Venus Concept Inc. Announces Multi-Tranche Private Placement of Senior Convertible Preferred Stock for up to $9 Million with EW Healthcare Partners

May 15 2023 - 7:00AM

Venus Concept Inc. (“Venus Concept” or the “Company”) (NASDAQ:

VERO), a global medical aesthetic technology leader, today

announced that it has entered into a stock purchase agreement (the

“Stock Purchase Agreement”) with funds affiliated with EW

Healthcare Partners (the “Investors”). Pursuant to the Stock

Purchase Agreement, the Company may issue and sell to the Investors

up to $9,000,000, before offering expenses, in shares of senior

convertible preferred stock (the “Senior Preferred Stock”), in

multiple tranches from time to time until December 31, 2025.

Offering proceeds will be used for working capital and general

corporate purposes.

At the initial closing, expected to occur today,

the Investors will purchase 280,899 Senor Preferred Stock at a

price of $7.12 per share for total gross proceeds to the Company of

$2.0 million. Following the initial closing, each subsequent

tranche request submitted by the Company to the Investors is

subject to acceptance by the Investors.

The purchase price for each share of Senior

Preferred Stock purchased in each tranche floats at a price equal

to the product of (a) the lower of (i) the closing price of the

Company’s common stock on the trading day immediately preceding the

applicable tranche closing date and (ii) the average closing price

of the Company’s common stock for the five trading days immediately

preceding the applicable closing date, multiplied by (b) two. Each

share of Senior Preferred Stock is convertible into common shares

on a 1-for-2.6667 basis at the option of (i) the Investors at any

time or (ii) the Company within 30 days following the occurrence of

specified trigger events.

“We appreciate the continued support from EW

Healthcare Partners, a longstanding investor in the Company,” said

Rajiv De Silva, Chief Executive Officer of Venus Concept. “This

financing provides Venus Concept with valuable capital to execute

our near-to-intermediate term strategic objectives. We look forward

to working with EW Healthcare Partners to access funding from this

multi-tranche private placement as needs arise.”

Additional information regarding the Stock

Purchase Agreement and the Senior Preferred Stock will be set forth

in a Current Report on Form 8-K, which Venus Concept expects to

file with the SEC today.

Canaccord Genuity acted as exclusive placement

agent and financial advisor to the Company in the offering.

The offer and sale of the foregoing securities

are being made in a transaction not involving a public offering and

have not been registered under the Securities Act of 1933, as

amended (the “Securities Act”), or applicable state securities

laws, and will be sold in a private placement pursuant to Section

4(a)(2) and/or Regulation D of the Securities Act. The securities

may not be offered or sold in the United States absent registration

or pursuant to an exemption from the registration requirements of

the Securities Act and applicable state securities laws. The

Company has agreed to file a registration statement covering the

resale of the Common Shares acquired by the investors in the

private placement, including the Common Shares issuable upon

conversion of the Senior Preferred Stock.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy the securities in

the described offering, nor shall there be any offer, solicitation

or sale of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction.

Cautionary Statement Regarding

Forward-Looking Statements

This communication contains “forward-looking”

statements within the meaning of Section 27A of the Securities

Act of 1933, as amended and Section 21E of the Securities

Exchange Act of 1934, as amended. Any statements contained herein

that are not of historical facts may be deemed to be

forward-looking statements. In some cases, you can identify these

statements by words such as such as “anticipates,” “believes,”

“plans,” “expects,” “projects,” “future,” “intends,” “may,”

“should,” “could,” “estimates,” “predicts,” “potential,”

“continue,” “guidance,” and other similar expressions that are

predictions of or indicate future events and future trends. These

forward-looking statements include, but are not limited to,

statements about the expecting timing of the initial closing

of the sale of Senior Preferred Stock and whether or not any

subsequent sales of the Senior Preferred Stock will occur. These

forward-looking statements are based on current expectations,

estimates, forecasts, and projections about our business and the

industry in which the Company operates and management's beliefs and

assumptions and are not guarantees of future performance or

developments and involve known and unknown risks, uncertainties,

and other factors that are in some cases beyond our control. As a

result, any or all of our forward-looking statements in this

communication may turn out to be inaccurate. Factors that could

materially affect our business operations and financial performance

and condition include, but are not limited to, general

economic conditions, including the global economic impact of

COVID-19, and involve risks and uncertainties that may cause

results to differ materially from those set forth in the statements

and those risks and uncertainties described under Part II Item

1A—“Risk Factors” in our Quarterly Reports on Form 10-Q and Part I

Item 1A—“Risk Factors” in our Annual Report on Form 10-K for

the fiscal year ended December 31, 2022. You are urged to

consider these factors carefully in evaluating the forward-looking

statements and are cautioned not to place undue reliance on the

forward-looking statements. The forward-looking statements are

based on information available to us as of the date of this

communication. Unless required by law, the Company does not intend

to publicly update or revise any forward-looking statements to

reflect new information or future events or otherwise.

About Venus Concept

Venus Concept is an innovative global medical

aesthetic technology leader with a broad product portfolio of

minimally invasive and non-invasive medical aesthetic and hair

restoration technologies and reach in over 60 countries and 14

direct markets. Venus Concept’s product portfolio consists of

aesthetic device platforms, including Venus Versa, Venus Legacy,

Venus Velocity, Venus Fiore, Venus Viva, Venus Glow, Venus Bliss,

Venus BlissMAX, Venus Epileve, Venus Viva MD and AI.ME. Venus

Concept’s hair restoration systems include NeoGraft® and the ARTAS

iX® Robotic Hair Restoration system. Venus Concept has been backed

by leading healthcare industry growth equity investors including EW

Healthcare Partners (formerly Essex Woodlands), HealthQuest

Capital, Longitude Capital Management, Aperture Venture Partners,

and Masters Special Situations.

Investor Relations Contact:

ICR Westwicke on behalf of Venus Concept:

Mike Piccinino, CFA

VenusConceptIR@westwicke.com

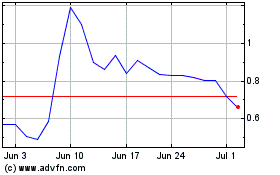

Venus Concept (NASDAQ:VERO)

Historical Stock Chart

From Mar 2024 to Apr 2024

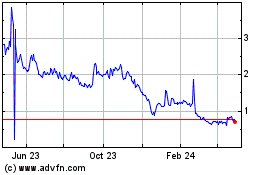

Venus Concept (NASDAQ:VERO)

Historical Stock Chart

From Apr 2023 to Apr 2024