First Quarter 2018

Highlights1

Victory Capital Holdings, Inc. (NASDAQ:VCTR) (“Victory Capital” or

the “Company”) today reported its results for the first quarter

ended March 31, 2018.

“In a quarter that marked a return to volatility

for the equity markets, I am pleased to report that Victory Capital

delivered very solid results, said David Brown, Chairman and Chief

Executive Officer. Our Investment Franchises and Solutions Platform

continued to deliver compelling long-term investment performance,

gross flows for the quarter remained robust at $3.7 billion, and

operating margins were strong.

“We continue to achieve strong momentum in our

Solutions Platform, including our VictoryShares ETFs. AUM in our

ETFs grew to $2.7 billion, an increase of nearly 19% quarter over

quarter, and we expect client demand for rules-based strategic beta

strategies to continue to grow throughout 2018.

“Total AUM was $60.9 billion as of March 31,

2018, an 8% increase from March 31, 2017. AUM declined from $61.8

billion at December 31, 2017, due to market depreciation and net

outflows of $633 million for the quarter. Given the elevated level

of client rebalancing activity we experienced and the lumpiness of

our business quarter to quarter with respect to flows, the outflows

were not outside our expectations. These results follow a

net-flow-positive Q4 2017, highlighting the importance of looking

at flows on an annual basis versus quarter to quarter.

“Looking ahead, we remain committed to creating

long-term value for our shareholders through the disciplined

execution of our corporate vision, which combines strategic

acquisitions with organic growth. We believe our next generation,

integrated multi-boutique business model is attractive to

investment firms looking for a strategic partner, and we have an

active pipeline of potential M&A opportunities. Additionally,

we continue to focus on growing organically by leveraging the

capabilities of our Franchises and Solutions Platform. Our

“won-but-not-funded” pipeline is healthy as are our overall sales

prospects. As in the past, serving the needs of our clients remains

our top priority.”

1 Adjusted measures are non-GAAP financial

measures. An explanation of these non-GAAP financial measures

is included under the heading “Information Regarding Non-GAAP

Financial Measures” at the end of this press release. Please

see the non-GAAP reconciliation tables.

The table below presents AUM, and certain GAAP and non-GAAP

(“adjusted”) financial results.

| |

|

|

|

|

| (in

millions except per share amounts or as otherwise

noted) |

|

|

|

|

| |

|

|

|

|

|

|

| |

|

For the Three Months Ended |

| |

|

March 31, |

|

December 31, |

|

March 31, |

| |

|

2018 |

|

2017 |

|

2017 |

| Assets

Under Management |

|

|

|

|

|

| |

Ending |

$ |

60,855 |

|

|

$ |

61,771 |

|

|

$ |

56,622 |

|

| |

Average |

|

62,020 |

|

|

|

60,354 |

|

|

|

56,277 |

|

| |

|

|

|

|

|

|

| Flows |

|

|

|

|

|

| |

Gross |

$ |

3,685 |

|

|

$ |

4,371 |

|

|

$ |

4,725 |

|

| |

Net |

|

(633 |

) |

|

|

294 |

|

|

|

(386 |

) |

| |

Net flows excluding

Diversified Equity(1) |

|

(633 |

) |

|

|

294 |

|

|

|

(54 |

) |

| |

|

|

|

|

|

|

|

Consolidated Financial Results (GAAP) |

|

|

|

|

|

| |

Revenue |

$ |

105.0 |

|

|

$ |

105.6 |

|

|

$ |

100.7 |

|

| |

Operating expenses |

|

77.7 |

|

|

|

78.7 |

|

|

|

81.1 |

|

| |

Income from

operations |

|

27.3 |

|

|

|

26.9 |

|

|

|

19.6 |

|

| |

Operating margin |

|

26.0 |

% |

|

|

25.5 |

% |

|

|

19.4 |

% |

| |

Net income |

|

10.5 |

|

|

|

11.2 |

|

|

|

4.4 |

|

| |

Earnings per diluted

share |

$ |

0.16 |

|

|

$ |

0.19 |

|

|

$ |

0.08 |

|

| |

|

|

|

|

|

|

| Adjusted

Performance Results (Non-GAAP)(2) |

|

|

|

|

|

| |

Adjusted EBITDA |

$ |

39.8 |

|

|

$ |

40.0 |

|

|

$ |

33.6 |

|

| |

Adjusted EBITDA

margin |

|

37.9 |

% |

|

|

37.9 |

% |

|

|

33.4 |

% |

| |

Adjusted net

income |

|

23.1 |

|

|

|

18.1 |

|

|

|

13.0 |

|

| |

Tax benefit of goodwill

and acquired intangibles |

|

3.3 |

|

|

|

5.0 |

|

|

|

4.9 |

|

| |

Adjusted net income

with tax benefit |

|

26.4 |

|

|

|

23.1 |

|

|

|

17.9 |

|

| |

Adjusted net income

with tax benefit per diluted share |

$ |

0.40 |

|

|

$ |

0.39 |

|

|

$ |

0.30 |

|

| |

|

|

|

|

|

|

| (1) In May

2017, the Company made a decision to exit the Diversified

Equity Franchise; all remaining AUM was transferred to the Munder

Capital Management Franchise to manage beginning May 15, 2017. |

| (2)

Adjusted EBITDA and Adjusted Net Income are non-GAAP financial

measures. Reconciliation of each of Adjusted EBITDA and

Adjusted Net Income to net income have been provided in the

non-GAAP reconciliation tables in this press release. An

explanation of these non-GAAP financial measures is included below

under the heading "Information Regarding Non-GAAP Financial

Measures". |

| |

|

AUM, Flows and Investment Performance

Victory Capital’s AUM declined by $0.9 billion

to $60.9 billion at March 31, 2018, compared to $61.8 billion at

December 31, 2017. The decrease was due to market depreciation of

$0.3 billion and net outflows of $0.6 billion. Gross flows for the

first quarter were $3.7 billion.

