated by reference in the accompanying prospectus, particularly in the “Risk Factors” section, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. For a summary of such factors, please refer to the section titled “Risk Factors” in this prospectus supplement, the accompanying prospectus, as updated and supplemented by the discussion of risks and uncertainties under “Risk Factors” contained in our most recent Annual Report on Form 20-F, as revised or supplemented by our subsequent periodic reports filed under the Exchange Act, as well as any amendments thereto, and any subsequently filed Reports on Form 6-K, as filed with the SEC and which are incorporated by reference. The information contained in this document is believed to be current as of the date of this document. We do not intend to update any of the forward-looking statements after the date of this document to conform these statements to actual results or to changes in our expectations, except as required by law.

In light of these assumptions, risks and uncertainties, the results and events discussed in the forward-looking statements contained in this prospectus supplement or in any document incorporated herein by reference might not occur. Investors are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this prospectus supplement or the date of the document incorporated by reference. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. All subsequent forward-looking statements attributable to us or to any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section.

PROSPECTUS SUPPLEMENT SUMMARY

This summary contains basic information about us and our business but does not contain all of the information that is important to your investment decision. Before making an investment decision, you should carefully read this summary together with the more detailed information contained elsewhere in this prospectus supplement and the accompanying prospectus and the documents incorporated herein and therein by reference, including our Annual Report on Form 20-F for the fiscal year ended June 30, 2021 (the “Annual Report”) and any subsequently filed Reports on Form 6-K. Investors should carefully consider the information set forth under the caption “Risk Factors” appearing elsewhere in this prospectus supplement, including those described in documents incorporated by reference herein.

Overview

VivoPower is an international sustainable energy solutions company whose core purpose is to provide its customers with turnkey decarbonization solutions that enable them to achieve net zero carbon status. It does this by delivering an enterprise solution encompassing electric vehicles, critical power services, battery and microgrid technology as well as solar. The Company is focused on battery storage, electric solutions for customized and ruggedized fleet applications, solar and critical power technology and services. Headquartered in London, VivoPower is a certified B Corporation and has operations in Australia, Canada, the Netherlands, the United States of America (“U.S.”), the United Kingdom (“U.K.”), and the United Arab Emirates.

Management analyzes our business in five reportable segments:

| |

●

|

Electric Vehicles (“EV”);

|

| |

●

|

Sustainable Energy Solutions (“SES”);

|

| |

●

|

Critical Power Services;

|

Critical Power Services is represented by VivoPower’s wholly owned subsidiary Aevitas O Holdings Pty Limited (“Aevitas”). In turn, Aevitas wholly owns Kenshaw Solar Pty Limited (“Kenshaw Solar”) and Kenshaw Electrical Pty Limited (“Kenshaw”). These companies operate in Australia with a focus on the design, supply, installation and maintenance of critical power, control and distribution systems, including for solar farms. EV is represented by Tembo e-LV B.V. and subsidiaries, Tembo 4x4 B.V. and FD 4x4 B.V. (“Tembo”), a Netherlands-based specialist battery-electric and off-road vehicle company delivering EVs for mining and other rugged industrial customers globally. SES is the design, evaluation, sale and implementation of renewable energy infrastructure to customers, both on a standalone basis and in support of Tembo EVs. Solar Development is represented by Caret, LLC (“Caret”), formerly Innovative Solar Ventures I, LLC, and comprises 12 solar projects in the United States. Corporate Office is the Company’s corporate functions, including costs to maintain the Nasdaq public company listing, comply with applicable SEC reporting requirements, and related investor relations and is located in the U.K.

Electric Vehicles

Tembo is a specialist battery-electric and off-road vehicle company that designs and builds ruggedized light electric vehicle solutions for customers across the globe in the mining, infrastructure, utilities, and government services sectors.

VivoPower acquired 51% of Tembo on November 5, 2020 for €4.0 million. On February 2, 2021, the Company completed the acquisition of the remaining 49% of Tembo, for a consideration of $2.2 million and 15,793 shares in the Company.

In parallel to recent development activities, a network of preferred suppliers has been set up. These have been selected based on quality, safety and durability, amongst other criteria. Consideration has also been given to cost, delivery, service as well as other requirements that are dictated within the automotive industry, and to align with VivoPower’s sustainability goals and principles. Furthermore, Tembo has been focusing on enhancing its quality standards and credentials, by obtaining, for example, the ISO 9001:2015 Quality Management Systems accreditation. An initiative remains underway to obtain a number of other quality standards, including, but not limited to ISO 14001:2015. In addition, the VivoPower board and leadership team have worked closely with the Tembo management team to further reinforce a culture of safety as well as to identify and implement industry best practice health and safety standards.

Tembo is focused on a number of objectives in the coming year, including securing additional distribution agreements globally, completing the development and commencement of full scale production of the 72kWh Toyota Landcruiser electric conversion kit, expanding its assembly and production capabilities in the Netherlands (including potentially moving to new purpose built facilities) as well as in other markets, and advancing research and development into the next generation of electric conversion kits and batteries.

Sustainable Energy Solutions

In August 2020, VivoPower announced a strategic pivot to enter the EV sector, due to interest from the Company’s existing customer base, with an initial focus on the mining, infrastructure and utilities sectors. At the same time, VivoPower also announced that it would undertake a strategic pivot to an SES strategy, where its core mission is to help corporate customers achieve their decarbonization goals.

The key differentiator of VivoPower’s strategy is that the Company intends to focus on delivering a holistic, SES to customers that comprise the following 3 key elements:

| |

●

|

EV and battery leasing;

|

| |

●

|

critical power “electric-retrofit” of customer’s sites (e.g., warehouses and depots) to enable optimized EV battery charging and encompassing renewable power generation (including solar), battery storage and microgrids; and

|

| |

●

|

EV battery reuse and recycling (including potential second life applications as an element of critical power requirements on a customer’s site)

|

In Australia, the SES business draws on the experience and capabilities of VivoPower’s Critical Power Services businesses (Kenshaw Solar and Kenshaw) to deliver solutions to customers, whilst in other markets, it intends to partner with experienced local critical power services companies.

In June 2021, VivoPower announced that it successfully completed its first full suite SES feasibility study with English Premier League Football Club Tottenham Hotspur F.C. (“THFC”) evaluating solar, battery and microgrid solutions for THFC’s stadium and training ground in the United Kingdom. VivoPower and THFC are now discussing the potential of moving forward with the implementation of one or more SES projects.

