false2024Q20001627475--12-31.0151338423276xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureupwk:tradingDayupwk:businessDayupwk:segmentiso4217:USDupwk:derivative00016274752024-01-012024-06-3000016274752024-06-3000016274752023-12-3100016274752024-04-012024-06-3000016274752023-04-012023-06-3000016274752023-01-012023-06-300001627475us-gaap:CommonStockMember2024-03-310001627475us-gaap:TreasuryStockCommonMember2024-03-310001627475us-gaap:AdditionalPaidInCapitalMember2024-03-310001627475us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001627475us-gaap:RetainedEarningsMember2024-03-3100016274752024-03-310001627475us-gaap:CommonStockMember2024-04-012024-06-300001627475us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001627475us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001627475us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001627475us-gaap:RetainedEarningsMember2024-04-012024-06-300001627475us-gaap:CommonStockMember2024-06-300001627475us-gaap:TreasuryStockCommonMember2024-06-300001627475us-gaap:AdditionalPaidInCapitalMember2024-06-300001627475us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001627475us-gaap:RetainedEarningsMember2024-06-300001627475us-gaap:CommonStockMember2023-03-310001627475us-gaap:AdditionalPaidInCapitalMember2023-03-310001627475us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001627475us-gaap:RetainedEarningsMember2023-03-3100016274752023-03-310001627475us-gaap:CommonStockMember2023-04-012023-06-300001627475us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001627475us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001627475us-gaap:RetainedEarningsMember2023-04-012023-06-300001627475us-gaap:CommonStockMember2023-06-300001627475us-gaap:AdditionalPaidInCapitalMember2023-06-300001627475us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001627475us-gaap:RetainedEarningsMember2023-06-3000016274752023-06-300001627475us-gaap:CommonStockMember2023-12-310001627475us-gaap:AdditionalPaidInCapitalMember2023-12-310001627475us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001627475us-gaap:RetainedEarningsMember2023-12-310001627475us-gaap:CommonStockMember2024-01-012024-06-300001627475us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001627475us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300001627475us-gaap:RetainedEarningsMember2024-01-012024-06-300001627475us-gaap:CommonStockMember2022-12-310001627475us-gaap:AdditionalPaidInCapitalMember2022-12-310001627475us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001627475us-gaap:RetainedEarningsMember2022-12-3100016274752022-12-310001627475us-gaap:CommonStockMember2023-01-012023-06-300001627475us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001627475us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001627475us-gaap:RetainedEarningsMember2023-01-012023-06-3000016274752023-05-012023-05-310001627475srt:MaximumMember2023-05-012023-05-310001627475srt:MinimumMember2023-01-012023-12-3100016274752024-07-012024-06-300001627475us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2024-06-300001627475us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:CashMember2024-06-300001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2024-06-300001627475us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2024-06-300001627475us-gaap:FairValueInputsLevel1Memberus-gaap:CashMemberus-gaap:USTreasurySecuritiesMember2024-06-300001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2024-06-300001627475us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-06-300001627475us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashMember2024-06-300001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-06-300001627475us-gaap:FairValueInputsLevel1Member2024-06-300001627475us-gaap:FairValueInputsLevel1Memberus-gaap:CashMember2024-06-300001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel1Member2024-06-300001627475us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2024-06-300001627475us-gaap:FairValueInputsLevel2Memberus-gaap:CashMemberus-gaap:CommercialPaperMember2024-06-300001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2024-06-300001627475us-gaap:FairValueInputsLevel2Memberus-gaap:DomesticCorporateDebtSecuritiesMember2024-06-300001627475us-gaap:FairValueInputsLevel2Memberus-gaap:DomesticCorporateDebtSecuritiesMemberus-gaap:CashMember2024-06-300001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DomesticCorporateDebtSecuritiesMember2024-06-300001627475upwk:CommercialDepositsMemberus-gaap:FairValueInputsLevel2Member2024-06-300001627475upwk:CommercialDepositsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashMember2024-06-300001627475upwk:MarketableSecuritiesCurrentMemberupwk:CommercialDepositsMemberus-gaap:FairValueInputsLevel2Member2024-06-300001627475us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2024-06-300001627475us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:CashMember2024-06-300001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2024-06-300001627475us-gaap:FairValueInputsLevel2Memberupwk:ForeignGovernmentAgenciesDebtSecuritiesMember2024-06-300001627475us-gaap:FairValueInputsLevel2Memberus-gaap:CashMemberupwk:ForeignGovernmentAgenciesDebtSecuritiesMember2024-06-300001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel2Memberupwk:ForeignGovernmentAgenciesDebtSecuritiesMember2024-06-300001627475us-gaap:FairValueInputsLevel2Member2024-06-300001627475us-gaap:FairValueInputsLevel2Memberus-gaap:CashMember2024-06-300001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel2Member2024-06-300001627475us-gaap:CashMember2024-06-300001627475upwk:MarketableSecuritiesCurrentMember2024-06-300001627475us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-12-310001627475us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:CashMember2023-12-310001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-12-310001627475us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2023-12-310001627475us-gaap:FairValueInputsLevel1Memberus-gaap:CashMemberus-gaap:USTreasurySecuritiesMember2023-12-310001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2023-12-310001627475us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-12-310001627475us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashMember2023-12-310001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-12-310001627475us-gaap:FairValueInputsLevel1Member2023-12-310001627475us-gaap:FairValueInputsLevel1Memberus-gaap:CashMember2023-12-310001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel1Member2023-12-310001627475us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2023-12-310001627475us-gaap:FairValueInputsLevel2Memberus-gaap:CashMemberus-gaap:CommercialPaperMember2023-12-310001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2023-12-310001627475us-gaap:FairValueInputsLevel2Memberus-gaap:DomesticCorporateDebtSecuritiesMember2023-12-310001627475us-gaap:FairValueInputsLevel2Memberus-gaap:DomesticCorporateDebtSecuritiesMemberus-gaap:CashMember2023-12-310001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DomesticCorporateDebtSecuritiesMember2023-12-310001627475upwk:CommercialDepositsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001627475upwk:CommercialDepositsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashMember2023-12-310001627475upwk:MarketableSecuritiesCurrentMemberupwk:CommercialDepositsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001627475us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2023-12-310001627475us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:CashMember2023-12-310001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2023-12-310001627475us-gaap:FairValueInputsLevel2Memberupwk:ForeignGovernmentAgenciesDebtSecuritiesMember2023-12-310001627475us-gaap:FairValueInputsLevel2Memberus-gaap:CashMemberupwk:ForeignGovernmentAgenciesDebtSecuritiesMember2023-12-310001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel2Memberupwk:ForeignGovernmentAgenciesDebtSecuritiesMember2023-12-310001627475us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001627475us-gaap:FairValueInputsLevel2Memberus-gaap:CashMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