0001606268FALSE00016062682021-11-032021-11-030001606268us-gaap:CommonClassAMember2021-11-032021-11-030001606268us-gaap:SeriesAPreferredStockMember2021-11-032021-11-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 2, 2021

|

|

|

|

|

|

|

|

|

|

|

Via Renewables, Inc.

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

Delaware

|

001-36559

|

46-5453215

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification Number)

|

|

|

|

|

12140 Wickchester Ln, Suite 100

Houston, Texas 77079

(Address of principal executive offices)

(713) 600-2600

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbols(s)

|

Name of exchange on which registered

|

|

Class A common stock, par value $0.01 per share

|

VIA

|

The NASDAQ Global Select Market

|

8.75% Series A Fixed-to-Floating Rate

Cumulative Redeemable Perpetual Preferred Stock, par value $0.01 per share

|

VIASP

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 2, 2021, but effective November 4, 2021, Via Renewables, Inc. (the “Company”) appointed Paul Konikowski as Chief Operating Officer.

Mr. Konikowski, age 50, previously served as Senior Vice President of National Gas and Electric (“NG&E”), an affiliated company, which is owned and controlled by the Company’s Chief Executive Officer and Chairman of the Board of Directors, a position he had held since April 2015. Prior to NG&E, Mr. Konikowski served as Chief Operating Officer of Glacial Energy. Prior to Glacial Energy, Mr. Konikowski served as Senior Vice President and Chief Information Officer of Via Renewables, Inc. (formerly Spark Energy, Inc.). Mr. Konikowski holds a Bachelor of Business Administration in Computer Information Systems and Marketing from Stephen F. Austin State University. There are no understandings or arrangements between Mr. Konikowski and any other person pursuant to which Mr. Konikowski was selected to serve as Chief Operating Officer. There are no existing relationships between Mr. Konikowski and any person that would require disclosure pursuant to Item 404(a) of Regulation S-K or any familial relationships that would require disclosure under Item 401(d) of Regulation S-K.

In connection with his appointment, the Company entered into an employment agreement, effective as of November 4, 2021 (the “Employment Agreement”), with Mr. Konikowski. Pursuant to the Employment Agreement, Mr. Konikowski will serve as Chief Operating Officer, and will receive an annual base salary of $350,000, as adjusted from time to time by the Company. The Employment Agreement provides for an initial term ending on December 31, 2022, and provides for subsequent one-year renewals unless either party gives at least 30 days prior notice to the end of the then existing term.

The Employment Agreement provides that, in the event Mr. Konikowski is terminated by the Company other than for “Cause” or Mr. Konikowski’s employment terminates due to either the Company’s election not to renew the term of the Employment Agreement or Mr. Konikowski’s resignation for “Good Reason,” Mr. Konikowski will, subject to execution of a release of claims, be entitled to receive the following payments and benefits:

•twelve months’ base salary plus an additional amount equal to Mr. Konikowski’s target annual bonus for the year of termination pro-rated based upon the number of days Mr. Konikowski was employed in the calendar year of termination and based upon the Company’s relative performance through such date of termination, payable in twelve substantially equal installments (the “Severance Payment”);

•any bonus earned for the calendar year prior to the year the termination occurs that is unpaid as of the date of termination (the “Post-Termination Bonus Payment”); and

•full vesting of any outstanding unvested awards held by Mr. Konikowski under the Company’s Long Term Incentive Plan.

“Cause” under the Employment Agreement is generally defined to include: (a) a material uncured breach by Mr. Konikowski of the Employment Agreement or any other material obligation owed to the Company, (b) commission of an act of gross negligence, willful misconduct, breach of fiduciary duty, fraud, theft or embezzlement, which has or can reasonably be expected to have an adverse effect on the Company, (c) any conviction, indictment or plea of nolo contendere with respect to any felony or any crime involving moral turpitude, (d) uncured willful failure or refusal to perform obligations pursuant to the Employment Agreement or uncured willful failure or refusal to follow the lawful instructions of the Company’s Board of Directors, and (e) any conduct which is materially injurious to the Company.

“Good Reason” under the Employment Agreement is generally defined to include (a) a material diminution in base salary, (b) a material diminution in title, duties, authority or responsibilities, (c) relocation of corporate offices by more than fifty miles, or (d) material and uncured breach of the Employment Agreement by the Company.

