Q4 aiWARE SaaS Solutions and Advertising

Revenue each up over 50% Year over Year

- Record Q4 Revenue of $16.8 Million, Up 35% Year over

Year

- Grew Q4 aiWARE SaaS Solutions and Advertising Revenues to

$4.4 Million and $9.7 Million, Up 31% and 11% Sequentially and 53%

and 50% Year over Year, Respectively

- Increased Q4 Gross Profit 43% Year over Year to $12.7

Million

- Improved Q4 GAAP Net Loss 17% Year over Year to $12.4

Million

- Improved Q4 Non-GAAP Net Loss 51% Year over Year to $3.9

Million

- Recorded Q4 Non-GAAP Net Income from Core Operations of $1.1

Million, an Improvement of 141% Sequentially and over $3.5 Million

Year over Year

- Sold 3.45 Million Shares of Common Stock for Net Cash

Proceeds of $59.8 Million in Q4 2020, Increasing Cash Balance to

Over $100 Million as of December 31, 2020

Veritone, Inc. (NASDAQ: VERI), a leading provider

of artificial intelligence (AI) technology and solutions, today

reported results for the fourth quarter and year ended December 31,

2020.

Veritone reported record revenue of $16.8 million and $57.7

million for the fourth quarter and full year of 2020, respectively,

reflecting record contributions in both periods from aiWARE SaaS

Solutions and Advertising. For the fourth quarter of 2020, GAAP net

loss was $12.4 million and non-GAAP net loss was $3.9 million,

improving $2.5 million and $4.1 million, respectively, compared

with the fourth quarter of 2019. For the full year 2020, GAAP net

loss was $47.9 million and non-GAAP net loss was $20.6 million,

improving $14.2 million and $15.6 million, respectively, compared

with 2019.

“During an unprecedented year, Veritone demonstrated great

agility and execution, and thrived -- delivering for our customers

while keeping true to our core mission,” said Chad Steelberg,

Chairman and CEO of Veritone. “I am proud to report that we

achieved record fourth quarter and full year results and started

2021 with the strongest balance sheet in our history. We will

continue to execute our strategic growth plans, and we expect 2021

full year revenue growth to be in excess of 40% at the high end of

our guidance range.”

Ryan Steelberg, President of Veritone, added, “Every area of our

business exceeded expectations. In Q4, we grew aiWARE SaaS revenue

by 53% year over year, led by our government, legal and compliance

and energy markets. Our fourth quarter 2020 Advertising revenue,

including the contribution of our VeriAds Network, also grew by

over 50% year over year despite a challenging pandemic-affected

advertising market. We are well positioned to accelerate our growth

in 2021, with a strong pipeline, low attrition rate, and strong

demand for our products and services.

Recent Business

Highlights

- Named to Forbes’ 2021 list of best small-cap companies in

America

- Launched new Automate Studio to accelerate AI-based digital

transformation initiatives

- Formed strategic relationship with Alteryx to power Alteryx

Analytical Process Automation with new, advanced AI

capabilities

- Announced integration of aiWARE with NVIDIA CUDA and EGX GPU

products to dramatically increase AI processing speeds

- Awarded three new patents, extending the Company’s technology

lead in renewable energy optimization

Business Outlook

First Quarter 2021

- Revenue is expected to range from $17.0 million to $17.5

million, representing a 45% increase year over year at the

midpoint.

- Non-GAAP net loss is expected to range from $4.4 million to

$3.9 million, representing a 38% improvement year over year at the

midpoint.

- Management also expects to record (i) a one-time, non-cash

charge of approximately $16.2 million for stock-based compensation

expense related to the vesting of its performance-based stock

options and (ii) a one-time charge of approximately $4.5 million

associated with the sublease of its former corporate headquarters

facility in Costa Mesa, California, which includes non-cash

write-downs of approximately $1.9 million.

Full Year 2021

- Revenue is expected to be in the range of $76.0 million to

$81.0 million, representing a year-over-year increase of 36% at the

midpoint and over 40% at the high end. aiWARE SaaS Solutions

revenue is expected to grow 60% to 65% year over year.

- Non-GAAP net loss is expected to be in the range of $18.0

million to $14.0 million, representing a 22% improvement year over

year at the midpoint.

