Treace Medical Concepts, Inc. (“Treace” or the “Company”)

(NasdaqGS: TMCI), a commercial-stage orthopaedic medical device

company driving a paradigm shift in the surgical treatment of

Hallux Valgus (commonly known as bunions), today reported financial

results for the second quarter ended June 30, 2021.

Recent Highlights:

- Revenue of $20.7 million, a 167%

increase over the same period last year

- Gross margin of 80.9%, an increase

of 780 basis points from the same period last year

- Interim results from ALIGN3D™

clinical study demonstrating positive radiographic and

patient-reported outcomes starting at 6 weeks and maintained at 12

months

“We are pleased to announce continued strength

in our business, with growth in the second quarter led by

increasing surgeon utilization and steady gains in our customer

base supported by our expanding direct sales channel” said John T.

Treace, CEO, Founder and Board Member of Treace. “While the return

to pre-pandemic levels may not be linear, we continue to believe we

are well-positioned to drive continued market penetration of our

Lapiplasty® system, with comprehensive strategies and offerings

that include a body of clinical evidence demonstrating consistent,

reliable correction and low recurrence rates.”

Second Quarter 2021 Financial

ResultsRevenue for the second quarter of 2021 was $20.7

million, representing an increase of 167% compared to $7.7 million

in the second quarter of 2020. The increase was driven by an

increased number of Lapiplasty® procedure kits sold and an expanded

customer base. Revenues during the 2020 second quarter were

severely impacted by the COVID-19 pandemic, including the

government-mandated restrictions on elective procedures.

Gross profit for the second quarter of 2021 was

$16.7 million, compared to a gross profit of $5.7 million in the

second quarter of 2020. Gross margin increased to 80.9% in the

second quarter of 2021, compared to 73.1% in the second quarter of

2020. Gross margin expansion was the result of an increased number

of Lapiplasty® procedure kits sold and a higher average blended

ASP. Gross margin for the 2020 period also reflects

pandemic-related disruptions.

Total operating expenses were $20.8 million in

the second quarter of 2021, including sales and marketing (S&M)

expenses of $14.0 million, research and development (R&D)

expenses of $2.4 million, and general and administrative (G&A)

expenses of $4.3 million. This compared to total operating expenses

of $7.2 million, including S&M expenses of $4.8 million,

R&D expenses of $1.0 million, and G&A expenses of $1.4

million in the second quarter of 2020. Expenses in the second

quarter of 2020 reflect cost-reduction initiatives and the effect

of shelter-in-place orders as a result of the COVID-19

pandemic.

Second quarter net loss was ($5.1) million, or

($0.10) per share, compared to net loss of ($2.1) million, or

($0.06) per share, for the same period of 2020.

Cash and cash equivalents were $119.6 million as

of June 30, 2021. This includes cash proceeds of $107.6 million

from the Company’s initial public offering that closed in April

2021.

Financial OutlookTreace now

expects revenue for the full year 2021 to range from $90 million to

$95 million, which represents approximately 57% to 65% growth over

the Company’s fiscal year 2020 revenue. Previous revenue

expectation was $87 million to $92 million.

Webcast and Conference Call

DetailsTreace will host a conference call today, August 5,

2021, at 4:30 p.m. ET to discuss its second quarter 2021 financial

results. The dial-in numbers are (888) 708-0264 for domestic

callers or (720) 405-2122 for international callers, followed by

Conference ID: 9779815. The live webcast of the conference call

will be available on the Investor Relations section of the

Company’s website at https://investors.treace.com/. The webcast

will be archived on the website following the completion of the

call.

Use of Non-GAAP Financial

MeasuresTo supplement the financial results presented in

accordance with GAAP, this earnings release presents Adjusted

EBITDA, which the Company defines as net loss before depreciation

and amortization expense, stock-based compensation expense and

interest income/expense. Adjusted EBITDA is being presented in

addition to, and not as a substitute for, or superior to, financial

measures calculated in accordance with GAAP. Management uses

Adjusted EBITDA to evaluate the Company’s operating performance and

trends, as well as for making planning decisions. The Company

believes that Adjusted EBITDA helps to identify underlying trends

in the Company’s business that could otherwise be masked by the

effect of the expenses and other items that it excludes in Adjusted

EBITDA. Accordingly, the Company believes Adjusted EBITDA provides

useful information to investors and others in understanding and

evaluating the Company’s operating results, enhancing the overall

understanding of its past performance and future prospects, and

allowing for greater transparency with respect to the key financial

metrics used by the Company’s management in their financial and

operational decision-making. The Company also presents Adjusted

EBITDA because it believes investors, analysts and rating agencies

consider it a useful metric in measuring the Company’s performance

against other companies and its ability to meet its debt service

obligations.