Given that the SES business segment was only newly established during the past financial year, it has generated immaterial revenues and has not incurred any significant costs. VivoPower expects there to be significant growth going forward, which will also necessitate investment in people and technology. VivoPower is actively working to originate new SES projects for both new and existing (through Kenshaw Solar and Kenshaw) customers of the VivoPower group of companies, with significant projects already proposed to major Australian mining companies.

Critical Power Services

Through a holding entity called Aevitas which was formed in 2013 and acquired by VivoPower in December 2016, VivoPower has two wholly-owned Australian subsidiaries, Kenshaw Solar and Kenshaw, VivoPower provides critical energy infrastructure generation and distribution solutions including the design, supply, installation and maintenance of power and control systems. The businesses are trusted power advisers to over 500 active government, commercial and industrial customers. Headquartered at Newcastle, in the Hunter Valley region of New South Wales, Kenshaw Solar and Kenshaw, are well situated to capitalize on a strong operating environment driven by growth in public and private sector investment in infrastructure, renewable energy, mining and healthcare.

With a gross regional product of more than A$50 billion, the Hunter Valley region is Australia’s leading regional economy. It has a multi-faceted economy and a skilled workforce, with traditional strengths in mining and advanced manufacturing complemented by fast-growing service, knowledge, and renewables sectors.

The Critical Power Services businesses have several core competencies, encompassing a range of electrical, mechanical, and renewable energy solutions. In addition, the businesses are preparing to be responsible for delivering electrical services and infrastructure to support VivoPower’s EV and SES offerings, including on-site renewable generation, batteries and microgrids, EV charging stations, and emergency backup power solutions.

Kenshaw Solar Pty Limited

Over the past 3 years, Kenshaw Solar has developed a strong reputation and position in the Australian solar EPC market, focusing on small and medium sized solar projects. During the financial year, Kenshaw Solar completed the provision of electrical installation and services for the 119MWdc Hillston Solar Farm, and is continuing work on two further solar projects, bringing its total of contracted or completed solar project work to 665MWdc.

As a result of strong growth in the Australian solar generation market, Kenshaw Solar’s growth is expected to continue with the New South Wales Government’s Electricity Strategy and Electricity Infrastructure Roadmap setting out a plan to deliver Renewable Energy Zones (“REZs”) in five regions across New South Wales, including the Hunter Valley-Central Coast region where Kenshaw Solar is headquartered. By connecting multiple renewable energy generators and ancillary storage in the same location, REZs capitalize on economies of scale and will play a vital role in delivering affordable, reliable, and clean energy generation to help replace the state’s existing power stations as they close over the coming decades.

Kenshaw Electrical Pty Limited

Kenshaw is a specialized provider of critical electrical power, critical mechanical power and non-destructive testing services that has been headquartered in the Newcastle and Hunter Valley region of New South Wales for almost 40 years since its founding in 1981. Operating from three premises across New South Wales and the Australian Capital Territory, Kenshaw’s head office is in Newcastle, with additional branches in Canberra and most recently, Sydney. The business’s success has been built on the capability of its highly skilled personnel to be able to provide a wide range of critical power generation solutions, products and services across the entire life cycle for electric motors, power generators, mechanical equipment and non-destructive testing. In addition, by partnering with several leading uninterruptible power supply (“UPS”) providers, the business is able to offer fully integrated UPS design, sales and installation.

With ISO9001 (Quality Management) certification evidence of its commitment to quality, Kenshaw is able to provide regular and responsive service on a contracted and ad-hoc basis to a loyal client base of over 500 local, national and multinational clients ranging from data centers, hospitals, mining and agriculture to aged care, transport and utility services.

Kenshaw’s core competencies include: generator design, turn-key sales and installation; generator servicing and emergency breakdown services; customized motor modifications; wheel cartridge motor electric repair and refurbishment; and non-destructive testing services including asset management of critical plant and equipment using diagnostic testing such as motor testing, oil analysis, thermal imaging and vibration analysis; and industrial electrical services.

The growing data center sector also continues to be a key market for Kenshaw. According to TeleGeography, COVID-19 pandemic-led demand for video conferencing, online schooling, entertainment, social networking and platforms to support remote working led to a 47% increase in global internet traffic in 2020, above initial forecasts of 28%. This translated to a spike in requirements for data storage, computing and networking.

VivoPower believes Kenshaw is benefiting from the growth in the data center market through its long-term relationship with one of Australia’s leading data center companies and newly established relationships with other data center providers. In addition, with a growing base of completed installation projects, the business is actively targeting the provision of contracted ongoing management of these power generator assets, through its Generator Service and Non-Destructive Testing divisions. The well-established Canberra branch and new Sydney branch, form an integral part of this offering by allowing for locally stored equipment and personnel with an aim for Kenshaw to become entrenched at its clients’ sites for the entire lifecycle of the assets.

In addition to the data center sector, the health and aged care sectors continue to be a key market for Kenshaw. An increase in regulatory requirements and the ageing of the population are driving growth in both sectors, with Australia currently in the middle of a significant demographic transition, as people in the baby boomer generation reach 65.

Kenshaw benefits from these demographic tailwinds through serving longstanding customers such as Health Infrastructure New South Wales, Public Works Advisory, Hunter New England Health, Anglican Care and Ramsay Health, for which it delivers customized critical back up power solutions and services as well as generator maintenance and thermal imaging services. These services utilize Kenshaw’s custom developed Generator Service App which results in more accurate reporting of servicing and detailed condition reporting.

Kenshaw’s traditional customer base includes companies that operate in or service the mining sector, which is Australia’s largest industry as measured by contribution to gross domestic product. Over the past 12 months, the mining sector in Australia has performed strongly and has continued to do so notwithstanding the effects of the global COVID-19 pandemic. Given its experience in the sector, Kenshaw is well positioned to benefit from future growth in the mining industry in Australia.

Relationships with its primary suppliers enables Kenshaw to sell and service their equipment as a dealer or agent. The business is a primary supplier and service agent for Cummins, Deutz and CAT generators, and WEG electric motors, and maintains long term relationships with other equipment manufacturers such as Siemens, Toshiba and Teco. This allows Kenshaw to offer a complete solution to its clients with flexibility of product choice.

