Virco Mfg. Corporation (NASDAQ: VIRC), the largest manufacturer and

supplier of movable furniture and equipment to the education market

in the United States, today reported financial results for the

quarter ended October 31, 2021 (third quarter of fiscal 2022 ending

January 31, 2022).

Net sales were $57.3 million for the third quarter of fiscal

2022, up slightly from $57.2 million for the same period of the

prior fiscal year.

Net income was $1.3 million, or $0.08 per diluted share for the

third quarter of fiscal 2022, a decline of 70.4%, compared to net

income of $4.5 million, or $0.28 per diluted share, for the same

period of the prior fiscal year. Material shortages and higher

input costs due to supply chain problems had negative impacts on

both gross margin and overall factory output and shipments during

the fiscal third quarter.

Order rates and demand for school furniture remain very strong.

As of November 30, 2021, the fiscal year-to-date shipments plus

unshipped backlog (“Shipments + Backlog), the Company’s preferred

measure of current and future business activity, was $205.7

million. This compares to $158.7 million and $191.2 million on the

same date in 2020 and 2019, respectively. As availability of

material supplies has improved, factory output and shipments have

begun to accelerate in recent weeks. The backlog component still

remains in record territory at $45.1 million, compared to $18.9

million and $19.0 million on the same date in 2020 and 2019,

respectively.

Robert Virtue, Chairman and CEO of Virco, said, “While our U.S.

production facilities continue to provide a significant competitive

advantage with shorter delivery times on orders, we have not been

immune from the impact of global supply chain problems. Shortages

of steel and other components limited factory output, and related

inflationary pressures on all raw materials reduced our gross

margin during our fiscal third quarter. However, supplies of

component materials have recently improved, and factory output has

increased as a result. For the months of October and November,

factory output was roughly two times higher than last year, which

has positively impacted our shipments and sales. We look forward to

an unusually busy fiscal fourth quarter as we work through our

record backlog and help schools with their reopening plans.”

Doug Virtue, President of Virco, added, “As material supplies

have improved, we have successfully added staff to increase our

production levels. Looking forward to the fiscal fourth quarter, we

believe the combination of record backlog and increasing output

should offset the normal seasonal slowdown, resulting in a strong

finish to the year. Even with this strong finish, we expect to

enter next year (fiscal 2023) with an unusually robust backlog as

order rates continue to be positively impacted by stimulus funding,

giving us an excellent start to the next shipping season. We have

also secured a substantial price increase on our public contracts

to help offset the margin impacts of this year’s supply chain

challenges. While we believe the issues that have impacted our

margins and profitability this year are temporary in nature, we

believe the market share gains we are seeing are sustainable and

will lead to higher revenue and improved profitability in future

years.”

Three Months Fiscal 2022 Results

Net sales were $57.3 million for the third quarter of fiscal

2022, a slight increase from $57.2 million for the same period of

the prior fiscal year.

Gross margin was 35.4% for the third quarter of fiscal 2022,

compared with 38.9% in the same period of the prior fiscal year.

The decrease in gross margin was primarily attributable to higher

raw material and inbound freight costs, which worsened as the

quarter progressed.

Selling, general, administrative and other expenses (SG&A)

was $17.8 million for the third quarter of fiscal 2022, compared to

$16.5 million in the same period of the prior fiscal year. The

increase in SG&A expense was attributable to a combination of

higher freight costs on shipments to customers as well as higher

selling expense.

Interest expense was $327,000 for the third quarter of fiscal

2022, compared with $419,000 in the same period of the prior fiscal

year. The decline in interest expense was primarily due to a lower

level of debt financing utilized compared to the prior year.

Income tax expense was $295,000 for the third quarter of fiscal

2022, representing an effective tax rate of 18.2%, compared with

income tax expense of $384,000 in the same period of the prior

year, representing an effective tax rate of 7.9%. The change in

effective tax rate was primarily attributable to lower operating

income and changes in the forecasted mix of income before taxes in

various jurisdictions as well as the recording of a partial

valuation allowance on net deferred tax assets.

