Filed Pursuant to Rule 424(b)(5)

Registration No. 333-264942

Prospectus Supplement

(To Prospectus dated August 25, 2022)

3,654,546 American Depositary Shares Representing

58,472,736 Class A Ordinary Shares

Pre-Funded Warrants to Purchase up to 1,800,000

American Depositary Shares

Warrants to Purchase up to 5,454,546 American

Depositary Shares

Up

to 7,254,546 American Depositary Shares (representing up to 116,072,736 Class A Ordinary Shares underlying the Warrants and Pre-Funded

Warrants)

TuanChe Limited

We are offering (1) 3,654,546 American depositary shares (the “ADSs”),

(2) certain pre-funded warrants to purchase 1,800,000 ADSs (the “Pre-Funded Warrants”) in lieu of the ADSs being offered,

and (3) certain warrants to purchase up to 5,454,546 ADSs (the “Warrants”), to certain institutional investors pursuant to

a securities purchase agreement dated November 21, 2022 (the “offering”). The Warrants are offered together with the ADSs

or the Pre-Funded Warrants. The combined purchase price of each ADS and the accompanying Warrants is US$2.75. The combined purchase price

of each Pre-Funded Warrant and the accompanying Warrants is US$2.749, which is equal to the offering price of the ADSs and accompanying

Warrants minus US$0.001. This prospectus supplement also relates to the offer and sale of up to 7,254,546 ADSs that are issuable, following

issuance and delivery of the underlying Class A ordinary shares, upon exercise of the Pre-Funded Warrants and the Warrants. Each ADS represents

sixteen (16) Class A ordinary shares, par value US$0.0001 per share.

Each Warrant is exercisable for one ADS at an exercise price of US$2.75

per ADS. The Warrants will be immediately exercisable and will expire on the fifth anniversary of the original issuance date. Each Pre-Funded

Warrant is exercisable for one ADS at an exercise price of US$0.001. We are offering the Pre-Funded Warrants to certain purchasers whose

purchase of the ADSs in this offering would otherwise result in such purchase, together with its affiliates and certain related parties,

beneficially owning more than 4.99% (or, at the election of the purchase, 9.99%) of our outstanding ordinary shares immediately following

the consummation of this offering. The Pre-Funded Warrants are exercisable immediately and may be exercised at any time until all of the

Pre-Funded Warrants are exercised in full. On November 22, 2022, certain investor partially exercised the Pre-Funded Warrants to purchase

800,000 ADSs at an exercise price of US$0.001 per ADS (the “Partial Exercise”).

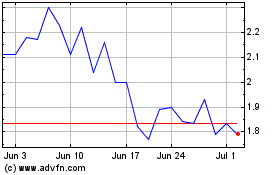

The ADSs are listed on the Nasdaq Capital Market under the symbol “TC.”

The last reported sale price of the ADSs on November 22, 2022 was US$1.20 per ADS. There is no established public trading market

for the Warrants or the Pre-Funded Warrants, and we do not expect a market to develop. We do not intend to apply for listing of the Warrants

or the Pre-Funded Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market,

the liquidity of the Warrants and Pre-Funded Warrants will be limited.

We have retained Aegis Capital Corp. (the “Placement Agent”)

to act as our placement agent in connection with this offering. The Placement Agent is not purchasing or selling any of the securities

offered pursuant to this prospectus supplement and the accompanying prospectus and the Placement Agent is not required to arrange the

purchase or sale of any specific number of securities or dollar amount. We will pay the Placement Agent a cash fee of 8.0% of the gross

proceeds raised in the offering. See “Plan of Distribution” beginning on page S-84 of this prospectus supplement for more information

regarding these arrangements.

The aggregate market value of our outstanding Class A ordinary

shares held by non-affiliates, or public float calculated pursuant to General Instruction I.B.5 of Form F-3, was approximately US$103.7

million, which was based on 164,496,607 Class A ordinary shares held by non-affiliates and the per ADS price of US$10.09, which was

the closing price of our ADSs on November 10, 2022. As a result, we believe we may sell the securities covered hereby without regard

to the value limitation under General Instruction I.B.5 of Form F-3.

Our ordinary shares consist of Class A ordinary shares and Class B

ordinary shares. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to fifteen

(15) votes on all matters subject to vote at general meetings of our company. Each Class B ordinary share is convertible into one

Class A ordinary share at any time at the option of the holder thereof, while Class A ordinary shares are not convertible into

Class B ordinary shares under any circumstances. Upon any sale, transfer, assignment or disposition of Class B ordinary shares

by a holder to any person or entity which is not an affiliate of such holder, or upon a change of ultimate beneficial ownership of any

Class B ordinary share to any person or entity who is not an affiliate of such holder, each of such Class B ordinary shares

shall be automatically and immediately converted into one Class A ordinary share.

We are not a Chinese operating company. TuanChe Limited, our ultimate

Cayman Islands holding company, does not have any substantive operations. We carry out our value-added telecommunications business in

mainland China through our subsidiaries as well as the variable interest entities (the “VIEs”) and their subsidiaries in

mainland China. Neither the investors in us nor we ourselves have an equity ownership in, direct foreign investment in, or control of,

through such ownership or investment, the VIEs. Instead, we, through our wholly owned subsidiaries in mainland China (the “WFOEs”),

entered into a series of contractual arrangements with the VIEs and their respective shareholders. Neither we nor our subsidiaries own

any share in the VIEs. Because of these contractual arrangements, we are the primary beneficiary of the VIEs for accounting purposes

and able to consolidate the financial results of the VIEs with ours only if we meet the conditions for consolidation under U.S. GAAP.

PRC laws and regulations restrict and impose conditions on foreign investment in value-added telecommunications services business. Accordingly,

we operate our value-added communications business in mainland China through the VIEs and their subsidiaries, and we could receive the

economic rights and exercise significant influence on the VIEs’ business operations that results in consolidation of the VIEs’

operations and financial results into our financial statements through the contractual arrangements, provided that we meet the conditions

for consolidation under U.S. GAAP. The VIE structure is used to replicate foreign investment in China-based companies where the PRC laws

restrict direct foreign investment in the operating companies. However, our contractual arrangements with the VIEs are not equivalent

of an investment in the VIEs. The VIE structure involves unique risks to investors in the ADSs. Investors in the ADSs are purchasing

equity securities of our ultimate Cayman Islands holding company rather than purchasing equity securities of the VIEs, and investors

in the ADSs may never hold equity interests in the VIEs. As used in this prospectus supplement, “we,” “us,” “our

company,” “our,” or “TuanChe” refers to TuanChe Limited and its subsidiaries, and the VIEs refer to TuanChe

Internet Information Service (Beijing) Co., Ltd. (“TuanChe Internet”), Shenzhen Drive New Media Co., Ltd. (“Drive

New Media”), Beijing Internet Drive Technology Co., Ltd., and/or Tansuojixian Technology (Beijing) Co., Ltd., and their

respective subsidiaries, as the context requires.

Our corporate structure is subject to risks associated with our contractual

arrangements with the VIEs. These contractual arrangements have not been properly tested in a court of law, and the PRC regulatory authorities

could disallow our corporate structure at any time, which could result in a material change in our operations and the value of our securities

could decline or become worthless. Because of our corporate structure, our Cayman Islands holding company, the WFOEs, the VIEs and their

subsidiaries, and our investors face uncertainty with respect to the interpretation and the application of the PRC laws and regulations,

including but not limited to limitation on foreign ownership of value-added telecommunications service companies, regulatory review of

overseas listing of companies in mainland China through a special purpose vehicle, and the validity and enforcement of the contractual

agreements. We are also subject to the risks of uncertainty about any future actions of the PRC government in this regard. Our contractual

agreements may not be effective in providing control over the VIEs. To the extent practicable commercially and in compliance with the

relevant PRC laws and regulations, we plan to conduct the VIEs’ current businesses through our subsidiaries in mainland China and

cease substantially all of the operation of the VIEs within the next three to five years. We may also be subject to sanctions imposed

by PRC regulatory agencies, including China Securities Regulatory Commission, if we fail to comply with their rules and regulations.