Financial Results for Fourth Quarter

Ended December 31, 2020

Revenue was a record $16.8 million, compared with $12.4 million

in the fourth quarter of 2019. The growth reflects a 53% increase

in aiWARE SaaS Solutions, including revenue from the Company’s new

energy solutions, and a 50% increase in Advertising, reflecting

contributions from both the VeriAds Network and Veritone One,

offset slightly by a 13% decrease in aiWARE Content Licensing and

Media Services due primarily to lower licensing activity resulting

from the cancellation of sporting events because of the pandemic.

Gross profit increased to $12.7 million, up 43% compared with $8.9

million in the fourth quarter of 2019, driven largely by the growth

in revenue in aiWARE SaaS Solutions and Advertising.

Loss from operations was $12.3 million, compared with $14.6

million in the fourth quarter of 2019. The $2.3 million improvement

was driven primarily by a $3.8 million increase in gross profit due

to the higher revenue level and cost savings on efficiencies

realized from enhancements to the Company’s aiWARE operating

system, offset in part by increased personnel-related costs,

including $1.2 million of additional non-cash stock-based

compensation expense.

GAAP net loss was $12.4 million, or $0.43 per share, an

improvement of $2.5 million compared with $14.9 million, or $0.61

per share, in the fourth quarter of 2019. Non-GAAP net loss was

$3.9 million, or $0.14 per share, compared with $8.1 million, or

$0.33 per share, in the fourth quarter of 2019. The $4.1 million

improvement in non-GAAP net loss was driven by the Company’s Core

Operations, which improved $3.5 million to non-GAAP net income of

$1.1 million, compared with a non-GAAP net loss of $2.5 million in

the fourth quarter of 2019, and by Corporate, which improved $0.6

million to a non-GAAP net loss of $5.0 million.

As of December 31, 2020, the Company had cash and cash

equivalents of $114.8 million, including $40.1 million of cash

received from Advertising clients for future payments to vendors,

and no long-term debt.

Financial Results for Year Ended

December 31, 2020

Revenue was a record $57.7 million, compared with $49.6 million

in 2019. The growth reflects a 30% increase in aiWARE SaaS

Solutions and a 29% increase in Advertising, with strong

contributions from both VeriAds and Veritone One, offset by a 16%

decrease in aiWARE Content Licensing and Media Services due

primarily to lower licensing activity resulting from the

cancellation of sporting events because of the pandemic.

GAAP net loss was $47.9 million, or $1.73 per share, an

improvement of $14.2 million compared with $62.1 million, or $2.85

per share, in 2019. Non-GAAP net loss was $20.6 million, or $0.75

per share, compared with $36.2 million, or $1.66 per share, in

2019. The $15.6 million improvement in Non-GAAP net loss was driven

by the Company’s Core Operations, which improved $13.7 million to

Non-GAAP net loss of $0.8 million, compared with a Non-GAAP net

loss of $14.5 million in 2019, and by Corporate, which improved

$1.9 million to a Non-GAAP net loss of $19.8 million.

Conference Call

Veritone will hold a conference call on Thursday, March 4, 2021

at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time) to discuss its

results for the fourth quarter and full year of 2020 and its

outlook for the first quarter and full year of 2021, provide an

update on the business, and conduct a question and answer session.

To listen, please join the webcast or dial-in. To avoid a wait, if

dialing in, please pre-register or call in 20 minutes in

advance.

● Preregister*

https://dpregister.com/10151804

● Live audio webcast:

investors.veritone.com

● Domestic call number:

844-750-4897

● International call number:

412-317-5293

● Call ID:

10151804

* Callers who pre-register will be emailed upon registering a

conference pass code and unique PIN to gain immediate access to the

call and bypass the live operator. Participants may pre-register at

any time, including up to and after the call start time. If you

have any difficulty connecting with the conference call, please

contact LHA Investor Relations at 415-433-3777.

