Prospectus Filed Pursuant to Rule 424(b)(7) (424b7)

March 09 2021 - 4:07PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(7)

Registration Statement No: 333-237139

PROSPECTUS SUPPLEMENT NO. 2

(To Prospectus Dated March 12, 2020)

Uniti Group Inc.

1,169,663 Shares of Common Stock

This prospectus supplement

No. 2 supplements and amends the selling stockholder information contained in the prospectus, dated March 12, 2020, as previously

supplemented by prospectus supplement dated June 22, 2020, relating to the offer and sale from time to time of up to 38,249,667

shares of our common stock, par value $0.0001 per share (the “Common Stock”), issuable upon exchange of $345,000,000

aggregate principal amount of 4.00% Exchangeable Senior Notes due 2024 (the “Notes”) issued by our indirect subsidiary,

Uniti Fiber Holdings Inc. (“Uniti Fiber”), in a private transaction that closed on June 28, 2019. Under certain circumstances,

we may issue shares of Common Stock upon the exchange of the Notes. In such circumstances, the recipients of such Common Stock

(the “Selling Stockholders”) may use this prospectus supplement to resell from time to time the shares of Common Stock

that we may issue to them upon the exchange of the Notes.

This prospectus supplement

names an additional Selling Stockholder who may receive shares of our Common Stock upon exchange of the Notes. Additional Selling

Stockholders may be named by future prospectus supplements.

You should read this

prospectus supplement in conjunction with the prospectus, including any amendments or supplements to it. This prospectus supplement

is not complete without, and may not be delivered or used except in conjunction with, the prospectus, including any amendments

or supplements to it. This prospectus supplement is qualified by reference to the prospectus, except to the extent that the information

provided by this prospectus supplement supersedes information contained in the prospectus.

The registration of

the shares of Common Stock covered by this prospectus supplement does not necessarily mean that any of the Selling Stockholders

will exchange their Notes for Common Stock, that upon any exchange of the Notes we will elect to exchange some or all of the Notes

for shares of Common Stock rather than cash, or that any shares of Common Stock received upon exchange of the Notes will be offered

or sold by the Selling Stockholders.

Our Common Stock is

listed on the NASDAQ Global Select Market under the symbol “UNIT.” On March 8, 2021, the last reported sales price

of our Common Stock was $11.08 per share.

Investing in our

Common Stock involves risks. You should carefully read and consider the risk factors included in in our Annual Report on Form 10-K

for the fiscal year ended December 31, 2020 and in other documents that we may file with the Securities and Exchange Commission

(the “SEC”). See “Risk Factors” on page 5 of the prospectus and the risks factors incorporated by reference

in the prospectus.

Neither the SEC

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement

or the prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus supplement is dated March

9, 2021.

SELLING STOCKHOLDERS

The Notes were originally

issued by Uniti Fiber, an indirect subsidiary of the Company, and sold by the initial purchasers of the Notes in transactions exempt

from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), to persons reasonably

believed by the initial purchasers to be qualified institutional buyers as defined by Rule 144A under the Securities Act. Under

certain circumstances, we may issue shares of our Common Stock upon the exchange of the Notes. In such circumstances, the Selling

Stockholders may use this prospectus supplement to resell from time to time the shares of our Common Stock that we may issue to

them upon the exchange of the Notes.

Information about a

certain Selling Stockholder is set forth herein, and information about additional Selling Stockholders may be set forth in a future

prospectus supplement, in a post-effective amendment, or in filings we make with the SEC under the Securities Exchange Act of 1934,

as amended, which are incorporated by reference in this prospectus supplement. Selling Stockholders, including their transferees,

pledgees, donees or their successors, may from time to time offer and sell pursuant to this prospectus supplement and any future

prospectus supplement or post-effective amendment any or all of the shares of our Common Stock that we may issue upon the exchange

of the Notes.

