TrueCar’s ALG Forecasts Average New Car Transaction Price to Reach $35,538 up 2.0% Year Over Year for February 2020

March 03 2020 - 9:00AM

TrueCar, the most efficient online platform to find a car, (NASDAQ:

TRUE) and its data and analytics subsidiary, ALG, project average

transaction prices (ATP) to be up 2.0% or $701 from a year ago and

down 1.0% or $360 from January 2020.

“Average transaction prices have increased for 51 consecutive

months. This is likely due to the healthy economy and consumers

opting for utility vehicles with generally higher price tags,” said

Eric Lyman, Chief Industry Analyst for ALG, a subsidiary of

TrueCar. “That being said, there are still plenty of new vehicles

for consumers to choose from that are not only affordable, but also

offer the latest safety and technology features. Brands such as

Kia, Nissan, Hyundai and Honda all have average transaction prices

below $30,000.”

Key Insights: (Forecast by ALG)

- Daimler and Volkswagen are expected to be down on ATP

year-over-year, 2.4% and 4.2%, respectively. BMW is expected to be

up on ATP again this month with a 4.2% year-over-year

increase.

- Hyundai and Kia continue to be up on ATP year-over-year 11.1%

and 8.6%, respectively, as consumer demand for utility vehicles

remains steady.

- In ALG’s Retail Health Index (RHI), which measures automaker

brand health, most luxury brands are expected to be down this

month, however Lincoln is expected to be up 3.3% with another

strong showing due to strong demand and lower incentive spend.

- Average automaker incentive spend is expected to reach $3,576,

up 0.2% or $8 dollars year-over-year, and down 4.2% or $158 from

January 2020. ○ The most notable year-over-year declines in

incentive spend are expected from Subaru, Ford and Honda. Meanwhile

Nissan, Volkswagen Group and Toyota are expected to have the

biggest incentive increases.

- Incentive spend as a percentage of ATP for the industry is

expected to be 10.1%, down 1.8% from a year ago and down 3.3% from

January 2020.

- ALG projects that U.S. revenue from new vehicle sales will

reach more than $48 billion for February 2020, up 10.8% (based on

an adjusted daily selling rate) from a year ago and up 14.8% from

last month.

“Hyundai has shown the biggest increase in average transaction

price this month primarily due to sales of the Palisade, their

popular three-row SUV, which has almost twice the average

transaction price of other vehicles in Hyundai’s portfolio,” said

Nick Woolard, Director of OEM and Affinity Partner Analytics at

TrueCar. “The all-new Sonata, winner of ALG’s best vehicle redesign

of 2020, is also peaking the interest of consumers looking for a

Hyundai at a lower price point.”

February 2020 forecasts for the 13 largest manufacturers

by volume: (Adjusted for same selling days as February

2019.) For additional data visit the ALG

Newsroom.

Average Transaction Price (ATP)

