Viemed Healthcare, Inc. (the “Company” or “Viemed”) (NASDAQ:VMD and

TSX:VMD.TO), a national leader in respiratory care and

technology-enabled home medical equipment services, announced today

that it has reported its financial results for the three and nine

months ended September 30, 2022.

Operational highlights (all dollar

amounts are USD):

- Net revenues attributable to the

Company's core business for the quarter ended September 30, 2022

were $35.8 million, a new Company record, and an increase of $7.9

million, or 28%, over core net revenues reported for the comparable

quarter ended September 30, 2021. This represents 7% sequential

growth in core revenue over the quarter ended June 30, 2022.

- Through September 30, 2022, the

Company has repurchased and cancelled 1,673,620 common shares under

the share repurchase program at a cost of $8.9 million,

representing an average buyback price of $5.29 per share.

- The Company grew its ventilator

patient count to 9,127, an 11% increase over the September 30, 2021

ventilator patient count, representing the highest year-over-year

growth rate since the beginning of the COVID-19 pandemic.

- Adjusted EBITDA for the quarter

ended September 30, 2022 totaled $7.0 million and Adjusted EBITDA

for the nine months ended September 30, 2022 totaled $20.7 million.

A reconciliation of reported non-GAAP financial measures to their

most directly comparable U.S. GAAP financial measures can be found

in the tables accompanying this press release.

- The Company had a cash balance of

$21.5 million at September 30, 2022 ($28.4 million at December 31,

2021) and an overall working capital balance of $22.3 million at

September 30, 2022 ($29.5 million at December 31, 2021). Total

long-term debt as of September 30, 2022 was $4.2 million ($4.3

million at December 31, 2021).

- The Company expects to generate net

revenues of approximately $37.1 million to $38.1 million during the

fourth quarter of 2022.

“Our impressive third quarter financial results

reflect robust growth and the team’s disciplined execution of

strategy,” said Casey Hoyt, Viemed’s CEO. “The momentum behind

patient and service expansion continues to exceed expectations and

we have successfully reversed margin compression in EBITDA. Looking

forward, our inflation-adjusted reimbursement environment combined

with tactical cost containment initiatives have the Company

incredibly well positioned to outperform during the upcoming

business cycle.”

Conference Call Details

The Company will host a conference call to

discuss second quarter results on Wednesday, November 2, 2022 at

11:00 a.m. ET.

Interested parties may participate in the call by dialing:

877-407-6176 (US Toll-Free)201-689-8451 (International)

Live Audio Webcast:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=cVEbVBdL

Following the conclusion of the call, an audio recording and

transcript of the call can be accessed on the Company's

website.

ABOUT VIEMED HEALTHCARE, INC.

Viemed is a provider of in-home medical

equipment and post-acute respiratory healthcare services in the

United States. Viemed’s service offerings are focused on effective

in-home treatment with clinical practitioners providing therapy and

counseling to patients in their homes using cutting edge

technology. Visit our website at www.viemed.com.

For further information, please contact:

Glen AkselrodBristol Capital905-326-1888glen@bristolir.com

Todd ZehnderChief Operating OfficerViemed Healthcare,

Inc.337-504-3802investorinfo@viemed.com

Forward-Looking Statements

Certain statements contained in this press

release may constitute “forward-looking statements” within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995 or “forward-looking information” as such term is defined in

applicable Canadian securities legislation (collectively,

“forward-looking statements”). Often, but not always,

forward-looking statements can be identified by the use of words

such as “plans”, “expects”, “is expected”, “budget”, “potential”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”,

“believes”, or “projects”, or the negatives thereof or variations

of such words and phrases or statements that certain actions,

events or results “will”, “should”, “may”, “could”, “would”,

“might” or “will be taken”, “occur” or “be achieved” or the

negative of these terms or comparable terminology. All statements

other than statements of historical fact, including those that

express, or involve discussions as to, expectations, beliefs,

plans, objectives, assumptions or future events or performance,

including the Company's net revenue guidance for the fourth

quarter, are not historical facts and may be forward-looking

statements and may involve estimates, assumptions and uncertainties

that could cause actual results or outcomes to differ materially

from those expressed in the forward-looking statements. Such

statements reflect the Company's current views and intentions with

respect to future events, and current information available to the

Company, and are subject to certain risks, uncertainties and

assumptions. Many factors could cause the actual results,

performance or achievements that may be expressed or implied by

such forward-looking statements to vary from those described herein

should one or more of these risks or uncertainties materialize.

