Filed by United Community

Banks, Inc.

Pursuant to Rule 425 under

the Securities Act of 1933, as amended

and deemed filed pursuant

to Rule 14a-12

under the Securities Exchange

Act of 1934, as amended

Subject Company:

Aquesta Financial Holdings, Inc.

Commission File No.: 001-35095

Date: July 21, 2021

Set forth below is a transcript of

United Community Banks, Inc.’s quarterly earnings conference call held on July 21, 2021 during which the proposed mergers of

Aquesta and Reliant with and into United were discussed.

UNITED COMMUNITY BANKS,

INC.

Moderator: Lynn Harton

July 21, 2021

11:00 a.m. EDT

Operator

Good morning and welcome to United Community Banks Second Quarter 2021 Earnings Call. Hosting the call today are Chairman and Chief Executive

Officer, Lynn Harton; Chief Financial Officer, Jefferson Harralson; President and Chief Banking Officer, Rich Bradshaw; and Chief Risk

Officer, Rob Edwards.

United's presentation today includes references to operating earnings,

pretax, pre-credit earnings and other non-GAAP financial information. For these non-GAAP financial measures, United has provided a reconciliation

to the corresponding GAAP financial measure in the Financial Highlights section of the earnings release as well as at the end of the investor

presentation. Both are included on the website at ucbi.com. Copies of the second quarter's earnings release and investor presentation

were filed last night on Form 8-K with the SEC, and a replay of this call will be available in the Investor Relations section of the company's

website at ucbi.com.

Please be aware that during this call, forward-looking statements may

be made by representatives of United. Any forward-looking statements should be considered in light of risks and uncertainties described

on Pages 5 and 6 of the company's 2020 Form 10-K as well as other information provided by the company in its filings with the SEC and

included on its website.

At this time, I'll turn the call over to Lynn Harton.

Lynn Harton

Chairman, President & CEO

Good morning and thanks, everyone, for joining our call today. This

has been a great quarter for United, and I want to start by congratulating our teams for what they are doing to build the company. We've

had several strategic accomplishments this quarter. We doubled the size of our investment advisory business and added offices in South

Carolina and Georgia with the acquisition of FinTrust Capital Advisors. We're excited to welcome that team to United and look forward

to the opportunities that our combination will bring.

We also announced a bank expansion in the Charlotte MSA with the acquisition

of Aquesta. Jim Engle has built a great team that will be additive to our franchise with approximately $750 million in assets and 9 offices.

We've had several lending divisions in Charlotte for some time and have been looking for a way to grow our presence there, and we're very

excited that Aquesta chose to partner with us. We anticipate closing the acquisition in the fourth quarter of this year.

And finally, last week, we were glad to announce our entry into the

Nashville, Tennessee market with the acquisition of Reliant Bank. Reliant is a high-performance community bank that will be a great fit

with our culture and strategy. Reliance team, led by DeVan Ard, Founder, Chairman and CEO, will lead our continued growth in the Tennessee

market, where we now will have a top 10 deposit market share.

From an operating perspective for the quarter, EPS was $0.78 per share,

equating to a 146 basis point ROA and a 17.8% return on tangible equity on an operating basis. Loan growth ex-PPP was 5% annualized. And

we had strong overall average balance sheet growth, resulting in strong growth in our spread income. Deposits continue to grow strongly,

while our cost of deposits dropped 5 basis points and now stands at only 9 basis points. Credit continues to be a strength, with net recoveries

of 2 basis points and a reserve release of $13.6 million. Overall, a great quarter, one we're very proud of.

And I'll turn it over to Jefferson for more details.

Jefferson Harralson

Executive VP & CFO

Thank you, Lynn. I'm going to start my comments on Page 9. The chart

highlights our consistent loan growth excluding PPP loans over the last year. It also shows our strong deposit growth over the same time

frame. And in combination, we have become a lot more liquid, and our loan-to-deposit ratio has moved to 70% from 80% a year ago.

On Page 10, we take a closer look at our loan book and the mix of our

loans. We had $123 million of loan growth, which is a 5% annualized loan growth rate, which is net of the sale of a number of SBA and

Navitas loans that totaled just over $45 million in the quarter.

Moving to Page 11, which details our deposit growth. While we had $123

million of loan growth, we also add $335 million of deposit growth, which annualizes at an 8% growth rate. We did have a lot of success

this quarter in continuing to lower our cost of deposits, which moved to 9 basis points this quarter, down 5 basis points from last quarter.

