UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of October 2021

Commission File Number 001-37974

VIVOPOWER INTERNATIONAL PLC

(Translation of registrant’s name into English)

The Scalpel, 18th Floor, 52 Lime Street

London EC3M 7AF

United Kingdom

+44-794-116-6696

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F:

Form 20- F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Update on Distribution Agreements and Investment Plan

During 2021, VivoPower International PLC (“VivoPower” or “the Company”) has continued to execute on its strategy to establish a global distribution network for Tembo e-LV B.V. (“Tembo”) electric Light Vehicle (“e-LV”) conversion kits. VivoPower has entered into four distribution agreements and one non-binding heads of terms for Tembo e-LV products and services across six continents. The Company announced definitive distribution agreements with GHH Group GmBH headquartered in Germany, Bodiz International Group LLC in Mongolia, GB Auto Group in Australia, and Acces Industriel Mining Inc. in Canada. The Company also announced a non-binding heads of terms with Arctic Trucks Limited for distribution of Tembo e-LVs in Norway, Sweden, Iceland and Finland. In addition, VivoPower announced a binding letter of intent with Toyota Motor Corporation Australia Limited (“Toyota Australia”) to create an initial collaboration program between VivoPower and Toyota Australia for the electrification of Toyota Landcruiser vehicles using Tembo e-LV conversion kits, with a view to potentially signing a Master Services Agreement.

Distribution Strategy

Following a detailed strategic assessment, VivoPower’s management team decided that a distribution partnership strategy for each key region would be the most capital efficient and fastest route to market. This is because it leverages the reputation, existing customer relationships and infrastructure of distribution partners. The Tembo distribution partners to date are companies that have a long established presence in their respective regions, including strong reputations among end-user customers, established infrastructure (in terms of warehouse and assembly facilities), as well as technical capabilities in ruggedization and customization of utility vehicles, which complement Tembo’s capabilities.

The distribution agreements are intended to be framework agreements where end-customers in each market must order electric vehicles through VivoPower’s distribution partner in each region. The estimated revenues under these framework agreements are based upon the good faith judgment of the distribution partners’ management, using reasonable assumptions about the demand for electric vehicles for industrial purposes, including existing purchase orders, as well as expected purchase orders from their respective customer bases.

Update on GB Auto Distribution and Referral Agreement

Despite the impact of stricter border closures and internal lockdowns between states in Australia since the emergence of the Delta strain of the COVID-19 virus in July 2021, VivoPower continues to pursue future customer sales contracts for its Tembo e-LV conversion kits in Australia with suitable potential end customers, including leading global mining companies with operations in Australia. Based on ongoing discussions with potential end customers, the demand for fleet electrification solutions has not been impacted by these lockdowns given the heightened emphasis on achieving accelerated net zero carbon goals, especially amongst the leading mining companies. However, the supply chain and delivery logistics have been impacted, resulting in cost inflation as well as delays in scheduled deliveries. The Australian Federal Government has announced that border closures will be relaxed once Australia achieves a vaccination rate of 80% and based on the current vaccination rate, this is expected to occur sometime in November 2021. The Company expects supply chain, delivery logistics as well as costs to normalize following the relaxation of border restrictions.

As previously advised, given the Company’s strong local presence in Australia and existing customer relationships through its Critical Power Services business unit, the Company’s market approach is for VivoPower to initiate and lead the customer relationships, and to coordinate and direct the production of complete vehicles to be delivered to these customers. As a step towards reinforcing such customer relationships, VivoPower signed a definitive distribution agreement with GB Auto Group Pty Limited and GB Electric Vehicles Pty Ltd (collectively, “GB Auto”) in January 2021 (the “GB Auto Distribution Agreement”).

The GB Auto Distribution Agreement provides a framework under which VivoPower can consummate sales contracts for complete electric vehicles to customers in Australia. Under the GB Auto Distribution Agreement, GB Auto will serve as VivoPower’s exclusive distributor in marketing, promoting and selling electric vehicles in Australia, and will also install Tembo assembled e-LV conversion kits in 4 x 4 utility vehicles that it procures from the Original Equipment Manufacturer (“OEM”) on behalf of VivoPower. Under the terms of the GB Auto Distribution Agreement, it is intended that VivoPower will direct GB Auto to participate in the procurement and assembly of these vehicles, for which GB Auto will earn a commission based on the sales price. The GB Auto Distribution Agreement contains a provision to the effect that the parties shall not have a relationship of agency, joint venture or partnership.