The following table

sets forth information, as of February 19, 2021, with respect to the Selling Stockholder and the number of shares of our Common

Stock that would become beneficially owned by such Selling Stockholder should we issue our Common Stock to such Selling Stockholder

that may be offered pursuant to this prospectus supplement upon the exchange of the Notes. The information is based solely on information

provided by or on behalf of the Selling Stockholder. The Selling Stockholder may offer all, some or none of the shares of our Common

Stock which we may issue upon the exchange of the Notes. Because the Selling Stockholder may offer all or some portion of such

shares of our Common Stock, we cannot estimate the number of shares of our Common Stock that will be held by the Selling Stockholder

upon termination of any of these sales. In addition, the Selling Stockholder identified below may have sold, transferred or otherwise

disposed of all or a portion of its Notes or shares of our Common Stock since the date on which it provided the information regarding

its Notes in transactions exempt from the registration requirements of the Securities Act.

The number of shares

of our Common Stock issuable upon the exchange of the Notes shown in the table below assumes exchange of the full amount of notes

held by the Selling Stockholder at an exchange rate of 110.8686 shares of our Common Stock per $1,000 principal amount of Notes

and a cash payment in lieu of any fractional share. This exchange rate is subject to adjustment in certain events, including, but

not limited to, the issuance of certain stock dividends on our Common Stock, the issuance of certain rights, options or warrants,

combinations, distributions of capital stock, indebtedness or other assets or property, cash dividends in excess of certain amounts,

and certain tender or exchange offers by us. Accordingly, the number of shares of our Common Stock issued upon the exchange of

the Notes may increase or decrease from time to time. The number of shares of our Common Stock owned by the other Selling Stockholders

or any future transferee from any such holder assumes that they do not beneficially own any shares of Common Stock other than the

Common Stock that we may issue to them upon the exchange of the Notes.

Based upon information

provided by the Selling Stockholders, none of the Selling Stockholders, including the Selling Stockholder identified below, nor

any of their affiliates, officers, directors or principal equity holders has held any positions or office or has had any material

relationship with us or any of our predecessors or affiliates within the past three years.

To the extent the Selling

Stockholder identified below is a broker-dealer, it may be deemed to be, under interpretations of the staff of the SEC, “underwriters”

within the meaning of the Securities Act. Unless otherwise indicated in the footnotes below, we believe that the persons and entities

named in the table have sole voting and investment power with respect to all shares of our Common Stock beneficially owned.

|

Name

|

|

Number of

Shares

Beneficially

Owned

Prior to the

Offering

|

|

|

Percentage of

Shares

Beneficially

Owned Prior to

the Offering(1)

|

|

|

Number of

Shares Offered

Hereby

|

|

|

Number of

Shares

Beneficially

Owned After

the Offering(2)

|

|

|

Percentage of

Shares

Beneficially

Owned After the

Offering(1)(2)

|

|

|

Thrivent Financial for Lutherans(3)

|

|

|

1,169,663

|

|

|

|

*%

|

|

|

|

1,169,663

|

|

|

|

—

|

|

|

|

—

|

|

Less than 1%.

|

|

(1)

|

Based on a total of 232,897,213 shares of our Common

Stock outstanding as of February 26, 2021.

|

|

|

(2)

|

Assumes the Selling Stockholder sells all of its shares

of our Common Stock offered pursuant to this prospectus supplement.

|

|

|

(3)

|

Thrivent Financial for Lutherans (“Thrivent”)

is a member-owned, not-for-profit fraternal benefit society that offers insurance products to its over two million members. Thrivent

is also registered with the SEC as an investment advisor. Thrivent is not a publicly traded entity, nor does Thrivent have any

principal owners. Accordingly, Thrivent does not have a natural person with sole or shared voting or dispositive power over the

securities listed. The address for Thrivent is 901 Marquette Avenue, Suite 2500, Minneapolis, MN 55402-3211.

|

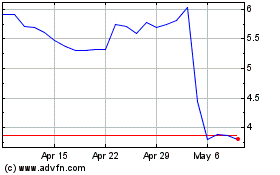

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

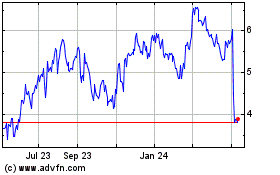

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Apr 2023 to Apr 2024