|

Manufacturer |

Feb 2020 Forecast |

Feb 2019 Actual |

Jan 2020 Actual |

YOY |

MOM |

|

BMW |

$58,130 |

$55,810 |

$57,990 |

4.2% |

0.2% |

|

Daimler |

$63,539 |

$65,114 |

$64,856 |

-2.4% |

-2.0% |

|

FCA |

$36,916 |

$35,929 |

$36,968 |

2.7% |

-0.1% |

|

Ford |

$40,999 |

$38,966 |

$41,192 |

5.2% |

-0.5% |

|

GM |

$38,065 |

$37,861 |

$37,709 |

0.5% |

0.9% |

|

Honda |

$28,458 |

$28,799 |

$28,287 |

-1.2% |

0.6% |

|

Hyundai |

$26,588 |

$23,935 |

$26,543 |

11.1% |

0.2% |

|

Kia |

$24,775 |

$22,810 |

$24,551 |

8.6% |

0.9% |

|

Nissan |

$26,937 |

$27,162 |

$27,612 |

-0.8% |

-2.4% |

|

Subaru |

$30,143 |

$29,484 |

$30,052 |

2.2% |

0.3% |

|

Toyota |

$33,058 |

$32,423 |

$32,953 |

2.0% |

0.3% |

|

Volkswagen Group |

$43,191 |

$45,067 |

$44,320 |

-4.2% |

-2.5% |

|

Industry |

$35,538 |

$34,837 |

$35,898 |

2.0% |

-1.0% |

Incentive Spending

|

Manufacturer |

Feb 2020 Forecast |

Feb 2019 Actual |

Jan 2020 Actual |

YOY |

MOM |

|

BMW |

$5,561 |

$5,685 |

$5,450 |

-2.2% |

2.0% |

|

Daimler |

$5,637 |

$5,769 |

$5,408 |

-2.3% |

4.2% |

|

FCA |

$4,622 |

$4,783 |

$4,504 |

-3.4% |

2.6% |

|

Ford |

$3,239 |

$3,981 |

$4,568 |

-18.6% |

-29.1% |

|

GM |

$4,846 |

$4,604 |

$4,872 |

5.3% |

-0.5% |

|

Honda |

$2,184 |

$2,280 |

$2,120 |

-4.2% |

3.0% |

|

Hyundai |

$2,557 |

$2,560 |

$2,686 |

-0.1% |

-4.8% |

|

Kia |

$4,005 |

$3,695 |

$3,543 |

8.4% |

13.0% |

|

Nissan |

$4,253 |

$3,697 |

$4,319 |

15.0% |

-1.5% |

|

Subaru |

$1,083 |

$1,427 |

$1,017 |

-24.1% |

6.6% |

|

Toyota |

$2,517 |

$2,245 |

$2,449 |

12.1% |

2.8% |

|

Volkswagen Group |

$3,877 |

$3,392 |

$4,055 |

14.3% |

-4.4% |

|

Industry |

$3,576 |

$3,568 |

$3,734 |

0.2% |

-4.2% |

Incentives as a Percentage of Average Transaction Price

(ATP)

|

Manufacturer |

Feb 2020 Forecast |

Feb 2019 Actual |

Jan 2020 Actual |

YOY |

MOM |

|

BMW |

9.6% |

10.2% |

9.4% |

-6.1% |

1.8% |

|

Daimler |

8.9% |

8.9% |

8.3% |

0.1% |

6.4% |

|

FCA |

12.5% |

13.3% |

12.2% |

-5.9% |

2.8% |

|

Ford |

7.9% |

10.2% |

11.1% |

-22.7% |

-28.7% |

|

GM |

12.7% |

12.2% |

12.9% |

4.7% |

-1.5% |

|

Honda |

7.7% |

7.9% |

7.5% |

-3.0% |

2.4% |

|

Hyundai |

9.6% |

10.7% |

10.1% |

-10.1% |

-5.0% |

|

Kia |

16.2% |

16.2% |

14.4% |

-0.2% |

12.0% |

|

Nissan |

15.8% |

13.6% |

15.6% |

16.0% |

0.9% |

|

Subaru |

3.6% |

4.8% |

3.4% |

-25.7% |

6.2% |

|

Toyota |

7.6% |

6.9% |

7.4% |

10.0% |

2.4% |

|

Volkswagen Group |

9.0% |

7.5% |

9.2% |

19.3% |

-1.9% |

|

Industry |

10.1% |

10.2% |

10.4% |

-1.8% |

-3.3% |

Retail Health Index

RHI measures the changes in retail market share

relative to changes in incentive spending and transaction price to

gauge whether OEMs are "buying" retail share through increased

incentives, or whether share increases are largely demand-driven.

An OEM with a positive RHI score is demonstrating a healthy balance

of incentive spend relative to market share, either by holding

incentive spending flat and increasing share or by increasing

incentives with a higher positive increase in retail share.

