United States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

United States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

Name of the Registrant: Tractor Supply Company

Name of persons relying on exemption: The Shareholder Commons

Address of persons relying on exemption: PO Box 7545, Wilmington, DE,

19803-545

Written materials are submitted pursuant to Rule 14a-6(g) (1) promulgated

under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule but is made voluntarily

in the interest of public disclosure and consideration of these important issues.

* * * * *

SHAREHOLDER REBUTTAL TO TRACTOR SUPPLY COMPANY

The Shareholder Commons urges you to vote FOR Item 4 on the

proxy card, the proposal requesting the Board of Directors of the Company (the “Board”) to take all action necessary to convert

Tractor Supply Company (“Tractor Supply” or “the Company”) to a public benefit corporation.

Summary

Proposal

The Proposal requests the Board to take steps necessary to convert

Tractor Supply to a public benefit corporation (PBC). A PBC operates just like a conventional corporation, except that it can make decisions

that promote the interests of stakeholders, such as employees and communities, without having to justify those decisions as also advancing

shareholders’ interest in receiving profits and financial gains from the corporation.

If successful, the Proposal would require the Board to adopt an amendment

to the Tractor Supply certificate of incorporation. The amendment would require the Company to balance three considerations:

|

|

1.

|

The

shareholders’ financial interests;

|

|

|

2.

|

The

best interests of those materially affected by the corporation’s conduct; and

|

|

|

3.

|

A

public benefit or benefits chosen by the Board and specified in the amendment.1

|

The amendment would then be presented to shareholders for a vote and,

if approved, filed in Delaware. From that point forward, the Company would be operated as a PBC.

The PBC Difference

As a conventional corporation, Tractor Supply is subject to a legal

requirement that the Board privilege financial return to shareholders over any other stakeholder interest. The Proposal is intended to

remove that requirement and require the Board to account for the Company’s impact on society and the environment as well. Specifically,

management explains that:

One of the main differences between conventional Delaware corporations

and PBCs is that directors of a PBC must manage the PBC in a manner that balances the stockholders’ pecuniary interests,

the best interests of those materially affected by the PBC’s conduct, and the specific public benefit or benefits identified in

the PBC’s certificate of incorporation. Accordingly, particularly if and when the interests of stockholders and other stakeholders

conflict, the directors of a PBC must balance the competing interests. As a result, decisions made by a PBC’s board of directors

may not necessarily be designed to prioritize or maximize the Company’s financial return to stockholders. In particular, as a PBC,

the board of directors is permitted to choose an alternative that is in the best interests of the corporation when balancing the interests

of the corporation’s various constituencies, even if it is not the best one from the standpoint of the pecuniary interests of the

stockholders.

The proposed change in legal status thus addresses the tension between

the desire of companies to commit to all stakeholders and the legal reality that the conventional corporate form privileges shareholders.

The solution in the Proposal—conversion to a PBC—has been celebrated by Leo Strine, the leading corporate commentator of his

generation and the former Chief Justice of Delaware, the state in which Tractor Supply is incorporated. Chief Justice Strine has argued

that conversion to PBC status could resolve the contradiction between the company-first shareholder primacy of conventional corporation

law and the need for corporations to account for the full impact of their business operations:

So how to resolve this legal impasse? A recent innovation offers

a sensible answer. … [T]he benefit corporation — [] puts legal force behind the idea that a business should have a positive

purpose, commit to do no harm, seek sustainable wealth creation, and treat all its stakeholders with equal respect.2

1 8 Del. C. §365.

2 Robert G. Eccles, Leo E. Strine, and Timothy Youmans,

3 Ways to Put Your Corporate Purpose into Action, Harvard Business Review (May 13,

2020), available at https://hbr.org/2020/05/3-ways-to-put-your-corporate-purpose-into-action.

For the reasons discussed below, we believe that the diversified shareholders

of Tractor Supply would benefit from a conversion to a PBC.

Why You Should Support this Resolution

Most of Tractor Supply’s shareholders are diversified investors

who depend on an economy that succeeds for everyone over the long term. Indeed, its two largest shareholders, who collectively own more

than 20% of the outstanding shares, are large asset managers who generally manage large, diversified pools of assets. The beneficiaries

of these diversified portfolios rely on overall market performance more than the success of any single company.