As of March 31, 2018, Victory Capital offered 72

investment strategies through its nine autonomous Investment

Franchises and Solutions Platform. The table below presents

outperformance against benchmarks by AUM and strategies as of March

31, 2018.

| |

|

|

|

|

|

|

|

|

| |

|

Trailing |

|

Trailing |

|

Trailing |

|

Trailing |

| |

|

1-Year |

|

3-Years |

|

5-Years |

|

10-Years |

| Percentage

of AUM Outperforming Benchmark |

87 |

% |

|

71 |

% |

|

83 |

% |

|

79 |

% |

| Percentage

of Strategies Outperforming Benchmark |

75 |

% |

|

70 |

% |

|

76 |

% |

|

72 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

First Quarter of 2018 Compared to Fourth Quarter of

2017

For the quarter ended March 31, 2018, GAAP net

income declined 6% to $10.5 million, or $0.16 per diluted share,

compared to GAAP net income of $11.2 million, or $0.19 per diluted

share, for the fourth quarter of 2017. GAAP operating margin was

26.0% for the quarter compared to 25.5% for the fourth quarter of

2017. Adjusted Net Income with tax benefit increased 14% to $26.4

million, or $0.40 per diluted share comprised of $0.35 per diluted

share in Adjusted Net Income and $0.05 per diluted share in tax

benefit, compared to $23.1 million, or $0.39 per diluted share

comprised of $0.30 per diluted share in Adjusted Net Income and

$0.09 per diluted share in tax benefit, for the fourth quarter of

2017.

Adjusted EBITDA and Adjusted EBITDA margin were

$39.8 million and 37.9%, respectively, for the first quarter of

2018, essentially flat compared to the fourth quarter of 2017.

- Revenue was $105.0 million, a slight decline from $105.6

million for the fourth quarter of 2017.

- Operating expenses declined to $77.7 million, compared to $78.7

million in the fourth quarter of 2017 due to operating

efficiencies, partially offset by costs associated with the debt

refinancing.

First Quarter of 2018 Compared to First

Quarter of 2017

For the quarter ended March 31, 2018, GAAP net

income was $10.5 million, or $0.16 per diluted share, compared to

$4.4 million, or $0.08 per diluted share, in the first quarter of

2017. GAAP operating margin increased to 26.0% for the quarter from

19.4% for the first quarter of 2017. Adjusted Net Income with tax

benefit increased 47% to $26.4 million, or $0.40 per diluted share

comprised of $0.35 per diluted share in Adjusted Net Income and

$0.05 per diluted share in tax benefit in the first quarter of

2018, compared to $17.9 million, or $0.30 per diluted share

comprised of $0.22 per diluted share in Adjusted Net Income and

$0.08 per diluted share in tax benefit, in the first quarter of

2017.

Adjusted EBITDA and Adjusted EBITDA margin were

$39.8 million and 37.9%, respectively, for the first quarter of

2018, compared to $33.6 million and 33.4%, respectively, for the

first quarter a year ago. Net income, Adjusted Net Income and

Adjusted EBITDA increased due to higher revenue coupled with

operational efficiencies, the successful integration of RS

Investments and, specific to net income and Adjusted Net Income, a

reduction in the tax rate and decreased interest expense during the

quarter as a result of refinancing activities which were partially

offset by one-time write-offs of debt issuance and debt discount

costs.

- Revenue increased $4.3 million to $105.0 million, compared to

$100.7 million for the first quarter of 2017, due to higher average

AUM, partially offset by a decrease in the realized fee rate due to

asset mix.

- Operating expenses decreased 4% to $77.7 million, compared to

$81.1 million in the first quarter of 2017, primarily due to

operational efficiencies and the successful integration of RS

Investments.

Balance Sheet / Capital

Management

Cash and cash equivalents were $12.3 million at

March 31, 2018, compared to $12.9 million at December 31, 2017.

During the quarter, the Company concurrently executed a $166.5

million IPO and $360.0 million debt refinancing which provided the

Company with a 7-year term loan facility and established a 5-year

revolving credit facility with aggregate commitments of $50.0

million. The Company used the net IPO proceeds of $156.5

million, which included the net proceeds from the underwriters’

exercise of their option to purchase additional shares, and $20.2

million of cash on hand to pay debt down from $499.7 million at

year end to $323.0 million at March 31, 2018, a 35% reduction

during the quarter.

Subsequent to quarter-end, the Company paid down

an additional $18.0 million of debt, bringing its term loan balance

to $305.0 million at May 8, 2018. The Company also increased its

revolving credit facility to $100.0 million.

Conference Call, Webcast and Slide

Presentation

The Company will host a conference call and

webcast at 10:00 a.m. Eastern Time today, May 8, 2018, to discuss

its financial results. Analysts and investors may participate

in the question-and-answer session. The call can be accessed via

telephone at (866) 465-5145. A recorded replay can be

accessed through May 22, 2018 by dialing (855) 859-2056; passcode:

6887603.