For the year ended June 30, 2021, 19% (year ended June 30, 2020: 69%; three months ended June 30, 2019: 76%) of Kenshaw’s revenue was earned from one customer. While this customer has been less active in FY2021, it is still expected to continue to provide significant revenue in future years. However, with almost 500 active customers for the year ended June 30, 2021, the business is not solely reliant on this customer, nor is the business reliant on any one patent, license, material contract, or process. Further, there are no government regulations which are material to the business, beyond those generally applicable to all businesses within the same statutory regime.

Solar Development

As a consequence of the Company’s strategic pivot to an SES strategy, VivoPower no longer intends to engage in solar project development activities in isolation, unless if it’s a component of a sustainable energy solution for a corporate customer that it is helping to achieve decarbonization goals. This segment has historically been characterized as the Solar Development segment and encompassed the Company’s solar development activities in the U.S. and Australia.

VivoPower’s historic strategy in relation to solar development has been to minimize capital intensity and maximize return on invested capital by pursuing a business model predicated on developing and selling projects prior to construction and continually recycling capital rather than owning assets. The stages of solar development can be broadly characterized as: (i) early stage; (ii) mid-stage; (iii) advanced stage; (iv) construction; and (v) operation. Our business model is to work through the development process from early stage through to advanced stage, and then sell those projects that have completed the advanced stage of development, also known as “shovel-ready” projects, to investors who will finance construction and ultimately own and operate the project.

Successful solar development requires an experienced team that can manage multiple work streams on a parallel path, from initially identifying attractive locations, to land control, permitting, interconnection, power marketing, and project sale to investors. Rather than build a substantial team internally to accomplish all of these activities, our business model has been to joint venture on a non-exclusive basis with existing experienced project development teams so that multiple projects can be advanced simultaneously and allow us to focus on provision of capital, project management, and marketing and sale of projects. In Australia we partnered with ITP Renewables (“ITP”), a global leader in renewable energy engineering, strategy and construction, and energy sector analytics. In the U.S., we entered into a development joint venture with Innovative Solar Systems, LLC (“ISS”). VivoPower assumed management control of this U.S. solar development joint venture in June 2020, having spent the prior 12 months initially focused on monetizing the projects in the portfolio, on an individual, group or whole of portfolio basis. VivoPower and its joint venture partner, ISS, were unable to align on monetization in relation to any of the projects. VivoPower subsequently engaged in a detailed review of the joint venture partner’s performance as a developer relative to the contractual agreement and decided to exercise its rights to assume management control of the joint venture. This was announced in June 2020. Subsequently, in June 2021 VivoPower announced that it had secured a settlement resulting in the Company gaining full ownership of the remaining 50% of the equity interest in the portfolio from ISS for nominal consideration of US $1.

Recent Developments

Sale of Australian Non-Core Business Units

On June 29, 2022, we announced the sale of our two non-core business units in Australia, J.A. Martin Electrical (“JAM Electrical”) and NDT Services (“NDT”), to ARA Group Limited (“ARA”), a leading diversified industrial services group based in Australia. This is as part of its strategic reorganization, in line with VivoPower’s strategy to focus on its core, fast-growth electric vehicle, and renewable critical power and sustainable solutions businesses. ARA is a leading diversified industrial services group based in Australia. VivoPower is retaining the fast-growing J.A. Martin Solar (“JAM Solar”) business, which will become a new division of its existing Australian business arm, Kenshaw (part of the wholly owned Aevitas group in Australia). The sale was completed and settled on July 1, 2022. VivoPower will receive upfront consideration as well as an earnout based on FY2023 EBITDA results for the businesses (including the value of synergies) which could total up to A$10m (subject to actual FY2023 EBITDA results).

Corporate Information

VivoPower International PLC, a public limited company incorporated under the laws of England, was formed on February 1, 2016. Our registered and principal executive offices are located at The Scalpel, 18th Floor, 52 Lime Street, London, U.K. Our general telephone number is +44-794-116-6696 and our internet address is http://www.vivopower.com. Our website and the information contained on or accessible through our website are not part of this prospectus supplement, and our website address is included in this document as an inactive textual reference only. Our agent for service of process in the U.S. is Corporation Service Company, 251 Little Falls Drive Wilmington, DE 19808.

VivoPower, the VivoPower logo and other trademarks or service marks of VivoPower International PLC appearing in this prospectus supplement are the property of VivoPower International PLC. Trade names, trademarks and service marks of other companies appearing in this prospectus supplement are the property of their respective owners. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus supplement are without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, service marks and trade names.

Emerging Growth Company

We are an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”). As an emerging growth company, we are eligible, and have elected, to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies. These include, but are not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 and reduced disclosure obligations regarding executive compensation (to the extent applicable to a foreign private issuer).

We could remain an emerging growth company until the last day of our fiscal year following the fifth anniversary of the consummation of our initial public offering. However, if our annual gross revenue is US $1.07 billion or more, or our non-convertible debt issued within a three year period exceeds US $1 billion, or the market value of our Ordinary Shares that are held by non-affiliates exceeds US $700 million on the last day of the second fiscal quarter of any given fiscal year, we would cease to be an emerging growth company as of the last day of that fiscal year.

Foreign Private Issuer

We are a “foreign private issuer” as defined under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a foreign private issuer under the Exchange Act, we are exempt from certain rules under the Exchange Act, including the proxy rules, which impose certain disclosure and procedural requirements for proxy solicitations. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic U.S. companies with securities registered under the Exchange Act, and we are not required to comply with Regulation FD, which imposes certain restrictions on the selective disclosure of material information. In addition, our officers, directors, and principal shareholders will be exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and sales of our Ordinary Shares.

The Nasdaq Listing Rules allow foreign private issuers, such as us, to follow home country corporate governance practices (in our case the U.K.) in lieu of the otherwise applicable Nasdaq corporate governance requirements, subject to certain exceptions and except to the extent that such exemptions would be contrary to U.S. federal securities laws. We currently do not intend to take advantage of any such exemptions.

Risks Affecting Our Company

In evaluating an investment in our securities, you should carefully read this prospectus supplement and especially consider the factors incorporated by reference in the sections titled “Risk Factors” commencing on page S-9 of this prospectus supplement and in our accompanying prospectus and the Annual Report incorporated by reference herein.

