UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under § 240.14a-12 |

VERB

TECHNOLOGY COMPANY, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

| |

1. |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

2. |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

3. |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

4. |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

5. |

Total

fee paid: |

| |

|

|

| |

|

|

| ☐ |

Fees

paid previously with preliminary materials. |

| |

|

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing. |

| |

|

| |

1. |

Amount

Previously Paid: |

| |

|

|

| |

|

|

| |

2. |

Form,

Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

3. |

Filing

Party: |

| |

|

|

| |

|

|

| |

4. |

Date

Filed: |

| |

|

|

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD ON APRIL 10, 2023

February 28, 2023

Dear

Fellow Verb Stockholders:

It

is my pleasure to invite you to a Special Meeting of Stockholders (the “Special Meeting”) of Verb Technology Company, Inc.,

a Nevada corporation (the “Company,” “Verb,” “us,” or “our”). The Special Meeting will

be held on April 10, 2023 at 11:00 a.m. Pacific Time virtually by means of remote communication and can be accessed by visiting www.virtualshareholdermeeting.com/VERB2023SM

where you will be able to listen to the meeting live, submit questions and vote online. You will not be able to attend the meeting in

person.

The

Special Meeting is being held for the following purposes:

| |

1. |

To

approve an amendment to our articles of incorporation, as amended, to increase the number of shares of authorized common

stock from 200,000,000 to 400,000,000 (the “Increase in the Authorized Common Stock Proposal”); |

| |

|

|

| |

2. |

To

grant discretionary authority to our board of directors (the “Board”) to (i) amend our articles of incorporation,

as amended, to combine outstanding shares of our common stock into a lesser number of outstanding shares, or a “reverse

stock split,” at a specific ratio within a range of one-for-five (1-for-5) to a maximum of a one-for-forty (1-for-40) split,

with the exact ratio to be determined by our board of directors in its sole discretion; and (ii) effect the reverse stock split,

if at all, within one year of the date the proposal is approved by stockholders (the “Reverse Stock Split Proposal”);

|

| |

|

|

| |

3. |

To

approve an amendment to our 2019 Stock and Incentive Compensation Plan to increase the number

of shares authorized under the plan by 15,000,000 shares of common stock (the “Incentive

Plan Amendment Proposal”);

|

| |

4. |

To

approve for purposes of Nasdaq Listing Rule 5635, the issuance of shares of common stock (“Common Stock”) in partial

or full satisfaction of the outstanding amounts due under that certain Promissory Note dated November 7, 2022 issued by the Company

to an accredited investor; (the “Nasdaq Approval Proposal”); and |

| |

|

|

| |

5. |

To

transact such other business as may properly come before the Special Meeting virtually, or any postponement or adjournment

thereof (the “Adjournment Proposal”). |

Only

stockholders of record as of the close of business on February 17, 2023 will be entitled to receive notice of and to vote at the Special

Meeting, or any postponement or adjournment thereof. The accompanying Proxy Statement contains details concerning the foregoing items,

as well as information on how to vote your shares. We urge you to read and consider these documents carefully.

Your

vote is very important. Whether or not you plan to attend the Special Meeting, we encourage you to submit your proxy or voting instructions

as soon as possible.

On

behalf of the Board and the officers and employees of the Company, I would like to take this opportunity to thank you for your continued

support.

| |

Sincerely, |

| |

|

| |

/s/

Rory J. Cutaia |

| |

Rory

J. Cutaia |

| |

Chairperson

of the Board, Chief Executive Officer,

President

and Secretary |

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

This

Proxy Statement contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may

relate to our future financial performance, business operations, and executive compensation decisions, or other future events. You can

identify forward-looking statements by the use of words such as “anticipate,” “believe,” “could,”

“expect,” “intend,” “may,” “will,” or the negative of such terms, or other comparable

terminology. Forward-looking statements also include the assumptions underlying or relating to such statements. We have based these forward-looking

statements on our current expectations and projections about future events that we believe may affect our business, results of operations

and financial condition.

The

outcomes of the events described in these forward-looking statements are subject to risks, uncertainties and other factors described

in the reports we file with the Securities and Exchange Commission. We cannot assure you that the events and circumstances reflected

in the forward-looking statements will be achieved or occur, and actual results could differ materially from those expressed or implied

in the forward-looking statements. The forward-looking statements made in this Proxy Statement relate only to events as of the date of

this Proxy Statement. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the

date on which the statement is made.

VERB

TECHNOLOGY COMPANY, INC.

PROXY

STATEMENT

FOR

SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD ON APRIL 10, 2023

TABLE

OF CONTENTS

VERB

TECHNOLOGY COMPANY, INC.

PROXY

STATEMENT

FOR

SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD ON APRIL 10, 2023

General

Information

The

enclosed proxy is solicited by the board of directors (the “Board”) of Verb Technology Company, Inc., a Nevada corporation

(the “Company,” “Verb,” “us,” or “our”), in connection with the Special Meeting of Stockholders

to be held on April 10, 2023 at 11:00 a.m. Pacific Time, for the purposes set forth in the accompanying Notice of Meeting. The Special

Meeting, and any adjournments thereof, will be held virtually by means of remote communication and can be accessed by visiting www.virtualshareholdermeeting.com/VERB2023SM

where you will be able to listen to the meeting live, submit questions and vote online. You will not be able to attend the meeting in

person.

QUESTIONS

AND ANSWERS ABOUT THIS PROXY STATEMENT AND VOTING

Why

did you send me this proxy statement?

We

sent you this proxy statement and proxy card because the Board is soliciting your proxy to vote at the Special Meeting and any

adjournment and postponement thereof. This proxy statement summarizes information related to your vote at the Special Meeting. All stockholders

who find it convenient to do so are cordially invited to attend the Special Meeting virtually. However, you do not need to attend the

meeting to vote your shares. Instead, you may simply complete, sign and return the proxy card or vote over the Internet, by phone, or

by fax.

What

Does it Mean if I Receive More than one set of proxy materials?

If

you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please

complete, sign, and return each proxy card to ensure that all of your shares are voted.

Who

can vote at the Special Meeting?

You

can vote if, as of the close of business on February 17, 2023 (the “Record Date”), you were a stockholder of record of our

common stock or Series B Preferred Stock. On the Record Date, there were 153,610,152 shares of our common stock one (1) share

of our Series B Preferred Stock issued and outstanding.

Stockholder

of Record: Shares Registered in Your Name

If,

on the Record Date, your shares were registered directly in your name with our transfer agent, VStock Transfer, LLC, then you are a stockholder

of record. As a stockholder of record, you may vote at the Special Meeting or by proxy. Whether or not you plan to attend the Special

Meeting, we urge you to provide your proxy to ensure your vote is counted. Even if you vote by proxy, you may still vote if you are able

to attend the Special Meeting.

Beneficial

Owner: Shares Registered in the Name of a Broker or Other Nominee

If,

on the Record Date, your shares were held in an account at a brokerage firm, bank, dealer, or other nominee, then you are the “beneficial

owner” of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The

organization holding your account is considered to be the stockholder of record for purposes of voting at the Special Meeting.