A slide presentation relating to the first

quarter 2018 results will be accessible prior to the scheduled

conference call. The slide presentation and webcast of the

conference call can be accessed on the Events and Presentations

page of the Company’s investor relations website at

https://ir.vcm.com.

About Victory Capital

Victory Capital is an investment management firm

operating a next-generation, integrated multi-boutique business

model with $60.9 billion in assets under management as of March 31,

2018.

Victory Capital’s differentiated model is

comprised of nine Investment Franchises, each with an independent

culture and investment approach. Additionally, the Company offers a

rules-based Solutions Platform, featuring the VictoryShares ETF

brand, as well as custom and multi-asset class solutions. The

Company’s Investment Franchises and Solutions Platform are

supported by a centralized distribution, marketing and operational

environment, in which the investment professionals can focus on the

pursuit of investment excellence.

Victory Capital provides institutions, financial

advisors and retirement platforms with a variety of asset classes

and investment vehicles, including separately managed accounts,

collective trusts, mutual funds, ETFs and UMA/SMA vehicles.

For more information, please visit

www.vcm.com.

FORWARD-LOOKING

STATEMENTS

This press release may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements may include, without

limitation, any statements preceded by, followed by or including

words such as “target,” “believe,” “expect,” “aim,” “intend,”

“may,” “anticipate,” “assume,” “budget,” “continue,” “estimate,”

“future,” “objective,” “outlook,” “plan,” “potential,” “predict,”

“project,” “will,” “can have,” “likely,” “should,” “would,” “could”

and other words and terms of similar meaning or the negative

thereof. Such forward-looking statements involve known and unknown

risks, uncertainties and other important factors beyond Victory

Capital’s control, as discussed in Victory Capital’s filings with

the SEC, that could cause Victory Capital’s actual results,

performance or achievements to be materially different from the

expected results, performance or achievements expressed or implied

by such forward-looking statements.

Although it is not possible to identify all such

risks and factors, they include, among others, the following:

reductions in AUM based on investment performance, client

withdrawals, difficult market conditions and other factors; the

nature of the Company’s contracts and investment advisory

agreements; the Company’s ability to maintain historical returns

and sustain its historical growth; the Company’s dependence on

third parties to market its strategies and provide products or

services for the operation of its business; the Company’s ability

to retain key investment professionals or members of its senior

management team; the Company’s reliance on the technology systems

supporting its operations; the Company’s ability to successfully

acquire and integrate new companies; the concentration of the

Company’s investments in long-only small- and mid-cap equity and

U.S. clients; risks and uncertainties associated with non-U.S.

investments; the Company’s efforts to establish and develop new

teams and strategies; the ability of the Company’s investment teams

to identify appropriate investment opportunities; the Company’s

ability to limit employee misconduct; the Company’s ability to meet

the guidelines set by its clients; the Company’s exposure to

potential litigation (including administrative or tax proceedings)

or regulatory actions; the Company’s ability to implement effective

information and cyber security policies, procedures and

capabilities; the Company’s substantial indebtedness; the potential

impairment of the Company’s goodwill and intangible assets;

disruption to the operations of third parties whose functions are

integral to the Company’s ETF platform; the Company’s determination

that Victory Capital is not required to register as an "investment

company" under the 1940 Act; the fluctuation of the Company’s

expenses; the Company’s ability to respond to recent trends in the

investment management industry; the level of regulation on

investment management firms and the Company’s ability to respond to

regulatory developments; the competitiveness of the investment

management industry; the dual class structure of the Company’s

common stock; the level of control over the Company retained by

Crestview GP; the Company’s status as an emerging growth company

and a controlled company; and other risks and factors listed under

"Risk Factors" and elsewhere in the Company’s filings with the

SEC.

Such forward-looking statements are based on

numerous assumptions regarding Victory Capital’s present and future

business strategies and the environment in which it will operate in

the future. Any forward-looking statement made in this press

release speaks only as of the date hereof. Except as required by

law, Victory Capital assumes no obligation to update these

forward-looking statements, or to update the reasons actual results

could differ materially from those anticipated in the

forward-looking statements, even if new information becomes

available in the future.

INVESTOR RELATIONS WEBSITE

Victory Capital may use the Investor Relations

section of its website, https://ir.vcm.com, to disclose material

information to investors and the marketplace as a means of

disclosing material, non-public information and for complying with

disclosure obligations under Regulation Fair Disclosure (“Reg

FD”). Victory Capital encourages investors, the media and

other interested parties to visit its investor relations website

regularly.

