Usio, Inc: (Nasdaq:USIO), a leading FinTech integrated payment

solutions provider, today announced financial results for the

second quarter of 2021, which ended June 30, 2021.

Louis Hoch, President and Chief Executive

Officer of Usio, said, "I am pleased to report another record

quarter with revenue growth accelerating to 119%, the fastest ever

rate of revenue growth. Profitability also continues to

significantly improve, with Adjusted EBITDA up $1.9 million

from a year ago as we achieved our third consecutive quarter of

positive Adjusted EBITDA. Processing volumes in the quarter were a

record $2.7 billion, up 389% from a year ago and up 46%

sequentially from our previous record quarter just achieved in the

first quarter of this year. Across the board, we are experiencing

outstanding performance as we leverage our multi-channel

distribution strategy and strong relationships to penetrate

attractive markets with our industry-leading technology. As a

result, we are raising our annual revenue guidance for the year to

an expected range between $56 million and $59 million,

which would represent increases of between 73% and 83% above fiscal

2020 revenues, while also anticipating positive operating cash

flows and Adjusted EBITDA. All of which are conditioned on the

continued enthusiasm in the fintech lending and cryptocurrency

industries.

Growth was strong in each of our businesses, led

by ACH, where revenues were up 125% due to a focus on penetrating

fast-growing industries like cryptocurrency and Fintech. ACH

remains our most profitable line of business. Card revenue growth

also accelerated, reflecting PayFac’s increasing market momentum.

Prepaid had another strong quarter, increasing its penetration of

the governmental, municipal, charitable and related markets where

they have become a leading provider of electronic payments

solutions. Usio Output Solutions continues to exceed expectations

and is now beginning to realize the anticipated cross selling

synergies.

It’s been an extremely strong first half of the

year. We are intent on building on this strong momentum through

continued flawless execution of our strategy and investing in our

innovative technology and unparalleled service to build value for

our shareholders. This quarter was a testament to the scalability

of our systems and associated products and services."

Second Quarter 2021 Financial

Summary

Revenues for the quarter ended June 30,

2021 increased 119% to $15.2 million, reflecting

growth in each of our ACH, Credit Card and Prepaid lines of

business as well as a full quarter of Usio Output Solutions

revenues, which was acquired in December 2020. Excluding the

results of Usio Output Solutions revenues, organic growth was

67% versus the same period last year. For the six months

ended June 30, 2021, revenues increased 95% with year over

year growth in all lines of business. Excluding the

results of Usio Output Solutions revenues for the six-month period,

organic growth was 45% versus the same period last year.

| |

|

Three Months Ended June 30, |

|

| |

|

2021 |

|

|

2020 |

|

|

$ Change |

|

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ACH and complementary service

revenue |

|

$ |

4,001,897 |

|

|

$ |

1,779,245 |

|

|

$ |

2,222,652 |

|

|

|

125 |

% |

| Credit card revenue |

|

|

6,558,076 |

|

|

|

4,588,199 |

|

|

|

1,969,877 |

|

|

|

43 |

% |

| Prepaid card services

revenue |

|

|

1,077,531 |

|

|

|

593,109 |

|

|

|

484,422 |

|

|

|

82 |

% |

| Output solutions revenue |

|

|

3,595,637 |

|

|

|

— |

|

|

|

3,595,637 |

|

|

|

100 |

% |

| Total Revenue |

|

$ |

15,233,141 |

|

|

$ |

6,960,553 |

|

|

$ |

8,272,588 |

|

|

|

119 |

% |

| |

|

Six Months Ended June 30, |

|

| |

|

2021 |

|

|

2020 |

|

|

$ Change |

|

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ACH and complementary service

revenue |

|

$ |

7,080,353 |

|

|

$ |

4,016,991 |

|

|

$ |

3,063,362 |

|

|

|

76 |

% |

| Credit card revenue |

|

|

12,281,785 |

|

|

|

9,570,857 |

|

|

|

2,710,928 |

|

|

|

28 |

% |

| Prepaid card services

revenue |

|

|

1,964,107 |

|

|

|

1,144,384 |

|

|

|

819,723 |

|

|

|

72 |

% |

| Output solutions revenue |

|

|

7,368,446 |

|

|

|

— |

|

|

|

7,368,446 |

|

|

|

100 |

% |

| Total Revenue |

|

$ |

28,694,691 |

|

|

$ |

14,732,232 |

|

|

$ |

13,962,459 |

|

|

|

95 |

% |

Gross profits

increased 221% to $4.1 million on gross margins of

27.1%, incrementally higher due to product mix and the scaling

of the ACH and PayFac business lines.