THE OFFERING

|

Issuer

|

VivoPower International PLC

|

| |

|

|

Ordinary Shares Offered

|

2,300,000 Ordinary Shares.

|

| |

|

| Pre-Funded Warrants Offered |

We are also offering Pre-Funded Warrants to purchase 1,930,770 Ordinary Shares to certain purchasers whose purchase of Ordinary Shares in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Ordinary Shares immediately following the consummation of this offering, in lieu of Ordinary Shares that would otherwise result in each such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Ordinary Shares. Each Pre-Funded Warrant is exercisable for one Ordinary Share. The purchase price of each Pre-Funded Warrant is equal to the price at which the Ordinary Shares are being sold to the public in this offering, minus $0.0001, and the exercise price of each Pre-Funded Warrant is $0.0001 per share. The Pre-Funded Warrants are exercisable immediately and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. This offering also relates to the Ordinary Shares issuable upon exercise of the Pre-Funded Warrants sold in this offering. |

| |

|

| Ordinary Shares to Be Outstanding Immediately Following This Offering |

23,669,763 Ordinary Shares (assuming no exercise of the Pre-Funded Warrants). |

| |

|

|

Use of Proceeds

|

We expect to receive net proceeds of approximately $5.0 million from this offering, excluding any proceeds that may be received upon the exercise of the Pre-Funded Warrants, after deducting the placement agent fees and estimated offering expenses payable by us. We intend to use the net proceeds from this offering to fund the expansion of our operations in the commercial electric vehicle segment and for working capital and other general purposes, including, but not limited to, working capital, capital expenditures, investments, acquisitions, should we choose to pursue any, and collaborations. See the section titled “Use of Proceeds” on page S-12. |

| |

|

|

Risk Factors

|

See the sections titled “Risk Factors” commencing on page S-9 of this prospectus supplement and in our accompanying prospectus and the Annual Report incorporated by reference herein for a discussion of factors you should consider carefully before deciding to invest in our securities.

|

| |

|

|

Listing

|

Our Ordinary Shares are listed on The Nasdaq Capital Market under the symbol “VVPR.” There is no established public trading market for the Pre-Funded Warrants, and we do not expect a market to develop. We do not intend to list the Pre-Funded Warrants on any securities exchange or nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited. |

| |

|

|

Transfer Agent

|

Computershare Trust Company, N.A. is the registrar and transfer agent of our Ordinary Shares.

|

| |

|

|

Concurrent private placement

|

In a concurrent private placement, we are also selling to purchasers of Ordinary Shares and Pre-Funded Warrants in this offering, Series A Warrants to purchase 4,230,770 Ordinary Shares. The Series A Warrants will be exercisable commencing on the six month anniversary of the date of issuance at an exercise price of $1.30 per share and will expire five and one-half years from the date of issuance. The Series A Warrants and the Ordinary Shares issuable upon the exercise of the Series A Warrants, are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder. See the section titled “Private Placement Transaction.” Pursuant to the securities purchase agreement, dated July 29, 2022, by and among the Company and the investor signatories thereto, we will use commercially reasonable efforts to cause a registration statement on Form F-1 providing for the resale by holders of shares of our Ordinary Shares issuable upon the exercise of the Series A Warrants, to become effective 180 days following the closing of this offering and to keep such registration statement effective at all times. |

The number of our Ordinary Shares to be outstanding after this offering is based on 20,908,800 of our Ordinary Shares outstanding as of December 31, 2021, and excludes the following:

| |

●

|

399,178 Ordinary Shares issued upon exercise of outstanding options at a weighted average exercise price of $nil per share or upon the settlement of outstanding restricted stock units, performance stock units or bonus stock awards under our equity plans as of July 29, 2022;

|

| |

●

|

252,954 Ordinary Shares issuable upon exercise of outstanding options at a weighted average exercise price of $nil per share or upon the settlement of outstanding restricted stock units, performance stock units or bonus stock awards under our equity plans as of July 29, 2022;

|

| |

●

|

A maximum of 196,213 Ordinary Shares authorized for issuance pursuant to future awards under our equity incentive plans;

|

| |

●

|

47,786 Ordinary Shares issued after December 31, 2021, pursuant to the Equity Distribution Agreement entered into by us and A.G.P./Alliance Global Partners on November 12, 2021; and

|

| |

●

|

14,000 Ordinary Shares issued to corporate advisors between January 1, 2022 and July 29, 2022.

|

Unless otherwise indicated, this prospectus supplement assumes no exercise of the Pre-Funded Warrants and the Series A Warrants issued in the concurrent private placement.

RISK FACTORS

An investment in our securities involves a high degree of risk. Before investing in our Ordinary Shares, you should carefully consider the risk factors set forth below and those described under “Risk Factors” in the documents incorporated by reference herein, including in our most recent Annual Report on Form 20-F filed with the SEC, together with the other information included in this prospectus supplement and incorporated by reference herein from our filings with the SEC. If any of such risks or uncertainties occurs, our business, financial condition, and operating results could be materially and adversely affected. Additional risks and uncertainties not currently known to us or that we currently deem immaterial also may materially and adversely affect our business operations. As a result, the trading price of our Ordinary Shares could decline and you could lose all or a part of your investment.

Risks Relating to Our Business

We will need to raise additional funding to execute our strategy to operate and grow our business. This additional financing may not be available on acceptable terms, or at all. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate our business mission and development efforts or other operations.

Our operations are capital intensive requiring significant investment in operational expenditures and capital expenditures to realize the growth potential of our electric vehicle, critical power services, sustainable energy solutions and solar development businesses. In addition, we are subject to substantial and ongoing administrative and related expenses required to operate and grow a public company. Furthermore, our operating plans may change as a result of many factors that may currently be unknown to us, and we may need to seek additional funds sooner than planned. Together these items impose substantial requirements on our cash flow. As a result, we expect to require some combination of additional financing options in order to execute our strategy and meet the operating cash flow requirements necessary to operate and grow our business. We may not be able to obtain the requisite funding in order to execute our strategic development plans or to meet our cash flow needs. Our inability to obtain funding or engage in strategic transactions could have a material adverse effect on our business, our strategic development plan for future growth, our financial condition, and our results of operations.