As a PBC, Tractor Supply will be able to account directly for the long-term

risks created by corporate decisions that affect multiple stakeholders and the overall economy, something it cannot do now. This flexibility

will allow Tractor Supply to protect these diversified investors by limiting activities that undermine the healthy systems necessary for

a successful economy, even if such limits have not been justified based on its anticipated impact on the Company’s own long- or

short-term rates of return.

Why PBCs are better for Tractor Supply shareholders

Conventional corporate law requires corporations to prioritize the

interests of their shareholders in financial returns from the company. As the Company explains in its proxy statement:

[B]ecause the Company is organized as a conventional Delaware

corporation, our Board owes fiduciary duties solely to the Company and our stockholders. As a result, our Board makes decisions through

the lens of what it reasonably believes is in the best interests of the Company and our stockholders.

This rule, called “shareholder primacy,” has requires a

company to optimize long-term financial returns to shareholders, ultimately received through dividends, buybacks, and stock appreciation.

But this company-first approach fails to account for the fact that that an individual company may profit from activity that undermines

the social and environmental fabric upon which the vast majority of diversified shareholders depend.

The Problem with Company-First Shareholder Primacy

The tension between company-first shareholder primacy and the needs

of diversified investors is demonstrated by a recent study that determined that publicly listed companies imposed impose social and

environmental costs on the economy equal to more than half of their profits. Those costs—$2.2 trillion annually—equal

more than 2.5% of global GDP.3 From the point of view of a diversified shareholder, these companies are only half as valuable

as their income statements would indicate.

3 Andrew Howard, SustainEx:

Examining the social value of corporate activities, Schroders (April 2019), available at https://www.schroders.com/en/sysglobalassets/digital/insights/2019/pdfs/sustainability/sustainex/sustainex-short.pdf.

As a conventional corporation, Tractor Supply is bound to participate

in this shell game, making profits that optimize its long-term profitability even while engaging in activities that put the global economy

at risk. To the extent that Tractor Supply creates economic costs that lower GDP, the value of shareholders’ portfolios is reduced.

Thus, by requiring Tractor Supply to prioritize financial return to shareholders above all else, the fiduciary requirements of conventional

corporation law threaten the Company’s own diversified shareholder base. In other words, while Tractor Supply may increase its

isolated return to shareholders by applying the company-first shareholder primacy model and neglecting the costs it externalizes, its

diversified shareholders will ultimately pay these costs.

Tractor Supply recognizes this concern in its Proxy Statement:

We also understand that one driver of proposals that public companies

generally convert into PBCs arises from a concern that there can be activities in any industry that may (or will) improve a company’s

financial value or stock price (whether in the short, medium or longer-term), but at some cost to important social, economic or environmental

systems and accordingly drive systemic negative externalities.

The PBC Form Creates Obligations that Protect Diversified Shareholders

In contrast to a conventional corporation, which must operate under

the company-first shareholder primacy model, a PBC is expected to operate in a “responsible and sustainable manner,”4

and to balance three considerations:

|

|

1.

|

The shareholders’ financial interests;

|

|

|

2.

|

The

best interests of those materially affected by the corporation’s conduct; and

|

|

|

3.

|

A

public benefit or benefits specified in the corporation’s certificate of incorporation.5

|

This new obligation would allow Tractor Supply to prioritize interests

of stakeholders, who can be affected by externalized costs. It is this change in focus that permits a PBC to reduce its negative impacts

on society and the environment, leading to healthier systems and better financial returns for diversified shareholders.

How the New Obligations Could Affect Tractor Supply

In its 2020 Environmental, Social and Governance Tear Sheet, Tractor

Supply provides data on certain impacts that it has on society and the environment. While the Company takes pride in improvement it has

made in these metrics, it appears that the changes are not sufficient to place Tractor Supply in the category of companies that are fully

addressing the limits on social and environmental resources.