On Page 12, I will touch briefly on capital. Our capital ratios grew in the quarter and are above peer levels partly because of a $100

million preferred raise we did last year. With our pending transactions, we are putting that raise to work, and we expect that our capital

ratios will be at peer levels on a pro forma basis. We did buy back a modest amount of shares in Q2, which totaled just over $5 million.

On Page 13, we talk about spread income and the margin. Excluding PPP

fees and loan accretion, our spread income grew at a 17% annualized pace in Q2. Our core margin was down 4 basis points, mainly due to

continued increased liquidity driven by strong deposit growth in combination with a significant cash flow coming in with PPP forgiveness.

Page 14 details our fee income, which was significantly down from last

quarter primarily because of mortgage. Our rate lock volume was down in Q2, and this combined with our gain-on-sale percentage also being

down from Q1. While down, our gain-on-sale percentage does still remain above pre-pandemic levels.

Then given the lower rates in the quarter, we also had a $3 million

MSR write-down this quarter, which compare to a $1.3 million gain last quarter, and created a $4.3 million negative swing in total from

Q1. We did resume Navitas loan sales this quarter and had $803,000 of gains on $18.9 million of loans sold. We would expect continued

Navitas loan sales for the rest of the year in addition to our normal SBA loan sales.

Page 15 shows our expenses, up $800,000 from last quarter excluding

merger-related charges. I expect relatively flat to possibly down expenses in Q3. Excluding the impact of FinTrust, that adds about $1.5

million of quarterly expenses.

I will finish up on Page 16 and talk about PPP loans. We had $411 million

of PPP loans forgiven in Q2, and we have $472 million remaining to be forgiven. We recognized $11 million of PPP fees in Q2 and have $19

million of fees yet to be recognized, of which we would expect to get the lion's share later in 2021.

And with that, I'll pass it to Rob to discuss credit. Rob?

Rob Edwards

Executive VP & Chief Risk Officer

Thank you, Jefferson. We are pleased to report the second quarter of

net recoveries for this year. The recoveries were driven by very low levels of losses at our equipment finance company, Navitas, and the

ongoing success of our collections and recovery efforts.

As we expected, the combined level of special mention and substandard

loans remained relatively flat this quarter at just under 5% of total loans. Our hotel and senior care borrowers continue to report improved

performance, and we expect to see upgrades materialize in the second half of the year. The largest improvement occurred in the hotel portfolio

as our top 50 hotel borrowers are now reporting a weighted average occupancy of 73%.

The low level of losses and strong credit quality metrics combined

with a positive economic outlook to drive a negative provision of $13.6 million for the quarter. The allowance for loan losses, including

the unfunded reserve, now amounts to $122 million and 1.12% of the loan portfolio excluding PPP loan balances.

And now I'll pass it back to Lynn for closing remarks.

Lynn Harton

Chairman, President & CEO

Thanks, Rob. Once again, congratulations to all of our bankers and

support staff for an outstanding quarter. In addition to having great business momentum across our geographies and businesses, our team

was once again recognized by J.D. Power for having the best retail banking satisfaction in the Southeast. That's an unprecedented 7 of

the past 8 years. Truly an incredible accomplishment and one that we believe is a driver of our financial success.

We're well positioned for continued earnings growth, with hiring success

in our current footprint and expected strong EPS accretion from our announced acquisitions. This is estimated on the final slide in our

deck. Once we have completed and converted our 2 pending deals, I believe we will have one of the most attractive footprints in the Southeast,

and I look forward to continuing success driven by our great United team. And I'd like to now open it up for questions.

Question and Answer

Operator

Our first question comes from Michael Rose with Raymond James.

Jefferson Harralson

Executive VP & CFO

You might be on mute, Michael. Perhaps move to the next call and get

Michael back on at the end.

Operator

Our next question comes from Kevin Fitzsimmons with D.A. Davidson.

Kevin Fitzsimmons

D.A. Davidson

Can you hear me okay?

Rob Edwards

Executive VP & Chief Risk Officer

Yes, Kevin.

Kevin Fitzsimmons

D.A. Davidson

Seems like we just spoke, but I wanted to ask about just with the negative

provision, which came in right in line with what you all preannounced last week. Looking forward, and I know this is -- there's a lot

of noise in this with past acquisitions and in acquisitions to come. But looking at that reserve ratio, where you stand, and looking at

economic -- your expectations for the economy improving, would you expect negative provisionings from here to abate and at some point

over the next few quarters, we start to transition over to more positive provisioning? I know that's tough. You load in the CECL model.