We cannot guarantee that future financing will be available in sufficient amounts or on terms acceptable to us, if at all. Moreover, the terms of any future financing may adversely affect the holdings or the rights of our shareholders and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our Ordinary Shares to decline. The incurrence of indebtedness could result in increased fixed payment obligations, and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborative partners or otherwise at an earlier stage than otherwise would be desirable, and we may be required to relinquish rights to some of our technologies or otherwise agree to terms that are unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects. In addition, raising additional capital through the issuance of equity or convertible debt securities would cause dilution to holders of our equity securities, and may affect the rights of then-existing holders of our equity securities. Even if we believe that we have sufficient funds for our current or future operating plans, we may seek additional capital if market conditions are favorable or if we have specific strategic considerations.

Risks Related to this Offering

You will experience immediate and substantial dilution in the net tangible book value per share of the Ordinary Shares you purchase.

Since the price per share of our Ordinary Shares being offered is substantially higher than the net tangible book value per share of our Ordinary Shares, you will suffer immediate and substantial dilution in the net tangible book value of the Ordinary Shares you purchase in this offering. As of December 31, 2021, our net tangible book value was approximately $(14.6) million, or $(0.70) per Ordinary Share. Based on the offering price of $1.30 per Ordinary Share, and our net tangible book value as of December 31, 2021, if you purchase securities in this offering, you will suffer immediate and substantial dilution of $1.71 per share with respect to the net tangible book value of our Ordinary Shares.

If we sell additional Ordinary Shares in future financings, shareholders may experience immediate dilution and, as a result, our share price may decline.

We may from time to time issue additional Ordinary Shares at a discount from the current market price of our Ordinary Shares. As a result, our shareholders would experience immediate dilution upon the purchase of any Ordinary Shares sold at such discount. In addition, as opportunities present themselves, we may enter into financing or similar arrangements in the future, including the issuance of debt securities, preferred stock or Ordinary Shares. If we issue Ordinary Shares or securities convertible or exercisable into Ordinary Shares, our shareholders would experience additional dilution and, as a result, our share price may decline.

We will have broad discretion in using the proceeds of this offering, and we may not effectively spend the proceeds.

We will use the net proceeds of this offering for working capital and general corporate purposes. We have not allocated any specific portion of the net proceeds to any particular purpose, and our management will have the discretion to allocate the proceeds as it determines. We will have significant flexibility and broad discretion in applying the net proceeds of this offering, and we may not apply these proceeds effectively. Our management might not be able to yield a significant return, if any, on any investment of these net proceeds, and you will not have the opportunity to influence our decisions on how to use our net proceeds from this offering.

An active trading market for our Ordinary Shares may not be sustained.

Although our Ordinary Shares are listed on Nasdaq, the market for our Ordinary Shares has demonstrated varying levels of trading activity. Furthermore, the current level of trading may not be sustained in the future. The lack of an active market for our Ordinary Shares may impair investors’ ability to sell their shares at the time they wish to sell them or at a price that they consider reasonable, may reduce the fair market value of their shares and may impair our ability to raise capital to continue to fund operations by selling shares.

Our share price may be subject to substantial volatility, and shareholders may lose all or a substantial part of their investment.

Our Ordinary Shares currently trade on Nasdaq. There is limited public float, and trading volume historically has been low and sporadic. As a result, the market price for our Ordinary Shares may not necessarily be a reliable indicator of our fair market value. The price at which our Ordinary Shares trade may fluctuate as a result of a number of factors, including the number of shares available for sale in the market, quarterly variations in our operating results, actual or anticipated announcements of new releases by us or competitors, the gain or loss of significant customers, changes in the estimates of our operating performance, market conditions in our industry and the economy as a whole.

Our failure to meet the continued listing requirements of Nasdaq could result in a delisting of our Ordinary Shares.

If we fail to satisfy the continued listing requirements of Nasdaq, such as minimum financial and other continued listing requirements and standards, including those regarding minimum shareholders’ equity, minimum share price, and certain corporate governance requirements, Nasdaq may take steps to delist our Ordinary Shares. Such a delisting would likely have a negative effect on the price of our Ordinary Shares and would impair your ability to sell or purchase our Ordinary Shares when you wish to do so. In the event of a delisting, we would expect to take actions to restore our compliance with Nasdaq’s listing requirements, but we can provide no assurance that any such action taken by us would allow our Ordinary Shares to become listed again, stabilize the market price or improve the liquidity of our Ordinary Shares, prevent our Ordinary Shares from dropping below the Nasdaq minimum bid price requirement, or prevent future non-compliance with Nasdaq’s listing requirements.

If our Ordinary Shares become subject to the penny stock rules, it may be more difficult to sell our Ordinary Shares.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or authorized for quotation on certain automated quotation systems, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). The OTC Bulletin Board does not meet such requirements and if the price of our Ordinary Shares is less than $5.00 and our Ordinary Shares are no longer listed on a national securities exchange such as Nasdaq, our Ordinary Shares may be deemed a penny stock. The penny stock rules require a broker-dealer, at least two business days prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver to the customer a standardized risk disclosure document containing specified information and to obtain from the customer a signed and date acknowledgment of receipt of that document. In addition, the penny stock rules require that prior to effecting any transaction in a penny stock not otherwise exempt from those rules, a broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive: (i) the purchaser’s written acknowledgment of the receipt of a risk disclosure statement; (ii) a written agreement to transactions involving penny stocks; and (iii) a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our Ordinary Shares, and therefore shareholders may have difficulty selling their shares.

Risks Related to the Pre-Funded Warrants

We do not intend to apply for any listing of the Pre-Funded Warrants on any exchange or nationally recognized trading system, and we do not expect a market to develop for the Pre-Funded Warrants.

We do not intend to apply for any listing of the Pre-Funded Warrants on Nasdaq or any other securities exchange or nationally recognized trading system, and we do not expect a market to develop for the Pre-Funded Warrants. Without an active market, the liquidity of the Pre-Funded Warrants will be limited. Further, the existence of the Pre-Funded Warrants may act to reduce both the trading volume and the trading price of our Ordinary Shares.

Except as otherwise provided in the Pre-Funded Warrants, holders of Pre-Funded Warrants purchased in this offering will have no rights as shareholders of Ordinary Shares until such holders exercise their Pre-Funded Warrants and acquire our Ordinary Shares.

The Pre-Funded Warrants offered in this offering do not confer any rights of Ordinary Share ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire our Ordinary Shares at a fixed price. A holder of a Pre-Funded Warrant may exercise the right to acquire an Ordinary Share and pay a nominal exercise price of $0.0001 at any time. Upon exercise of the Pre-Funded Warrants, the holders thereof will be entitled to exercise the rights of a holder of our Ordinary Shares only as to matters for which the record date occurs after the exercise date.

