Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

March 19 2020 - 7:59AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

File No. 333-232115

March

19, 2020

|

|

|

|

|

Village Farms International, Inc.

Underwritten Public Offering of Common Shares

Term

Sheet

|

|

March 19, 2020

|

The Company (as

defined below) has filed a registration statement (including a prospectus) with the United States Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the

prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC website at

www.sec.gov. Alternatively, the Company, the agent or any dealer participating in the offering will arrange to send you the prospectus if you request it by contacting the Chief Financial Officer of Village Farms International, Inc. at 4700-80th

Street, Delta, British Columbia, Canada, V4K 3N3 or toll-free at 1 (877) 777-7718.

A final base shelf prospectus containing important information

relating to the securities described in this document has been filed with the securities regulatory authorities in each of the provinces of Canada, other than Quebec (the “Qualifying Jurisdictions”). A copy of the final base shelf

prospectus, any amendment to the final base shelf prospectus and any applicable shelf prospectus supplement that has been filed, is required to be delivered with this document.

This document does not provide full disclosure of all material facts relating to the securities offered. Investors should read the final base shelf

prospectus, any amendment and any applicable shelf prospectus supplement for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

|

|

|

|

|

Issuer:

|

|

Village Farms International, Inc. (the “Company”).

|

|

|

|

|

Offering:

|

|

3,125,000 common shares (the “Offered Shares”) in the capital of the Company (the “Offering”).

|

|

|

|

|

Offering Price:

|

|

$3.20 per Offered Share (the “Issue Price”).

|

|

|

|

|

Gross Proceeds:

|

|

$10,000,000.

|

|

|

|

|

Over-Allotment Option:

|

|

The Company has granted the Underwriter (as defined below) an option (the “Over-Allotment Option”), exercisable, in whole or in part, by the Underwriter, at any time and from time to time up to 30 days following the

Closing Date (as defined below), to purchase up to an additional number of Offered Shares (the “Additional Shares”) equal to 15% of the number of Offered Shares sold pursuant to the Offering at a price per Additional Share equal to

the Issue Price to cover over-allotments, if any, and for market stabilization purposes.

|

|

|

|

|

Use of Proceeds:

|

|

The Company intends to use the net proceeds for working capital and general corporate purposes.

|

|

|

|

|

Form of Offering:

|

|

Underwritten public offering by way of a prospectus supplement to the Company’s base shelf prospectus dated June 20, 2019, in each of the Qualifying Jurisdictions, and a prospectus supplement to the base shelf prospectus

under the Company’s effective registration statement on Form F-10 (File No. 333-232115) previously filed with the U.S. Securities and Exchange Commission, and

by way of private placement to eligible purchasers resident in jurisdictions other than the Qualifying Jurisdictions and the United States that are mutually agreed to by the Company and the Underwriter, each acting reasonably, provided that the

Company will not be required to become registered or file a prospectus or registration statement or similar document in such jurisdictions.

|

|

|

|

|

Eligibility:

|

|

The Offered Shares will be eligible for investment under certain statutes as well as for RRSPs, RRIFs, RESPs, DPSPs and TFSAs.

|

|

|

|

|

|

Village Farms International, Inc.

Underwritten Public Offering of Common Shares

Term

Sheet

|

|

March 19, 2020

|

|

|

|

|

|

Listing:

|

|

The Company shall obtain the necessary approvals to list the Offered Shares under the Company’s trading symbol “VFF” on the Toronto Stock Exchange, which listing shall be conditionally approved prior to the Closing

Date. The Company shall also make the necessary notification(s) in respect of the Offering to The NASDAQ Stock Market LLC.

|

|

|

|

|

Underwriter:

|

|

Beacon Securities Limited (the “Underwriter”).

|

|

|

|

|

Underwriter’s Compensation:

|

|

6% cash fee.

|

|

|

|

|

Closing Date:

|

|

On or about March 24, 2020 or such other date as mutually agreed to in writing by the Underwriter and the Company, each acting reasonably.

|

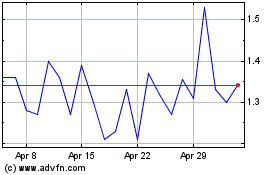

Village Farms (NASDAQ:VFF)

Historical Stock Chart

From Mar 2024 to Apr 2024

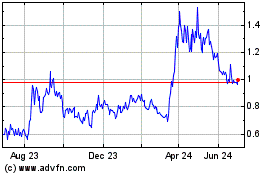

Village Farms (NASDAQ:VFF)

Historical Stock Chart

From Apr 2023 to Apr 2024