These factors include, without limitation: the general business,

market and economic conditions in the regions in which the Company

operates; the impact of the COVID-19 pandemic and the actions taken

by governmental authorities, individuals and companies in response

to the pandemic on our business, financial condition and results of

operations, including on the Company's patient base, revenues,

employees, and equipment and supplies; significant capital

requirements and operating risks that the Company may be subject

to; the ability of the Company to implement business strategies and

pursue business opportunities; volatility in the market price of

the Company's common shares; the Company’s novel business model;

the risk that the clinical application of treatments that

demonstrate positive results in a study may not be positively

replicated or that such test results may not be predictive of

actual treatment results or may not result in the adoption of such

treatments by providers; the state of the capital markets; the

availability of funds and resources to pursue operations;

reductions in reimbursement rates and audits of reimbursement

claims by various governmental and private payor entities;

dependence on few payors; possible new drug discoveries; dependence

on key suppliers and the recall of certain Royal Philips BiPAP and

CPAP devices and ventilators that we distribute and sell; granting

of permits and licenses in a highly regulated business;

competition; low profit market segments; disruptions in or attacks

(including cyber-attacks) on the Company's information technology,

internet, network access or other voice or data communications

systems or services; the evolution of various types of fraud or

other criminal behavior to which the Company is exposed; the

failure of third parties to comply with their obligations;

difficulty integrating newly acquired businesses; the impact of new

and changes to, or application of, current laws and regulations;

the overall difficult litigation and regulatory environment;

increased competition; changes in foreign currency rates; increased

funding costs and market volatility due to market illiquidity and

competition for funding; critical accounting estimates and changes

to accounting standards, policies, and methods used by the Company;

the Company’s status as an emerging growth company and a smaller

reporting company; and the occurrence of natural and unnatural

catastrophic events or health epidemics or concerns, such as the

COVID-19 pandemic, and claims resulting from such events or

concerns; as well as those risk factors discussed or referred to in

the Company’s disclosure documents filed with the U.S. Securities

and Exchange Commission (the “SEC”) available on the SEC’s website

at www.sec.gov, including the Company’s most recent Annual Report

on Form 10-K and Quarterly Report on Form 10-Q, and with the

securities regulatory authorities in certain provinces of Canada

available at www.sedar.com. Should any factor affect the Company in

an unexpected manner, or should assumptions underlying the

forward-looking statements prove incorrect, the actual results or

events may differ materially from the results or events predicted.

Any such forward-looking statements are expressly qualified in

their entirety by this cautionary statement. Moreover, the Company

does not assume responsibility for the accuracy or completeness of

such forward-looking statements. The forward-looking statements

included in this press release are made as of the date of this

press release and the Company undertakes no obligation to publicly

update or revise any forward-looking statements, other than as

required by applicable law.

VIEMED HEALTHCARE,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(Expressed in thousands of U.S. Dollars,

except share amounts)(Unaudited)