Other selling, general and administrative

expenses were $2.8 million for the quarter ended June 30,

2021, as compared to $1.9 million in the prior year

period up 53%. The increase reflects a full quarter of

Output Solutions operating costs and continued investments in our

ACH, PayFac and Prepaid business line. For the six-month period

ended June 30, 2021, other selling, general and administrative

expenses were $5.5 million compared

to $4.0 million for same prior year period, up 38%,

again reflecting incremental Output Solutions costs plus

investments in our ACH, PayFac and Prepaid

initiatives.

The Company reported operating income

of $0.3 million for the quarter, a $1.6 million

improvement from the $1.3 million loss in the prior year

period. For the six months ended June 30, 2021, operating income

was a loss of $0.5 million versus a prior period loss

of $2.1 million, an improvement

of $1.6 million.

Adjusted EBITDA was

positive $1.3 million in the quarter, an improvement

of $1.9 million compared to an Adjusted EBITDA loss

of $0.6 million in the same period a year ago. This

was the third consecutive quarter of positive Adjusted

EBITDA. For the six months ended June 30, 2021, Adjusted

EBITDA was a positive $1.5 million versus a loss

of $0.8 million in the prior year period, an improvement

of $2.3 million. Operating Cash Flows (excluding

merchant reserve funds, prepaid card load assets, customer deposits

and net operating lease assets and obligations) was

$1.1 million for the six-month period ended June 30,

2021.

The Company reported net income of

$0.2 million for the quarter ended June 30, 2021 for

income of $0.01 per share compared to a net loss of

$1.3 million for a loss of $0.10 per share for

the same period in the prior year. For the six-month period,

the net loss was $0.5 million for a loss

of $0.03 per share compared to a net loss

of $2.1 million for a loss of $0.16 per

share for the prior year period, a net loss

improvement of $1.6 million or $0.13 per

share.

Usio continues to be in solid financial

condition with $5.6 million in cash and cash equivalents

on June 30, 2021, a $0.6 million improvement from

December 31, 2020 and a $1.3 million improvement from

March 31, 2021.

Conference Call and Webcast

Usio, Inc.'s management will host a conference call Friday,

August 13, 2021 at 11:00 am Eastern time to review financial

results and provide a business update. To listen to the

conference call, interested parties within

the U.S. should call +1-844-883-3890. International

callers should call + 1-412-317-9246. All callers should

ask for the Usio conference call. The conference call will also be

available through a live webcast, which can be accessed via the

company’s website at www.usio.com/investors.

A replay of the call will be available approximately one hour

after the end of the call through August 27, 2021. The replay

can be accessed via the Company’s website or by

dialing +1-877-344-7529 (U.S.)

or 1-412-317-0088 (international). The replay conference

playback code is 10156027.

About Usio, Inc.

Usio, Inc. (Nasdaq: USIO), a leading FinTech

integrated payment solutions provider, offers a wide range of

payment solutions to merchants, billers, banks, service bureaus,

crypto exchanges and card issuers. The Company operates credit,

debit/prepaid, and ACH payment processing platforms to deliver

convenient, world-class payment solutions and services to their

clients. With the acquisition of the assets of IMS in December

2020, the Company now offers additional services relating to

electronic bill presentment, document composition, document

decomposition and printing and mailing services. The strength

of the Company lies in its ability to provide tailored solutions

for card issuance, payment acceptance, and bill payments as well as

its unique technology in the prepaid sector. Usio is headquartered

in San Antonio, Texas, and has offices in Austin, Texas and

Franklin, Tennessee, just outside of

Nashville. Websites: www.usio.com, www.payfacinabox.com, www.akimbocard.com

and www.usiooutput.com. Find us on Facebook® and

Twitter.

