Venus Concept Announces Debt Refinancing

December 10 2020 - 6:30AM

Venus Concept Inc. (“Venus Concept” or the “Company”) (NASDAQ:

VERO), a global medical aesthetic technology leader, announced

today that it has amended its existing revolving credit facility

with City National Bank of Florida (“CNB”) and successfully

refinanced its long-term debt obligations. Specifically, the

Company secured a new loan with CNB in the aggregate amount of

$50.0 million as part of the Main Street Priority Loan Facility

established by the Board of Governors of the Federal Reserve System

Section 13(3) of the Federal Reserve Act. The loan has a term of

five years and bears interest at an annual rate of LIBOR plus 3%. A

portion of the proceeds were used to pay down $3.2 million of the

Company’s revolving line of credit with CNB. The Company also

entered into agreements with Madryn Health Partners, LP (Madryn)

and Madryn Health Partners (Cayman Master), LP (collectively,

“Madryn”), whereby the Company repaid $42.5 million of aggregate

principal amount owed under the existing credit agreement with

Madryn and issued 8% secured subordinated convertible notes to

Madryn for an aggregate principal amount of $26.7 million to

exchange and retire the remaining debt obligations owed to Madryn

that would have matured in 2022. The convertible notes

have a 5-year term and the interest rate on the convertible notes

decreases to 6% on the third anniversary of the issuance. The notes

are convertible at any time into shares of common stock of the

Company at an initial conversion price of $3.25 per share, subject

to adjustment.

“We are pleased to announce these significant enhancements to

Venus Concept's balance sheet and financial condition, reducing our

cost of debt from 9% to less than 5% based on current rates,” said

Domenic Della Penna, Chief Financial Officer of Venus Concept.

“This new loan agreement allows us to refinance our long-term debt

obligations which provides us with greater flexibility to support

the execution of our growth strategy.”

Additional information regarding these loan and securities

agreements are available in the Company’s Current Report on Form

8-K filed with the Securities and Exchange Commission on December

10, 2020.

About Venus Concept

Venus Concept is an innovative global medical

aesthetic technology leader with a broad product portfolio of

minimally invasive and non-invasive medical aesthetic and hair

restoration technologies and reach in over 60 countries and 25

direct markets. Venus Concept focuses its product sales strategy on

a subscription-based business model in North America and in its

well-established direct global markets. Venus Concept’s product

portfolio consists of aesthetic device platforms, including Venus

Versa, Venus Legacy, Venus Velocity, Venus Fiore, Venus Viva, Venus

Freeze Plus, Venus Heal, Venus Glow, Venus Bliss, Venus Epileve and

Venus Viva MD. Venus Concept’s hair restoration systems includes

NeoGraft®, an automated hair restoration system that facilitates

the harvesting of follicles during a FUE process and the ARTAS® and

ARTAS iX® Robotic Hair Restoration systems, which harvest

follicular units directly from the scalp and create recipient

implant sites using proprietary algorithms. Venus Concept has been

backed by leading healthcare industry growth equity investors

including EW Healthcare Partners (formerly Essex Woodlands),

HealthQuest Capital, Longitude Capital Management, and Aperture

Venture Partners.

Cautionary Statement Regarding

Forward-Looking Statements

This

communication contains “forward-looking” statements

within the meaning of Section 27A of the Securities Act of

1933, as amended (the “1933 Act”) and Section 21E of the

Securities Exchange Act of 1934, as amended (the “1934 Act”),

including, without limitation, statements about the Company’s

financial condition, and other statements containing the words

“expect,” “intend,” “may,” “will,” and similar expressions,

constitute forward-looking statements within the meaning of The

Private Securities Litigation Reform Act of 1995. These

forward-looking statements are based on current expectations,

estimates, forecasts, and projections about the Company’s business

and the industry in which it operates and management’s beliefs and

assumptions and are not guarantees of future performance or

developments and involve known and unknown risks, uncertainties,

and other factors that are in some cases beyond the Company’s

control. Factors that could materially affect the Company’s

business operations and financial performance and condition

include, but are not limited to, those risks and uncertainties

described under Part I Item 1A—“Risk Factors” in the Company’s most

recent Annual Report on Form 10-K, Part II

Item 1A—“Risk Factors” in the Company’s most recent Form 10-Q

and in other documents the Company may file with the SEC. You are

urged to consider these factors carefully in evaluating the

forward-looking statements and are cautioned not to place undue

reliance on the forward-looking statements. The forward-looking

statements are based on information available to the Company as of

the date hereof. Unless required by law, the Company does not

intend to publicly update or revise any forward-looking statements

to reflect new information or future events or otherwise.

Investor Relations Contact:

Westwicke Partners on behalf of Venus Concept:

Mike Piccinino, CFA

VenusConceptIR@westwicke.com

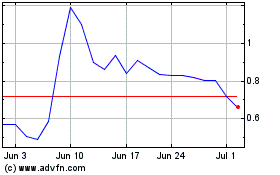

Venus Concept (NASDAQ:VERO)

Historical Stock Chart

From Mar 2024 to Apr 2024

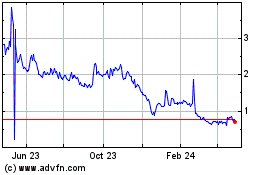

Venus Concept (NASDAQ:VERO)

Historical Stock Chart

From Apr 2023 to Apr 2024