001627475us-gaap:FairValueInputsLevel2Member2023-12-310001627475us-gaap:FairValueInputsLevel2Memberus-gaap:CashMember2023-12-310001627475upwk:MarketableSecuritiesCurrentMemberus-gaap:FairValueInputsLevel2Member2023-12-310001627475us-gaap:CashMember2023-12-310001627475upwk:MarketableSecuritiesCurrentMember2023-12-310001627475us-gaap:USTreasurySecuritiesMember2024-06-300001627475us-gaap:USGovernmentDebtSecuritiesMember2024-06-300001627475us-gaap:DomesticCorporateDebtSecuritiesMember2024-06-300001627475us-gaap:AssetBackedSecuritiesMember2024-06-300001627475upwk:ForeignGovernmentAgenciesDebtSecuritiesMember2024-06-300001627475us-gaap:USGovernmentDebtSecuritiesMember2023-12-310001627475us-gaap:DomesticCorporateDebtSecuritiesMember2023-12-310001627475us-gaap:AssetBackedSecuritiesMember2023-12-310001627475us-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310001627475us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-06-300001627475us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310001627475us-gaap:LeaseholdImprovementsMember2024-06-300001627475us-gaap:LeaseholdImprovementsMember2023-12-310001627475us-gaap:ComputerEquipmentMember2024-06-300001627475us-gaap:ComputerEquipmentMember2023-12-310001627475us-gaap:OfficeEquipmentMember2024-06-300001627475us-gaap:OfficeEquipmentMember2023-12-310001627475us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMember2024-01-012024-06-300001627475us-gaap:PerformanceSharesMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-06-300001627475us-gaap:PerformanceSharesMember2024-01-012024-06-300001627475us-gaap:TreasuryStockCommonMember2024-01-012024-03-310001627475upwk:ConvertibleSeniorNotesMember2024-06-300001627475upwk:ConvertibleSeniorNotesMember2023-12-310001627475upwk:ConvertibleSeniorNotesMember2021-08-310001627475upwk:ConvertibleSeniorNotesMember2021-08-012021-08-310001627475upwk:ConvertibleSeniorNotesMember2024-04-012024-06-300001627475upwk:ConvertibleSeniorNotesMember2023-04-012023-06-300001627475upwk:ConvertibleSeniorNotesMember2024-01-012024-06-300001627475upwk:ConvertibleSeniorNotesMember2023-01-012023-06-300001627475us-gaap:FairValueInputsLevel2Memberupwk:ConvertibleSeniorNotesMember2024-06-300001627475upwk:ConvertibleSeniorNotesMemberus-gaap:CallOptionMember2021-08-310001627475upwk:ConvertibleSeniorNotesMemberus-gaap:CallOptionMember2021-08-012021-08-310001627475upwk:ConvertibleSeniorNotesMemberus-gaap:CallOptionMember2021-08-050001627475us-gaap:EmployeeStockOptionMember2024-04-012024-06-300001627475us-gaap:EmployeeStockOptionMember2023-04-012023-06-300001627475us-gaap:EmployeeStockOptionMember2024-01-012024-06-300001627475us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001627475upwk:RestrictedStockUnitsRSUsAndPerformanceSharesMember2024-04-012024-06-300001627475upwk:RestrictedStockUnitsRSUsAndPerformanceSharesMember2023-04-012023-06-300001627475upwk:RestrictedStockUnitsRSUsAndPerformanceSharesMember2024-01-012024-06-300001627475upwk:RestrictedStockUnitsRSUsAndPerformanceSharesMember2023-01-012023-06-300001627475us-gaap:EmployeeStockOptionMember2024-04-012024-06-300001627475us-gaap:EmployeeStockOptionMember2023-04-012023-06-300001627475us-gaap:EmployeeStockOptionMember2024-01-012024-06-300001627475us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001627475us-gaap:WarrantMember2024-04-012024-06-300001627475us-gaap:WarrantMember2023-04-012023-06-300001627475us-gaap:WarrantMember2024-01-012024-06-300001627475us-gaap:WarrantMember2023-01-012023-06-300001627475upwk:RestrictedStockUnitsRSUsAndPerformanceSharesMember2024-04-012024-06-300001627475upwk:RestrictedStockUnitsRSUsAndPerformanceSharesMember2023-04-012023-06-300001627475upwk:RestrictedStockUnitsRSUsAndPerformanceSharesMember2024-01-012024-06-300001627475upwk:RestrictedStockUnitsRSUsAndPerformanceSharesMember2023-01-012023-06-300001627475us-gaap:EmployeeStockMember2024-04-012024-06-300001627475us-gaap:EmployeeStockMember2023-04-012023-06-300001627475us-gaap:EmployeeStockMember2024-01-012024-06-300001627475us-gaap:EmployeeStockMember2023-01-012023-06-300001627475us-gaap:ConvertibleDebtMember2024-04-012024-06-300001627475us-gaap:ConvertibleDebtMember2023-04-012023-06-300001627475us-gaap:ConvertibleDebtMember2024-01-012024-06-300001627475us-gaap:ConvertibleDebtMember2023-01-012023-06-300001627475upwk:MarketplaceMember2024-04-012024-06-300001627475upwk:MarketplaceMember2023-04-012023-06-300001627475upwk:MarketplaceMember2024-01-012024-06-300001627475upwk:MarketplaceMember2023-01-012023-06-300001627475upwk:EnterpriseAndManagedServicesMember2024-04-012024-06-300001627475upwk:EnterpriseAndManagedServicesMember2023-04-012023-06-300001627475upwk:EnterpriseAndManagedServicesMember2024-01-012024-06-300001627475upwk:EnterpriseAndManagedServicesMember2023-01-012023-06-300001627475us-gaap:SalesChannelThroughIntermediaryMembercountry:US2024-04-012024-06-300001627475us-gaap:SalesChannelThroughIntermediaryMembercountry:US2023-04-012023-06-300001627475us-gaap:SalesChannelThroughIntermediaryMembercountry:US2024-01-012024-06-300001627475us-gaap:SalesChannelThroughIntermediaryMembercountry:US2023-01-012023-06-300001627475us-gaap:SalesChannelThroughIntermediaryMembercountry:IN2024-04-012024-06-300001627475us-gaap:SalesChannelThroughIntermediaryMembercountry:IN2023-04-012023-06-300001627475us-gaap:SalesChannelThroughIntermediaryMembercountry:IN2024-01-012024-06-300001627475us-gaap:SalesChannelThroughIntermediaryMembercountry:IN2023-01-012023-06-300001627475country:PHus-gaap:SalesChannelThroughIntermediaryMember2024-04-012024-06-300001627475country:PHus-gaap:SalesChannelThroughIntermediaryMember2023-04-012023-06-300001627475country:PHus-gaap:SalesChannelThroughIntermediaryMember2024-01-012024-06-300001627475country:PHus-gaap:SalesChannelThroughIntermediaryMember2023-01-012023-06-300001627475us-gaap:SalesChannelThroughIntermediaryMemberupwk:RestOfWorldMember2024-04-012024-06-300001627475us-gaap:SalesChannelThroughIntermediaryMemberupwk:RestOfWorldMember2023-04-012023-06-300001627475us-gaap:SalesChannelThroughIntermediaryMemberupwk:RestOfWorldMember2024-01-012024-06-300001627475us-gaap:SalesChannelThroughIntermediaryMemberupwk:RestOfWorldMember2023-01-012023-06-300001627475us-gaap:SalesChannelThroughIntermediaryMember2024-04-012024-06-300001627475us-gaap:SalesChannelThroughIntermediaryMember2023-04-012023-06-300001627475us-gaap:SalesChannelThroughIntermediaryMember2024-01-012024-06-300001627475us-gaap:SalesChannelThroughIntermediaryMember2023-01-012023-06-300001627475country:USus-gaap:SalesChannelDirectlyToConsumerMember2024-04-012024-06-300001627475country:USus-gaap:SalesChannelDirectlyToConsumerMember2023-04-012023-06-300001627475country:USus-gaap:SalesChannelDirectlyToConsumerMember2024-01-012024-06-300001627475country:USus-gaap:SalesChannelDirectlyToConsumerMember2023-01-012023-06-300001627475upwk:RestOfWorldMemberus-gaap:SalesChannelDirectlyToConsumerMember2024-04-012024-06-300001627475upwk:RestOfWorldMemberus-gaap:SalesChannelDirectlyToConsumerMember2023-04-012023-06-300001627475upwk:RestOfWorldMemberus-gaap:SalesChannelDirectlyToConsumerMember2024-01-012024-06-300001627475upwk:RestOfWorldMemberus-gaap:SalesChannelDirectlyToConsumerMember2023-01-012023-06-300001627475us-gaap:SalesChannelDirectlyToConsumerMember2024-04-012024-06-300001627475us-gaap:SalesChannelDirectlyToConsumerMember2023-04-012023-06-300001627475us-gaap:SalesChannelDirectlyToConsumerMember2024-01-012024-06-300001627475us-gaap:SalesChannelDirectlyToConsumerMember2023-01-012023-06-300001627475upwk:OlivierMarieMember2024-04-012024-06-300001627475upwk:ElizabethNelsonMember2024-04-012024-06-300001627475upwk:ElizabethNelsonMember2024-06-300001627475upwk:DaveBottomsMember2024-04-012024-06-300001627475upwk:OlivierMarieMemberupwk:IssuedUponVestingOfRestrictedStockUnitsVestedAndReleasedPriorToAdoptionDateMember2024-06-300001627475upwk:OlivierMarieMemberupwk:PreviouslyPurchasedUnder2018EmployeeStockPurchasePlanMember2024-06-300001627475upwk:OlivierMarieMemberupwk:IssuableUponVestingOfRestrictedStockUnitsWillVestAndBeReleasedMember2024-06-300001627475upwk:DaveBottomsMember2024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