But just trying to get from a -- taking a step back, how you guys are viewing it.

Rob Edwards

Executive VP & Chief Risk Officer

Kevin, this is Rob. You're exactly right. The economic environment

and forecast does play a big role in it. And the modeling, really for the first 2 quarters, did have very positive expectations and forecasting

elements. And modeling in the CECL model, that did play a role in the negative provision.

The economy from where we sit continues to perform very well. And so

at the moment, we don't expect any changes there. And we do expect continued, I'll say, reduction in criticized and classified or special

mention and substandard assets as we go forward. So it's quite possible we could see additional negative provisions in the latter half

of the year.

Kevin Fitzsimmons

D.A. Davidson

Okay. Great. And maybe looking at the balance sheet. I know we talked

a lot about loans, but securities went up. And I'm just wondering with where rates stand today, Jefferson, how we should be thinking about

the likelihood of you guys taking securities -- putting some of that excess liquidity to work more in securities going forward.

Jefferson Harralson

Executive VP & CFO

Yes. Kevin, it's a great question. So you should think about that securities

portfolio continuing to grow and albeit at a slower pace than it did this quarter. As I mentioned in the prepared remarks, we have significant

cash. We have significant cash coming in from PPP. We've got more PPP to be forgiven. Our deposit growth remains strong, but our securities

portfolio has grown, and it will continue to grow just at a lower -- a smaller -- at a lower growth rate than in the past.

Kevin Fitzsimmons

D.A. Davidson

Okay. And I just want to ask one kind of more housekeeping question

on -- with the combination with Reliant. They had that mortgage joint venture. And my understanding in modeling Reliant and covering them

was always that even when mortgage turned profitable, common shareholders of Reliant didn't benefit from that just because of the turns

in the joint venture, and it was going to stay that way for quite some time. And in modeling, I basically pulled that out, just so I didn't

have to forecast noncontrolling interest adjustment. But is that -- does anything from a legal standpoint change with the combination?

Is that still the way to think of it? Or should we be building in the revenues and expenses from that mortgage joint venture?

Lynn Harton

Chairman, President & CEO

I think the way you've been thinking about it correct going forward.

We're in conversations with the joint venture partner about the future strategy for that business. But as it sits today, you're exactly

right. It has no kind of positive or negative impact.

I will say also that the terms of the joint venture do not preclude

us from any other mortgage operations that we have. So all those are totally separate, and we're not bound in any way by the joint venture

agreement. So yes, I would just kind of put it aside, and we'll see what develops with it.

Jefferson Harralson

Executive VP & CFO

Yes. When we talked about the cost savings from the deal, we talked

about 31%. That was on the bank-only side of it. If you do think about it, excluding the joint venture, it's an extra $16 million of cost

savings, but it's a similar amount of revenue. So again, not a major impact on underlying earnings but does improve the efficiency ratio.

So...

Operator

Our next question comes from Jennifer Demba with Truist Securities.

Jennifer Demba

Truist Securities

Just wondering about 2022 after you have Reliant and Aquesta integrated,

what kind of your interest level in future transactions would be. And are there any markets you really want to build scale in like Tennessee?

Lynn Harton

Chairman, President & CEO

Yes. So -- well, first off -- embedded in your question is effectively

a statement that is correct in that our focus right now is on getting Aquesta and Reliant both operationally and culturally integrated.

So we're not interested at this point in doing additional deals until we feel confident that that's behind us.

But beyond that, we've got a great footprint today. There's not any

places that we are looking at outside of our current footprint. But there's any number of markets in the Carolinas, Tennessee, Georgia,

and Florida for that matter, that we think would be additive to our current footprint. And if we have the same combination of great markets

and great teams and a great cultural fit, then we'd be interested in pursuing those opportunities when they come.

So I think we've -- in 2022, if you look at how many deals we've done

over the years, we typically have done at least 1 and sometimes 2 deals a year, but again, have been very selective about that, if you

look at the markets we've gone into, again, Nashville, Charlotte, Raleigh, Greenville, Charleston, Orlando, Myrtle Beach, et cetera. We're

going to be very selective as to the people. And -- but with all that said, I mean, our focus right now is Reliant and Aquesta and getting

those done and in bed, and we'll figure out what we do from there.

Operator

Our next question comes from Catherine Mealor with KBW.

Catherine Mealor

KBW

I was asked, it was nice to see that you bought back some stock this

quarter. Do you anticipate continuing buyback activity with your 2 deals pending? Or do you think that's off the table until we get past

close?