ContactsInvestors:Lauren Crawford,

310-622-8239lcrawford@finprofiles.com

Media: Tricia Ross, 310-622-8226tross@finprofiles.com

| |

| Victory Capital Holdings, Inc. and

Subsidiaries |

| Unaudited Condensed Consolidated Statements of

Operations |

| (unaudited; in thousands except

shares) |

| |

|

|

|

|

|

| |

For the Three Months Ended |

| |

March 31, |

|

December 31, |

|

March 31, |

| |

2018 |

|

2017 |

|

2017 |

|

Revenue |

|

|

|

|

|

| Investment management

fees |

$ |

89,130 |

|

|

$ |

89,206 |

|

|

$ |

84,115 |

|

| Fund administration and

distribution fees |

|

15,834 |

|

|

|

16,440 |

|

|

|

16,546 |

|

| Total revenue |

|

104,964 |

|

|

|

105,646 |

|

|

|

100,661 |

|

| |

|

|

|

|

|

|

Expenses |

|

|

|

|

|

| Personnel compensation

and benefits |

|

36,803 |

|

|

|

37,339 |

|

|

|

35,650 |

|

| Distribution and other

asset-based expenses |

|

25,161 |

|

|

|

25,213 |

|

|

|

26,881 |

|

| General and

administrative |

|

9,056 |

|

|

|

7,947 |

|

|

|

8,921 |

|

| Depreciation and

amortization |

|

6,412 |

|

|

|

6,570 |

|

|

|

8,154 |

|

| Change in value of

consideration payable for acquisition of business |

|

- |

|

|

|

(269 |

) |

|

|

- |

|

| Acquisition-related

costs |

|

- |

|

|

|

659 |

|

|

|

363 |

|

| Restructuring and

integration costs |

|

264 |

|

|

|

1,261 |

|

|

|

1,130 |

|

| Total operating

expenses |

|

77,696 |

|

|

|

78,720 |

|

|

|

81,099 |

|

| |

|

|

|

|

|

| Income from

operations |

|

27,268 |

|

|

|

26,926 |

|

|

|

19,562 |

|

| Operating

margin |

|

26.0 |

% |

|

|

25.5 |

% |

|

|

19.4 |

% |

| |

|

|

|

|

|

| Other income

(expense) |

|

|

|

|

|

| Interest income and

other income/(expense) |

|

(37 |

) |

|

|

(2,097 |

) |

|

|

345 |

|

| Interest expense and

other financing costs |

|

(7,092 |

) |

|

|

(10,308 |

) |

|

|

(12,628 |

) |

| Loss on debt

extinguishment |

|

(6,058 |

) |

|

|

- |

|

|

|

- |

|

| Total other income

(expense), net |

|

(13,187 |

) |

|

|

(12,405 |

) |

|

|

(12,283 |

) |

| Income before income

taxes |

|

14,081 |

|

|

|

14,521 |

|

|

|

7,279 |

|

| |

|

|

|

|

|

| Income tax expense |

|

(3,557 |

) |

|

|

(3,312 |

) |

|

|

(2,866 |

) |

| Net

income |

$ |

10,524 |

|

|

$ |

11,209 |

|

|

$ |

4,413 |

|

| Earnings per share -

basic |

$ |

0.17 |

|

|

$ |

0.20 |

|

|

$ |

0.08 |

|

| Earnings per share -

diluted |

|

0.16 |

|

|

|

0.19 |

|

|

|

0.08 |

|

| Weighted average shares

outstanding - basic |

|

61,599,057 |

|

|

|

55,119,711 |

|

|

|

54,813,823 |

|

| Weighted average shares

outstanding - diluted |

|

66,283,621 |

|

|

|

59,768,134 |

|

|

|

58,746,227 |

|

| Dividends declared per

share |

$ |

- |

|

|

$ |

0.23 |

|

|

$ |

2.19 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

| Victory Capital Holdings, Inc. and

Subsidiaries |

| Reconcilation of GAAP to Non-GAAP

Measures |

| (unaudited; in thousands except

shares) |

| |

|

|

|

|

|

|

| |

For the Three Months Ended |

|

| |

March 31, |

|

December 31, |

|

March 31, |

|

| |

2018 |

|

2017 |

|

2017 |

|

| Net

income |

$ |

10,524 |

|

|

$ |

11,209 |

|

|

$ |

4,413 |

|

|

| GAAP income tax

expense |

|

(3,557 |

) |

|

|

(3,312 |

) |

|

|

(2,866 |

) |

|

| Income before

taxes |

$ |

14,081 |

|

|

$ |

14,521 |

|

|

$ |

7,279 |

|

|

| Interest expense |

|

8,094 |

|

|

|

9,328 |

|

|

|

11,596 |

|

|

| Depreciation |

|

736 |

|

|

|

895 |

|

|

|

915 |

|

|

| Other business

taxes |

|

375 |

|

|

|

428 |

|

|

|

450 |

|

|

| GAAP amortization of

acquisition-related intangibles |

|

5,676 |

|

|

|

5,676 |

|

|

|

7,238 |

|

|

| Stock-based

compensation |

|

3,322 |

|

|

|

1,740 |

|

|

|

2,301 |

|

|

| Acquisition,

restructuring and exit costs |

|

518 |

|

|

|

6,001 |

|

|

|

2,603 |

|

|

| Debt issuance

costs |

|

6,702 |

|

|

|

788 |

|

|

|

914 |

|

|

| Pre-IPO governance

expenses |

|

141 |

|

|

|

347 |

|

|

|

288 |

|

|

| Earnings/losses from

equity method investments |

|

137 |

|

|

|

319 |

|

|

|

- |

|

|

| Adjusted

