Filed by Aquesta Financial

Holdings, Inc.

Pursuant to Rule 425 under

the Securities Act of 1933

and deemed filed pursuant

to Rule 14a-12

under the Securities Exchange

Act of 1934

Subject Company: Aquesta

Financial Holdings, Inc.

(Commission File No. 001-35095)

Date: July 23, 2021

Set forth below is the

earnings release of Aquesta Financial Holdings, Inc., which references the proposed merger with United Community Banks, Inc.

PRESS

RELEASE

FOR IMMEDIATE RELEASE:

Aquesta Financial Holdings, Inc Announces Results

of Operations for the

Second Quarter of 2021 and Declares Annual Cash

Dividend of 14 Cents Per Share

CORNELIUS, NC – July 23, 2021 -- Aquesta Financial Holdings,

Inc and subsidiaries (“Aquesta”) (OTC Market symbol AQFH) – including its subsidiary Aquesta Bank announced today net

income for the second quarter of 2021 (three month period ending June 30, 2021). For the second quarter of 2021, Aquesta had unaudited

income from continuing operations of $1.9 million (35 cents per share) compared to the second quarter of 2020 net income of $1.4 million

(26 cents per share). Thus, earnings excluding merger related expenses grew at 34.0 percent in the second quarter of 2021 compared to

the second quarter of 2020. For the six month period ended June 30, 2021, Aquesta had had unaudited income from continuing operations

of $4.4 million compared to the six month period ended June 30, 2020 of $2.3 million. This is an increase of $2.1 million or 92.4 percent.

Additionally, the Board of Directors has declared the payment of Aquesta’s

ninth consecutive annual cash dividend in the amount of 14 cents per share to shareholders of record as of September 15, 2021. The dividend

is payable on September 30, 2021.

Jim Engel, CEO and President of Aquesta, said “I am pleased to

announce another quarter of excellent earnings growth and our annual dividend. In addition to our continued very good performance and

dividend, this is also an exciting time as we announced the proposed sale of Aquesta including its wholly-owned subsidiary, Aquesta Bank,

to United Community Banks, Inc. (“UCBI”) on May 27, 2021. We believe that our partnership with UCBI will prove beneficial

not only to our shareholders, but also our customers, employees and communities as UCBI offers expanded products and services while maintaining

a strong focus on customer and community service."

Key Highlights

|

|

·

|

Announced

the proposed sale of Aquesta Financial Holdings to United Community Banks, Inc. (NASDAQ: UCBI) for $131 million in a combination of cash

and stock. The sale is expected to be finalized later this year.

|

|

|

·

|

Total

core deposit growth of $102.7 million for the six months ended June 30, 2021 or 20.8 percent (annualized 41.6 percent). Core deposit

growth was due to Paycheck Protection Program (“PPP”) loan related deposits as well as organic growth.

|

|

|

·

|

Growth

in earnings from continuing operations for the three months ended June 30, 2021 compared to the three months June 30, 2020 of $483 thousand

or 34.0 percent. Additionally, earnings from continuing operations for the six months ended June 30, 2021 grew by $2.1 million or 92.4

percent compared to the six months ended June 30, 2020.

|

|

|

·

|

The

Board of Directors declared the payment of Aquesta’s ninth consecutive annual cash dividend in the amount of 14 cents per share

to shareholders of record as of September 15, 2021. The dividend is payable on September 30, 2021.

|

Solid Balance Sheet Growth

At June 30, 2021, Aquesta’s total assets were $736.1 million

compared to $680.2 million at December 31, 2020. Total loans were $523.6 million at June 30, 2021 compared to $554.9 million at December

31, 2020. Decrease in loans primarily relates to forgiveness of PPP loans. PPP loan forgiveness totaled $96.6 million for the six months

ended June 30, 2021. Core deposits were $597.1 million at June 30, 2021 compared to $494.3 million at December 31, 2020.

Asset Quality

Nonperforming assets were at $1.1 million as of June 30, 2021 compared

to $6.1 million as of December 31, 2020. Aquesta had $939 thousand in non-accrual loans as of June 30, 2021 compared to $5.7 million as

of December 31, 2020. The decrease in the non-accrual loan balance relates primarily to a paydown received on a single non-accrual loan

in the second quarter of 2021.

