Current Report Filing (8-k)

February 03 2021 - 8:36AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 3, 2021

Vaxart, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35285

|

|

59-1212264

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

170 Harbor Way, Suite 300, South San Francisco, California

|

|

94080

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (650) 550-3500

|

N/A

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

|

VXRT

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Vaxart, Inc. (the “Company”) estimates that its cash and cash equivalents as of December 31, 2020, was approximately $126.9 million, compared to $13.5 million and $11.5 million as of December 31, 2019 and 2018, respectively. The increase in 2020 is primarily due to $97 million received from the ATM facility in July 2020, $26 million from the exercise of warrants throughout the year, $9 million from the registered direct offering in February 2020, and $5 million from the ATM facility in October 2020 offset by $24 million used in operations. The Company estimates that its revenue for the year ending December 31, 2020 was approximately $4.0 million, compared to $9.9 million and $4.2 million for the years ended December 31, 2019 and 2018 respectively. The decrease was due primarily to the impact of COVID-19 on the royalty revenue stream from Daiichi for the Inavir product.

The Company’s audited, consolidated financial statements as of December 31, 2020, are not yet available. Accordingly, the information presented above reflects the Company’s preliminary estimates, subject to the completion of the Company’s financial closing procedures and the annual audit of its financial statements by its auditors. As a result, these preliminary estimates may differ from the actual results that will be reflected in the Company’s audited, consolidated financial statements for the fiscal year ended December 31, 2020 when they are completed and publicly disclosed. These preliminary estimates may change, and those changes may be material.

Because these financial results are only preliminary estimates and are based on information available to management as of the date of this report, these expectations could change. The Company’s actual financial results as of December 31, 2020 are subject to the audit of the Company’s financial statements as of and for such period, and are not indicative of future performance. The Company’s independent registered public accountants have not audited, reviewed or performed any procedures with respect to such preliminary estimates and accordingly do not express an opinion or any other form of assurance with respect thereto.

Item 8.01 Other Events.

Preliminary Financial Information

The preliminary financial information disclosed under Item 2.02 above is incorporated herein by reference.

Janssen Research Collaboration Agreement

As previously disclosed, the Company entered into a research collaboration agreement (the “Collaboration Agreement”) with Janssen Vaccines & Prevention B.V. (“Janssen”) to evaluate the Company’s proprietary oral vaccine platform for the Janssen universal influenza vaccine program. Under the agreement, the Company produced non-GMP oral vaccine containing certain proprietary antigens from Janssen and tested the product in a preclinical challenge model. The study has been completed, and recently the Company delivered the final report in connection with the Collaboration Agreement. Upon delivery of the report, Janssen has a three-month option to negotiate an exclusive worldwide license to the Company’s technology encompassing the Janssen antigens. Janssen has not notified the Company whether it will exercise this option.

Non-Human Primate Study Update

As previously disclosed, the Company’s oral COVID-19 vaccine was selected to participate in a non-human primate challenge (“NHP”) study, organized by Operation Warp Speed and funded by the Biomedical Advanced Research and Development Authority (“BARDA”) under contract with a research laboratory and in collaboration with USG partners. The Company recently received data from the NHP challenge study of its COVID-19 vaccine candidate. After reviewing the information provided by BARDA, the Company concluded that the study was unable to evaluate the Company’s COVID-19 vaccine candidate because of oral vaccine delivery challenges in non-human primate model systems. The Company has significant previous experience with the NHP model and the difficulties of oral administration in this model. Therefore, the Company asked that an active control arm be included in the study, with a vaccine (norovirus) that has previously shown high immunogenicity in both NHP and clinical (human) studies, to validate that protocols and procedures were adequate for the NHP model. Data from the active control arm led the Company to conclude that the NHP study was unable to evaluate either vaccine.

Preliminary Data from Phase 1 Clinical Trial Evaluating Oral COVID-19 Tablet Vaccine Candidate

On February 3, 2021, the Company announced that preliminary data from its Phase 1 study of VXA-CoV2-1 showed that its oral COVID-19 tablet vaccine candidate was generally well-tolerated, and immunogenic as measured by multiple markers of immune responses to the SARS-CoV-2 antigens. On February 3, 2021, the Company issued a press release announcing this preliminary data and related matters. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1.

Item 9.01 – Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Vaxart, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: February 3, 2021

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Andrei Floroiu

|

|

|

|

|

|

|

Andrei Floroiu

|

|

|

|

|

|

|

President and Chief Executive Officer

|

|

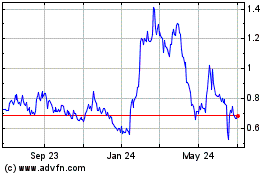

Vaxart (NASDAQ:VXRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

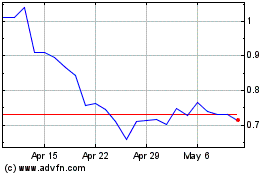

Vaxart (NASDAQ:VXRT)

Historical Stock Chart

From Apr 2023 to Apr 2024