Verisk Analytics, Inc. (Nasdaq: VRSK) (“Verisk” or the “Company”),

a leading global data analytics and technology provider, today

announced the Reference Yield and Total Consideration, each as

summarized in the table below and as defined in the Offer to

Purchase dated May 21, 2024 (as amended or supplemented from time

to time, the “Offer to Purchase”), to be paid in connection with

the previously announced cash tender offer (the “Tender Offer”) for

up to $400,000,000 aggregate principal amount (the “Maximum

Amount”) of its 4.000% Senior Notes due 2025 (the “Notes”).

The Tender Offer is being made upon the terms and subject to the

conditions set forth in the Offer to Purchase, which sets forth a

detailed description of the Tender Offer. The Tender Offer is open

to all registered holders (individually, a “Holder” and

collectively, the “Holders”) of Notes.

The Reference Yield for the Notes and the Total Consideration

for the Notes are summarized in the table below:

|

Title of Notes |

CUSIP / ISIN Number |

UST Reference Security |

Fixed Spread (bps) |

Reference Yield |

Total Consideration (1) |

| 4.000% Senior Notes due

2025 |

92345YAD8/US92345YAD85 |

2.875%UST due 6/15/2025 |

20 |

5.113 |

% |

987.09 |

(1) Per $1,000 principal amount of Notes validly tendered at or

prior to the Early Tender Date (as defined below) and accepted for

purchase.

The Total Consideration for each $1,000 principal amount of

Notes was determined in the manner described in the Offer to

Purchase by reference to the fixed spread set forth in the table

above plus the yield to maturity of the U.S. Treasury reference

security (the "UST Reference Security") set forth in the table

above on the bid-side price of such UST Reference Security as of

10:00 a.m., New York City time, on June 5, 2024.

The Company expects to accept for purchase and make payment for

Notes validly tendered and not validly withdrawn at or prior to

5:00 p.m., New York City time, on June 4, 2024 (the “Early Tender

Date”), on a prorated basis in accordance with the Offer to

Purchase, on June 7, 2024 (the “Early Settlement Date”). Holders of

all Notes validly tendered and not validly withdrawn at or prior to

the Early Tender Date and accepted for purchase are eligible to

receive the Total Consideration, which includes the Early Tender

Payment of $30 per $1,000 principal amount of Notes tendered at or

prior to the Early Tender Date (the “Early Tender Payment”). In

addition to the Total Consideration, Holders of Notes accepted for

purchase will receive accrued and unpaid interest up to, but not

including, the Early Settlement Date.

As of the Early Tender Date, $469,627,000 aggregate principal

amount of the Notes has been validly tendered and not validly

withdrawn. Because the aggregate principal amount of Notes validly

tendered exceeds the Maximum Amount, the Company expects that it

will accept validly tendered Notes on a prorated basis in

accordance with the Offer to Purchase.

Because the Company expects to accept for purchase approximately

the Maximum Amount of Notes, no additional Notes will be purchased

pursuant to the Tender Offer after the Early Settlement Date. As

described in the Offer to Purchase, Notes tendered and not accepted

for purchase will be promptly returned to the tendering Holder's

account.

The Company expressly reserves the right, in its sole

discretion, subject to applicable law, to terminate the Tender

Offer at any time prior to 5:00 p.m., New York City time, on June

20, 2024 (the “Expiration Date”). The Tender Offer is not

conditioned on any minimum principal amount of Notes being tendered

but the Tender Offer is subject to certain conditions, as described

in the Offer to Purchase.

The Company has retained BofA Securities (the “Dealer Manager”)

for the Tender Offer. D.F. King & Co., Inc. has been retained

to act as the tender and information agent for the Tender Offer

(the “Tender and Information Agent”). Requests for assistance

relating to the procedures for tendering Notes may be directed to

the Tender and Information Agent by phone (212) 269-5550 (for banks

and brokers only) or (800) 755-7250 (for all others toll free) or

by email at verisk@dfking.com. Requests for assistance relating to

the terms and conditions of the Tender Offer may be directed to

BofA Securities at (980) 387-3907 (collect) or (888) 292-0070 (toll

free) or by email at debt_advisory@bofa.com. Beneficial owners may

also contact their broker, dealer, commercial bank, trust company

or other nominee for assistance.

