false

0000101594

US ENERGY CORP

0000101594

2024-09-25

2024-09-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2024

U.S. ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-06814

|

|

83-0205516

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

1616 S. Voss, Suite 725, Houston, Texas

|

|

77057

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (303) 993-3200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

USEG

|

|

NASDAQ Stock Market LLC

(Nasdaq Capital Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On September 25, 2024, U.S. Energy Corp. (the “Company”) posted a September 2024 presentation on its website, disclosing certain information about the Company. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated into this Item 7.01 by reference.

The information responsive to Item 7.01 of this Form 8-K and Exhibit 99.2, attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

On September 25, 2024, the Company filed a press release disclosing a corporate update including commencement of the Company’s development program and the repayment of debt, a copy of which is attached hereto as Exhibit 99.1, which is incorporated by reference into this Item 8.01 in its entirety.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

No.

|

|

Description

|

|

99.1*

|

|

|

|

99.2**

|

|

|

|

104

|

|

Inline XBRL for the cover page of this Current Report on Form 8-K

|

* Filed herewith.

** Filed herewith.

FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K, including Exhibits 99.1 and 99.2 hereto, contain forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, and, as such, may involve known and unknown risks, uncertainties and assumptions. You can identify these forward-looking statements by words such as “may,” “should,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan” and other similar expressions. These forward-looking statements relate to the Company’s current expectations and are subject to the limitations and qualifications set forth in the press release and presentation as well as in the Company’s other filings with the Securities and Exchange Commission, including, without limitation, that actual events and/or results may differ materially from those projected in such forward-looking statements. These statements also involve known and unknown risks, which may cause the results of the Company, its divisions and concepts to be materially different than those expressed or implied in such statements, which include, without limitation, risks associated with changes in inflation and interest rates and possible recessions; the ability of the Company to retain and hire key personnel; the business, economic and political conditions in the markets in which the Company operates; fluctuations in oil and natural gas prices, uncertainties inherent in estimating quantities of oil and natural gas reserves and projecting future rates of production and timing of development activities; competition; operating risks; drilling, completions, workovers and other activities and the anticipated costs and results of such activities; the Company’s anticipated operational results for 2024 including, but not limited to, estimated or anticipated production levels, capital expenditures and drilling plans; acquisition risks; liquidity and capital requirements; the effects of governmental regulation; anticipated future production and revenue; drilling plans including the timing of drilling, commissioning, and startup and the impact of delays thereon; adverse changes in the market for the Company’s oil and natural gas production; dependence upon third-party vendors; economic uncertainty relating to increased inflation and global conflicts; the lack of capital available on acceptable terms to finance the Company’s continued growth; the review and evaluation of potential strategic transactions and their impact on stockholder value; the process by which the Company engages in evaluation of strategic transactions; the outcome of potential future strategic transactions and the terms thereof; political conditions in or affecting oil and natural gas producing regions and/or pipelines, including in Eastern Europe, the Middle East and South America, for example, as experienced with the Russian invasion of the Ukraine in February 2022 and the current war in Israel, which conflicts are ongoing; the Company’s ability to maintain the listing of its common stock on Nasdaq; and others, including those referenced in the press release and presentation and the Company’s filings with the Securities and Exchange Commission. Accordingly, readers should not place undue reliance on any forward-looking statements. Forward-looking statements may include comments as to the Company’s beliefs and expectations as to future financial performance, events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside the Company’s control. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Cautionary Statement Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s periodic and current filings with the SEC, including the Form 10-Qs and Form 10-Ks, filed with the SEC and available at www.sec.gov and in the “Investors” – “SEC Filings” section of the Company’s website at https://usnrg.com. Forward-looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as otherwise provided by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

U.S. ENERGY CORP.

|

| |

|

|

| |

By:

|

/s/ Ryan Smith

|

| |

|

Ryan Smith

|

| |

|

Chief Executive Officer

|

| |

|

|

| |

Dated:

|

September 25, 2024

|

Exhibit 99.1

U.S. Energy Corp. Provides Corporate Update including Commencement of Development Program and Complete Debt Repayment

HOUSTON, Texas, September 25, 2024 — U.S. Energy Corporation (NASDAQ: USEG, “U.S. Energy” or the “Company”) a growth-focused company engaged in the operation and development of high-quality producing energy assets, today announced a series of transformational developments and balance sheet updates.