If

you do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still

be able to vote your shares depends on whether the New York Stock Exchange, or NYSE, deems the particular proposal to be a “routine”

matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered

to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE,

“non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as elections

of directors (even if not contested). Accordingly, your broker or nominee may not vote your shares on Proposal Nos. 3 or 4 without your

instructions, but may vote your shares on Proposals Nos. 1 and 2 even in the absence of your instruction.

As

a beneficial owner of shares, you are also invited to attend the Special Meeting. However, since you are not the stockholder of record,

you may not vote your shares at the Special Meeting unless you request and obtain a valid proxy from your broker or other nominee. Please

contact your broker or other nominee for additional information.

How

many votes do I have?

On

the Record Date, there were 153,610,152 shares of common stock outstanding and one (1) share of Series B Preferred Stock. Each

share of common stock represents one vote that may be voted on each proposal that may come before the Special Meeting. The Series B Preferred

Stock does not have any voting rights except with respect to the Proposal 1- Increase in the Authorized Common Stock Proposal and Proposal

2- the Reverse Stock Split Proposal. Each share of Series B Preferred Stock represents 700,000,000 votes that may be voted on each of

the Increase in the Authorized Common Stock Proposal and the Reverse Stock Split Proposal; provided that such votes must be counted in

the same proportion as the shares of common stock voted FOR Proposal 1 and Proposal 2, respectively. As an example, if 50.5% of

the shares of common stock are voted FOR Proposal 1, 50.5% of the votes cast by the holder of the Series B Preferred Stock will be cast

as votes FOR Proposal 1. Holders of common stock and Series B Preferred Stock will vote on Proposal 1 and on Proposal 2 as a single class.

What

is the quorum requirement?

One-third

of the outstanding shares of common stock entitled to vote at the Special Meeting must be present at the Special Meeting, either virtually

or represented by proxy, in order for us to hold the Special Meeting. This is referred to as a quorum. On the Record Date, there were

153,610,152 outstanding shares of our common stock entitled to vote. Thus, 51,203,384 shares of our common stock must be present

at the Special Meeting, either virtually or represented by proxy, to have a quorum. The Series B Preferred Stock will not count towards

the quorum.

Your

shares will be counted towards the quorum only if you submit a valid proxy or vote at the Special Meeting. Abstentions and broker non-votes

will also be counted towards the quorum requirement.

What

proposals am I being asked to vote upon?

The

Special Meeting is being held for the following purposes:

| |

● |

To approve an amendment to our articles of incorporation, as amended, to increase the number of shares of authorized common stock from 200,000,000 to 400,000,000 (the “Increase in the Authorized Common Stock Proposal”); |

| |

● |

To grant discretionary

authority to the Board to (i) amend our articles of incorporation, as amended, to combine outstanding shares of our common

stock into a lesser number of outstanding shares, or a “reverse stock split,” at a specific ratio within a range of one-for-five

(1-for-5) to a maximum of a one-for-one forty (1-for-40) split, with the exact ratio to be determined by our board of directors in

its sole discretion; and (ii) effect the reverse stock split, if at all, within one year of the date the proposal is approved by

stockholders (the “Reverse Stock Split Proposal”); |

| |

● |

To approve an amendment

to our 2019 Stock and Incentive Compensation Plan to increase the number of shares authorized under the Incentive Plan by 15,000,000

shares of common stock (the “Incentive Plan Amendment Proposal”); |

| |

● |

To approve for purposes

of Nasdaq Listing Rule 5635the issuance of shares of Common Stock in partial or full satisfaction of the outstanding amounts

due under that certain Promissory Note dated November 7, 2022 issued by the Company to an accredited investor; (the “Nasdaq

Approval Proposal”); and |

| |

● |

To transact such other business as may properly come before the Special Meeting, or any postponement or adjournment thereof (the “Adjournment Proposal”). |

What

if another matter is properly brought before the Special Meeting?

The

board of directors knows of no other matters that will be presented for consideration at the Special Meeting. The proxies also have discretionary

authority to vote to adjourn the Special Meeting, including for the purpose of soliciting votes in accordance with our Board’s

recommendations. If any other matters are properly brought before the Special Meeting, it is the intention of the person named in the

accompanying proxy to vote on those matters in accordance with their best judgment.

How

do I vote?

Stockholder

of Record: Shares Registered in Your Name

If

you are a stockholder of record, you may vote using the following methods:

| ● | At

the Special Meeting. To vote at the Special Meeting, attend the Special Meeting via the

Internet and follow the instructions. |

| ● | By

Telephone. To vote by proxy via telephone within the United States and Canada,

use the toll-free number on the proxy card. |

| | | |

| | ● | By

Internet. To vote by proxy via the Internet, follow the instructions described on the

proxy card. |

| ● | By

Mail. To vote by mail, complete, sign, and date the proxy card and return it in the envelope

provided. |

Whether

or not you plan to attend the Special Meeting, we urge you to vote by proxy using one of the methods described above to ensure your vote

is counted. You may still attend the Special Meeting and vote even if you have already voted by proxy.

Beneficial

Owner: Shares Registered in the Name of Broker or Other Nominee

If

you are a beneficial owner of shares registered in the name of your broker or other nominee, you may vote using the following methods:

| ● | At

the Special Meeting. To vote at the Special Meeting, you must obtain a valid proxy from

your broker or other nominee. Follow the instructions from your broker or other nominee,

or contact them to request a proxy form. |

| ● | By

Internet. You may vote through the Internet if your broker or other nominee makes this

method available, in which case the instructions will be included in the proxy materials

provided to you. |

| ● | By

Telephone. You may vote by telephone if your broker or other nominee makes this method

available, in which case the instructions will be included in the proxy materials provided

to you. |

| ● | By

Mail. If you received a proxy card and voting instructions from the broker or other nominee

holding your shares rather than from us, follow the instructions on the proxy card. |

What

if I am a stockholder of record and return a proxy card but do not make specific choices?

You

should specify your choice for each matter on the proxy card. If you return a signed and dated proxy card without marking voting selections

for the specific proposals, your shares will be voted:

| ● | “FOR”

Proposal 1 – The Increase in the Authorized Common Stock Proposal; |

| ● | “FOR”

Proposal 2 – The Reverse Stock Split Proposal |

| ● | “FOR”

Proposal 3 – The Incentive Plan Amendment Proposal |

| ● | “FOR”

Proposal 4 – The Nasdaq Approval Proposal |

| ● | “FOR”

Proposal 5 – The Adjournment Proposal |

In

the event any other matters are properly presented at the Special Meeting, or any postponement or adjournment thereof, the person named

as proxy will vote in accordance with his discretion with respect to those matters.

What

if I am a beneficial owner and do not give voting instructions to my broker or other nominee?

