The Donerail Group Responds to Turtle Beach

August 26 2021 - 4:05PM

The Donerail Group LP (together with its affiliates, “Donerail”,

“We”, or “Us”), one of the largest shareholders of Turtle Beach

Corporation (the “Company” or “Turtle Beach”), responded today to

Turtle Beach’s press release issued on August 23, 2021:

While Turtle Beach stated in its release that

Donerail’s public statements had been “misleading”, the Company

failed to detail how any of Donerail’s previous public statements

were misleading and, instead, proceeded to present its own

narrative misrepresenting Donerail’s acquisition efforts to

date.

We read Turtle Beach’s August 23rd press release

with great disappointment, as the Turtle Beach Board of Directors

(the “Board”) has grossly distorted the facts and circumstances

regarding Donerail’s acquisition efforts in order, we believe, to

further its self-serving entrenchment efforts.

In the Company’s release, we are at least

gratified that the Board acknowledged its rejection of our revised,

heightened $36.50 offer, which it claims was due to fact that the

Board “did not view Donerail’s acquisition price to be sufficient”.

We believe all shareholders deserve an explanation as to why this

Board outright rejected a proposal that would provide a 42% premium

from last Wednesday’s share price and a 32% premium from

yesterday’s closing price.

And while our principal concern begins and ends

with the Company’s distorted view of value and stubborn refusal to

explore value-maximizing acquisition offers, the balance of the

Company’s August 23rd press release served as an unexpected effort

to misdirect shareholders on the recent series of events,

introducing significant concern regarding the Board’s ability to

credibly uphold its fiduciary obligations to shareholders.

-

Financing Capabilities. In its press release,

Turtle Beach stated that it had “concerns regarding

Donerail’s…financing sources” and that “the Company has not yet

received satisfactory evidence of Donerail’s financing sources”.

The truth is that although the Company did initially focus on our

financing capabilities, we subsequently worked collaboratively with

Turtle Beach’s financial advisor, Bank of America, to provide them

exhaustive details regarding the financing construct for our

proposal and how we planned to secure the debt and equity capital

it contemplated.Ultimately, the Board’s financial advisor

communicated to us on July 9th, 2021, that the Board’s concerns

about our ability to finance our proposal to acquire the Company

had been largely allayed, that it considered Donerail’s proposal

both “credible” and “fundable”, and that it was prepared to move

forward to discuss price.We had not heard any further challenges to

our ability to finance our proposal until the Company’s August

23rd, 2021, press release. Rather, what was, in fact, made clear

was that on July 9th the Board rejected our $34.50 offer price and

refused to engage with us unless we “meaningfully” increased our

offer price. This critical July 9th interaction clearly indicated

that our financing was not a principal concern in the least: price

had become the primary focus.As a result of the July 9th rejection

of our $34.50 offer price, we proactively chose to bid against

ourselves, and we raised our offer price to $36.50 per share,

subject to confirmatory due diligence. Naturally, we understood

that the process of conducting such due diligence would entail

executing a non-disclosure agreement (“NDA”). Unfortunately, the

Board proposed an NDA that we doubt any rational person would

sign.

- The

NDA. In its press release, Turtle Beach detailed that

“Donerail has…refused to further engage with Bank of America on a

customary NDA”. Such a statement grossly misrepresents the cadence

and history of discussions between the Company and Donerail. The

first iteration of the NDA proposed by the Board was far from

“customary”. It not only included a highly restrictive two-year

standstill, which is off-market for a financial buyer, but it also

included a provision that would make us liable for a $5,000,000

cash penalty merely by alleging that we had breached its

confidentiality provisions – without any need to prove it. Such an

egregious term that creates an uncontrollable, significant

liability is not typically found in an NDA. We doubt any

sophisticated party would be willing to agree to any such clause,

and we advised the Board that we certainly would not.The offensive

$5 million presumption of liability clause remained in the proposed

NDA until August 14th, 2021, and when the Board finally agreed to

remove it from the NDA, the restrictive two-year standstill

remained. At the same time, however, the Board clearly indicated

that our $36.50 offer price was still unacceptable. This Board’s

confusing actions forced us to continue to question its good faith

in pursuing a potential transaction. What is the point of signing

an NDA to incur meaningful restrictions if the Board is telling

you, in no uncertain terms, that the process will be futile because

your price has already been rejected?Lastly, the Company’s press

release detailed an unwillingness by Donerail to provide a Due

Diligence Request List to Bank of America. Such a complaint is

quite trite. Given we have limited desire to sign an NDA with the

Company assuming their continued rejection of a $36.50 offer,

providing the Company with a Due Diligence Request List that they

cannot respond to is nothing more than a futile exercise. With that

being said, in order to provide a sign of good faith upon their

request, we will be sending our initial Due Diligence Request List

to the Board in short order.

Let shareholders not be confused: Donerail is

one of the largest shareholders of the Company; has engaged with

the Company in good faith in an attempt to acquire it; has provided

robust and comprehensive details to the Board and its financial

advisor regarding our prospective acquisition financing; and has

attempted for months to review confirmatory diligence to confirm

our price and finalize our bid. But the most salient fact remains:

the Board has rejected a bona fide $36.50 offer with the Company’s

stock price trading meaningfully lower. We do not understand the

Board’s actions, and shareholders have a right to be concerned.

Turtle Beach is a unique, strategic and

defensive brand with highly durable and highly visible cash flows.

Notwithstanding the disappointing quality of engagement heretofore

with the Board, we are hopeful that the Board recognizes the

Company needs to be sold immediately and that we stand willing to

engage as a prospective buyer.

About Donerail

The Donerail Group LP is a Los Angeles-based

investment adviser that employs a value-oriented investment lens

focusing on special situations and event driven investments.

Investor Contact:Wes Calvert, (310) 564-9992

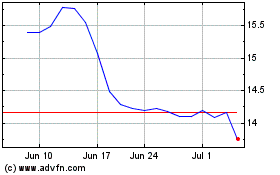

Turtle Beach (NASDAQ:HEAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

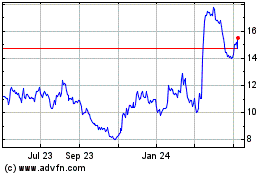

Turtle Beach (NASDAQ:HEAR)

Historical Stock Chart

From Apr 2023 to Apr 2024