About Non-GAAP Financial Measures

This press release includes non-GAAP financial

measures, EBITDA and adjusted EBITDA, as defined in Regulation G of

the Securities and Exchange Act of 1934, as amended. The Company

reports its financial results in compliance with GAAP, but believes

that also discussing non-GAAP measures provides investors with

financial measures it uses in the management of its business. The

Company defines EBITDA as operating income (loss), before interest,

taxes, depreciation and amortization of intangibles. The Company

defines adjusted EBITDA as EBITDA, as defined above, plus non-cash

stock option costs and certain non-recurring items, such as

acquisitions. These measures may not be comparable to similarly

titled measures reported by other companies. Management uses EBITDA

and adjusted EBITDA as indicators of the Company's operating

performance and ability to fund acquisitions, capital expenditures

and other investments and, in the absence of refinancing options,

to repay debt obligations.

Management believes EBITDA and adjusted EBITDA

are helpful to investors in evaluating the Company's operating

performance because non-cash costs and other items that management

believes are not indicative of its results of operations are

excluded. EBITDA and adjusted EBITDA are supplemental non-GAAP

measures, which have limitations as an analytical tool. Non-GAAP

financial measures should not be considered as a substitute for, or

superior to, measures of financial performance prepared in

accordance with GAAP. Non-GAAP financial measures do not reflect a

comprehensive system of accounting, may differ from GAAP measures

with the same names, and may differ from non-GAAP financial

measures with the same or similar names that are used by other

companies. For a description of our use of EBITDA and adjusted

EBITDA, and a reconciliation of EBITDA and adjusted EBITDA to

operating income (loss), see the section of this press release

titled "Non-GAAP Reconciliation."

FORWARD-LOOKING STATEMENTS DISCLAIMER

Except for the historical information contained

herein, the matters discussed in this release include

forward-looking statements which are covered by safe harbors. Those

statements include, but may not be limited to, all statements

regarding management's intent, belief and expectations, such as

statements concerning our future and our operating and growth

strategy. These forward-looking statements are identified by the

use of words such as "believe," "intend," "look forward,"

"anticipate," "continue,” and "expect" among others.

Forward-looking statements in this press release are subject to

certain risks and uncertainties inherent in the Company's business

that could cause actual results to vary, including such risks

related to an economic downturn as a result of the COVID-19

pandemic, the realization of opportunities from the IMS

acquisition, the management of the Company's growth, the loss of

key resellers, the relationships with the Automated Clearinghouse

network, bank sponsors, third-party card processing providers and

merchants, the security of our software, hardware and information,

the volatility of the stock price, the need to obtain additional

financing, risks associated with new legislation, and compliance

with complex federal, state and local laws and regulations, and

other risks detailed from time to time in the Company's filings

with the Securities and Exchange Commission including its annual

report on Form 10-K for the fiscal year ended December 31,

2020. One or more of these factors have affected, and in the

future, could affect the Company’s businesses and financial results

in the future and could cause actual results to differ materially

from plans and projections. The Company believes that the

assumptions underlying the forward-looking statements included in

this release will prove to be accurate. In light of the significant

uncertainties inherent in the forward-looking statements included

herein, the inclusion of such information should not be regarded as

a representation by us or any other person that the objectives and

plans will be achieved. All forward-looking statements made in this

release are based on information presently available to management.

The Company assumes no obligation to update any forward-looking

statements, except as required by law.

Contact:

Joe Hassett, Investor

Relationsjoeh@gregoryfca.com484-686-6600

USIO, INC.CONSOLIDATED

BALANCE SHEETS

| |

|

June 30, 2021 |

|

|

December 31, 2020 |

|

| |

|

(Unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

5,614,702 |

|

|

$ |

5,011,132 |

|

| Accounts receivable, net |

|

|

3,160,449 |

|

|

|

2,863,638 |

|

| Settlement processing

assets |

|

|

35,515,375 |

|

|

|

43,558,442 |

|

| Prepaid card load assets |

|

|

9,157,519 |

|

|

|

7,610,242 |

|

| Customer deposits |

|

|

1,410,607 |

|

|

|

1,305,296 |

|

| Inventory |

|

|

214,918 |

|

|

|

176,466 |

|

| Prepaid expenses and

other |

|

|

432,417 |

|

|

|

301,755 |

|

|

Current assets before merchant reserves |

|

|

55,505,987 |

|

|

|

60,826,971 |

|

| Merchant reserves |

|

|

8,101,153 |

|

|

|

8,265,555 |

|

|

Total current assets |

|

|

63,607,140 |

|

|

|

69,092,526 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

3,326,356 |

|

|

|

3,105,926 |

|

| |

|

|

|

|

|

|

|

|

| Other assets: |

|

|

|

|

|

|

|

|

|

Intangibles, net |

|

|

5,099,828 |

|

|

|

6,035,761 |

|

|

Deferred tax asset |

|

|

1,394,000 |

|

|

|

1,394,000 |

|

|

Operating lease right-of-use assets |

|

|

3,038,920 |

|

|

|

2,671,266 |

|

|

Other assets |

|

|

413,961 |

|

|

|

368,078 |

|

|

Total other assets |

|

|

9,946,709 |

|

|

|

10,469,105 |

|

| |

|

|

|

|

|

|

|

|

| Total

Assets |

|

$ |

76,880,205 |

|

|

$ |

82,667,557 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

645,224 |

|

|

$ |

851,349 |

|

|

Accrued expenses |

|

|

1,847,384 |

|

|

|

1,463,944 |

|

|

Operating lease liabilities, current portion |

|

|

487,410 |

|

|

|

346,913 |

|

|

Equipment loan, current portion |

|

|

53,673 |

|

|

|

- |

|

|

Settlement processing obligations |

|

|

35,515,375 |

|

|

|

43,558,442 |

|

|

Prepaid card load obligations |

|

|

9,157,519 |

|

|

|

7,610,242 |

|

|

Customer deposits |

|

|

1,410,607 |

|

|

|

1,305,296 |

|

|

Deferred revenues |

|

|

44,118 |

|

|

|

66,572 |

|

| Current liabilities before

merchant reserve obligations |

|

|

49,161,310 |

|

|

|

55,202,758 |

|

|

Merchant reserve obligations |

|

|

8,101,153 |

|

|

|

8,265,555 |

|

|

Total current liabilities |

|

|

57,262,463 |

|

|

|

63,468,313 |

|

| |

|

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

|

Equipment loan, non-current portion |

|

|

99,102 |

|

|

|

— |

|

|

Operating lease liabilities, non-current portion |

|

|

2,733,343 |

|

|

|

2,495,883 |

|

|

Total liabilities |

|

|

60,094,908 |

|

|

|

65,964,196 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, 10,000,000 shares authorized; -0-

shares outstanding at June 30, 2021 (unaudited) and December

31, 2020, respectively |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value, 200,000,000 shares authorized;