Aquesta held Other Real Estate Owned (i.e., “OREO” or foreclosed

property) of $120 thousand as of June 30, 2021 compared to $381 thousand as of December 31, 2020. Decrease in OREO balance was due to

the sale of one of the foreclosed properties in the second quarter of 2021.

Net Interest Income

Net interest income was $11.9 million for the six months ended June

30, 2021 compared to $8.7 million for the six months ended June 30, 2020. This is an increase of $3.3 million or 37.5 percent. Net interest

margin for the six months ended June 30, 2021 was 3.44 percent compared to 3.14 percent for the six months ended June 30, 2020. The increase

in net interest income and net interest margin is associated with an increased reliance on lower cost core deposits replacing higher cost

funding. Additionally, Aquesta was able to accrete $2.1 million of PPP fees into interest income for PPP loans that were held, forgiven,

or paid off during the first six months of 2021.

Provision for Loan Losses

The provision for loan losses was $207 thousand for the six months

ended June 30, 2021 compared to $1.1 million for the six months ended June 30, 2020. The decrease is due to management’s 2020 response

to the COVID-19 pandemic and an estimation of any resulting potential losses in the loan portfolio.

The ratio of allowance for loan and lease losses (“ALLL”)

to total loans is 1.01% as of June 30, 2021. The ratio of ALLL to total loans, excluding PPP loans, is 1.21% as of June 30, 2021. The

ratio of ALLL to total loans, excluding PPP loans and balances guaranteed by the SBA, is 1.33% as of June 30, 2021.

Non Interest Income

Non interest income was $1.9 million for the six months ended June

30, 2021 compared to $1.3 thousand for the six months ended June 30, 2020. This is an increase of $703 thousand or 54.6 percent. The increase

is largely attributable to SBA loan sale income which totaled $690 thousand and $242 thousand as of June 30, 2021 and June 30, 2020, respectively.

Non Interest Expense

Non interest expense was $8.1 million for the six months ended June

30, 2021 compared to $5.9 million for the six months ended June 30, 2020. Personnel expense was at $4.9 million as of June 30, 2021 compared

to $3.1 million as of June 31, 2020. The increase in personnel expense is due to the deferral of salary related costs incurred with the

closing and funding of PPP loans that occurred in 2020.

Occupancy expense increased by $42 thousand for the six months ended

June 30, 2021 compared to the six months ending June 30, 2020. The increase is due to the addition of the Mt. Pleasant, South Carolina

branch in January 2021. While the lease began in January 2021, the Mt. Pleasant branch has not opened for business as of June 30, 2021

but is expected to in the fourth quarter of 2021.

Below are the financial highlights for comparison

Aquesta Financial Holdings, Inc.

Select Financial Highlights

(Dollars in thousands, except per share data)

|

|

|

06/30/21

|

|

|

12/31/20

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

(audited)

|

|

|

|

|

|

|

|

|

|

|

Period End Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans

|

|

$

|

523,638

|

|

|

$

|

554,952

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan and lease losses

|

|

|

5,290

|

|

|

|

5,319

|

|

|

|

|

|

|

|

|

|

|

Investment securities

|

|

|

65,296

|

|

|

|

52,535

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

736,146

|

|

|

|

680,168

|

|

|

|

|

|

|

|

|

|

|

Core deposits

|

|

|

597,076

|

|

|

|

494,345

|

|

|

|

|

|

|

|

|

|

|

CDs and IRAs

|

|

|

43,622

|

|

|

|

63,623

|

|

|

|

|

|

|

|

|

|

|

Shareholders equity

|

|

|

62,059

|

|

|

|

58,549

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ending shares outstanding*

|

|

|

5,503,315

|

|

|

|

5,473,205

|

|

|

|

|

|

|

|

|

|

|

Book value per share*

|

|

|

11.28

|

|

|

|

10.70

|

|

|

|

|

|

|

|

|

|

|

Tangible book value per share*

|

|

|

11.27

|

|

|

|

10.69

|

|

|

|

|

|

|

|

|

|

*assumes conversion of Series A Convertible Perpetual Preferred Stock

|

|

|

For the three months ended

|

|

|

For the six months ended

|

|

|

|

|

06/30/21

|

|

|

06/30/20

|

|

|

06/30/21

|

|

|

06/30/20

|

|

|

|

|

(unaudited)