The GB Auto Distribution Agreement includes a commitment by GB Auto to purchase a minimum of 2,000 Tembo e-LV conversion kits (Toyota Landcruiser and Hilux models) in the first four years of the agreement. This is based on GB Auto’s current contracted orders and GB Auto management estimates of future contracted purchases from its customer base. These commitments are expected to be fulfilled upon GB Auto generating these purchase orders of electric vehicles from its end-customers. As is customary in the industry, GB Auto will not be required to remit payment for its orders of conversion kits until end-customers enter into purchase orders for electric vehicles unless GB Auto purchases conversion kits prospectively ahead of end-customer orders. In the event that GB Auto fails to satisfy the minimum commitment, the GB Auto Distribution Agreement will undergo a review process under which the parties will attempt to agree to an acceptable outcome. If no acceptable resolution is reached, the parties may terminate the agreement, and GB Auto would lose its exclusivity in Australia.

The GB Auto Distribution Agreement is unique in that the estimated sales reflect the full supply of the ruggedized and customized vehicles, incorporating the e-LV conversion kits. This is because of the market dynamics in Australia, where VivoPower has an established presence through its Aevitas operations. The Company is seeking to further reinforce this presence through the relationship between Tembo and GB Auto. This is part of the Company’s strategy to not only deliver the vehicles but also the ancillary sustainable energy solutions, including microgrids, solar farms, charging stations and battery re-use (where appropriate) through working with the existing Aevitas businesses.

Further terms governing other aspects of the GB Auto Distribution Agreement are in the process of being finalized and are contingent upon the outcome of commercial negotiations with OEM counterparties, which continue as of this date but have been prolonged in part due to the impact of strict COVID-19 lockdowns in Australia and Japan. This includes the negotiation and execution of a Supply and Modification Agreement which will further define the terms of the commercial relationship with OEM counterparties, including the settlement mechanics of payments and the procurement of materials between VivoPower, Tembo, GB Auto and OEMs. While the Company has consulted with its auditors and believes that it will be able to recognize the revenue under IFRS for the full value of the converted vehicles, the proposed Supply and Modification Agreement that would set forth the terms to support revenue recognition for the full value has not yet been finalized. Accordingly, in light of the fact that certain language in the GB Auto Distribution Agreement regarding the absence of an agency relationship might not be consistent with such revenue recognition, there can be no assurance that the final Supply and Modification Agreement will contain terms needed to support revenue recognition for the full value of the converted vehicles sold under the distribution agreement.

VivoPower has previously disclosed that the potential electric vehicles that it expects could be sold to end-customers under the GB Auto Distribution Agreement could generate up to US$250 million in revenues. That estimate does not represent firm purchase orders, and actual results may differ materially given potential changes to input costs as a result of supply chain challenges as a result of wider issues impacting the automotive industry including border closures, chip demand and hence probable changes in vehicle and conversion kit pricing that may or may not impact demand. Based upon VivoPower management estimates that without any price increments to offset any cost increases, the Company believes that once prototype and test production is complete and full-scale series production commences, it could achieve gross margins of between 18% and 22% under the GB Auto Distribution Agreement. VivoPower does not as a matter of course make public projections as to future sales, earnings, gross margins or other results. VivoPower’s management prepared such an estimate based on advice from GB Auto’s management and applying good faith judgment using what it believed to be reasonable assumptions regarding the future sales of electric vehicles to end-customers in Australia, including minimum average pricing per unit that is based upon existing orders of prototype vehicles (which are priced at a discount to the expected market price). As future electric vehicle sales remain contingent on successful negotiation of end-customer sales contracts, the quantity, pricing and timing of each contract will be different. This estimation is not a formal projection of future revenue, but rather an indication of the expected sales under such contracts to VivoPower. There can be no assurance as to whether or not actual results will differ materially from those indicated. Therefore investors are cautioned not to attribute undue certainty to estimates of sales under the Company’s current or future distribution agreements.

Update on Acces, Bodiz and GHH Distribution Agreements

Acces Distribution Agreement

In June 2021, the Company announced that it had signed a definitive agreement with Acces Industriel Mining Inc. (“Acces”) for Acces to distribute e-LVs in Canada using e-LV conversion kits from Tembo (the “Access Distribution Agreement”). The term of the Acces Distribution Agreements expires in December 2026.