26,261,016 and 26,260,776 issued, and 24,954,529 and

24,974,995 outstanding at June 30, 2021 (unaudited) and December

31, 2020, respectively |

|

|

194,691 |

|

|

|

194,692 |

|

|

Additional paid-in capital |

|

|

89,662,665 |

|

|

|

89,659,433 |

|

|

Treasury stock, at cost; 1,306,487 and 1,285,781 shares at June 30,

2021 (unaudited) and December 31, 2020, respectively |

|

|

(2,244,985 |

) |

|

|

(2,165,721 |

) |

|

Deferred compensation |

|

|

(5,267,134 |

) |

|

|

(5,926,872 |

) |

|

Accumulated deficit |

|

|

(65,559,940 |

) |

|

|

(65,058,171 |

) |

|

Total stockholders' equity |

|

|

16,785,297 |

|

|

|

16,703,361 |

|

| |

|

|

|

|

|

|

|

|

| Total Liabilities and

Stockholders' Equity |

|

$ |

76,880,205 |

|

|

$ |

82,667,557 |

|

USIO, INC.CONSOLIDATED

STATEMENTS OF OPERATIONS

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

15,233,141 |

|

|

$ |

6,960,553 |

|

|

$ |

28,694,691 |

|

|

$ |

14,732,232 |

|

| Cost of services |

|

|

11,105,696 |

|

|

|

5,674,887 |

|

|

|

21,660,009 |

|

|

|

11,518,282 |

|

|

Gross profit |

|

|

4,127,445 |

|

|

|

1,285,666 |

|

|

|

7,034,682 |

|

|

|

3,213,950 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

317,285 |

|

|

|

348,393 |

|

|

|

645,000 |

|

|

|

636,103 |

|

|

Other expenses |

|

|

2,845,213 |

|

|

|

1,856,924 |

|

|

|

5,505,247 |

|

|

|

3,979,030 |

|

|

Depreciation and amortization |

|

|

627,149 |

|

|

|

382,244 |

|

|

|

1,249,356 |

|

|

|

770,039 |

|

| Total operating expenses |

|

|

3,789,647 |

|

|

|

2,587,561 |

|

|

|

7,399,603 |

|

|

|

5,385,172 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

337,798 |

|

|

|

(1,301,895 |

) |

|

|

(364,921 |

) |

|

|

(2,171,222 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

2,169 |

|

|

|

1,487 |

|

|

|

4,636 |

|

|

|

12,643 |

|

|

Other income (expense) |

|

|

(1,484 |

) |

|

|

38 |

|

|

|

(1,484 |

) |

|

|

726 |

|

|

Other income and (expense), net |

|

|

685 |

|

|

|

1,525 |

|

|

|

3,152 |

|

|

|

13,369 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income

taxes |

|

|

338,483 |

|

|

|

(1,300,370 |

) |

|

|

(361,769 |

) |

|

|

(2,157,853 |

) |

| Income tax expense

(benefit) |

|

|

120,000 |

|

|

|

(12,201 |

) |

|

|

140,000 |

|

|

|

(34,675 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income

(Loss) |

|

$ |

218,483 |

|

|

$ |

(1,288,169 |

) |

|

$ |

(501,769 |

) |

|

$ |

(2,123,178 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (Loss) Per

Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings (loss) per

common share: |

|

$ |

0.01 |

|

|

$ |

(0.10 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.16 |

) |

| Diluted earnings (loss) per

common share: |

|

$ |

0.01 |

|

|

$ |

(0.10 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.16 |

) |

| Weighted average common shares

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

19,993,387 |

|

|

|

13,173,009 |

|

|

|

19,962,661 |

|

|

|

13,150,119 |

|

|

Diluted |

|

|

24,962,389 |

|

|

|

13,173,009 |

|

|

|

19,962,661 |

|

|

|

13,150,119 |

|

USIO, INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS

| |

|

Six Months Ended |

|

| |

|

June 30, 2021 |

|

|

June 30, 2020 |

|

| Operating

Activities |

|

|

|

|

|

|

|

|

| Net (loss) |

|

$ |

(501,769 |

) |

|

$ |

(2,123,178 |

) |

| Adjustments to reconcile net

(loss) to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

313,423 |

|

|

|

270,038 |

|

|

Amortization |

|

|

935,933 |

|

|

|

500,001 |

|

|

Bad debt |

|

|

86,402 |

|

|

|

— |

|

|

Non-cash stock-based compensation |

|

|

645,000 |

|

|

|

636,103 |

|

|

Amortization of warrant costs |

|

|

17,970 |

|

|

|

17,973 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(383,213 |

) |

|

|

149,794 |

|

|

Prepaid expenses and other |

|

|

(130,662 |

) |

|

|

(4,039 |

) |

|

Operating lease right-of-use assets |

|

|

(367,654 |

) |

|

|

114,127 |

|

|

Other assets |

|

|

(38,452 |

) |

|

|

— |

|

|

Inventory |

|

|

(45,883 |

) |

|

|

(24,568 |

) |

|

Accounts payable and accrued expenses |

|

|

177,315 |

|

|

|

(139,748 |

) |

|

Operating lease liabilities |

|

|

377,957 |

|

|

|

(110,725 |

) |

|

Prepaid card load obligations |

|

|

1,547,277 |

|

|

|

18,752,859 |

|

|

Merchant reserves |

|

|

(164,402 |

) |

|

|

(1,586,565 |

) |

|

Customer deposits |

|

|

105,311 |

|

|

|

— |

|

|

Deferred revenue |

|

|

(22,454 |

) |

|

|

(26,470 |

) |

| Net cash provided by operating

activities |

|

|

2,552,099 |

|

|

|

16,425,602 |

|

| |

|

|

|

|

|

|

|

|

| Investing

Activities |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(533,854 |

) |

|

|

(334,688 |

) |

| Net cash (used) by investing

activities |

|

|

(533,854 |

) |

|

|

(334,688 |

) |

| |

|

|

|

|

|

|

|

|

| Financing

Activities |

|

|

|

|

|

|

|

|

|

Proceeds from PPP Loan Program |

|

|

— |

|

|

|

813,500 |

|

|

Proceeds from equipment loan |

|

|

165,996 |

|

|

|

— |

|

|

Payments on equipment loan |

|

|

(13,221 |

) |

|

|

— |

|

|

Purchases of treasury stock |

|

|

(79,264 |

) |

|

|

(82,448 |

) |

| Net cash provided by financing

activities |

|

|

73,511 |

|

|

|

731,052 |

|

| |

|

|

|

|

|

|

|

|

| Change in cash, cash

equivalents, prepaid card loads, customer deposits and

merchantreserves |

|

|

2,091,756 |

|

|

|

16,821,966 |

|

| Cash, cash equivalents,

prepaid card loads, customer deposits and merchant

reserves,beginning of year |

|

|

22,192,225 |

|

|

|

12,682,918 |

|

| |

|

|

|

|

|

|

|

|

| Cash, Cash Equivalents,

Prepaid Card Loads, Customer Deposits and Merchant Reserves,End of

Period |

|

$ |

24,283,981 |

|

|

$ |

29,504,884 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosures of cash flow information |