________________________________________________

FORM 10-Q

_____________________________________________

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission File Number: 001-38678

________________________________________________

UPWORK INC.

(Exact Name of Registrant as Specified in its Charter)

________________________________________________

| | | | | | | | |

| Delaware | 46-4337682 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| 475 Brannan Street, Suite 430 | |

| San Francisco, | California | 94107 |

| (Address of principal executive offices) | (Zip Code) |

(650) 316-7500

(Registrant’s telephone number, including area code)

_______________________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 par value per share | UPWK | The Nasdaq Stock Market LLC |

_______________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2024, there were 132,006,676 shares of the registrant’s common stock outstanding.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| Special Note Regarding Forward-Looking Statements | |

| | |

| PART I—FINANCIAL INFORMATION | |

| Item 1. | Financial Statements (Unaudited) | |

| Condensed Consolidated Balance Sheets as of June 30, 2024 and December 31, 2023 | |

| Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) for the Three and Six Months Ended June 30, 2024 and 2023 | |

| Condensed Consolidated Statements of Stockholders’ Equity for the Three and Six Months Ended June 30, 2024 and 2023 | |

| Condensed Consolidated Statements of Cash Flows for the Six Months Ended June 30, 2024 and 2023 | |

| Notes to Condensed Consolidated Financial Statements | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | |

| Item 4. | Controls and Procedures | |

| | |

| PART II—OTHER INFORMATION | |

| Item 1. | Legal Proceedings | |

| Item 1A. | Risk Factors | |

| Item 2. | Unregistered Sales of Equity Securities, Use of Proceeds, and Issuer Purchases of Equity Securities | |

| Item 3. | Defaults Upon Senior Securities | |

| Item 4. | Mine Safety Disclosures | |

| Item 5. | Other Information | |

| Item 6. | Exhibits | |

| Signatures | |

Unless otherwise expressly stated or the context otherwise requires, references in this Quarterly Report on Form 10-Q, which we refer to as this Quarterly Report, to “Upwork,” “Company,” “our,” “us,” and “we” and similar references refer to Upwork Inc. and its wholly owned subsidiaries.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report contains forward-looking statements within the meaning of the federal securities laws. All statements contained in this Quarterly Report, other than statements of historical fact, including any statements regarding our future operating results and financial position, our business strategy and plans, potential growth or growth prospects, active clients, future research and development, sales and marketing, and general and administrative expenses, provision for transaction losses, our plans with respect to share repurchases, and our objectives for future operations, are forward-looking statements. Words such as “believes,” “may,” “will,” “estimates,” “potential,” “continues,” “anticipates,” “intends,” “expects,” “could,” “would,” “projects,” “plans,” “targets,” and variations of such words and similar expressions are intended to identify forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections as of the date of this filing about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in Part II, Item 1A, “Risk Factors” in this Quarterly Report. Readers are urged to carefully review and consider the various disclosures made in this Quarterly Report and in other documents we file from time to time with the Securities and Exchange Commission, which we refer to as the SEC, that disclose risks and uncertainties that may affect our business. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the future events and circumstances discussed in this Quarterly Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. In addition, the forward-looking statements in this Quarterly Report are made as of the date of this filing, and we do not undertake, and expressly disclaim any duty, to update such statements for any reason after the date of this Quarterly Report or to conform statements to actual results or revised expectations, except as required by law.

You should read this Quarterly Report and the documents that we reference herein and have filed with the SEC or incorporated by reference as exhibits to this Quarterly Report with the understanding that our actual future results, performance, and events and circumstances may be materially different from what we expect.

| | | | | |

| PART I—FINANCIAL INFORMATION | |

Item 1. Financial Statements.

UPWORK INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

(In thousands, except share and per share data) | June 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 182,803 | | | $ | 79,641 | |

| Marketable securities | 314,941 | | | 470,457 | |

| Funds held in escrow, including funds in transit | 218,656 | | | 212,387 | |

Trade and client receivables – net of allowance of $4,893 and $5,141 as of June 30, 2024 and December 31, 2023, respectively | 116,522 | | | 103,061 | |

| Prepaid expenses and other current assets | 22,743 | | | 17,825 | |

| Total current assets | 855,665 | | | 883,371 | |

| Property and equipment, net | 28,149 | | | 27,140 | |

| Goodwill | 118,219 | | | 118,219 | |

| Intangible assets, net | 2,258 | | | 3,048 | |

| Operating lease asset | 2,627 | | | 4,333 | |

| Other assets, noncurrent | 1,645 | | | 1,430 | |

| Total assets | $ | 1,008,563 | | | $ | 1,037,541 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 5,863 | | | $ | 5,063 | |

| Escrow funds payable | 218,656 | | | 212,387 | |

| | | |

| Accrued expenses and other current liabilities | 49,811 | | | 58,192 | |

| Deferred revenue | 10,766 | | | 17,361 | |

| Total current liabilities | 285,096 | | | 293,003 | |

| Debt, noncurrent | 357,008 | | | 356,087 | |

| Operating lease liability, noncurrent | 4,835 | | | 6,088 | |

| Other liabilities, noncurrent | 528 | | | 1,288 | |

| Total liabilities | 647,467 | | | 656,466 | |

| | | |

| Commitments and contingencies (Note 6) | | | |

| | | |

| Stockholders’ equity | | | |

Common stock, $0.0001 par value; 490,000,000 shares authorized as of June 30, 2024 and December 31, 2023; 132,006,676 and 137,272,754 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | 13 | | | 14 | |

| | | |

| Additional paid-in capital | 615,012 | | | 674,918 | |

| Accumulated other comprehensive income (loss) | (529) | | | 205 | |

| Accumulated deficit | (253,400) | | | (294,062) | |

| Total stockholders’ equity | 361,096 | | | 381,075 | |

| Total liabilities and stockholders’ equity | $ | 1,008,563 | | | $ | 1,037,541 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

UPWORK INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME (LOSS)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

(In thousands, except per share data) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 193,129 | | | $ | 168,611 | | | $ | 384,066 | | | $ | 329,469 | |

| Cost of revenue | 43,852 | | | 40,882 | | | 88,045 | | | 81,309 | |

| Gross profit | 149,277 | | | 127,729 | | | 296,021 | | | 248,160 | |

| Operating expenses | | | | | | | |

| Research and development | 52,465 | | | 43,246 | | | 105,381 | | | 87,727 | |

| Sales and marketing | 47,333 | | | 59,069 | | | 95,184 | | | 124,069 | |

| General and administrative | 29,924 | | | 28,983 | | | 61,925 | | | 58,270 | |

| Provision for transaction losses | 1,774 | | | 2,547 | | | 2,701 | | | 9,248 | |

| Total operating expenses | 131,496 | | | 133,845 | | | 265,191 | | | 279,314 | |

| Income (loss) from operations | 17,781 | | | (6,116) | | | 30,830 | | | (31,154) | |

| Other income, net | 5,620 | | | 3,982 | | | 12,342 | | | 46,982 | |

| Income (loss) before income taxes | 23,401 | | | (2,134) | | | 43,172 | | | 15,828 | |

| Income tax provision | (1,181) | | | (1,857) | | | (2,510) | | | (2,652) | |

| Net income (loss) | $ | 22,220 | | | $ | (3,991) | | | $ | 40,662 | | | $ | 13,176 | |

| | | | | | | |

| Net income (loss) per share: | | | | | | | |

| Basic | $ | 0.17 | | | $ | (0.03) | | | $ | 0.30 | | | $ | 0.10 | |

| Diluted | $ | 0.17 | | | $ | (0.03) | | | $ | 0.30 | | | $ | (0.18) | |

| | | | | | | |

| Weighted-average shares used to compute net income (loss) per share | | | | | | | |

| Basic | 131,436 | | | 134,142 | | | 133,809 | | | 133,492 | |

| Diluted | 138,266 | | | 134,142 | | | 140,798 | | | 135,049 | |

| | | | | | | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Net unrealized holding (loss) gain on marketable securities, net | $ | (143) | | | $ | 297 | | | $ | (734) | | | $ | 2,220 | |

| Total comprehensive income (loss) | $ | 22,077 | | | $ | (3,694) | | | $ | 39,928 | | | $ | 15,396 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