HIGHLIGHTS

| |

■

|

Recently repaid the entire outstanding balance of credit facility, leaving the Company debt-free.

|

| |

■

|

Commenced Kevin Dome development program in Northwest Montana.

|

| |

■

|

3rd party contingent and prospective resource report with mid-point Helium estimates of 23.7 BCF and 13.3 BCF, respectively (see table below).

|

| |

■

|

3rd party legacy hydrocarbon reserve report of 3.5 Mmboe (100% PDP and 62% oil) and a PV-10 of $50.9 million (see table below).

|

| |

■

|

Active share repurchase program with 0.8 million shares, or approximately 3% of outstanding shares, repurchased to date.

|

| |

■

|

Available liquidity of approximately $22.0 million.

|

MANAGEMENT COMMENTARY

“I am pleased to announce that U.S. Energy has achieved multiple key milestones, including initiating our initial development program around our recent transformative transaction, as well as completely paying off the entirety of the Company’s outstanding debt,” said Ryan Smith, U.S. Energy’s Chief Executive Officer. “With U.S. Energy’s current balance sheet profile, combined with cash flow from our legacy operations, we have the financial flexibility to accelerate the development of our newly acquired assets in a highly accretive manner and continue our disciplined capital allocation strategy and commitment to driving value and compelling risk-adjusted returns.

“The initiation of U.S. Energy’s development program marks the beginning of our expansion in the region and our stated objective of becoming a leading integrated gas company. With a strong, conservative financial foundation and clear strategic goal, we are well positioned to deliver results and long-term value to the Company’s shareholders.”

COMMENCEMENT OF DEVELOPMENT PROGRAM

U.S. Energy has commenced the initial development program targeting helium and various other industrial gases across the Kevin Dome structure in Northwest Montana. The Company will target and test several pay zones which it believes to be economic, including multiple Duperow, Souris River, and Flathead formations. U.S. Energy owns approximately 82.5% of the working interest across the Company’s initial development area.

Additionally, the Company continues to make progress on its carbon sequestration initiatives and have begun the planning and engineering phase of U.S. Energy-owned infrastructure to both sequester and monetize carbon. Along with carbon sequestration, U.S. Energy believes there is significant economic upside in its development plan through the monetization of both carbon dioxide and nitrogen to meet the growing demand domestically and plans to pursue these avenues going forward.

INDUSTRIAL GAS OVERVIEW - RESOURCE REPORT

The Company’s position across the Kevin Dome structure in Northwest Montana is supported by a contingent and prospective resource report prepared by a third-party engineering firm.(1)(2)

|

Contingent Resources

|

|

|

|

|

|

|

|

|

| |

|

Discovered Gas initially in Place (Bcf)

|

|

Remaining Helium Resource (Bcf)

|

| |

|

|

|

|

|

|

|

|

|

Formation

|

|

1c (Low)

|

2c (Best)

|

3c (High)

|

|

1c (Low)

|

2c (Best)

|

3c (High)

|

| |

|

|

|

|

|

|

|

|

|

Middle Duperow:

|

|

1,293.0

|

1,947.0

|

2,904.0

|

|

8.1

|

16.8

|

31.5

|

| |

|

|

|

|

|

|

|

|

|

Lower Duperow:

|

|

428.2

|

806.4

|

1,459.0

|

|

2.9

|

6.9

|

14.8

|

| |

|

|

|

|

|

|

|

|

|

Totals:

|

|

1,721.2

|

2,753.4

|

4,363.0

|

|

10.9

|

23.7

|

46.3

|

|

Prospective Resources

|

|

|

|

|

|

|

|

|

| |

|

Undiscovered Gas initially in Place (Bcf)

|

|

Remaining Helium Resource (Bcf)

|

| |

|

|

|

|

|

|

|

|

|

Formation

|

|

1u (Low)

|

2u (Best)

|

3u (High)

|

|

1u (Low)

|

2u (Best)