|

|

|

(audited)

|

|

|

(unaudited)

|

|

|

(audited)

|

|

|

Income and Per Share Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

$

|

6,600

|

|

|

$

|

5,668

|

|

|

$

|

13,543

|

|

|

$

|

11,344

|

|

|

Interest expense

|

|

|

767

|

|

|

|

1,208

|

|

|

|

1,561

|

|

|

|

2,627

|

|

|

Net interest income

|

|

|

5,833

|

|

|

|

4,460

|

|

|

|

11,982

|

|

|

|

8,717

|

|

|

Provision for loan losses

|

|

|

-

|

|

|

|

808

|

|

|

|

207

|

|

|

|

1,133

|

|

|

Net interest income after provision for loan losses

|

|

|

5,833

|

|

|

|

3,652

|

|

|

|

11,775

|

|

|

|

7,584

|

|

|

Non interest income

|

|

|

697

|

|

|

|

657

|

|

|

|

1,990

|

|

|

|

1,287

|

|

|

Non interest expense

|

|

|

4,120

|

|

|

|

2,503

|

|

|

|

8,068

|

|

|

|

5,947

|

|

|

Income before income taxes

|

|

|

2,410

|

|

|

|

1,806

|

|

|

|

5,697

|

|

|

|

2,924

|

|

|

Income tax expense

|

|

|

508

|

|

|

|

387

|

|

|

|

1,271

|

|

|

|

624

|

|

|

Income from continuing operations

|

|

|

1,902

|

|

|

|

1,419

|

|

|

|

4,426

|

|

|

|

2,300

|

|

|

Merger related expenses

|

|

|

477

|

|

|

|

-

|

|

|

|

477

|

|

|

|

-

|

|

|

Related income tax benefit

|

|

|

110

|

|

|

|

-

|

|

|

|

110

|

|

|

|

-

|

|

|

Net Income

|

|

|

1,535

|

|

|

|

1,419

|

|

|

|

4,059

|

|

|

|

2,300

|

|

|

|

|

For the three months ended

|

|

|

For the six months ended

|

|

|

|

|

06/30/21

|

|

|

06/30/20

|

|

|

06/30/21

|

|

|

06/30/20

|

|

|

|

|

(unaudited)

|

|

|

(audited)

|

|

|

(unaudited)

|

|

|

(audited)

|

|

|

Earnings per share - basic*

|

|

$

|

0.28

|

|

|

$

|

0.26

|

|

|

$

|

0.74

|

|

|

$

|

0.42

|

|

|

Earnings per share - diluted*

|

|

|

0.26

|

|

|

|

0.25

|

|

|

|

0.69

|

|

|

|

0.40

|

|

|

Weighted average shares - basic*

|

|

|

5,503,315

|

|

|

|

5,473,727

|

|

|

|

5,498,051

|

|

|

|

5,469,360

|

|

|

Weighted average shares - diluted*

|

|

|

5,970,638

|

|

|

|

5,749,853

|

|

|

|

5,914,754

|

|

|

|

5,787,407

|

|

* assumes conversion of Series A Convertible

Perpetual Preferred Stock

|

|

|

06/30/21

|

|

|

12/31/20

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited)

|

|

|

(audited)

|

|

|

|

|

|

|

|

|

|

|

Select performance ratios:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets

|

|

|

1.15

|

%

|

|

|

0.87

|

%

|

|

|

|

|

|

|

|

|

|

Return on average equity

|

|

|

13.46

|

%

|

|

|

9.41

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset quality data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

90 days or more and accruing

|

|

$

|

-

|

|

|

$

|

40

|

|

|

|

|

|

|

|

|

|

|

Non accrual loans

|

|

|

939

|

|

|

|

5,655

|

|

|

|

|

|

|

|

|

|

|

Other real estate owned

|

|

|

120

|

|

|

|

381

|

|

|

|

|

|

|

|

|

|

|

Total non performing assets

|

|

|

1,059

|

|

|

|

6,076

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Troubled debt restructurings

|

|

$

|

51

|

|

|

$

|

54

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non performing assets / total assets

|

|

|

0.14

|

%

|

|

|

0.89

|

%

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses / total loans

|

|

|

1.01

|

%

|

|

|

0.96

|

%

|

|

|

|

|

|

|

|

|

Aquesta Financial Holdings, Inc. is the holding company to its wholly

owned subsidiary, Aquesta Bank. Aquesta Bank is a full-service community bank headquartered in Cornelius, North Carolina with eight branches

in the Charlotte, Lake Norman and Wilmington, North Carolina areas and loan production offices in Raleigh, North Carolina, as well as

Greenville and Charleston, South Carolina.