UPWORK INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(In thousands, except share amounts) | | | | Common Stock | | Treasury Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Loss | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Three Months Ended June 30, 2024 | | | | | | Shares | | Amount | | Shares | | Amount | | | | |

| Balances as of March 31, 2024 | | | | | | 133,118,345 | | | $ | 13 | | | (175,000) | | | $ | (2,138) | | | $ | 627,007 | | | $ | (386) | | | $ | (275,620) | | | $ | 348,876 | |

| Issuance of common stock upon exercise of stock options | | | | | | 159,907 | | | — | | | — | | | — | | | 664 | | | — | | | — | | | 664 | |

| Stock-based compensation expense | | | | | | — | | | — | | | — | | | — | | | 19,678 | | | — | | | — | | | 19,678 | |

| Issuance of common stock for settlement of RSUs | | | | | | 1,344,711 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Tides Foundation common stock warrant expense | | | | | | — | | | — | | | — | | | — | | | 187 | | | — | | | — | | | 187 | |

| Issuance of common stock in connection with employee stock purchase plan | | | | | | 414,159 | | | — | | | — | | | — | | | 2,917 | | | — | | | — | | | 2,917 | |

| Repurchase of common stock | | | | | | (3,030,446) | | | — | | | 175,000 | | | 2,138 | | | (35,441) | | | — | | | — | | | (33,303) | |

| Unrealized loss on marketable securities | | | | | | — | | | — | | | — | | | — | | | — | | | (143) | | | — | | | (143) | |

| Net income | | | | | | — | | | — | | | — | | | — | | | — | | | — | | | 22,220 | | | 22,220 | |

| Balances as of June 30, 2024 | | | | | | 132,006,676 | | | $ | 13 | | | — | | | $ | — | | | $ | 615,012 | | | $ | (529) | | | $ | (253,400) | | | $ | 361,096 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(In thousands, except share amounts) | | | | Common Stock | | | Additional Paid-in Capital | | Accumulated

Other Comprehensive Loss | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Three Months Ended June 30, 2023 | | | | | | Shares | | Amount | | | | | | | |

| Balances as of March 31, 2023 | | | | | | 133,464,264 | | | $ | 13 | | | | | | $ | 613,887 | | | $ | (1,162) | | | $ | (323,782) | | | $ | 288,956 | |

| Issuance of common stock upon exercise of stock options | | | | | | 50,842 | | | — | | | | | | 177 | | | — | | | — | | | 177 | |

| Stock-based compensation expense | | | | | | — | | | — | | | | | | 18,733 | | | — | | | — | | | 18,733 | |

| Issuance of common stock for settlement of RSUs | | | | | | 991,476 | | | — | | | | | | — | | | — | | | — | | | — | |

| Tides Foundation common stock warrant expense | | | | | | — | | | — | | | | | | 187 | | | — | | | — | | | 187 | |

| Issuance of common stock in connection with employee stock purchase plan | | | | | | 377,015 | | | — | | | | | | 2,564 | | | — | | | — | | | 2,564 | |

| Unrealized gain on marketable securities | | | | | | — | | | — | | | | | | — | | | 297 | | | — | | | 297 | |

| Net loss | | | | | | — | | | — | | | | | | — | | | — | | | (3,991) | | | (3,991) | |

| Balances as of June 30, 2023 | | | | | | 134,883,597 | | | $ | 13 | | | | | | $ | 635,548 | | | $ | (865) | | | $ | (327,773) | | | $ | 306,923 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands, except share amounts) | | | | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Income (Loss) | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Six Months Ended June 30, 2024 | | | | | | Shares | | Amount | | | | |

| Balances as of December 31, 2023 | | | | | | 137,272,754 | | | $ | 14 | | | $ | 674,918 | | | $ | 205 | | | $ | (294,062) | | | $ | 381,075 | |

| Issuance of common stock upon exercise of stock options and common stock warrants | | | | | | 197,557 | | | — | | | 770 | | | — | | | — | | | 770 | |

| Stock-based compensation expense | | | | | | — | | | — | | | 36,763 | | | — | | | — | | | 36,763 | |

| Issuance of common stock for settlement of RSUs | | | | | | 2,198,932 | | | — | | | — | | | — | | | — | | | — | |

| Tides Foundation common stock warrant expense | | | | | | — | | | — | | | 375 | | | — | | | — | | | 375 | |

| Issuance of common stock in connection with employee stock purchase plan | | | | | | 414,159 | | | — | | | 2,917 | | | — | | | — | | | 2,917 | |

| Repurchase of common stock | | | | | | (8,076,726) | | | (1) | | | (100,731) | | | — | | | | | (100,732) | |

| Unrealized loss on marketable securities | | | | | | — | | | — | | | — | | | (734) | | | — | | | (734) | |

| Net income | | | | | | — | | | — | | | — | | | — | | | 40,662 | | | 40,662 | |

| Balances as of June 30, 2024 | | | | | | 132,006,676 | | | $ | 13 | | | $ | 615,012 | | | $ | (529) | | | $ | (253,400) | | | $ | 361,096 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(In thousands, except share amounts) | | | | Common Stock | | Additional Paid-in Capital | | Accumulated Other Comprehensive Loss | | Accumulated

Deficit | | Total

Stockholders’

Deficit |

| Six Months Ended June 30, 2023 | | | | | | Shares | | Amount | | | | |

| Balances as of December 31, 2022 | | | | | | 132,368,265 | | | $ | 13 | | | $ | 592,900 | | | $ | (3,085) | | | $ | (340,949) | | | $ | 248,879 | |

| Issuance of common stock upon exercise of stock options | | | | | | 274,093 | | | — | | | 935 | | | — | | | — | | | 935 | |

| Stock-based compensation expense | | | | | | — | | | — | | | 38,774 | | | — | | | — | | | 38,774 | |

| Issuance of common stock for settlement of RSUs | | | | | | 1,864,224 | | | — | | | — | | | — | | | — | | | — | |

| Tides Foundation common stock warrant expense | | | | | | — | | | — | | | 375 | | | — | | | — | | | 375 | |

| Issuance of common stock in connection with employee stock purchase plan | | | | | | 377,015 | | | — | | | 2,564 | | | — | | | — | | | 2,564 | |

| Unrealized gain on marketable securities | | | | | | — | | | — | | | — | | | 2,220 | | | — | | | 2,220 | |

| Net income | | | | | | — | | | — | | | — | | | — | | | 13,176 | | | 13,176 | |

| Balances as of June 30, 2023 | | | | | | 134,883,597 | | | $ | 13 | | | $ | 635,548 | | | $ | (865) | | | $ | (327,773) | | | $ | 306,923 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