For a detailed discussion of risks related to our corporate structure, see “Risk Factors—Risks Related to Our Corporate Structure.”

Under our corporate structure, our ability to pay dividends and to

service any debt we may incur and pay our operating expenses principally depends on dividends paid by our subsidiaries in mainland China.

Cash is transferred through our organization in the manner as follows: (1) we may transfer funds to our WFOEs through our Hong Kong

subsidiary, TuanChe Information Limited, by additional capital contributions or shareholder loans, as the case may be; (2) our subsidiaries

in mainland China may provide loans to the VIEs, subject to statutory limits and restrictions; (3) the VIEs may pay service fees

to our subsidiaries in mainland China for services rendered by our subsidiaries in mainland China; (4) our subsidiaries in mainland

China may pay service fees to the VIEs for services rendered by the VIEs; and (5) our subsidiaries in mainland China may make dividends

or other distributions to us through TuanChe Information Limited. We do not have cash management policies dictating how funds are transferred

throughout our organization. In 2021, our subsidiaries in mainland China received cash of RMB2.0 million from the VIEs for services rendered

to the VIEs and their subsidiaries. In 2021, our subsidiaries in mainland China paid cash of RMB0.6 million to the VIEs for services

rendered by the VIEs and their subsidiaries. The foregoing cash flows include all distributions and transfers between our Cayman Islands

holding company, our subsidiaries and the VIEs as of the date of this prospectus supplement. As of the date of this prospectus supplement,

none of our subsidiaries have ever issued any dividends or made other distributions to us or their respective holding companies nor have

we or any of our subsidiaries ever paid dividends or made other distributions to U.S. investors. We currently intend to retain all future

earnings to finance the VIEs’ and our subsidiaries’ operations and to expand their business and we do not expect to pay any

cash dividends in the foreseeable future. For details regarding distributions and transfers between our Cayman Islands holding company,

our subsidiaries and the VIEs, see “Item 5. Operating and Financial Review and Prospects—Financial Information Related to

the VIEs” and “Item 5. Operating and Financial Review and Prospects—Cash Flows through Our Organization” in our

annual

report on Form 20-F for the fiscal year ended December 31, 2021 filed with the SEC on April 29, 2022 (the “2021

Form 20-F”), which is incorporated herein by reference, and “Prospectus Summary—Financial Information Related

to the VIEs” and “Prospectus Summary—Cash Flows through Our Organization” in this prospectus supplement.

There are limitations on our ability to transfer cash between us,

our subsidiaries and the VIEs, and there is no assurance that the PRC government will not intervene or impose restrictions on cash transfer

between us, our subsidiaries and the VIEs. We may encounter difficulties in our ability to transfer cash between subsidiaries in mainland

China and other subsidiaries largely due to various PRC laws and regulations imposed on foreign exchange. The majority of our income

is denominated in Renminbi, and shortage in foreign currencies may restrict our ability to pay dividends or other payment to satisfy

our foreign currency denominated obligations, if any. Under existing PRC foreign exchange regulations, payments of current account items,

including profit distributions, interest payments and expenditures from trade-related transactions can be made in foreign currencies

without prior approval from the State Administration of the Foreign Exchange in the PRC as long as certain procedural requirements are

met. Approval from appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of

the PRC to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion,

impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be

able to pay dividends in foreign currencies to our shareholders. The PRC government has implemented a series of capital control measures,

including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments

and shareholder loan repayments. It may continue to strengthen its capital controls and dividends and other distributions of our subsidiaries

in mainland China may be subjected to tighter scrutiny and may limit the ability of our Cayman Islands holding company, to use capital

from our subsidiaries in mainland China, which may restrict our ability to satisfy our liquidity requirements. To the extent cash

or assets in the business is in mainland China or Hong Kong or in an entity domiciled in mainland China or Hong Kong, and may need to

be used to fund operations outside of mainland China or Hong Kong, the funds and assets may not be available to fund operations or for

other uses outside of mainland China or Hong Kong due to interventions in or the imposition of restrictions and limitations by the government

on our, our subsidiaries’ or the VIEs’ ability to transfer cash and assets. For more detailed discussion of the restrictions

and limitations on the ability to transfer cash or distribute earnings between our subsidiaries and the VIEs, and between our Cayman

Islands holding company and the VIEs, see “Prospectus Summary—Cash Flows through Our Organization” and “Risk

Factors—Risks Related to Our Corporate Structure—We may rely on dividends and other distributions on equity paid by our subsidiaries

in mainland China and Hong Kong to fund any cash and financing requirements we may have, and any limitation on the ability of our subsidiaries

to make payments to us could have a material and adverse effect on our ability to conduct the business” in this prospectus supplement.

See “Prospectus Summary—Financial Information Related to the VIEs” for the reconciliation between the deconsolidated

financial information of our Cayman Islands holding company, our subsidiaries and the VIEs and our condensed consolidated financial statements.

We and the VIEs face various legal and operational risks and uncertainties

related to being based in and having significant operations in mainland China. The PRC government has significant authority to exert

influence on the ability of a China-based company, such as us and the VIEs, to conduct its business, accept foreign investments or list

on U.S. or other foreign exchanges. For example, we and the VIEs face risks associated with regulatory approvals of offshore offerings,

oversight on cybersecurity and data privacy, as well as the lack of inspection by the Public Company Accounting Oversight Board (the

“PCAOB”) on our auditors. Such risks could result in a material change in our operations and/or the value of the ADSs or

could significantly limit or completely hinder our ability to offer ADSs and/or other securities to investors and cause the value of

such securities to significantly decline or be worthless. These regulatory risks and uncertainties could become applicable to our Hong

Kong subsidiary if regulatory authorities in Hong Kong adopt similar rules and/or regulatory actions. For a detailed description

of risks relating to doing business in mainland China, see “Risk Factors—Risks Related to Doing Business in China”

in this prospectus supplement.

Our financial statements contained in the 2021 Form 20-F have

been audited by an independent registered public accounting firm that was not included in the list of PCAOB Identified Firms of having

been unable to be inspected or investigated completely by the PCAOB in the PCAOB Determination Report issued in December 2021. We

have not been identified by the Securities and Exchange Commission (the “SEC”) as a commission-identified issuer under the

Holding Foreign Companies Accountable Act (the “HFCA Act”) as of the date of this prospectus supplement. If, in the future,

we have been identified by the SEC for three consecutive years (or two consecutive years if the Accelerating Holding Foreign Companies

Accountable Act is signed into law) as a commission-identified issuer whose registered public accounting firm is determined by the PCAOB

that it is unable to inspect or investigate completely because of a position taken by one or more authorities in China, the SEC may prohibit

our shares or the ADSs from being traded on a national securities exchange or in the over the counter trading market in the United States.