If

you fail to provide your broker voting instructions before the Special Meeting, your broker may use his or her discretion to cast a vote

on any routine matter for which you did not provide voting instructions. If you fail to provide your broker with voting instructions,

your broker will be unable to vote on the non-routine matters.

| Proposal |

|

Votes

Required |

|

Voting

Options |

|

Effect

of

“Withhold”

or “Abstain”

Votes |

|

Effect

of Non-Votes |

| Proposal

1: Increase in the number of shares of authorized common stock |

|

The

affirmative vote of a majority of the voting power of the issued and outstanding shares of common stock and Series B preferred stock,

voting together as a single class. |

|

“FOR”

“AGAINST”

“ABSTAIN” |

|

Abstentions will have no effect |

|

No effect |

| Proposal

2: Authorization of Reverse Stock Split |

|

The

affirmative vote of a majority of the voting power of the issued and outstanding shares of common stock and Series B preferred stock,

voting together as a single class. |

|

“FOR”

“AGAINST”

“ABSTAIN” |

|

Abstentions will have no effect |

|

No effect |

| Proposal

3: Incentive Plan Amendment |

|

The

affirmative vote of a majority of the voting power present in person or by proxy and entitled to vote on the matter. |

|

“FOR”

“AGAINST”

“ABSTAIN” |

|

Abstentions will have no effect |

|

No

effect |

Proposal

No. 4 The Nasdaq Approval Proposal

|

|

The

affirmative vote of a majority of the voting power present in person or by proxy and entitled to vote on the matter. |

|

“FOR”

“AGAINST”

“ABSTAIN” |

|

Abstentions will have no effect |

|

No effect |

Who

is paying for this proxy solicitation?

We will pay for the entire cost

of soliciting proxies. We have engaged D.F. King & Co., Inc., which we refer to herein as

the “proxy solicitor” to assist in the solicitation of proxies for the Special Meeting. We have agreed to pay the proxy solicitor

a fee of $15,000, plus disbursements. We will also reimburse the proxy solicitor for reasonable and documented costs and expenses and

will indemnify and hold harmless the proxy solicitor and its affiliates and their officers, directors, employees, agents, other representatives

and controlling persons from and against certain losses, damages, liabilities and expenses. In addition to these mailed proxy materials,

our directors, officers, and employees may also solicit proxies by mail, in person, by telephone, or by other means of communication.

Directors, officers, and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokerage

firms, banks, and other agents for the cost of forwarding proxy materials to beneficial owners.

What

is “householding”?

The

SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy the delivery requirements for proxy statements

with respect to two or more security holders sharing the same address by delivering a single copy of a notice and, if applicable, a proxy

statement, to those security holders.

A

single copy of the Notice and, if applicable, this Proxy Statement will be delivered to multiple stockholders sharing an address unless

contrary instructions have been received from these stockholders. Once you have received notice from your broker, or from us, that they

will be “householding” communications to your address, “householding” will continue until you are notified otherwise

or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to

receive a separate Notice and Proxy Statement, please notify your broker and also notify us by sending your written request to: Verb

Technology Company, Inc., 3401 North Thanksgiving Way, Suite 240, Lehi, Utah 84043, Attention: Investor Relations or by calling Investor

Relations at (855) 250-2300.

A

stockholder who currently receives multiple copies of the Notice or Proxy Statement at its address and would like to request “householding”

should also contact its broker and notify us using the contact information above.

Can

I revoke or change my vote after submitting my proxy?

Yes.

You can revoke your proxy at any time before the final vote at the Special Meeting as discussed below.

If

you are a stockholder of record, you may revoke your proxy by:

| ● | sending

written notice of revocation to Verb Technology Company, Inc., 3401 North Thanksgiving Way,

Suite 240, Lehi, Utah 84043, Attention: Corporate Secretary, in time for it to be received

before the Special Meeting |

| ● | submitting

a new proxy with a later date using any of the voting methods described above (subject to

the deadlines for voting with respect to each method); or |

| ● | voting

at the Special Meeting (provided that attending the meeting will not, by itself, revoke your

proxy) |

If

you are a beneficial owner of shares and have instructed your broker or other nominee to vote your shares, you may change your vote by

following the directions received from your nominee to change those voting instructions or by attending the Special Meeting and voting.

However, you may not vote your shares at the Special Meeting unless you request and obtain a valid proxy from your broker or other nominee.

Who

will count votes at the Special Meeting?

Votes

will be counted by the inspector of election appointed for the Special Meeting. The inspector of election will also determine the number

of shares outstanding, the number of shares represented at the Special Meeting, the existence of a quorum, and whether or not the proxies

and ballots are valid and effective.

Do

I Have Dissenters’ Rights of Appraisal?

Stockholders

do not have appraisal rights under Nevada law or under the Company’s governing documents with respect to the matters to be voted

upon at the Special Meeting.

How

can I find out the results of the voting at the Special Meeting?

We

will announce preliminary voting results at the Special Meeting. We will report the final voting results in a Current Report on Form

8-K that we expect to file with the SEC within four business days following the date on which such results become final.

Who

can help answer my questions?

If

you have questions about the proposals or if you need additional copies of this proxy statement or the enclosed proxy card you should

contact us or our proxy solicitor at:

Verb

Technology Company, Inc.

3401

North Thanksgiving Way, Suite 240

Lehi,

Utah 84043

(855)

250-2300

D.F. King & Co., Inc.

48 Wall Street

New York, NY 10005

1 (800) 714-3306 (toll free in North America)

outside North America, Banks, Brokers and Collect calls: 1 (212) 269-5550

Email: VERB@dfking.com

To

obtain timely delivery, Verb stockholders must request the materials no later than five (5) business days prior to the Special Meeting.

You may also obtain additional information about the Company from documents filed with the SEC by following the instructions in the section

titled “Where You Can Find More Information.”

PROPOSAL

1:

INCREASE

IN THE NUMBER OF SHARES OF AUTHORIZED COMMON STOCK

Introduction

Our

Articles of Incorporation, as amended, currently authorizes the issuance of up to 200,000,000 shares of common shares, 15,000,000

shares of preferred stock, of which 6,000 shares have been designated as Series A Convertible Preferred Stock and 1 share has been designated

as Series B Preferred Stock. Our board of directors has approved an amendment to increase the number of authorized shares of common stock

from 200,000,000 to 400,000,000 shares (the “Increase in Authorized Common Shares Amendment”).

The

proposed form of amendment to our Articles of Incorporation to effect the Increase in Authorized Common Shares Amendment is attached

as Appendix A to this Proxy Statement.

Following

the increase in authorized shares as contemplated in the Amended Articles of Incorporation, 400,000,000 shares of common stock will be

authorized and 15,000,000 shares of Preferred Stock will be authorized of which 6,000 shares have been designated as Series A Convertible

Preferred Stock and 1 share has been designated as Series B Preferred Stock. There will be no changes to the issued and outstanding shares

common stock or preferred stock.

Reasons

for the Increase in Authorized Common Shares Amendment

The

board of directors determined that the Increase in Authorized Common Shares Amendment is in the best interests of the Company and unanimously

recommends approval by the stockholders. The board of directors believes that the availability of additional authorized shares of common

stock is required for several reasons including, but not limited to, the additional flexibility to issue common stock for a variety of

general corporate purposes as the board of directors may determine to be desirable including, without limitation, future financings,

investment opportunities, acquisitions, or other distributions and stock splits (including splits effected through the declaration of

stock dividends).