EBITDA |

$ |

39,782 |

|

|

$ |

40,043 |

|

|

$ |

33,584 |

|

|

| Adjusted EBITDA

margin |

|

37.9 |

% |

|

|

37.9 |

% |

|

|

33.4 |

% |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Net

income |

$ |

10,524 |

|

|

$ |

11,209 |

|

|

$ |

4,413 |

|

|

| Adjustment to reflect

the operating performance of the Company |

|

|

|

|

|

|

| Other business

taxes |

|

375 |

|

|

|

428 |

|

|

|

450 |

|

|

| GAAP amortization of

acquisition-related intangibles |

|

5,676 |

|

|

|

5,676 |

|

|

|

7,238 |

|

|

| Stock-based

compensation |

|

3,322 |

|

|

|

1,740 |

|

|

|

2,301 |

|

|

| Acquisition,

restructuring and exit costs |

|

518 |

|

|

|

6,001 |

|

|

|

2,603 |

|

|

| Debt issuance

costs |

|

6,702 |

|

|

|

788 |

|

|

|

914 |

|

|

| Pre-IPO governance

expenses |

|

141 |

|

|

|

347 |

|

|

|

288 |

|

|

| Tax effect of above

adjustments |

|

(4,183 |

) |

|

|

(5,692 |

) |

|

|

(5,242 |

) |

|

| Remeasurement of net

deferred taxes |

|

- |

|

|

|

(2,422 |

) |

|

|

- |

|

|

| Adjusted net

income |

$ |

23,075 |

|

|

$ |

18,075 |

|

|

$ |

12,965 |

|

|

| Adjusted net

income per diluted share |

$ |

0.35 |

|

|

$ |

0.30 |

|

|

$ |

0.22 |

|

|

| |

|

|

|

|

|

|

| Tax benefit of

goodwill and acquired intangibles |

$ |

3,320 |

|

|

$ |

4,998 |

|

|

$ |

4,891 |

|

|

| Tax benefit of

goodwill and acquired intangibles per diluted share |

$ |

0.05 |

|

|

$ |

0.09 |

|

|

$ |

0.08 |

|

|

| |

|

|

|

|

|

|

| Adjusted net

income with tax benefit |

$ |

26,395 |

|

|

$ |

23,073 |

|

|

$ |

17,856 |

|

|

| Adjusted net

income with tax benefit per diluted share |

$ |

0.40 |

|

|

$ |

0.39 |

|

|

$ |

0.30 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Victory Capital Holdings, Inc. and

Subsidiaries |

| Unaudited Condensed Consolidated Balance

Sheets |

| (In thousands, except for shares) |

|

|

|

|

|

| |

|

|

|

| |

March 31, 2018 |

|

December 31, 2017 |

|

ASSETS |

|

|

|

| Cash and

cash equivalents |

$ |

12,296 |

|

|

$ |

12,921 |

|

|

Receivables |

|

54,763 |

|

|

|

55,917 |

|

| Prepaid

expenses |

|

4,102 |

|

|

|

5,441 |

|

|

Investments |

|

12,243 |

|

|

|

11,336 |

|

| Property and

equipment, net |

|

8,776 |

|

|

|

8,844 |

|

|

Goodwill |

|

284,108 |

|

|

|

284,108 |

|

| Other intangible

assets, net |

|

402,325 |

|

|

|

408,000 |

|

| Other

assets |

|

6,532 |

|

|

|

6,055 |

|

| Total

assets |

$ |

785,145 |

|

|

$ |

792,622 |

|

| |

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

| Accounts

payable and accrued expenses |

$ |

25,396 |

|

|

$ |

21,996 |

|

| Accrued

compensation and benefits |

|

21,031 |

|

|

|

29,305 |

|

| Consideration

payable for acquisition of business |

|

9,997 |

|

|

|

9,856 |

|

| Deferred tax

liability, net |

|

5,582 |

|

|

|

4,068 |

|

| Other

liabilities |

|

13,878 |

|

|

|

12,989 |

|

| Long-term

debt(1) |

|

310,435 |

|

|

|

483,225 |

|

| Total liabilities |

|

386,319 |

|

|

|

561,439 |

|

| |

|

|

|

| Stockholders'

equity: |

|

|

|

| Common

stock, $0.01 par value per share: 2018 - no shares authorized, |

|

– |

|

|

|

572 |

|

| issued

and outstanding; 2017 - 78,837,300 shares authorized,

57,182,730 |

|

|

|

| issued

and 55,118,673 shares outstanding |

|

|

|

| Class A

common stock, $0.01 par value per share: 2018 - 400,000,000 |

|

129 |

|

|

|

– |

|

| shares

authorized, 12,899,315 shares issued and outstanding; 2017 -

no |

|

|

|

| shares

authorized, issued and outstanding |

|

|

|

| Class B

common stock, $0.01 par value per share: 2018 - 200,000,000 |

|

571 |

|

|

|

– |

|

| shares

authorized, 57,115,842 shares issued and 55,051,785 shares |

|

|

|

|

outstanding; 2017 - no shares authorized, issued and

outstanding |

|

|

|

|

Additional paid-in capital |

|

591,038 |

|

|

|

435,334 |

|

| Treasury

stock, at cost: 2018 and 2017 - 2,064,057 shares |

|

(20,899 |

) |

|

|

(20,899 |

) |

|

Accumulated other comprehensive loss |

|

98 |

|

|

|

64 |

|

| Retained

deficit |

|

(172,111 |

) |

|

|

(183,888 |

) |

| Total stockholders'

