TrueCar’s ALG Forecasts December 2019 New Car Sales to Finish the Year Up

December 23 2019 - 9:00AM

TrueCar, Inc.’s (NASDAQ: TRUE) data and analytics subsidiary, ALG,

projects total new vehicle sales will reach 1,567,254 units in

December 2019, up 0.2% from a year ago when adjusted for the same

number of selling days. This month’s seasonally adjusted annualized

rate (SAAR) for total light vehicle sales is an estimated 17.2

million units. Excluding fleet sales, ALG expects U.S. retail

deliveries of new cars and light trucks to be 1,322,551 units, a

decrease of 2% from a year ago when adjusted for the same number of

selling days.

“We expect 2019 sales to come in right where we forecast at the

beginning of the year,” said Oliver Strauss, Chief Economist at

ALG, a subsidiary of TrueCar. “For December, we’re seeing an uptick

in consumer sentiment and some softening in recession uncertainty

which all bode well for the industry. Higher incentives this month

are helping lift total auto sales versus a year ago.”

Additional Insights: (Forecast by

ALG)Month

- Among mainstream brands, Ford stood out for total sales, up

5.1% year-over-year. This is likely due to its slate of new

(Explorer and Escape) and young (Expedition) SUV lineup, including

some pent-up demand for the Explorer due to production hiccups at

launch.

- Toyota is showing a gain in retail market share this month off

the success of its RAV4, including the new hybrid trim.

- For the luxury brands, BMW and Mercedes Benz are battling it

out in December to capture the annual luxury sales crown. BMW is

hitting the gas on incentives and fleet sales, in an attempt to

overtake Daimler.

- BMW is expected to be up 6.2% year-over-year in December with

incentives up 13.2%, meanwhile Daimler is expected to be up 4.7%,

while holding incentives flat compared with last year.

- The other legacy battles have mostly been settled; with the

Toyota RAV4 expected to beat the Honda CR-V by over 50,000 units,

and the Toyota Camry expected to top the Honda Accord by over

60,000 units by year’s end.

- Tesla is forecast to be down 8% in December (and down for the

second month in a row) compared with last year, as it continues to

face difficult compares from last year’s surge in buyers hoping to

secure the last of their federal EV credits.

- Nissan continues to struggle, and is forecast to be down 21% in

total unit sales compared to a year ago.

- Meanwhile GM is still rebounding from its 40-day strike, that

was resolved at the end of October. It’s expected to be down 1.6%

on total units, with the biggest drop in incentive spend by any

manufacturer at 4.7%, and a reduction in fleet compared with last

year as it replenishes supply.

- Average automaker incentive spend is expected to reach $3,944

in December, up 3.6% or $138 dollars year-over-year.

- The most notable year-over-year increases in incentive spend

are expected from Toyota, BMW and Volkswagen, up 13.9%, 13.2% and

11% respectively.

- Used vehicle sales for December 2019 are expected to reach

3,058,423, up 9% from a year ago and down 1% from November

2019.

Quarter:

- Total unit sales for the quarter should reach

4,324,609, down 2.3% compared with the same period

last year adjusted for the same number of selling days.

- Used vehicle sales for the fourth quarter are expected to reach

9,514,373 up 6.1% year-over-year and down 8.5% from Q3 2019.

- TrueCar and ALG assessed brand retention performance for the

fourth quarter through the replacement vehicle indicated via

TrueCar Trade, TrueCar’s consumer trade experience.

- The top five brands with the highest indicated brand retention

this quarter are Ram, Subaru, Toyota, Honda and Chevrolet.

- Ram showed the biggest increase in indicated brand retention

this quarter according to TrueCar Trade data, moving from 43% in Q3

to 48% in Q4.

“December is one of the busiest times of year for auto retail

and the best time of year for consumers to buy a car and save off

MSRP,” said Eric Lyman, Chief Industry Analyst at ALG, a subsidiary

of TrueCar.

“Over one third of December vehicle transactions typically

happen in the last week of the month, and year,” added Lyman.

“Automakers and dealers will sweeten deals to move remaining

inventory off their lots and make room for the 2020 model year

vehicles.”

December 2019 forecasts for the 13 largest manufacturers

by volume: (Adjusted for same selling days as December

2018) For additional data visit the ALG

Newsroom.