As

of the Record Date 153,610,152 shares of our common stock were outstanding out of the 200,000,000 shares that we are authorized

to issue. In addition, as of the Record Date, an aggregate of approximately 46,201,868 shares of common stock are issuable, including:

(i) 5,757,273 shares that are issuable upon the exercise of outstanding stock options; (ii) 2,373,187 shares of common stock that are

issuable upon vesting of restricted stock unit awards; and (iii) 824,630 shares of common stock reserved for future issuance under

out 2019 Stock and Incentive Compensation Plan; and (iv) warrants to purchase 38,071,408 shares of common stock.

Based

on our issued and outstanding shares of common stock and the outstanding options under our stock incentive plan and outstanding warrants,

as of February 17, 2023, we had 187,980 shares of common stock remaining available for issuance in the future. Accordingly,

we will file the Amended Articles to increase the authorized number of shares of our common stock from 200,000,000 shares to 400,000,000

shares.

In

addition, our working capital requirements are significant and may require us to raise additional capital through additional equity financings

in the future. If we issue additional shares of common stock or other securities convertible into shares of our common stock in the future,

it could dilute the voting rights of existing stockholders and could also dilute earnings per share and book value per share of existing

stockholders. The increase in authorized number of common stock could also discourage or hinder efforts by other parties to obtain control

of the Company, thereby having an anti-takeover effect. The increase in authorized number of common stock is not being proposed in response

to any known threat to acquire control of the Company.

Current

Plans, Proposals or Arrangements to Issue Shares of Common Stock

As

of the Record Date, the Company had:

| ● | 5,757,273

shares of common stock issuable upon the exercise of outstanding stock options with a weighted-average

exercise price of $1.24 per share; |

| ● | 2,373,187

shares of common stock issuable upon vesting of restricted stock unit awards with a weighted-average

exercise price of $0.74 per share; |

| ● | 824,630

shares of common stock reserved for future issuance under our 2019 Stock and Incentive

Compensation Plan; and |

| ● | 38,071,408

shares of common stock issuable upon exercise of warrants to purchase common stock with a

weighted-average exercise price of $0.82 per share. |

The

Company is also in discussion with one of its debt holders to settle the debt for shares of its common stock in full satisfaction of

the debt.

Other

than as set forth above, the Company has no current plans, proposals or arrangements, written or oral, to issue any of the additional

authorized shares of common stock that would become available as a result of the amended Articles of Incorporation (the “Amended

Articles”).

In

addition, following the effectiveness of the Amended Articles, the Company may explore additional financing opportunities or

strategic transactions that would require the issuance of additional shares of common stock, but no such plans are currently in

existence and the Company has not begun any negotiations with any party related thereto. If we issue additional shares, the

ownership interest of holders of our capital stock will be diluted.

Effects

of the Increase in Authorized Common Shares Amendment

Following

the filing of the Increase in Authorized Common Shares Amendment with the Secretary of State of the State of Nevada, we will have the

authority to issue up to an additional 200,000,000 shares of common stock. These shares may be issued without stockholder approval

at any time, in the sole discretion of our board of directors. The authorized and unissued shares may be issued for cash or for any other

purpose that is deemed in the best interests of the Company.

In

addition, the Increase in Authorized Common Shares Amendment could have a number of effects on the Company’s stockholders depending

upon the exact nature and circumstances of any actual issuances of authorized but unissued shares. If we issue additional shares of common

stock or other securities convertible into shares of our common stock in the future, it could dilute the voting rights of existing stockholders

and could also dilute earnings per share and book value per share of existing stockholders. The increase in authorized number of common

stock could also discourage or hinder efforts by other parties to obtain control of the Company, thereby having an anti-takeover effect.

The increase in authorized number of common stock is not being proposed in response to any known threat to acquire control of the Company.

The

Increase in Authorized Common Shares Amendment will not change the number of shares of common stock issued and outstanding, nor will

it have any immediate dilutive effect or change the rights of current holders of our common stock.

Advantages

and Disadvantages of Increasing Authorized Common Stock

There

are certain advantages and disadvantages of increasing the Company’s authorized common stock.

The

advantages include:

| |

● |

The

ability to settle outstanding debt through the issuance of shares of the Company’s common stock |

| |

|

|

| |

● |

The

ability to raise capital by issuing capital stock under future financing transactions, if any. |

| |

|

|

| |

● |

To

have shares of common stock available to pursue business expansion opportunities, if any. |

The

disadvantages include:

| |

● |

In

the event that additional shares of common stock are issued, dilution to the existing stockholders, including a decrease in our net

income per share in future periods. This could cause the market price of our stock to decline. |

| |

|

|

| |

● |

The

issuance of authorized but unissued stock could be used to deter a potential takeover of the Company that may otherwise be beneficial

to stockholders by diluting the shares held by a potential suitor or issuing shares to a stockholder that will vote in accordance with

the desires of the Company’s Board, at that time. A takeover may be beneficial to independent stockholders because, among other

reasons, a potential suitor may offer such stockholders a premium for their shares of stock compared to the then-existing market price.

The Company does not have any plans or proposals to adopt provisions or enter into agreements that may have material anti-takeover

consequences. |

Procedure

for Implementing the Amendment

The

Increase in Authorized Common Shares Amendment will become effective upon the filing or such later time as specified in the filing with

the Secretary of State of the State of Nevada. The form of the Increase in Authorized Common Shares Amendment is attached hereto as Appendix

A. The exact timing of the filing of the Increased in Authorized Amendment will be determined by our board of directors based on

its evaluation as to when such action will be the most advantageous to the Company and our stockholders.

Interests

of Officers and Directors in this Proposal

Our

officers and directors do not have any substantial interest, direct or indirect, in in this proposal.

Required

Vote of Stockholders

The

affirmative vote of the holders of a majority of the outstanding shares of our voting capital stock is required to approve this proposal.

In order to attempt to procure the vote necessary to effect the Increase in the Authorized Shares Amendment and Reverse Stock Split,

as described below, on February 17, 2023, we issued one share of our Series B Preferred Stock to our President, Rory J. Cutaia. The terms

of the Series B Preferred Stock are set forth in a Certificate of Designation of Series B Preferred Stock (the “Certificate of

Designation”), filed with the Secretary of State of the State of Nevada, and effective on February 17, 2023. The Series B Preferred

Stock does not have any voting rights except with respect to an increase in authorized common stock proposal and a reverse stock split

proposal, or otherwise as required by law. With respect to the proposal on the Increase in the Authorized Shares Amendment, the outstanding

share of Series B Preferred Stock is entitled to 700,000,000 votes on such proposal, which is referred to as supermajority voting; however

the votes by the holder of Series B Preferred Stock will be counted in the same “mirrored” proportion as the aggregate votes

cast by the holders of common stock who vote on this proposal. For example, if 50.5% of the shares of common stock voted in person or

by proxy at the Special Meeting are voted FOR Proposal 1, then the Company will count 50.5% of the votes cast (or votes) by the holder

of the Series B Preferred Stock as votes FOR Proposal 1. Holders of common stock and Series B Preferred Stock will vote on the Increase

in the Authorized Shares Amendment proposal as a single class.

