Additional Proxy Soliciting Materials (definitive) (defa14a)

April 09 2019 - 4:51PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant

to Section 14(a) of the

Securities Exchange Act

of 1934

Filed by the Registrant

x

Filed by a Party other

than the Registrant

¨

Check the appropriate box:

|

|

¨

|

Preliminary

Proxy Statement

|

|

|

¨

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive

Proxy Statement

|

|

|

x

|

Definitive

Additional Materials

|

|

|

¨

|

Soliciting

Material Pursuant to § 240.14a-12

|

VILLAGE

BANK AND TRUST FINANCIAL CORP.

(Name of Registrant

as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check

the appropriate box):

|

|

¨

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it

was determined:)

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

¨

|

Fee

paid previously with preliminary materials.

|

|

¨

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify

the previous filing by registration statement number, or the Form or Schedule and the

date of its filing.

|

|

|

1)

|

Amount

Previously Paid:

|

|

|

2)

|

Form,

Schedule or Registration Statement No.:

|

April 8, 2019

Dear Shareholder,

During the second half of 2018, we hit our stride. Over the

four quarters of 2018, we successfully combined strong loan and deposit growth with net interest margin expansion and stable noninterest

expenses to produce substantial growth in pretax income. The reduction in the corporate tax rates made a good year even better.

The result was record pretax earnings for the Company, 154% growth in pretax earnings over 2017, and a return on average equity

of 10.96% for the second half of the year.

We intend to build on this positive momentum during 2019. Our

fourth quarter earnings release described actions we took during the fourth quarter of 2018 to control expenses and grow earnings

in the coming year. We will have to accomplish our objectives in an economic environment that has slowed noticeably from the strong

pace we were experiencing during most of 2018, but businesses are still growing and borrowing. We expect to take share from our

larger competitors who are going through mergers and strategy changes. We are optimistic about 2019.

Our Williamsburg Advisory Board has been a significant factor

in our early success in that market. As previously noted, we have been earning a profit in that market since August of 2018. We

hired the right people for our team, and they put together an Advisory Board that is exceptionally well respected in the community

and working on our behalf to make us visible and to bring us business. Congratulations to Bill Carr (our Peninsula market President),

Channing Hall (our Advisory Board Chair) and Bill Hamner (our Advisory Board Vice Chair) and their associates on the excellent

first full year of operations.

We have a corporate board that is functioning at a very high

level right now. Over the past two years, we have reduced the size of our board and welcomed two new directors. The fresh perspectives

of our new directors have helped us look at opportunities and challenges in a different light. All of this has been healthy for

us and is helping our board execute its governance role and support our growth objectives.

We have intensified the board’s work in generating business

referrals, and we have built a robust risk management process that includes a bank-level Board Risk Committee on which all members

serve. We would like to acknowledge the work of Randy Whittemore and Jay Hendricks in standing up the Board Risk Committee. Randy

serves as the Chair of this committee and has made an enormous commitment of time to his board duties. As our Chief Risk Officer

and Chief Operating Officer, Jay has been the lead architect of our enterprise risk management process. His is an unusual talent

to have in a community bank. He does the heavy lifting for the Board Risk Committee for our management team. The risk management

work of a community bank is more complicated and mission critical than ever. It is essential that we do it well and that we have

smart, disciplined people on point for our efforts. We are fortunate to have Jay and Randy involved in this work.

As we acknowledged in our fourth quarter earnings release, we

still have work to do to produce the consistent high returns and sustainable earnings growth we aspire to achieve. We expect to

make more progress in 2019.

We hope to see you at the shareholders meeting on May 21, 2019,

and thank you for your continued support.

Regards,

|

|

|

William G. Foster

|

Craig D. Bell

|

|

President and Chief Executive Officer

|

Chairman, Board of Directors

|

Forward-Looking Statements

In addition to historical information, this letter may contain

forward-looking statements. For this purpose, any statement that is not a statement of historical fact may be deemed to be a forward-looking

statement. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, and actual results could differ

materially from historical results or those anticipated by such statements. There are many factors that could cause actual results

to differ materially from those expressed in the forward-looking statements including, but not limited to, changes in interest

rates, the effects of future economic, business and market conditions, legislative and regulatory changes, governmental monetary

and fiscal policies, changes in accounting policies, rules and practices, and other factors described from time to time in our

reports filed with the Securities and Exchange Commission (“SEC”). For further information, contact Donald M. Kaloski,

Jr., Executive Vice President and Chief Financial Officer, at 804-897-3900 or dkaloski@villagebank.com.

Additional Information

This letter may be deemed to be solicitation material in respect

of the Company’s 2019 annual meeting of shareholders. The Company filed a definitive proxy statement with the SEC on

April 8, 2019 in connection with the annual meeting. Shareholders are urged to read the proxy statement and any other relevant

documents that the Company files with the SEC because they will contain important information. The Company, its directors

and certain of its executive officers will be participants in the solicitation of proxies from shareholders in connection with

the annual meeting. Information about the Company’s directors and executive officers is included in the proxy statement.

Investors and shareholders may obtain a copy of the proxy statement and other documents filed by the Company free of charge from

the SEC’s website at www.sec.gov. Shareholders may obtain a copy of the proxy statement free of charge by writing to the

Company’s Corporate Secretary, Deborah M. Golding, whose address is P.O. Box 330, Midlothian, Virginia, 23113-0330, or from

the Company’s website at www.villagebank.com.

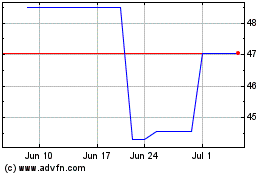

Village Bank and Trust F... (NASDAQ:VBFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

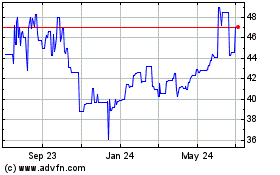

Village Bank and Trust F... (NASDAQ:VBFC)

Historical Stock Chart

From Apr 2023 to Apr 2024