Investing

in these securities involves risks. See the “Risk Factors” on page S-26 of this prospectus

supplement, and those included in the accompanying prospectus and the documents incorporated by reference herein and therein to read

about factors you should consider before investing in these securities.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of the disclosures in this prospectus,

including any prospectus supplement and documents incorporated by reference. Any representation to the contrary is a criminal offense.

| |

|

Per ADS and

Accompanying

Warrants |

|

Per

Pre-Funded

Warrant and

Accompanying

Warrants |

|

Total |

| Offering price |

|

US$ |

2.75 |

|

US$ |

2.749 |

|

US$ |

14,998,201 |

| Placement Agent’s Fees (1) |

|

US$ |

0.22 |

|

US$ |

0.220 |

|

US$ |

1,200,000 |

| Proceeds to us (before expenses) (2) |

|

US$ |

2.53 |

|

US$ |

2.529 |

|

US$ |

13,798,201 |

| (1) |

We have agreed

to pay the Placement Agent a cash fee equal to 8.0% of the aggregate gross proceeds of this offering. See “Plan of Distribution”

for additional information regarding total compensation payable to the Placement Agent, including expenses for which we have agreed to

reimburse the Placement Agent. |

| (2) |

The amount

of the offering proceeds to us presented in this table does not give effect to any exercise of the Pre-Funded Warrants or the Warrants

being issued in this offering. |

The ADSs are expected to be delivered through the book-entry transfer

facilities of The Depository Trust Company in New York, New York, and the Pre-Funded Warrants, together with the associated Warrants,

are expected to be delivered against payment therefor, in each case, on or about November 23, 2022.

Aegis Capital Corp.

Prospectus Supplement dated November 21, 2022

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is the prospectus supplement,

which describes the specific terms of this offering of ADSs, the Pre-Funded Warrants and the Warrants and also adds to and updates information contained in the accompanying prospectus

and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part is the accompanying

prospectus dated August 25, 2022 included in the registration statement on Form F-3

(No. 333-264942), including the documents incorporated by reference therein, which provides more general information, some of

which may not be applicable to this offering.

This prospectus supplement provides specific details regarding

the offering of the ADSs, the Pre-Funded Warrants and the Warrants. If the description of the offering varies between this

prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained or incorporated by

reference in this prospectus supplement and the accompanying prospectus or any free writing prospectus provided in connection with this

offering. We have not authorized any other person to provide you with different information. If anyone provides you with different or

inconsistent information, you should not rely on it. You should assume that the information appearing in this prospectus supplement, the

accompanying prospectus and the documents incorporated by reference is accurate only as of their respective dates, regardless of the time

of delivery of this prospectus supplement, the accompanying prospectus or any other offering materials, or any sale of the ADSs, the Pre-Funded

Warrants or the Warrants. Our business, financial condition, results of operations and prospects may have changed since those dates. We

are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. Neither this prospectus

supplement nor the accompanying prospectus constitutes an offer, or an invitation on behalf of us to subscribe for and purchase, any of

the ADSs, the Pre-Funded Warrants or the Warrants and may not be used for or in connection with an offer or solicitation by anyone, in

any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer

or solicitation.

It is important for you to read and consider all the information contained

or incorporated by reference in this prospectus supplement and the accompanying prospectus in making your investment decision.

In this prospectus supplement and the accompanying prospectus, unless

otherwise indicated or unless the context otherwise requires, references to:

| ● | “ADSs”

refers to American depositary shares, each representing 16 Class A ordinary shares; |

| ● | “auto

dealer(s)” refers to both franchised dealers and secondary dealers; |

| ● | “China”

refers to the People’s Republic of China; and “mainland China” or the “PRC”

refers to the People’s Republic of China, and only in the context of describing the

industry matters, the PRC laws, rules, regulations, regulatory authorities, and any PRC entities

or citizens under such rules, laws and regulations and other legal or tax matters in this

prospectus supplement, and excludes Taiwan, the Hong Kong Special Administrative Region and

the Macau Special Administrative Region; |

| ● | “franchised

dealer(s)” refers to primary dealers authorized to sell the products of a single brand

of automobiles that integrate four standard automotive related businesses including sales,

spare parts, service and survey; |

| ● | “GMV”

refers to gross merchandise value, reflecting the total sales dollar value for automobiles

sold through our and the VIEs’ marketplace; |

| ● | “industry

customer(s)” refers to business customers to which we offer services, including auto

dealers, automakers, automobile accessory manufacturers, aftermarket service providers and

other automotive related goods and service providers; |

| ● | “ordinary

shares” or “shares” refer to our Class A and Class B ordinary

shares of par value US$0.0001 per share; |

| ● | “Renminbi”

or “RMB” refers to the legal currency of China; |

| ● | “SEC”

refers to the United States Securities and Exchange Commission; |

| ● | “secondary

dealer(s)” refers to car dealers that have no automobile manufacturers certification

and do not have specific sales brand restrictions; |

| ● | “TuanChe,”

“we,” “us,” “our company” or “our” refers

to TuanChe Limited, a Cayman Islands exempted company with limited liability and its subsidiaries; |

| ● | “U.S.

GAAP” refers to generally accepted accounting principles in the United States; |

| ● | “US$,”

“dollars” or “U.S. dollars” refers to the legal currency of the United

States; and |

| ● | “VIEs”

refers to TuanChe Internet Information Service (Beijing) Co., Ltd., Shenzhen Drive New

Media Co., Ltd., Beijing Internet Drive Technology Co., Ltd. and/or Tansuojixian

Technology (Beijing) Co., Ltd., and their respective subsidiaries, as the context requires. |

All discrepancies in any table between the amounts identified as total

amounts and the sum of the amounts listed therein are due to rounding.

This prospectus supplement contains translations between Renminbi

and U.S. dollars solely for the convenience of the reader. The translations from Renminbi to U.S. dollars and from U.S. dollars to Renminbi

in this prospectus supplement were made at a rate of RMB6.3726 to US$1.00 and RMB6.6981 to US$1.00, representing the noon buying rate

in The City of New York for cable transfers of RMB as certified for customs purposes by the Federal Reserve Bank of New York on December 30,

2021 and June 30, 2022, respectively. We make no representation that the Renminbi or U.S. dollar amounts referred to in this prospectus

supplement could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

PROSPECTUS SUPPLEMENT SUMMARY

This prospectus supplement summary highlights selected information

included elsewhere in or incorporated by reference into this prospectus supplement and the accompanying prospectus and does not contain

all the information that you should consider before making an investment decision. You should read this entire prospectus supplement

and the accompanying prospectus carefully, including the “Risk Factors” sections and the financial statements and related

notes and other information incorporated by reference, before making an investment decision.