|

3u (High)

|

| |

|

|

|

|

|

|

|

|

|

Souris River:

|

|

428.4

|

995.3

|

20.7

|

|

3.3

|

9.1

|

21.7

|

| |

|

|

|

|

|

|

|

|

|

Flathead:

|

|

114.1

|

282.6

|

701.7

|

|

1.6

|

4.2

|

10.8

|

| |

|

|

|

|

|

|

|

|

|

Totals:

|

|

542.5

|

1,277.9

|

722.4

|

|

4.9

|

13.3

|

32.5

|

|

(1)

|

Gross volumes in the ground before applying any commercial or economic parameters.

|

|

(2)

|

Discovered Gas Initially in Place is raw gas volumes, predominately CO2 and nitrogen, before applying helium content.

|

LEGACY HYDROCARBON OVERVIEW – RESERVE REPORT

The Company's 2024 SEC proved reserves as of July 1, 2024, as prepared by an independent third-party reserve engineer, were 3.5 Mboe and comprised of 62% oil. The amounts presented below are the present value of the Company's SEC proved reserves, discounted 10% ('PV-10'), as of July 1, 2024, adjusted for all subsequent divestiture activities.

|

Proved Reserves

|

|

|

|

|

|

|

|

|

| |

|

Overview

|

|

PV-10 ($mm)(1)

|

| |

|

|

|

|

|

|

|

Classification

|

|

Oil (Mbo)

|

Gas (Mmcf)

|

Total (Mboe)

|

|

|

| |

|

|

|

|

|

|

|

Proved Developed Producing:

|

|

2,543

|

6,533

|

3,542

|

|

$50.9

|

| |

|

|

|

|

|

|

|

Total Proved Reserves:

|

|

2,543

|

6,533

|

3,542

|

|

$50.9

|

| |

|

|

|

|

|

|

|

(3)

|

Mid-year 2024 reserves were run at the SEC twelve-month first day of month average price used for mid-year 2024 of $79.00 per Bbl for oil and $2.33 per Mcf for natural gas.

|

BALANCE SHEET AND LIQUIDITY UPDATE

During September 2024, U.S. Energy repaid the entire outstanding balance under its existing borrowing base. The Company’s reserves-based credit facility remains unchanged with a $20.0 million undrawn borrowing base. U.S. Energy currently has approximately $2.0 million in cash and expects to fund its development plan through its current liquidity profile, including cash flow from operations.

SHARE REPURCHASE PROGRAM

As previously disclosed, U.S. Energy’s Board of Directors authorized the extension of the Company’s share repurchase program through June 30, 2025. Under the share repurchase program, the Company may purchase up to $5.0 million of its outstanding common stock in the open market, in accordance with all applicable securities laws and regulations. To date, U.S. Energy has repurchased 799,500 shares at a total cost of approximately $0.9 million. The Company anticipates continuing to be active with the share repurchase program going forward.

ABOUT U.S. ENERGY CORP.

We are a growth company focused on consolidating high-quality energy assets in the United States through low-risk development while maintaining an attractive shareholder returns program. We are committed to being a leader in reducing our carbon footprint in the areas in which we operate. More information about U.S. Energy Corp. can be found at www.usnrg.com.

INVESTOR RELATIONS CONTACT

Mason McGuire

Vice President – Finance and Strategy

IR@usnrg.com

(303) 993-3200

www.usnrg.com

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed in this communication which are not statements of historical fact constitute forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, that involve a number of risks and uncertainties. Words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “would,” “will,” “estimates,” “intends,” “projects,” “goals,” “targets” and other words of similar meaning are intended to identify forward-looking statements but are not the exclusive means of identifying these statements.