We may not receive any additional funds upon the exercise of the Pre-Funded Warrants.

Each Pre-Funded Warrant may be exercised by way of a cashless exercise, meaning that the holder may not pay a cash purchase price upon exercise, but instead would receive upon such exercise the net number of our Ordinary Shares determined according to the formula set forth in the Pre-Funded Warrant. Accordingly, we may not receive any additional funds upon the exercise of the Pre-Funded Warrants.

Risks Related to our Ordinary Shares

We may issue additional securities in the future, which may result in dilution to our shareholders.

We are not restricted from issuing additional Ordinary Shares or securities convertible into or exchangeable for Ordinary Shares. Because we anticipate we will need to raise additional capital to operate and/or expand our business, we expect to conduct equity offerings in the future.

There is no limit on the number of Ordinary Shares we may issue under our articles of association, however the directors’ authority to allot Ordinary Shares is limited to the extent authorized by the shareholders of the Company. On December 18, 2020 at an extraordinary general meeting, the shareholders authorized the Company to allot shares in the Company and to grant rights to subscribe for, or to convert any security into, shares in the Company up to an aggregate nominal value of $180,000, such authority to expire on December 18, 2025, and the shareholders waived all and any pre-emption rights in respect of the same. To the extent we conduct additional equity offerings, additional Ordinary Shares will be issued, which may result in dilution to our shareholders. The Ordinary Shares underlying our securities may be eligible for public resale in the future, either pursuant to registration or an exemption from registration. Issuance of additional equity awards, or future sales of substantial numbers of shares in the public market could adversely affect the market price of our Ordinary Shares. In addition, issuances of a substantial number of shares will reduce the equity interest of our existing investors and could cause a change in control of our Company.

The market for our Ordinary Shares may not provide investors with adequate liquidity.

Liquidity of the market for our Ordinary Shares depends on a number of factors, including our financial condition and operating results, the number of holders of our Ordinary Shares, the market for similar securities and the interest of securities dealers in making a market in the securities. We cannot predict the extent to which investor interest in the Company will maintain a trading market in our Ordinary Shares, or how liquid that market will be. If an active market is not maintained, investors may have difficulty selling Ordinary Shares that they hold.

We do not intend to pay any dividends on our Ordinary Shares at this time.

We have not paid any cash dividends on our Ordinary Shares to date. The payment of cash dividends on our Ordinary Shares in the future will be dependent upon our revenue and earnings, if any, capital requirements, and general financial condition, as well as the limitations on dividends and distributions that exist under the applicable laws and regulations of England and Wales and will be within the discretion of our board of directors. It is the present intention of our board of directors to retain all earnings, if any, for use in our business operations and, accordingly, our board of directors does not anticipate declaring any dividends on our Ordinary Shares in the foreseeable future. As a result, any gain you will realize on our Ordinary Shares will result solely from the appreciation of such shares.

USE OF PROCEEDS

We expect to receive net proceeds of approximately $5.0 million from this offering, after deducting the placement agent fee and estimated offering expenses payable by us, and excluding the proceeds, if any, from the exercise of the Pre-Funded Warrants issued in this offering.

We intend to use the net proceeds from this offering to fund growth related capital expenditures, working capital, investments or acquisitions, should we choose to pursue any. We have not determined the amounts we plan to spend on any of the areas listed above or the timing of these expenditures. As a result, our management will have broad discretion to allocate the net proceeds, if any, we receive in connection with securities offered pursuant to this prospectus supplement for any purpose. Pending application of the net proceeds as described above, we may initially invest the net proceeds in short-term, investment-grade and interest-bearing securities.

CAPITALIZATION

The following table sets forth our cash and cash equivalents and capitalization as of December 31, 2021 as follows:

| |

●

|

on an actual basis; and

|

| |

●

|

on an as adjusted basis to give effect to this offering.

|

You should read this table together with our financial statements and the related notes thereto, as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the other financial information, incorporated by reference in this prospectus supplement or the accompanying prospectus from our SEC filings, including our Annual Report any subsequently filed Reports on Form 6-K. The information presented in the capitalization table below is unaudited.

| |

|

As at December 31, 2021

|

|

|

(US dollars in thousands)

|

|

Actual

|

|

|

As adjusted

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

3,293 |

|

|

|

8,248 |

|

|

Shareholders' equity:

|

|

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

Non-current loans & borrowings

|

|

|

22,392 |

|

|

|

22,392 |

|

|

Current loans & borrowings

|

|

|

2,807 |

|

|

|

2,807 |

|

|

Total debt

|

|

|

25,199 |

|

|

|

25,199 |

|

|

Equity

|

|

|

|

|

|

|

|

|

|

Issued capital

|

|

|

251 |

|

|

|

279 |

|

|

Share premium

|

|

|

98,642 |

|

|

|

101,604 |

|

|

Retained earnings / (accumulated deficit) and other reserves

|

|

|

(65,356 |

)

|

|

|

(63,391 |

)

|

|

Total shareholders' equity

|

|

|

33,537 |

|

|

|

38,492 |

|

|

Total capitalization

|

|

|

55,929 |

|

|

|

60,884 |

|

The number of our Ordinary Shares to be outstanding after this offering is based on 20,908,800 of our Ordinary Shares outstanding as of December 31, 2021, and excludes the following:

| |

●

|

399,178 Ordinary Shares issued upon exercise of outstanding options at a weighted average exercise price of $nil per share or upon the settlement of outstanding restricted stock units, performance stock units or bonus stock awards under our equity plans as of July 29, 2022;

|

| |

●

|

252,954 Ordinary Shares issuable upon exercise of outstanding options at a weighted average exercise price of $nil per share or upon the settlement of outstanding restricted stock units, performance stock units or bonus stock awards under our equity plans as of July 29, 2022;

|

| |

●

|

A maximum of 196,213 Ordinary Shares authorized for issuance pursuant to future awards under our equity incentive plans;

|

| |

●

|

47,786 Ordinary Shares issued after December 31, 2021, pursuant to the Equity Distribution Agreement entered into by us and A.G.P./Alliance Global Partners on November 12, 2021; and

|

| |

●

|

14,000 Ordinary Shares issued to corporate advisors between January 1, 2022 and July 29, 2022.

|

Unless otherwise indicated, this prospectus supplement assumes no exercise of the Pre-Funded Warrants and the Series A Warrants issued in the concurrent private placement.