A replay of the audio webcast will be available on the Company’s

website approximately one hour after the call ends. A telephonic

replay of the call will be available through March 18, 2021:

Replay number:

1-877-344-7529

International replay number:

1-412-317-0088

Replay ID:

10151804

About the Presentation of Supplemental

Non-GAAP Financial Information

In this news release, the Company has supplemented its financial

measures prepared in accordance with U.S. generally accepted

accounting principles (GAAP) with certain non-GAAP financial

measures: “gross profit,” “Non-GAAP net loss,” and “Non-GAAP net

loss per share.” Gross profit is the Company’s revenue less its

cost of revenue. Non-GAAP net loss is the Company’s net loss,

adjusted to exclude interest expense, provision for income taxes,

depreciation expense, amortization expense, stock-based

compensation expense, a reserve for state sales taxes, lease

termination charges, severance costs, and certain acquisition,

integration and financing-related costs. Non-GAAP net loss should

not be considered as an alternative to net income (loss), operating

income (loss) or any other financial measures so calculated and

presented, nor as an alternative to cash flow from operating

activities as a measure of liquidity. The items excluded from

Non-GAAP net loss, as well as a breakdown of GAAP net loss,

non-GAAP net income (loss) and these excluded items between the

Company’s core operations and corporate, are detailed in the

reconciliations included following the financial statements

attached to this news release. Other companies (including the

Company’s competitors) may define Non-GAAP net loss

differently.

Core Operations consists of the Company’s aiWARE operating

platform of software, SaaS and related services; content, licensing

and advertising agency services; and their supporting operations,

including direct costs of sales as well as operating expenses for

sales, marketing and product development and certain general and

administrative costs dedicated to these operations. Corporate

principally consists of general and administrative functions such

as executive, finance, legal, people operations, fixed overhead

expenses (including facilities and information technology

expenses), other income (expenses) and taxes, and other expenses

that support the entire Company, including public company driven

costs.

In addition, following the financial statements attached to this

news release, the Company has provided additional supplemental

non-GAAP measures of gross profit, operating expenses, loss from

operations, other income (expense), net, and loss before income

taxes, excluding the items excluded from non-GAAP net loss as noted

above, and reconciling such non-GAAP measures to the applicable

GAAP measures.

The Company presents this supplemental non-GAAP financial

information because management believes such information to be

important supplemental measures of performance that are commonly

used by securities analysts, investors and other interested parties

in the evaluation of companies in its industry. Management also

uses this information internally for forecasting and budgeting.

These non-GAAP measures may not be indicative of the historical

operating results of Veritone or predictive of potential future

results. Investors should not consider this supplemental non-GAAP

financial information in isolation or as a substitute for analysis

of the Company’s results as reported in accordance with GAAP.

About Veritone

Veritone (NASDAQ: VERI) is a leading provider of artificial

intelligence (AI) technology and solutions. The Company’s

proprietary operating system, aiWARE™, powers a diverse set of AI

applications and intelligent process automation solutions that are

transforming both commercial and government organizations. aiWARE

orchestrates an expanding ecosystem of machine learning models to

transform audio, video, and other data sources into actionable

intelligence. The Company’s AI developer tools enable its customers

and partners to easily develop and deploy custom applications that

leverage the power of AI to dramatically improve operational

efficiency and unlock untapped opportunities. Veritone is

headquartered in Denver, Colorado, and has offices in Costa Mesa,

London, New York, and San Diego. To learn more, visit

Veritone.com.

Safe Harbor Statement

This news release contains forward-looking statements, including

without limitation statements regarding the Company’s expectations

regarding its continued execution of its strategic growth plans,

its expectation of accelerated growth in 2021, and the Company’s

expected total revenue and Non-GAAP net loss in the first quarter

and full year of 2021. In addition, words such as “may,” “will,”

“expect,” “believe,” “anticipate,” “intend,” “plan,” “should,”