VivoPower selected Acces as the Company’s distribution partner in Canada because of Acces’ established, long-term experience supplying, customizing and servicing Toyota Landcruisers, as well as its extensive active relationships with dozens of mining companies which make Acces a leading provider of ruggedized vehicle solutions to Canada’s mining segment.

The Acces Distribution Agreement includes a commitment by Acces to purchase a minimum of 1,675 Tembo e-LV conversion kits (for Toyota 4x4 vehicles) in the first five years of the agreement, with the delivery schedule weighted towards the latter part of the term. This is based on Acces’ management estimates of future contracted purchases from its customer base. The Acces Distribution Agreement contains a price range for the e-LV conversion kits to be sold to Acces, which may be varied, and the purchase commitments are expected to be fulfilled upon Acces generating purchase orders of e-LVs from its end-customers.

At the time of entering into the Acces Distribution Agreement, Canada’s COVID-19 daily case numbers were in decline and the Canadian government had commenced a plan to reopen borders. From August 2021, it has reopened borders to fully vaccinated travelers and at the time of writing, intends to reopen borders to all fully vaccinated nationalities before the end of the 2021 calendar year. Notwithstanding a reopening of Canadian borders, we do expect to experience some delays in delivery schedules due to supply chain bottlenecks, which may take six months to normalise.

Bodiz Distribution Agreement

In July 2021 the Company announced that it signed a definitive agreement with Bodiz International Group LLC (“Bodiz”) for Bodiz to distribute e-LVs in Mongolia, using e-LV conversion kits from Tembo (the “Bodiz Distribution Agreement”). The term of the Bodiz Distribution Agreement expires in December 2026.

VivoPower selected Bodiz as the Company’s distribution partner in Mongolia because Bodiz has been distributing ruggedized SUVs and other heavy duty vehicles to the Mongolian market since its founding in 1997.

The Bodiz Distribution Agreement includes a commitment by Bodiz to purchase a minimum of 350 Tembo e-LV conversion kits in the first five years of the agreement, with the delivery schedule weighted towards the latter part of the term of the agreement. This is based on Bodiz’s management estimates of future contracted purchases from its customer base.

At the time of entering into the Bodiz Distribution Agreement, COVID-19 cases were on the decline in Mongolia. However, since the middle of August, Mongolia experienced a resurgence of cases with daily numbers hitting a record level in September, but now starting to decline once again. As a result, the expected pathway to reopening borders has been delayed and there are now internal movement restrictions with most domestic flights suspended at present. Currently, we do not expect to see any changes to the Bodiz Distribution Agreement, but expected delivery schedules and timelines will likely be delayed.

GHH Distribution Agreement

In September 2021, the Company announced that it signed a definitive agreement with GHH Group GmBH headquartered in Germany (“GHH”) to distribute e-LVs in over 50 countries across Africa, Asia, Europe, and the Americas, using e-LV conversion kits from Tembo (the “GHH Distribution Agreement”).

VivoPower selected GHH, which traces its roots back to 1782, Germany, as the Company’s distribution partner in these countries because GHH has an unrivalled experience of operating in these markets and has been distributing ruggedized utility vehicles and other heavy duty vehicles to these markets for a substantial period of time.

The GHH Distribution Agreement includes a commitment by GHH to purchase a minimum of 3,000 Tembo e-LV conversion kits through to December 2026, with the delivery schedule weighted towards the latter part of the term of the agreement. This is based on GHH’s management estimates of future contracted purchases from its customer base. GHH will be responsible for acquiring original vehicles from OEMs, converting the vehicles to ruggedized e-LVs using the Tembo e-LV conversion kits, selling the units to end-customers, and providing ongoing servicing and maintenance.

At the time of writing, border restrictions are still in place for many of the countries covered by the agreement with GHH, which could result in delays for delivery.

The Distribution Agreements described above provide a framework under which VivoPower can consummate sales contracts for e-LV conversion kits to be installed in vehicles to be sold to end-customers. Under the Distribution Agreements, Acces, Bodiz and GHH will serve as VivoPower’s exclusive distributors in marketing, promoting and selling electric vehicles in the agreed countries respectively, and will also assemble and install e-LV conversion kits provided by VivoPower in vehicles that the distributors procure from the OEMs. The Distribution Agreements contain provisions to the effect that the parties shall not have a relationship of agency, joint venture or partnership.