Our Business

We believe we, together with the VIEs, are a leading omni-channel

automotive marketplace in mainland China. We, together with the VIEs, provide a scalable omni-channel automotive marketplace approach

to automobile marketing and distribution. Our business model features high sales conversion effectiveness and efficiency, delivering

a high and measurable return on investment for our industry customers relative to their overall marketing expenditures. We,

together with the VIEs, operate and generate net revenue from the following businesses:

| |

● |

Offline marketing solutions. We and the VIEs turn individual and isolated automobile purchase transactions into large-scale collective purchase activities through our auto shows. By attracting a large number of consumers, these events serve as integrated marketing solutions to industry customers, which include automakers, franchised dealerships, secondary dealers and automotive service providers. We and the VIEs enable interactions between large numbers of participants on both sides of a potential transaction, creating a “many-to-many” environment, within a short period of time, thus enhancing the value we and the VIEs offer to both consumer and industry customer participants of our offline events. We and the VIEs organize auto shows and charge industry customers for booth spaces in the auto shows. In addition, we and the VIEs have developed special promotion event services to better support industry customers in organizing their special promotion events through various integrated services, including event planning and executing, marketing training and onsite coaching. We and the VIEs charge fixed service fees for special promotion event services. |

| |

|

|

| |

● |

Referral service for commercial bank. We collaborate with and facilitate a commercial bank in expanding its cooperation with our industry customers to grow its auto loan business. We charge the bank service fees for approved loan applications. We have ceased to operate the referral services since April 2022. |

| |

|

|

| |

● |

Online marketing services and others. We and the VIEs provide online marketing services for industry customers to increase the efficiency and effectiveness of their marketing campaigns. |

Our and the VIEs’ business model features the integration of

two complementary elements: our and the VIEs’ online platform and offline events. The online platform consists of our and the VIEs’

website, tuanche.com, official WeChat account, WeChat mini-program and mobile applications. Together, these channels promote

our and the VIEs’ offline events and serve as a consumer acquisition tool for the offline events. Our and the VIEs’ offline

events provide consumers physical access to a broad selection of automobiles and serve as a gateway to useful data from consumer participants

who have not previously entered their information on our and the VIEs’ online platform. With our and the VIEs’ data analytics

capabilities, these data enhance our and the VIEs’ understanding of the automobile demand in various localities and continuously

improve the effectiveness of our and the VIEs’ event planning.

We, together with the VIEs, complement our and the VIEs’ service

offerings by collaborating with service and product providers in mainland China’s automotive industry, such as aftermarket service

providers, financial institutions, and insurance companies. By extending our and the VIEs’ services beyond automobile purchases,

we, together with the VIEs, offer consumers one-stop end-to-end shopping experience, establish ongoing relationships with consumers,

and attract new consumers who are contemplating automobile purchases. As our and the VIEs’ consumer base increases, we believe

more automakers and auto dealers are incentivized to become our and the VIEs’ industry customers, which leads to a broader selection

of automobiles and more favorable pricing terms for our and the VIEs’ consumers, driving a self-reinforcing virtuous cycle.

In 2019, 2020 and 2021 and the six months ended June 30, 2021

and 2022, we, together with the VIEs, hosted 1,055, 449, 450, 278 and 61 auto shows across 233, 172, 142, 133 and 49 cities in mainland

China, respectively. Our and the VIEs’ auto shows offered a total of 29,063, 14,341, 12,372, 7,789 and 1,303 booth spaces in 2019,

2020 and 2021 and the six months ended June 30, 2021 and 2022. The total number of automobile sales transactions we and the VIEs

facilitated was 354,355, 140,264, 104,689, 64,187 and 16,591 in 2019, 2020 and 2021 and the six months ended June 30, 2021 and 2022,

respectively, with a total GMV of approximately RMB47.5 billion, RMB19.8 billion, RMB14.6 billion (US$2.3 billion), RMB9.0 billion and

RMB2.4 billion (US$0.4 billion) in the same periods, respectively. In 2019, 2020 and 2021 and the six months ended June 30, 2021

and 2022, we, together with the VIEs, facilitated 627, 207, 158, 61 and 46 special promotion events for our and the VIEs’ industry

customers, respectively.

Our net revenues were RMB644.8 million, RMB330.2 million, RMB357.6

million (US$56.1 million), RMB213.3 million and RMB89.2 million (US$13.3 million) in 2019, 2020 and 2021 and the six months ended June 30,

2021 and 2022, respectively. Historically, we generated our net revenues primarily through our offline events. We also generated net

revenue from other services, including among others, referral services, virtual dealership and online marketing services, of RMB21.6

million, RMB74.9 million, RMB110.7 million (US$17.4 million), RMB53.3 million and RMB63.6 million (US$9.5 million) in 2019, 2020 and

2021 and the six months ended June 30, 2021 and 2022, respectively, representing 3.3%, 22.7%, 31.0%, 25.0% and 71.2% of our net

revenues for the same periods, respectively. For a detailed breakdown of our net revenues, see “Summary Consolidated Financial

Data—Summary Consolidated Statements of Operations and Comprehensive Loss” in this prospectus supplement. Our net loss

was RMB251.3 million, RMB163.5 million, RMB101.9 million (US$16.0 million), RMB22.6 million and RMB56.2 million (US$8.4 million) in 2019,

2020 and 2021 and the six months ended June 30, 2021 and 2022, respectively. Our adjusted EBITDA was RMB(143.9) million, RMB(141.1)

million, RMB(82.9) million (US$(13.0) million), RMB(11.8) million and RMB(30.8) million (US$(4.6) million) in 2019, 2020 and 2021 and

the six months ended June 30, 2021 and 2022, respectively. We recorded adjusted net loss of RMB140.3 million, RMB145.8 million,

RMB90.0 million (US$14.1 million), RMB15.9 million and RMB34.4 million (US$5.1 million) in 2019, 2020 and 2021 and the six months ended

June 30, 2021 and 2022, respectively. For a detailed description of our non-GAAP measures, see “Summary Consolidated Financial

Data—Non-GAAP Measures” in this prospectus supplement.

Our Strengths

We attribute our success to the following strengths.

Leading omni-channel automotive marketplace with an effective

business model

We believe

we, together with the VIEs, are a leading omni-channel automotive marketplace in mainland China. The total number of automobile

sales transactions we and the VIEs facilitated was 354,355, 140,264, 104,689, 64,187 and 16,591 in 2019, 2020 and 2021 and the six months

ended June 30, 2021 and 2022, respectively, with a total GMV of approximately RMB47.5 billion, RMB19.8 billion, RMB14.6 billion

(US$2.3 billion), RMB9.0 billion and RMB2.4 billion (US$0.4 billion) in the same periods, respectively.

The scale of our and the VIEs’ business results in a self-reinforcing

network effect whereby the participation of consumer participants and industry customers drives industry customer stickiness and predictable

and recurring revenue streams. Moreover, our scale and reach, combined with our user-centric approach, helped us establish a trusted

brand.

One of the key features of our and the VIEs’ business model

is the integration of the online platform and offline events. Our and the VIEs’ online platform serves both as a consumer acquisition

tool and a marketplace for the services we and the VIEs offer. We and the VIEs supplement this with offline events where consumers have

the opportunity to physically interact with the auto dealers and automakers and learn about the automobiles in person. By integrating

online and offline elements, we, together with the VIEs, have created a more transparent and efficient environment for automobile transactions.

Extensive nationwide network of industry customers

We, together with the VIEs, have accumulated an extensive, nationwide,

and cross-brand network of industry customers since the inception of our and the VIEs’ business. As of June 30, 2022, our

network served over 546 domestic and international automobile brands and over 1,069 industry customers in mainland China. This network

provides consumer participants of our and the VIEs’ offline events a broad selection of automobiles and automotive services, thereby

attracting more consumers to attend our and the VIEs’ offline events. Meanwhile, increased consumer attendance reduces consumer

acquisition costs of our and the VIEs’ industry customers, further incentivizing them to attend our and the VIEs’ offline

events. This self-reinforcing cycle solidifies our network of industry customers. Our network also features high industry customer stickiness.

For example, in 2020, a total of 5,616 industry customers participated in our auto shows, approximately 54.0% of which also participated

in our auto shows in 2021.