UPWORK INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| (In thousands) | 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income | $ | 40,662 | | | $ | 13,176 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | |

| Provision for transaction losses | 2,433 | | | 5,442 | |

| Depreciation and amortization | 6,775 | | | 3,878 | |

| Amortization of debt issuance costs | 921 | | | 1,177 | |

| Accretion of discount on purchases of marketable securities, net | (8,159) | | | (6,154) | |

| Amortization of operating lease asset | 1,706 | | | 1,611 | |

| Tides Foundation common stock warrant expense | 375 | | | 375 | |

| Stock-based compensation expense | 36,180 | | | 38,337 | |

| | | |

| Gain on early extinguishment of convertible senior notes | — | | | (38,945) | |

| Changes in operating assets and liabilities: | | | |

| Trade and client receivables | (16,158) | | | (6,957) | |

| Prepaid expenses and other assets | (5,133) | | | (1,464) | |

| Operating lease liability | (3,129) | | | (2,866) | |

| Accounts payable | 701 | | | (3,371) | |

| Accrued expenses and other liabilities | (6,847) | | | (5,141) | |

| Deferred revenue | (7,381) | | | (3,490) | |

| Net cash provided by (used in) operating activities | 42,946 | | | (4,392) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchases of marketable securities | (194,299) | | | (254,119) | |

| Proceeds from maturities of marketable securities | 321,846 | | | 307,410 | |

| Proceeds from sale of marketable securities | 35,394 | | | 149,859 | |

| Purchases of property and equipment | (775) | | | (135) | |

| Internal-use software and platform development costs | (5,637) | | | (6,072) | |

| Net cash provided by investing activities | 156,529 | | | 196,943 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Changes in escrow funds payable | 6,269 | | | 16,197 | |

| Proceeds from exercises of stock options | 770 | | | 935 | |

| Proceeds from employee stock purchase plan | 2,917 | | | 2,564 | |

| | | |

| Repurchase of common stock | (100,000) | | | — | |

| Net cash paid for early extinguishment of convertible senior notes | — | | | (171,327) | |

| | | |

| | | |

| Net cash used in financing activities | (90,044) | | | (151,631) | |

| NET CHANGE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | 109,431 | | | 40,920 | |

| Cash, cash equivalents, and restricted cash—beginning of period | 296,418 | | | 295,231 | |

| Cash, cash equivalents, and restricted cash—end of period | $ | 405,849 | | | $ | 336,151 | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | |

| | | |

| Cash paid for interest | $ | 463 | | | $ | 837 | |

| SUPPLEMENTAL DISCLOSURES OF NON-CASH INVESTING ACTIVITIES: | | | |

| Property and equipment purchased but not yet paid | $ | 118 | | | $ | 124 | |

| Internal-use software and platform development costs incurred but not yet paid | $ | 134 | | | $ | 93 | |

| | | |

| | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

UPWORK INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1—Organization and Description of Business

Upwork Inc., which is referred to as the Company or Upwork, operates a work marketplace that connects businesses, which are referred to as clients, with independent talent. Independent talent on the Company’s work marketplace, which are referred to as talent, and, together with clients, as customers, include independent professionals and agencies of varying sizes and are an increasingly sought-after, critical, and expanding segment of the global workforce. The Company is incorporated in the state of Delaware and is headquartered in San Francisco, California.

Unless otherwise expressly stated or the context otherwise requires, the terms “Upwork” and the “Company” in these notes to the condensed consolidated financial statements refer to Upwork and its wholly owned subsidiaries.

Note 2—Basis of Presentation and Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States, which is referred to as U.S. GAAP, and applicable rules and regulations of the SEC regarding interim financial reporting. Certain information and note disclosures normally included in the financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations. As such, the information included in this Quarterly Report should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, which is referred to as the Annual Report, filed with the SEC on February 15, 2024.

The condensed consolidated balance sheet as of December 31, 2023 included herein was derived from the audited financial statements as of that date but does not include all disclosures including notes required by U.S. GAAP.

The condensed consolidated financial statements include the accounts of Upwork and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated.

The accompanying condensed consolidated financial statements reflect all normal recurring adjustments necessary for a fair statement of the financial position, results of operations, changes in stockholders’ equity and cash flows for the interim periods, but do not purport to be indicative of the results of operations or financial condition to be anticipated for the full year ending December 31, 2024. Prior period presentation has been revised to conform to the current period presentation as of June 30, 2024.

In 2023, the Company changed the name of its Upwork Enterprise offering to Enterprise Solutions. Concurrently, to align with customer needs and internal decision-making, the Company combined Enterprise Solutions and Managed Services into a suite of Enterprise offerings. To conform to the current period presentation as of June 30, 2024, the Company presents revenue from Enterprise Solutions and Managed Services together as Enterprise revenue in prior periods and no longer reports revenue from its Enterprise Solutions offering in Marketplace revenue.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with U.S. GAAP requires management to make certain estimates, judgments, and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the periods presented. Such estimates include, but are not limited to: the useful lives of assets; assessment of the recoverability of long-lived assets; goodwill impairment; standalone selling price of material rights and the period of time over which to defer and recognize the consideration allocated to the material rights; allowance for expected credit losses; liabilities relating to transaction losses; stock-based compensation; and

accounting for income taxes. Management bases its estimates on historical experience and on various other assumptions that management believes to be reasonable under the circumstances. The Company evaluates its estimates, assumptions, and judgments on an ongoing basis using historical experience and other factors and revises them when facts and circumstances dictate.

The Company is not aware of any specific event or circumstance that would require an update to its estimates or judgments or a revision of the carrying value of its assets or liabilities. These estimates may change as new events occur and additional information is obtained. Actual results could differ materially from these estimates under different assumptions or conditions.

Summary of Significant Accounting Policies

The significant accounting policies applied in the Company’s audited consolidated financial statements, as disclosed in the Annual Report, are applied consistently in these unaudited interim condensed consolidated financial statements.

Recent Accounting Pronouncements Not Yet Adopted

The Company has reviewed the accounting pronouncements issued during the six months ended June 30, 2024 and concluded they were either not applicable or not expected to have a material impact on the Company’s condensed consolidated financial statements.

In December 2023, the Financial Accounting Standards Board, which is referred to as the FASB, issued Accounting Standards Update, which is referred to as ASU, 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which requires public entities, on an annual basis, to provide disclosure of specific categories in the rate reconciliation, as well as disclosure of income taxes paid disaggregated by jurisdiction. ASU 2023-09 is effective for fiscal years beginning after December 15, 2024, with early adoption permitted. The Company is currently evaluating the impact this ASU will have on the footnotes included in the Company’s consolidated financial statements.

In November 2023, the FASB issued ASU No. 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures” (“ASU 2023-07”), which requires public entities to disclose information about their reportable segments’ significant expenses and other segment items on an interim and annual basis. Public entities with a single reportable segment are required to apply the disclosure requirements in ASU 2023-07, as well as all existing segment disclosures and reconciliation requirements in ASC 280 on an interim and annual basis. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and for interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. The Company is currently evaluating the new disclosures that will be added to the footnotes included in the Company’s consolidated financial statements for the year ending December 31, 2024.

Note 3—Revenue

Disaggregation of Revenue

See “Note 9—Segment and Geographical Information” for the Company’s revenue disaggregated by type of service and geographic area.

Remaining Performance Obligations

As of June 30, 2024, the Company had $5.1 million of remaining performance obligations associated with the transaction price that has been allocated to unexercised material rights related to the Company’s arrangements with talent subject to tiered service fees. In May 2023, the Company retired its tiered service fee structure for talent and introduced a simplified flat service fee of 10%. This change took effect for new contracts and existing contracts that would have otherwise been subject to a 20% fee under the former tiered service fee model. Contracts under the former tiered service fee model that had a 5% fee retained that rate for those contracts through the end of 2023. With this change to the Company’s tiered service fee structure, the Company no longer allocates a portion of the transaction price to unexercised material rights. As of June 30, 2024, the Company expects to recognize substantially all of the $5.1 million

of remaining performance obligations associated with unexercised material rights related to tiered service fees over the next 12 months, with an immaterial amount recognized thereafter.

The Company has applied the practical expedients and exemptions and does not disclose the value of remaining performance obligations for: (i) contracts with an original expected length of one year or less; and (ii) contracts for which the variable consideration is allocated entirely to a wholly unsatisfied promise to transfer a distinct service that forms part of a single performance obligation under the series guidance.