Jefferson Harralson

Executive VP & CFO

Yes. So great question, Catherine. Thanks. I do think that we will

buy back some shares. We have authorization. Our stock has underperformed a little bit since the announcement of Reliant. We're pretty

excited about that deal and about our outlook. So I would expect us to repurchase shares in the third quarter and in fourth, most likely.

Catherine Mealor

KBW

Okay. Awesome. And then on the margin, what's your outlook for the

core margin? Do you feel like we've hit a bottom? And how are you kind of thinking about how excess liquidity plays out maybe over just

the next couple of quarters?

Jefferson Harralson

Executive VP & CFO

Yes. It's a great question. So we have some tailwind from cash going

into securities, but we also have some headwind in the area of the loan yield. Loan yields continue to come down a little bit, sort of

a factor of the cash that you mentioned on everybody's balance sheet. We are seeing some pressure on loan pricing.

This quarter, we did a lot of really good work on the cost of funds

to make our margin relatively flat even with a lot of balance sheet growth. But that lever is pretty much pulled now. We expect some improvement

there but not as much. So I think the impact of the loan yield for now offsets the impact of moving some cash into securities.

Some of that depends on what your forecast of deposit growth is. Once

the deposit growth falls down or normalizes, then I think that mix change on the asset side can overwhelm the loan piece of it. But I

think in the third quarter, you're going to see some core margin -- a handful of basis points of margin -- core margin pressure because

of the loan yield.

Operator

Our next question comes from Christopher Marinac with Janne Montgomery Scott.

Christopher Marinac

Janney Montgomery Scott

I wanted just to drill down on Navitas just for a second. Is the progress

that they keep seeing part of kind of where we are with the economy and the restart? Or would you imagine that as the economy continues

to evolve that they accelerate their pace of activity?

Rob Edwards

Executive VP & Chief Risk Officer

So Chris, this is Rob. When you're talking about pace of activity,

I'm assuming you're talking about the strong -- or low level of charge-offs for the quarter. So from that aspect, I think they continue

to focus very closely. We've always said they've had great underwriting and great industry selection. I think the combination of the government

stimulus and economic optimism is really creating that.

And then maybe I'll pass it to Jefferson on the gross side.

Jefferson Harralson

Executive VP & CFO

So I'll make 1 comment or 2 on the gross side is that they're seeing

record growth right now, a lot of activity, a really full pipeline. And if you think it had strong loan growth this quarter, especially

if you put in that we sold $19 million this quarter.

And talking to the team down there, they're optimistic. They're feeling

really good, and the growth pipelines continue to be really strong. So it's a very positive outlook for Reliant1 credit and

their growth.

Christopher Marinac

Janney Montgomery Scott

Got it. And then just a follow-up on the second topic is on your technology

spending and as you assimilate Reliant and Aquesta and even on the wealth management side, do you have incremental investments there?

Or is there anything large that's going into our overall systems?

Lynn Harton

Chairman, President & CEO

We don't have anything large, but we do have multiple projects going

on, whether from new systems we're bringing on, the development group at Navitas that we brought on to tackle several internal projects

as well. So there's no -- we're not looking at any kind of core system change out or anything like that. We do have several pretty exciting

things that we're working on throughout the company.

Operator

Our next question comes from Brody Preston with Stephens Inc.

Brody Preston

Stephens Inc.

So I just wanted to circle back on Navitas. And Jefferson, maybe talk

about the pace of sales going forward. Do you kind of think this $20 million-ish or so kind of quarterly range will be used moving forward?

Or do you need to increase that? I'm just trying to think about the percentage of that portfolio moving forward. Because post-RBC, even

if you kind of run rate the growth at 20% annualized from here to there, it kind of falls back down to 7.5% of loans. So do you need to

keep selling them at this level? Or does it need to go up? Just some kind of color there.

Jefferson Harralson

Executive VP & CFO

Yes. That's some of the questions that we're asking ourselves internally.

I would expect $15 million to $30 million a quarter.

You're exactly right. We do get some more cushion to grow Navitas with

the acquisitions that are coming on to keep below our 10% thresholds, that gives us some room to keep them if we want. But I think we

also want to have a pretty steady flow of sales to keep that lane open for us. So I think $15 million to $30 million is the number to

expect. And within that, maybe even the 20% to 25% range is the most likely.

Brody Preston

Stephens Inc.