equity |

|

398,826 |

|

|

|

231,183 |

|

| Total

liabilities and stockholders’ equity |

$ |

785,145 |

|

|

$ |

792,622 |

|

| |

|

|

|

| (1) Balance

at March 31, 2018 is shown net of unamortized loan discount and

debt issuance costs in the amount of $12.6 million. The gross

amount of the debt outstanding was $323.0 million. |

| |

| |

| Victory Capital Holdings, Inc. and

Subsidiaries |

| Assets Under Management |

| (unaudited; in millions) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

% Change from |

| |

|

March 31, |

|

December 31, |

|

March 31, |

|

December 31, |

|

March 31, |

| |

|

2018 |

|

2017 |

|

2017 |

|

2017 |

|

2017 |

| Beginning

assets under management |

$ |

61,771 |

|

|

$ |

58,997 |

|

|

$ |

54,965 |

|

|

5% |

|

12% |

| |

Gross client cash

inflows |

|

3,685 |

|

|

|

4,371 |

|

|

|

4,725 |

|

|

-16% |

|

-22% |

| |

Gross client cash

outflows |

|

(4,318 |

) |

|

|

(4,077 |

) |

|

|

(5,111 |

) |

|

6% |

|

-16% |

| Net client

cash flows |

|

(633 |

) |

|

|

294 |

|

|

|

(386 |

) |

|

N/M |

|

64% |

| Market

appreciation (depreciation) |

|

(275 |

) |

|

|

2,575 |

|

|

|

2,042 |

|

|

N/M |

|

N/M |

| Net

transfers |

|

(8 |

) |

|

|

(95 |

) |

|

|

- |

|

|

-92% |

|

N/M |

| Ending

assets under management |

|

60,855 |

|

|

|

61,771 |

|

|

|

56,622 |

|

|

-1% |

|

7% |

| Average

assets under management |

|

62,020 |

|

|

|

60,354 |

|

|

|

56,277 |

|

|

3% |

|

10% |

| Net client

cash flows excluding Diversified Equity |

|

(633 |

) |

|

|

294 |

|

|

|

(54 |

) |

|

N/M |

|

1072% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Victory Capital Holdings, Inc. and

Subsidiaries |

| Assets Under Management by Asset

Class |

| (unaudited; in millions) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the Three Months Ended |