Important factors that may cause actual results and outcomes to differ materially from those contained in such forward-looking statements include, without limitation: (1) the ability of the Company to grow and manage growth profitably and retain its key employees; (2) the ability of the Company to close previously announced transactions and the terms of such transactions; (3) risks associated with the integration of recently acquired assets; (4) the Company’s ability to comply with the terms of its senior credit facilities; (5) the ability of the Company to retain and hire key personnel; (6) the business, economic and political conditions in the markets in which the Company operates; (7) the volatility of oil and natural gas prices; (8) the Company’s success in discovering, estimating, developing and replacing oil and natural gas reserves; (9) risks of the Company’s operations not being profitable or generating sufficient cash flow to meet its obligations; (10) risks relating to the future price of oil, natural gas and NGLs; (11) risks related to the status and availability of oil and natural gas gathering, transportation, and storage facilities; (12) risks related to changes in the legal and regulatory environment governing the oil and gas industry, and new or amended environmental legislation and regulatory initiatives; (13) risks relating to crude oil production quotas or other actions that might be imposed by the Organization of Petroleum Exporting Countries and other producing countries; (14) technological advancements; (15) changing economic, regulatory and political environments in the markets in which the Company operates; (16) general domestic and international economic, market and political conditions, including the military conflict between Russia and Ukraine and the global response to such conflict; (17) actions of competitors or regulators; (18) the potential disruption or interruption of the Company’s operations due to war, accidents, political events, severe weather, cyber threats, terrorist acts, or other natural or human causes beyond the Company’s control; (19) pandemics, governmental responses thereto, economic downturns and possible recessions caused thereby; (20) inflationary risks and recent changes in inflation and interest rates, and the risks of recessions and economic downturns caused thereby or by efforts to reduce inflation; (21) risks related to military conflicts in oil producing countries; (22) changes in economic conditions; limitations in the availability of, and costs of, supplies, materials, contractors and services that may delay the drilling or completion of wells or make such wells more expensive; (23) the amount and timing of future development costs; (24) the availability and demand for alternative energy sources; (25) regulatory changes, including those related to carbon dioxide and greenhouse gas emissions; (26) uncertainties inherent in estimating quantities of oil and natural gas reserves and projecting future rates of production and timing of development activities; (27) risks relating to the lack of capital available on acceptable terms to finance the Company’s continued growth; (28) the review and evaluation of potential strategic transactions and their impact on stockholder value and the process by which the Company engages in evaluation of strategic transactions; and (29) other risk factors included from time to time in documents U.S. Energy files with the Securities and Exchange Commission, including, but not limited to, its Form 10-Ks, Form 10-Qs and Form 8-Ks. Other important factors that may cause actual results and outcomes to differ materially from those contained in the forward-looking statements included in this communication are described in the Company’s publicly filed reports, including, but not limited to, the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, and future annual reports and quarterly reports. These reports and filings are available at www.sec.gov. Unknown or unpredictable factors also could have material adverse effects on the Company’s future results.

The Company cautions that the foregoing list of important factors is not complete and does not undertake to update any forward-looking statements except as required by applicable law. All subsequent written and oral forward-looking statements attributable to the Company or any person acting on behalf of the Company are expressly qualified in their entirety by the cautionary statements referenced above. Other unknown or unpredictable factors also could have material adverse effects on the Company’s future results. The forward-looking statements included in this communication are made only as of the date hereof. The Company cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. Finally, the Company undertakes no obligation to update these statements after the date of this release, except as required by law, and takes no obligation to update or correct information prepared by third parties that are not paid for by the Company. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

Exhibit 99.2

v3.24.3

Document And Entity Information

|

Sep. 25, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

US ENERGY CORP

|

| Document, Type |

8-K

|

| Document, Period End Date |

Sep. 25, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-06814

|

| Entity, Tax Identification Number |

83-0205516

|

| Entity, Address, Address Line One |

1616 S. Voss

|

| Entity, Address, Address Line Two |

Suite 725

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77057

|

| City Area Code |

303

|

| Local Phone Number |

993-3200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

USEG

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000101594

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

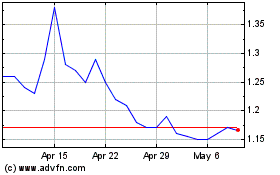

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Aug 2024 to Sep 2024

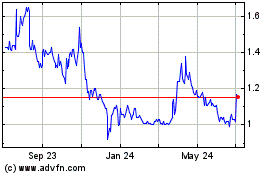

US Energy (NASDAQ:USEG)

Historical Stock Chart

From Sep 2023 to Sep 2024