| |

|

AtSeptember 30, 2022 |

|

AtDecember 31, 2021 |

| ASSETS |

|

|

|

|

| Current

assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

21,478 |

|

$ |

28,408 |

|

|

Accounts receivable, net of allowance for doubtful accounts of

$8,516 and $7,031 at September 30, 2022 and December 31, 2021,

respectively |

|

|

14,982 |

|

|

12,823 |

|

|

Inventory, net of inventory reserve of $0 and $1,418 at September

30, 2022 and December 31, 2021, respectively |

|

|

3,178 |

|

|

2,457 |

|

|

Income tax receivable |

|

|

91 |

|

|

1,893 |

|

|

Prepaid expenses and other assets |

|

|

3,135 |

|

|

1,729 |

|

| Total current

assets |

|

$ |

42,864 |

|

$ |

47,310 |

|

| Long-term

assets |

|

|

|

|

|

Property and equipment, net |

|

|

68,109 |

|

|

62,846 |

|

|

Equity investments |

|

|

2,220 |

|

|

2,157 |

|

|

Deferred tax asset |

|

|

3,925 |

|

|

4,787 |

|

|

Other long-term assets |

|

|

2,301 |

|

|

862 |

|

| Total long-term

assets |

|

$ |

76,555 |

|

$ |

70,652 |

|

| TOTAL

ASSETS |

|

$ |

119,419 |

|

$ |

117,962 |

|

| |

|

|

|

|

|

LIABILITIES |

|

|

|

|

| Current

liabilities |

|

|

|

|

|

Trade payables |

|

$ |

3,737 |

|

$ |

3,239 |

|

|

Deferred revenue |

|

|

4,645 |

|

|

3,753 |

|

|

Accrued liabilities |

|

|

11,789 |

|

|

8,875 |

|

|

Current portion of lease liabilities |

|

|

220 |

|

|

464 |

|

|

Current portion of long-term debt |

|

|

165 |

|

|

1,480 |

|

| Total current

liabilities |

|

$ |

20,556 |

|

$ |

17,811 |

|

| Long-term

liabilities |

|

|

|

|

|

Accrued liabilities |

|

|

562 |

|

|

757 |

|

|

Long-term lease liabilities |

|

|

236 |

|

|

268 |

|

|

Long-term debt |

|

|

4,156 |

|

|

4,306 |

|

| Total long-term

liabilities |

|

$ |

4,954 |

|

$ |

5,331 |

|

| TOTAL

LIABILITIES |

|

$ |

25,510 |

|

$ |

23,142 |

|

| |

|

|

|

|

| Commitments and

Contingencies |

|

|

— |

|

|

— |

|

| |

|

|

|

|

| SHAREHOLDERS'

EQUITY |

|

|

|

|

|

Common stock - No par value: unlimited authorized; 38,102,547 and

39,640,388 issued and outstanding as of September 30, 2022 and

December 31, 2021, respectively |

|

|

14,927 |

|

|

14,014 |

|

|

Additional paid-in capital |

|

|

10,808 |

|

|

7,749 |

|

|

Accumulated other comprehensive loss |

|

|

56 |

|

|

(278 |

) |

|

Retained earnings |

|

|

68,118 |

|

|

73,335 |

|

| TOTAL SHAREHOLDERS'

EQUITY |

|

$ |

93,909 |

|

$ |

94,820 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

$ |

119,419 |

|

$ |

117,962 |

|

VIEMED HEALTHCARE,

INC.CONDENSED CONSOLIDATED STATEMENTS OF INCOME

AND COMPREHENSIVE INCOME(Expressed in thousands of

U.S. Dollars, except outstanding shares and per share

amounts)(Unaudited)