There are limitations related to the use of

non-GAAP financial measures such as Adjusted EBITDA because they

are not prepared in accordance with GAAP, may exclude significant

expenses required by GAAP to be recognized in the Company’s

financial statements, and may not be comparable to non-GAAP

financial measures used by other companies. The Company encourages

investors to carefully consider its results under GAAP, as well as

its supplemental non‐GAAP information and the reconciliation

between these presentations, to more fully understand its business.

Reconciliations between GAAP and non‐GAAP results are presented

below.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

All statements other than statements of historical fact are

forward-looking statements, including, but not limited to the

Company’s expectations regarding the recovery of the market to

pre-pandemic levels; the Company’s belief that it is well

positioned to drive continued market penetration of the Lapiplasty®

system; and the Company’s expected revenue for full year 2021.

Forward-looking statements are based on management’s current

assumptions and expectations of future events and trends, which

affect or may affect the Company’s business, strategy, operations

or financial performance, and actual results and other events may

differ materially from those expressed or implied in such

statements due to numerous risks and uncertainties. Forward-looking

statements are inherently subject to risks and uncertainties, some

of which cannot be predicted or quantified. Factors that could

cause actual results or other events to differ materially from

those contemplated in this press release can be found in the Risk

Factors section of Treace’s public filings with the Securities and

Exchange Commission (SEC), including in the final prospectus filed

with the SEC on April 26, 2021 in connection with Treace’s initial

public offering. Because forward-looking statements are inherently

subject to risks and uncertainties, you should not rely on these

forward-looking statements as predictions of future events. These

forward-looking statements speak only as of their date and, except

to the extent required by law, the Company undertakes no obligation

to update these statements, whether as a result of any new

information, future developments or otherwise. The Company’s

results for the quarter ended June 30, 2021 are not necessarily

indicative of our operating results for any future periods.

About Treace Medical

ConceptsTreace Medical Concepts is a commercial-stage

orthopaedic medical device company with the goal of advancing the

standard of care for the surgical management of bunion deformities.

Bunions are complex 3-dimensional deformities that originate from

an unstable joint in the middle of the foot. Treace has pioneered

and patented the Lapiplasty® 3D Bunion Correction™ system - a

combination of instruments, implants, and surgical methods designed

to correct all 3 planes of the bunion deformity and secure the

unstable joint, addressing the root cause of the bunion and getting

patients back to their active lives quickly.

Contacts:

Treace Medical ConceptsMark L. HairChief

Financial Officermhair@treace.net(904) 373-5940

Investors:

Gilmartin GroupLynn Lewis or Vivian

CervantesIR@treace.net

Treace Medical Concepts, Inc.

Condensed Statements of Operations and Comprehensive

Loss (in thousands, except share and per share

amounts) (unaudited)