“could,” “estimate” or “continue” or the plural, negative or other

variations thereof or comparable terminology are intended to

identify forward-looking statements, and any statements that refer

to expectations, projections or other characterizations of future

events or circumstances are forward-looking statements. These

forward-looking statements speak only as of the date hereof, and

are based on management’s current assumptions, beliefs and

information. As such, the Company’s actual results could differ

materially and adversely from those expressed in any

forward-looking statement as a result of various factors. Important

factors that could cause such differences include, among other

things, the impact of the economic disruption caused by COVID-19

pandemic on the business of the Company and that of its existing

and potential customers; the Company’s ability to achieve broad

recognition and customer acceptance of its products and services;

the Company’s ability to continue to develop and add additional

capabilities and features to its aiWARE operating system; the

development of the market for cognitive analytics solutions; the

ability of third parties to develop and provide additional high

quality, relevant cognitive engines and applications; the Company’s

ability to successfully identify and integrate such additional

third-party cognitive engines and applications onto its aiWARE

operating system, and to continue to be able to access and utilize

such engines and applications, and the cost thereof; as well as the

impact of future economic, competitive and market conditions,

particularly those related to its strategic end markets; and future

business decisions, all of which are difficult or impossible to

predict accurately and many of which are beyond the control of the

Company. Certain of these judgments and risks are discussed in more

detail in the Company’s Annual Report on Form 10-K and other

periodic reports filed with the Securities and Exchange Commission.

In light of the significant uncertainties inherent in the

forward-looking information included herein, the inclusion of such

information should not be regarded as a representation by the

Company or any other person that the Company’s objectives or plans

will be achieved. The forward-looking statements contained herein

reflect the Company’s beliefs, estimates and predictions as of the

date hereof, and the Company undertakes no obligation to revise or

update the forward-looking statements contained herein to reflect

events or circumstances after the date hereof or to reflect the

occurrence of unanticipated events for any reason, except as

required by law.

VERITONE, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

(in thousands)

As of

December 31,

December 31,

2020

2019

ASSETS

Cash and cash equivalents

$

114,817

$

44,065

Accounts receivable, net

16,666

21,352

Expenditures billable to clients

18,365

10,286

Prepaid expenses and other current

assets

6,719

5,409

Total current assets

156,567

81,112

Property, equipment and improvements,

net

2,354

3,214

Intangible assets, net

10,744

16,126

Goodwill

6,904

6,904

Long-term restricted cash

855

855

Other assets

230

315

Total assets

$

177,654

$

108,526

LIABILITIES AND STOCKHOLDERS'

EQUITY

Accounts payable

$

15,632

$

17,014

Accrued media payments

55,874

26,664

Client advances

6,496

9,080

Other accrued liabilities

10,246

6,978

Total current liabilities

88,248

59,736

Other non-current liabilities

1,196

1,379

Total liabilities

89,444

61,115

Total stockholders' equity

88,210

47,411

Total liabilities and stockholders'

equity

$

177,654

$

108,526

VERITONE, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

AND COMPREHENSIVE LOSS

(in thousands, except per

share and share data)

Three Months Ended

Year Ended

December 31,

December 31,

2020

2019

2020

2019

Revenue

$

16,818

$

12,448

$

57,708

$

49,648

Operating expenses:

Cost of revenue

4,097

3,536

15,663

15,261

Sales and marketing

4,761

5,587

19,877

23,508

Research and development

3,706

4,526

14,379

22,776

General and administrative

15,244

12,085

50,080

47,314

Amortization

1,342

1,345

5,382

4,860

Total operating expenses

29,150

27,079

105,381

113,719

Loss from operations

(12,332

)

(14,631

)

(47,673

)

(64,071

)

Other (expense) income, net

(19

)

95

(127

)

541

Loss before provision for (benefit from)

income taxes

(12,351

)

(14,536

)

(47,800

)

(63,530

)

Provision for (benefit from) income

taxes

35

348

76

(1,452

)

Net loss

$

(12,386

)

$

(14,884

)

$

(47,876

)

$

(62,078

)

Net loss per share:

Basic and diluted

$

(0.43

)

$

(0.61

)

$

(1.73

)

$

(2.85

)

Weighted average shares outstanding:

Basic and diluted

28,881,610

24,514,128

27,594,911

21,797,714

Comprehensive loss:

Net loss

$

(12,386

)

$

(14,884

)

$

(47,876

)

$

(62,078

)

Unrealized gain on marketable securities,

net of income taxes

-

-

-

48

Foreign currency translation gain (loss),

net of income taxes

9

4

20

(3

)

Total comprehensive loss

$

(12,377

)

$

(14,880

)

$

(47,856

)

$

(62,033

)