The Distributors will not be required to remit payment for their orders of e-LV conversion kits until end-customers enter into purchase orders for e-LVs or the Distributors purchase conversion kits prospectively ahead of end-customer orders. In the event that the Distributors fail to satisfy the minimum purchase commitment, the Distribution Agreements will undergo a review process. If no acceptable resolution is reached, VivoPower is entitled to withdraw exclusivity for Acces in Canada, for Bodiz in Mongolia and GHH in relation to their countries.

VivoPower believes that the potential e-LV conversion kits that it expects could be sold under the Acces Distribution Agreement, the Bodiz Distribution Agreement and the GHH Distribution Agreement could generate approximately US$120 million, US$29 million and US$215 million in revenues, respectively. The unit price used by the Company to estimate a dollar value of the minimum purchase commitment under the Acces Distribution Agreement and GHH Distribution Agreement is at the low end of the indicative price range set forth in the Acces Distribution Agreement and GHH Distribution Agreement, respectively, and based upon the Company’s current minimum price for e-LV conversion kits. The unit price used by the Company to estimate a dollar value of the minimum purchase commitment under the Bodiz Distribution Agreement is the high end of the indicative price range set forth in the Bodiz Distribution Agreement, which takes into consideration the relatively small volume of the purchase commitment and the challenges of doing business in Mongolia. These estimates do not represent a firm commitment for purchase orders, and actual results may differ materially. Based upon VivoPower’s management estimates, the Company believes that, once prototype and test production is complete and full scale series production commences, it could achieve gross margins of between 25%% and 33% under the Distribution Agreements. VivoPower does not as a matter of course make public projections as to future sales, gross margins, earnings or other results. VivoPower’s management prepared such an estimate based on its good faith judgment using what it believed to be reasonable assumptions regarding the future sales of e-LVs to end-customers in each country and territory covered by the respective Distribution Agreements. As future e-LV sales remain contingent on successful negotiation of end-customer sales contracts, and as the quantity, pricing and timing of each sales contract will be different, this estimation is not a formal projection of future revenue, but an indication of the expected sales under such contracts. The foregoing estimates are subjective in many respects and there can be no assurance that actual results will not differ materially from these estimates. Therefore, as with any projections or forecasts, investors are cautioned not to attribute undue certainty to estimates of sales under the Company’s Distribution Agreements.

Unlike in Australia, where VivoPower has its presence through the Aevitas operations, VivoPower does not have established operating business units as yet in the Canadian or Mongolian markets or any other market. Therefore, at this stage, the Company is seeking only to supply e-LV conversion kits through Acces, Bodiz and GHH (as opposed to fully-converted vehicles). As a result, the estimated potential sales under these Distribution Agreements reflects the current pricing of the e-LV conversion kits alone, as opposed to the full vehicle pricing as estimated for the GB Auto Distribution Agreement.

Further terms governing other aspects of the Distribution Agreements with the Distributors are in the process of being finalized and are contingent upon the outcome of commercial negotiations with OEM counterparties.

Update on Head of Terms and Proposed Agreement with Arctic Trucks

In June 2021, the Company announced that it signed a non-binding heads of terms with Arctic Trucks Limited (“Arctic Trucks”) for Arctic Trucks to convert and distribute Tembo e-LVs in Norway, Sweden, Iceland and Finland (the “Heads of Terms”). Under the proposed agreement (the “Proposed Agreement”), Arctic Trucks would commit to purchase 800 Tembo e-LV conversion kits through to December 2026. Based upon the Company’s estimates, these orders could generate an estimated US$58 million in total revenue over the term of the Proposed Agreement. The unit price used by the Company to estimate a dollar value of the minimum purchase commitment under the Proposed Agreement is based upon the Company’s current minimum price for e-LV conversion kits, which may likely change as a result of cost inflation.

The Heads of Terms provided that the Proposed Agreement must be finalized prior to June 30, 2021, however negotiations of the final terms of the Proposed Agreement are ongoing. Whilst there has been a delay to the finalization of the Proposed Agreement as a result of COVID-19 related border closures delaying site visits, discussions are continuing with Arctic Trucks.

All purchase commitments would be subject to the terms and conditions set forth in the final agreement. It is anticipated that the terms of the Proposed Agreement will be substantially similar to the Distribution Agreements discussed above.