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

Revenue |

$ |

35,759 |

|

|

$ |

29,285 |

|

|

$ |

101,324 |

|

|

$ |

85,100 |

|

| |

|

|

|

|

|

|

|

| Cost of revenue |

|

14,108 |

|

|

|

10,904 |

|

|

|

39,540 |

|

|

|

31,352 |

|

| |

|

|

|

|

|

|

|

| Gross

profit |

$ |

21,651 |

|

|

$ |

18,381 |

|

|

$ |

61,784 |

|

|

$ |

53,748 |

|

| |

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

17,677 |

|

|

|

13,260 |

|

|

|

50,989 |

|

|

|

40,653 |

|

|

Research and development |

|

670 |

|

|

|

576 |

|

|

|

1,974 |

|

|

|

1,498 |

|

|

Stock-based compensation |

|

1,309 |

|

|

|

1,302 |

|

|

|

3,885 |

|

|

|

3,845 |

|

|

Depreciation |

|

291 |

|

|

|

211 |

|

|

|

771 |

|

|

|

618 |

|

|

Loss on disposal of property and equipment |

|

292 |

|

|

|

145 |

|

|

|

168 |

|

|

|

304 |

|

|

Other expense (income) |

|

(57 |

) |

|

|

(32 |

) |

|

|

(721 |

) |

|

|

(85 |

) |

| Income from

operations |

$ |

1,469 |

|

|

$ |

2,919 |

|

|

$ |

4,718 |

|

|

$ |

6,915 |

|

| |

|

|

|

|

|

|

|

| Non-operating income

and expenses |

|

|

|

|

|

|

|

|

Income from equity method investments |

|

84 |

|

|

|

331 |

|

|

|

853 |

|

|

|

782 |

|

|

Interest expense, net of interest income |

|

(42 |

) |

|

|

(75 |

) |

|

|

(165 |

) |

|

|

(249 |

) |

| |

|

|

|

|

|

|

|

| Net income before

taxes |

|

1,511 |

|

|

|

3,175 |

|

|

|

5,406 |

|

|

|

7,448 |

|

|

Provision for income taxes |

|

456 |

|

|

|

1,386 |

|

|

|

1,622 |

|

|

|

2,409 |

|

| |

|

|

|

|

|

|

|

| Net

income |

$ |

1,055 |

|

|

$ |

1,789 |

|

|

$ |

3,784 |

|

|

$ |

5,039 |

|

| |

|

|

|

|

|

|

|

| Other comprehensive

income |

|

|

|

|

|

|

|

|

Change in unrealized gain/loss on derivative instruments, net of

tax |

|

112 |

|

|

|

21 |

|

|

|

334 |

|

|

|

121 |

|

| Other comprehensive

income |

$ |

112 |

|

|

$ |

21 |

|

|

$ |

334 |

|

|

$ |

121 |

|

| |

|

|

|

|

|

|

|

| Comprehensive

income |

$ |

1,167 |

|

|

$ |

1,810 |

|

|

$ |

4,118 |

|

|

$ |

5,160 |

|

| |

|

|

|

|

|

|

|

| Net income per

share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.03 |

|

|

$ |

0.05 |

|

|

$ |

0.10 |

|

|

$ |

0.13 |

|

|

Diluted |

$ |

0.03 |

|

|

$ |

0.04 |

|

|

$ |

0.09 |

|

|

$ |

0.12 |

|

| |

|

|

|

|

|

|

|

| Weighted average

number of common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

38,232,788 |

|

|

|

39,607,540 |

|

|

|

38,870,949 |

|

|

|

39,442,088 |

|

|

Diluted |

|

39,583,438 |

|

|

|

40,659,353 |

|

|

|

39,852,297 |

|

|

|

40,716,747 |

|

VIEMED HEALTHCARE,

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(Expressed in thousands of U.S.

Dollars)(Unaudited)