|

|

Three Months EndedJune 30, |

|

|

Six Months EndedJune 30, |

|

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

|

Revenue |

$ |

20,654 |

|

|

$ |

7,739 |

|

|

$ |

39,361 |

|

|

$ |

18,995 |

|

| Cost of goods sold |

|

3,944 |

|

|

|

2,085 |

|

|

|

7,271 |

|

|

|

4,474 |

|

| Gross profit |

|

16,710 |

|

|

|

5,654 |

|

|

|

32,090 |

|

|

|

14,521 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

14,010 |

|

|

|

4,789 |

|

|

|

26,158 |

|

|

|

12,127 |

|

|

Research and development |

|

2,422 |

|

|

|

982 |

|

|

|

4,290 |

|

|

|

2,415 |

|

|

General and administrative |

|

4,329 |

|

|

|

1,401 |

|

|

|

7,095 |

|

|

|

2,696 |

|

| Total operating expenses |

|

20,761 |

|

|

|

7,172 |

|

|

|

37,543 |

|

|

|

17,238 |

|

| Loss from operations |

|

(4,051 |

) |

|

|

(1,518 |

) |

|

|

(5,453 |

) |

|

|

(2,717 |

) |

| Interest and other income,

net |

|

6 |

|

|

|

3 |

|

|

|

7 |

|

|

|

36 |

|

| Interest expense |

|

(1,038 |

) |

|

|

(458 |

) |

|

|

(2,069 |

) |

|

|

(899 |

) |

| Other expense, net |

|

(1,032 |

) |

|

|

(455 |

) |

|

|

(2,062 |

) |

|

|

(863 |

) |

| Net loss and comprehensive

loss |

|

(5,083 |

) |

|

|

(1,973 |

) |

|

|

(7,515 |

) |

|

|

(3,580 |

) |

| Convertible preferred stock

cumulative and undeclared dividends |

|

(39 |

) |

|

|

(159 |

) |

|

|

(196 |

) |

|

|

(318 |

) |

| Net loss attributable to common

stockholders |

$ |

(5,122 |

) |

|

$ |

(2,132 |

) |

|

$ |

(7,711 |

) |

|

$ |

(3,898 |

) |

| Net loss per share attributable

to common stockholders, basic and diluted |

$ |

(0.10 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.11 |

) |

|

Weighted-average shares used in computing net loss per share

attributable to common stockholders, basic and diluted |

|

49,187,285 |

|

|

|

37,068,288 |

|

|

|

43,556,107 |

|

|

|

37,060,491 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Treace Medical Concepts, Inc.

Condensed Balance Sheets (in thousands,

except share and per share amounts)

(unaudited)

|

|

June 30, |

|

|

December 31, |

|

|

|

2021 |

|

|

2020 |

|

|

Assets |

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

119,621 |

|

|

$ |

18,079 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $271

and $446 as of June 30, 2021 and December 31, 2020,

respectively |

|

10,047 |

|

|

|

14,486 |

|

|

Inventories |

|

7,643 |

|

|

|

7,820 |

|

|

Prepaid expenses and other current assets |

|

3,512 |

|

|

|

593 |

|

| Total current assets |

|

140,823 |

|

|

|

40,978 |

|

| Property and equipment, net |

|

1,475 |

|

|

|

829 |

|

| Total assets |

$ |

142,298 |

|

|

$ |

41,807 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

2,921 |

|

|

$ |

2,265 |

|

|

Accrued liabilities |

|

1,957 |

|

|

|

1,848 |

|

|

Accrued commissions |

|

2,553 |

|

|

|

3,513 |

|

|

Accrued compensation |

|

2,434 |

|

|

|

2,183 |

|

|

Short-term debt |

|

- |

|

|

|

1,788 |

|

| Total current liabilities |

|

9,865 |

|

|

|

11,597 |

|

| Derivative liability on term

loan |

|

245 |

|

|

|

245 |

|

| Long-term debt, net of discount

of $723 and $811 as of June 30, 2021 and December 31, 2020,

respectively |

|

29,277 |

|

|

|

29,189 |

|

| Total liabilities |

|

39,387 |

|

|

|

41,031 |

|

| Commitments and contingencies

(Note 7) |

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

|

Series A convertible preferred stock, $0.001 par value, 0 shares

authorized and 0 shares issued and outstanding as of June 30, 2021;

6,687,500 shares authorized and 6,687,475 shares issued and

outstanding as of December 31, 2020, respectively; liquidation

value of $0 and $8,000 as of June 30, 2021 and December 31, 2020,

respectively |

|

— |

|

|

|

7,935 |

|

|

Preferred stock, $0.001 par value, 5,000,000 shares authorized; 0

shares issued and outstanding as of June 30, 2021; 0 shares

authorized, issued and outstanding as of December 31, 2020 |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value, 300,000,000 shares authorized;

52,755,981 issued and outstanding as of June 30, 2021; 66,875,000

shares authorized, 37,366,865 issued and outstanding as of December

31, 2020 |

45 |

|

|

28 |

|

|

Common stock Class B, $0.001 par value, 0 shares authorized, issued

and outstanding as of June 30, 2021; 1,000,000 shares authorized

and 0 shares issued and outstanding as of December 31, 2020 |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

131,734 |

|

|

|

14,166 |

|

|

Accumulated deficit |

|

(28,868 |

) |

|

|

(21,353 |

) |

| Total stockholders’ equity |

|

102,911 |

|

|

|

776 |

|

|

Total liabilities and stockholders’ equity |

$ |

142,298 |

|

|

$ |

41,807 |

|

|

|

|

|

|

|

|

|

|

Treace Medical Concepts, Inc.