The

Board of Directors determined that it was in the best interests of the Company to provide for supermajority voting of the Series B Preferred

Stock in order to obtain sufficient votes for the Increase in the Authorized Shares Amendment proposal and thereby to attempt to avoid

delisting by Nasdaq of the common stock. Due to the required proportional voting structure of the Series B Preferred Stock that mirrors

the actual voting by holders of the common stock, the supermajority voting will serve to reflect the voting preference of the holders

of common stock that actually vote on the matter, whether for or against the proposal, and therefore will not override the stated preference

of the holders of common stock.

If

the Increase in the Authorized Shares Amendment proposal and the Reverse Stock Split proposal are approved, the outstanding share of

Series B Preferred Stock will be automatically redeemed upon the effectiveness of the amendment to the amended Articles of

Incorporation implementing the Reverse Stock Split.

Board

Recommendation

The

board of directors unanimously recommends a vote “FOR” Proposal 1.

PROPOSAL

2:

THE

REVERSE STOCK SPLIT PROPOSAL

Our

board of directors has approved an amendment to our Articles of Incorporation, as amended, to combine the outstanding shares of our common

stock into a lesser number of outstanding shares (a “Reverse Stock Split”).

If

approved by our stockholders, this proposal would permit (but not require) the board of directors to effect a Reverse Stock Split of

the outstanding shares of our common stock within one (1) year of the date the proposal is approved by stockholders, at a specific ratio

within a range of one-for-five (1-for-5) to a maximum of a one-for-forty (1-for-40) split, with the specific ratio to be fixed within

this range by the board of directors in its sole discretion without further stockholder approval. We believe that enabling the board

of directors to fix the specific ratio of the Reverse Stock Split within the stated range will provide us with the flexibility to implement

it in a manner designed to maximize the anticipated benefits for our stockholders.

In

fixing the ratio, the board of directors may consider, among other things, factors such as: the initial and continued listing requirements

of the Nasdaq Capital Market; the number of shares of our common stock outstanding; potential financing opportunities; and prevailing

general market and economic conditions.

The

Reverse Stock Split, if approved by our stockholders, would become effective upon the filing of the amendment to our Articles of Incorporation

with the Secretary of State of the State of Nevada, or at the later time set forth in the amendment. The exact timing of the amendment

will be determined by the board of directors based on its evaluation as to when such action will be the most advantageous to our Company

and our stockholders. In addition, the board of directors reserves the right, notwithstanding stockholder approval and without further

action by the stockholders, to abandon the amendment and the Reverse Stock Split if, at any time prior to the effectiveness of the filing

of the amendment with the Secretary of State of the State of Nevada, the board of directors, in its sole discretion, determines that

it is no longer in our best interest and the best interests of our stockholders to proceed.

The

proposed form of amendment to our certificate of incorporation to effect the Reverse Stock Split is attached as Appendix B to

this Proxy Statement. Any amendment to our certificate of incorporation to effect the Reverse Stock Split will include the Reverse Stock

Split ratio fixed by the board of directors, within the range approved by our stockholders.

Reasons

for the Reverse Stock Split

The

Company’s primary reasons for approving and recommending the Reverse Stock Split is to increase the per share price and bid price

of our common stock to regain compliance with the continued listing requirements of Nasdaq.

On

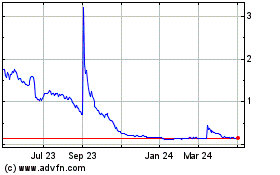

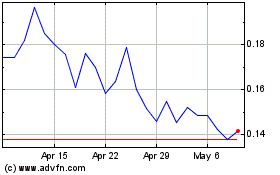

May 12, 2022, we received a written notice from Nasdaq notifying the Company that it was not

in compliance with Nasdaq Listing Rule 5550(a)(2), which requires listed companies to maintain a minimum bid price of $1.00 per share

(the “Bid Price Requirement”). Under Nasdaq Listing Rule 5810(c)(3)(A), the Company had been granted a period of 180 calendar

days, or until November 8, 2022, to regain compliance with the Bid Price Requirement. On November 9, 2022, we were granted an additional

180-day period from the Nasdaq Stock Market Listing Qualifications Staff, through May 8, 2023, to regain compliance with the $1.00 minimum

bid price requirement for continued listing on the Nasdaq Capital Market. To demonstrate compliance with this requirement, the closing

bid price of our common stock needs to be at least $1.00 per share for a minimum of 10 consecutive business days before May 8, 2023.

Reducing

the number of outstanding shares of common stock should, absent other factors, generally increase the per share market price of the common

stock. Although the intent of the Reverse Stock Split is to increase the price of the common stock, there can be no assurance, however,

that even if the Reverse Stock Split is effected, that the Company’s bid price of the Company’s common stock will be sufficient,

over time, for the Company to regain or maintain compliance with the Nasdaq minimum bid price requirement.

In

addition, if the Company fails to meet Nasdaq’s minimum bid price requirement and its common stock is removed from listing on

Nasdaq such failure will constitute an event of default under the terms of that certain promissory note

dated November 7, 2022. Pursuant to the terms of the note, upon the occurrence of an event of default, the outstanding balance

multiplied by 15% may upon notice from the lender become immediately due and payable in full.

Additionally,

the Company believes the Reverse Stock Split will make its common stock more attractive to a broader range of investors, as it believes

that the current market price of the common stock may prevent certain institutional investors, professional investors and other members

of the investing public from purchasing stock. Many brokerage houses and institutional investors have internal policies and practices

that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks

to their customers. Furthermore, some of those policies and practices may function to make the processing of trades in low-priced stocks

economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher

percentage of the stock price than commissions on higher-priced stocks, the current average price per share of common stock can result

in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case

if the share price were higher. The Company believes that the Reverse Stock Split will make our common stock a more attractive and cost

effective investment for many investors, which in turn would enhance the liquidity of the holders of our common stock.

Reducing

the number of outstanding shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the

per share market price of our common stock. However, other factors, such as our financial results, market conditions and the market perception

of our business may adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Stock

Split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following

the Reverse Stock Split, that as a result of the Reverse Stock Split we will be able to meet or maintain a bid price over the minimum

Bid Price Requirement of Nasdaq or that the market price of our common stock will not decrease in the future. Additionally, we cannot

assure you that the market price per share of our common stock after the Reverse Stock Split will increase in proportion to the reduction

in the number of shares of our common stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization

of our common stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

The

Board believes that the Reverse Stock Split will result in a more appropriate and effective structure for the Company and the resultant

trading price would be more appealing to a wider range of investors and will reduce vulnerability to speculative day trading and short

selling which generates price volatility.

If

the Reverse Stock Split proposal is approved, the outstanding share of Series B Preferred Stock will be automatically redeemed upon the

effectiveness of the amendment to the Articles of Incorporation implementing the Reverse Stock Split.

In

evaluating whether to seek stockholder approval for the Reverse Stock Split, our Board took into consideration negative factors associated

with reverse stock splits. These factors include: the negative perception of reverse stock splits that investors, analysts and other

stock market participants may hold; the fact that the stock prices of some companies that have effected reverse stock splits have subsequently

declined, sometimes significantly, following their reverse stock splits; the possible adverse effect on liquidity that a reduced number

of outstanding shares could cause; and the costs associated with implementing a reverse stock split.