Contract Balances

The following table provides information about the balances of the Company’s trade and client receivables, net of allowance and contract liabilities included in deferred revenue and other liabilities, noncurrent:

| | | | | | | | | | | |

| (In thousands) | June 30, 2024 | | December 31, 2023 |

| Trade and client receivables, net of allowance | $ | 116,522 | | | $ | 103,061 | |

| Contract liabilities | | | |

| Deferred revenue | 10,766 | | | 17,361 | |

| Deferred revenue (component of other liabilities, noncurrent) | 4 | | | 790 | |

During the three and six months ended June 30, 2024, changes in the contract liabilities balances were a result of normal business activity and deferral, and subsequent recognition, of revenue related to arrangements with talent subject to tiered service fees and related allocation of transaction price to material rights.

Revenue recognized during the three and six months ended June 30, 2024 that was included in deferred revenue as of March 31, 2024 and December 31, 2023 was $8.9 million and $13.0 million, respectively. Revenue recognized during the three and six months ended June 30, 2023 that was included in deferred revenue as of March 31, 2023 and December 31, 2022 was $9.8 million and $15.2 million, respectively.

Note 4—Fair Value Measurements

The Company defines fair value as the exchange price that would be received from the sale of an asset or paid to transfer a liability in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques used to measure fair value must maximize the use of observable inputs and minimize the use of unobservable inputs. The authoritative guidance describes three levels of inputs that may be used to measure fair value:

•Level I—Observable inputs that reflect unadjusted quoted prices for identical assets or liabilities in active markets;

•Level II—Observable inputs other than Level I prices, such as unadjusted quoted prices for similar assets or liabilities in active markets, unadjusted quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities; and

•Level III—Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. These inputs are based on the Company’s own assumptions used to measure assets and liabilities at fair value and require significant management judgment or estimation.

The categorization of a financial instrument within the fair value hierarchy is based upon the lowest level of input that is significant to its fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires management to make judgments and consider factors specific to the assets or liabilities.

The Company’s financial instruments that are carried at fair value consist of Level I and Level II assets as of June 30, 2024 and December 31, 2023. The following tables summarize the Company’s available-for-sale marketable securities’ amortized cost, gross unrealized gains, gross unrealized losses, and fair value by significant investment category reported as cash equivalents or marketable securities as of June 30, 2024 and December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(In thousands) June 30, 2024 | | Amortized

Cost | | Unrealized

Gain | | Unrealized

Loss | | Fair

Value | | Cash Equivalents | | Marketable

Securities |

| | | | | | | | | | | | |

| Level I | | | | | | | | | | | | |

| Money market funds | | $ | 108,360 | | | $ | — | | | $ | — | | | $ | 108,360 | | | $ | 108,360 | | | $ | — | |

| Treasury bills | | 137,436 | | | — | | | (203) | | | 137,233 | | | 23,277 | | | 113,956 | |

| U.S. government securities | | 19,020 | | | 4 | | | (106) | | | 18,918 | | | — | | | 18,918 | |

| Total Level I | | 264,816 | | | 4 | | | (309) | | | 264,511 | | | 131,637 | | | 132,874 | |

| Level II | | | | | | | | | | | | |

| Commercial paper | | 25,575 | | | — | | | — | | | 25,575 | | | — | | | 25,575 | |

| Corporate bonds | | 133,226 | | | 68 | | | (231) | | | 133,063 | | | — | | | 133,063 | |

| Commercial deposits | | 14,377 | | | — | | | — | | | 14,377 | | | — | | | 14,377 | |

| Asset-backed securities | | 5,100 | | | — | | | (12) | | | 5,088 | | | — | | | 5,088 | |

| Foreign government and agency securities | | 3,973 | | | — | | | (9) | | | 3,964 | | | — | | | 3,964 | |

| | | | | | | | | | | | |

| Total Level II | | 182,251 | | | 68 | | | (252) | | | 182,067 | | | — | | | 182,067 | |

| Total | | $ | 447,067 | | | $ | 72 | | | $ | (561) | | | $ | 446,578 | | | $ | 131,637 | | | $ | 314,941 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(In thousands) December 31, 2023 | | Amortized

Cost | | Unrealized

Gain | | Unrealized

Loss | | Fair

Value | | Cash Equivalents | | Marketable

Securities |

| | | | | | | | | | | | |

| Level I | | | | | | | | | | | | |

| Money market funds | | $ | 4,782 | | | $ | — | | | $ | — | | | $ | 4,782 | | | $ | 4,782 | | | $ | — | |

| Treasury bills | | 291,611 | | | 109 | | | — | | | 291,720 | | | 13,955 | | | 277,765 | |

| U.S. government securities | | 26,213 | | | 3 | | | (18) | | | 26,198 | | | — | | | 26,198 | |

| Total Level I | | 322,606 | | | 112 | | | (18) | | | 322,700 | | | 18,737 | | | 303,963 | |

| Level II | | | | | | | | | | | | |

| Commercial paper | | 35,699 | | | — | | | — | | | 35,699 | | | — | | | 35,699 | |

| Corporate bonds | | 92,979 | | | 189 | | | (12) | | | 93,156 | | | — | | | 93,156 | |

| Commercial deposits | | 15,371 | | | — | | | — | | | 15,371 | | | — | | | 15,371 | |

| Asset-backed securities | | 14,728 | | | 2 | | | (42) | | | 14,688 | | | — | | | 14,688 | |

Foreign government and agency securities | | 3,075 | | | 5 | | | — | | | 3,080 | | | — | | | 3,080 | |

U.S. agency securities | | 4,506 | | | — | | | (6) | | | 4,500 | | | — | | | 4,500 | |

| Total Level II | | 166,358 | | | 196 | | | (60) | | | 166,494 | | | — | | | 166,494 | |

| Total | | $ | 488,964 | | | $ | 308 | | | $ | (78) | | | $ | 489,194 | | | $ | 18,737 | | | $ | 470,457 | |

Additionally, the Company deposits funds held in escrow in interest-bearing and non-interest-bearing cash accounts. The interest earned on the interest-bearing accounts is included in revenue in the Company’s condensed consolidated statement of operations and comprehensive income (loss). As of June 30, 2024 and December 31, 2023, the fair value of the Company’s funds held on behalf of customers and held in interest-bearing cash accounts was measured using Level I inputs.

Unrealized Investment Losses

The following tables summarize, for all debt securities classified as available-for-sale in an unrealized loss position as of June 30, 2024 and December 31, 2023, the aggregate fair value and gross unrealized loss by the length of time those securities have been continuously in an unrealized loss position.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Less Than 12 Months | | 12 Months or Longer | | Total |

Duration of unrealized losses June 30, 2024 | Fair Value | | Unrealized loss | | Fair Value | | Unrealized loss | | Fair Value | | Unrealized loss |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Treasury bills | $ | 137,233 | | | $ | (203) | | | $ | — | | | $ | — | | | $ | 137,233 | | | $ | (203) | |

| U.S. government securities | 14,819 | | | (78) | | | 2,860 | | | (28) | | | 17,679 | | | (106) | |

| Corporate bonds | 79,151 | | | (231) | | | — | | | — | | | 79,151 | | | (231) | |

| Asset-backed securities | — | | | — | | | 4,907 | | | (12) | | | 4,907 | | | (12) | |

| | | | | | | | | | | |

| Foreign government and agency securities | 3,631 | | | (9) | | | — | | | — | | | 3,631 | | | (9) | |

| | | | | | | | | | | |

| Total | $ | 234,834 | | | $ | (521) | | | $ | 7,767 | | | $ | (40) | | | $ | 242,601 | | | $ | (561) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Less Than 12 Months | | 12 Months or Longer | | Total |

Duration of unrealized losses December 31, 2023 | Fair Value | | Unrealized loss | | Fair Value | | Unrealized loss | | Fair Value | | Unrealized loss |

| | | | | | | | | | | |

| U.S. government securities | $ | 15,381 | | | $ | (15) | | | $ | 5,182 | | | $ | (3) | | | $ | 20,563 | | | $ | (18) | |

| Corporate bonds | 24,062 | | | (10) | | | 552 | | | (2) | | | 24,614 | | | (12) | |

| Asset-backed securities | 6,598 | | | (20) | | | 7,348 | | | (22) | | | 13,946 | | | (42) | |

| | | | | | | | | | | |

U.S. agency securities | 1,995 | | | (1) | | | 2,505 | | | (5) | | | 4,500 | | | (6) | |

| Total | $ | 48,036 | | | $ | (46) | | | $ | 15,587 | | | $ | (32) | | | $ | 63,623 | | | $ | (78) | |

For available-for-sale marketable debt securities with unrealized loss positions, the Company does not intend to sell these securities, nor does it anticipate that it will need to or be required to sell the securities. As of June 30, 2024 and December 31, 2023, the decline in fair value of these securities was due to increases in interest rates and not due to credit related factors. As of June 30, 2024 and 2023, the Company considered any decreases in market value to be temporary in nature and did not consider any of the Company’s marketable securities to be other-than-temporarily impaired. The Company did not record any impairment charges with respect to its marketable securities during each of the three and six months ended June 30, 2024 and 2023.