Net income was $1.3 million, or $0.08 per diluted share, for the

third quarter of 2022, a decline of 70.4% from net income of $4.5

million, or $0.28 per diluted share, for the same period of the

prior fiscal year. The decrease in net income was primarily

attributable to higher input costs for raw materials as well as

higher freight costs on shipments to customers.

Nine Months Fiscal 2022 Financial Results

Net sales were $144.7 million for the nine months ended October

31, 2021, an increase of 7.6% from $134.5 million for the same

period of the prior fiscal year. The increase in net sales was

primarily attributable to increased funding provided by federal and

state stimulus packages as well as the Company’s ability to take

market share from overseas competitors experiencing longer delays

in product availability and shipping times.

Gross margin was 34.8% for the nine months ended October 31,

2021, compared with 37.5% in the same period of the prior fiscal

year. The decrease in gross margin was primarily attributable to

higher raw material and inbound freight costs, in addition to

reduced overhead absorption due to material shortages impacting

production levels.

Selling, general, administrative and other expenses (SG&A)

was $46.0 million for the nine months ended October 31, 2021,

compared with $43.9 million in the same period of the prior fiscal

year. The increase in SG&A expense was primarily attributable

to higher freight costs to customers as well as higher selling

costs.

Interest expense was $979,000 for the nine months ended October

31, 2021, compared with $1.3 million in the same period of the

prior fiscal year. The decline in interest expense was primarily

attributable to a lower level of debt financing compared to the

prior year period, despite the increase in revenue as improved

working capital management has increased the Company’s ability to

be self-funding.

Income tax expense was $335,000 for the nine months ended

October 31, 2021, compared with income tax expense of $235,000 for

the same period of the prior year. Changes in income tax expense

were primarily attributable to the change in forecasted mix of

income before taxes in various jurisdictions, estimated permanent

differences and the recording of a partial valuation allowance on

net deferred tax assets.

Net income was $1.2 million, or $0.07 per diluted share, for the

nine months ended October 31, 2021, compared to net income of $3.3

million, or $0.21 per diluted share, for the same period of the

prior fiscal year. The decrease in net income was primarily

attributable to higher input costs for materials and inbound

freight, in addition to higher freight expense for customer

shipments.

About Virco Mfg. Corporation

Founded in 1950, Virco Mfg. Corporation is the largest

manufacturer and supplier of moveable educational furniture and

equipment for the preschool through 12th grade market in the United

States. The Company manufactures a wide assortment of products,

including mobile tables, mobile storage equipment, desks, computer

furniture, chairs, activity tables, folding chairs and folding

tables. Along with serving customers in the education market -

which in addition to preschool through 12th grade public and

private schools includes: junior and community colleges; four-year

colleges and universities; trade, technical and vocational schools

- Virco is a furniture and equipment supplier for convention

centers and arenas; the hospitality industry with respect to

banquet and meeting facilities; government facilities at the

federal, state, county and municipal levels; and places of worship.

The Company also sells to wholesalers, distributors, traditional

retailers and catalog retailers that serve these same markets. With

operations entirely based in the United States, Virco designs,

manufactures, and ships its furniture and equipment from one

facility in Torrance, CA and three facilities in Conway, AR. More

information on the Company can be found at www.virco.com.

Contact:

Virco Mfg. Corporation (310) 533-0474Robert A. Virtue, Chairman

and Chief Executive OfficerDoug Virtue, PresidentRobert Dose, Chief

Financial Officer

Non-GAAP Financial Information

This press release includes a statement of shipments plus

unshipped backlog as of November 30, 2021 compared to the same date

in the prior fiscal years. Shipments represent the dollar amount of

net sales actually shipped during the period presented. Unshipped

backlog represents the dollar amount of net sales that we expect to

recognize in the future from sales orders that have been received

from customers in the ordinary course of business. The Company

considers shipments plus unshipped backlog a relevant and preferred

supplemental measure for production and delivery planning. However,

such measure has inherent limitations, is not required to be

uniformly applied or audited and other companies may use

methodologies to calculate similar measures that are not

comparable. Readers should be aware of these limitations and should

be cautious as to their use of such measure.