| |

|

Nine Months Ended September 30, |

| |

|

2022 |

|

2021 |

| Cash flows from

operating activities |

|

|

|

|

|

Net income |

|

$ |

3,784 |

|

|

$ |

5,039 |

|

| Adjustments for: |

|

|

|

|

|

Depreciation |

|

|

11,257 |

|

|

|

8,192 |

|

|

Provision for uncollectible accounts |

|

|

7,811 |

|

|

|

5,250 |

|

|

Change in inventory reserve |

|

|

(1,418 |

) |

|

|

(116 |

) |

|

Share-based compensation expense |

|

|

3,885 |

|

|

|

3,845 |

|

|

Distributions of earnings received from equity method

investments |

|

|

931 |

|

|

|

172 |

|

|

Income from equity method investments |

|

|

(853 |

) |

|

|

(782 |

) |

|

Loss on disposal of property and equipment |

|

|

168 |

|

|

|

304 |

|

|

Deferred income tax expense |

|

|

745 |

|

|

|

2,410 |

|

| Net change in working

capital |

|

|

|

|

|

Increase in accounts receivable |

|

|

(9,970 |

) |

|

|

(5,573 |

) |

|

Decrease (increase) in inventory |

|

|

697 |

|

|

|

(196 |

) |

|

Increase in prepaid expenses and other assets |

|

|

(2,870 |

) |

|

|

(2,259 |

) |

|

Increase in trade payables |

|

|

33 |

|

|

|

2,638 |

|

|

Increase in deferred revenue |

|

|

892 |

|

|

|

386 |

|

|

Increase (decrease) in accrued liabilities |

|

|

3,170 |

|

|

|

(3,711 |

) |

|

Change in income tax payable/receivable |

|

|

1,802 |

|

|

|

(1,760 |

) |

| Net cash provided by

operating activities |

|

$ |

20,064 |

|

|

$ |

13,839 |

|

| |

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

|

Purchase of property and equipment |

|

|

(17,326 |

) |

|

|

(13,080 |

) |

|

Investment in equity investments |

|

|

(141 |

) |

|

|

(599 |

) |

|

Proceeds from sale of property and equipment |

|

|

869 |

|

|

|

496 |

|

| Net cash used in

investing activities |

|

$ |

(16,598 |

) |

|

$ |

(13,183 |

) |

| |

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

Proceeds from exercise of options |

|

|

87 |

|

|

|

112 |

|

|

Principal payments on notes payable |

|

|

(119 |

) |

|

|

(113 |

) |

|

Principal payments on term note |

|

|

(1,321 |

) |

|

|

(1,255 |

) |

|

Shares redeemed to pay income tax |

|

|

(143 |

) |

|

|

(1,434 |

) |

|

Shares repurchased under the share repurchase program |

|

|

(8,858 |

) |

|

|

— |

|

|

Repayments of lease liabilities |

|

|

(42 |

) |

|

|

(2,080 |

) |

| Net cash used in

financing activities |

|

$ |

(10,396 |

) |

|

$ |

(4,770 |

) |

| |

|

|

|

|

| Net decrease in cash

and cash equivalents |

|

|

(6,930 |

) |

|

|

(4,114 |

) |

| Cash and cash

equivalents at beginning of year |

|

|

28,408 |

|

|

|

30,981 |

|

| Cash and cash

equivalents at end of period |

|

$ |

21,478 |

|

|

$ |

26,867 |

|

| |

|

|

|

|

| Supplemental

disclosures of cash flow information |

|

|

|

|

|

Cash paid during the period for interest |

|

$ |

185 |

|

|

$ |

278 |

|

|

Cash paid (received) during the period for income taxes, net of

refunds |

|

$ |

(920 |

) |

|

$ |

1,760 |

|

| Supplemental

disclosures of non-cash transactions |

|

|

|

|

|

Net non-cash changes to finance leases |

|

$ |

— |

|

|

$ |

42 |

|

|

Net non-cash changes to operating leases |

|

$ |

150 |

|

|

$ |

372 |

|

Non-GAAP Financial Measures

This press release refers to “Adjusted EBITDA”

which is a non-GAAP financial measure that does not have a

standardized meaning prescribed by U.S. GAAP. The Company's

presentation of this financial measure may not be comparable to

similarly titled measures used by other companies. Adjusted EBITDA

is defined as net income (loss) before interest expense, income tax

expense (benefit), depreciation, and stock-based compensation.

Management believes Adjusted EBITDA provides helpful information

with respect to the Company’s operating performance as viewed by

management, including a view of the Company’s business that is not

dependent on the impact of the Company’s capitalization structure

and items that are not part of the Company’s day-to-day operations.

Management uses Adjusted EBITDA (i) to compare the Company’s

operating performance on a consistent basis, (ii) to calculate

incentive compensation for the Company’s employees, (iii) for

planning purposes, including the preparation of the Company’s

internal annual operating budget, and (iv) to evaluate the

performance and effectiveness of the Company’s operational

strategies. Accordingly, management believes that Adjusted EBITDA

provides useful information in understanding and evaluating the

Company’s operating performance in the same manner as management.

The following table is a reconciliation of net income (loss), the

most directly comparable U.S. GAAP measure, to Adjusted EBITDA, on

a historical basis for the periods indicated:

VIEMED HEALTHCARE,

INC.Reconciliation of Net Income to Non-GAAP

Adjusted EBITDA(Expressed in thousands of U.S.

Dollars)(Unaudited)