Climate Change

For example, the Company highlights that it has reduced Scope 1 and

2 carbon emissions by 52% measured against sales. Yet in the last two years, its total Scope 1 and 2 emissions have fallen by only 5%

and 2%, respectively, and it has yet to inventory its Scope 3 emissions. In the Company’s earnings call for Q1 2021, it emphasized

that “[b]ig-ticket purchases had robust growth, up strong double digits that well outpaced our average comp sales increase . . .,

utility vehicles, trailers and outdoor power equipment, such as the zero-turn mowers, were some of the notable gainers in the quarter.”

These items emit significant quantities of greenhouse gases, so that the direction of the Company’s total carbon footprint is still

very opaque.

4 8 Del. C. §362.

5 8 Del. C. §365.

These items indicate that while Tractor Supply may be considering the

environment and its carbon footprint, such efforts remain confined by company-first shareholder primacy. While Tractor Supply has recognized

the need to address greenhouse gas emissions, it must rely on the illusory promise that the status quo can somehow serve the interests

of stockholders and other stakeholders in equal measure, a proposition that clearly does not reflect reality.

Instead, as Olivier Elamine, CEO of the German REIT Alstria, recently

explained, companies must make trade-offs with respect to climate change:

If reaching the goals of the Paris Agreement was a good business

opportunity, Elamine continues, it would be happening at a much faster pace already: “We need to acknowledge that somewhere along

the line, it stops being about the business opportunity - that good business decisions alone won’t get us there - and we need to

accept, collectively, that it will come at a cost. Only then will we be able to achieve it.”6

As a PBC, Tractor Supply would have the option to take the steps that

are necessary to address these economic harms (such as optimizing its product mix to minimize Scope 3 emissions and significantly reducing

its absolute Scope 1 and 2 emissions), even if the steps could not be justified by the Board as necessarily optimizing its long-term profits.

Using its business judgment, Tractor Supply’s Board would have greater discretion to participate in authentic long-term solutions

to constrain climate change and minimize the associated impacts to diversified shareholders.

This matters to diversified shareholders. The consequences of climate

change are well established and include property destruction, forced migration, worsened global health and increased mortality, food

system disruption, and more. These outcomes harm communities, customers, employees, suppliers, and shareholders, and degrade many of

the social and environmental systems upon which thriving economies depend. According to The Economist Intelligence Unit’s Climate

Change Resilience Index, climate change could directly cost the world economy $7.9 trillion and shave off 3% of global GDP by 2050.7

This drag on GDP directly reduces the return on a diversified portfolio over the long term.8

Inequality and Racial Disparity

The Company is justifiably proud of a number of initiatives that have

improved salary and benefits for its employees. Yet the average company employee makes $14.30 per hour, with the median employee receiving

a salary of $24,437, while the CEO received 654 times that median salary. It also remains the case that while the Company’s work

force is 49% female and 18% minority, those groups make up only 21% and 5% of executive and senior management.

Racial disparity and inequality not only harm employees and their

families, but also degrade social systems and communities. According to the Economic Policy Institute, income inequality is slowing U.S.

economic growth by reducing demand by 2-4%.9 Similarly, the Federal Reserve Bank of San Francisco determined that gender and

racial gaps created $2.9 trillion in losses to U.S. GDP in 2019.10 Moreover, a recent report from Citigroup calculated that

eliminating racial disparity would add $5 trillion to the U.S. economy over the next five years.11 The same study explains

steps that corporations could take to reduce the gap. This drag on GDP directly reduces the return on a diversified portfolio over the

long term.12

6 Sophie Robinson-Tillett, The CEO’s perspective:

‘Surely it’s more responsible to tell the truth than to come up with Net Zero claims,’ Responsible

Investor (March 29, 2021), available at https://www.responsible-investor.com/articles/the-ceo-s-perspective-surely-it-s-more-responsible-to-tell-the-truth-than-to-come-up-with-net-zero-claims.

7 Global economy will be 3 percent smaller by 2050 due

to lack of climate resilience, The Economist Intelligence Unit (November 20, 2019), available at https://www.eiu.com/n/global-economy-will-be-3-percent-smaller-by-2050-due-to-lack-of-climate-resilience/.