Okay. And then maybe just as I think about margins between that and

your -- and the SBA and use the loans. Is a 4% to sort of 4.25% margin good to use for the Navitas sales? And then separately is -- it

looks like it was about a 10% margin on the SBA and use the loans. Is that a good gain on sale margin to use for those loans?

1 Reference should have been

to “Navitas” rather than “Reliant”

Jefferson Harralson

Executive VP & CFO

So I'll start with -- on the Navitas side, I like your range there.

I think we may be able to do a little better, but I think that's a good range to put it in the model. And I'll pass to Rich on the SBA

piece of it.

Rich Bradshaw

Executive VP & Chief Banking Officer

Yes. I would say that's probably a good number. If anything, it's a

little bit on the low side. So the SBA market and the USDA market continue to be strong.

Brody Preston

Stephens Inc.

Okay. And Rich, what do you expect for the pace of origination and

sales on those SBA and USDA loans?

Rich Bradshaw

Executive VP & Chief Banking Officer

I think because of the yield that we get on them, the amount of cash

we have on the balance sheet, we'll probably pull back just a little bit in third quarter on the amount of sales.

Jefferson Harralson

Executive VP & CFO

So might be a little -- possibly a little higher on Navitas if I had

to throw out a number now and a little lower on the SBA.

Brody Preston

Stephens Inc.

Understood. Understood. And then a question for Rob, just on the senior

care segment. So it looks like net-net, quarter-over-quarter, the portfolio remained relatively stable in terms of size. But there were

some moving parts that I was kind of hoping you could maybe help me dig in on, especially as it came to stabilized versus the lease-up.

There's kind of a big shift in the percentage there between those buckets. And so could you help me understand, were there some projects

that kind of rolled off versus new ones rolling on? Or did some projects that were previously stabilized fall below a percentage that

made them fall back in the lease-up? Just some kind of color there would be helpful.

Rob. Edwards

Executive VP & Chief Risk Officer

So there's no backwards on stabilized versus in lease -- or the next

category -- or stabilized versus lease-up, yes. So they go from construction to lease-up to stabilize. It's possible -- and we did have

a couple of projects during the quarter, it's possible that just in the ebb and flow of the projects in stabilized, they may -- we did

downgrade a couple to substandard during the quarter. So that does happen. We also upgrade them.

But really, the grades are based on the -- based on where they are

in terms of expectations. So once they're in stabilized, we expect them to perform. If they drop the occupancy, they have some -- people

pass away and then they go through a period, and they need to lease back up. That happens. They stay in that category. What we have had

is some projects in the lease-up category sell or pay us out. And so that would be more likely to create movement than -- and then, of

course, as they're going through the stabilization process -- or the lease-up process, they move into stabilization, and that would also

play some movement.

I will tell you that -- I don't think it's in the charts, but we did

see an increase in occupancy in the lease-up category of 10 percentage points. So we went from 36% to 46%. Now that's just sort of telling

you it's not like the hotel space where you re-lease the room every night. But so -- but we are seeing improvement there, continued improvement

and expect to see improvement there. Our occupancy in the stabilized remains stable over the quarter. So continue to feel good about the

product that we have there.

Lynn Harton

Chairman, President & CEO

And I would say not only do we monitor this with our own portfolio.

We're monitoring this nationally, and we've seen positive trends as well as lease-up nationally in this area.

Brody Preston

Stephens Inc.

Okay. Understood. And then I did just want to touch just on the loan

portfolio. Jefferson, I appreciate the disclosure you gave with the variable rate loans. I think it was $1.2 billion or so are at their

floors. I guess I wanted to ask, could you just remind me, and I think I've asked this in the past, just what percent of the loan portfolio

is floating rate? And then if you do have the data, and understand if you don't, what percent of the portfolios you're acquiring in the

coming quarters are floating rate as well?

Jefferson Harralson

Executive VP & CFO

All right. So I don't have the data on the acquired banks right here,

but I can get that for you. We are at -- 53% for us is floating. Now if you take into the -- take into account the loans that are below

the floors, that's going to behave as if 41% are floating now. And if you go up by 100 basis points, it would be -- it'll get you really

close to that 53% again. And I can get you the data the acquired -- to-be acquired banks.

Operator

And I'm not showing any further questions at this time. I would now

like to turn the call back over to Lynn Harton for any further remarks.

Lynn Harton

Chairman, President & CEO

Well, great. Well, once again, we appreciate you joining our call.

And we hope you have a great day, and we'll talk again soon. Thank you.