DILUTION

If you invest in our Ordinary Shares in this offering, your ownership interest will be diluted to the extent of the difference between the public offering price per share of our Ordinary Shares in this offering and the as adjusted net tangible book value per share of our Ordinary Shares immediately after the closing of this offering.

As of December 31, 2021, our historical net tangible book value was $(14.6) million, or $(0.70) per Ordinary Share. Our historical net tangible book value per share is equal to our total tangible assets, less total liabilities, divided by the number of outstanding Ordinary Shares as of December 31, 2021. After giving effect to the sale of 2,300,000 Ordinary Shares at an offering price of $1.30 per Ordinary Share and 1,930,770 Pre-Funded Warrants at an offering price of $1.2999 per Pre-Funded Warrant in this offering, and after deducting fees, commissions and estimated offering expenses payable by us, and excluding the proceeds, if any, from the exercise of the Pre-Funded Warrants, our as adjusted net tangible book value as of December 31, 2021 would have been $(9.6) million, or $(0.41) per Ordinary Share. This amount represents an immediate increase in as adjusted net tangible book value of $0.28 per share to our existing shareholders and an immediate dilution of $1.71 per share to investors participating in this offering. We determine dilution per share to investors participating in this offering by subtracting as adjusted net tangible book value per share after this offering from the assumed public offering price per share paid by investors participating in this offering.

|

Offering price per share

|

|

|

|

|

|

$ |

1.30 |

|

|

Net tangible book value per share as of December 31, 2021

|

|

$ |

(0.70 |

)

|

|

|

|

|

|

Increase in net tangible book value per share attributable to new investors in this offering

|

|

$ |

0.28 |

|

|

|

|

|

|

As adjusted net tangible book value per share as of December 31, 2021, after giving effect to this offering

|

|

|

|

|

|

$ |

(0.41 |

)

|

|

Dilution per share to new investors in this offering

|

|

$ |

1.71 |

|

|

|

|

|

The foregoing discussion and table do not take into account the potential dilution to new investors from (i) the exercise of Pre-Funded Warrants to purchase up to 1,930,770 Ordinary Shares and (ii) the exercise of outstanding options or warrants to purchase our Ordinary Shares or take into account the dilution that would result from the exercise of the Series A Warrants sold in the concurrent private placement transaction, as described below under the section titled “Private Placement Transaction.” The as adjusted dilution information discussed above is illustrative only and will change based on the actual public offering price and other terms of this offering determined at pricing.

The number of our Ordinary Shares to be outstanding after this offering is based on 20,908,800 of our Ordinary Shares outstanding as of December 31, 2021, and excludes the following:

|

●

|

399,178 Ordinary Shares issued upon exercise of outstanding options at a weighted average exercise price of $nil per share or upon the settlement of outstanding restricted stock units, performance stock units or bonus stock awards under our equity plans as of July 29, 2022;

|

|

●

|

252,954 Ordinary Shares issuable upon exercise of outstanding options at a weighted average exercise price of $nil per share or upon the settlement of outstanding restricted stock units, performance stock units or bonus stock awards under our equity plans as of July 29, 2022;

|

|

●

|

A maximum of 196,213 Ordinary Shares authorized for issuance pursuant to future awards under our equity incentive plans;

|

|

●

|

47,786 Ordinary Shares issued after December 31, 2021, pursuant to the Equity Distribution Agreement entered into by us and A.G.P./Alliance Global Partners on November 12, 2021; and

|

|

●

|

14,000 Ordinary Shares issued to corporate advisors between January 1, 2022 and July 29, 2022.

|

Unless otherwise indicated, this prospectus supplement assumes no exercise of the Pre-Funded Warrants and the Series A Warrants issued in the concurrent private placement

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

We are offering our Ordinary Shares and Pre-Funded Warrants. The following description of our Ordinary Shares and Pre-Funded Warrants summarizes the material terms and provisions thereof, including the material terms of the Ordinary Shares we are offering under this prospectus supplement and the accompanying prospectus.

Ordinary Shares

For a description of the rights associated with the Ordinary Shares, see “Description of Share Capital” in the accompanying prospectus.

Pre-Funded Warrants

The following summary of certain terms and provisions of the Pre-Funded Warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions of the Pre-Funded Warrant, the form of which will be filed as an exhibit to our Report on Form 6-K. Prospective investors should carefully review the terms and provisions of the form of Pre-Funded Warrant for a complete description of the terms and conditions of the Pre-Funded Warrants.

Each Pre-Funded Warrant will be sold in this offering at a purchase price equal to $1.2999 (equal to the purchase price per Ordinary Share, minus $0.0001). The purpose of the Pre-Funded Warrants is to enable investors that may have restrictions on their ability to beneficially own more than 4.99% (or, upon election of the holder, 9.99%) of our outstanding Ordinary Shares following the consummation of this offering the opportunity to make an investment in the Company without triggering their ownership restrictions, by receiving Pre-Funded Warrants in lieu of our Ordinary Shares which would result in such ownership of more than 4.99% (or 9.99%), and receive the ability to exercise their option to purchase the shares underlying the Pre-Funded Warrants at such nominal price at a later date.

Exercise Price and Duration

The Pre-Funded Warrants will have an exercise price of $0.0001 per share. The Pre-Funded Warrants are exercisable immediately upon issuance, and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. The exercise price is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our Ordinary Shares and also upon any distributions of assets, including cash, stock or other property to our shareholders.

Exercisability

The Pre-Funded Warrants will be exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and, at any time a registration statement registering the issuance of the Ordinary Shares underlying the Pre-Funded Warrants under the Securities Act is effective and available for the issuance of such shares, or an exemption from registration under the Securities Act is available for the issuance of such shares, by payment in full in immediately available funds for the number of common shares purchased upon such exercise.

Cashless Exercise

If, at the time of exercise there is no effective registration statement registering, or the prospectus contained therein is not available for the issuance of, the Ordinary Shares underlying the Pre-Funded Warrants, then the Pre-Funded Warrants may also be exercised, in whole or in part, at such time by means of a cashless exercise, in which case the holder would receive upon such exercise the net number of common shares determined according to the formula set forth in the Pre-Funded Warrant.