8 Richard

Mattison et al., Universal Ownership: Why environmental externalities matter to institutional investors, Appendix IV (demonstrating

linear relationship between GDP and a diversified portfolio) (2011), UNEP Finance Initiative and PRI, available at https://www.unepfi.org/fileadmin/documents/universal_ownership_full.pdf.

9 Josh Bivens, Inequality is slowing U.S. economic growth:

Faster wage growth for low- and middle-wage workers is the solution, Economic Policy Institute (December 12, 2017), available at

https://www.epi.org/publication/secular-stagnation/.

10 Shelby R. Buckman et al., The Economic Gains from

Equity, Federal Reserve Bank of San Francisco (January 19, 2021), available at https://www.frbsf.org/our-district/files/economic-gains-from-equity.pdf.

11 Dana M. Peterson and Catherine L. Mann, Closing the

Racial Inequality Gaps: The Economic Cost of Black Inequality in the U.S., Tractor Supply GPS (September 2020), available at http://Tractor

Supply.us/3olxWH0.

12 Ibid n. 8.

To date, while the Company has taken steps to reduce these impacts,

it has done so within the confines of company-first shareholder primacy. Addressing inequality and racial injustice will not always align

with an interest in increasing company financial return, and in the face of such conflicting interests, the Board will be obligated to

privilege financial return until Tractor Supply becomes a PBC.

As a PBC, Tractor Supply could take steps to address these economic

harms, even if the steps do not optimize its long-term profits. Using its business judgment, Tractor Supply’s Board could work toward

meaningful, long-term solutions to noxious inequality and racial disparities, without being constrained by a narrow view of its shareholders’

interests.

* * * * *

If the Proposal is implemented, Tractor Supply could take action that

reduces externalities so as to improve local and global economies and returns to diversified shareholders even if the action reduced its

long-term internal rate of return. Such actions might involve unilateral reduction of externalities, support for regulation and taxes

that imposed limits on externalities, or following extra-legal guardrails mediated by shareholders, industry groups, or others. As a PBC,

Tractor Supply would not be obligated to take these actions, but it would have the option to do so, expanding the range of choices available

to the board and management to authentically protect the broad interests of its diversified shareholders and other stakeholders.

Signing the BRT Statement alone does not address company-first

shareholder primacy

Tractor Supply’s Commitment under the BRT Statement

In August 2019, the Company made a commitment to stakeholders by signing

the Business Roundtable Statement on the Purpose of a Corporation (the BRT Statement).13 That commitment will remain an empty

promise unless Tractor Supply becomes a PBC.

Specifically, the statement says, “While each of our individual

companies serves its own corporate purpose, we share a fundamental commitment to all of our stakeholders,” including

customers, employees, suppliers, and the communities in which companies work. Were Tractor Supply able to authentically adhere to the

BRT Statement, it could address some of the problems created by company-first shareholder primacy. However, as explained above, the legal

rules that govern Tractor Supply have been authoritatively interpreted to require it to subordinate important stakeholder interests when

they diverge from those of the shareholders.

13 https://system.businessroundtable.org/app/uploads/sites/5/2021/02/BRT-Statement-on-the-Purpose-of-a-Corporation-Feburary-2021-compressed.pdf

As a conventional corporation, Tractor Supply cannot shake the specter

of company-first shareholder primacy and the constant concern that any significant decision it makes must be consistent with optimizing

its financial return. Thus, the BRT Statement accomplishes little, but it does leave Tractor Supply vulnerable to the charge of hypocrisy

and violation of trust, because it has publicly made a pledge that it cannot adhere to consistently when profits and systemic risks collide.

Conversion to a PBC would allow Tractor Supply to follow through on

the BRT Statement, improve the lives of its stakeholders, and increase the long-term value of the portfolios of its diversified shareholders.