Even

if our stockholders approve the Reverse Stock Split, our Board reserves the right not to effect the Reverse Stock Split if in our Board’s

opinion it would not be in the best interests of the Company or our stockholders to effect such Reverse Stock Split.

Potential

Effects of the Proposed Amendment

If

our stockholders approve the Reverse Stock Split and the board of directors effects it, the number of shares of common stock issued and

outstanding will be reduced, depending upon the ratio determined by the board of directors. The Reverse Stock Split will affect all holders

of our common stock uniformly and will not affect any stockholder’s percentage ownership interest in the Company, except that as

described below in “Fractional Shares,” record holders of common stock otherwise entitled to a fractional share as a result

of the Reverse Stock Split because they hold a number of shares not evenly divisible by the Reverse Stock Split ratio will automatically

be entitled to receive an additional fraction of a share of common stock to round up to the next whole share. In addition, the Reverse

Stock Split will not affect any stockholder’s proportionate voting power (subject to the treatment of fractional shares).

The

Reverse Stock Split will not change the terms of the common stock. Additionally, the Reverse Stock Split will have no effect on the number

of common stock that we are authorized to issue. After the Reverse Stock Split, the shares of common stock will have the same voting

rights and rights to dividends and distributions and will be identical in all other respects to the common stock now authorized. The

common stock will remain fully paid and non-assessable.

After

the effective time of the Reverse Stock Split, we will continue to be subject to the periodic reporting and other requirements of the

Exchange Act.

Registered

“Book-Entry” Holders of Common Stock

Our

registered holders of common stock hold some or all of their shares electronically in book-entry form with the transfer agent. These

stockholders do not have stock certificates evidencing their ownership of the common stock. They are, however, provided with statements

reflecting the number of shares registered in their accounts.

Stockholders

who hold shares electronically in book-entry form with the transfer agent will not need to take action to receive evidence of their shares

of post-Reverse Stock Split common stock.

Holders

of Certificated Shares of Common Stock

Stockholders

holding shares of our common stock in certificated form will be sent a transmittal letter by the transfer agent after the effective time

of the Reverse Stock Split. The letter of transmittal will contain instructions on how a stockholder should surrender his, her or its

certificate(s) representing shares of our common stock (the “Old Certificates”) to the transfer agent. Unless a stockholder

specifically requests a new paper certificate or holds restricted shares, upon the stockholder’s surrender of all of the stockholder’s

Old Certificates to the transfer agent, together with a properly completed and executed letter of transmittal, the transfer agent will

register the appropriate number of shares of post-Reverse Stock Split common stock electronically in book-entry form and provide the

stockholder with a statement reflecting the number of shares registered in the stockholder’s account. No stockholder will be required

to pay a transfer or other fee to exchange his, her or its Old Certificates. Until surrendered, we will deem outstanding Old Certificates

held by stockholders to be cancelled and only to represent the number of shares of post-Reverse Stock Split common stock to which these

stockholders are entitled. Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of stock,

will automatically be exchanged for appropriate number of shares of post-Reverse Stock Split common stock. If an Old Certificate has

a restrictive legend on its reverse side, a new certificate will be issued with the same restrictive legend on its reverse side.

STOCKHOLDERS

SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Fractional

Shares

We

will not issue fractional shares in connection with the Reverse Stock Split. Instead, stockholders who otherwise would be entitled to

receive fractional shares because they hold a number of shares not evenly divisible by the Reverse Stock Split ratio will automatically

be entitled to receive an additional fraction of a share of common stock to round up to the next whole share. In any event, cash will

not be paid for fractional shares.

Effect

of the Reverse Stock Split on Outstanding Stock Options and Warrants

Based

upon the Reverse Stock Split ratio, proportionate adjustments are generally required to be made to the per share exercise price and the

number of shares issuable upon the exercise of all outstanding options and warrants. This would result in approximately the same aggregate

price being required to be paid under such options or warrants upon exercise, and approximately the same value of shares of common stock

being delivered upon such exercise immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock

Split. The number of shares reserved for issuance pursuant to these securities will be reduced proportionately based upon the Reverse

Stock Split ratio.

Accounting

Matters

The

proposed amendment to our Articles of Incorporation will not affect the par value of our common stock. As a result, at the effective

time of the Reverse Stock Split, the stated capital on our balance sheet attributable to the common stock will be reduced in the same

proportion as the Reverse Stock Split ratio, and the additional paid-in capital account will be credited with the amount by which the

stated capital is reduced. The per share net income or loss will be restated for prior periods to conform to the post-Reverse Stock Split

presentation.

Certain

Federal Income Tax Consequences of the Reverse Stock Split

The

following summary describes, as of the date of this proxy statement, certain U.S. federal income tax consequences of the Reverse Stock

Split to holders of our common stock. This summary addresses the tax consequences only to a U.S. holder, which is a beneficial owner

of our common stock that is either:

| |

● |

an

individual citizen or resident of the United States; |

| |

|

|

| |

● |

a

corporation, or other entity taxable as a corporation for U.S. federal income tax purposes, created or organized in or under the laws

of the United States or any state thereof or the District of Columbia; |

| |

|

|

| |

● |

an

estate, the income of which is subject to U.S. federal income taxation regardless of its source; or |

| |

|

|

| |

● |

a

trust, if: (i) a court within the United States is able to exercise primary jurisdiction over its administration and one or more U.S.

persons has the authority to control all of its substantial decisions or (ii) it was in existence before August 20, 1996 and a valid

election is in place under applicable Treasury regulations to treat such trust as a U.S. person for U.S. federal income tax purposes |

This

summary is based on the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury regulations,

administrative rulings and judicial authority, all as in effect as of the date of this proxy statement. Subsequent developments in U.S.

federal income tax law, including changes in law or differing interpretations, which may be applied retroactively, could have a material

effect on the U.S. federal income tax consequences of the Reverse Stock Split.

This

summary does not address all of the tax consequences that may be relevant to any particular investor, including tax considerations that

arise from rules of general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be known

by investors. This summary also does not address the tax consequences to (i) persons that may be subject to special treatment under U.S.

federal income tax law, such as banks, insurance companies, thrift institutions, regulated investment companies, real estate investment

trusts, tax-exempt organizations, U.S. expatriates, persons subject to the alternative minimum tax, persons whose functional currency

is not the U.S. dollar, partnerships or other pass-through entities, traders in securities that elect to mark to market and dealers in

securities or currencies, (ii) persons that hold our common stock as part of a position in a “straddle” or as part of a “hedging

transaction,” “conversion transaction” or other integrated investment transaction for federal income tax purposes or

(iii) persons that do not hold our common stock as “capital assets” (generally, property held for investment). This summary

does not address backup withholding and information reporting. This summary does not address U.S. holders who beneficially own common

stock through a “foreign financial institution” (as defined in Code Section 1471(d)(4)) or certain other non-U.S. entities

specified in Code Section 1472. This summary does not address tax considerations arising under any state, local or foreign laws, or under

federal estate or gift tax laws.