|

RHI, Top 12 Manufacturers |

|

|

|

Feb 2020 Forecast |

YOY Change |

MOM Change |

|

BMW |

-0.1% |

-0.7% |

|

Daimler |

-0.3% |

-0.3% |

|

FCA |

2.0% |

1.3% |

|

Ford |

0.3% |

2.8% |

| GM |

-1.6% |

1.3% |

|

Honda |

-1.6% |

-0.2% |

|

Hyundai |

-0.4% |

0.8% |

|

Kia |

0.1% |

-1.3% |

|

Nissan |

-1.9% |

0.2% |

|

Subaru |

-0.1% |

0.5% |

|

Toyota |

1.1% |

0.3% |

|

Volkswagen |

0.0% |

0.8% |

| |

|

|

| |

|

|

|

Mainstream |

|

|

|

Feb 2020 Forecast |

YOY Change |

MOM Change |

|

Buick |

-1.1% |

0.8% |

|

Chevrolet |

-1.5% |

1.5% |

|

Chrysler |

0.4% |

0.6% |

|

Dodge |

0.5% |

1.9% |

|

Fiat |

-3.0% |

-4.2% |

|

Ford |

0.1% |

2.8% |

|

GMC |

-2.5% |

0.6% |

|

Honda |

-1.3% |

-0.2% |

|

Hyundai |

-0.4% |

0.7% |

|

Jeep |

3.3% |

0.4% |

|

Kia |

0.1% |

-1.3% |

|

Mazda |

-1.3% |

0.4% |

|

MINI |

1.0% |

0.7% |

|

Mitsubishi |

2.5% |

0.6% |

|

Nissan |

-1.7% |

0.1% |

|

Ram |

0.8% |

3.0% |

|

Subaru |

-0.1% |

0.5% |

|

Toyota |

1.6% |

0.3% |

|

Volkswagen |

2.5% |

0.6% |

|

Luxury |

|

|

|

Feb 2020 Forecast |

YOY Change |

MOM Change |

|

Acura |

-4.8% |

-1.1% |

| Alfa

Romeo |

1.2% |

1.5% |

|

Audi |

-3.8% |

1.5% |

|

BMW |

-0.2% |

-0.8% |

|

Cadillac |

-1.1% |

1.0% |

|

Genesis |

-0.9% |

1.9% |

|

INFINITI |

-3.4% |

0.7% |

|

Jaguar |

-3.1% |

0.5% |

| Land

Rover |

-3.6% |

0.4% |

|

Lexus |

-2.3% |

0.4% |

|

Lincoln |

3.3% |

2.4% |

|

Maserati |

-0.1% |

5.3% |

|

Mercedes-Benz |

-0.3% |

-0.3% |

|

Porsche |

-0.7% |

-0.3% |

|

Volvo |

-3.4% |

0.1% |

(Note: This forecast is based solely on ALG's analysis

of industry sales trends and conditions and is not a projection of

TrueCar Inc.’s operations.)

About TrueCar

TrueCar is a leading automotive digital marketplace that

enables car buyers to connect to our network of 16,500 Certified

Dealers. We are building the industry's most personalized and

efficient car buying experience as we seek to bring more of the

purchasing process online. Consumers who visit our marketplace will

find a suite of vehicle discovery tools, price ratings and market

context on new and used cars -- all with a clear view of what's a

great deal. When they are ready, TrueCar will enable them

to connect with a local Certified Dealer who shares in our belief

that truth, transparency and fairness are the foundation of a great

car buying experience. As part of our

marketplace, TrueCar powers car-buying programs for over

250 leading brands, including USAA, Sam’s Club, and American

Express. Nearly half of all new-car buyers engage

with TrueCar powered sites, where they buy smarter and

drive happier. TrueCar is headquartered in Santa

Monica, California, with offices in Austin,

Texas and Boston, Massachusetts.

For more information, please visit www.truecar.com, and

follow us on Facebook or Twitter. TrueCar media

line: +1-844-469-8442 (US toll-free) |

Email: pr@truecar.com

About ALG

Founded in 1964 and headquartered in Santa Monica, California,

ALG is an industry authority on automotive residual value

projections in both the United States and Canada. By analyzing

nearly 2,500 vehicle trims each year to assess residual value, ALG

provides auto industry and financial services clients with market

industry insights, residual value forecasts, consulting and vehicle

portfolio management and risk services. ALG is a wholly-owned

subsidiary of TrueCar, Inc., a digital automotive marketplace that

provides comprehensive pricing transparency about what other people

paid for their cars. ALG has been publishing residual values for

all cars, trucks and SUVs in the U.S. for over 55 years and in

Canada since 1981.

TrueCar and ALG PR Contact:Shadee

Malekafzalishadee@truecar.com424.258.8694

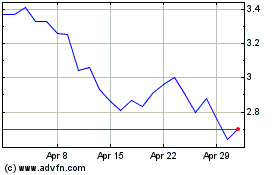

TrueCar (NASDAQ:TRUE)

Historical Stock Chart

From Mar 2024 to Apr 2024

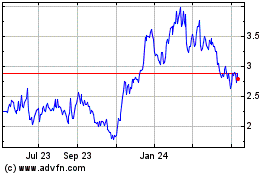

TrueCar (NASDAQ:TRUE)

Historical Stock Chart

From Apr 2023 to Apr 2024