During the three months ended June 30, 2024 and 2023, interest income, net was $6.2 million and $4.8 million, respectively. During the six months ended June 30, 2024 and 2023, interest income, net was $13.9 million and $10.3 million, respectively. Interest income, net is included in other income, net in the Company’s condensed consolidated statement of operations and comprehensive income (loss).

Note 5—Balance Sheet Components

Cash and Cash Equivalents, Restricted Cash, and Funds Held In Escrow, Including Funds In Transit

The following table reconciles cash and cash equivalents, restricted cash, and funds held in escrow that are restricted as reported in the condensed consolidated balance sheets as of June 30, 2024 and

December 31, 2023 to the total of the same amounts shown in the condensed consolidated statement of cash flows for the six months ended June 30, 2024:

| | | | | | | | | | | |

| (In thousands) | June 30, 2024 | | December 31, 2023 |

| Cash and cash equivalents | $ | 182,803 | | | $ | 79,641 | |

| Restricted cash | 4,390 | | | 4,390 | |

| Funds held in escrow, including funds in transit | 218,656 | | | 212,387 | |

| Total cash, cash equivalents, and restricted cash as shown in the condensed consolidated statement of cash flows | $ | 405,849 | | | $ | 296,418 | |

Property and Equipment, Net

Property and equipment, net consisted of the following:

| | | | | | | | | | | |

| (In thousands) | June 30, 2024 | | December 31, 2023 |

| Internal-use software and platform development | $ | 53,148 | | | $ | 47,096 | |

| Leasehold improvements | 11,857 | | | 11,644 | |

| Computer equipment and software | 7,314 | | | 6,605 | |

| Office furniture and fixtures | 2,745 | | | 2,745 | |

| Total property and equipment | 75,064 | | | 68,090 | |

| Less: accumulated depreciation | (46,915) | | | (40,950) | |

| Property and equipment, net | $ | 28,149 | | | $ | 27,140 | |

For the three months ended June 30, 2024 and 2023, depreciation expense related to property and equipment, excluding internal-use software and platform development, was $0.6 million and $0.8 million, respectively. For the six months ended June 30, 2024 and 2023, depreciation expense related to property and equipment, excluding internal-use software and platform development, was $1.3 million and $1.5 million, respectively.

For each of the three months ended June 30, 2024 and 2023, the Company capitalized $3.6 million of internal-use software and platform development costs. For the six months ended June 30, 2024 and 2023, the Company capitalized $6.1 million and $6.4 million of internal-use software and platform development costs, respectively.

For the three months ended June 30, 2024 and 2023, amortization expense related to the capitalized internal-use software and platform development costs was $2.6 million and $1.1 million, respectively. For the six months ended June 30, 2024 and 2023, amortization expense related to the capitalized internal-use software and platform development costs was $4.7 million and $2.3 million, respectively.

Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consisted of the following:

| | | | | | | | | | | |

| (In thousands) | June 30, 2024 | | December 31, 2023 |

| Accrued compensation and related benefits | $ | 18,636 | | | $ | 25,872 | |

| Accrued indirect taxes | 12,552 | | | 13,171 | |

| Accrued vendor expenses | 8,513 | | | 8,844 | |

| Operating lease liability, current | 3,812 | | | 5,687 | |

| Accrued payment processing fees | 3,780 | | | 2,090 | |

| Accrued talent costs | 1,668 | | | 1,415 | |

| Other | 850 | | | 1,113 | |

| Total accrued expenses and other current liabilities | $ | 49,811 | | | $ | 58,192 | |

Stockholders’ Equity

2024 PSU Awards

During the three months ended March 31, 2024, the compensation committee of the Company’s board of directors, which is referred to as the compensation committee, approved the grant of performance stock unit awards to certain members of the Company’s leadership team under the Company’s 2018 Equity Incentive Plan, which are referred to as the 2024 PSU Awards. These awards were granted on March 18, 2024, which is referred to as the PSU Grant Date.

Up to fifty percent of the total number of shares subject to the 2024 PSU Awards are eligible to vest based on the Company’s achievement of certain financial performance targets in the fiscal year ending December 31, 2025 and up to the remaining fifty percent of the total number of shares subject to the 2024 PSU Awards are eligible to vest based on the Company’s achievement of certain financial performance targets in the fiscal year ending December 31, 2026. For each year, the financial performance targets consist of year-over-year revenue growth and adjusted EBITDA margin targets that were established by the compensation committee at the time of grant, which is referred to as the PSU Performance Condition. In order to receive the vested PSUs, a recipient must remain in continuous service with the Company until the compensation committee certifies the achievement of the PSU Performance Condition for the applicable year, which is referred to as the PSU Service Condition. The dates on which such certification takes place are referred to as Certification Dates.

The Company classifies the 2024 PSU Awards as equity awards. Stock-based compensation expense related to the 2024 PSU Awards is a component of operating expenses in the Company’s condensed consolidated statements of operations and comprehensive income (loss) and is recognized over the longer of the expected achievement period for the PSU Performance Condition and the PSU Service Condition, which is 23 months and 35 months for the shares eligible to vest under the 2024 PSU Awards based on performance in each of the years ending December 31, 2025 and 2026, respectively. The grant date fair value of the 2024 PSU Awards was determined using the Company’s closing common stock price on the PSU Grant Date multiplied by the number of 2024 PSU Awards that were probable of vesting on the PSU Grant Date. At each reporting date prior to the Certification Dates, the number of 2024 PSU Awards that are probable of vesting will be reassessed and any changes are reflected in stock-based compensation expense for the period.

Share Repurchase Program

During 2023, the Company’s board of directors authorized the repurchase of up to $100.0 million of shares of the Company’s outstanding common stock, which is referred to as the Share Repurchase Program. Repurchases of the Company’s common stock under the Share Repurchase Program may be made from time to time on the open market (including through the use of trading plans intended to qualify under Rule 10b5-1 under the Securities Exchange Act of 1934, as amended), in privately negotiated transactions, or by other methods, at the Company’s discretion, and in accordance with applicable securities laws and other restrictions. The Share Repurchase Program has no expiration date and will continue until otherwise suspended, terminated, or modified at any time for any reason. The Share Repurchase Program does not obligate the Company to repurchase any dollar amount or number of shares, and the timing and amount of any repurchases will depend on market and business conditions.

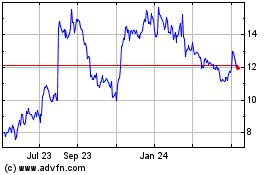

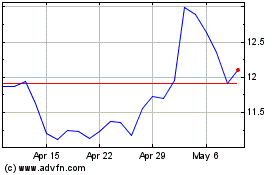

During the three and six months ended June 30, 2024, the Company repurchased and subsequently retired 2.9 million and 8.1 million shares of its common stock for an aggregate amount of $33.1 million and $100.0 million at an average price of $11.60 and $12.38 per share, including fees associated with the repurchases, respectively. As of June 30, 2024, the Company had no remaining balance available for repurchases under the Share Repurchase Program.