Condensed Statements of Cash Flows (in

thousands)(unaudited)

|

|

Six Months EndedJune 30, |

|

|

Six Months EndedJune 30, |

|

|

|

2021 |

|

|

2020 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

| Net loss |

$ |

(7,515 |

) |

|

$ |

(3,580 |

) |

| Adjustments to reconcile net loss

to net cash used in operating activities |

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

220 |

|

|

|

667 |

|

|

(Recovery) Provision for allowance for doubtful accounts |

|

(72 |

) |

|

|

228 |

|

|

Share-based compensation expense |

|

1,277 |

|

|

|

457 |

|

|

Amortization of debt issuance costs |

|

88 |

|

|

|

118 |

|

|

Provision for inventory obsolescence |

|

88 |

|

|

|

412 |

|

|

Net changes in operating assets and

liabilities: |

|

|

|

|

|

|

|

|

Accounts Receivable |

|

4,511 |

|

|

|

3,532 |

|

|

Inventory |

|

89 |

|

|

|

(2,590 |

) |

|

Prepaid expenses and other assets |

|

(2,919 |

) |

|

|

178 |

|

|

Accounts payable |

|

656 |

|

|

|

1,071 |

|

|

Accrued liabilities |

|

(600 |

) |

|

|

(3,233 |

) |

| Net cash used in operating

activities |

|

(4,177 |

) |

|

|

(2,740 |

) |

| Cash flows from investing

activities |

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

(866 |

) |

|

|

(923 |

) |

| Net cash used in investing

activities |

|

(866 |

) |

|

|

(923 |

) |

| Cash flows from financing

activities |

|

|

|

|

|

|

|

|

Proceeds from SBA Loan |

|

— |

|

|

|

1,788 |

|

|

Repayments on SBA Loan |

|

(1,788 |

) |

|

|

— |

|

|

Proceeds from issuance of common stock upon initial public

offering, net of issuance costs and underwriting fees of $10.6

million |

|

107,610 |

|

|

|

— |

|

|

Proceeds from exercise of employee stock options |

|

763 |

|

|

|

41 |

|

| Net cash provided by financing

activities |

|

106,585 |

|

|

|

1,829 |

|

| Net increase (decrease) in cash

and cash equivalents |

|

101,542 |

|

|

|

(1,834 |

) |

| Cash and cash equivalents at

beginning of period |

|

18,079 |

|

|

|

12,139 |

|

| Cash and cash equivalents at end

of period |

$ |

119,621 |

|

|

$ |

10,305 |

|

| Supplemental disclosure

of cash flow information: |

|

|

|

|

|

|

|

|

Cash paid for interest |

|

2,917 |

|

|

|

— |

|

| NONCASH FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

|

Issuance of common stock upon exercise of warrants |

|

1 |

|

|

|

— |

|

|

Conversion of convertible preferred stock and accrued dividends on

convertible preferred stock into common stock |

|

7,935 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Treace Medical Concepts,

Inc.Reconciliation of GAAP Net Loss to Adjusted

EBITDA

| |

Three Months Ended June 30, |

|

Six Months EndedJune 30, |

|

|

|

2021 |

|

|

|

2020 |

|

|

|

2021 |

|

|

|

2020 |

|

| Net loss |

$ |

(5,083 |

) |

|

$ |

(1,973 |

) |

|

$ |

(7,515 |

) |

|

$ |

(3,580 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

Interest |

$ |

1,032 |

|

|

$ |

455 |

|

|

$ |

2,062 |

|

|

$ |

863 |

|

|

Taxes |

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

|

|

Depreciation & Amortization |

$ |

124 |

|

|

$ |

364 |

|

|

$ |

220 |

|

|

$ |

667 |

|

|

Non-cash compensation expense |

$ |

875 |

|

|

$ |

248 |

|

|

$ |

1,277 |

|

|

$ |

457 |

|

| Adjusted EBITDA |

$ |

(3,052 |

) |

|

$ |

(906 |

) |

|

$ |

(3,956 |

) |

|

$ |

(1,593 |

) |

|

|

|

|

|

|

|

|

|

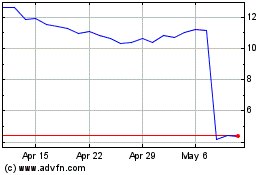

Treace Medical Concepts (NASDAQ:TMCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

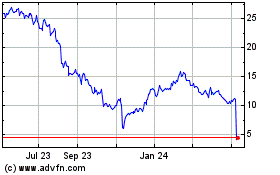

Treace Medical Concepts (NASDAQ:TMCI)

Historical Stock Chart

From Apr 2023 to Apr 2024