|

By Asset Class |

| |

|

|

U.S. Mid Cap Equity |

|

U.S. Small Cap Equity |

|

Fixed Income |

|

U.S. Large Cap Equity |

|

Global / Non-U.S. Equity |

|

Solutions |

|

Commodity |

|

Other |

|

Total |

|

March 31, 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Beginning

assets under management |

|

$ |

25,185 |

|

|

$ |

15,308 |

|

|

$ |

7,551 |

|

|

$ |

4,789 |

|

|

$ |

4,105 |

|

|

$ |

3,028 |

|

|

$ |

1,419 |

|

|

$ |

386 |

|

|

$ |

61,771 |

|

| |

Gross client cash

inflows |

|

|

1,203 |

|

|

|

776 |

|

|

|

394 |

|

|

|

55 |

|

|

|

443 |

|

|

|

606 |

|

|

|

127 |

|

|

|

81 |

|

|

|

3,685 |

|

| |

Gross client cash

outflows |

|

|

(2,080 |

) |

|

|

(922 |

) |

|

|

(640 |

) |

|

|

(211 |

) |

|

|

(220 |

) |

|

|

(77 |

) |

|

|

(146 |

) |

|

|

(22 |

) |

|

|

(4,318 |

) |

| Net client

cash flows |

|

|

(877 |

) |

|

|

(146 |

) |

|

|

(246 |

) |

|

|

(156 |

) |

|

|

223 |

|

|

|

529 |

|

|

|

(19 |

) |

|

|

59 |

|

|

|

(633 |

) |

| Market

appreciation (depreciation) |

|

|

(103 |

) |

|

|

(67 |

) |

|

|

6 |

|

|

|

3 |

|

|

|

14 |

|

|

|

(34 |

) |

|

|

(102 |

) |

|

|

8 |

|

|

|

(275 |

) |

| Net

transfers |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1 |

) |

|

|

(8 |

) |

|

|

40 |

|

|

|

- |

|

|

|

(39 |

) |

|

|

(8 |

) |

| Ending

assets under management |

|

|

24,205 |

|

|

|

15,095 |

|

|

|

7,311 |

|

|

|

4,635 |

|

|

|

4,334 |

|

|

|

3,563 |

|

|

|

1,298 |

|

|

|

414 |

|

|

|

60,855 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Beginning

assets under management |

|

$ |

23,389 |

|

|

$ |

14,833 |

|

|

$ |

7,777 |

|

|

$ |

4,806 |

|

|

$ |

3,735 |

|

|

$ |

2,591 |

|

|

$ |

1,517 |

|

|

$ |

349 |

|

|

$ |

58,997 |

|

| |

Gross client cash

inflows |

|

|

2,335 |

|

|

|

716 |

|

|

|

403 |

|

|

|

57 |

|

|

|

366 |

|

|

|

377 |

|

|

|

71 |

|

|

|

46 |

|

|

|

4,371 |

|

| |

Gross client cash

outflows |

|

|

(1,819 |

) |

|

|

(873 |

) |

|

|

(654 |

) |

|

|

(282 |

) |

|

|

(211 |

) |

|

|

(62 |

) |

|

|

(154 |

) |

|

|

(22 |

) |

|

|

(4,077 |

) |

| Net client

cash flows |

|

|

515 |

|

|

|

(158 |

) |

|

|

(251 |

) |

|

|

(225 |

) |

|

|

155 |

|

|

|

315 |

|

|

|

(83 |

) |

|

|

24 |

|

|

|

294 |

|

| Market

appreciation (depreciation) |

|

|

1,281 |

|

|

|

633 |

|

|

|

68 |

|

|

|

210 |

|

|

|

232 |

|

|

|

150 |

|

|

|

(16 |

) |

|

|

18 |

|

|

|

2,575 |

|

| Net

transfers |

|

|

0 |

|

|

|

0 |

|

|

|

(43 |

) |

|

|

(1 |

) |

|

|

(18 |

) |

|

|

(28 |

) |

|

|

0 |

|

|

|

(5 |

) |

|

|

(95 |

) |

| Ending

assets under management |

|

|

25,185 |

|

|

|

15,308 |

|

|

|

7,551 |

|

|

|

4,789 |

|

|

|

4,105 |

|

|

|

3,028 |

|

|

|

1,419 |

|

|

|

386 |

|

|

|

61,771 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2017 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Beginning

assets under management |

|

$ |

20,083 |

|

|

$ |

14,090 |

|

|

$ |

7,726 |

|

|

$ |

5,921 |

|

|

$ |

3,460 |

|

|

$ |

1,602 |

|

|

$ |

1,882 |

|

|

$ |

202 |

|

|

$ |

54,965 |

|

| |

Gross client cash

inflows |

|

|

2,209 |

|

|

|

1,249 |

|

|

|

503 |

|

|

|

68 |

|

|

|

208 |

|

|

|

347 |

|

|

|

108 |

|

|

|

33 |

|

|

|

4,725 |

|

| |

Gross client cash

outflows |

|

|

(1,873 |

) |

|

|

(1,201 |

) |

|

|

(588 |

) |

|

|

(711 |

) |

|

|

(472 |

) |

|

|

(47 |

) |

|

|

(205 |

) |

|

|

(14 |

) |

|

|

(5,111 |

) |

| Net client

cash flows |

|

|

336 |

|

|

|

48 |

|

|

|

(85 |

) |

|

|

(643 |

) |

|

|

(264 |

) |

|

|

300 |

|

|

|

(97 |

) |

|

|

19 |

|

|

|

(386 |

) |

| Market

appreciation (depreciation) |

|

|

1,135 |

|

|

|

418 |

|

|

|

117 |

|

|

|

7 |

|

|

|

286 |

|

|

|

68 |

|

|

|

(15 |

) |

|

|

26 |

|

|

|

2,042 |

|

| Net

transfers |

|

$ |

1 |

|

|

|

|

$ |

(2 |

) |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

1 |

|

|

|

- |

|

| Ending

assets under management |

|

|

21,555 |

|

|

|

14,556 |

|

|

|

7,756 |

|

|

|

5,285 |

|

|

|

3,482 |

|

|

|

1,970 |

|

|

|

1,770 |

|

|

|

248 |

|

|

|

56,622 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Victory Capital Holdings, Inc. and