Operator

Thank you. Ladies and gentlemen, this concludes today's conference

call. Thank you for participating. You may now Disconnect

IMPORTANT INFORMATION FOR SHAREHOLDERS

AND INVESTORS

In connection with the proposed mergers with

Aquesta Financial Holdings, Inc. (“Aquesta”) and Reliant Bancorp, Inc. (“Reliant”) (each a “Merger”

and, collectively, the “Mergers”), United Community Banks, Inc. (“UCBI”) intends to file registration statements

on Form S-4 with the Securities and Exchange Commission (“SEC”) that will include proxy statements of Aquesta and Reliant

to be sent to Aquesta’s and Reliant’s shareholders, respectively, seeking their approval of the respective Mergers. Each of

the registration statements also will contain a prospectus of UCBI to register the shares of UCBI common stock to be issued in connection

with the Mergers. A definitive proxy statement/prospectus will also be provided to Aquesta’s and Reliant’s shareholders as

required by applicable law.

INVESTORS AND SHAREHOLDERS OF AQUESTA AND

RELIANT ARE ENCOURAGED TO READ THE APPLICABLE REGISTRATION STATEMENT, INCLUDING THE APPLICABLE PROXY STATEMENT/PROSPECTUS THAT WILL BE

A PART OF THE REGISTRATION STATEMENT, WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED BY AQUESTA, RELIANT OR UCBI WITH

THE SEC, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THE REGISTRATION STATEMENTS AND THOSE OTHER DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT UCBI, AQUESTA RELIANT AND THE MERGERS.

The registration statements and other documents

filed with the SEC may be obtained for free at the SEC’s website (www.sec.gov). You will also be able to obtain these documents,

free of charge, from UCBI at the “Investor Relations” section of UCBI’s website at www.ucbi.com, from Aquesta at the

“Investor Relations” section of Aquesta’s website at www.aquesta.com. or from Reliant at the “Investors”

section of Reliant’s website at www.reliantbank.com. Copies of the respective definitive proxy statements/prospectuses will also

be made available, free of charge, by contacting United Community Banks, Inc., P.O. Box 398, Blairsville, GA 30514, Attn: Jefferson Harralson,

Telephone: (864) 240-6208, Aquesta Financial Holdings, Inc., 19510 Jetton Road, Cornelius, North Carolina 28031, Attn: Kristin Couch,

Telephone: (704) 439-4325, Reliant Bancorp, Inc., 1736 Carothers Parkway Suite 100, Brentwood, TN 37027, Attn: Jerry Cooksey, Telephone:

(615) 221-2020.

This communication is for informational purposes

only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of such jurisdiction.

PARTICIPANTS IN THE SOLICITATION

Aquesta, Reliant and UCBI and certain of their

respective directors and executive officers, under the rules of the SEC, may be deemed to be participants in the solicitation of proxies

from Aquesta’s shareholders and Reliant’s shareholders in favor of the approval of the respective Mergers. Information about

the directors and officers of UCBI and their ownership of UCBI common stock can also be found in UCBI’s definitive proxy statement

in connection with its 2021 annual meeting of shareholders, as filed with the SEC on March 30, 2021, and other documents subsequently

filed by UCBI with the SEC. Information about the directors and executive officers of Aquesta and their ownership of Aquesta’s capital

stock, as well as information regarding the interests of other persons who may be deemed participants in the transaction, may be obtained

by reading the proxy statement/prospectus regarding the Merger with Aquesta when it becomes available. Information about the directors

and executive officers of Reliant and their ownership of Reliant capital stock, as well as information regarding the interests of other

persons who may be deemed participants in the transaction, may be found in Reliant’s definitive proxy statement in connection with

its 2021 annual meeting of shareholders, as filed with the SEC on April 8, 2021, and other documents subsequently filed by Reliant with

the SEC. Additional information regarding the interests of these participants will also be included in the proxy statement/prospectus

pertaining to the respective Merger if and when it becomes available. Free copies of this document may be obtained as described above.

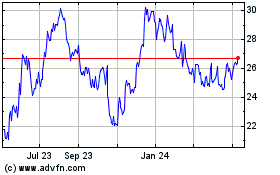

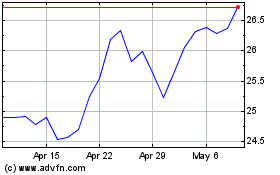

United Communty Banks (NASDAQ:UCBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

United Communty Banks (NASDAQ:UCBI)

Historical Stock Chart

From Apr 2023 to Apr 2024