Comprehensive service offerings

Our and the VIEs’ comprehensive suite of service offerings addresses

consumers’ needs in the process of purchasing a new automobile. Our and the VIEs’ offline events are designed to offer consumers

the convenience of a one-stop end-to-end shopping experience. During an offline event, consumers have access to not only automakers and

auto dealers, but also other businesses in mainland China’s automotive industry, such as insurance companies, financial institutions,

and aftermarket service providers. We believe such comprehensive offline service offerings and our and the VIEs’ ability to offer

one-stop end-to-end shopping experience increase our and the VIEs’ attractiveness to consumers, which in turn make us and the VIEs

an attractive partner for auto dealers and automakers and contribute to our financial success. In addition to consumers, our service

offerings also address the various needs of our and the VIEs’ industry customers. The offline events serve as a low-cost consumer

acquisition channel which increases the efficiency of industry customers’ marketing spending. These events increase the level of

their brand exposure, and help increase their sales volume. We, together with the VIEs, also offer demand-side platform services, which

help our and the VIEs’ industry customers increase the efficiency and effectiveness of their advertising placements.

Effective consumer acquisition strategy and a growing consumer

base

We, together with the VIEs, utilize both online and offline channels

to increase consumer awareness of our and the VIEs’ events. The online-and-offline split mostly depends on the region and city

tier. We, together with the VIEs, attract consumer participants of offline events mainly through online platforms in tier-1 and tier-2

cities, whereas our and the VIEs’ offline channels play a more prominent role in attracting consumers in lower tier cities. This

hybrid strategy helped us and the VIEs achieve low consumer acquisition cost in the past, and effectively helped us and the VIEs target

consumers who are more likely to purchase automobiles in the near term. Our effective consumer acquisition strategy led to a continuously

growing consumer base, with which we believe industry customers are more willing to participate in our and the VIEs’ offline events,

thus contributing to our and the VIEs’ financial and operational success.

Strong operational capabilities driven by data analytics

Based on numerous offline events we and the VIEs have hosted in the

past, we and the VIEs have accumulated extensive operational capabilities and logistical know-how on event planning and operations. We,

together with the VIEs, have standardized operational procedures while keeping sufficient flexibility to accommodate local factors. Equipped

with years of operational experience from group-purchase facilitation services and hosting offline events, our and the VIEs’

field employees play a critical role in carrying out standardized operational procedures and ensuring the operational success of offline

events. Under the supervision of our and the VIEs’ operations team at our and the VIEs’ corporate headquarters, our and the

VIEs’ field employees and regional supervisors ensure that offline events are planned and executed in an efficient and coordinated

fashion, in line with our and the VIEs’ overall annual strategic operational plan and financial budget.

The data-driven nature of our and the VIEs’ operations also

contributes to our and the VIEs’ superior operational results as well as improved business collaboration experience for our and

the VIEs’ business partners. We, together with the VIEs, support industry customers by providing data analytics regarding consumer

automobile preferences in a particular city, helping them better understand consumer trends and manage inventory and production activities.

In addition, our and the VIEs’ big-data analytics increases our and the VIEs’ event operation efficiency. We, together with

the VIEs, use data to reshape consumer acquisition strategy and tailor our and the VIEs’ services and offline events to better

cater to consumer needs. We, together with the VIEs, also use data to direct our and the VIEs’ financial and human resources to

the most efficient use.

Our Strategies

We intend to pursue the following strategies:

| ● | Expand

into new electric vehicle business and develop related expertise through collaboration with

industry partners; |

| ● | Continue

to broaden our and the VIEs’ service offerings, enhance service capabilities and improve

consumer experience; |

| ● | Expand

our and the VIEs’ geographic coverage and further grow our and the VIEs’ consumer

base; |

| ● | Strengthen

collaboration with automakers, auto dealers and automotive service providers; and |

| ● | Further

enhance our technology and data analytics capabilities. |

Our Corporate Structure and Contractual

Arrangements with the VIEs

TuanChe Limited, our ultimate Cayman Islands

holding company and the entity in which investors are purchasing their interest, does not have any substantive operations. We carry out

our value-added telecommunications business in mainland China through our subsidiaries as well as the VIEs and their subsidiaries in

mainland China. We, through our WFOEs, entered into a series of contractual arrangements with the VIEs and their respective shareholders.

The VIE structure involves unique risks to investors in the ADSs. Investors in the ADSs are purchasing equity securities of our ultimate

Cayman Islands holding company rather than purchasing equity securities of the VIEs, and investors in the ADSs may never hold equity

interests in the VIEs. The following diagram illustrates our corporate structure, including our principal subsidiaries and affiliated

entities, as of the date of this prospectus supplement.

| |

(1) |

As of the date of this prospectus

supplement, shareholders who own 5% or more of our issued and outstanding ordinary shares include Mr. Wei Wen (directly and

through WW Long Limited), K2 Partners, Highland Funds, Beijing Z-Park Fund Investment Center (Limited Partner), BAI GmbH, who hold

18.6%, 12.9%, 9.5%, 9.5% and 8.9% of the total outstanding shares of TuanChe Limited on an as-converted basis, respectively. Shareholders

who are directors and executive officers of TuanChe Limited include Mr. Wei Wen and Mr. Jianchen Sun, who hold 18.6% and

4.4% of outstanding shares of TuanChe Limited on an as-converted basis; Ms. Wendy Hayes, Mr. Zijing Zhou, Mr. Hui

Yuan and Mr. Chenxi Yu, each of whom hold less than 1% of outstanding shares of TuanChe Limited on an as-converted basis. Directors

and executive officers as a group hold 24.2% of the total outstanding shares of TuanChe Limited on an as-converted basis. |

| |

(2) |

Mr. Zhiwen

Lan, Mr. Jianchen Sun, Mr. Qiuhua Xu, Mr. Xingyu Du, Mr. Zijing Zhou, Mr. Zhen Ye, and Lanxi Puhua Juli

Equity Investment L.P. hold a 1.1226%, 15.2170%, 0.9972%, 13.2840%, 0.0973%, 0.5836%, and 2.7000% equity interest in TuanChe Internet,

respectively. |

| |

(3) |

Mr. Wei Wen, Mr. Jianchen

Sun and Mr. Congwu Cheng hold a 77.59%, 20.00% and 2.41% equity interest in Tansuojixian (Beijing) Co., Ltd. |

| |

(4) |

Mr. Mingyou

Li and Mr. Xingyu Du hold a 99.0% and 1.0% equity interest in Shenzhen Drive New Media Co., Ltd., respectively. |

| |

(5) |

Mr. Mingyou Li and Mr. Xingyu

Du hold a 99.0% and 1.0% equity interest in Beijing Internet Drive Technology Co., Ltd., respectively. |

We, through the WFOEs, entered into a series of contractual arrangements

with the VIEs and their respective shareholders. Neither we nor our subsidiaries own any share in the VIEs. Because of these contractual

arrangements, we are the primary beneficiary of the VIEs for accounting purposes and able to consolidate the financial results of the

VIEs with ours only if we meet the conditions for consolidation under U.S. GAAP. PRC laws and regulations restrict and impose conditions

on foreign investment in value-added telecommunications services business. Accordingly, we operate our value-added telecommunications

business in mainland China through the VIEs and their subsidiaries, and we could receive the economic rights and exercise significant

influence on the VIEs’ business operations that results in consolidation of the VIEs’ operations and financial results into

our financial statements through the contractual arrangements, provided that we meet the conditions for consolidation under U.S. GAAP.