If

a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our common

stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the

activities of the partnership. Partnerships that hold our common stock, and partners in such partnerships, should consult their own tax

advisors regarding the U.S. federal income tax consequences of the Reverse Stock Split.

Each

holder should consult his, her or its own tax advisors concerning the particular U.S. federal tax consequences of the Reverse Stock Split,

as well as the consequences arising under the laws of any other taxing jurisdiction, including any foreign, state, or local income tax

consequences.

General

Tax Treatment of the Reverse Stock Split

The

Reverse Stock Split is intended to qualify as a “reorganization” under Section 368 of the Code that should constitute a “recapitalization”

for U.S. federal income tax purposes. Assuming the Reverse Stock Split qualifies as a reorganization, a U.S. holder generally will not

recognize gain or loss upon the exchange of our ordinary shares for a lesser number of ordinary shares, based upon the Reverse Stock

Split ratio. A U.S. holder’s aggregate tax basis in the lesser number of ordinary shares received in the Reverse Stock Split will

be the same such U.S. holder’s aggregate tax basis in the shares of our common stock that such U.S. holder owned immediately prior

to the Reverse Stock Split. The holding period for the ordinary shares received in the Reverse Stock Split will include the period during

which a U.S. holder held the shares of our common stock that were surrendered in the Reverse Stock Split. The United States Treasury

regulations provide detailed rules for allocating the tax basis and holding period of the shares of our common stock surrendered to the

shares of our common stock received pursuant to the Reverse Stock Split. U.S. holders of shares of our common stock acquired on different

dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such

shares.

THE

FOREGOING IS INTENDED ONLY AS A SUMMARY OF CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT, AND DOES NOT CONSTITUTE

A TAX OPINION. EACH HOLDER OF OUR COMMON SHARES SHOULD CONSULT ITS OWN TAX ADVISOR REGARDING THE TAX CONSEQUENCES OF THE REVERSE STOCK

SPLIT TO THEM AND FOR REFERENCE TO APPLICABLE PROVISIONS OF THE CODE.

Interests

of Officers and Directors in this Proposal

Our

officers and directors do not have any substantial interest, direct or indirect, in in this proposal.

Required

Vote of Stockholders

The affirmative vote of the

holders of a majority of the outstanding shares of our capital stock is required to approve this proposal. In order to attempt to procure

the vote necessary to effect the Reverse Stock Split and the Increase in the Authorized Shares Amendment, as described above,

on February 17, 2023, we issued one share of our Series B Preferred Stock to our Chief Executive Officer, Rory J. Cutaia. The terms

of the Series B Preferred Stock are set forth in a Certificate of Designation of Series B Preferred Stock (the “Certificate of

Designation”), filed with the Secretary of State of the State of Nevada, and effective on February 17, 2023. The Series B Preferred

Stock does not have any voting rights except with respect to the Increase in the Authorized Common Stock Proposal and the Reverse Stock

Split Proposal, or otherwise as required by law. With respect to the proposal on the Reverse Stock Split, the outstanding share of Series

B Preferred Stock is entitled to 700,000,000 votes on such proposal, which is referred to as supermajority voting; however the votes

by the holder of Series B Preferred Stock will be counted in the same “mirrored” proportion as the aggregate votes cast by

the holders of common stock who vote on this proposal. For example, if 50.5% of the shares of common stock voted in person or by proxy

at the Special Meeting are voted FOR Proposal 2, then the Company will count 50.5% of the votes cast (or votes) by the holder of the

Series B Preferred Stock as votes FOR Proposal 2. Holders of common stock and Series B Preferred Stock will vote on the Reverse Stock

Split proposal as a single class.

The

Board of Directors determined that it was in the best interests of the Company to provide for supermajority voting of the Series B Preferred

Stock in order to obtain sufficient votes for the Reverse Stock Split proposal and thereby to attempt to avoid delisting by Nasdaq of

the common stock. Due to the required proportional voting structure of the Series B Preferred Stock that mirrors the actual voting by

holders of the common stock, the supermajority voting will serve to reflect the voting preference of the holders of common stock that

actually vote on the matter, whether for or against the proposal, and therefore will not override the stated preference of the holders

of common stock.

If

the Increase in the Authorized Shares Amendment proposal and the Reverse Stock Split proposal are approved, the outstanding share of

Series B Preferred Stock will be automatically redeemed upon the effectiveness of the amendment to the amended Articles of Incorporation implementing the Reverse Stock Split.

Board

Recommendation

The

board of directors unanimously recommends a vote “FOR” Proposal 2.

PROPOSAL

3

AMENDMENT

OF THE 2019 STOCK AND INCENTIVE COMPENSATION PLAN

On

November 11, 2019, our Board approved our Incentive Plan, and on December 20, 2019, our stockholders approved and adopted the Incentive

Plan. On September 2, 2020, our Board approved, an amendment to the Incentive Plan to add 8,000,000 shares of common stock authorized

under the Incentive Plan for a total of 16,000,000, and on October 16, 2020, our stockholders approved the amendment.

On

February 17, 2023, our Board approved, subject to stockholder approval, an amendment to the Incentive Plan to add 15,000,000 shares of

common stock authorized under the Incentive Plan to the 16,000,000 shares previously approved. The proposed amendment is attached hereto

as Appendix C.

Our

Board recommends approval of the amendment to the Incentive Plan to enable the continued use of the Incentive Plan for stock-based grants

consistent with the objectives of our compensation program. The Incentive Plan is intended to promote our interests by providing eligible

persons in our service with the opportunity to acquire a proprietary or economic interest, or otherwise increase their proprietary or

economic interest, in us as an incentive for them to remain in service and render superior performance during their service.

A

total of 16,000,000 shares of common stock are authorized for issuance under the Incentive Plan. A total of 31,000,000 shares of common

stock will be authorized for issuance under the Incentive Plan upon stockholder approval of this proposal. Currently, equity awards totaling

31,000,000 shares of common stock have been issued under the Incentive Plan. We believe that the Incentive Plan will be exhausted

of shares available for issuance in 2023, leaving insufficient shares available for equity grants in 2023 and future years. By increasing

the number of shares authorized for issuance under the Incentive Plan by 15,000,000, a total of 15,824,630 shares of common stock

would be available for issuance. This increase would, in essence, provide us with the flexibility to continue to make stock-based grants

in amounts deemed appropriate by our Compensation Committee and Board. We believe that our equity incentive program and grants made under

the program are essential to retaining critical personnel and aligning the incentives of our personnel with our stockholders.

The

proposed share increase amendment will not be implemented unless approved by our stockholders, and no additional equity awards beyond

the existing 16,000,000 shares of common stock have been or will be issued under the Incentive Plan unless and until stockholder approval

of the amended Incentive Plan is obtained. If the proposed share increase amendment is not approved by our stockholders, the Incentive

Plan will remain in effect in its present form.