Statement Concerning Forward-Looking

Information

This news release contains “forward-looking statements” as

defined by the Private Securities Litigation Reform Act of 1995.

These statements include, but are not limited to, statements

regarding: market share, net sales and profitability in future

periods; the impact of the COVID-19 pandemic on our business,

customers, competitors, supply chain and workforce; the anticipated

recovery of our customers from COVID-19 and re-opening of school

districts; business strategies; market demand and product

development; estimates of unshipped backlog; order rates and trends

in seasonality; product relevance; economic conditions and

patterns; the educational furniture industry including the domestic

market for classroom furniture; state and municipal bond and/or tax

funding; the rate of completion of bond funded construction

projects; cost control initiatives; absorption rates; the relative

competitiveness of domestic vs. international supply chains; trends

in shipping costs; use of temporary workers; marketing initiatives;

and international or non K-12 markets. Forward-looking statements

are based on current expectations and beliefs about future events

or circumstances, and you should not place undue reliance on these

statements. Such statements involve known and unknown risks,

uncertainties, assumptions and other factors, many of which are out

of our control and difficult to forecast. These factors may cause

actual results to differ materially from those that are

anticipated. Such factors include, but are not limited to:

uncertainties surrounding the severity, duration and effects of the

COVID-19 pandemic; changes in general economic conditions including

raw material, energy and freight costs; state and municipal bond

funding; state, local, and municipal tax receipts; order rates; the

seasonality of our markets; the markets for school and office

furniture generally, the specific markets and customers with which

we conduct our principal business; the impact of cost-saving

initiatives on our business; the competitive landscape, including

responses of our competitors and customers to changes in our

prices; demographics; and the terms and conditions of available

funding sources. See our Annual Report on Form 10-K for the year

ended January 31, 2021, our Quarterly Reports on Form 10-Q, and

other reports and material that we file with the Securities and

Exchange Commission for a further description of these and other

risks and uncertainties applicable to our business. We assume no,

and hereby disclaim any, obligation to update any of our

forward-looking statements. We nonetheless reserve the right to

make such updates from time to time by press release, periodic

reports, or other methods of public disclosure without the need for

specific reference to this press release. No such update shall be

deemed to indicate that other statements which are not addressed by

such an update remain correct or create an obligation to provide

any other updates.