The VIE structure is used to replicate foreign investment in China-based companies where the PRC laws restrict direct foreign investment

in the operating companies. The VIE structure is used to replicate foreign investment in China-based companies where the PRC laws restrict

direct foreign investment in the operating companies. However, our contractual arrangements with the VIEs are not equivalent of an investment

in the VIEs. The VIE structure involves unique risks to investors in the ADSs. Investors in the ADSs are purchasing equity securities

of our ultimate Cayman Islands holding company rather than purchasing equity securities of the VIEs, and investors in the ADSs may never

hold equity interests in the VIEs. Chinese regulatory authorities could disallow this structure,

which would likely result in a material change in our and/or the VIE’s operations and/or a material change in the value of the

securities we are registering for sale, including that it could cause the value of such securities to significantly decline or become

worthless. If the PRC government deems that the contractual arrangements with the consolidated VIEs domiciled in mainland China do not

comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation

of existing regulations change or are interpreted differently in the future, we, our subsidiaries and the VIEs could be subject to severe

penalties or be forced to relinquish their interests in those operations. It is uncertain whether any new PRC laws or regulations relating

to variable interest entity structures will be adopted or if adopted, what they would provide. To the extent cash or assets in the business

is in mainland China or Hong Kong or in an entity domiciled in mainland China or Hong Kong, and may need to be used to fund operations

outside of mainland China or Hong Kong, the funds and assets may not be available to fund operations or for other uses outside of mainland

China or Hong Kong due to interventions in or the imposition of restrictions and limitations by the government on our, our subsidiaries’

or the VIEs’ ability to transfer cash and assets. See “Risk Factors—Risks Related to Our Corporate Structure.”

Our Contractual Arrangements

PRC laws and regulations place certain restrictions

on foreign investment in value-added telecommunications service businesses. We conduct our operations in mainland China principally through

our subsidiaries in mainland China, the VIEs, and their subsidiaries (collectively, the “consolidated affiliated entities”).

We have entered into a series of contractual arrangements, through TuanYuan Internet Technology (Beijing) Co., Ltd. (“TuanYuan”),

Beijing SanguMaolu Information Technology Limited (“Sangu Maolu”) and Chema Technology (Beijing) Co., Ltd. (“Chema

Beijing”), with each of the VIEs and their respective shareholders, respectively, which enable us to:

| |

● |

exercise

significant influence over each of the consolidated affiliated entities; |

| |

● |

receive

substantially all of the economic benefits of the consolidated affiliated entities; and |

| |

● |

have an

exclusive call option to purchase all or part of the equity interests in and/or assets of each of the VIEs when and to the extent

permitted by PRC laws. |

As a result of these contractual arrangements, we are the primary

beneficiary of the consolidated affiliated entities, and, therefore, have consolidated their financial results in our consolidated financial

statements in accordance with U.S. GAAP.

Below is a summary of the currently effective

contractual arrangements by and among our WFOEs, the VIEs and their respective shareholders.

Exclusive Business Cooperation Agreement

Pursuant to the exclusive business cooperation

agreement between each of the VIEs and the applicable WFOE, the respective WFOE has the exclusive right to provide or designate any third

party to provide, among other things, comprehensive business support, technical support and consulting services to the VIEs. In exchange,

the VIEs pay service fees to the respective WFOE in an amount determined at such WFOE’s discretion. Without the prior written consent

of the applicable WFOE, the VIEs cannot accept any consulting and/or services provided by or establish similar cooperation relationship

with any third party. Such WFOE owns the exclusive intellectual property rights created as a result of the performance of this agreement.

The agreement shall remain effective unless unilaterally terminated by such WFOE with a written notice or pursuant to other provisions

of the agreement, whereas the VIEs do not have any right to unilaterally terminate the exclusive business cooperation agreement.

Exclusive Call Option Agreement

Under the exclusive call option agreement among the applicable WFOE,

each of the VIEs and their respective shareholders, each of the shareholders of the VIEs irrevocably granted such WFOE a right to purchase,

or designate a third party to purchase, all or any part of their equity interests in the VIEs at a purchase price equal to the lowest

price permissible by the then-applicable PRC laws and regulations at such WFOE’s sole and absolute discretion to the extent permitted

by PRC law. The shareholders of the VIEs shall promptly give all considerations they received from the exercise of the options to our

WFOEs (as applicable). Without the applicable WFOE’s prior written consent, the VIEs and their respective shareholders shall not

enter into any major contract except for those entered in the daily business operations. Without the applicable WFOE’s prior written

consent, the VIEs and their respective shareholders shall not sell, transfer, license or otherwise dispose of any of the VIEs’

assets or allow any encumbrance of any assets. The VIEs shall not be dissolved or liquidated without the written consent by the applicable

WFOE. This agreement shall remain in effect and the VIEs do not have any right to unilaterally terminate the exclusive call option agreement.

Equity Pledge Agreement

Under the equity interest pledge agreement

among the applicable WFOE, each of the VIEs and their respective shareholders, the VIEs’ shareholders pledged all of their equity

of the VIEs to WFOEs as security for performance of the obligations of the VIEs and their respective shareholders under the exclusive

call option agreement, the exclusive business cooperation agreement and the powers of attorney. If any of the specified events of default

occurs, the respective WFOE may exercise the right to enforce the pledge immediately. Such WFOE may transfer all or any of its rights

and obligations under the equity pledge agreement to its designee(s) at any time. The equity pledge agreement is binding on the

VIEs’ shareholders and their successors. The equity pledge agreement shall remain in effect and the VIEs do not have any right

to unilaterally terminate the equity interest pledge agreement.

Powers of Attorney

Pursuant to the powers of attorney executed by the shareholders of

the VIEs, each of them irrevocably authorized the applicable WFOE to act on their respective behalf as exclusive agent and attorney,

with respect to all rights of shareholders concerning all the equity interest held by each of them in the VIEs, including but not limited

to the right to attend shareholder meetings on behalf of such shareholder, the right to exercise all shareholder rights and the voting

rights (including the right to sell, transfer, pledge and dispose of all or a portion of the equity interests held by such shareholder),

and the right to appoint legal representatives, directors, supervisors and chief executive officers and other senior management.

In the opinion of Shihui Partners, our PRC legal counsel, the contractual

arrangements among WFOEs, the VIEs and their respective shareholders are valid, binding and enforceable under applicable PRC law currently

in effect, except that the equity pledge under that certain equity pledge agreement would not be deemed validly created until they are

registered with the competent governmental authorities. However, Shihui Partners has also advised us that there are substantial uncertainties

regarding the interpretation and application of current or future PRC laws and regulations and there can be no assurance that the PRC

government will ultimately take a view that is consistent with the opinion of our PRC legal counsel. For a description of the risks related

to our corporate structure, see “Risk Factors — Risks Related to Our Corporate Structure.”

Spousal Consent Letters

Pursuant to the spousal consent letters,

each of the spouses of the individual shareholders of the VIEs unconditionally and irrevocably agrees that the equity interest in the

VIEs held by and registered in the name of her respective spouse will be disposed of pursuant to the relevant equity pledge agreement,

the exclusive call option agreement and the powers of attorney. In addition, each of them agrees not to assert any rights over the equity

interest in the VIEs held by his or her respective spouse. In addition, in the event that any of them obtains any equity interest in

the VIEs held by her respective spouse for any reason, such spouse agrees to be bound by similar obligations and agreed to enter into

similar contractual arrangements.

Our corporate structure is subject to risks associated with our contractual

arrangements with the VIEs. These contractual arrangements have not been properly tested in a court of law, and the PRC regulatory authorities

could disallow our corporate structure at any time, which could result in a material change in our operations and the value of our securities

could decline or become worthless. The legal system in the PRC is not as developed as in other jurisdictions such as the United States.