Subsidiaries |

| Assets Under Management by

Vehicle |

| (unaudited; in millions) |

| |

|

|

|

|

|

|

|

|

|

| For the Three Months Ended |

|

By Vehicle |

| |

|

|

Mutual Funds(1) |

|

ETFs |

|

Separate Accounts and Other

Vehicles(2) |

|

Total |

|

March 31, 2018 |

|

|

|

|

|

|

|

|

| Beginning

assets under management |

|

$ |

37,967 |

|

|

$ |

2,250 |

|

|

$ |

21,555 |

|

|

$ |

61,771 |

|

| |

Gross client cash

inflows |

|

|

2,626 |

|

|

|

481 |

|

|

|

578 |

|

|

|

3,685 |

|

| |

Gross client cash

outflows |

|

|

(3,266 |

) |

|

|

(29 |

) |

|

|

(1,023 |

) |

|

|

(4,318 |

) |

| Net client

cash flows |

|

|

(640 |

) |

|

|

452 |

|

|

|

(445 |

) |

|

|

(633 |

) |

| Market

appreciation (depreciation) |

|

|

(307 |

) |

|

|

(28 |

) |

|

|

60 |

|

|

|

(275 |

) |

| Net

transfers |

|

|

(31 |

) |

|

|

- |

|

|

|

22 |

|

|

|

(8 |

) |

| Ending

assets under management |

|

$ |

36,989 |

|

|

$ |

2,674 |

|

|

$ |

21,192 |

|

|

$ |

60,855 |

|

| |

|

|

|

|

|

|

|

|

|

|

December 31, 2017 |

|

|

|

|

|

|

|

|

| Beginning

assets under management |

|

$ |

37,341 |

|

|

$ |

1,875 |

|

|

$ |

19,782 |

|

|

$ |

58,997 |

|

| |

Gross client cash

inflows |

|

|

2,264 |

|

|

|

278 |

|

|

|

1,829 |

|

|

|

4,371 |

|

| |

Gross client cash

outflows |

|

|

(3,121 |

) |

|

|

(16 |

) |

|

|

(941 |

) |

|

|

(4,077 |

) |

| Net client

cash flows |

|

|

(857 |

) |

|

|

262 |

|

|

|

889 |

|

|

|

294 |

|

| Market

appreciation (depreciation) |

|

|

1,577 |

|

|

|

113 |

|

|

|

886 |

|

|

|

2,575 |

|

| Net

transfers |

|

|

(93 |

) |

|

|

- |

|

|

|

(2 |

) |

|

|

(95 |

) |

| Ending

assets under management |

|

$ |

37,967 |

|

|

$ |

2,250 |

|

|

$ |

21,555 |

|

|

$ |

61,771 |

|

| |

|

|

|

|

|

|

|

|

|

|

March 31, 2017 |

|

|

|

|

|

|

|

|

| Beginning

assets under management |

|

$ |

33,975 |

|

|

$ |

906 |

|

|

$ |

20,085 |

|

|

$ |

54,965 |

|

| |

Gross client cash

inflows |

|

|

3,945 |

|

|

|

317 |

|

|

|

463 |

|

|

|

4,725 |

|

| |

Gross client cash

outflows |

|

|

(3,635 |

) |

|

|

(2 |

) |

|

|

(1,474 |

) |

|

|

(5,111 |

) |

| Net client

cash flows |

|

|

310 |

|

|

|

315 |

|

|

|

(1,011 |

) |

|

|

(386 |

) |

| Market

appreciation (depreciation) |

|

|

1,360 |

|

|

|

46 |

|

|

|

636 |

|

|

|

2,042 |

|

| Net

transfers |

|

|

(5 |

) |

|

|

- |

|

|

|

5 |

|

|

|

- |

|

| Ending

assets under management |

|

$ |

35,640 |

|

|

$ |

1,267 |

|

|

$ |

19,715 |

|

|

$ |

56,622 |

|

| |

|

|

|

|

|

|

|

|

|

| (1)

Includes institutional and retail share classes and VIP

funds. |

| (2)

Includes collective trust funds, wrap program separate accounts and

unified managed accounts or UMAs. |

| |

Information Regarding Non-GAAP Financial

Measures

Victory Capital uses non-GAAP financial measures

referred to as Adjusted EBITDA and Adjusted Net Income to measure

the operating profitability of the business. These measures

eliminate the impact of one‑time acquisition, restructuring and

integration costs and demonstrate the ongoing operating earnings

metrics of the business. The Company has included these non‑GAAP

measures to provide investors with the same financial metrics used

by management to assess the operating performance of the

Company.

Adjusted EBITDA

Adjustments made to GAAP net income to calculate

Adjusted EBITDA are:

- Adding back GAAP income tax;

- Adding back interest paid on debt and other financing costs net

of interest income;

- Adding back depreciation on property and equipment;

- Adding back other business taxes;

- Adding back GAAP amortization of acquisition‑related

intangibles;

- Adding back the expense associated with stock‑based

compensation associated with equity issued from pools that were

created in connection with the management‑led buyout with Crestview

GP from KeyCorp, the Munder Acquisition and the RS Acquisition and

as a result of any equity grants related to the IPO;

- Adding back direct incremental costs of acquisitions and the

IPO, including expenses associated with third‑party advisors, proxy

solicitations of mutual fund shareholders for transaction consents,

vendor contract early termination costs, impairment of receivables

recorded in connection with an acquisition and severance, retention

and transaction incentive compensation;

- Adding back debt issuance costs;

- Adding back pre‑IPO governance expenses paid to the Company’s

private equity partners that terminated as of the completion of the

IPO; and

- Adjusting for earnings/losses on equity method

investments.

Adjusted Net Income

Adjustments made to GAAP net income to calculate

Adjusted Net Income are:

- Adding back other business taxes;

- Adding back GAAP amortization of acquisition‑related

intangibles;

- Adding back the expense associated with stock‑based

compensation associated with equity issued from pools that were

created in connection with the management‑led buyout with Crestview

GP from KeyCorp, the Munder Acquisition and the RS Acquisition and

as a result of any equity grants related to the IPO;

- Adding back direct incremental costs of acquisitions and the

IPO, including expenses associated with third‑party advisors, proxy

solicitations of mutual fund shareholders for transaction consents,

vendor contract early termination costs, impairment of receivables

recorded in connection with an acquisition and severance, retention

and transaction incentive compensation;

- Adding back debt issuance costs;

- Adding back pre‑IPO governance expenses paid to the Company’s

private equity partners that terminated as of the completion of the

IPO;

- Subtracting an estimate of income tax expense on the

adjustments; and

- Subtracting the impact of remeasuring the U.S. net deferred

taxes under the Tax Act.

Tax Benefit of Goodwill and Acquired

Intangibles

Due to Victory Capital’s acquisitive nature, tax

deductions allowed on acquired intangible assets and goodwill

provide it with additional significant supplemental economic

benefit. The tax benefit of goodwill and intangibles

represents the tax benefits associated with deductions allowed for

intangibles and goodwill generated from prior acquisitions in which

the Company received a step‑up in basis for tax purposes. Acquired

intangible assets and goodwill may be amortized for tax purposes,

generally over a 15‑year period. The tax benefit from amortization

on these assets is included to show the full economic benefit of

deductions for all acquired intangibles with a step‑up in tax

basis.

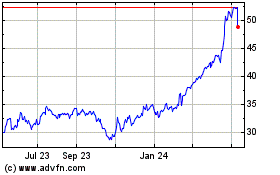

Victory Capital (NASDAQ:VCTR)

Historical Stock Chart

From Aug 2024 to Sep 2024

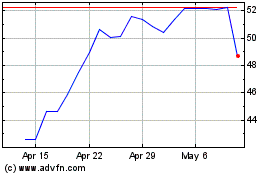

Victory Capital (NASDAQ:VCTR)

Historical Stock Chart

From Sep 2023 to Sep 2024