Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 07 2023 - 6:07AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2023

Commission File Number 001-39885

VERSUS SYSTEMS INC.

(Translation of registrant’s name into English)

1558 West Hastings Street

Vancouver BC V6G 3J4 Canada

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒

Form 40-F ☐

Entry into Material Definitive Agreement in

Connection with a Registered Direct Offering.

On

February 2, 2023, Versus Systems Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Purchase Agreement”)

with institutional investors (the “Purchasers”) pursuant to which the Company agreed to sell to the Purchasers, in a registered

direct offering, an aggregate of 2,500,000 common shares, no par value, of the Company (“Common Shares”), at a purchase price

of $0.90 per Common Share (the “Offering”).

On

February 6, 2023, the Company closed the Offering, raising gross proceeds of $2,250,000 before deducting placement agent fees and

other offering expenses payable by the Company. The Company intends to use the net proceeds of the offering for working capital and general

corporate purposes.

Pursuant

to the terms of the Purchase Agreement, the Company agreed that, subject to certain exceptions, the Company will not, within 45 calendar

days following the closing of the Offering, (i) enter into any agreement to issue or announce the issuance or proposed issuance or disposition

of any Common Shares or Common Share equivalents or (ii) file any registration statement or any amendment or supplement thereto, other

than the prospectus supplement relating to the Offering.

The

Common Shares were offered by the Company pursuant to an effective shelf registration statement on Form F-3, which was filed with the

Securities and Exchange Commission on March 24, 2022 and was declared effective on March 31, 2022 (File No. 333-263834).

Roth

Capital Partners, LLC (“Roth”) acted as the exclusive placement agent in connection with the Offering pursuant to the terms

of a placement agency agreement, dated February 2, 2023, between the Company and Roth (the “Placement Agency Agreement”).

Pursuant to the Placement Agency Agreement, the Company paid Roth a cash fee equal to 7% of the aggregate proceeds received by the Company

from the sale of Common Shares in the Offering. In addition to the cash fee, the Company issued to the Placement Agent warrants to purchase

up to 175,000 Common Shares (the “Placement Agent Warrants”). The Placement Agent Warrants have an exercise price of $0.90

per share and are exercisable immediately upon issuance, at any time and from time to time, in whole or in part, for a period of five

years. The Placement Agent Warrants were sold pursuant to the exemptions from registration provided in Section 4(a)(2) under the Securities

Act and Regulation D promulgated thereunder.

The

foregoing descriptions of the Placement Agency Agreement, the Purchase Agreement and the Placement Agent Warrants do not purport to be

complete and are qualified in their entirety by reference to the full text of such agreements or securities, copies or forms of which

are attached hereto as Exhibits 10.1, 10.2 and 4.1, respectively, and are incorporated herein by reference. Readers should review such

agreements and forms of securities for a complete understanding of the terms and conditions associated with these transactions.

On

February 2, 2023, the Company issued a press release announcing the pricing of the Offering, a copy of which is attached hereto as Exhibit

99.1. On February 6, 2023, the Company issued a press release announcing the closing of the Offering, a copy of which is attached hereto

as Exhibit 99.2.

Financial Statements and Exhibits

Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: February 6, 2023

| |

VERSUS SYSTEMS INC. |

| |

|

| |

By: |

/s/ Matthew Pierce |

| |

|

Name: |

Matthew Pierce |

| |

|

Title: |

Chief Executive Officer |

3

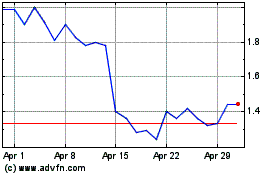

Versus Systems (NASDAQ:VS)

Historical Stock Chart

From Mar 2024 to Apr 2024

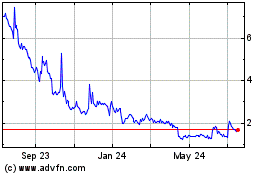

Versus Systems (NASDAQ:VS)

Historical Stock Chart

From Apr 2023 to Apr 2024