For additional information, please contact Kristin Couch (Executive

Vice President and Chief Financial Officer) at 704-439-4343 or visit us online at www.aquesta.com.

Information in this press release may contain forward looking statements

that might involve risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include

without limitation, the effects of future economic conditions, governmental fiscal and monetary policies, legislative and regulatory changes,

and changes in interest rates.

IMPORTANT INFORMATION FOR SHAREHOLDERS

AND INVESTORS

In connection with the proposed merger with

Aquesta Financial Holdings, Inc. (“Aquesta”) (the “Merger”), United Community Banks, Inc. (“UCBI”)

intends to file a registration statement on Form S-4 with the Securities and Exchange Commission (“SEC”) that will include

proxy statement of Aquesta to be sent to Aquesta’s shareholders, seeking their approval of the Merger. The registration statement

also will contain a prospectus of UCBI to register the shares of UCBI common stock to be issued in connection with the Merger. A definitive

proxy statement/prospectus will also be provided to Aquesta’s shareholders as required by applicable law.

INVESTORS AND SHAREHOLDERS OF AQUESTA ARE

ENCOURAGED TO READ THE APPLICABLE REGISTRATION STATEMENT, INCLUDING THE APPLICABLE PROXY STATEMENT/PROSPECTUS THAT WILL BE A PART OF THE

REGISTRATION STATEMENT, WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED BY AQUESTA OR UCBI WITH THE SEC, INCLUDING ANY

AMENDMENTS OR SUPPLEMENTS TO THE REGISTRATION STATEMENT AND THOSE OTHER DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

UCBI, AQUESTA AND THE MERGER.

The registration statement and other documents

filed with the SEC may be obtained for free at the SEC’s website (www.sec.gov). You will also be able to obtain these documents,

free of charge, from UCBI at the “Investor Relations” section of UCBI’s website at www.ucbi.com or from Aquesta at the

“Investor Relations” section of Aquesta’s website at www.aquesta.com. Copies of the definitive proxy statement/prospectus

will also be made available, free of charge, by contacting United Community Banks, Inc., P.O. Box 398, Blairsville, GA 30514, Attn: Jefferson

Harralson, Telephone: (864) 240-6208 or Aquesta Financial Holdings, Inc., 19510 Jetton Road, Cornelius, North Carolina 28031, Attn: Kristin

Couch, Telephone: (704) 439-4325.

This communication is for informational purposes

only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of such jurisdiction.

PARTICIPANTS IN THE SOLICITATION

Aquesta and UCBI and certain of their respective

directors and executive officers, under the rules of the SEC, may be deemed to be participants in the solicitation of proxies from Aquesta’s

shareholders in favor of the approval of the Merger. Information about the directors and officers of UCBI and their ownership of UCBI

common stock can also be found in UCBI’s definitive proxy statement in connection with its 2021 annual meeting of shareholders,

as filed with the SEC on March 30, 2021, and other documents subsequently filed by UCBI with the SEC. Information about the directors

and executive officers of Aquesta and their ownership of Aquesta’s capital stock, as well as information regarding the interests

of other persons who may be deemed participants in the transaction, may be obtained by reading the proxy statement/prospectus regarding

the Merger with Aquesta when it becomes available. Additional information regarding the interests of these participants will also

be included in the proxy statement/prospectus pertaining to the Merger if and when it becomes available. Free copies of this document

may be obtained as described above.

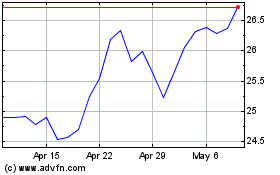

United Communty Banks (NASDAQ:UCBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

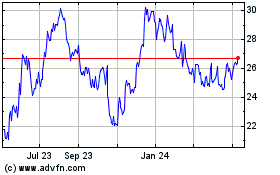

United Communty Banks (NASDAQ:UCBI)

Historical Stock Chart

From Apr 2023 to Apr 2024