Exercise Limitation

A holder will not have the right to exercise any portion of the Pre-Funded Warrant if the holder (together with its affiliates) would beneficially own in excess of 4.99% (or 9.99% upon the request of the holder) of the number of common shares outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrants. However, any holder may increase or decrease such percentage, provided that any increase will not be effective until the 61st day after such election.

Transferability

Subject to applicable laws, the Pre-Funded Warrants may be offered for sale, sold, transferred or assigned without our consent.

Fractional Shares

No fractional common shares will be issued upon the exercise of the Pre-Funded Warrants. Rather, the number of common shares to be issued will be rounded to the nearest whole number.

Trading Market

There is no established public trading market for the Pre-Funded Warrants being issued in this offering, and we do not expect a market to develop. We do not intend to apply for listing of the Pre-Funded Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants will be limited.

Fundamental Transactions

If a fundamental transaction occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every right and power that we may exercise and will assume all of our obligations under the Pre-Funded Warrants with the same effect as if such successor entity had been named in the Pre-Funded Warrant itself. If holders of our common shares are given a choice as to the securities, cash or property to be received in a fundamental transaction, then the holder shall be given the same choice as to the consideration it receives upon any exercise of the Pre-Funded Warrant following such fundamental transaction. Additionally, as more fully described in the form of Pre-Funded Warrant, in the event of certain fundamental transactions, the holders of the Pre-Funded Warrants will be entitled to receive consideration in an amount equal to the Black Scholes value of the Pre-Funded Warrants on the date of consummation of the transaction.

Rights as a Shareholder

Except as otherwise provided in the Pre-Funded Warrants or by virtue of such holder’s ownership of our Ordinary Shares, the holder of a Pre-Funded Warrant does not have the rights or privileges of a holder of our common shares, including any voting rights, until the holder exercises the Pre-Funded Warrant.

Amendment and Waiver

The Pre-Funded Warrants may be modified or amended or the provisions thereof waived with the written consent of our company and the respective holder.

PRIVATE PLACEMENT TRANSACTION

Concurrent Private Placement

In a concurrent private placement, we are selling to purchasers of our Ordinary Shares and Pre-Funded Warrants in this offering, Series A Warrants to purchase 4,230,770 Ordinary Shares.

The Series A Warrants and the Ordinary Shares issuable upon the exercise of the Series A Warrants are not being registered under the Securities Act, are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder. Accordingly, purchasers of the Series A Warrants, may only sell Ordinary Shares issued upon exercise of the Series A Warrants being sold to them in the concurrent private placement, pursuant to an effective registration statement under the Securities Act covering the resale of those shares, an exemption under Rule 144 under the Securities Act or another applicable exemption under the Securities Act.

Each Series A Warrant will be exercisable commencing on the six month anniversary of the date of issuance at an exercise price of $1.30 per share, subject to adjustment, and will remain exercisable for five and one-half years from the date of issuance, but not thereafter. A holder of Series A Warrants will not have the right to exercise any portion of its Series A Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% of the number of Ordinary Shares outstanding immediately after giving effect to such exercise; provided, however, that upon notice to the Company, the holder may increase or decrease such beneficial ownership limitation, provided that in no event shall such beneficial ownership limitation exceed 9.99% and any increase in the beneficial ownership limitation will not be effective until 61 days following notice of such increase from the holder to us In addition, the holders of the Series A Warrants will have the right to participate in any rights offering or distribution of assets together with the holders of our Ordinary Shares on an as-exercised basis.

The exercise price and number of the Ordinary Shares issuable upon the exercise of the Series A Warrants will be subject to adjustment for stock splits, reverse splits, and similar capital transactions, as described in the Series A Warrants. The Series A Warrants will be exercisable on a “cashless” basis in certain circumstances.

CERTAIN TAX CONSIDERATIONS

You should carefully read the discussion of the material U.K. and U.S. federal income tax considerations associated with our operations and the acquisition, ownership and disposition of our Ordinary Shares set forth in Section E, “Taxation,” of Item 10 of our Annual Report, filed with the SEC on September 15, 2021 and incorporated by reference herein.

PLAN OF DISTRIBUTION

A.G.P./Alliance Global Partners, which we refer to herein as the placement agent, has agreed to act as our exclusive placement agent in connection with this offering subject to the terms and conditions of the placement agency agreement, dated July 29, 2022. The placement agent is not purchasing or selling any of the Ordinary Shares and Pre-Funded Warrants offered by this prospectus supplement, nor is it required to arrange the purchase or sale of any specific number or dollar amount of Ordinary Shares and Pre-Funded Warrants, but has agreed to use its reasonable best efforts to arrange for the sale of all of the Ordinary Shares and Pre-Funded Warrants offered hereby. We will enter into a securities purchase agreement directly with investors in connection with this offering and we may not sell the entire amount of Ordinary Shares and Pre-Funded Warrants offered pursuant to this prospectus supplement. We will make offers only to a limited number of qualified institutional buyers and accredited investors. The placement agent is also acting as placement agent for the concurrent private placement. The placement agent may retain sub-agents and selected dealers in connection with this offering.

We have agreed to indemnify the placement agent against specified liabilities, including liabilities under the Securities Act, and to contribute to payments the placement agent may be required to make in respect thereof.

Fees and Expenses

We have agreed to pay the placement agent a cash fee of $384,987, or 7.0% of the aggregate purchase price of our Ordinary Shares and Pre-Funded Warrants sold in this offering. The following table shows the per share and total cash placement agent’s fees we will pay to the placement agent in connection with the sale of the Ordinary Shares and Pre-Funded Warrants offered pursuant to this prospectus supplement and the accompanying prospectus, assuming the purchase of all of the shares offered hereby.

| |

|

Per

Ordinary

Share

|

|

|

Per Pre-

Funded

Warrant

|

|

|

Total

|

|

|

Public Offering Price

|

|

$ |

1.30 |

|

|

$ |

1.2999 |

|

|

$ |

5,499,808 |

|

|

Placement Agent Fees

|

|

$ |

0.091 |

|

|

$ |

0.09099 |

|

|

$ |

384,987 |

|

|

Proceeds, before expenses, to us

|

|

$ |

1.209 |

|

|

$ |

1.20891 |

|

|

$ |

5,114,822 |

|

We estimate that the total expenses of the offering payable by us, excluding the placement agent fees, will be approximately $160,000, which includes up to $50,000 of legal fees and expenses that we have agreed to reimburse the placement agent in connection with this offering.