A non-renewal of the term of the Employment Agreement by Mr. Konikowski, a termination by reason of Mr. Konikowski’s death or disability, a termination by the Company for “Cause,” a termination of employment by Mr. Konikowski without “Good Reason,” or a separation in connection with a “Change in Control” described below, does not give rise to a right to the Severance Payment or Post-Termination Bonus Payment.

If within 120 days prior to execution of a definitive agreement for a “Change in Control” transaction and 365 days after consummation or final closing of such transaction, Mr. Konikowski’s employment is terminated by the Company other than for “Cause” or Mr. Konikowski’s employment terminates due to either the Company’s election not to renew the term of the Employment Agreement or Mr. Konikowski’s resignation for “Good Reason,” subject to execution of a release of claims and other conditions, Mr. Konikowski is entitled to receive the following payments and benefits:

•a lump sum payment equal to 1.0 times Mr. Konikowski’s base salary then in effect, and the full target annual bonus for the year the termination occurs, and payable within 15 days following the date the employment is terminated;

•any bonus earned for the calendar year prior to the year the termination occurs that is unpaid as of the date of termination, payable within 15 days following the date the employment is terminated;

•a pro rata target annual bonus for the year of termination, calculated based upon relative achievement through such date and payable within 15 days following the date in which employment is terminated;

•full vesting of any outstanding awards held by Mr. Konikowski under the Company’s Long Term Incentive Plan; and

•reimbursement or payment of certain continuing health benefits, if elected by Mr. Konikowski.

The Employment Agreement generally defines “Change in Control” to mean:

•the consummation of an agreement to acquire or a tender offer for beneficial ownership by any person, of 50% or more of the combined voting power of the Company’s

outstanding voting securities entitled to vote generally in the election of directors, or by any person of 90% or more of the then total outstanding shares of Class A common stock;

•individuals who constitute the incumbent board cease for any reason to constitute at least a majority of the Board;

•consummation of certain reorganizations, mergers or consolidations or a sale or other disposition of all or substantially all of the Company’s assets;

•approval by the Company’s shareholders of a complete liquidation or dissolution;

•a public offering or series of public offerings by Retailco and its affiliates, as a selling shareholder group, in which their total interest drops below 10 million of the Company’s total outstanding voting securities;

•a disposition by Retailco and its affiliates in which their total interest drops below 10 million of the Company’s total outstanding voting securities; or

•any other business combination, liquidation event of Retailco and its affiliates or restructuring of the Company that the Compensation Committee deems in its discretion to achieve the principles of a Change in Control.

•

The Employment Agreement also provides for noncompetition and nonsolicitation covenants that are in effect during the period of Mr. Konikowski’s employment and for a period of 12 months thereafter, and customary provisions regarding the return of property.

In connection with his appointment and pursuant to the Employment Agreement, the Board approved a grant of 10,000 RSUs with dividend equivalent rights to Mr. Konikowski. The RSUs vest as follows: (1) 25% on May 18, 2022, (2) 25% on May 18, 2023, (3) 25% on May 18, 2024 and (4) 25% on May 18, 2025. The grant of RSUs will be made pursuant to the Company’s Form of Restricted Stock Unit Agreement and Form of Notice of Grant of Restricted Stock Unit.

The foregoing description of the Employment Agreement does not purport to be complete and is qualified in its entirety to the full text of the Employment Agreement, which is filed herewith as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

|

|

10.1†

|

Employment Agreement, dated November 4, 2021, by and between Via Renewables, Inc. and Paul Konikowski.

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

† Compensatory plan or arrangement

EXHIBIT INDEX

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

|

|

10.1†

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Dated: November 8, 2021

|

|

|

|

|

|

Spark Energy, Inc.

|

|

|

|

By:

|

|

/s/ Mike Barajas

|

|

Name:

|

|

Mike Barajas

|

|

Title:

|

|

Chief Financial Officer

|

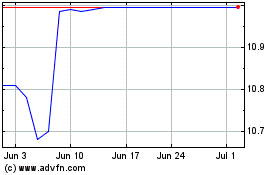

Via Renewables (NASDAQ:VIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Via Renewables (NASDAQ:VIA)

Historical Stock Chart

From Apr 2023 to Apr 2024