It will be able to focus on the creation of real value for all stakeholders and reject profits that come from the exploitation of vulnerable

populations and common resources. Indeed, because it will be able to give full weight to stakeholder concerns, Tractor Supply will earn

their trust and loyalty in a manner not available to companies that follow a company-first shareholder primacy model.14

Reaction to the BRT Statement Confirms the Advisability of Converting

to a PBC

The reaction to the BRT Statement’s issuance revealed a degree

of skepticism that turned out to be well placed. One skeptical commentator noted that “For many of the BRT signatories, truly internalizing

the meaning of their words would require rethinking their whole business.”15 Others noted the importance of the change,

but also that it was meaningless without ending shareholder primacy:

Ensuring that our capitalist system is designed to create a shared

and durable prosperity for all requires this culture shift. But it also requires corporations, and the investors who own them, to go

beyond words and take action to upend the self-defeating doctrine of shareholder primacy.16

Still others viewed the entire exercise as a PR stunt, and one that

ultimately could harm the very stakeholders the BRT Statement purported to support. “The statement is largely a rhetorical public

relations move rather than the harbinger of meaningful change,” asserted a Harvard Law School article, noting that the incentives

CEOs face had not changed, so neither would their behavior.17

Sadly, evidence of the false promise of the BRT Statement has begun

to emerge. For example, Wharton management professor Tyler Wry compiled data on signatories’ behavior through the early stages of

the COVID-19 pandemic to see if they were “living up to their word.” He found quite the reverse, as a recent article explains:

As COVID-19 spread in March and April, did signers give less

of their capital to shareholders (via dividends and stock buybacks)? No. On average, signers actually paid out 20 percent more of

their capital than similar companies that did not sign the statement. Then, as the coronavirus swept the country, did they

lay off fewer workers? On the contrary, in the first four weeks of the crisis, Wry found, signers were almost 20 percent more prone to

announce layoffs or furloughs. Signers were less likely to donate to relief efforts, less likely to offer customer discounts, and less

likely to shift production to pandemic-related goods.18

14 See Frederick Alexander, Benefit

Corporation Law and Governance: Pursuing Profit with Purpose p. 48 (2018) (“The

Paradox of the Value of Commitment: The Concession that Isn’t”).

15 Andrew Winston, Is the Business Roundtable Statement

Just Empty Rhetoric?, Harvard Business Review (August 30, 2019), available at https://hbr.org/2019/08/is-the-business-roundtable-statement-just-empty-rhetoric.

16 Jay Coan Gilbert, Andrew Kassoy, and Bart Houlahan,

Don’t believe the Business Roundtable has changed until its CEOs’ actions match their words, Fast

Company (August 22, 2019), available at https://www.fastcompany.com/90393303/dont-believe-the-business-roundtable-has-changed-until-its-ceos-actions-match-their-words.

17 Lucian Bebchuk and Roberto Tallarita, The Illusory

Promise of Stakeholder Governance, Harvard Law School Forum on Corporate Governance

(March 2, 2020), available at https://corpgov.law.harvard.edu/2020/03/02/the-illusory-promise-of-stakeholder-governance/.

18 Jerry Useem, Beware of Corporate Promises: When firms

issue statements of support for social causes, they don’t always follow through, The

Atlantic (August 6, 2020), available at https://www.theatlantic.com/ideas/archive/2020/08/companies-stand-solidarity-are-licensing-themselves-discriminate/614947/.

But PBC conversion represents a real solution, as Chief Justice Strine

noted in the article quoted earlier in this document.

Tractor Supply’s opposition statement

The Company’s opposition statement to the Proposal contains a

number of arguments that do not address the fundamental underlying question whether converting to PBC status will benefit its diversified

shareholders.

Tractor Supply argues there is a lack of precedents for conversion.

Hundreds of PBCs have raised billions of dollars over the last few

years, and there are already nine publicly traded PBCs and additional foreign companies with PBC-like provisions trading in the U.S. Moreover,

the lack of precedent alone would not argue against conversion because the law itself is clear about how the obligations of the directors

would change—the directors would have greater discretion to account for the effects that their decisions would have on the social

and environmental systems upon which the global economy depends.

Tractor Supply argues that “Business Decisions May Not

Prioritize or Maximize our Financial Returns to our Stockholders.”