|

For the quarter ended |

September 30, 2022 |

June 30, 2022 |

March 31, 2022 |

December 31, 2021 |

September 30, 2021 |

June 30, 2021 |

March 31, 2021 |

December 31, 2020 |

|

Net Income |

$ |

1,055 |

$ |

967 |

$ |

1,762 |

$ |

4,087 |

$ |

1,789 |

$ |

1,566 |

$ |

1,684 |

|

$ |

5,071 |

| Add back: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

4,120 |

|

3,740 |

|

3,397 |

|

3,120 |

|

2,867 |

|

2,716 |

|

2,609 |

|

|

2,835 |

|

Interest expense |

|

42 |

|

59 |

|

64 |

|

69 |

|

75 |

|

83 |

|

91 |

|

|

100 |

|

Stock-based compensation |

|

1,309 |

|

1,271 |

|

1,305 |

|

1,305 |

|

1,302 |

|

1,236 |

|

1,307 |

|

|

1,301 |

|

Income tax expense (benefit) |

|

456 |

|

421 |

|

745 |

|

968 |

|

1,386 |

|

1,246 |

|

(223 |

) |

|

151 |

|

Adjusted EBITDA |

$ |

6,982 |

$ |

6,458 |

$ |

7,273 |

$ |

9,549 |

$ |

7,419 |

$ |

6,847 |

$ |

5,468 |

|

$ |

9,458 |

|

|

|

Three Months Ended September 30, 2022 |

|

Nine Months Ended September 30, 2022 |

|

Net Income |

|

$ |

1,055 |

|

$ |

3,784 |

| Add back: |

|

|

|

|

|

Depreciation |

|

|

4,120 |

|

|

11,257 |

|

Interest expense |

|

|

42 |

|

|

165 |

|

Stock-based compensation |

|

|

1,309 |

|

|

3,885 |

|

Income tax expense (benefit) |

|

|

456 |

|

|

1,622 |

|

Adjusted EBITDA |

|

$ |

6,982 |

|

$ |

20,713 |

Use of Non-GAAP Financial Measures

Adjusted EBITDA should be considered in addition

to, not as a substitute for, or superior to, financial measures

calculated in accordance with U.S. GAAP. It is not a measurement of

the Company’s financial performance under U.S. GAAP and should not

be considered as an alternative to revenue or net income, as

applicable, or any other performance measures derived in accordance

with U.S. GAAP and may not be comparable to other similarly titled

measures of other businesses. Adjusted EBITDA has limitations as an

analytical tool and you should not consider it in isolation or as a

substitute for analysis of the Company’s operating results as

reported under U.S. GAAP. Adjusted EBITDA does not reflect the

impact of certain cash charges resulting from matters the Company

considers not to be indicative of ongoing operations; and other

companies in the Company’s industry may calculate Adjusted EBITDA

differently than we do, limiting its usefulness as a comparative

measure.

VIEMED HEALTHCARE,

INC.Key Financial and Operational

Information(Expressed in thousands of U.S.

Dollars, except vent

patients)(Unaudited)

|

For the quarter ended |

September 30,2022 |

June 30,2022 |

March 31,2022 |

December 31, 2021 |

September 30,2021 |

June 30,2021 |

March 31,2021 |

December 31,2020 |

| Financial

Information: |

|

|

|

|

|

|

|

|

Revenue |

$ |

35,759 |

|

$ |

33,310 |

|

$ |

32,255 |

|

$ |

31,962 |

|

$ |

29,285 |

|

$ |

27,399 |

|

$ |

28,416 |

|

$ |

31,202 |

|

| Gross Profit |

$ |

21,651 |

|

$ |

20,390 |

|

$ |

19,743 |

|

$ |

19,662 |

|

$ |

18,381 |

|

$ |

17,625 |

|

$ |

17,742 |

|

$ |

19,178 |

|

| Gross Profit % |

|

61 |

% |

|

61 |

% |

|

61 |

% |

|

62 |

% |

|

63 |

% |

|

64 |

% |

|

62 |

% |

|

61 |

% |

| Net Income |

$ |

1,055 |

|

$ |

967 |

|

$ |

1,762 |

|

$ |

4,087 |

|

$ |

1,789 |

|

$ |

1,566 |

|

$ |

1,684 |

|

$ |

5,071 |

|

| Cash (As of) |

$ |

21,478 |

|

$ |

21,922 |

|

$ |

29,248 |

|

$ |

28,408 |

|

$ |

26,867 |

|

$ |

31,151 |

|

$ |

31,097 |

|

$ |

30,981 |

|

| Total Assets (As of) |

$ |

119,419 |

|

$ |

115,904 |

|

$ |

119,007 |

|

$ |

117,962 |

|

$ |

115,486 |

|

$ |

111,014 |

|

$ |

113,001 |

|

$ |

112,560 |

|

| Adjusted EBITDA(1) |

$ |

6,982 |

|

$ |

6,458 |

|

$ |

7,273 |

|

$ |

9,549 |

|

$ |

7,419 |

|

$ |

6,847 |

|

$ |

5,468 |

|

$ |

9,458 |

|

|

Operational Information: |

|

|

|

|

|

|

|

| Vent Patients(2) |

|

9,127 |

|

|

8,837 |

|

|

8,434 |

|

|

8,405 |

|

|

8,200 |

|

|

8,103 |

|

|

7,733 |

|

|

7,892 |

|

(1)Refer to "Non-GAAP Financial Measures"

section above for definition of Adjusted EBITDA.

(2)Vent Patients represents the number of active

ventilator patients on recurring billing service at the end of each

calendar quarter.

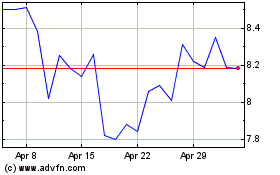

VieMed Healthcare (NASDAQ:VMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

VieMed Healthcare (NASDAQ:VMD)

Historical Stock Chart

From Apr 2023 to Apr 2024