UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of November 2021

Commission File Number 001-37974

VIVOPOWER INTERNATIONAL PLC

(Translation of registrant’s name into English)

The Scalpel, 18th Floor, 52 Lime Street

London EC3M 7AF

United Kingdom

+44-794-116-6696

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20- F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Update on Distribution Agreements

On November 12, 2021, VivoPower International PLC, a public limited company organized under the laws of England and Wales (the “Company”) entered into an Equity Distribution Agreement (the “Agreement”) with A.G.P./Alliance Global Partners, as sales agent (the “Agent”), under which the Company may, from time to time, sell ordinary shares of the Company, nominal value $0.012 per share (the “Shares”), having an aggregate offering price of up to $20,000,000 on terms set forth in the Agreement. Upon any sale of Shares pursuant to General Instruction I.B.5 of Form F-3, in no event will the aggregate market value of securities sold by the Company or on the Company’s behalf pursuant to General Instruction I.B.5 of Form F-3 during the 12 calendar month period immediately prior to, and including, the date of any such sale exceed one-third of the aggregate market value of the Company’s Shares held by non-affiliates.

Sale of Shares, if any, may be made by the Agent designated by the Company in a transaction notice by any method permitted by law deemed to be an “at the market” offering as defined in Rule 415 promulgated under the Securities Act of 1993, as amended (the “Securities Act”), including sales made directly on or through the Nasdaq Capital Market (“Nasdaq”), the existing trading market for the Shares, or on any other existing trading market for the Shares, and, if expressly authorized by the Company, in negotiated transactions. Subject to the terms and conditions of the Agreement, the Agent will use commercially reasonable efforts, consistent with its normal trading and sales practices, to sell the Shares from time to time, based upon the Company’s instructions, subject to applicable state and federal laws, rules and regulations, and the rules of Nasdaq.

The Company is not obligated to, and the Company cannot provide any assurance that it will, make any sales of the Shares under the Agreement. The Agreement will terminate upon the earlier of (i) the sale of Shares having an aggregate offering price of $20,000,000 or (ii) the termination by either the Agent or the Company upon the provision of ten (10) days written notice. The Agent shall have the right to terminate the Agreement if (i) any material adverse change occurs, (ii) the Company fails, refuses, or is unable to perform under the Agreement, provided, however, in the event of failure to deliver, the Agent’s right shall not arise for thirty (30) days from the date delivery was required, (iii) any other condition of the Agent’s obligations is not fulfilled, or (iv) any suspension or limitation of trading occurs.

The Company will pay the Agent a commission of 3% of the gross proceeds from the sale of Shares, and has provided the Agent with customary indemnification and contribution rights. Pursuant to the Agreement, the Company shall reimburse the Agent upon request for actual, reasonable and documented costs and expenses, including fees for legal counsel, up to an aggregate of $30,000. In addition, the Company agreed to pay up to $10,000 for reasonable and documented fees and expenses of the Agent’s legal counsel on an annual basis.

The description of the Agreement does not purport to be complete and is qualified in its entirety by the Agreement which is filed as Exhibit 10.1 hereto and is incorporated by reference herein.

The opinion of the Company’s counsel regarding the validity of the Shares to be issued pursuant to the Agreement is also filed herewith as Exhibit 5.1.

The consent of the Company’s independent registered public accounting firm regarding the validity of the Shares to be issued pursuant to the Agreement is also filed herewith as Exhibit 23.1.

The Shares will be issued pursuant to: the Company’s registration statement on Form F-3 (File No. 333-251304) (the “Registration Statement”), previously filed, which was declared effective by the Securities and Exchange Commission (the “SEC”) on December 23, 2020; the base prospectus filed as part of the Registration Statement; and the prospectus supplement dated November 12, 2021 filed by the Company with the SEC. This report shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the Shares in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such states.

In connection with the Company entering into the Agreement, the Company terminated the equity distribution agreement, dated December 11, 2020 (the “Prior Sales Agreement”), by and between the Company and Maxim Group LLC. The termination of the Prior Sales Agreement was effective on November 11, 2021. The Company is not subject to any termination penalties related to the termination of the Prior Sales Agreement. The Company issued and sold 768,277 ordinary shares, for gross proceeds of approximately $6,192,427 pursuant to the Prior Sales Agreement through the termination date of such agreement. The Company will not make any further sales of ordinary shares under the Prior Sales Agreement and the related prospectus supplement and accompanying prospectus.

This Form 6-K, including the exhibits hereto, is hereby incorporated by reference into the registration statements of the Company on Form S-8 (Registration Numbers 333-227810 and 333-251546) and on Form F-3 (Registration Number 333-251304) and to be a part thereof from the date on which this report on Form 6-K is filed, to the extent not superseded by documents or reports subsequently filed by the Company under the Securities Act, or the Securities Exchange Act of 1934, as amended.

EXHIBIT INDEX

Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: November 12, 2021

|

|

|

|

|

|

|

|

|

|

VivoPower International PLC

|

|

|

|

|

|

|

|

|

/s/ Kevin Chin

|

|

|

Kevin Chin

|

|

|

Executive Chairman

|

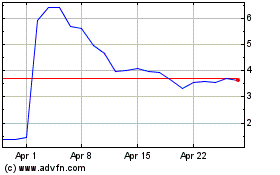

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

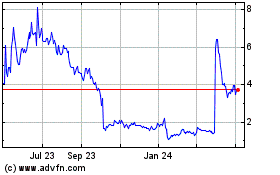

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Apr 2023 to Apr 2024