This press release does not constitute an offer to sell or

purchase, or a solicitation of an offer to sell or purchase, or the

solicitation of tenders with respect to, any Notes. No offer,

solicitation, purchase or sale will be made in any jurisdiction in

which such an offer, solicitation or sale would be unlawful. The

Tender Offer is being made solely pursuant to the Offer to Purchase

made available to Holders of Notes. None of the Company, the Dealer

Manager, Tender and Information Agent or the trustee with respect

to Notes, or any of their respective affiliates, is making any

recommendation as to whether or not Holders should tender or

refrain from tendering all or any portion of their Notes in

response to the Tender Offer. Holders are urged to evaluate

carefully all information in the Offer to Purchase, consult their

own investment and tax advisers and make their own decisions

whether to tender Notes in the Tender Offer, and, if so, the

principal amount of Notes to tender.

About Verisk

Verisk (Nasdaq: VRSK) is a leading strategic data analytics and

technology partner to the global insurance industry. It empowers

clients to strengthen operating efficiency, improve underwriting

and claims outcomes, combat fraud and make informed decisions about

global risks, including climate change, extreme events, ESG and

political issues. Through advanced data analytics, software,

scientific research and deep industry knowledge, Verisk helps build

global resilience for individuals, communities and businesses. With

teams across more than 20 countries, Verisk consistently earns

certification by Great Place to Work and fosters

an inclusive culture where all team members feel they

belong.

Forward-Looking Statements

This press release contains forward-looking statements. These

statements relate to the Company’s current expectations and beliefs

as to its ability to consummate the tender offer, including the

timing, size, pricing or other terms of the tender offer, and other

future events. In some cases, you can identify forward-looking

statements by the use of words such as “may,” “could,” “expect,”

“intend,” “plan,” “target,” “seek,” “anticipate,” “believe,”

“estimate,” “predict,” “potential,” or “continue” or the negative

of these terms or other comparable terminology. You should not

place undue reliance on forward-looking statements, because they

involve known and unknown risks, uncertainties, and other factors

that are, in some cases, beyond the Company’s control and that

could materially affect actual results, levels of activity,

performance, or achievements.

Other factors that could materially affect actual results,

levels of activity, performance, or achievements can be found in

the Company’s quarterly reports on Form 10-Q, annual reports on

Form 10-K, and current reports on Form 8-K filed with the

Securities and Exchange Commission. If any of these risks or

uncertainties materialize or if the Company’s underlying

assumptions prove to be incorrect, actual results may vary

significantly from what the Company projected. Any forward-looking

statement in this release reflects the Company’s current views with

respect to future events and is subject to these and other risks,

uncertainties, and assumptions relating to the Company’s

operations, results of operations, growth strategy, and liquidity.

The Company assumes no obligation to publicly update or revise

these forward-looking statements for any reason, whether as a

result of new information, future events, or otherwise.

Investor Relations

Stacey Brodbar

Head of Investor Relations

Verisk

201-469-4327

IR@verisk.com

Media

Alberto Canal

Verisk Public Relations

201-469-2618

Alberto.Canal@verisk.com

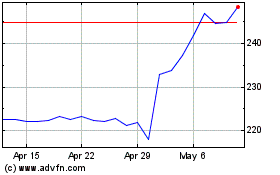

Verisk Analytics (NASDAQ:VRSK)

Historical Stock Chart

From Jan 2025 to Feb 2025

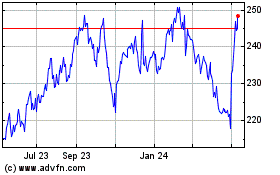

Verisk Analytics (NASDAQ:VRSK)

Historical Stock Chart

From Feb 2024 to Feb 2025