VERITONE, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS (UNAUDITED)

(in thousands)

Year Ended

December 31,

2020

2019

Cash flows from operating

activities:

Net loss

$

(47,876

)

$

(62,078

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

6,407

5,947

Deferred income taxes, net

-

(1,489

)

Warrant expense

102

-

Change in fair value of warrant

liability

200

(16

)

Provision for doubtful accounts

293

51

Stock-based compensation expense

19,539

20,657

Common stock returned from acquisition

escrow

(146

)

-

Other

(46

)

-

Changes in assets and liabilities:

Accounts receivable

4,393

7,739

Expenditures billable to clients

(8,079

)

(7,591

)

Prepaid expenses and other current

assets

(1,726

)

(1,622

)

Accounts payable

(1,382

)

(11,718

)

Accrued media payments

29,210

9,135

Client advances

(2,584

)

9,554

Other accrued liabilities

3,311

1,006

Other liabilities

(183

)

(7

)

Net cash provided by (used in) operating

activities

1,433

(30,432

)

Cash flows from investing

activities:

Proceeds from sales of marketable

securities

-

13,614

Proceeds from the sale of equipment

56

-

Capital expenditures

(175

)

(293

)

Intangible assets acquired

-

(477

)

Acquisition of businesses, net of cash

acquired

-

(883

)

Net cash (used in) provided by investing

activities

(119

)

11,961

Cash flows from financing

activities:

Proceeds from common stock offerings,

net

66,278

23,851

Proceeds from loan

6,491

-

Repayment of loan

(6,491

)

-

Proceeds from the exercise of warrants

2,100

-

Proceeds from issuances of stock under

employee stock plans, net

1,060

764

Net cash provided by financing

activities

69,438

24,615

Net increase in cash and cash equivalents

and restricted cash

70,752

6,144

Cash and cash equivalents and restricted

cash, beginning of period

44,920

38,776

Cash and cash equivalents and restricted

cash, end of period

$

115,672

$

44,920

VERITONE, INC.

REVENUE DETAIL

(UNAUDITED)

(in thousands)

Three Months Ended

Year Ended

December 31,

December 31,

2020

2019

2020

2019

Advertising

$

9,747

$

6,517

$

31,550

$

24,364

aiWARE SaaS Solutions

4,402

2,872

13,863

10,653

aiWARE Content Licensing and Media

Services

2,669

3,059

12,295

14,631

Revenue

$

16,818

$

12,448

$

57,708

$

49,648

VERITONE, INC.

RECONCILIATION OF NON-GAAP NET

LOSS TO GAAP NET INCOME (LOSS) (UNAUDITED)

(in thousands)

Three Months Ended December

31,

2020

2019

Core

Operations(1)

Corporate(2)

Total

Core

Operations(1)

Corporate(2)

Total

Net loss

$

(1,297

)

$

(11,089

)

$

(12,386

)

$

(4,613

)

$

(10,271

)

$

(14,884

)

Provision for (benefit from) income

taxes

—

35

35

—

348

348

Depreciation and amortization

1,348

243

1,591

1,347

258

1,605

Stock-based compensation expense

1,004

4,837

5,841

549

4,059

4,608

Change in fair value of warrant

liability

—

—

—

—

(9

)

(9

)

State sales tax reserve

—

818

818

—

—

—

Stock offering costs

—

27

27

—

—

—

Lease termination charges

—

16

16

—

—

—

Business realignment and officer severance

costs

—

145

145

242

37

279

Non-GAAP Net Income (Loss)

$

1,055

$

(4,968

)

$

(3,913

)

$

(2,475

)

$

(5,578

)

$

(8,053

)

Year Ended December

31,

2020

2019

Core

Operations(1)

Corporate(2)

Total

Core

Operations(1)

Corporate(2)

Total

Net loss

$

(9,060

)

$

(38,816

)

$

(47,876

)

$

(24,019

)

$

(38,059

)

$

(62,078

)

Provision for (benefit from) income

taxes

—

76

76

—

(1,452

)

(1,452

)

Depreciation and amortization

5,538

869

6,407

4,836

1,111

5,947

Stock-based compensation expense

2,720

16,819

19,539

2,680

16,722

19,402

Change in fair value of warrant

liability

—

200

200

—

(16

)