Financial Tables Follow

|

Virco Mfg. Corporation |

|

|

|

|

|

|

|

Unaudited Condensed Consolidated Statements of

Income |

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

10/31/2021 |

|

10/31/2020 |

|

|

|

(In thousands, except per share data) |

|

|

|

|

|

|

| Net

sales |

|

$ |

57,331 |

|

|

$ |

57,221 |

|

|

| Costs of

goods sold |

|

37,032 |

|

|

34,946 |

|

|

| Gross

Profit |

|

20,299 |

|

|

22,275 |

|

|

| Selling,

general and administrative expenses |

|

17,782 |

|

|

16,457 |

|

|

| Gain on

sale of property, plant & equipment |

|

— |

|

|

(7 |

) |

|

| Operating

income |

|

2,517 |

|

|

5,825 |

|

|

| Pension

expense |

|

570 |

|

|

542 |

|

|

| Interest

expense |

|

327 |

|

|

419 |

|

|

| Income

before income taxes |

|

1,620 |

|

|

4,864 |

|

|

| Income

tax expense |

|

295 |

|

|

384 |

|

|

| Net

income |

|

$ |

1,325 |

|

|

$ |

4,480 |

|

|

|

|

|

|

|

|

| Net

income per common share: |

|

|

|

|

|

Basic |

|

$ |

0.08 |

|

|

$ |

0.28 |

|

|

|

Diluted |

|

$ |

0.08 |

|

|

$ |

0.28 |

|

|

| Weighted

average shares of common stock outstanding: |

|

|

|

|

|

Basic |

|

16,033 |

|

|

15,733 |

|

|

|

Diluted |

|

16,082 |

|

|

15,767 |

|

|

|

|

|

|

|

|

|

Virco Mfg. Corporation |

|

|

|

Unaudited Condensed Consolidated Statements of

Income |

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

10/31/2021 |

|

10/31/2020 |

|

|

|

(In thousands, except per share data) |

|

|

|

|

|

|

| Net

sales |

|

$ |

144,720 |

|

|

$ |

134,494 |

|

|

| Costs of

goods sold |

|

94,414 |

|

|

84,112 |

|

|

| Gross

profit |

|

50,306 |

|

|

50,382 |

|

|

| Selling,

general and administrative expenses |

|

46,016 |

|

|

43,876 |

|

|

| Gain on

sale of property, plant & equipment |

|

— |

|

|

(7 |

) |

|

| Operating

income |

|

4,290 |

|

|

6,513 |

|

|

| Pension

expense |

|

1,800 |

|

|

1,626 |

|

|

| Interest

expense |

|

979 |

|

|

1,317 |

|

|

| Income

before income taxes |

|

1,511 |

|

|

3,570 |

|

|

| Income

tax expense |

|

335 |

|

|

235 |

|

|

| Net

income |

|

$ |

1,176 |

|

|

$ |

3,335 |

|

|

|

|

|

|

|

|

| Net

income per common share: |

|

|

|

|

|

Basic |

|

$ |

0.07 |

|

|

$ |

0.21 |

|

|

|

Diluted |

|

$ |

0.07 |

|

|

$ |

0.21 |

|

|

| Weighted

average shares of common stock outstanding: |

|

|

|

|

|

Basic |

|

15,927 |

|

|

15,566 |

|

|

|

Diluted |

|

15,963 |

|

|

15,586 |

|

|

|

|

|

|

|

|

|

|

|

Virco Mfg. Corporation |

|

|

|

|

|

|

|

|

|

Unaudited Condensed Consolidated Balance

Sheets |

|

|

|

|

|

|

|

|

|

|

|

10/31/2021 |

|

1/31/2021 |

|

10/31/2020 |

|

|

|

(In thousands) |

|

Assets |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

| Cash |

|

$ |

1,742 |

|

|

$ |

402 |

|

|

$ |

1,202 |

|

| Trade

accounts receivables, net |

|

24,824 |

|

|

9,759 |

|

|

16,877 |

|

| Other

receivables |

|

60 |

|

|

26 |

|

|

60 |

|

| Income

tax receivable |

|

108 |

|

|

199 |

|

|

322 |

|

|

Inventories |

|

40,483 |

|

|

38,270 |

|

|

36,872 |

|

| Prepaid

expenses and other current assets |

|

1,839 |

|

|

2,311 |

|

|

1,608 |

|

| Total

current assets |

|

69,056 |

|

|

50,967 |

|

|

56,941 |

|

|

Non-current assets |

|

|

|

|

|

|

| Property,

plant and equipment |

|

|

|

|

|

|

| Land |

|

3,731 |

|

|

3,731 |

|

|

3,731 |

|

| Land

improvements |

|

734 |

|

|

734 |

|

|

734 |

|

| Buildings

and building improvements |

|

51,308 |

|

|

51,262 |

|

|

51,191 |

|

| Machinery

and equipment |

|

113,816 |

|

|

112,098 |

|

|

111,844 |

|

| Leasehold

improvements |

|

1,017 |

|

|

1,004 |

|

|

1,003 |

|

| Total

property, plant and equipment |

|

170,606 |

|

|

168,829 |

|

|

168,503 |

|

| Less

accumulated depreciation and amortization |

|

134,659 |

|

|

132,003 |

|

|

130,808 |

|

| Net

property, plant and equipment |

|

35,947 |

|

|

36,826 |

|

|

37,695 |

|

| Operating

lease right-of-use assets |

|

14,685 |

|

|

17,596 |

|

|

18,645 |

|

| Deferred

tax assets, net |

|

10,364 |

|

|

11,716 |

|

|

10,682 |

|

| Other

assets, net |

|

8,034 |

|

|

7,931 |

|

|

7,949 |

|

| Total

assets |

|

$ |

138,086 |

|

|

$ |

125,036 |

|

|

$ |

131,912 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Virco Mfg. Corporation |