|

|

|

|

|

|

|

|

| Cash paid during the period

for: |

|

|

|

|

|

|

|

|

|

Interest |

|

$ |

1,484 |

|

|

$ |

— |

|

|

Income taxes |

|

|

92,850 |

|

|

|

— |

|

| Non-cash transactions: |

|

|

|

|

|

|

|

|

|

Issuance of deferred stock compensation |

|

|

— |

|

|

|

1,559,520 |

|

USIO, INC.STATEMENT OF

CHANGES IN STOCKHOLDERS' EQUITY

| |

|

Common Stock |

|

|

AdditionalPaid- In |

|

|

Treasury |

|

|

Deferred |

|

|

Accumulated |

|

|

TotalStockholders' |

|

| |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Stock |

|

|

Compensation |

|

|

Deficit |

|

|

Equity |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December

31, 2020 |

|

|

26,260,776 |

|

|

$ |

194,692 |

|

|

$ |

89,659,433 |

|

|

$ |

(2,165,721 |

) |

|

$ |

(5,926,872 |

) |

|

$ |

(65,058,171 |

) |

|

$ |

16,703,361 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock under

equity incentive plan |

|

|

51,000 |

|

|

|

51 |

|

|

|

120,484 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

120,535 |

|

| Warrant compensation

costs |

|

|

— |

|

|

|

— |

|

|

|

8,985 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,985 |

|

| Cashless warrant exercise |

|

|

19,795 |

|

|

|

19 |

|

|

|

(19 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Reversal of deferred

compensation amortization that did not vest |

|

|

(17,111 |

) |

|

|

(17 |

) |

|

|

(48,599 |

) |

|

|

— |

|

|

|

5,994 |

|

|

|

— |

|

|

|

(42,622 |

) |

| Deferred compensation

amortization |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

249,801 |

|

|

|

— |

|

|

|

249,801 |

|

| Purchase of treasury stock

costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(49,454 |

) |

|

|

— |

|

|

|

— |

|

|

|

(49,454 |

) |

| Net (loss) for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(720,252 |

) |

|

|

(720,252 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at March 31,

2021 |

|

|

26,314,460 |

|

|

$ |

194,745 |

|

|

$ |

89,740,284 |

|

|

$ |

(2,215,175 |

) |

|

$ |

(5,671,077 |

) |

|

$ |

(65,778,423 |

) |

|

$ |

16,270,354 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock under

equity incentive plan |

|

|

61,556 |

|

|

|

61 |

|

|

|

150,481 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

150,542 |

|

| Warrant compensation

costs |

|

|

— |

|

|

|

— |

|

|

|

8,985 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,985 |

|

| Reversal of deferred

compensation amortization that did not vest |

|

|

(115,000 |

) |

|

|

(115 |

) |

|

|

(237,085 |

) |

|

|

— |

|

|

|

158,096 |

|

|

|

— |

|

|

|

(79,104 |

) |

| Deferred compensation

amortization |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

245,847 |

|

|

|

— |

|

|

|

245,847 |

|

| Purchase of treasury stock

costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(29,810 |

) |

|

|

— |

|

|

|

— |

|

|

|

(29,810 |

) |

| Net income for the

period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

218,483 |

|

|

|

218,483 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at June 30,

2021 |

|

|

26,261,016 |

|

|

$ |

194,691 |

|

|

$ |

89,662,665 |

|

|

$ |

(2,244,985 |

) |

|

$ |

(5,267,134 |

) |

|

$ |

(65,559,940 |

) |

|

$ |

16,785,297 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December

31, 2019 |

|

|

18,224,577 |

|

|

$ |

186,656 |

|

|

$ |

77,055,273 |

|

|

$ |