Equity

Compensation Plan Information

The

following table summarizes certain information regarding our equity compensation plans as of December 31, 2022:

| Plan

Category | |

Number

of Securities to be Issued Upon Exercise of Outstanding Awards (#) | | |

Weighted-Average

Exercise Price of Outstanding Awards ($)(1) | | |

Number

of Securities Remaining Available for Future Issuance (#) | |

| Equity

compensation plans approved by security holders | |

| 8,334,107 | | |

$ | 0.90 | | |

| 641,924 | |

| Equity

compensation plans not approved by security holders | |

| 467,543 | | |

$ | 3.70 | | |

| - | |

| Total | |

| 8,801,650 | | |

$ | 1.05 | | |

| 641,924 | |

| (1) |

This

amount does not take into account shares issuable upon the vesting or settlement of outstanding restricted stock units, which have

no exercise price. |

2019

Stock and Incentive Compensation Plan

The following is a summary of

the principal features of our Incentive Plan, as amended to reflect the proposed plan amendment. The summary does not purport to be a

complete description of all provisions of our Incentive Plan and is qualified in its entirety by the text of the Incentive Plan. A

copy of the amendment is attached to this Proxy Statement as Appendix C.

General

The

purpose of the Incentive Plan is to enhance stockholder value by linking the compensation of our officers, directors, key employees,

and consultants to increases in the price of our common stock and the achievement of other performance objections and to encourage ownership

in our company by key personnel whose long-term employment is considered essential to our continued progress and success. The Incentive

Plan is also intended to assist us in recruiting new employees and to motivate, retain, and encourage such employees and directors to

act in our stockholders’ interest and share in our success.

Term

The

Incentive Plan became effective upon approval by our stockholders and will continue in effect from that date until it is terminated in

accordance with its terms.

Administration

The

Incentive Plan may be administered by our Board, a committee designated by it, and/or their respective delegates. Currently, our Compensation

Committee administers the Incentive Plan. The administrator has the power to determine the directors, employees, and consultants who

may participate in the Incentive Plan and the amounts and other terms and conditions of awards to be granted under the Incentive Plan.

All questions of interpretation and administration with respect to the Incentive Plan will be determined by the administrator. The administrator

also will have the complete authority to adopt, amend, rescind, and enforce rules and regulations pertaining to the administration of

the Incentive Plan; to correct administrative errors; to make all other determinations deemed necessary or advisable for administering

the Incentive Plan and any award granted under the Incentive Plan; and to authorize any person to execute, on behalf of us, all agreements

and documents previously approved by the administrator, among other items.

Eligibility

Any

of our directors, employees, or consultants, or any directors, employees, or consultants of any of our affiliates (except that with respect

to incentive stock options, only employees of us or any of our subsidiaries are eligible), are eligible to participate in the Incentive

Plan. As of the Record Date, approximately 121 individuals would be eligible to participate

in the Incentive Plan. However, the Company has not at the present time determined who will receive the additional shares that will be

authorized for issuance upon the approval of the amendment to increase the number of shares subject to the Inventive Plan or how they

will be allocated.

Available

Shares

Subject

to the adjustment provisions included in the Incentive Plan, a total of 31,000,000 shares of our common stock would be authorized for

awards granted under the Incentive Plan. Shares subject to awards that have been canceled, expired, settled in cash, or not issued or

forfeited for any reason (in whole or in part), will not reduce the aggregate number of shares that may be subject to or delivered under

awards granted under the Incentive Plan and will be available for future awards granted under the Incentive Plan.

Types

of Awards

We

may grant the following types of awards under the Incentive Plan: stock awards; options; stock appreciation rights; stock units; or other

stock-based awards.

Stock

Awards. The Incentive Plan authorizes the grant of stock awards to eligible participants. The administrator determines (i) the number

of shares subject to the stock award or a formula for determining such number, (ii) the purchase price of the shares, if any, (iii) the

means of payment for the shares, (iv) the performance criteria, if any, and the level of achievement versus these criteria, (v) the grant,

issuance, vesting, and/or forfeiture of the shares, (vi) restrictions on transferability, and such other terms and conditions determined

by the administrator.

Options.

The Incentive Plan authorizes the grant of non-qualified and/or incentive options to eligible participants, which options give the participant

the right, after satisfaction of any vesting conditions and prior to the expiration or termination of the option, to purchase shares

of our common stock at a fixed price. The administrator determines the exercise price for each share subject to an option granted under

the Incentive Plan, which exercise price cannot be less than the fair market value (as defined in the Incentive Plan) of our common stock

on the grant date. The administrator also determines the number of shares subject to each option, the time or times when each option

becomes exercisable, and the term of each option (which cannot exceed ten (10) years from the grant date).

Stock

Appreciation Rights. The Incentive Plan authorizes the grant of stock appreciation rights to eligible participants, which stock appreciation

rights give the participant the right, after satisfaction of any vesting conditions and prior to the expiration or termination of the

stock appreciation right, to receive in cash or shares of our common stock the excess of the fair market value (as defined in the Incentive

Plan) of our common stock on the date of exercise over the exercise price of the stock appreciation right. All stock appreciation rights

under the Incentive Plan shall be granted subject to the same terms and conditions applicable to options granted under the Incentive

Plan. Stock appreciation rights may be granted to awardees either alone or in addition to or in tandem with other awards granted under

the Incentive Plan and may, but need not, relate to a specific option granted under the Incentive Plan.

Stock

Unit Awards and Other Stock-Based Awards. In addition to the award types described above, the administrator may grant any other type

of award payable by delivery of our common stock in such amounts and subject to such terms and conditions as the administrator determines

in its sole discretion, subject to the terms of the Incentive Plan. Such awards may be made in addition to or in conjunction with other

awards under the Incentive Plan. Such awards may include unrestricted shares of our common stock, which may be awarded, without limitation

(except as provided in the Incentive Plan), as a bonus, in payment of director fees, in lieu of cash compensation, in exchange for cancellation

of a compensation right, or upon the attainment of performance goals or otherwise, or rights to acquire shares of our common stock from

us.

Award

Limits

Subject

to the terms of the Incentive Plan, the aggregate number of shares that may be subject to all incentive stock options granted under the

Incentive Plan cannot exceed the total aggregate number of shares that may be subject to or delivered under awards under the Incentive

Plan. Notwithstanding any other provisions of the Incentive Plan to the contrary, the aggregate grant date fair value (computed as specified

in the Incentive Plan) of all awards granted to any non-employee director during any single calendar year shall not exceed 300,000 shares

during 2019 and, thereafter, 200,000 shares.

New

Plan Benefits

The

amount of future grants under the Incentive Plan is not determinable, as awards under the Incentive Plan will be granted at the sole

discretion of the administrator. We cannot determinate at this time either the persons who will receive awards under the Incentive Plan

or the amount or types of such any such awards.

Transferability

Unless

determined otherwise by the administrator, an award may not be sold, pledged, assigned, hypothecated, transferred, or disposed of in

any manner other than by beneficiary designation, will, or by the laws of descent or distribution, including but not limited to any attempted

assignment or transfer in connection with the settlement of marital property or other rights incident to a divorce or dissolution, and

any such attempted sale, assignment, or transfer shall be of no effect prior to the date an award is vested and settled.

Termination

of Employment or Board Membership

At

the grant date, the administrator is authorized to determine the effect a termination from membership on the Board by a non-employee

director for any reason or a termination of employment (as defined in the Incentive Plan) due to disability (as defined in the Incentive