(16

)

Warrant expense

—

102

102

—

—

—

Gain on sale of asset

—

(56

)

(56

)

—

—

—

Interest expense

—

9

9

—

—

—

State sales tax reserve

—

818

818

—

—

—

Stock offering costs

—

27

27

—

—

—

Lease termination charges

—

16

16

—

—

—

Machine Box contingent payments

—

—

—

1,600

—

1,600

Performance Bridge earn-out fair value

adjustment

—

—

—

139

—

139

Business realignment and officer severance

costs

—

145

145

242

37

279

Non-GAAP Net Loss

$

(802

)

$

(19,791

)

$

(20,593

)

$

(14,522

)

$

(21,657

)

$

(36,179

)

(1)Core operations consists of the

Company’s aiWARE operating platform of software, SaaS and related

services; content, licensing and advertising agency services; and

their supporting operations, including direct costs of sales as

well as operating expenses for sales, marketing and product

development and certain general and administrative costs dedicated

to these operations.

(2)Corporate consists of general and

administrative functions such as executive, finance, legal, people

operations, fixed overhead expenses (including facilities and

information technology expenses), other income (expenses) and

taxes, and other expenses that support the entire company,

including public company driven costs.

VERITONE, INC.

RECONCILIATION OF EXPECTED

NON-GAAP NET LOSS RANGE

TO EXPECTED GAAP NET LOSS

RANGE (UNAUDITED)

(in millions)

Three Months Ending

Year Ending

March 31, 2021

December 31, 2021

Net loss

($31.5) to ($31.0)

($66.1) to ($62.1)

Provision for income taxes

—

—

Lease abandonment

$4.5

$4.5

Depreciation and amortization

$1.4

$5.6

Stock-based compensation expense

$21.2

$38.0

Non-GAAP net loss

($4.4) to ($3.9)

($18.0) to ($14.0)

VERITONE, INC.

RECONCILIATION OF NON-GAAP TO

GAAP FINANCIAL INFORMATION (UNAUDITED)

(in thousands, except per

share data)

Three Months Ended

Year Ended

December 31,

December 31,

2020

2019

2020

2019

Revenue

$

16,818

$

12,448

$

57,708

$

49,648

Cost of revenue

4,097

3,536

15,663

15,261

Gross profit

12,721

8,912

42,045

34,387

GAAP sales and marketing expenses

4,761

5,587

19,877

23,508

Stock-based compensation expense

(235

)

(240

)

(889

)

(1,035

)

Lease termination charges

(5

)

—

(5

)

—

Business realignment and officer severance

costs

—

(72

)

—

(72

)

Non-GAAP sales and marketing expenses

4,521

5,275

18,983

22,401

GAAP research and development expenses

3,706

4,526

14,379

22,776

Stock-based compensation expense

(453

)

(231

)

(1,046

)

(1,294

)

Machine Box contingent payments

—

—

—

(1,600

)

Business realignment and officer severance

costs

—

(142

)

—

(142

)

Non-GAAP research and development

expenses

3,253

4,153

13,333

19,740

GAAP general and administrative

expenses

15,244

12,085

50,080

47,314

Depreciation

(249

)

(260

)

(1,025

)

(1,087

)

Stock-based compensation expense

(5,153

)

(4,137

)

(17,604

)

(17,073

)

Warrant expense

—

—

(102

)

—

State sales tax reserve

(818

)

—

(818

)

—

Stock offering costs

(27

)

—

(27

)

—

Performance Bridge earn-out fair value

adjustment

—

—

—

(139

)

Business realignment and officer severance

costs

(145

)

(65

)

(145

)

(65

)

Non-GAAP general and administrative

expenses

8,852

7,623

30,359

28,950

GAAP amortization

(1,342

)

(1,345

)

(5,382

)

(4,860

)

GAAP loss from operations

(12,332

)

(14,631

)

(47,673

)

(64,071

)

Total non-GAAP adjustments (1)

8,427

6,492

27,043

27,367

Non-GAAP loss from operations

(3,905

)

(8,139

)

(20,630

)

(36,704

)

GAAP other (expense) income, net

(19

)