As a result, uncertainties in the PRC legal system could limit our ability, as a Cayman Islands holding company, to enforce these contractual

arrangements and doing so may be costly. Because of our corporate structure, our Cayman Islands holding company, the WFOEs, the VIEs

and their subsidiaries, and our investors face uncertainty with respect to the interpretation and the application of the PRC laws and

regulations, including but not limited to limitation on foreign ownership of value-added telecommunications service companies and the

validity and enforcement of the contractual agreements. We are also subject to the risks of uncertainty about any future actions of the

PRC government in this regard. Our contractual agreements may not be as effective as direct ownership in providing control over the VIEs.

We may also be subject to sanctions imposed by PRC regulatory agencies, including China Securities Regulatory Commission, if we fail

to comply with their rules and regulations. For a detailed discussion of risks related to our corporate structure, see “Risk

Factors — Risks Related to Our Corporate Structure.”

Cash Flows through Our Organization

TuanChe Limited is a holding company with no material operations of

its own. We currently conduct our operations through our WFOEs, the VIEs and their respective subsidiaries. Cash is transferred through

our organization in the manner as follows: (1) we may transfer funds to our WFOEs through our Hong Kong subsidiary, TuanChe Information

Limited, by additional capital contributions or shareholder loans, as the case may be; (2) our subsidiaries in mainland China may

provide loans to the VIEs, subject to statutory limits and restrictions; (3) the VIEs may pay service fees to our subsidiaries in

mainland China for services rendered by our subsidiaries in mainland China; (4) our subsidiaries in mainland China may pay service

fees to the VIEs for services rendered by the VIEs; and (5) our subsidiaries in mainland China may make dividends or other distributions

to us through TuanChe Information Limited. We do not have cash management policies dictating how funds are transferred throughout our

organization. We may encounter difficulties in our ability to transfer cash between subsidiaries in mainland China and other subsidiaries

largely due to various PRC laws and regulations imposed on foreign exchange. If we intend to distribute dividends through TuanChe Limited

(the “Parent”), our WFOEs will transfer the dividends to TuanChe Information Limited in accordance with the laws and regulations

of the PRC, and then TuanChe Information Limited will transfer the dividends to the Parent, and the dividends will be distributed from

the Parent to all shareholders respectively in proportion to the shares they hold, regardless of whether the shareholders are U.S. investors

or investors in other countries or regions.

In 2021, our subsidiaries in mainland China received cash of RMB2.0

million from the VIEs for services rendered to the VIEs and their subsidiaries. In 2021, our subsidiaries in mainland China paid cash

of RMB0.6 million to the VIEs for services rendered by the VIEs and their subsidiaries. The foregoing cash flows include all distributions

and transfers between our Cayman Islands holding company, our subsidiaries and the VIEs as of the date of this prospectus supplement.

For details regarding distributions and transfers between our Cayman Islands holding company, our subsidiaries and the VIEs, see “Item

5. Operating and Financial Review and Prospects—Cash Flows through Our Organization” in the 2021 Form 20-F.

Dividend Distribution

to U.S. Investors and Tax Consequences

As of the date of this prospectus supplement, none of our subsidiaries

has issued any dividends or made other distributions to us or their respective holding companies nor have we or any of our subsidiaries

ever paid dividends or made other distributions to U.S. investors. We currently intend to retain all future earnings to finance the VIEs’

and our subsidiaries’ operations and to expand their business. As a result, we do not expect to pay and cash dividends in the foreseeable

future.

Under our corporate structure, our ability to pay dividends and to

service any debt we may incur and pay our operating expenses principally depends on dividends paid by our subsidiaries in mainland China.

Under applicable PRC laws and regulations, our subsidiaries in mainland China are

permitted to pay dividends to us only out of their accumulated profits, if any, determined in accordance with PRC accounting standards

and regulations. In addition, our subsidiaries in mainland China are required to allocate

at least 10% of their accumulated profits each year, if any, to fund statutory reserves of up to 50% of the registered capital of the

enterprise. Statutory reserves are not distributable as cash dividends except in the event of liquidation. Furthermore, if our

subsidiaries incur debt on their own behalf in the future, the instruments governing the debt may restrict their ability to pay dividends

or make other payments to us. In addition, the PRC tax authorities may require us to adjust the taxable income under the contractual

arrangements we currently have in place in a manner that would materially and adversely affect our WFOEs’ ability to pay dividends

and other distributions to us. Any limitation on the ability of our subsidiary to distribute dividends to us or on the ability of the

VIEs to make payments to us may restrict our ability to satisfy our liquidity requirements.

Restrictions on Our and

the VIEs’ Ability to Transfer Cash Out of Mainland China

To the extent cash or assets

in the business is in mainland China or Hong Kong or in an entity domiciled in mainland China or Hong Kong, and may need to be used to

fund operations outside of mainland China or Hong Kong, the funds and assets may not be available to fund operations or for other uses

outside of mainland China or Hong Kong due to interventions in or the imposition of restrictions and limitations by the government on

our, our subsidiaries’ or the VIEs’ ability to transfer cash and assets.

We may encounter difficulties in our ability to transfer cash between

subsidiaries in mainland China and other subsidiaries largely due to various PRC laws and regulations imposed on foreign exchange. The

majority of our income is denominated in Renminbi, and shortage in foreign currencies may restrict our ability to pay dividends or other

payment to satisfy our foreign currency denominated obligations, if any. Under existing PRC foreign exchange regulations, payments of

current account items, including profit distributions, interest payments and expenditures from trade-related transactions can be made

in foreign currencies without prior approval from the State Administration of the Foreign Exchange in the PRC as long as certain procedural

requirements are met. Approval from appropriate government authorities is required if Renminbi is converted into foreign currency and

remitted out of the PRC to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government

may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the

future, we may not be able to pay dividends in foreign currencies to our shareholders. The PRC government has implemented a series of

capital control measures, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions,

dividend payments and shareholder loan repayments. It may continue to strengthen its capital controls and dividends and other distributions

of our subsidiaries in mainland China may be subjected to tighter scrutiny and may limit the ability of our Cayman Islands holding company,

to use capital from our subsidiaries in mainland China, which may restrict our ability to satisfy

our liquidity requirements. For more detailed discussion of the restrictions and limitations on the ability to transfer cash or distribute

earnings between our subsidiaries in mainland China and the VIEs, and between our Cayman

Islands holding company and the VIEs, see “Risk Factors — Risks Related to Our Corporate Structure — We may rely on

dividends and other distributions on equity paid by our subsidiaries in mainland China and Hong Kong to fund any cash and financing requirements

we may have, and any limitation on the ability of our subsidiaries to make payments to us could have a material and adverse effect on

our ability to conduct the business” in this prospectus supplement.