This is not really an argument against converting the Company to a

PBC: it is simply a description of what it means to do so. As we discuss in detail above, prioritizing financial returns harms

shareholders in many cases, because that prioritization hurts those shareholders by degrading the social and environmental systems that

their portfolios depend upon. Becoming a PBC allows the directors to rationally weigh these competing concerns.

Tractor Supply argues that “Converting to a PBC Could Have

an Uncertain Impact on the Value of our Common Stock and Have Certain Costs.”

Again, this is a correct description of the impact of converting, but

not really an argument against it. Diversified shareholders care about the overall return they receive from their portfolios, which will

ultimately depend on a healthy economy. Swings of individual share prices are much less important. And while there are no doubt costs

involved with the conversion, several public companies have already done so, suggesting that such costs are not prohibitive. The real

question is whether those costs would outweigh the benefits of conversion, and the Company has not shown that they would.

Tractor Supply argues that the Proposal fails to identify the

public benefit that the amendment effecting the conversion would include.

As noted above, a PBC must name a specific public benefit in addition

to its general obligation to account for social and environmental impacts. The Proposal does not include such a purpose, as it is more

appropriate to allow the board to make that determination in the first instance. By asking the Board to take all action necessary to effect

a conversion to a PBC, the Proposal asks the board to use its business judgment, as well as all of the resources available to the directors,

including legal counsel, corporate management, and other advisors, to draft the optimal public benefit provision for the Company. We are

confident that the Board is best positioned to design a public benefit or benefits that address the role of workers, customers, communities,

or other stakeholders closely associated with the Company.

Moreover, the Proposal does not represent a blank check from shareholders

to the Board on this issue. If the Board assents to the Proposal, they will have to adopt an amendment, including the public benefit provisions,

which will then be presented to the shareholders, who will have the opportunity to vote for or against the amendment. No objectionable

purpose will be slipped past them. Again, the Proposal only requests that the Board take the steps necessary to give shareholders an opportunity

to have that vote.

Tractor Supply argues that the Proposal should be voted down

because “the Company Currently Takes Into Account its Stakeholders When Making Business Decisions Intended to Be in the Best Interests

of the Company and its Stockholders – And is Committed to Continuing to Do So.”

Tractor Supply enumerates a number of ways in which it addresses the

concerns of the stakeholders named in the BRT Statement. But this entirely misses the point. The Proposal in no way suggests that the

Company is not considering its stakeholders. Rather, the Proposal addresses the fact that Tractor Supply is limited in how far it can

go in protecting stakeholders because it is obligated to prioritize financial return to shareholders above all else—a fact the Company

recognizes in the Proxy Statement. Thus, consideration of stakeholders as the Company now practices it and as it would be practiced by

a PBC are completely different.

Conclusion

Please vote FOR Item No. 4

By voting FOR Item 4, shareholders can urge Tractor Supply to become

a PBC, as hundreds of companies have already done. Becoming a PBC will permit Tractor Supply to better serve the needs of its diversified

shareholders and directly account for the critical social and environmental systems upon which a thriving economy depends. The stakeholder

orientation permitted by the PBC form is more likely to create value for diversified shareholders than the prevailing “profit at

any cost” approach that imposes substantial costs on those same shareholders.

Simply signing the BRT Statement is not sufficient to create the type

of corporation that can authentically serve the needs of all stakeholders and prevent the dangerous implications of company-first shareholder

primacy.

The Shareholder Commons urges you to vote FOR Item 4 on the

proxy ballot, the Shareholder Proposal requesting the Board to convert Tractor Supply to a Public Benefit Corporation at the Tractor Supply

Inc. Annual Meeting on May 6, 2021.

For questions regarding Tractor Supply Company Item 4 – submitted

by James McRitchie, please contact Sara E. Murphy, The Shareholder Commons at +1.202.578.0261 or via email at sara@theshareholdercommons.com.

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA

TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES, AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS

A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY.

PROXY CARDS WILL NOT BE ACCEPTED BY FILER NOR BY THE SHAREHOLDER

COMMONS. TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

10

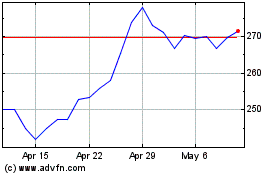

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024