|

|

|

|

|

|

|

|

|

Unaudited Condensed Consolidated Balance

Sheets |

|

|

|

|

|

|

|

|

|

|

|

10/31/2021 |

|

1/31/2021 |

|

10/31/2020 |

|

|

|

(In thousands, except share and par value

data) |

|

Liabilities |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

| Accounts

payable |

|

$ |

15,786 |

|

|

|

$ |

8,421 |

|

|

|

$ |

11,509 |

|

|

| Accrued

compensation and employee benefits |

|

5,547 |

|

|

|

4,576 |

|

|

|

5,514 |

|

|

| Current

portion of long-term debt |

|

504 |

|

|

|

887 |

|

|

|

885 |

|

|

| Current

portion operating lease liability |

|

4,686 |

|

|

|

4,672 |

|

|

|

4,662 |

|

|

| Other

accrued liabilities |

|

6,983 |

|

|

|

3,550 |

|

|

|

4,121 |

|

|

| Total

current liabilities |

|

33,506 |

|

|

|

22,106 |

|

|

|

26,691 |

|

|

|

Non-current liabilities |

|

|

|

|

|

|

| Accrued

self-insurance retention |

|

1,121 |

|

|

|

935 |

|

|

|

1,313 |

|

|

| Accrued

pension expenses |

|

18,654 |

|

|

|

21,889 |

|

|

|

21,445 |

|

|

| Income

tax payable |

|

68 |

|

|

|

65 |

|

|

|

72 |

|

|

| Long-term

debt, less current portion |

|

12,547 |

|

|

|

9,553 |

|

|

|

5,185 |

|

|

| Operating

lease liability, less current portion |

|

12,402 |

|

|

|

15,619 |

|

|

|

16,745 |

|

|

| Other

long-term liabilities |

|

687 |

|

|

|

682 |

|

|

|

655 |

|

|

| Total

non-current liabilities |

|

45,479 |

|

|

|

48,743 |

|

|

|

45,415 |

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

| Preferred

stock: |

|

|

|

|

|

|

|

Authorized 3,000,000 shares, $0.01 par value; none issued or

outstanding |

|

— |

|

|

|

— |

|

|

|

— |

|

|

| Common

stock: |

|

|

|

|

|

|

|

Authorized 25,000,000 shares, $0.01 par value; issued and

outstanding 16,102,023 shares at 10/31/2021 and 15,918,642 at

1/31/2021 and 10/31/2020 |

|

161 |

|

|

|

159 |

|

|

|

159 |

|

|

|

Additional paid-in capital |

|

120,238 |

|

|

|

119,655 |

|

|

|

119,402 |

|

|

|

Accumulated deficit |

|

(50,866 |

) |

|

|

(52,042 |

) |

|

|

(46,475 |

) |

|

|

Accumulated other comprehensive loss |

|

(10,432 |

) |

|

|

(13,585 |

) |

|

|

(13,280 |

) |

|

| Total

stockholders’ equity |

|

59,101 |

|

|

|

54,187 |

|

|

|

59,806 |

|

|

| Total

liabilities and stockholders’ equity |

|

$ |

138,086 |

|

|

|

$ |

125,036 |

|

|

|

$ |

131,912 |

|

|

|

|

|

|

|

|

|

|

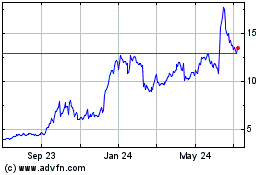

Virco Manufacturing (NASDAQ:VIRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

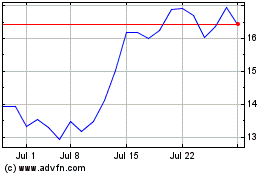

Virco Manufacturing (NASDAQ:VIRC)

Historical Stock Chart

From Apr 2023 to Apr 2024