(1,885,452 |

) |

|

$ |

(5,636,154 |

) |

|

$ |

(62,151,988 |

) |

|

$ |

7,568,335 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock under

equity incentive plan |

|

|

51,000 |

|

|

|

51 |

|

|

|

59,440 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

59,491 |

|

| Warrant compensation

costs |

|

|

— |

|

|

|

— |

|

|

|

8,985 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,985 |

|

| Deferred compensation

amortization |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

228,219 |

|

|

|

— |

|

|

|

228,219 |

|

| Purchase of treasury stock

costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(26,629 |

) |

|

|

— |

|

|

|

— |

|

|

|

(26,629 |

) |

| Net (loss) for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(835,009 |

) |

|

|

(835,009 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at March 31,

2020 |

|

|

18,275,577 |

|

|

$ |

186,707 |

|

|

$ |

77,123,698 |

|

|

$ |

(1,912,081 |

) |

|

$ |

(5,407,935 |

) |

|

$ |

(62,986,997 |

) |

|

$ |

7,003,392 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock under

equity incentive plan |

|

|

1,500,544 |

|

|

|

1,500 |

|

|

|

1,641,304 |

|

|

|

— |

|

|

|

(1,559,520 |

) |

|

|

— |

|

|

|

83,284 |

|

| Warrant compensation cost |

|

|

— |

|

|

|

— |

|

|

|

8,988 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,988 |

|

| Deferred compensation

amortization |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

267,207 |

|

|

|

— |

|

|

|

267,207 |

|

| Purchase of treasury

stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(55,819 |

) |

|

|

— |

|

|

|

— |

|

|

|

(55,819 |

) |

| Net (loss) for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,288,169 |

) |

|

|

(1,288,169 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at June 30,

2020 |

|

|

19,776,121 |

|

|

$ |

188,207 |

|

|

$ |

78,773,990 |

|

|

$ |

(1,967,900 |

) |

|

$ |

(6,700,248 |

) |

|

$ |

(64,275,166 |

) |

|

$ |

6,018,883 |

|

RECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL MEASURES

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation from Operating

Income (Loss) to Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income (Loss) |

|

$ |

337,798 |

|

|

$ |

(1,301,895 |

) |

|

$ |

(364,921 |

) |

|

$ |

(2,171,222 |

) |

|

Depreciation and amortization |

|

|

627,149 |

|

|

|

382,244 |

|

|

|

1,249,356 |

|

|

|

770,039 |

|

|

EBITDA |

|

|

964,947 |

|

|

|

(919,651 |

) |

|

|

884,435 |

|

|

|

(1,401,183 |

) |

|

Non-cash stock-based compensation expense, net |

|

|

317,285 |

|

|

|

348,393 |

|

|

|

645,000 |

|

|

|

636,103 |

|

|

Adjusted EBITDA |

|

$ |

1,282,232 |

|

|

$ |

(571,258 |

) |

|

$ |

1,529,435 |

|

|

$ |

(765,080 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Calculation of Adjusted EBITDA

margins: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

15,233,141 |

|

|

$ |

6,960,553 |

|

|

$ |

28,694,691 |

|

|

$ |

14,732,232 |

|

| Adjusted EBITDA |

|

|

1,282,232 |

|

|

|

(571,258 |

) |

|

|

1,529,435 |

|

|

|

(765,080 |

) |

| Adjusted EBITDA

margins |

|

|

8.4 |

% |

|

|

(8.2 |

)% |

|

|

5.3 |

% |

|

|

(5.2 |

)% |

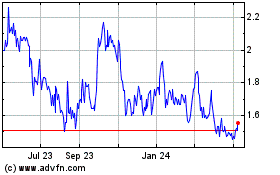

Usio (NASDAQ:USIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

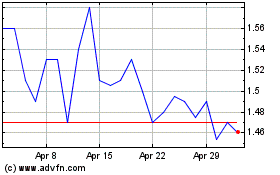

Usio (NASDAQ:USIO)

Historical Stock Chart

From Apr 2023 to Apr 2024