During the three months ended March 31, 2024, the Company repurchased 0.2 million shares of its common stock that were recorded as treasury stock in the Company’s condensed consolidated balance sheet as of March 31, 2024 and retired in April 2024. As of June 30, 2024, the Company did not hold any shares of treasury stock.

Note 6—Commitments and Contingencies

Letters of Credit

In conjunction with the Company’s operating lease agreements, as of June 30, 2024 and December 31, 2023, the Company had irrevocable letters of credit outstanding in the aggregate amount of $0.8 million. The letters of credit are collateralized by restricted cash in the same amount. No amounts had been drawn against these letters of credit as of June 30, 2024 and December 31, 2023.

Contingencies

The Company accrues contingent liabilities when it is probable that future expenditures will be made and such expenditures can be reasonably estimated. Potential contingencies may include various claims and litigation or non-income tax matters that arise from time to time in the normal course of business. Due to uncertainties inherent in such contingencies, the Company can give no assurance that it will prevail in any such matters, which could subject the Company to significant liability or damages. Any claims, litigation, or other contingencies could have an adverse effect on the Company’s business, financial position, results of operations, or cash flows in or following the period that claims, litigation, or other contingencies are resolved.

As of June 30, 2024 and December 31, 2023, the Company was not a party to any material legal proceedings or claims, nor is the Company aware of any pending or threatened litigation or claims, including non-income tax matters, that could reasonably be expected to have a material adverse effect on its business, operating results, cash flows, or financial condition. Accordingly, the amounts accrued for contingencies for which the Company believes a loss is probable were not material as of June 30, 2024 and December 31, 2023.

Indemnification

The Company has indemnification agreements with its officers, directors, and certain key employees to indemnify them while they are serving in good faith in their respective positions. In the ordinary course of business, the Company enters into contractual arrangements under which it agrees to provide indemnification of varying scope and terms to clients, business partners, vendors, and other parties, including, but not limited to, losses arising out of the Company’s breach of such agreements, claims related to potential data or information security breaches, intellectual property infringement claims made by third parties, and other liabilities relating to or arising from the Company’s products and services or its acts or omissions. In addition, subject to the terms of the applicable agreement, as part of the Company’s Enterprise Solutions and certain other premium offerings, the Company indemnifies clients that subscribe to worker classification services for losses arising from worker misclassification. It is not possible to determine the maximum potential loss under these indemnification provisions due to the Company’s limited history of prior indemnification claims and the facts and circumstances involved in each particular provision.

Note 7—Debt

The following table presents the carrying value of the Company’s debt obligations as of June 30, 2024 and December 31, 2023:

| | | | | | | | | | | | | | |

| (In thousands) | | June 30, 2024 | | December 31, 2023 |

| Convertible senior notes | | $ | 360,998 | | | $ | 360,998 | |

| Total debt | | 360,998 | | | 360,998 | |

| Less: unamortized debt issuance costs | | (3,990) | | | (4,911) | |

| | | | |

| | | | |

| Debt, noncurrent | | $ | 357,008 | | | $ | 356,087 | |

| Weighted-average interest rate | | 0.76 | % | | 0.77 | % |

Convertible Senior Notes Due 2026

In August 2021, the Company issued 0.25% convertible senior notes due 2026, which are referred to as the Notes. The Notes were issued pursuant to and are subject to the terms and conditions of an indenture between the Company and Computershare Trust Company, National Association (as successor in interest to Wells Fargo Bank, National Association), as trustee, which is referred to as the Indenture. The Notes were offered and sold in a private offering to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended. As of June 30, 2024 and December 31, 2023, $361.0 million aggregate principal amount of the Notes remained outstanding.

The Notes are senior, unsecured obligations of the Company and bear interest at a rate of 0.25% per year. Interest will accrue from August 10, 2021 and is payable semiannually in arrears on February 15 and August 15 of each year, beginning on February 15, 2022, and the principal amount of the Notes will not accrete. The Notes will mature on August 15, 2026, unless earlier redeemed, repurchased, or converted in accordance with the terms of the Notes.

Holders may convert all or any portion of their Notes, in multiples of $1,000 principal amount at the option of the holder (i) on or after May 15, 2026, at any time until the close of business on the second scheduled trading day immediately preceding the maturity date, and (ii) prior to the close of business on the business day immediately preceding May 15, 2026, only upon satisfaction of certain conditions and during certain periods specified as follows:

•during any calendar quarter commencing after the calendar quarter ending on December 31, 2021, if the last reported sale price of the Company’s common stock is greater than or equal to 130% of the conversion price for at least 20 trading days (whether or not consecutive) during a period of 30 consecutive trading days ending on, and including, the last trading day of the immediately preceding calendar quarter of the conversion price on each applicable trading day;

•during the five consecutive business day period after any five consecutive trading day period, which is referred to as the Measurement Period, in which the trading price (as defined in the Indenture) per $1,000 principal amount of Notes for each trading day of the Measurement Period was less than 98% of the product of the last reported sale price per share of the Company’s common stock on such trading day and the conversion rate on such trading day;

•if the Company calls such Notes for redemption, at any time prior to the close of business on the second scheduled trading day immediately preceding the redemption date; and

•upon the occurrence of specified corporate events described in the Indenture.

Upon conversion, the Notes may be settled in shares of the Company’s common stock, cash or a combination of cash and shares of the common stock, at the election of the Company. The Notes have an initial conversion rate of 15.1338 shares of common stock per $1,000 principal amount of Notes, which is subject to adjustment in certain circumstances. This is equivalent to an initial conversion price of approximately $66.08 per share of the Company’s common stock. The conversion rate is subject to customary adjustments under certain circumstances in accordance with the terms of the Indenture. In

addition, if certain corporate events that constitute a make-whole fundamental change (as defined in the Indenture) occur or if the Company issues a notice of redemption with respect to the Notes prior to the maturity date, then the conversion rate will, in certain circumstances, be increased for a specified period of time.

The Company may redeem for cash all or any portion of the Notes (subject to a partial redemption limitation), at the Company’s option, on or after August 20, 2024, if the last reported sale price per share of the Company’s common stock has been at least 130% of the conversion price then in effect for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading day period (including the last trading day of such period) ending on, and including, the trading day immediately preceding the date on which the Company provides notice of redemption at a redemption price equal to 100% of the principal amount of the Notes to be redeemed, plus any accrued and unpaid interest, if any, to, but excluding, the redemption date. No sinking fund is provided for the Notes, which means that the Company is not required to redeem or retire the Notes periodically.

Upon the occurrence of a fundamental change (as defined in the Indenture), subject to certain conditions, holders have the right to require the Company to repurchase for cash all or a portion of their Notes at a price equal to 100% of the principal amount of the Notes to be repurchased, plus any accrued and unpaid interest thereon, if any, until, but excluding, the fundamental change repurchase date.

The Notes are the Company’s senior unsecured obligations and rank senior in right of payment to any of the Company’s existing and future indebtedness that is expressly subordinated in right of payment to the Notes; equal in right of payment to any of the Company’s existing and future unsecured indebtedness that is not so subordinated; effectively junior in right of payment to any of the Company’s existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness; and structurally junior to all existing and future indebtedness and other liabilities (including trade payables) of the Company’s subsidiaries.

For each of the three months ended June 30, 2024 and 2023, interest expense was $0.2 million and amortization of the issuance costs was $0.5 million related to the Notes.

For the six months ended June 30, 2024 and 2023, interest expense was $0.5 million and $0.6 million, respectively, and amortization of the issuance costs was $0.9 million and $1.2 million, respectively, related to the Notes.

As of June 30, 2024 and December 31, 2023, the if-converted value of the Notes did not exceed the outstanding principal amount. As of June 30, 2024, the total estimated fair value of the Notes was $320.4 million and was determined based on a market approach using actual bids and offers of the Notes in an over-the-counter market on the last trading day of the period. The Company considers these assumptions to be Level II inputs in accordance with the fair value hierarchy described in “Note 4—Fair Value Measurements.”

Capped Calls

In connection with the issuance of the Notes, the Company entered into privately negotiated capped call transactions, which are referred to as the Capped Calls, with various financial institutions.