Financial Information Related to the VIEs

The following table presents the consolidated

balance sheet information relating to the Parent, the VIEs and the non-variable interest entities as of December 31, 2020 and 2021

and June 30, 2022 (unaudited).

| |

|

As

of December 31, 2020 |

|

| |

|

|

|

|

|

|

|

Non-VIE |

|

|

|

|

|

|

|

| |

|

|

|

|

VIE |

|

|

|

|

|

Other |

|

|

Intercompany |

|

|

Group |

|

| |

|

Parent |

|

|

Consolidated |

|

|

WFOE |

|

|

subsidiaries |

|

|

Elimination |

|

|

Consolidated |

|

| Cash, cash equivalents and restricted

cash |

|

|

46,501 |

|

|

|

20,178 |

|

|

|

66,481 |

|

|

|

6,585 |

|

|

|

— |

|

|

|

139,745 |

|

| Amount due from the subsidiaries

of the Group |

|

|

101,952 |

|

|

|

73,036 |

|

|

|

70,094 |

|

|

|

1,134 |

|

|

|

(246,216 |

) |

|

|

— |

|

| Other current assets |

|

|

50,358 |

|

|

|

18,132 |

|

|

|

120,747 |

|

|

|

— |

|

|

|

(17,581 |

) |

|

|

171,656 |

|

| Total current assets |

|

|

198,811 |

|

|

|

111,346 |

|

|

|

257,322 |

|

|

|

7,719 |

|

|

|

(263,797 |

) |

|

|

311,401 |

|

| Property and equipment, net |

|

|

— |

|

|

|

578 |

|

|

|

17,946 |

|

|

|

— |

|

|

|

(12,816 |

) |

|

|

5,708 |

|

| Intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

21,821 |

|

|

|

21,821 |

|

| Long-term investments |

|

|

— |

|

|

|

8,949 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,949 |

|

| Investments in subsidiaries, VIEs and subsidiaries

of VIEs |

|

|

97,465 |

|

|

|

— |

|

|

|

30,100 |

|

|

|

565,453 |

|

|

|

(693,018 |

) |

|

|

— |

|

| Operating lease right-of-use assets, net |

|

|

— |

|

|

|

2,003 |

|

|

|

8,798 |

|

|

|

— |

|

|

|

— |

|

|

|

10,801 |

|

| Goodwill |

|

|

— |

|

|

|

— |

|

|

|

115,414 |

|

|

|

— |

|

|

|

— |

|

|

|

115,414 |

|

| Other non-current assets |

|

|

— |

|

|

|

— |

|

|

|

5,728 |

|

|

|

— |

|

|

|

(5,415 |

) |

|

|

313 |

|

| Total non-current assets |

|

|

97,465 |

|

|

|

11,530 |

|

|

|

177,986 |

|

|

|

565,453 |

|

|

|

(689,428 |

) |

|

|

163,006 |

|

| Total assets |

|

|

296,276 |

|

|

|

122,876 |

|

|

|

435,308 |

|

|

|

573,172 |

|

|

|

(953,225 |

) |

|

|

474,407 |

|

| Accounts payable |

|

|

— |

|

|

|

3,827 |

|

|

|

17,967 |

|

|

|

— |

|

|

|

— |

|

|

|

21,794 |

|

| Amount due to the subsidiaries of the Group |

|

|

— |

|

|

|

210,102 |

|

|

|

65,590 |

|

|

|

7,358 |

|

|

|

(283,050 |

) |

|

|

— |

|

| Short-term operating lease liabilities |

|

|

— |

|

|

|

1,025 |

|

|

|

4,886 |

|

|

|

— |

|

|

|

— |

|

|

|

5,911 |

|

| Other current liabilities |

|

|

6,614 |

|

|

|

61,473 |

|

|

|

80,372 |

|

|

|

— |

|

|

|

— |

|

|

|

148,459 |

|

| Total current liabilities |

|

|

6,614 |

|

|

|

276,427 |

|

|

|

168,815 |

|

|

|

7,358 |

|

|

|

(283,050 |

) |

|

|

176,164 |

|

| Lease liabilities, non-current |

|

|

— |

|

|

|

978 |

|

|

|

3,070 |

|

|

|

— |

|

|

|

— |

|

|

|

4,048 |

|

| Other non-current liabilities |

|

|

1,498 |

|

|

|

185 |

|

|

|

5,451 |

|

|

|

— |

|

|

|

— |

|

|

|

7,134 |

|

| Total non-current liabilities |

|

|

1,498 |

|

|

|

1,163 |

|

|

|

8,521 |

|

|

|

— |

|

|

|

— |

|

|

|

11,182 |

|

| Total liabilities |

|

|

8,112 |

|

|

|

277,590 |

|

|

|

177,336 |

|

|

|

7,358 |

|

|

|

(283,050 |

) |

|

|

187,346 |

|

| Total equity/(deficit) |

|

|

288,164 |

|

|

|

(154,714 |

) |

|

|

257,972 |

|

|

|

565,814 |

|

|

|

(670,175 |

) |

|

|

287,061 |

|

| |

|

As

of December 31, 2021 |

|

| |

|

|

|

|

|

|

|

Non-VIE |

|

|

|

|

|

|

|

| |

|

|

|

|

VIE |

|

|

|

|

|

Other |

|

|

Intercompany |

|

|

Group |

|

| |

|

Parent |

|

|

Consolidated |

|

|

WFOE |

|

|

subsidiaries |

|

|

Elimination |

|

|

Consolidated |

|

| Cash, cash

equivalents and restricted cash |

|

|

41,811 |

|

|

|

4,974 |

|

|

|

44,076 |

|

|

|

6,437 |

|

|

|

— |

|

|

|

97,298 |

|

| Amount due from the subsidiaries

of the Group |

|

|

106,845 |

|

|

|

91,767 |

|

|

|

1,976 |

|

|

|

133,860 |

|

|

|

(334,448 |

) |

|

|

— |

|

| Other current assets |

|

|

1,016 |

|

|

|

29,100 |

|

|

|

95,876 |

|

|

|

— |

|

|

|

(17,581 |

) |

|

|

108,411 |

|

| Total current assets |

|

|

149,672 |

|

|

|

125,841 |

|

|

|

141,928 |

|

|

|

140,297 |

|

|

|

(352,029 |

) |

|

|

205,709 |

|

| Property and equipment,

net |

|

|

— |

|

|

|

379 |

|

|

|

32,989 |

|

|

|

— |

|

|

|

(29,901 |

) |

|

|

3,467 |

|

| Intangible assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

17,711 |

|

|

|

17,711 |

|

| Long-term investments |

|

|

— |

|

|

|

5,357 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,357 |

|

| Investments in subsidiaries,

VIEs and subsidiaries of VIEs |

|

|

52,139 |

|

|

|

— |

|

|

|

30,100 |

|

|

|

596,994 |

|

|

|

(679,233 |

) |

|

|

|

|

| Operating lease right-of-use

assets, net |

|

|

— |

|

|

|

1,025 |

|

|

|

4,079 |

|

|

|

— |

|

|

|

— |

|

|

|

5,104 |

|

| Goodwill |

|

|

— |

|

|

|

— |

|

|

|

115,414 |

|

|

|

— |

|

|

|

— |

|

|

|

115,414 |

|

| Other non-current assets |

|

|

— |

|

|

|

— |

|

|

|

2,256 |

|

|

|

— |

|

|

|

(1,943 |

) |

|

|

313 |

|

| Total non-current assets |

|

|

52,139 |

|

|

|

6,761 |

|

|

|

184,838 |

|

|

|

596,994 |

|

|

|

(693,366 |

) |

|

|

147,366 |

|

| Total assets |

|

|

201,811 |

|

|

|

132,602 |

|

|

|

326,766 |

|

|

|

737,291 |

|

|

|

(1,045,395 |

) |

|

|

353,075 |

|

| Accounts payable |

|

|

— |

|

|

|

395 |

|

|

|

29,182 |

|

|

|

— |

|

|

|

— |

|

|

|

29,577 |

|

| Amount due to the subsidiaries

of the Group |

|

|

1,232 |

|

|

|

253,003 |

|

|

|

102,196 |

|

|

|

13,756 |

|

|

|

(370,187 |

) |

|

|

— |

|

| Short-term operating lease

liabilities |

|

|

— |

|

|

|

1,025 |

|

|

|

1,564 |

|

|

|

— |

|

|

|

— |

|

|

|

2,589 |

|

| Other current liabilities |

|

|

5,210 |

|

|

|

52,646 |

|

|

|

61,762 |

|

|

|

— |

|

|

|

— |