Investment Required to Develop Distribution Agreements

In order to attain the estimated volume of sales discussed above, the parties will be required to invest in capital equipment as part of an expansion of assembly and production facilities, additional research and development (R&D) and additional personnel as well as investment in training.

Below, the Company provides its estimates of the quantum and timing of such amounts:

● Tembo R&D capitalized development cost. Total investment required by Tembo in product development (including personnel) is estimated at between US$16 million and US$21 million, between July 2021 and June 2024.

● New facilities. The investment required to establish Tembo’s new kit assembly facility in the Netherlands (also incorporating facilities for R&D) and two other locations internationally, is estimated at between US$22 million and US$28 million between July 2022 and June 2024.

● Distribution partner investments. Our partners have made and will continue to make significant investments in facilities, tooling, personnel and training. For example, GB Auto has leased an additional workshop, purchased new equipment, has dedicated engineers and has purchased a number of chassis from Toyota Australia to use for training and demonstrations. In addition, GHH and Acces in particular are long established businesses with significant operations and resources across multiple locations globally and in Canada respectively. Bodiz is also a long established operator in Mongolia.

VivoPower’s strategy is to fund its investments from existing cash reserves, including free cashflow generated from its Aevitas business unit, as well as potentially from UK and EU green economy funding grants, R&D grants and asset financing. The Company has been in discussions with UK and EU entities in relation to government grant funding, R&D grant funding, trade and supply chain financing as well as asset financing. If needed, the Company may seek to raise additional equity capital in the future but would carefully consider whether that is in the best interests of shareholders.

Use of Estimates

The preceding discussion of the Company’s Distribution Agreements with GB Auto, Acces, Bodiz, GHH and the non-binding Heads of Terms with Artic Trucks, contains estimates of revenues and gross margins related to the Distribution Agreements. The revenue estimates provided above related to the purchase commitments under the Distribution Agreements do not represent measures of income or profitability, and do not take into consideration the costs that would be incurred in the course of realizing the estimated revenues. These estimates are based solely on the specific terms of purchase commitments set forth in the Distribution Agreements (which are negotiated contractual term based upon the counterparties’ estimates of future contracted purchases from their customer base using their assessments of the market), the estimates do not include an attempt to quantify the total addressable market for specialized electric vehicles in Canada or Mongolia, and the estimates are not associated with projections of activity that involve other broader considerations beyond the scope of the specific terms of the Distribution Agreements. It is the opinion of VivoPower’s management that the estimates discussed above are reasonable and represent what it believes to be the most probable amounts attributable to the purchase commitments in the Distribution Agreements and that these estimates are consistent with management’s expectations based upon current information.

Forward-Looking Statements

This communication includes certain statements that may constitute “forward-looking statements” for purposes of the United States federal securities laws. Forward-looking statements include, but are not limited to, statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements may include, for example, statements about the potential timing and completion of the proposed distribution agreements, including finalizing due diligence and negotiations with distribution partners, the formal execution of and entry into the final distribution agreements or other definitive transaction documents, anticipated gross margins, and the related potential sales under distribution agreements, or potential revenue to be derived from distribution agreements. These statements are based on VivoPower’s management’s current expectations or beliefs based upon what it believes to be reasonable assumptions made in good faith. These statements are subject to risk, uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive and/or regulatory factors, and other risks and uncertainties affecting the operation of VivoPower’s business. These risks, uncertainties and contingencies include changes in business conditions, fluctuations in customer demand, changes in accounting interpretations, management of rapid growth, intensity of competition from other providers of products and services, changes in general economic conditions, geopolitical events and regulatory changes and other factors set forth in VivoPower’s filings with the United States Securities and Exchange Commission. The information set forth herein should be read in light of such risks.

The information in this Current Report on Form 6-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

VivoPower International PLC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Kevin Chin

|

|

|

|

|

Kevin Chin

|

|

|

|

|

Executive Chairman

|

|

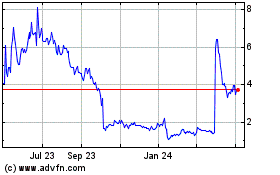

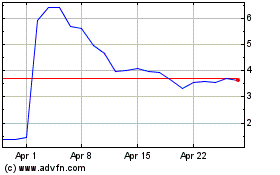

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

VivoPower (NASDAQ:VVPR)

Historical Stock Chart

From Apr 2023 to Apr 2024