95

(127

)

541

Change in fair value of warrant

liability

—

(9

)

200

(16

)

Interest expense

—

—

9

—

Lease termination charges

11

—

11

—

Gain on sale of asset

—

—

(56

)

—

Non-GAAP other income, net

(8

)

86

37

525

GAAP loss before income taxes

(12,351

)

(14,536

)

(47,800

)

(63,530

)

Total non-GAAP adjustments (1)

8,438

6,483

27,207

27,351

Non-GAAP loss before income taxes

(3,913

)

(8,053

)

(20,593

)

(36,179

)

Income tax provision (benefit)

35

348

76

(1,452

)

GAAP net loss

(12,386

)

(14,884

)

(47,876

)

(62,078

)

Total non-GAAP adjustments (1)

8,473

6,831

27,283

25,899

Non-GAAP net loss

$

(3,913

)

$

(8,053

)

$

(20,593

)

$

(36,179

)

Shares used in computing non-GAAP basic

and diluted net loss per share

28,882

24,514

27,595

21,798

Non-GAAP basic and diluted net loss per

share

$

(0.14

)

$

(0.33

)

$

(0.75

)

$

(1.66

)

(1) Adjustments are comprised of the

adjustments to GAAP gross profit, sales and marketing expenses,

research and development expenses and general and administrative

expenses and other income (expense), net (where applicable) listed

above.

VERITONE, INC.

KEY PERFORMANCE INDICATORS

(KPI's) (UNAUDITED)

Quarter Ended

Mar 31,

Jun 30,

Sept 30,

Dec 31,

Mar 31,

Jun 30,

Sept 30,

Dec 31,

2019

2019

2019

2019

2020

2020

2020

2020

Advertising

Average gross billings per active client

(in 000's)(1)

469

488

490

511

533

614

625

632

Revenue during quarter (in 000's)

$

5,714

$

5,842

$

6,197

$

6,517

$

5,881

$

6,140

$

7,372

$

8,138

Quarter Ended

Mar 31,

Jun 30,

Sept 30,

Dec 31,

Mar 31,

Jun 30,

Sept 30,

Dec 31,

2019

2019

2019

2019

2020

2020

2020

2020

aiWARE SaaS Solutions

Total accounts on platform at quarter

end

911

941

980

1,069

1,587

1,753

1,791

1,896

New bookings received during quarter (in

000's)(2)

$

1,316

$

1,351

$

1,384

$

2,522

$

1,397

$

2,319

$

2,083

$

1,437

Total contract value of new bookings

received during quarter (in 000’s)(3)

$

2,092

$

1,351

$

1,724

$

12,872

$

2,312

$

2,502

$

2,469

$

2,431

Revenue during quarter (in 000's)

$

2,754

$

2,677

$

2,350

$

2,872

$

3,108

$

3,002

$

3,351

$

4,402

(1)

For each quarter, reflects the average

gross quarterly billings per agency client over the twelve month

period through the end of such quarter for agency clients that are

active during such quarter.

(2)

Represents the contractually committed

fees payable during the first 12 months of the contract term, or

the non-cancellable portion of the contract term (if shorter), for

new contracts received in the quarter, excluding any variable fees

under the contract (i.e., fees for cognitive processing, storage,

professional services and other variable services).

(3)

Represents the total fees payable during

the full contract term for new contracts received in the quarter

(including fees payable during any cancellable portion and an

estimate of license fees that may fluctuate over the term),

excluding any variable fees under the contract (i.e., fees for

cognitive processing, storage, professional services and other

variable services).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210304006050/en/

Company Contact: Brian

Alger, CFA SVP, Corporate Development & Investor Relations

Veritone, Inc. (949) 386-4318 investors@veritone.com

Investor Relations Contact:

Kirsten Chapman LHA Investor Relations (415) 433-3777

veritone@lhai.com

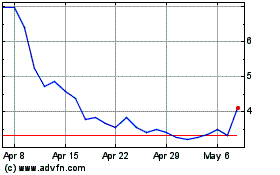

Veritone (NASDAQ:VERI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Veritone (NASDAQ:VERI)

Historical Stock Chart

From Apr 2023 to Apr 2024