Total Unit Sales

|

Manufacturer |

Dec 2019 |

Dec 2018 |

YoY % Change (Days selling rate) |

|

BMW |

38,036 |

37,249 |

6.2% |

|

Daimler |

36,492 |

36,254 |

4.7% |

|

FCA |

187,266 |

196,520 |

-0.9% |

|

Ford |

221,909 |

219,632 |

5.1% |

|

GM |

280,519 |

296,632 |

-1.6% |

|

Honda |

155,357 |

155,115 |

4.2% |

|

Hyundai |

68,392 |

65,721 |

8.2% |

|

Kia |

49,277 |

47,428 |

8.1% |

|

Nissan |

112,843 |

148,720 |

-21.1% |

|

Subaru |

64,743 |

64,541 |

4.3% |

|

Tesla |

17,789 |

20,100 |

-8.0% |

|

Toyota |

216,842 |

220,910 |

2.1% |

|

Volkswagen Group |

58,591 |

59,443 |

2.5% |

|

Industry |

1,567,254 |

1,627,481 |

0.2% |

Retail Unit Sales

|

Manufacturer |

Dec 2019 |

Dec 2018 |

YoY % Change(Days selling

rate) |

|

BMW |

35,401 |

36,041 |

2.2% |

|

Daimler |

34,392 |

34,248 |

4.4% |

|

FCA |

149,263 |

158,298 |

-1.9% |

|

Ford |

162,031 |

166,855 |

1.0% |

|

GM |

220,032 |

249,709 |

-8.4% |

|

Honda |

152,226 |

154,429 |

2.5% |

|

Hyundai |

57,215 |

57,185 |

4.1% |

|

Kia |

41,121 |

42,423 |

0.8% |

|

Nissan |

77,805 |

107,899 |

-25.0% |

|

Subaru |

62,457 |

62,464 |

4.0% |

|

Tesla |

17,789 |

20,100 |

-8.0% |

|

Toyota |

200,794 |

202,767 |

3.0% |

|

Volkswagen Group |

55,393 |

56,588 |

1.8% |

|

Industry |

1,322,551 |

1,403,824 |

-2.0% |

Total Unit Sales Fourth

Quarter

|

Manufacturer |

Q4 2019 |

Q4 2018 |

YoY % Change(Days selling

rate) |

|

BMW |

100,952 |

95,726 |

4.1% |

|

Daimler |

105,885 |

101,047 |

3.4% |

|

FCA |

538,710 |

555,221 |

-4.2% |

|

Ford |

604,198 |

606,569 |

-1.7% |

|

GM |

735,497 |

784,262 |

-7.4% |

|

Honda |

420,752 |

397,831 |

4.4% |

|

Hyundai |

190,189 |

176,245 |

6.5% |

|

Kia |

149,788 |

137,631 |

7.4% |

|

Nissan |

309,353 |

369,195 |

-17.3% |

|

Subaru |

177,167 |

176,717 |

-1.0% |

|

Tesla |

48,239 |

51,700 |

-7.9% |

|

Toyota |

613,486 |

602,435 |

0.5% |

|

Volkswagen Group |

168,233 |

159,606 |

4.1% |

|

Industry |

4,324,609 |

4,368,404 |

-2.3% |

Retail Market Share Fourth Quarter

|

Manufacturer |

Q4 2019 |

|

Q4 2018 |

|

YoY % Change(Days selling

rate) |

|

|

BMW |

2.5% |

|

2.5% |

|

1.9% |

|

|

Daimler |

2.8% |

|

2.6% |

|

2.1% |

|

|

FCA |

11.2% |

|

11.5% |

|

11.8% |

|

|

Ford |

12.3% |

|

12.1% |

|

11.8% |

|

|

GM |

14.8% |

|

16.1% |

|

16.2% |

|

|

Honda |

11.3% |

|

10.8% |

|

11.7% |

|

|

Hyundai |

4.4% |

|

4.0% |

|

4.2% |

|

|

Kia |

3.6% |

|

3.2% |

|

3.7% |

|

|

Nissan |

6.6% |

|

7.8% |

|

7.3% |

|

|

Subaru |

4.7% |

|

4.7% |

|

4.7% |

|

|

Tesla |

1.3% |

|

1.4% |

|

1.1% |

|

|

Toyota |

15.9% |

|

15.1% |

|

15.7% |

|

|

Volkswagen Group |

4.4% |

|

4.2% |

|

4.0% |

|

|

|

|

|

|

(Note: This forecast is based solely on ALG’s

analysis of industry sales trends and conditions and is not a

projection of TrueCar Inc.’s operations.)

About TrueCarTrueCar, Inc. (NASDAQ: TRUE) is a

digital automotive marketplace that provides comprehensive pricing

transparency about what other people paid for their cars and

enables consumers to engage with TrueCar Certified Dealers who are

committed to providing a superior purchase experience. TrueCar

operates its own branded site and its nationwide network of more

than 16,500 Certified Dealers, and also powers car-buying programs

for some of the largest U.S. membership and service organizations,

including USAA, AARP, American Express, AAA and Sam's Club. Nearly

half of all new car buyers engage with the TrueCar network during

their purchasing process. TrueCar is headquartered in Santa Monica,

California, with an office in Austin, Texas.

For more information, please visit www.truecar.com, and follow

us on Facebook or Twitter. TrueCar media line: +1-844-469-8442 (US

toll-free) | Email: pressinquiries@truecar.com

About ALGFounded in 1964 and headquartered in

Santa Monica, California, ALG is an industry authority on

automotive residual value projections in both the United States and

Canada. By analyzing nearly 2,500 vehicle trims each year to assess

residual value, ALG provides auto industry and financial services

clients with market industry insights, residual value forecasts,

consulting and vehicle portfolio management and risk services. ALG

is a wholly-owned subsidiary of TrueCar, Inc., a digital automotive

marketplace that provides comprehensive pricing transparency about

what other people paid for their cars. ALG has been publishing

residual values for all cars, trucks and SUVs in the U.S. for over

55 years and in Canada since 1981.

TrueCar & ALG PR Contact: Shadee

Malekafzalishadee@truecar.com424.258.8694

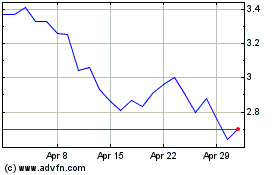

TrueCar (NASDAQ:TRUE)

Historical Stock Chart

From Mar 2024 to Apr 2024

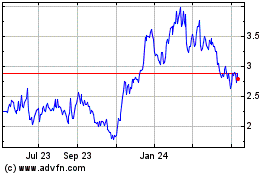

TrueCar (NASDAQ:TRUE)

Historical Stock Chart

From Apr 2023 to Apr 2024